Professional Documents

Culture Documents

5th Homework CMA

5th Homework CMA

Uploaded by

Ahmed RazaCopyright:

Available Formats

You might also like

- Case 16 Answers - Hospital Supply IncDocument14 pagesCase 16 Answers - Hospital Supply IncRaul Carrera, Jr.100% (3)

- FINMAN Decision AnalysisDocument5 pagesFINMAN Decision AnalysisTrish GarridoNo ratings yet

- CIBN SyllabusDocument170 pagesCIBN Syllabusdamola2real100% (1)

- Business English 2 PDFDocument134 pagesBusiness English 2 PDFRobert Saunders83% (6)

- Finance Interview QuestionsDocument12 pagesFinance Interview QuestionsMD RehanNo ratings yet

- Case Bill FrenchDocument3 pagesCase Bill FrenchROSHAN KUMAR SAHOONo ratings yet

- Depreciation AnswersDocument13 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (2)

- Csit321 Project Requirements v2Document15 pagesCsit321 Project Requirements v2api-544270691No ratings yet

- Special Decision Making HandoutDocument8 pagesSpecial Decision Making Handoutrashinisanchalani20No ratings yet

- Solved Problems: OlutionDocument9 pagesSolved Problems: OlutionSweta PandeyNo ratings yet

- Solved Prblem of Budget PDFDocument9 pagesSolved Prblem of Budget PDFSweta PandeyNo ratings yet

- Marginal Costing - Module 3: Learning ObjectivesDocument111 pagesMarginal Costing - Module 3: Learning Objectives727822TPMB005 ARAVINTHAN.SNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- Unit - 5-1Document12 pagesUnit - 5-1MOHAIDEEN THARIQ MNo ratings yet

- AR Management WorkbookDocument7 pagesAR Management WorkbookyukiNo ratings yet

- Turnover - 8 Turnover - 10 BenefitsDocument7 pagesTurnover - 8 Turnover - 10 BenefitsJoshua CabinasNo ratings yet

- AR ManagementDocument7 pagesAR ManagementJoshua CabinasNo ratings yet

- Formula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductDocument6 pagesFormula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductChris MarasiganNo ratings yet

- Unit 7 Budgeting SolutionsDocument15 pagesUnit 7 Budgeting SolutionsYogesh BandiNo ratings yet

- Deltron Company's Break Even Analysis Particulars Amount: PV RatioDocument7 pagesDeltron Company's Break Even Analysis Particulars Amount: PV RatiorajyalakshmiNo ratings yet

- Total Variable Cost/unit Existing Selling Price/unit PV RatioDocument4 pagesTotal Variable Cost/unit Existing Selling Price/unit PV RatioMullapudi TejaNo ratings yet

- 8th Homework CMADocument3 pages8th Homework CMAAhmed RazaNo ratings yet

- 3271010Document4 pages3271010mohitgaba19No ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisDwain pinakapogiNo ratings yet

- Problem Set 5: Capital StructureDocument3 pagesProblem Set 5: Capital StructureGautam PatilNo ratings yet

- Matrix CosmeticDocument2 pagesMatrix Cosmeticyimin liuNo ratings yet

- Reg. No.: Q.P. Code: (07 DMB 03)Document3 pagesReg. No.: Q.P. Code: (07 DMB 03)umamaheswari palanisamyNo ratings yet

- Personal ProfileDocument13 pagesPersonal ProfileKristine Lei Del MundoNo ratings yet

- Multi Product Break Even Analysis - Excel Tutorials - Subscribe Excel A-Z...Document2 pagesMulti Product Break Even Analysis - Excel Tutorials - Subscribe Excel A-Z...sharjeelraja876No ratings yet

- Equity Valuation Assignment Chapter 7Document7 pagesEquity Valuation Assignment Chapter 7mehandiNo ratings yet

- Quiz 2Document2 pagesQuiz 2imagineimfNo ratings yet

- Reg No: 189282J Y.A.P.M Yahampath: Calculation of RevenueDocument2 pagesReg No: 189282J Y.A.P.M Yahampath: Calculation of Revenuece badullaNo ratings yet

- C - 2021MBA160 - Case ScenariosRBCDocument7 pagesC - 2021MBA160 - Case ScenariosRBCmohammedsuhaim abdul gafoorNo ratings yet

- BUSINESS PLAN 2009-2011 LOTHO HK (Sunglasses Brand)Document8 pagesBUSINESS PLAN 2009-2011 LOTHO HK (Sunglasses Brand)Sebastien MorinNo ratings yet

- Bill French Google Docs Group 5Document7 pagesBill French Google Docs Group 5Jay Florence DalucanogNo ratings yet

- Yuvraj Patil Section B 2010PGP435 Case: Bill French Mac IiDocument4 pagesYuvraj Patil Section B 2010PGP435 Case: Bill French Mac Iiyuveesp5207No ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- Quiz 2 Costing 23 AprilDocument2 pagesQuiz 2 Costing 23 Aprilfarsi786No ratings yet

- Budgetory Control ContinuedDocument4 pagesBudgetory Control ContinuedFalak Falak fatimaNo ratings yet

- Product Mix - 50% For Large and 50% For MediumDocument2 pagesProduct Mix - 50% For Large and 50% For Mediumemem buezaNo ratings yet

- Cost Volume Profit Analysis - Part II v.2Document8 pagesCost Volume Profit Analysis - Part II v.2Rameir Angelo CatamoraNo ratings yet

- Depreciation AnswersDocument22 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (1)

- CA Lecture 2022Document25 pagesCA Lecture 2022Kristine Lei Del MundoNo ratings yet

- Coffee Shop 3 Statement Model SolvedDocument27 pagesCoffee Shop 3 Statement Model SolvedDEV DUTT VASHIST 22111116No ratings yet

- Management Accounting: Group 5Document9 pagesManagement Accounting: Group 5YATIN BAJAJNo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- 9th Homework MFADocument2 pages9th Homework MFAAhmed RazaNo ratings yet

- 4 - Shrayan SarkarDocument6 pages4 - Shrayan SarkarKunal DagaNo ratings yet

- Materi Untuk Tugas Topik 2Document11 pagesMateri Untuk Tugas Topik 2Violen AmeliaNo ratings yet

- Cost-Volume-Profit Relationships1Document52 pagesCost-Volume-Profit Relationships1Kamrul Huda100% (1)

- Internal Teston ProfitabilityDocument1 pageInternal Teston Profitabilityapi-3820619No ratings yet

- 7th Homework CMADocument3 pages7th Homework CMAAhmed RazaNo ratings yet

- Apartment Excel AnalysisDocument234 pagesApartment Excel AnalysisCeline TeeNo ratings yet

- Hilton 11e Chap007PPT-STUDocument52 pagesHilton 11e Chap007PPT-STUNgọc ĐỗNo ratings yet

- Main Assumptions: Chapter 5: Financial PlanDocument5 pagesMain Assumptions: Chapter 5: Financial PlanValeria Quispe ToribioNo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Cost-Volume-Profit Analysis: Mcgraw-Hill/IrwinDocument78 pagesCost-Volume-Profit Analysis: Mcgraw-Hill/IrwinSheila Jane Maderse AbraganNo ratings yet

- Hilton 11e Chap007PPTDocument53 pagesHilton 11e Chap007PPTNgô Khánh HòaNo ratings yet

- Book 1Document35 pagesBook 1Tarun BohraNo ratings yet

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- 8th Homework CMADocument3 pages8th Homework CMAAhmed RazaNo ratings yet

- All 9 Homeworks MFADocument18 pagesAll 9 Homeworks MFAAhmed RazaNo ratings yet

- 8th Homework FAR 1Document3 pages8th Homework FAR 1Ahmed RazaNo ratings yet

- 7th Homework FAR 1Document2 pages7th Homework FAR 1Ahmed RazaNo ratings yet

- 6th Homework FAR 1Document1 page6th Homework FAR 1Ahmed RazaNo ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- 8th Homework MFADocument3 pages8th Homework MFAAhmed RazaNo ratings yet

- 7th Homework MFADocument2 pages7th Homework MFAAhmed RazaNo ratings yet

- 9th Homework FAR 1Document1 page9th Homework FAR 1Ahmed RazaNo ratings yet

- 9th Homework MFADocument2 pages9th Homework MFAAhmed RazaNo ratings yet

- 9th Homework CMADocument2 pages9th Homework CMAAhmed RazaNo ratings yet

- Net Assets Valuation BasisDocument2 pagesNet Assets Valuation BasisAhmed RazaNo ratings yet

- 6th Homework MFADocument2 pages6th Homework MFAAhmed RazaNo ratings yet

- Preliminary Checklist: No Name Position Email Phone/MobileDocument4 pagesPreliminary Checklist: No Name Position Email Phone/MobileherfianNo ratings yet

- TAF - 2017 - ValuationAdvisory-3 - 10 - FINAL (Highlight)Document62 pagesTAF - 2017 - ValuationAdvisory-3 - 10 - FINAL (Highlight)HC ChanNo ratings yet

- A Study On Fringe Benefits Provided by The Salem Co-Operative Sugar Mills LTD., MohanurDocument68 pagesA Study On Fringe Benefits Provided by The Salem Co-Operative Sugar Mills LTD., MohanurParthiban Ak88% (8)

- Performance Management and Reward Systems1Document449 pagesPerformance Management and Reward Systems1Shikhar MehtaNo ratings yet

- Employment Agreement - RelieverDocument2 pagesEmployment Agreement - RelievernuguidedralynNo ratings yet

- Case Study Analysis of Nike and GoogleDocument37 pagesCase Study Analysis of Nike and GoogleThanh VoNo ratings yet

- Canada's Billion-Dollar FirmsDocument123 pagesCanada's Billion-Dollar FirmspkGlobalNo ratings yet

- Proton MM CombinedDocument42 pagesProton MM CombinedaquistarNo ratings yet

- Comprehensive Problem Master BudgetDocument1 pageComprehensive Problem Master BudgethdejnNo ratings yet

- OM Chapter 2 Lecture Note Final 1Document9 pagesOM Chapter 2 Lecture Note Final 1Jiru AlemayehuNo ratings yet

- Powerpoint Siomai PizzazzDocument10 pagesPowerpoint Siomai PizzazzKenneth SunicoNo ratings yet

- E Commerce Report 2Document72 pagesE Commerce Report 2BANANI DASNo ratings yet

- Best Practices For Managing Information SecurityDocument22 pagesBest Practices For Managing Information SecurityNikhil AggarwalNo ratings yet

- Backflush CostingDocument45 pagesBackflush CostingKIROJOHNo ratings yet

- Stakeholder Interview TemplateDocument2 pagesStakeholder Interview Templatewenli suNo ratings yet

- Negotiable Instruments Law Finals ReviewerDocument17 pagesNegotiable Instruments Law Finals ReviewerKaren Gina100% (2)

- Airport Management As A CareerDocument2 pagesAirport Management As A Careerthang du kimNo ratings yet

- Sma PDFDocument22 pagesSma PDFivanNo ratings yet

- Revenue Models For Social-Networking SitesDocument40 pagesRevenue Models For Social-Networking Sitesmariyam_amreen100% (1)

- A Research Project Report On Retail Banking Serivices at Axis BankDocument75 pagesA Research Project Report On Retail Banking Serivices at Axis BankRohitNo ratings yet

- Peran Pelaku Tataniaga Dalam Meningkatkan Aksesibilitas Pasokan Beras Di Kabupaten LandakDocument12 pagesPeran Pelaku Tataniaga Dalam Meningkatkan Aksesibilitas Pasokan Beras Di Kabupaten LandakIndahNo ratings yet

- Fraud Examination 3rd Edition Albrecht Test BankDocument14 pagesFraud Examination 3rd Edition Albrecht Test Bankjoshuacoxxqwdmpjfkb100% (13)

- Celia Boukhamla-9Document1 pageCelia Boukhamla-9api-494752333No ratings yet

- Introduction EBayDocument3 pagesIntroduction EBayIqra TanveerNo ratings yet

- FCCB (Assignment)Document10 pagesFCCB (Assignment)loveaute15No ratings yet

- Inital Flow Management Productivity ProcedureDocument4 pagesInital Flow Management Productivity Procedureshaggyrahul100% (3)

5th Homework CMA

5th Homework CMA

Uploaded by

Ahmed RazaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5th Homework CMA

5th Homework CMA

Uploaded by

Ahmed RazaCopyright:

Available Formats

Question

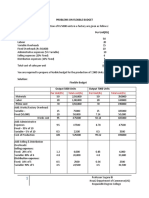

Suleman Limited produces three products. Details are as under:

A B C

Selling Price 140 80 210

Variable Cost 70 44 147

Expected sales 12,500 17,500 10,000

Annual fixed costs per anum are expected to be Rs 1,110,200.

Required

calculate break even in Units and in Rs

Solution

A B C

Selling Price 140 80 210

Variable Cost per unit (70) (44) (147)

CM per unit 70 36 63

CM Ratio 50.00% 45.00% 30.00%

Ratio in Units 12.50 17.50 10.00

Ratio in Rs 1,750 1,400 2,100

Break Even in Units

CM of a Comp Unit 875 630 630 2,135

Fixed Cost 1,110,200

Composites (Break-Even) 520

Units in a comp Total Units

A 12.50 6,500 12.5x520

B 17.50 9,100 17.5x520

C 10.00 5,200 10.0x520

Break Even in Rupees

CM of a Comp Unit 875 630 630 2,135

(1750x50%) (1,400x45%) (2,100x30%)

Total Sales in a composit (Rs) (1,750+1,400+2,100) 5,250

Weighted average CM Ratio for the company (2,135/5250) 40.667%

Fixed Cost 1,110,200

Break even in Rupees 2,730,000

Ratio in Rupees Rupees to BE

A 1,750.00 910,000 2.73x1750/5250

B 1,400.00 728,000 2.73x1400/5250

C 2,100.00 1,092,000 2.73x2100/5250

5,250.00 2,730,000

Question 2

Following is the budgeted sales of 3 products of Jamal and copmany:

X Y Z Total

Sales (Rs) 5,100,000 6,750,000 3,150,000 15,000,000

Variable Cost 2,320,500 3,543,750 1,496,250 7,360,500

Annual Fixed Cost 5,831,485

Required

Calculate break even point in Rs.

Total Sales 15,000,000

Total Variable Cost (7,360,500)

Total CM in Rupees 7,639,500

CM Ratio for the company 50.93%

Annual Fixed Cost 5,831,485

Break Even in Rupees 11,450,000

Breakup

A B C

Ratio 34.00% 45.00% 21.00% (Sales/Total Sales)

BE Sales in Rupees 3,893,000 5,152,500 2,404,500 11,450,000

You might also like

- Case 16 Answers - Hospital Supply IncDocument14 pagesCase 16 Answers - Hospital Supply IncRaul Carrera, Jr.100% (3)

- FINMAN Decision AnalysisDocument5 pagesFINMAN Decision AnalysisTrish GarridoNo ratings yet

- CIBN SyllabusDocument170 pagesCIBN Syllabusdamola2real100% (1)

- Business English 2 PDFDocument134 pagesBusiness English 2 PDFRobert Saunders83% (6)

- Finance Interview QuestionsDocument12 pagesFinance Interview QuestionsMD RehanNo ratings yet

- Case Bill FrenchDocument3 pagesCase Bill FrenchROSHAN KUMAR SAHOONo ratings yet

- Depreciation AnswersDocument13 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (2)

- Csit321 Project Requirements v2Document15 pagesCsit321 Project Requirements v2api-544270691No ratings yet

- Special Decision Making HandoutDocument8 pagesSpecial Decision Making Handoutrashinisanchalani20No ratings yet

- Solved Problems: OlutionDocument9 pagesSolved Problems: OlutionSweta PandeyNo ratings yet

- Solved Prblem of Budget PDFDocument9 pagesSolved Prblem of Budget PDFSweta PandeyNo ratings yet

- Marginal Costing - Module 3: Learning ObjectivesDocument111 pagesMarginal Costing - Module 3: Learning Objectives727822TPMB005 ARAVINTHAN.SNo ratings yet

- Costing CaseDocument6 pagesCosting CasenguyenthingocmaimkNo ratings yet

- Unit - 5-1Document12 pagesUnit - 5-1MOHAIDEEN THARIQ MNo ratings yet

- AR Management WorkbookDocument7 pagesAR Management WorkbookyukiNo ratings yet

- Turnover - 8 Turnover - 10 BenefitsDocument7 pagesTurnover - 8 Turnover - 10 BenefitsJoshua CabinasNo ratings yet

- AR ManagementDocument7 pagesAR ManagementJoshua CabinasNo ratings yet

- Formula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductDocument6 pagesFormula: (Individual Sales/total Sales) No of Sales in Units. No of Sales in Unit Per ProductChris MarasiganNo ratings yet

- Unit 7 Budgeting SolutionsDocument15 pagesUnit 7 Budgeting SolutionsYogesh BandiNo ratings yet

- Deltron Company's Break Even Analysis Particulars Amount: PV RatioDocument7 pagesDeltron Company's Break Even Analysis Particulars Amount: PV RatiorajyalakshmiNo ratings yet

- Total Variable Cost/unit Existing Selling Price/unit PV RatioDocument4 pagesTotal Variable Cost/unit Existing Selling Price/unit PV RatioMullapudi TejaNo ratings yet

- 8th Homework CMADocument3 pages8th Homework CMAAhmed RazaNo ratings yet

- 3271010Document4 pages3271010mohitgaba19No ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisDwain pinakapogiNo ratings yet

- Problem Set 5: Capital StructureDocument3 pagesProblem Set 5: Capital StructureGautam PatilNo ratings yet

- Matrix CosmeticDocument2 pagesMatrix Cosmeticyimin liuNo ratings yet

- Reg. No.: Q.P. Code: (07 DMB 03)Document3 pagesReg. No.: Q.P. Code: (07 DMB 03)umamaheswari palanisamyNo ratings yet

- Personal ProfileDocument13 pagesPersonal ProfileKristine Lei Del MundoNo ratings yet

- Multi Product Break Even Analysis - Excel Tutorials - Subscribe Excel A-Z...Document2 pagesMulti Product Break Even Analysis - Excel Tutorials - Subscribe Excel A-Z...sharjeelraja876No ratings yet

- Equity Valuation Assignment Chapter 7Document7 pagesEquity Valuation Assignment Chapter 7mehandiNo ratings yet

- Quiz 2Document2 pagesQuiz 2imagineimfNo ratings yet

- Reg No: 189282J Y.A.P.M Yahampath: Calculation of RevenueDocument2 pagesReg No: 189282J Y.A.P.M Yahampath: Calculation of Revenuece badullaNo ratings yet

- C - 2021MBA160 - Case ScenariosRBCDocument7 pagesC - 2021MBA160 - Case ScenariosRBCmohammedsuhaim abdul gafoorNo ratings yet

- BUSINESS PLAN 2009-2011 LOTHO HK (Sunglasses Brand)Document8 pagesBUSINESS PLAN 2009-2011 LOTHO HK (Sunglasses Brand)Sebastien MorinNo ratings yet

- Bill French Google Docs Group 5Document7 pagesBill French Google Docs Group 5Jay Florence DalucanogNo ratings yet

- Yuvraj Patil Section B 2010PGP435 Case: Bill French Mac IiDocument4 pagesYuvraj Patil Section B 2010PGP435 Case: Bill French Mac Iiyuveesp5207No ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- Quiz 2 Costing 23 AprilDocument2 pagesQuiz 2 Costing 23 Aprilfarsi786No ratings yet

- Budgetory Control ContinuedDocument4 pagesBudgetory Control ContinuedFalak Falak fatimaNo ratings yet

- Product Mix - 50% For Large and 50% For MediumDocument2 pagesProduct Mix - 50% For Large and 50% For Mediumemem buezaNo ratings yet

- Cost Volume Profit Analysis - Part II v.2Document8 pagesCost Volume Profit Analysis - Part II v.2Rameir Angelo CatamoraNo ratings yet

- Depreciation AnswersDocument22 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (1)

- CA Lecture 2022Document25 pagesCA Lecture 2022Kristine Lei Del MundoNo ratings yet

- Coffee Shop 3 Statement Model SolvedDocument27 pagesCoffee Shop 3 Statement Model SolvedDEV DUTT VASHIST 22111116No ratings yet

- Management Accounting: Group 5Document9 pagesManagement Accounting: Group 5YATIN BAJAJNo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- 9th Homework MFADocument2 pages9th Homework MFAAhmed RazaNo ratings yet

- 4 - Shrayan SarkarDocument6 pages4 - Shrayan SarkarKunal DagaNo ratings yet

- Materi Untuk Tugas Topik 2Document11 pagesMateri Untuk Tugas Topik 2Violen AmeliaNo ratings yet

- Cost-Volume-Profit Relationships1Document52 pagesCost-Volume-Profit Relationships1Kamrul Huda100% (1)

- Internal Teston ProfitabilityDocument1 pageInternal Teston Profitabilityapi-3820619No ratings yet

- 7th Homework CMADocument3 pages7th Homework CMAAhmed RazaNo ratings yet

- Apartment Excel AnalysisDocument234 pagesApartment Excel AnalysisCeline TeeNo ratings yet

- Hilton 11e Chap007PPT-STUDocument52 pagesHilton 11e Chap007PPT-STUNgọc ĐỗNo ratings yet

- Main Assumptions: Chapter 5: Financial PlanDocument5 pagesMain Assumptions: Chapter 5: Financial PlanValeria Quispe ToribioNo ratings yet

- Flexible Budget: ProblemsDocument3 pagesFlexible Budget: ProblemsRenu PoddarNo ratings yet

- Cost-Volume-Profit Analysis: Mcgraw-Hill/IrwinDocument78 pagesCost-Volume-Profit Analysis: Mcgraw-Hill/IrwinSheila Jane Maderse AbraganNo ratings yet

- Hilton 11e Chap007PPTDocument53 pagesHilton 11e Chap007PPTNgô Khánh HòaNo ratings yet

- Book 1Document35 pagesBook 1Tarun BohraNo ratings yet

- 3 Departmental AccountsDocument13 pages3 Departmental AccountsJayesh VyasNo ratings yet

- Ch8 PDFDocument11 pagesCh8 PDFGiang NguyenNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- 8th Homework CMADocument3 pages8th Homework CMAAhmed RazaNo ratings yet

- All 9 Homeworks MFADocument18 pagesAll 9 Homeworks MFAAhmed RazaNo ratings yet

- 8th Homework FAR 1Document3 pages8th Homework FAR 1Ahmed RazaNo ratings yet

- 7th Homework FAR 1Document2 pages7th Homework FAR 1Ahmed RazaNo ratings yet

- 6th Homework FAR 1Document1 page6th Homework FAR 1Ahmed RazaNo ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- 8th Homework MFADocument3 pages8th Homework MFAAhmed RazaNo ratings yet

- 7th Homework MFADocument2 pages7th Homework MFAAhmed RazaNo ratings yet

- 9th Homework FAR 1Document1 page9th Homework FAR 1Ahmed RazaNo ratings yet

- 9th Homework MFADocument2 pages9th Homework MFAAhmed RazaNo ratings yet

- 9th Homework CMADocument2 pages9th Homework CMAAhmed RazaNo ratings yet

- Net Assets Valuation BasisDocument2 pagesNet Assets Valuation BasisAhmed RazaNo ratings yet

- 6th Homework MFADocument2 pages6th Homework MFAAhmed RazaNo ratings yet

- Preliminary Checklist: No Name Position Email Phone/MobileDocument4 pagesPreliminary Checklist: No Name Position Email Phone/MobileherfianNo ratings yet

- TAF - 2017 - ValuationAdvisory-3 - 10 - FINAL (Highlight)Document62 pagesTAF - 2017 - ValuationAdvisory-3 - 10 - FINAL (Highlight)HC ChanNo ratings yet

- A Study On Fringe Benefits Provided by The Salem Co-Operative Sugar Mills LTD., MohanurDocument68 pagesA Study On Fringe Benefits Provided by The Salem Co-Operative Sugar Mills LTD., MohanurParthiban Ak88% (8)

- Performance Management and Reward Systems1Document449 pagesPerformance Management and Reward Systems1Shikhar MehtaNo ratings yet

- Employment Agreement - RelieverDocument2 pagesEmployment Agreement - RelievernuguidedralynNo ratings yet

- Case Study Analysis of Nike and GoogleDocument37 pagesCase Study Analysis of Nike and GoogleThanh VoNo ratings yet

- Canada's Billion-Dollar FirmsDocument123 pagesCanada's Billion-Dollar FirmspkGlobalNo ratings yet

- Proton MM CombinedDocument42 pagesProton MM CombinedaquistarNo ratings yet

- Comprehensive Problem Master BudgetDocument1 pageComprehensive Problem Master BudgethdejnNo ratings yet

- OM Chapter 2 Lecture Note Final 1Document9 pagesOM Chapter 2 Lecture Note Final 1Jiru AlemayehuNo ratings yet

- Powerpoint Siomai PizzazzDocument10 pagesPowerpoint Siomai PizzazzKenneth SunicoNo ratings yet

- E Commerce Report 2Document72 pagesE Commerce Report 2BANANI DASNo ratings yet

- Best Practices For Managing Information SecurityDocument22 pagesBest Practices For Managing Information SecurityNikhil AggarwalNo ratings yet

- Backflush CostingDocument45 pagesBackflush CostingKIROJOHNo ratings yet

- Stakeholder Interview TemplateDocument2 pagesStakeholder Interview Templatewenli suNo ratings yet

- Negotiable Instruments Law Finals ReviewerDocument17 pagesNegotiable Instruments Law Finals ReviewerKaren Gina100% (2)

- Airport Management As A CareerDocument2 pagesAirport Management As A Careerthang du kimNo ratings yet

- Sma PDFDocument22 pagesSma PDFivanNo ratings yet

- Revenue Models For Social-Networking SitesDocument40 pagesRevenue Models For Social-Networking Sitesmariyam_amreen100% (1)

- A Research Project Report On Retail Banking Serivices at Axis BankDocument75 pagesA Research Project Report On Retail Banking Serivices at Axis BankRohitNo ratings yet

- Peran Pelaku Tataniaga Dalam Meningkatkan Aksesibilitas Pasokan Beras Di Kabupaten LandakDocument12 pagesPeran Pelaku Tataniaga Dalam Meningkatkan Aksesibilitas Pasokan Beras Di Kabupaten LandakIndahNo ratings yet

- Fraud Examination 3rd Edition Albrecht Test BankDocument14 pagesFraud Examination 3rd Edition Albrecht Test Bankjoshuacoxxqwdmpjfkb100% (13)

- Celia Boukhamla-9Document1 pageCelia Boukhamla-9api-494752333No ratings yet

- Introduction EBayDocument3 pagesIntroduction EBayIqra TanveerNo ratings yet

- FCCB (Assignment)Document10 pagesFCCB (Assignment)loveaute15No ratings yet

- Inital Flow Management Productivity ProcedureDocument4 pagesInital Flow Management Productivity Procedureshaggyrahul100% (3)