Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

23 viewsRatio Analysis Template 2

Ratio Analysis Template 2

Uploaded by

pradhan13The document contains financial statements and ratios for years 2020 and 2019. It shows that total income increased in 2020 but total expenses also increased significantly, leading to higher losses. Total assets and liabilities doubled from 2019 to 2020. Most profitability and efficiency ratios declined, indicating worsening performance in 2020 compared to the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Spencer Sporting Goods CaseDocument13 pagesSpencer Sporting Goods CaseJenniNo ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- Case Study On Financial Risk AnalysisDocument6 pagesCase Study On Financial Risk AnalysisolafedNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Corporate Membership Application FormDocument2 pagesCorporate Membership Application Formpradhan13100% (1)

- 335872Document7 pages335872pradhan13No ratings yet

- Project On Innovative Banking Service To NRIDocument77 pagesProject On Innovative Banking Service To NRIShubham Shukla29% (7)

- Trading Secrets Revealed: Confidential - F P C ODocument34 pagesTrading Secrets Revealed: Confidential - F P C Oliamsi100% (1)

- CBRE 2008 - RatiosDocument2 pagesCBRE 2008 - RatiosMatthew TinkelmanNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Credit Memo For Gas Authority of IndiaDocument15 pagesCredit Memo For Gas Authority of IndiaKrina ShahNo ratings yet

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioDocument8 pagesUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyNo ratings yet

- สำเนา Financial Model 2Document6 pagesสำเนา Financial Model 2Chananya SriromNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Jubilant FoodsDocument24 pagesJubilant FoodsMagical MakeoversNo ratings yet

- Financial Model SolvedDocument29 pagesFinancial Model SolvedSaad KhanNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- Egyptian Tourism Resorts-Mohamed Ahmed AbdelateyDocument19 pagesEgyptian Tourism Resorts-Mohamed Ahmed AbdelateyMohamed Ahmed AbdelatyNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- Sapm Stock AnalysisDocument23 pagesSapm Stock AnalysisAthira K. ANo ratings yet

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Titan Company TemplateDocument18 pagesTitan Company Templatesejal aroraNo ratings yet

- Acc Project by Nitu KumariDocument46 pagesAcc Project by Nitu Kumarifunkypeoples63No ratings yet

- Assignment Brief - Accounting and Finance For Managers - ACC3015Document16 pagesAssignment Brief - Accounting and Finance For Managers - ACC3015AtiqEyashirKanakNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- SVA ModelDocument15 pagesSVA ModelArshdeep SaroyaNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- Bandhan BankDocument38 pagesBandhan BankJapish MehtaNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- 02C) Financial Ratios - ExamplesDocument21 pages02C) Financial Ratios - ExamplesMuhammad AtherNo ratings yet

- Company Name: Orion Pharma LTDDocument18 pagesCompany Name: Orion Pharma LTDMehenaj Sultana BithyNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Rohit Pandey-15E-064 - FSA - EnduranceDocument6 pagesRohit Pandey-15E-064 - FSA - EnduranceROHIT PANDEYNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document47 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Syed Ameer Ali ShahNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document46 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996José Carlos GBNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANNo ratings yet

- Tire City ClassDocument2 pagesTire City ClasshamedkharrazNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Interim Report q3 2023Document26 pagesInterim Report q3 2023jvnshrNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaNo ratings yet

- Group 11 - Mahindra and MahindraDocument10 pagesGroup 11 - Mahindra and Mahindrasovinahalli 1234No ratings yet

- ACCOUNTS March 2020 PaperDocument10 pagesACCOUNTS March 2020 PaperShania AlertNo ratings yet

- Company Name: Reneta LTD.: Group MemberDocument19 pagesCompany Name: Reneta LTD.: Group MemberMehenaj Sultana BithyNo ratings yet

- Afm Project by IndraDocument27 pagesAfm Project by Indramadhav.agarwal23hNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- November 2016 Reading Between The Lines by Dhiraj Dave Version 1Document22 pagesNovember 2016 Reading Between The Lines by Dhiraj Dave Version 1Abhinav SrivastavaNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic Treesara_AlQuwaifliNo ratings yet

- Ikhtisar Data Keuangan 2022Document4 pagesIkhtisar Data Keuangan 2022Dimas SukmanaNo ratings yet

- Godrej Consumer Products Balance Sheet, Godrej Consumer Products Financial Statement & AccountsDocument1 pageGodrej Consumer Products Balance Sheet, Godrej Consumer Products Financial Statement & AccountsTanisha PhogaatNo ratings yet

- PDFGallery_20240701_230605Document48 pagesPDFGallery_20240701_230605titanworldgangavathiNo ratings yet

- Book 3Document62 pagesBook 3pg23ishika.kumariNo ratings yet

- SSAOpenCyberReceipt16 02 2022Document2 pagesSSAOpenCyberReceipt16 02 2022pradhan13No ratings yet

- Pavan Trading Co. LTD: LANDLINE: +256-790-915-162 MOBILE: +256-759-359-557Document1 pagePavan Trading Co. LTD: LANDLINE: +256-790-915-162 MOBILE: +256-759-359-557pradhan13No ratings yet

- House No-172, Sector-22, Gurgaon Mob No-+91 9953071865: Vinay Kumar SinghDocument3 pagesHouse No-172, Sector-22, Gurgaon Mob No-+91 9953071865: Vinay Kumar Singhpradhan13No ratings yet

- Imc-Ihk Specialist Schedule 2017Document6 pagesImc-Ihk Specialist Schedule 2017pradhan13No ratings yet

- Consultants ListsDocument30 pagesConsultants Listspradhan13No ratings yet

- Job Description: Send Me Jobs Like ThisDocument2 pagesJob Description: Send Me Jobs Like Thispradhan13No ratings yet

- Ross Warner HR Solutions Kailash Vaib: Datum Recruitment ServicesDocument1 pageRoss Warner HR Solutions Kailash Vaib: Datum Recruitment Servicespradhan13No ratings yet

- CPP Market SurveyDocument13 pagesCPP Market Surveypradhan13No ratings yet

- Conversion Gate02Document5 pagesConversion Gate02pradhan13No ratings yet

- Copycooperative Financial Ratio Calculator 2011Document10 pagesCopycooperative Financial Ratio Calculator 2011pradhan13No ratings yet

- Uganda PDFDocument2 pagesUganda PDFpradhan13No ratings yet

- Amazon ComputationDocument1 pageAmazon Computationpradhan13No ratings yet

- Period Financier Transaction Type Amount (Us$)Document2 pagesPeriod Financier Transaction Type Amount (Us$)pradhan13No ratings yet

- Cot 1411 Carioca SPRLDocument2 pagesCot 1411 Carioca SPRLpradhan130% (1)

- Tax Audit Plan and ProgrammeDocument39 pagesTax Audit Plan and Programmepradhan13No ratings yet

- State Name Code AN AP AR AS BH CH CG DN DD ND GA GJ HR HP JK JH KR KL LK MP MH MN MG MZ NG OR PN PB RJDocument2 pagesState Name Code AN AP AR AS BH CH CG DN DD ND GA GJ HR HP JK JH KR KL LK MP MH MN MG MZ NG OR PN PB RJpradhan13No ratings yet

- Salary Tds Computation Sheet Sec 192bDocument1 pageSalary Tds Computation Sheet Sec 192bpradhan13No ratings yet

- (Nomura) Correlation PrimerDocument16 pages(Nomura) Correlation PrimeranuragNo ratings yet

- Eng Econ - Cash - Flow - L3 - MME 4272Document55 pagesEng Econ - Cash - Flow - L3 - MME 4272Ayesha RalliyaNo ratings yet

- 06 Cafmst14 - CH - 04Document35 pages06 Cafmst14 - CH - 04Mahabub AlamNo ratings yet

- Mrunal PCB 7 HandoutDocument52 pagesMrunal PCB 7 HandoutSikha SharmaNo ratings yet

- Chapter 1 - Concept of ValueDocument6 pagesChapter 1 - Concept of ValueSteffany RoqueNo ratings yet

- Man StraDocument4 pagesMan StraardaNo ratings yet

- 2237-7760-2-PB Jur TerDocument14 pages2237-7760-2-PB Jur TerChristin AgapeNo ratings yet

- CRM GlossaryDocument5 pagesCRM GlossaryRahila KosayevaNo ratings yet

- Agency TheoryDocument5 pagesAgency TheoryChiah ChyiNo ratings yet

- Tute2 Sol StudentsDocument10 pagesTute2 Sol StudentsAAA820No ratings yet

- (Babson) - Investment PerformanceDocument4 pages(Babson) - Investment PerformancecogitatorNo ratings yet

- What Is A Coupon BondDocument3 pagesWhat Is A Coupon BondNazrul Islam0% (1)

- Loans and Advances Final Version 2 PowerpointDocument75 pagesLoans and Advances Final Version 2 PowerpointMd Tanjir Islam JerryNo ratings yet

- SEBI N FEMADocument28 pagesSEBI N FEMAD Attitude KidNo ratings yet

- Investment AttributesDocument4 pagesInvestment AttributesNiranjan PhuyalNo ratings yet

- Go Ahead For F&O Report 16 December 2011-Mansukh Investment and Trading SolutionDocument6 pagesGo Ahead For F&O Report 16 December 2011-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- An Empirical Detection of High Frequency Trading StrategiesDocument35 pagesAn Empirical Detection of High Frequency Trading Strategiesdoc_oz3298No ratings yet

- Morningstar US Market Outlook 2023 Near Term TurbulenceDocument55 pagesMorningstar US Market Outlook 2023 Near Term TurbulenceBrainNo ratings yet

- Parkin Public Announcement of Offering - EnglishDocument1 pageParkin Public Announcement of Offering - Englishbasitrasheed18No ratings yet

- SOS Options Cheat Sheet v2.2Document14 pagesSOS Options Cheat Sheet v2.2Yash Raj KumarNo ratings yet

- I. Objective: Property Held Under An Operating LeaseDocument5 pagesI. Objective: Property Held Under An Operating Leasemusic niNo ratings yet

- RTP - I Group PDFDocument177 pagesRTP - I Group PDFMadan SharmaNo ratings yet

- Shiko Busness PlanDocument38 pagesShiko Busness PlanmosesNo ratings yet

- Geojit Financial Services Limited PDFDocument41 pagesGeojit Financial Services Limited PDFDavid John100% (1)

- Britannia Industries - Initiating Coverage 281020Document12 pagesBritannia Industries - Initiating Coverage 281020Aniket DhanukaNo ratings yet

- The Cost of CapitalDocument23 pagesThe Cost of CapitalqamarNo ratings yet

- NEO SOC Summary of Changes ENDocument3 pagesNEO SOC Summary of Changes ENAli HamzaNo ratings yet

- Integrated Case 3-20Document5 pagesIntegrated Case 3-20Cayden BrookeNo ratings yet

Ratio Analysis Template 2

Ratio Analysis Template 2

Uploaded by

pradhan130 ratings0% found this document useful (0 votes)

23 views3 pagesThe document contains financial statements and ratios for years 2020 and 2019. It shows that total income increased in 2020 but total expenses also increased significantly, leading to higher losses. Total assets and liabilities doubled from 2019 to 2020. Most profitability and efficiency ratios declined, indicating worsening performance in 2020 compared to the previous year.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains financial statements and ratios for years 2020 and 2019. It shows that total income increased in 2020 but total expenses also increased significantly, leading to higher losses. Total assets and liabilities doubled from 2019 to 2020. Most profitability and efficiency ratios declined, indicating worsening performance in 2020 compared to the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

23 views3 pagesRatio Analysis Template 2

Ratio Analysis Template 2

Uploaded by

pradhan13The document contains financial statements and ratios for years 2020 and 2019. It shows that total income increased in 2020 but total expenses also increased significantly, leading to higher losses. Total assets and liabilities doubled from 2019 to 2020. Most profitability and efficiency ratios declined, indicating worsening performance in 2020 compared to the previous year.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

Input Financials

Sample Input Cells

Income Statement

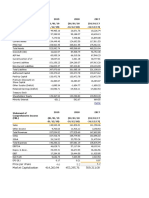

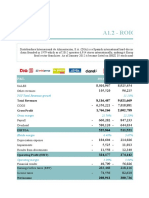

Particulars (Amt in Crs.) 2,020 % 2,019 %

Net Sales 293,511 100.00% 184,411 100.00%

Other Income 120 0.04% -264 -0.14%

Total Income 293,631 100.04% 184,147 99.86%

Total Expense -360,094 -122.69% -232,805 -126.24%

EBIDTA -66,463 -22.64% -48,658 -26.39%

Less: Depreciation - 0.00% 0.00%

PBIT -66,463 -22.64% -48,658 -26.39%

Less: Interest 1,163 0.40% 2,657 1.44%

PBT -65,300 -22.25% -46,001 -24.94%

Less: Prov for Tax -433 -0.15% -511 -0.28%

Net Profit (PAT) -65,733 -22.40% -46,512 -25.22%

Balance Sheet

Particulars (Amount in Rs. Crs.) 2,020 % 2,019 %

Equity 648 5.36% 624 8.92%

Reserves 10,488 86.79% 4,970 71.03%

Shareholder Funds 11,136 92.15% 5,594 79.95%

Non-Current Liabilities 227 1.88% 191 2.72%

Creditors 446 3.69% 458 6.55%

Other Current Liabilities 276 2.28% 754 10.78%

Total Current Liabilities 722 5.97% 1,213 17.33%

Total Liabilities 12,084 100.00% 6,998 100.00%

Non Current Assets 9,792 81.03% 4,969 71.00%

Inventories 1,909 15.80% 1,576 22.53%

Trade Receivables 49 0.40% 76 1.08%

Cash & Cash Equivalents 91 0.76% 120 1.72%

Other Current Assets 243 2.01% 257 3.67%

Total Current Assets 2,292 18.97% 2,029 29.00%

Total Assets 12,084 100% 6,998 100%

- -

Ratios

Sr. No. Name of the Ratio Forumla Unit 2020 2019

1 OPM (Operating Profit / Sales) X 100 Percent -22.64% -26.39%

2 PBIT Margin (PBIT / Sales) X 100 Percent -22.64% -26.39%

3 PAT Margin (PAT / Sales) X 100 Percent -22.40% -25.22%

4 Networth Equity Capital + Reserves Rs. Crs. 11135.52 5594.48

5 Working Capital Current Assets - Current Liabilities Rs. Crs. 1570.46 816.48

6 Current Ratio (Sign Neutral) Current Assets / Current Liabilities :1 3.18 1.67

7 Debt to Equity Long Term Debt / (Equity + Reserves) :1 0.02 0.03

8 ROE (Return on Equity) PAT / (Average Equity + Reserves) Percent -785.81% -831.40%

9 ROCE (Return on Capital Employed) PBIT / (Average Networth + Debt Funds) Percent -696.62% -695.36%

10 Fixed Assets T/O Sales / Average Fixed Assets Times 39.77 37.12

11 Inventory Turnover Ratio Sales / Average Inventory Times 168.41 117.00

12 Average Inventory Holding Period 365 / Inventory Turnover Ratio Days 2 3

13 Debtors Turnover Ratio Sales / Average Receivables Times 4732.14 2441.88

14 Average Collection Period (DSO) 365 / Debtors Turnover Ratio Days 0 0

15 Creditors Turnover Ratio COGS / Average Payables Times -796 -508

16 Average Payment Period 365 / Creditors Turnover Ratio Days 0 -1

17 Current Assets T/O Sales / Average Current Assets Times 128.04 90.89

18 Wkg Capital T/O Sales / Average Wkg Capital Times 245.93 225.86

19 Length of Operating Cycle 365 / Working Capital Turnover Ratio Days 1 2

20 Networth T/O Sales / Average Networth Times 35.09 32.96

21 Length of Own Investment 365 / Networth Turnover Ratio Days 10 11

22 Total Capital T/O Sales / (Average Networth + Debt Funds) Times 30.76 26.35

23 Length of Total Investment 365 / Capital Turnover Ratio Days 12 14

24 Interest Coverage Ratio PBIT / Interest Cost Times -57.15 -18.31

Solvency Ratio

Profitability Ratio

Liquidity Ratio

Efficiency Ratio

Balance Sheet Concept

You might also like

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal20% (5)

- Spencer Sporting Goods CaseDocument13 pagesSpencer Sporting Goods CaseJenniNo ratings yet

- Financial Analysis Coles GroupDocument5 pagesFinancial Analysis Coles GroupAmmar HassanNo ratings yet

- Case Study On Financial Risk AnalysisDocument6 pagesCase Study On Financial Risk AnalysisolafedNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Corporate Membership Application FormDocument2 pagesCorporate Membership Application Formpradhan13100% (1)

- 335872Document7 pages335872pradhan13No ratings yet

- Project On Innovative Banking Service To NRIDocument77 pagesProject On Innovative Banking Service To NRIShubham Shukla29% (7)

- Trading Secrets Revealed: Confidential - F P C ODocument34 pagesTrading Secrets Revealed: Confidential - F P C Oliamsi100% (1)

- CBRE 2008 - RatiosDocument2 pagesCBRE 2008 - RatiosMatthew TinkelmanNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Credit Memo For Gas Authority of IndiaDocument15 pagesCredit Memo For Gas Authority of IndiaKrina ShahNo ratings yet

- Unitedhealth Care Income Statement & Balance Sheet & PE RatioDocument8 pagesUnitedhealth Care Income Statement & Balance Sheet & PE RatioEhab elhashmyNo ratings yet

- สำเนา Financial Model 2Document6 pagesสำเนา Financial Model 2Chananya SriromNo ratings yet

- Competitors Bajaj MotorsDocument11 pagesCompetitors Bajaj MotorsdeepaksikriNo ratings yet

- Jubilant FoodsDocument24 pagesJubilant FoodsMagical MakeoversNo ratings yet

- Financial Model SolvedDocument29 pagesFinancial Model SolvedSaad KhanNo ratings yet

- Mar-19 Dec-18 Sep-18 Jun-18 Figures in Rs CroreDocument12 pagesMar-19 Dec-18 Sep-18 Jun-18 Figures in Rs Croreneha singhNo ratings yet

- Valuation: Beta and WACCDocument4 pagesValuation: Beta and WACCnityaNo ratings yet

- Comprehensive IT Industry Analysis - ProjectDocument52 pagesComprehensive IT Industry Analysis - ProjectdhruvNo ratings yet

- Egyptian Tourism Resorts-Mohamed Ahmed AbdelateyDocument19 pagesEgyptian Tourism Resorts-Mohamed Ahmed AbdelateyMohamed Ahmed AbdelatyNo ratings yet

- Particulars 2018-19 2017-18 Liquidity AnalysisDocument10 pagesParticulars 2018-19 2017-18 Liquidity AnalysisIvy MajiNo ratings yet

- Sapm Stock AnalysisDocument23 pagesSapm Stock AnalysisAthira K. ANo ratings yet

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- Aditya nuVODocument12 pagesAditya nuVOPriyanshi yadavNo ratings yet

- Titan Company TemplateDocument18 pagesTitan Company Templatesejal aroraNo ratings yet

- Acc Project by Nitu KumariDocument46 pagesAcc Project by Nitu Kumarifunkypeoples63No ratings yet

- Assignment Brief - Accounting and Finance For Managers - ACC3015Document16 pagesAssignment Brief - Accounting and Finance For Managers - ACC3015AtiqEyashirKanakNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- SVA ModelDocument15 pagesSVA ModelArshdeep SaroyaNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- Bandhan BankDocument38 pagesBandhan BankJapish MehtaNo ratings yet

- SENEA Financial AnalysisDocument22 pagesSENEA Financial Analysissidrajaffri72No ratings yet

- 02C) Financial Ratios - ExamplesDocument21 pages02C) Financial Ratios - ExamplesMuhammad AtherNo ratings yet

- Company Name: Orion Pharma LTDDocument18 pagesCompany Name: Orion Pharma LTDMehenaj Sultana BithyNo ratings yet

- Ratio Analysis of Engro Vs NestleDocument24 pagesRatio Analysis of Engro Vs NestleMuhammad SalmanNo ratings yet

- Ratio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDDocument9 pagesRatio Analysis of Over The Last 5 Years: Power Grid Corporation of India LTDKrishna NimmakuriNo ratings yet

- Rohit Pandey-15E-064 - FSA - EnduranceDocument6 pagesRohit Pandey-15E-064 - FSA - EnduranceROHIT PANDEYNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document47 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Syed Ameer Ali ShahNo ratings yet

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Document46 pagesPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996José Carlos GBNo ratings yet

- in Rs. Cr.Document19 pagesin Rs. Cr.Ashish Kumar SharmaNo ratings yet

- Bemd RatiosDocument12 pagesBemd RatiosPRADEEP CHAVANNo ratings yet

- Tire City ClassDocument2 pagesTire City ClasshamedkharrazNo ratings yet

- AFM Section C Group 1 Assignment CalculationsDocument12 pagesAFM Section C Group 1 Assignment CalculationsAkshitNo ratings yet

- WorkingsDocument10 pagesWorkingsKi KiNo ratings yet

- Interim Report q3 2023Document26 pagesInterim Report q3 2023jvnshrNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- Sub: Financial Accounting Sub: Financial AccountingDocument14 pagesSub: Financial Accounting Sub: Financial AccountingMilan PateliyaNo ratings yet

- Group 11 - Mahindra and MahindraDocument10 pagesGroup 11 - Mahindra and Mahindrasovinahalli 1234No ratings yet

- ACCOUNTS March 2020 PaperDocument10 pagesACCOUNTS March 2020 PaperShania AlertNo ratings yet

- Company Name: Reneta LTD.: Group MemberDocument19 pagesCompany Name: Reneta LTD.: Group MemberMehenaj Sultana BithyNo ratings yet

- Afm Project by IndraDocument27 pagesAfm Project by Indramadhav.agarwal23hNo ratings yet

- This Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksDocument32 pagesThis Is An Open Book Examination. 2. Attempt Any Four Out of Six Questions. 3. All Questions Carry Equal MarksSukanya Shridhar 1 9 9 0 3 5No ratings yet

- November 2016 Reading Between The Lines by Dhiraj Dave Version 1Document22 pagesNovember 2016 Reading Between The Lines by Dhiraj Dave Version 1Abhinav SrivastavaNo ratings yet

- A1.2 Roic TreeDocument9 pagesA1.2 Roic Treesara_AlQuwaifliNo ratings yet

- Ikhtisar Data Keuangan 2022Document4 pagesIkhtisar Data Keuangan 2022Dimas SukmanaNo ratings yet

- Godrej Consumer Products Balance Sheet, Godrej Consumer Products Financial Statement & AccountsDocument1 pageGodrej Consumer Products Balance Sheet, Godrej Consumer Products Financial Statement & AccountsTanisha PhogaatNo ratings yet

- PDFGallery_20240701_230605Document48 pagesPDFGallery_20240701_230605titanworldgangavathiNo ratings yet

- Book 3Document62 pagesBook 3pg23ishika.kumariNo ratings yet

- SSAOpenCyberReceipt16 02 2022Document2 pagesSSAOpenCyberReceipt16 02 2022pradhan13No ratings yet

- Pavan Trading Co. LTD: LANDLINE: +256-790-915-162 MOBILE: +256-759-359-557Document1 pagePavan Trading Co. LTD: LANDLINE: +256-790-915-162 MOBILE: +256-759-359-557pradhan13No ratings yet

- House No-172, Sector-22, Gurgaon Mob No-+91 9953071865: Vinay Kumar SinghDocument3 pagesHouse No-172, Sector-22, Gurgaon Mob No-+91 9953071865: Vinay Kumar Singhpradhan13No ratings yet

- Imc-Ihk Specialist Schedule 2017Document6 pagesImc-Ihk Specialist Schedule 2017pradhan13No ratings yet

- Consultants ListsDocument30 pagesConsultants Listspradhan13No ratings yet

- Job Description: Send Me Jobs Like ThisDocument2 pagesJob Description: Send Me Jobs Like Thispradhan13No ratings yet

- Ross Warner HR Solutions Kailash Vaib: Datum Recruitment ServicesDocument1 pageRoss Warner HR Solutions Kailash Vaib: Datum Recruitment Servicespradhan13No ratings yet

- CPP Market SurveyDocument13 pagesCPP Market Surveypradhan13No ratings yet

- Conversion Gate02Document5 pagesConversion Gate02pradhan13No ratings yet

- Copycooperative Financial Ratio Calculator 2011Document10 pagesCopycooperative Financial Ratio Calculator 2011pradhan13No ratings yet

- Uganda PDFDocument2 pagesUganda PDFpradhan13No ratings yet

- Amazon ComputationDocument1 pageAmazon Computationpradhan13No ratings yet

- Period Financier Transaction Type Amount (Us$)Document2 pagesPeriod Financier Transaction Type Amount (Us$)pradhan13No ratings yet

- Cot 1411 Carioca SPRLDocument2 pagesCot 1411 Carioca SPRLpradhan130% (1)

- Tax Audit Plan and ProgrammeDocument39 pagesTax Audit Plan and Programmepradhan13No ratings yet

- State Name Code AN AP AR AS BH CH CG DN DD ND GA GJ HR HP JK JH KR KL LK MP MH MN MG MZ NG OR PN PB RJDocument2 pagesState Name Code AN AP AR AS BH CH CG DN DD ND GA GJ HR HP JK JH KR KL LK MP MH MN MG MZ NG OR PN PB RJpradhan13No ratings yet

- Salary Tds Computation Sheet Sec 192bDocument1 pageSalary Tds Computation Sheet Sec 192bpradhan13No ratings yet

- (Nomura) Correlation PrimerDocument16 pages(Nomura) Correlation PrimeranuragNo ratings yet

- Eng Econ - Cash - Flow - L3 - MME 4272Document55 pagesEng Econ - Cash - Flow - L3 - MME 4272Ayesha RalliyaNo ratings yet

- 06 Cafmst14 - CH - 04Document35 pages06 Cafmst14 - CH - 04Mahabub AlamNo ratings yet

- Mrunal PCB 7 HandoutDocument52 pagesMrunal PCB 7 HandoutSikha SharmaNo ratings yet

- Chapter 1 - Concept of ValueDocument6 pagesChapter 1 - Concept of ValueSteffany RoqueNo ratings yet

- Man StraDocument4 pagesMan StraardaNo ratings yet

- 2237-7760-2-PB Jur TerDocument14 pages2237-7760-2-PB Jur TerChristin AgapeNo ratings yet

- CRM GlossaryDocument5 pagesCRM GlossaryRahila KosayevaNo ratings yet

- Agency TheoryDocument5 pagesAgency TheoryChiah ChyiNo ratings yet

- Tute2 Sol StudentsDocument10 pagesTute2 Sol StudentsAAA820No ratings yet

- (Babson) - Investment PerformanceDocument4 pages(Babson) - Investment PerformancecogitatorNo ratings yet

- What Is A Coupon BondDocument3 pagesWhat Is A Coupon BondNazrul Islam0% (1)

- Loans and Advances Final Version 2 PowerpointDocument75 pagesLoans and Advances Final Version 2 PowerpointMd Tanjir Islam JerryNo ratings yet

- SEBI N FEMADocument28 pagesSEBI N FEMAD Attitude KidNo ratings yet

- Investment AttributesDocument4 pagesInvestment AttributesNiranjan PhuyalNo ratings yet

- Go Ahead For F&O Report 16 December 2011-Mansukh Investment and Trading SolutionDocument6 pagesGo Ahead For F&O Report 16 December 2011-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- An Empirical Detection of High Frequency Trading StrategiesDocument35 pagesAn Empirical Detection of High Frequency Trading Strategiesdoc_oz3298No ratings yet

- Morningstar US Market Outlook 2023 Near Term TurbulenceDocument55 pagesMorningstar US Market Outlook 2023 Near Term TurbulenceBrainNo ratings yet

- Parkin Public Announcement of Offering - EnglishDocument1 pageParkin Public Announcement of Offering - Englishbasitrasheed18No ratings yet

- SOS Options Cheat Sheet v2.2Document14 pagesSOS Options Cheat Sheet v2.2Yash Raj KumarNo ratings yet

- I. Objective: Property Held Under An Operating LeaseDocument5 pagesI. Objective: Property Held Under An Operating Leasemusic niNo ratings yet

- RTP - I Group PDFDocument177 pagesRTP - I Group PDFMadan SharmaNo ratings yet

- Shiko Busness PlanDocument38 pagesShiko Busness PlanmosesNo ratings yet

- Geojit Financial Services Limited PDFDocument41 pagesGeojit Financial Services Limited PDFDavid John100% (1)

- Britannia Industries - Initiating Coverage 281020Document12 pagesBritannia Industries - Initiating Coverage 281020Aniket DhanukaNo ratings yet

- The Cost of CapitalDocument23 pagesThe Cost of CapitalqamarNo ratings yet

- NEO SOC Summary of Changes ENDocument3 pagesNEO SOC Summary of Changes ENAli HamzaNo ratings yet

- Integrated Case 3-20Document5 pagesIntegrated Case 3-20Cayden BrookeNo ratings yet