Professional Documents

Culture Documents

INTX211 Overview

INTX211 Overview

Uploaded by

Jemima FernandezCopyright:

Available Formats

You might also like

- FNSTPB401 Student Assessment TasksDocument32 pagesFNSTPB401 Student Assessment Tasksdeathnote lNo ratings yet

- NOTES 1 - Income Tax 601 - BBA-6 SemDocument15 pagesNOTES 1 - Income Tax 601 - BBA-6 SemRajeev Kumar75% (4)

- The Essential Tax Guide - 2023 EditionDocument116 pagesThe Essential Tax Guide - 2023 Editionธนวัฒน์ ปิยะวิสุทธิกุล100% (3)

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- Taxation 1Document61 pagesTaxation 1lucky javellanaNo ratings yet

- Scope of TaxDocument12 pagesScope of TaxHajra MalikNo ratings yet

- Intro VatDocument26 pagesIntro VatJohn RellonNo ratings yet

- Cannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsDocument3 pagesCannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsAreel GalvanNo ratings yet

- M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6Document1 pageM/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6fergusonaf555No ratings yet

- Taxability of PartnershipDocument6 pagesTaxability of PartnershipPrincess Janine SyNo ratings yet

- CA Inter Income Tax Basic ConceptDocument16 pagesCA Inter Income Tax Basic Concepttauseefalam917No ratings yet

- General Principles of Income Taxation in The PHDocument1 pageGeneral Principles of Income Taxation in The PHJm CruzNo ratings yet

- Taxation Management: Prof. Naveed Iqbal CHDocument14 pagesTaxation Management: Prof. Naveed Iqbal CHBader ZiaNo ratings yet

- Taxation Matrix of LumberaDocument14 pagesTaxation Matrix of LumberaYannie EsparteroNo ratings yet

- Income TaxesDocument6 pagesIncome TaxesKezNo ratings yet

- Accounting For Income Tax FinDocument8 pagesAccounting For Income Tax FinAmparo ReyesNo ratings yet

- TLR-Session 5Document39 pagesTLR-Session 5borgygavinaNo ratings yet

- RMC 35-2011 IaetDocument2 pagesRMC 35-2011 IaetDyan de la FuenteNo ratings yet

- IA2 FINALS FormulaDocument8 pagesIA2 FINALS FormulaPushTheStart GamingNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Tax Classification Activity in ColombiaDocument2 pagesTax Classification Activity in ColombiaScribdTranslationsNo ratings yet

- Allowable DeductionsDocument17 pagesAllowable DeductionsShanelle SilmaroNo ratings yet

- Screenshot 2023-10-29 at 9.17.46 PMDocument25 pagesScreenshot 2023-10-29 at 9.17.46 PMshubhanshiphogat062000No ratings yet

- Financial Indicators (eSRE)Document2 pagesFinancial Indicators (eSRE)Florence ParcareyNo ratings yet

- Favorite Bar Exam Topics (1999-2008)Document61 pagesFavorite Bar Exam Topics (1999-2008)Lien PatrickNo ratings yet

- Explanations of Deferred Tax Principle DisclosureDocument3 pagesExplanations of Deferred Tax Principle Disclosureokuhle4002No ratings yet

- DT Marathon PDFDocument161 pagesDT Marathon PDFAbhi JoshiNo ratings yet

- Tax Bar QuestionsDocument14 pagesTax Bar QuestionsPisto PalubosNo ratings yet

- Background On Philippine Tax Rates: Provisions)Document10 pagesBackground On Philippine Tax Rates: Provisions)Anonymous VPY5t7fdLQNo ratings yet

- CSPs-Tax System of PakistanDocument45 pagesCSPs-Tax System of PakistanRida E Zainab AliNo ratings yet

- Revenue Memorandum Circular No. 016-13: February 8, 2013 February 8, 2013Document2 pagesRevenue Memorandum Circular No. 016-13: February 8, 2013 February 8, 2013Ravenclaws91No ratings yet

- Bangladesh Tax PresentationDocument34 pagesBangladesh Tax Presentationjewel59No ratings yet

- Roydz - Gls Optimum PrimeDocument2 pagesRoydz - Gls Optimum PrimeJig-Etten SaxorNo ratings yet

- Income Taxes: Practical Accounting 1 1Document2 pagesIncome Taxes: Practical Accounting 1 1Bryan ReyesNo ratings yet

- S3 BTDocument2 pagesS3 BTJaved IqbalNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorPapun Kumar SwainNo ratings yet

- Income Tax Compliance, Schemes of Income Taxation and Final Income TaxationDocument45 pagesIncome Tax Compliance, Schemes of Income Taxation and Final Income TaxationMonica MonicaNo ratings yet

- Form-1770-Attachment I Page 1Document1 pageForm-1770-Attachment I Page 1rover2010No ratings yet

- 1701-2023-Charito P2Document1 page1701-2023-Charito P2markposadas.0831No ratings yet

- CGT Notes - AnnotatedDocument54 pagesCGT Notes - AnnotatedDr SafaNo ratings yet

- Tax Summary 2019 Ver.1Document163 pagesTax Summary 2019 Ver.1Aiko Cherrie NakamuraNo ratings yet

- SPT PPH BDN 2009 English OrtaxDocument29 pagesSPT PPH BDN 2009 English OrtaxCoba SajaNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- TX-UK Career Compass Complete Guide FA2021Document244 pagesTX-UK Career Compass Complete Guide FA2021DG Mero Nepal GreatNo ratings yet

- 0 Control Sheet - Charge of Tax & 4 Key ConceptsDocument1 page0 Control Sheet - Charge of Tax & 4 Key ConceptsArman KhanNo ratings yet

- Unit 3 Spec Incl & Exempt IncomeDocument5 pagesUnit 3 Spec Incl & Exempt Incometetelomakgata1No ratings yet

- Assessments and ReassessmentsDocument31 pagesAssessments and ReassessmentsRam PrasadNo ratings yet

- Chapter 10 - Introduction To Government FinanceDocument26 pagesChapter 10 - Introduction To Government Financewatts175% (4)

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- Tax Deduction at SourceDocument59 pagesTax Deduction at Sourcepand09No ratings yet

- 1 Conceptual FrameworkDocument11 pages1 Conceptual FrameworkYong Kwang HanNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- 2023 01 01TheEssentialTaxGuide 2023editionDocument116 pages2023 01 01TheEssentialTaxGuide 2023editionroshanjoseNo ratings yet

- Advance Taxation (P6) Summary of NoteDocument31 pagesAdvance Taxation (P6) Summary of NoteYivon TeoNo ratings yet

- Performa Income StatementDocument1 pagePerforma Income StatementAhsan JamalNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3JunnetteTevesPujidaNo ratings yet

- 2307 BlankDocument2 pages2307 BlankJames Brooke PalomaNo ratings yet

- Technical Article 07 Corporate TaxDocument3 pagesTechnical Article 07 Corporate TaxTawanda Tatenda HerbertNo ratings yet

- TXVNM - Lecturer Notes 2023Document257 pagesTXVNM - Lecturer Notes 2023huyen9bbbbbNo ratings yet

- Computation of Income Tax Due and PayableDocument14 pagesComputation of Income Tax Due and Payablealia fauniNo ratings yet

- Lumbera The Tax QueenDocument29 pagesLumbera The Tax QueenKristine MagbojosNo ratings yet

- Intermediate Accounting 2Document2 pagesIntermediate Accounting 2Jemima FernandezNo ratings yet

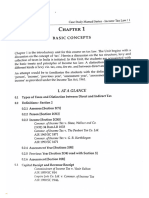

- Chapter 1Document3 pagesChapter 1Jemima FernandezNo ratings yet

- STCM211 NotesDocument2 pagesSTCM211 NotesJemima FernandezNo ratings yet

- IA1BDocument3 pagesIA1BJemima FernandezNo ratings yet

- 2020 1040 Ramirez, Raul & Adriana Tax ReturnDocument86 pages2020 1040 Ramirez, Raul & Adriana Tax ReturnAlberto Lucio50% (2)

- LN 6.1 IHC (Unlisted, Listed & Inv. Deal.)Document21 pagesLN 6.1 IHC (Unlisted, Listed & Inv. Deal.)muhammadsbs-wb20No ratings yet

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- Apple Zena 13 Sabah 2Document1 pageApple Zena 13 Sabah 2Gh UnlockersNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (67)

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- InvoiceDocument1 pageInvoicejkjeetkr8t80% (1)

- Cfas Chapter 25Document6 pagesCfas Chapter 25Kristel FieldsNo ratings yet

- List of Expenses: Cash Flow Report Expenses - From January To AprilDocument1 pageList of Expenses: Cash Flow Report Expenses - From January To AprilYameteKudasaiNo ratings yet

- 2019 CIA P3 SIV 1E Capital Structure Capitl Budgeting Taxes and Transfer PricingDocument133 pages2019 CIA P3 SIV 1E Capital Structure Capitl Budgeting Taxes and Transfer PricingMarieJoiaNo ratings yet

- Armhyla Olivar - Module 6 ActivityDocument3 pagesArmhyla Olivar - Module 6 ActivityGrace Umbaña YangaNo ratings yet

- Taxation - Vietnam (TX - VNM) : Applied SkillsDocument16 pagesTaxation - Vietnam (TX - VNM) : Applied SkillsFive FifthNo ratings yet

- E34Document9 pagesE34Nguyen Nguyen KhoiNo ratings yet

- 1511256898711park Cubix Price Sheet 2 9 17 PDFDocument1 page1511256898711park Cubix Price Sheet 2 9 17 PDFManjunathNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- (See Rule 31 (1) (B) ) : Form No. 16ADocument38 pages(See Rule 31 (1) (B) ) : Form No. 16AsamNo ratings yet

- IRS PUB 519 US TAX GUIDE FOR ALIENS - TAX TREATIES (2018) 68 PagesDocument68 pagesIRS PUB 519 US TAX GUIDE FOR ALIENS - TAX TREATIES (2018) 68 PagesTitle IV-D Man with a planNo ratings yet

- Tutorial 9 Year End Adjustments (Q)Document4 pagesTutorial 9 Year End Adjustments (Q)lious lii0% (1)

- Provisions For Filing of Return of IncomeDocument17 pagesProvisions For Filing of Return of IncomeJoseph SalidoNo ratings yet

- Difference Between Negotiated Sale and ExpropriatiDocument3 pagesDifference Between Negotiated Sale and ExpropriatiKathleen Kaye Dial100% (1)

- CIR V Va de PrietoDocument2 pagesCIR V Va de PrietoAngela ConejeroNo ratings yet

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- Income StatementDocument3 pagesIncome StatementAlyssa Denise E. OrtezaNo ratings yet

- Bank of Baroda PPF Withdrawal Form PDFDocument1 pageBank of Baroda PPF Withdrawal Form PDFmufaddal.pittalwala51350% (2)

- Tax Estate CreditableDocument2 pagesTax Estate Creditablepatburner1108No ratings yet

- Multan Electric Power Company: Say No To CorruptionDocument2 pagesMultan Electric Power Company: Say No To Corruptionsdo sNo ratings yet

INTX211 Overview

INTX211 Overview

Uploaded by

Jemima FernandezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INTX211 Overview

INTX211 Overview

Uploaded by

Jemima FernandezCopyright:

Available Formats

NOTES:

TIME: 4:50PM – 7:50PM

REQUIRED BOOK: Income Taxation 2021 by Rex Manggawan

ASSIGNMENTS: Notebook to be collected every assignment

QUIZZES: Once before major exams (Prelims, Midterms, Finals) 3 in total

SEATWORKS: Will answer activities on the book timely

RECITATIONS: Depends on the performance of the class or individual grades

A. NATIONAL INTERNAL REVENUE CODE (NIRC)

NATIONAL INTERNAL

REVENUE CODE (NIRC)

INCOME TRANSFER BUSINESS DOCUMENTARY

EXCISE

TAXATION TAXES TAXES STAMP TAX

ESTATE - V.A.T. - more

patay na than 3M income

nagpamana (e.g.

last will)

PERCENTAGE

DONORS - TAX - less than

buhay pa 3M income

nagpamana

B. LOCAL GOVERNMENT TAXATION – yung mga amelioration, etc.

C. PREFERENTIAL TAXATION – yung may rules na may consideration sa mga mahihirap na citizens.

D. TAX REMEDIES – mga exceptions and solutions about tax payment. POV of both government and payor.

INCOME TAXATION

GENERAL ADMINISTRATIVE

PRINCIPLES OF GENERAL PRINCIPLES

OF INCOME TAXATION COMPLIANCE

TAXATION

A. INDIVIDUAL –

INCOME

Tax table gagamitin

FINAL INCOME TAX B. CORPORATE –

Fixed tax gagamitin

TAXPAYER

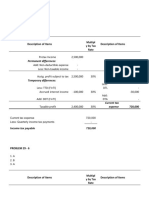

CAPITAL GAINS TAX FORMULA:

Gross Income XXX

SITUS/ Allowable Deduction

TERRITORIALITY (XXX)

REGULAR INCOME

TAX Taxable Income XXX

Tax Due XXX

Tax Credit

(XXX)

You might also like

- FNSTPB401 Student Assessment TasksDocument32 pagesFNSTPB401 Student Assessment Tasksdeathnote lNo ratings yet

- NOTES 1 - Income Tax 601 - BBA-6 SemDocument15 pagesNOTES 1 - Income Tax 601 - BBA-6 SemRajeev Kumar75% (4)

- The Essential Tax Guide - 2023 EditionDocument116 pagesThe Essential Tax Guide - 2023 Editionธนวัฒน์ ปิยะวิสุทธิกุล100% (3)

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDocument3 pagesActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNo ratings yet

- Taxation 1Document61 pagesTaxation 1lucky javellanaNo ratings yet

- Scope of TaxDocument12 pagesScope of TaxHajra MalikNo ratings yet

- Intro VatDocument26 pagesIntro VatJohn RellonNo ratings yet

- Cannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsDocument3 pagesCannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsAreel GalvanNo ratings yet

- M/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6Document1 pageM/S ABC Limited NTN: Cnic: Income Tax Computation Tax Year 20X6fergusonaf555No ratings yet

- Taxability of PartnershipDocument6 pagesTaxability of PartnershipPrincess Janine SyNo ratings yet

- CA Inter Income Tax Basic ConceptDocument16 pagesCA Inter Income Tax Basic Concepttauseefalam917No ratings yet

- General Principles of Income Taxation in The PHDocument1 pageGeneral Principles of Income Taxation in The PHJm CruzNo ratings yet

- Taxation Management: Prof. Naveed Iqbal CHDocument14 pagesTaxation Management: Prof. Naveed Iqbal CHBader ZiaNo ratings yet

- Taxation Matrix of LumberaDocument14 pagesTaxation Matrix of LumberaYannie EsparteroNo ratings yet

- Income TaxesDocument6 pagesIncome TaxesKezNo ratings yet

- Accounting For Income Tax FinDocument8 pagesAccounting For Income Tax FinAmparo ReyesNo ratings yet

- TLR-Session 5Document39 pagesTLR-Session 5borgygavinaNo ratings yet

- RMC 35-2011 IaetDocument2 pagesRMC 35-2011 IaetDyan de la FuenteNo ratings yet

- IA2 FINALS FormulaDocument8 pagesIA2 FINALS FormulaPushTheStart GamingNo ratings yet

- Problem 29 - 5: Gonzales, Aira Jaimee SDocument11 pagesProblem 29 - 5: Gonzales, Aira Jaimee SAira Jaimee GonzalesNo ratings yet

- Tax Classification Activity in ColombiaDocument2 pagesTax Classification Activity in ColombiaScribdTranslationsNo ratings yet

- Allowable DeductionsDocument17 pagesAllowable DeductionsShanelle SilmaroNo ratings yet

- Screenshot 2023-10-29 at 9.17.46 PMDocument25 pagesScreenshot 2023-10-29 at 9.17.46 PMshubhanshiphogat062000No ratings yet

- Financial Indicators (eSRE)Document2 pagesFinancial Indicators (eSRE)Florence ParcareyNo ratings yet

- Favorite Bar Exam Topics (1999-2008)Document61 pagesFavorite Bar Exam Topics (1999-2008)Lien PatrickNo ratings yet

- Explanations of Deferred Tax Principle DisclosureDocument3 pagesExplanations of Deferred Tax Principle Disclosureokuhle4002No ratings yet

- DT Marathon PDFDocument161 pagesDT Marathon PDFAbhi JoshiNo ratings yet

- Tax Bar QuestionsDocument14 pagesTax Bar QuestionsPisto PalubosNo ratings yet

- Background On Philippine Tax Rates: Provisions)Document10 pagesBackground On Philippine Tax Rates: Provisions)Anonymous VPY5t7fdLQNo ratings yet

- CSPs-Tax System of PakistanDocument45 pagesCSPs-Tax System of PakistanRida E Zainab AliNo ratings yet

- Revenue Memorandum Circular No. 016-13: February 8, 2013 February 8, 2013Document2 pagesRevenue Memorandum Circular No. 016-13: February 8, 2013 February 8, 2013Ravenclaws91No ratings yet

- Bangladesh Tax PresentationDocument34 pagesBangladesh Tax Presentationjewel59No ratings yet

- Roydz - Gls Optimum PrimeDocument2 pagesRoydz - Gls Optimum PrimeJig-Etten SaxorNo ratings yet

- Income Taxes: Practical Accounting 1 1Document2 pagesIncome Taxes: Practical Accounting 1 1Bryan ReyesNo ratings yet

- S3 BTDocument2 pagesS3 BTJaved IqbalNo ratings yet

- Tax CalculatorDocument3 pagesTax CalculatorPapun Kumar SwainNo ratings yet

- Income Tax Compliance, Schemes of Income Taxation and Final Income TaxationDocument45 pagesIncome Tax Compliance, Schemes of Income Taxation and Final Income TaxationMonica MonicaNo ratings yet

- Form-1770-Attachment I Page 1Document1 pageForm-1770-Attachment I Page 1rover2010No ratings yet

- 1701-2023-Charito P2Document1 page1701-2023-Charito P2markposadas.0831No ratings yet

- CGT Notes - AnnotatedDocument54 pagesCGT Notes - AnnotatedDr SafaNo ratings yet

- Tax Summary 2019 Ver.1Document163 pagesTax Summary 2019 Ver.1Aiko Cherrie NakamuraNo ratings yet

- SPT PPH BDN 2009 English OrtaxDocument29 pagesSPT PPH BDN 2009 English OrtaxCoba SajaNo ratings yet

- Chapter 23 IAS 12 Income TaxesDocument26 pagesChapter 23 IAS 12 Income TaxesKelvin Chu JY100% (1)

- TX-UK Career Compass Complete Guide FA2021Document244 pagesTX-UK Career Compass Complete Guide FA2021DG Mero Nepal GreatNo ratings yet

- 0 Control Sheet - Charge of Tax & 4 Key ConceptsDocument1 page0 Control Sheet - Charge of Tax & 4 Key ConceptsArman KhanNo ratings yet

- Unit 3 Spec Incl & Exempt IncomeDocument5 pagesUnit 3 Spec Incl & Exempt Incometetelomakgata1No ratings yet

- Assessments and ReassessmentsDocument31 pagesAssessments and ReassessmentsRam PrasadNo ratings yet

- Chapter 10 - Introduction To Government FinanceDocument26 pagesChapter 10 - Introduction To Government Financewatts175% (4)

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- Tax Deduction at SourceDocument59 pagesTax Deduction at Sourcepand09No ratings yet

- 1 Conceptual FrameworkDocument11 pages1 Conceptual FrameworkYong Kwang HanNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- 2023 01 01TheEssentialTaxGuide 2023editionDocument116 pages2023 01 01TheEssentialTaxGuide 2023editionroshanjoseNo ratings yet

- Advance Taxation (P6) Summary of NoteDocument31 pagesAdvance Taxation (P6) Summary of NoteYivon TeoNo ratings yet

- Performa Income StatementDocument1 pagePerforma Income StatementAhsan JamalNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3JunnetteTevesPujidaNo ratings yet

- 2307 BlankDocument2 pages2307 BlankJames Brooke PalomaNo ratings yet

- Technical Article 07 Corporate TaxDocument3 pagesTechnical Article 07 Corporate TaxTawanda Tatenda HerbertNo ratings yet

- TXVNM - Lecturer Notes 2023Document257 pagesTXVNM - Lecturer Notes 2023huyen9bbbbbNo ratings yet

- Computation of Income Tax Due and PayableDocument14 pagesComputation of Income Tax Due and Payablealia fauniNo ratings yet

- Lumbera The Tax QueenDocument29 pagesLumbera The Tax QueenKristine MagbojosNo ratings yet

- Intermediate Accounting 2Document2 pagesIntermediate Accounting 2Jemima FernandezNo ratings yet

- Chapter 1Document3 pagesChapter 1Jemima FernandezNo ratings yet

- STCM211 NotesDocument2 pagesSTCM211 NotesJemima FernandezNo ratings yet

- IA1BDocument3 pagesIA1BJemima FernandezNo ratings yet

- 2020 1040 Ramirez, Raul & Adriana Tax ReturnDocument86 pages2020 1040 Ramirez, Raul & Adriana Tax ReturnAlberto Lucio50% (2)

- LN 6.1 IHC (Unlisted, Listed & Inv. Deal.)Document21 pagesLN 6.1 IHC (Unlisted, Listed & Inv. Deal.)muhammadsbs-wb20No ratings yet

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- Apple Zena 13 Sabah 2Document1 pageApple Zena 13 Sabah 2Gh UnlockersNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (67)

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- InvoiceDocument1 pageInvoicejkjeetkr8t80% (1)

- Cfas Chapter 25Document6 pagesCfas Chapter 25Kristel FieldsNo ratings yet

- List of Expenses: Cash Flow Report Expenses - From January To AprilDocument1 pageList of Expenses: Cash Flow Report Expenses - From January To AprilYameteKudasaiNo ratings yet

- 2019 CIA P3 SIV 1E Capital Structure Capitl Budgeting Taxes and Transfer PricingDocument133 pages2019 CIA P3 SIV 1E Capital Structure Capitl Budgeting Taxes and Transfer PricingMarieJoiaNo ratings yet

- Armhyla Olivar - Module 6 ActivityDocument3 pagesArmhyla Olivar - Module 6 ActivityGrace Umbaña YangaNo ratings yet

- Taxation - Vietnam (TX - VNM) : Applied SkillsDocument16 pagesTaxation - Vietnam (TX - VNM) : Applied SkillsFive FifthNo ratings yet

- E34Document9 pagesE34Nguyen Nguyen KhoiNo ratings yet

- 1511256898711park Cubix Price Sheet 2 9 17 PDFDocument1 page1511256898711park Cubix Price Sheet 2 9 17 PDFManjunathNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalion100% (1)

- (See Rule 31 (1) (B) ) : Form No. 16ADocument38 pages(See Rule 31 (1) (B) ) : Form No. 16AsamNo ratings yet

- IRS PUB 519 US TAX GUIDE FOR ALIENS - TAX TREATIES (2018) 68 PagesDocument68 pagesIRS PUB 519 US TAX GUIDE FOR ALIENS - TAX TREATIES (2018) 68 PagesTitle IV-D Man with a planNo ratings yet

- Tutorial 9 Year End Adjustments (Q)Document4 pagesTutorial 9 Year End Adjustments (Q)lious lii0% (1)

- Provisions For Filing of Return of IncomeDocument17 pagesProvisions For Filing of Return of IncomeJoseph SalidoNo ratings yet

- Difference Between Negotiated Sale and ExpropriatiDocument3 pagesDifference Between Negotiated Sale and ExpropriatiKathleen Kaye Dial100% (1)

- CIR V Va de PrietoDocument2 pagesCIR V Va de PrietoAngela ConejeroNo ratings yet

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- Income StatementDocument3 pagesIncome StatementAlyssa Denise E. OrtezaNo ratings yet

- Bank of Baroda PPF Withdrawal Form PDFDocument1 pageBank of Baroda PPF Withdrawal Form PDFmufaddal.pittalwala51350% (2)

- Tax Estate CreditableDocument2 pagesTax Estate Creditablepatburner1108No ratings yet

- Multan Electric Power Company: Say No To CorruptionDocument2 pagesMultan Electric Power Company: Say No To Corruptionsdo sNo ratings yet