Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsBE 10 B SEBI

BE 10 B SEBI

Uploaded by

Anmol HuriyaThe Securities and Exchange Board of India (SEBI) regulates the securities and commodity markets in India. It was established in 1988 and given statutory powers in 1992 through the SEBI Act. SEBI has three main powers - quasi-legislative, quasi-judicial, and quasi-executive. It drafts regulations, conducts investigations and enforcement actions, and passes rulings and orders. SEBI is responsible for protecting investors, promoting development of the securities market, and regulating market intermediaries like brokers and sub-brokers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Project Report On SEBIDocument26 pagesProject Report On SEBIRahul Pillai56% (36)

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar88% (17)

- Sebi Sensex Nifty Bse NseDocument47 pagesSebi Sensex Nifty Bse NseKushal WaliaNo ratings yet

- SEBIDocument4 pagesSEBINMRaycNo ratings yet

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriNo ratings yet

- Securities and Exchange Board of India (SEBI)Document10 pagesSecurities and Exchange Board of India (SEBI)Utkarsh SethiNo ratings yet

- Securities and Exchange Board of IndiaDocument21 pagesSecurities and Exchange Board of IndiaDeepa A PoojaryNo ratings yet

- SEBIDocument2 pagesSEBIDhananjay VermaNo ratings yet

- Functions and Responsibilities: PowersDocument2 pagesFunctions and Responsibilities: PowersaefaefNo ratings yet

- SebiDocument18 pagesSebiSandeep Galipelli50% (2)

- INTRODUCTIONDocument48 pagesINTRODUCTIONtanisq10100% (2)

- Chapter 2Document3 pagesChapter 2cvb cgbNo ratings yet

- Sebi Main ProjectDocument36 pagesSebi Main ProjectMinal DalviNo ratings yet

- Securities and Exchange Board of IndiaDocument13 pagesSecurities and Exchange Board of Indiasonal jainNo ratings yet

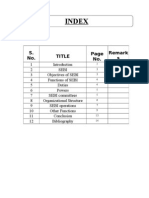

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaNo ratings yet

- SEBI PPT III BADocument15 pagesSEBI PPT III BAKeerthi RajeshNo ratings yet

- SEBIDocument2 pagesSEBIAkash ShrivastavaNo ratings yet

- Sebi Functional ReportDocument7 pagesSebi Functional ReportRohan Pawar61% (18)

- Sebi & RbiDocument35 pagesSebi & Rbibhaviniparmar100% (7)

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Business Environment - 5Document10 pagesBusiness Environment - 5phanisantoshNo ratings yet

- Sebi'S Background: Securities and Exchange Board of IndiaDocument15 pagesSebi'S Background: Securities and Exchange Board of IndiaAnjaliNo ratings yet

- Name-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)Document6 pagesName-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)MechiluhoNo ratings yet

- Securities and Exchange Board of IndiaDocument10 pagesSecurities and Exchange Board of IndiajaseelekaNo ratings yet

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaNo ratings yet

- SebiDocument26 pagesSebikhilchiadilNo ratings yet

- SEBI - The Securities and Exchange Board of IndiaDocument35 pagesSEBI - The Securities and Exchange Board of IndiaRohan FodnaikNo ratings yet

- Mfsi Unit 4 FinalDocument15 pagesMfsi Unit 4 Finalsauravnagpal309No ratings yet

- SEBI - Introduction: The Basic Objectives of The Board Were Identified AsDocument5 pagesSEBI - Introduction: The Basic Objectives of The Board Were Identified AsSenthilKumar SubramanianNo ratings yet

- Securities and Exchange Board of IndiaDocument5 pagesSecurities and Exchange Board of IndiaKanna RajeshNo ratings yet

- Project Name: Securities and Exchange Board of India (Sebi)Document24 pagesProject Name: Securities and Exchange Board of India (Sebi)Ronak DalmiaNo ratings yet

- Financial Regulatory Bodies in India: Market ParticipantsDocument8 pagesFinancial Regulatory Bodies in India: Market ParticipantsAnonymous aAMqLLNo ratings yet

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- Introductio 1Document2 pagesIntroductio 1Anil ShelarNo ratings yet

- SEBIDocument3 pagesSEBILion Naresh PradhanNo ratings yet

- CLASS - 1 Introduction of SEBIDocument7 pagesCLASS - 1 Introduction of SEBIPawas SinghNo ratings yet

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalNo ratings yet

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanNo ratings yet

- Role of SebiDocument3 pagesRole of SebiAnkush PoojaryNo ratings yet

- SebiDocument26 pagesSebiHitesh MendirattaNo ratings yet

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Document6 pagesSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaNo ratings yet

- Investment Law PresentationDocument11 pagesInvestment Law PresentationNanda SurajNo ratings yet

- Securities and Exchange Board of India PDFDocument18 pagesSecurities and Exchange Board of India PDFShifa RasheedNo ratings yet

- Securities and Exchange Board of IndiaDocument32 pagesSecurities and Exchange Board of IndiaMohan kashyapNo ratings yet

- Securities and Exchange Board of India: SEBI - A Brief IntroductionDocument37 pagesSecurities and Exchange Board of India: SEBI - A Brief IntroductionBhushan KharatNo ratings yet

- Internal Backlog Company Law Role of Sebi in Stock ExchangeDocument9 pagesInternal Backlog Company Law Role of Sebi in Stock ExchangeApoorv SrivastavaNo ratings yet

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalNo ratings yet

- Role of Sebi in Regulating Capital Market in IndiaDocument7 pagesRole of Sebi in Regulating Capital Market in IndiaSunil KumarNo ratings yet

- Corporate Governance: Discuss The Role of Market Regulators in Corporate Governance. Sebi Irda RBI FemaDocument9 pagesCorporate Governance: Discuss The Role of Market Regulators in Corporate Governance. Sebi Irda RBI FemaISMR PlacementsNo ratings yet

- National Stock of IndiaDocument18 pagesNational Stock of IndiaVipin KapoorNo ratings yet

- Executive SummaryDocument35 pagesExecutive SummaryAmit PasiNo ratings yet

- Financial ServicesDocument14 pagesFinancial ServicesChaitanya NandaNo ratings yet

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanNo ratings yet

- Role of S.E.B.I. As A Regulatory Authority: AbhinavDocument5 pagesRole of S.E.B.I. As A Regulatory Authority: AbhinavRahul JagwaniNo ratings yet

- Corporate Law-Ii Important QuestionsDocument26 pagesCorporate Law-Ii Important QuestionsNishaath ShareefNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- BE 3 (Individual Ethics & Groups - China Etc)Document6 pagesBE 3 (Individual Ethics & Groups - China Etc)Anmol HuriyaNo ratings yet

- Business EthicsDocument8 pagesBusiness EthicsAnmol HuriyaNo ratings yet

- BE 4 (Work Ethics)Document2 pagesBE 4 (Work Ethics)Anmol HuriyaNo ratings yet

- BE 9 Ethical Issues For EnvironmentDocument5 pagesBE 9 Ethical Issues For EnvironmentAnmol HuriyaNo ratings yet

BE 10 B SEBI

BE 10 B SEBI

Uploaded by

Anmol Huriya0 ratings0% found this document useful (0 votes)

9 views1 pageThe Securities and Exchange Board of India (SEBI) regulates the securities and commodity markets in India. It was established in 1988 and given statutory powers in 1992 through the SEBI Act. SEBI has three main powers - quasi-legislative, quasi-judicial, and quasi-executive. It drafts regulations, conducts investigations and enforcement actions, and passes rulings and orders. SEBI is responsible for protecting investors, promoting development of the securities market, and regulating market intermediaries like brokers and sub-brokers.

Original Description:

Pgdm material

Original Title

BE 10 b SEBI

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Securities and Exchange Board of India (SEBI) regulates the securities and commodity markets in India. It was established in 1988 and given statutory powers in 1992 through the SEBI Act. SEBI has three main powers - quasi-legislative, quasi-judicial, and quasi-executive. It drafts regulations, conducts investigations and enforcement actions, and passes rulings and orders. SEBI is responsible for protecting investors, promoting development of the securities market, and regulating market intermediaries like brokers and sub-brokers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageBE 10 B SEBI

BE 10 B SEBI

Uploaded by

Anmol HuriyaThe Securities and Exchange Board of India (SEBI) regulates the securities and commodity markets in India. It was established in 1988 and given statutory powers in 1992 through the SEBI Act. SEBI has three main powers - quasi-legislative, quasi-judicial, and quasi-executive. It drafts regulations, conducts investigations and enforcement actions, and passes rulings and orders. SEBI is responsible for protecting investors, promoting development of the securities market, and regulating market intermediaries like brokers and sub-brokers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

SEBI (BE 11)

The Securities and Exchange Board of India (SEBI) is the regulator of

the securities and commodity market in India owned by the Government of India. It was

established on 12 April 1988 and given Statutory Powers on 30 January 1992 through

the SEBI Act, 1992.[1]

Functions and Responsibilities

The Preamble of the Securities and Exchange Board of India describes the basic

functions of the Securities and Exchange Board of India as "...to protect the interests of

investors in securities and to promote the development of, and to regulate the securities

market and for matters connected there with or incidental there to".

SEBI has to be responsive to the needs of three groups, which constitute the market:

(i) Issuers of securities

(ii) Investors

(iii) Market intermediaries

SEBI has three powers: quasi-legislative, quasi-judicial and quasi-executive.

(i) It drafts regulations in its legislative capacity

(ii) It conducts investigation and enforcement action in its executive function and

(iii) It passes rulings and orders in its judicial capacity..

Note: SEBI has taken a very proactive role in streamlining disclosure requirements to

international standards.

Functions

For the discharge of its functions efficiently, SEBI has been vested with the following

powers:

Approval by−laws of Securities exchanges.

Amendment of By-laws of Securities exchanges (whenever required) to amend their

by−laws.

Inspection of the books of accounts and call for periodical returns from recognized

Securities exchanges.

Inspection of the books of accounts of financial intermediaries.

Compelling certain companies to list their shares in one or more Securities

exchanges (if considered necessary )

Registration of Brokers and sub-brokers

BE (SDG) Page 1

You might also like

- Project Report On SEBIDocument26 pagesProject Report On SEBIRahul Pillai56% (36)

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar88% (17)

- Sebi Sensex Nifty Bse NseDocument47 pagesSebi Sensex Nifty Bse NseKushal WaliaNo ratings yet

- SEBIDocument4 pagesSEBINMRaycNo ratings yet

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriNo ratings yet

- Securities and Exchange Board of India (SEBI)Document10 pagesSecurities and Exchange Board of India (SEBI)Utkarsh SethiNo ratings yet

- Securities and Exchange Board of IndiaDocument21 pagesSecurities and Exchange Board of IndiaDeepa A PoojaryNo ratings yet

- SEBIDocument2 pagesSEBIDhananjay VermaNo ratings yet

- Functions and Responsibilities: PowersDocument2 pagesFunctions and Responsibilities: PowersaefaefNo ratings yet

- SebiDocument18 pagesSebiSandeep Galipelli50% (2)

- INTRODUCTIONDocument48 pagesINTRODUCTIONtanisq10100% (2)

- Chapter 2Document3 pagesChapter 2cvb cgbNo ratings yet

- Sebi Main ProjectDocument36 pagesSebi Main ProjectMinal DalviNo ratings yet

- Securities and Exchange Board of IndiaDocument13 pagesSecurities and Exchange Board of Indiasonal jainNo ratings yet

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaNo ratings yet

- SEBI PPT III BADocument15 pagesSEBI PPT III BAKeerthi RajeshNo ratings yet

- SEBIDocument2 pagesSEBIAkash ShrivastavaNo ratings yet

- Sebi Functional ReportDocument7 pagesSebi Functional ReportRohan Pawar61% (18)

- Sebi & RbiDocument35 pagesSebi & Rbibhaviniparmar100% (7)

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Business Environment - 5Document10 pagesBusiness Environment - 5phanisantoshNo ratings yet

- Sebi'S Background: Securities and Exchange Board of IndiaDocument15 pagesSebi'S Background: Securities and Exchange Board of IndiaAnjaliNo ratings yet

- Name-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)Document6 pagesName-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)MechiluhoNo ratings yet

- Securities and Exchange Board of IndiaDocument10 pagesSecurities and Exchange Board of IndiajaseelekaNo ratings yet

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaNo ratings yet

- SebiDocument26 pagesSebikhilchiadilNo ratings yet

- SEBI - The Securities and Exchange Board of IndiaDocument35 pagesSEBI - The Securities and Exchange Board of IndiaRohan FodnaikNo ratings yet

- Mfsi Unit 4 FinalDocument15 pagesMfsi Unit 4 Finalsauravnagpal309No ratings yet

- SEBI - Introduction: The Basic Objectives of The Board Were Identified AsDocument5 pagesSEBI - Introduction: The Basic Objectives of The Board Were Identified AsSenthilKumar SubramanianNo ratings yet

- Securities and Exchange Board of IndiaDocument5 pagesSecurities and Exchange Board of IndiaKanna RajeshNo ratings yet

- Project Name: Securities and Exchange Board of India (Sebi)Document24 pagesProject Name: Securities and Exchange Board of India (Sebi)Ronak DalmiaNo ratings yet

- Financial Regulatory Bodies in India: Market ParticipantsDocument8 pagesFinancial Regulatory Bodies in India: Market ParticipantsAnonymous aAMqLLNo ratings yet

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- Introductio 1Document2 pagesIntroductio 1Anil ShelarNo ratings yet

- SEBIDocument3 pagesSEBILion Naresh PradhanNo ratings yet

- CLASS - 1 Introduction of SEBIDocument7 pagesCLASS - 1 Introduction of SEBIPawas SinghNo ratings yet

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalNo ratings yet

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanNo ratings yet

- Role of SebiDocument3 pagesRole of SebiAnkush PoojaryNo ratings yet

- SebiDocument26 pagesSebiHitesh MendirattaNo ratings yet

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Document6 pagesSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaNo ratings yet

- Investment Law PresentationDocument11 pagesInvestment Law PresentationNanda SurajNo ratings yet

- Securities and Exchange Board of India PDFDocument18 pagesSecurities and Exchange Board of India PDFShifa RasheedNo ratings yet

- Securities and Exchange Board of IndiaDocument32 pagesSecurities and Exchange Board of IndiaMohan kashyapNo ratings yet

- Securities and Exchange Board of India: SEBI - A Brief IntroductionDocument37 pagesSecurities and Exchange Board of India: SEBI - A Brief IntroductionBhushan KharatNo ratings yet

- Internal Backlog Company Law Role of Sebi in Stock ExchangeDocument9 pagesInternal Backlog Company Law Role of Sebi in Stock ExchangeApoorv SrivastavaNo ratings yet

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalNo ratings yet

- Role of Sebi in Regulating Capital Market in IndiaDocument7 pagesRole of Sebi in Regulating Capital Market in IndiaSunil KumarNo ratings yet

- Corporate Governance: Discuss The Role of Market Regulators in Corporate Governance. Sebi Irda RBI FemaDocument9 pagesCorporate Governance: Discuss The Role of Market Regulators in Corporate Governance. Sebi Irda RBI FemaISMR PlacementsNo ratings yet

- National Stock of IndiaDocument18 pagesNational Stock of IndiaVipin KapoorNo ratings yet

- Executive SummaryDocument35 pagesExecutive SummaryAmit PasiNo ratings yet

- Financial ServicesDocument14 pagesFinancial ServicesChaitanya NandaNo ratings yet

- Regulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2Document12 pagesRegulators-Sebi: Courses Offered: Rbi Grade B Sebi Grade A Nabard Grade A and B Ugc Net Paper 1 and 2ramanNo ratings yet

- Role of S.E.B.I. As A Regulatory Authority: AbhinavDocument5 pagesRole of S.E.B.I. As A Regulatory Authority: AbhinavRahul JagwaniNo ratings yet

- Corporate Law-Ii Important QuestionsDocument26 pagesCorporate Law-Ii Important QuestionsNishaath ShareefNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- BE 3 (Individual Ethics & Groups - China Etc)Document6 pagesBE 3 (Individual Ethics & Groups - China Etc)Anmol HuriyaNo ratings yet

- Business EthicsDocument8 pagesBusiness EthicsAnmol HuriyaNo ratings yet

- BE 4 (Work Ethics)Document2 pagesBE 4 (Work Ethics)Anmol HuriyaNo ratings yet

- BE 9 Ethical Issues For EnvironmentDocument5 pagesBE 9 Ethical Issues For EnvironmentAnmol HuriyaNo ratings yet