Professional Documents

Culture Documents

Technical Question Overview (Tuesday May 29, 7pm)

Technical Question Overview (Tuesday May 29, 7pm)

Uploaded by

Anna AkopianOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technical Question Overview (Tuesday May 29, 7pm)

Technical Question Overview (Tuesday May 29, 7pm)

Uploaded by

Anna AkopianCopyright:

Available Formats

Technical Questions Conversation for Pre-MBA IB internship opportunities May 29th at 7pm!

This doc is started by Ashley, but built via input from everyone! I don’t have many answers, but am

pumped to crowdsource this with everyone!

Call in number (thanks Kory!): 1-314-765-0400 The call in pin is 33 223 239

Recording of the 5.29.18 call (start at that 9 minute mark to avoid the chit chat):

https://componentstudios.com/callrecorder/call/6mAWGAbh7Gv4e2FrreeCuA.RE6ca8c9ceb7a4b8d

5e5cdc93aa8953958

The google sheet with all known IB Diversity Fellowships (please edit carefully):

https://docs.google.com/spreadsheets/d/1onQWCnAiO70RVzUde9xWla4cnOUjGZ0T3VKsEaL-Ksc

Agenda:

1- overview of recruiting process (based on Barclays conversations)

2- upcoming deadlines

3- example technical questions which have been asked and approaches to answering them

Technical questions asked to date (Barclays primarily) and technical means all non-basic behavioral

questions:

● Do you have the technical/financial skills for the next interview round?

● If you were to make a skeleton of a pitchbook what would be in the table of contents?

● What is your familiarity with the groups at Barclays (Financial Sponsors group, Product vs.

Coverage)

● What does an Associate do?

● What are your transferable skills for the associate role?

● Do you know the valuation methods?

● Take me through a DCF

● How do you value a company when you're the seller?

● Between Transaction comps and trading comps which is usually higher?

● How does a DCF rank between the valuation methods (trading and transactions) when the

seller provides the information?

● Why is a transaction usually ranked higher between transaction and trading?

● What do I know about Financial statements? Walkthrough

● What's my knowledge of company valuation?

Questions you would like answered (if possible):

● How would you answer:

○ If depreciation goes up by $50M, how does it affect the 3 financial statements?

○ If you had an industrials company retail company restaurant and services company

(kaplan), using net working capital as a factor, which one would you want to

purchase if you expect the economy to decline vs. If you expect it to improve?

○ If you have two companies same industry similar size, why would one trade for 10x

and another trade for 7x?

Some Resources (if you don’t have the PDFs below please let me know so I can share):

● The 400 investment Banking q&a (mergers and inquisitions) PDF

● Investment Banking text by Josh & Josh PDF

● https://tinyurl.com/MoneyBag2018

● www.ibankingfaq.com

● https://outline.com

● http://pillarsofwallstreet.com/resources/deal-of-the-week/

You might also like

- ICT Forex Money Concept A Z Day Trading Practical Guide To ICT StrategyDocument43 pagesICT Forex Money Concept A Z Day Trading Practical Guide To ICT StrategyHarith Zar80% (5)

- OPER312 Exercise5Document4 pagesOPER312 Exercise5Berk AlbakerNo ratings yet

- Blueprint - TEMPLATE - SEO Onboarding QuestionsDocument7 pagesBlueprint - TEMPLATE - SEO Onboarding QuestionsKen CarrollNo ratings yet

- Interview Question Prep For PM InterviewsDocument9 pagesInterview Question Prep For PM InterviewsVarsha ShirsatNo ratings yet

- Flavius PFS CW2 Task 2Document11 pagesFlavius PFS CW2 Task 2Md Shaifullah HasimNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireAmit MandavilliNo ratings yet

- Sample Interview QuestionsDocument9 pagesSample Interview Questionsnoname19753100% (1)

- Hevo Data - AssignmentDocument8 pagesHevo Data - Assignmentmansoor.jNo ratings yet

- Consolidated Interview Questions (IB) PDFDocument7 pagesConsolidated Interview Questions (IB) PDFEric LukasNo ratings yet

- Brilliant Cover Letter ExamplesDocument7 pagesBrilliant Cover Letter Exampleszpxjybifg100% (2)

- Induction & Interview Script and GuidelinesDocument21 pagesInduction & Interview Script and Guidelinesfreakfitness571No ratings yet

- Business Plan Sample BDCDocument4 pagesBusiness Plan Sample BDCgtc7b7dhNo ratings yet

- 12 - ChatGPT-The-Secret-to-Upwork-and-Fiverr-Freelancing-SuccessDocument12 pages12 - ChatGPT-The-Secret-to-Upwork-and-Fiverr-Freelancing-SuccessCarlos Antônio Ribeiro JúniorNo ratings yet

- Business Analyst Resume ExamplesDocument4 pagesBusiness Analyst Resume Examplesbotav1nakak3100% (2)

- Somehow I Manage!! Rulebook With Problem StatementDocument3 pagesSomehow I Manage!! Rulebook With Problem Statementgorika chawlaNo ratings yet

- The Comprehensive Guide To Landing A Six Figure Job in Data AnalyticsDocument14 pagesThe Comprehensive Guide To Landing A Six Figure Job in Data AnalyticsEduardo CherñajovskyNo ratings yet

- AI Tech Vendor Assessment v1-201023-102941Document4 pagesAI Tech Vendor Assessment v1-201023-102941Julio SousaNo ratings yet

- Current Resume ExamplesDocument8 pagesCurrent Resume Examplesafdmjphtj100% (1)

- CTS Interview Prep @freshersinfoDocument6 pagesCTS Interview Prep @freshersinfoPuneethNo ratings yet

- Company ResumeDocument8 pagesCompany Resumec2qaz2p3100% (1)

- Assignment 3 E-Commerce Project 2020/2021 - Summer Semester SubmissionDocument5 pagesAssignment 3 E-Commerce Project 2020/2021 - Summer Semester SubmissionVibhuNo ratings yet

- Research NisaDocument5 pagesResearch NisaSebyca2309No ratings yet

- Business Plan Template BtecDocument6 pagesBusiness Plan Template BtecxdjzssovfNo ratings yet

- Here Are The Details of HCL Technical Interview Questions 2011 Job in HCLDocument4 pagesHere Are The Details of HCL Technical Interview Questions 2011 Job in HCLAli HussainNo ratings yet

- Quetionnaire For Sales Operations and Order Management LeadDocument3 pagesQuetionnaire For Sales Operations and Order Management Leadprabodh tayadeNo ratings yet

- Pre-Interview - Funding Relationship ManagerDocument2 pagesPre-Interview - Funding Relationship ManagerRonny JohanNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireAnonymous xHeTIP2DGNo ratings yet

- Business Profit QuestionnaireDocument3 pagesBusiness Profit QuestionnaireAmit MandavilliNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireGul PanraNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireGul PanraNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireRashid HamudNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis Questionnairekareensiitha morenoNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireBrahim El HammouchNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireDoctorado EconomiaNo ratings yet

- Business Analysis QuestionnaireDocument3 pagesBusiness Analysis QuestionnaireGul PanraNo ratings yet

- Business Analyst Research PapersDocument6 pagesBusiness Analyst Research Papersfysxfjac100% (1)

- Resume in Hong KongDocument8 pagesResume in Hong Kongc2zqd0ct100% (1)

- Biz Plan Presentation TemplateDocument13 pagesBiz Plan Presentation Templatekorak_sportsmgmt7061No ratings yet

- Question Bank and GD Topics - 20-21Document40 pagesQuestion Bank and GD Topics - 20-21tulikaNo ratings yet

- Vusal Gahramanov HR MidtermDocument7 pagesVusal Gahramanov HR MidtermVusal GahramanovNo ratings yet

- Marketing Term Paper PDFDocument5 pagesMarketing Term Paper PDFafmzrxbdfadmdq100% (1)

- PWC Interview Questions: What Do You Consider To Be Your Strengths?Document2 pagesPWC Interview Questions: What Do You Consider To Be Your Strengths?Karl Alfonso100% (1)

- 02-Hiring SOP Imperium Agency 2Document6 pages02-Hiring SOP Imperium Agency 2lvcac321No ratings yet

- Breaking In to SAP HR: Interview Questions, Answers and ExplanationsFrom EverandBreaking In to SAP HR: Interview Questions, Answers and ExplanationsRating: 4 out of 5 stars4/5 (4)

- Key Takeaways From TOPO Sales Summit 20161 PDFDocument144 pagesKey Takeaways From TOPO Sales Summit 20161 PDFShah Manzur E KhudaNo ratings yet

- Bootcamp Business Plan Template: Executive SummaryDocument4 pagesBootcamp Business Plan Template: Executive SummaryJason BrownNo ratings yet

- The Research Report PlaybookDocument98 pagesThe Research Report PlaybookHelloNo ratings yet

- In-House Management Versus Management OutsourcedDocument38 pagesIn-House Management Versus Management OutsourcedAmit Bhandari100% (4)

- HR QuestionsDocument5 pagesHR QuestionsVampireNo ratings yet

- Top 10 Wipro BPODocument7 pagesTop 10 Wipro BPODhiraj GawhaneNo ratings yet

- Question Bank From CompaniesDocument7 pagesQuestion Bank From CompaniesGopi NathNo ratings yet

- MGT602 Quiz 3 10-01-2024 Finals Mam MehwishDocument6 pagesMGT602 Quiz 3 10-01-2024 Finals Mam MehwishIshmal RizwanNo ratings yet

- Cover LettterDocument11 pagesCover LettterParamsrikant KatariyaNo ratings yet

- Kpi Ebook v2Document42 pagesKpi Ebook v2Adela MinceaNo ratings yet

- Business Planning ToolsDocument5 pagesBusiness Planning Toolsfdfgiiwlf100% (1)

- Resume Help Explaining Computer SkillsDocument5 pagesResume Help Explaining Computer Skillsdgmtutlfg100% (2)

- QuestionaireDocument7 pagesQuestionaireNitin MehtaNo ratings yet

- CoverDocument5 pagesCoverAyodeji AkinolaNo ratings yet

- Good Resume 2020Document6 pagesGood Resume 2020f5d17e05100% (2)

- SheenaUppal (3 10)Document2 pagesSheenaUppal (3 10)milapdhamiNo ratings yet

- World Bank - Indonesia Outlook 2045Document68 pagesWorld Bank - Indonesia Outlook 2045Fendy FendyNo ratings yet

- Channels of DistributionDocument31 pagesChannels of DistributionBavly MakramNo ratings yet

- Presentation 43Document22 pagesPresentation 43nidhuchauhan720No ratings yet

- 2023 JA - FM - QuestionDocument4 pages2023 JA - FM - Questionmiradvance studyNo ratings yet

- BlueBox Funds - BlueBox Global Technology FundDocument2 pagesBlueBox Funds - BlueBox Global Technology Fundfilipe.game.97No ratings yet

- Porter's Five Forces in Market CompetitionDocument4 pagesPorter's Five Forces in Market CompetitionMd. Ziawr RahmanNo ratings yet

- PCCIDocument2 pagesPCCIlucadiegomoNo ratings yet

- دور الكفاءة التشغيلية في إدارة مخاطر السيولة في البنوك التجارية دراسة لعينة من البنوك العاملة بالجزائر خلال الفترة (2010 2015)Document17 pagesدور الكفاءة التشغيلية في إدارة مخاطر السيولة في البنوك التجارية دراسة لعينة من البنوك العاملة بالجزائر خلال الفترة (2010 2015)Rashd AlqupajNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- Marketing Management - PricingDocument18 pagesMarketing Management - PricingJon JonNo ratings yet

- PR1MA - Sukuk PTC VfinalDocument28 pagesPR1MA - Sukuk PTC VfinallemNo ratings yet

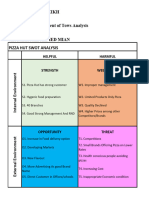

- Tows Assignment Sohaib Pizza Hut FinalDocument2 pagesTows Assignment Sohaib Pizza Hut Finalسعد احمد خاںNo ratings yet

- 3.2 - Strategic Groups and Market SegmentationDocument5 pages3.2 - Strategic Groups and Market SegmentationMinhal shafiqueNo ratings yet

- Ch1 - PowerpointsDocument28 pagesCh1 - PowerpointsleenNo ratings yet

- Company Law RTP Compilation Question BankDocument40 pagesCompany Law RTP Compilation Question BankNoorul Zaman KhanNo ratings yet

- Definition of Round TrippingDocument6 pagesDefinition of Round Trippingjdx sanNo ratings yet

- Notary Business PlanDocument48 pagesNotary Business PlanJoseph QuillNo ratings yet

- Kurhat Akshay NitinDocument60 pagesKurhat Akshay NitinSrushti DeshmukhNo ratings yet

- Kebijakan Modal Kerja Dalam Keuangan Syariah.Document11 pagesKebijakan Modal Kerja Dalam Keuangan Syariah.shivakarlina273No ratings yet

- Chapter 4Document17 pagesChapter 4aurorashiva1No ratings yet

- IT Final Ch.3.2023Document11 pagesIT Final Ch.3.2023Amgad ElshamyNo ratings yet

- Koh Li Leng Expenses Statement (Rev2022)Document2 pagesKoh Li Leng Expenses Statement (Rev2022)ano neNo ratings yet

- 2023-10-28 Sub Prime Mortgage Crisis V0.02amDocument13 pages2023-10-28 Sub Prime Mortgage Crisis V0.02amb23036No ratings yet

- CCW322-Digital-Marketing Notes 1 UnitDocument36 pagesCCW322-Digital-Marketing Notes 1 UnitKarnan SuganyaNo ratings yet

- Blue and Gray Modern Marketing Budget PresentationDocument14 pagesBlue and Gray Modern Marketing Budget PresentationPPTI 40 I Gede Arinata KP.No ratings yet

- (TOPIC 6) PQs and ANSsDocument5 pages(TOPIC 6) PQs and ANSsjjho4832No ratings yet

- Insight Series LCs WebDocument13 pagesInsight Series LCs WebhabchiNo ratings yet