Professional Documents

Culture Documents

All 1

All 1

Uploaded by

Prashant ThamanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

All 1

All 1

Uploaded by

Prashant ThamanCopyright:

Available Formats

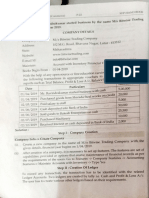

Cash Accounts- Any one can

open, Customer pays full for

securities Purchased

Margin Accounts- Allows customer

to borrow money for investing-

All Details of the customers are

2 3 Corporate Accounts - must

collected according to except

Types of Accounts establish the following.

customer signature(USA Patriot Account Creation

1)legal right to open account

Act 2001)

2)if there are any limitations on

business or stakeholder or court

has placed on the securities in

which the busness can invest

Fee- based Accounts- better for

high trading activity

Prime Brokerage Accounts-

Through Margin accounts

investors can borrow money

Customer Purchase securities and

through Pledging Capital

Pay interest on the money

borrowed until loan is repaid

Long

1 (customer borrow money)

Stock is borrowed and sold short,

Types of Margin Accounts Short

Enabling the customer to profit if

(customer borrow securities) the value declines

Margin- Refers to Minimum 2

amount of cash or marginable Purchase more securities with a

securites a customer must deposit lower cash

To customers

Advantages

3 margin account generates interest

Regulation T states Customer

income

must deposit a minimum of 50%

of the market value within 5

business days 5 To brokers

Customers tend to trade large

4 positions, generating higher

Identifies Marginable Securities commisions

Regulation T Credit Agreement

that can be used as collateral

Customer Signs Margin

Agreement which has 3 parts Hypothecation agreement - gives

Exempt Securities power to broker/dealer to pledge

customer margin securities as

collateral.

Open Margin Account,

Loan Consent form- The firm can

Risk Disclosure Form loan the customer marginable

securities to other customers for

short sales

securities ct 1933- companies

issuing securities should provide

enough information

The Underwriter informs the

issuer best financing

mechanism(equity or Debt) based

on the tax considerations or

Issuer should fill the registration

Regulations statement and submit prospectus

Assists Issuer with registration

and distribution of the new

security

The syndicate manager takes

care of the agreement, decide the

The Responsibilities of an Forms underwriting syndicate with timing of offering. control

underwriter other underwriters for distribution advertising

1 of the shares

Filing the registration statement

New Issue with the SEC,

Filing the registration statement

The works of an issuers with the states in which it intends

to sell Securities(Blue Skying the

issue)

2

Issuing Securities The Underwriting Process

Negotiating the Securities price

and amount of spread with the

underwriter

Investors buy a share of can be traded multiple times

ownership in the company’s without direct involvement from

networth After the IPO, the company’s the company

Public Offering - sold to investing shares are listed in the Stock

public Exchange

Equity

Assets - Liabilitites =. Equity Types of Offering Company rcieved proceeds from

Private Placement - sold to IPO, subsequest trading in the

istitutional investors , generally secondary market doesnot affect

exempt from Securities Act 1933 the company’s Finance’s

Price Appreciation

ROI

Cash Dividends

Types of

Dividends Dividends

Stock Dividends

Brought to Market by Negotiated

Underwrting by Issuer and

Underwriter

Issued in Bullet form- Entire issue

has single mturity date

Bonds

interest rate high enough to

compete with other bonds , but interest rate with assistance of the

not high enough that company underwriter

can’t pay-

Default

The bond buyers buy the

reciever’s certificate

better that liquidation of assets

Income bonds Pay when earned basis,

extremeely risky high interest rate

SEC gives its bylaws, constituion OTC Pink- limited information Participating market makers can

and articles of incorporation

Non-NASDAQ set a paramenter below which it

automatically executes( example

OTC Bulletin Board market maker set a value of

Exchange should report any SOES 10000 long or short, anything let is

change in the rules automatically executed)

OTC NASDAQ/ Dealer market Market

some brokerage firms act a

makers make markets for the

The Regulation of trading ACES branch are not market making

securities he possesses based on Electronic Systems firms and they route their orders to

SEC-registered company should the price movements example:

the market making firms

file their 10k’s and 10Qs infromin virtu

the SEC their financial status CAES

2 Augments Inter market trading

system by bringing into the

IPO primary markets OTC Listed system OTC securities

3

Trading equity Security Markets Secondary Markets Overseeing the trading in the

Specialists assigned securties

Making markets - by buying and

NYSE selling the securities to maintain

NYSE and other exchanges interact near the trading posts for the supply and demand

auction

House Brokers

Brokers from members firm who

two dollar brokers assist house execute orders for their customers

brokers

Electronic communication

Fourth Market networks- available 24hours

DarkPools of liquidity. example If i

want to sell 200,000 shares out

of 500,000 share I have un-assisted by brokers

Voting Rights

Pre-emptive Rights

Rights of Common stock

ownership

Limited Liability

Inspection of Corporate books

Price Appreciation

Residual claims to assets

Cash Dividends The Stock Certificate

Types of

Dividends Dividends

Cusip Numbers

Stock Dividends

ROI Featured of Transferable

Securities

Negotiability

Transferability of Ownership

2

Equity

Preferred Stock Common Stock

Assets - Liabilitites =. Equity Transfer Agents

Transfer Procedures

Investors buy a share of

ownership in the company’s Registrar

networth

Straight Preferred The Dividend rate,

Cumulative(non Types of Common Stock

cumulative),Callable(not),converti

ble(), adjustable rate, reverse

Cumulative Preferred Types of Preferred Stock Authorize

floating rate, putable, self Treasury Issued Outstanding

liquidating d

Convertible Preferred

Participating Preferred

Company authorized to sell the no

Callable Preferred of stocks present in original

Stock the investor owned-

charter

Company has issued and not re

purchaese

Authorized and distributed to the

investors

Price Appreciation

Cash Dividends

Types of

Dividends Dividends

Stock Dividends

ROI

New Note

Equity

Assets - Liabilitites =. Equity

Investors buy a share of

ownership in the company’s

networth

New Note

New Note

You might also like

- Test Bank For Fundamentals of Investing 14th by SmartDocument25 pagesTest Bank For Fundamentals of Investing 14th by SmartPatrick Kavanaugh100% (44)

- Danamon Host To Host Untuk PERUSAHAANDocument15 pagesDanamon Host To Host Untuk PERUSAHAANKevyn HiaNo ratings yet

- In Processing Steps in A 40 Week Project Funding Trade ProgramDocument1 pageIn Processing Steps in A 40 Week Project Funding Trade ProgramMuhammad AffendiNo ratings yet

- Bitwise BTC/ETH Equal Weight SMA: Why Invest in The Strategy? DetailsDocument2 pagesBitwise BTC/ETH Equal Weight SMA: Why Invest in The Strategy? DetailsTop NazNo ratings yet

- Stock Investment Starting GuideDocument1 pageStock Investment Starting GuidethillaiNo ratings yet

- StockInvestmentStartingGuide PDFDocument1 pageStockInvestmentStartingGuide PDFTayalanNo ratings yet

- StockInvestmentStartingGuide PDFDocument1 pageStockInvestmentStartingGuide PDFAiman ArshadNo ratings yet

- StockInvestmentStartingGuide PDFDocument1 pageStockInvestmentStartingGuide PDFVinod JeyapalanNo ratings yet

- StockInvestmentStartingGuide PDFDocument1 pageStockInvestmentStartingGuide PDFAdilawi MuhammadNo ratings yet

- The Same Exp. Form But The Original One Where You Can Fully See My Duties PDFDocument1 pageThe Same Exp. Form But The Original One Where You Can Fully See My Duties PDFMuhammad AbduNo ratings yet

- Castler Real Estate DeckDocument14 pagesCastler Real Estate Deckpanshul.gupta3223No ratings yet

- Points To Remember Users of AccountingDocument4 pagesPoints To Remember Users of Accountingmontejojuryceasar2216No ratings yet

- Special Purpose FrameworkDocument5 pagesSpecial Purpose Frameworkanishcholkar5No ratings yet

- Tutorial 1 Q - MergedDocument37 pagesTutorial 1 Q - MergedWeiqin ChanNo ratings yet

- Financial Accounting & Decision Making NotesDocument27 pagesFinancial Accounting & Decision Making Notessuhanibhatt90No ratings yet

- Mastercard WhitePaper Virtual Card ServicesDocument6 pagesMastercard WhitePaper Virtual Card Serviceshammadwatto545No ratings yet

- Epicor Iscala Financial Highlights FS ENSDocument4 pagesEpicor Iscala Financial Highlights FS ENSalconla1No ratings yet

- Key Facts Document FD Savings Englis Version 2021 02 04 11 2021Document16 pagesKey Facts Document FD Savings Englis Version 2021 02 04 11 2021ANALYZING CRICKETNo ratings yet

- CBSE Class 11 Accounting-Vouchers and Their Preparation PDFDocument13 pagesCBSE Class 11 Accounting-Vouchers and Their Preparation PDFZâ Ś ŤîńNo ratings yet

- CBSE Class 11 Accounting-Vouchers and Their Preparation PDFDocument13 pagesCBSE Class 11 Accounting-Vouchers and Their Preparation PDFDiksha60% (5)

- Uk FintechDocument1 pageUk FintechcoloradoresourcesNo ratings yet

- Financial and Management Accounting: BITS PilaniDocument29 pagesFinancial and Management Accounting: BITS PilaniSajid RehmanNo ratings yet

- Líneas de Crédito para Pymes: Beatriz Elena Londoño PatiñoDocument18 pagesLíneas de Crédito para Pymes: Beatriz Elena Londoño PatiñoValeria GonzálezNo ratings yet

- FABM 2 Reviewer PrelimsDocument2 pagesFABM 2 Reviewer Prelimssushi nakiriNo ratings yet

- Anual Report 2009Document4 pagesAnual Report 2009Noman MiaNo ratings yet

- Financial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Document20 pagesFinancial Accounting Chapter 1 - 3: By: Stefanie (125180444) Angela (125180447) Yuvina (125180464)Elafan storeNo ratings yet

- My Jar AlternativesDocument3 pagesMy Jar AlternativesSAI SUVEDHYA RNo ratings yet

- Financial Reporting WDocument345 pagesFinancial Reporting Wgordonomond2022No ratings yet

- Epicor IScala Financial Highlights FS ENSDocument4 pagesEpicor IScala Financial Highlights FS ENSMalikNo ratings yet

- Secl - Evidencia 1 - Act - 3iiDocument3 pagesSecl - Evidencia 1 - Act - 3iisofia castilloNo ratings yet

- ACCOUNTINGDocument3 pagesACCOUNTING11ABM Isamiel Grace MendozaNo ratings yet

- 13 Short Term FinancingDocument3 pages13 Short Term FinancingIrene LimpinNo ratings yet

- CE TrainingDocument44 pagesCE TrainingAzizzulHassanNo ratings yet

- Manage Account Conditions (Corporate)Document1 pageManage Account Conditions (Corporate)Ram Mohan MishraNo ratings yet

- Fabm 2 Week 2Document20 pagesFabm 2 Week 2mary rose aragonNo ratings yet

- Basic Accounting Handouts (LS 2)Document55 pagesBasic Accounting Handouts (LS 2)Yohanne MissNo ratings yet

- Audit of Investments NotesDocument3 pagesAudit of Investments NotesDestiny LazarteNo ratings yet

- Business Solutions For Start-Ups: Citibusiness LeapDocument10 pagesBusiness Solutions For Start-Ups: Citibusiness LeapAnand BiNo ratings yet

- Accounts ReceivableDocument3 pagesAccounts Receivablelea atienza100% (1)

- Capitalizing On The New M-Commerce Environment: A Gcash Case StudyDocument11 pagesCapitalizing On The New M-Commerce Environment: A Gcash Case StudyAaditya ParanjapeNo ratings yet

- Information Systems M Rafeeq: Chapter-IIIDocument19 pagesInformation Systems M Rafeeq: Chapter-IIIMohd RafeeqNo ratings yet

- CH 3.1 ReceivablesDocument3 pagesCH 3.1 ReceivablesKate CamachoNo ratings yet

- Fabm 1ST Sem CH1234Document12 pagesFabm 1ST Sem CH1234Mary Franchesca RodaNo ratings yet

- SAP Collateral Management System CMS Configuration Guide User ManualDocument4 pagesSAP Collateral Management System CMS Configuration Guide User ManualAatish Jain0% (1)

- 3.4 Final Accounts TextbookDocument24 pages3.4 Final Accounts Textbookkayla1807115No ratings yet

- Chapter 1 - Accounting in BusinessDocument1 pageChapter 1 - Accounting in BusinessLê Nguyễn Anh ThưNo ratings yet

- Audi 24 ReviewerDocument9 pagesAudi 24 Reviewerkathlenejane.garciaNo ratings yet

- Accounting Simplified 1Document6 pagesAccounting Simplified 1kala1975No ratings yet

- Basic AccountingDocument7 pagesBasic AccountingIya GarciaNo ratings yet

- ERP-3 - Group 9Document6 pagesERP-3 - Group 9Jaswasi SahooNo ratings yet

- To Accounting: Prepared By: Nurul Hassanah Binti Hamzah Room: Blok I Email: Hassanahhamzah@uitm - Edu.myDocument10 pagesTo Accounting: Prepared By: Nurul Hassanah Binti Hamzah Room: Blok I Email: Hassanahhamzah@uitm - Edu.myNur Amira NadiaNo ratings yet

- Topic 6Document12 pagesTopic 6MOHD RASLIZAM ABDUL RASHADNo ratings yet

- MapDocument1 pageMapddi40275No ratings yet

- Country Risk Annexure IiDocument1 pageCountry Risk Annexure Iisreedev sureshbabuNo ratings yet

- Account TitlesDocument5 pagesAccount TitlesalyNo ratings yet

- Tally SOP 1Document4 pagesTally SOP 1Saksham AgarwalNo ratings yet

- Financial Accounting NotesDocument7 pagesFinancial Accounting NotesGan JessieNo ratings yet

- Delegationofauthorityregistertemplatejun 19 XLSXDocument2 pagesDelegationofauthorityregistertemplatejun 19 XLSXJacob YeboaNo ratings yet

- FinanceDocument24 pagesFinancezavierrrofficialNo ratings yet

- Nectar India-Project ReportDocument30 pagesNectar India-Project ReportMani VarshneyNo ratings yet

- Paytm Masterclass DSP AMCDocument17 pagesPaytm Masterclass DSP AMCDaniel JamesNo ratings yet

- Pss Suppandi Comic Booklet (English) April 2018Document42 pagesPss Suppandi Comic Booklet (English) April 2018t.m. suriyaaNo ratings yet

- Module 1 Special Topics in Financial ManagementDocument22 pagesModule 1 Special Topics in Financial Managementkimjoshuadiaz12No ratings yet

- Chapter 1 - 1 IFMDocument24 pagesChapter 1 - 1 IFMVaibhav PandeyNo ratings yet

- Switzerlan D: Rishabh Tanisha Raj Kumar Durgesh HimanshuDocument13 pagesSwitzerlan D: Rishabh Tanisha Raj Kumar Durgesh HimanshuNikhilNo ratings yet

- Operational Risk Management - 2013 - Girling - Appendix Answers To Review QuestionsDocument7 pagesOperational Risk Management - 2013 - Girling - Appendix Answers To Review Questionssalehamallick659No ratings yet

- Pimco Global Bond FundDocument5 pagesPimco Global Bond FundKelvin TanNo ratings yet

- CGC - 2.2.1 Study - 8FDLaelerDocument7 pagesCGC - 2.2.1 Study - 8FDLaelerCaleb Gonzalez CruzNo ratings yet

- 1 StocksDocument5 pages1 StocksMelNo ratings yet

- Finlatics Ibep Project 4 Softbank & FlipkartDocument1 pageFinlatics Ibep Project 4 Softbank & FlipkartAngel Aliya100% (2)

- Cross Hedging: Nupur Gill 08D1328 Fin-2 (BBM D)Document9 pagesCross Hedging: Nupur Gill 08D1328 Fin-2 (BBM D)Priti ChowdaryNo ratings yet

- FM 02-Financial Markets and Institutions The Process of Capital AllocationDocument3 pagesFM 02-Financial Markets and Institutions The Process of Capital AllocationJPIA Scholastica DLSPNo ratings yet

- Security Analysis and Investment Management Unit 1 Investment: Meaning, Nature, ScopeDocument10 pagesSecurity Analysis and Investment Management Unit 1 Investment: Meaning, Nature, ScopeMD SHUJAATULLAH SADIQNo ratings yet

- Chapter 11 - Overview of Hedge FundsDocument7 pagesChapter 11 - Overview of Hedge FundsJoel Christian MascariñaNo ratings yet

- Corporate Valuation - 16th October 2021Document2 pagesCorporate Valuation - 16th October 2021Shivam ChoudharyNo ratings yet

- Catholic Educational Association of The Philippines Retirement PlanDocument2 pagesCatholic Educational Association of The Philippines Retirement PlanRosannaNo ratings yet

- FIN 5001 - Course Outline 2022Document8 pagesFIN 5001 - Course Outline 2022adharsh veeraNo ratings yet

- Financial Planning Engagement Letter SampleDocument3 pagesFinancial Planning Engagement Letter SampleCalvin YeohNo ratings yet

- Fin Interview QuestionsDocument3 pagesFin Interview QuestionspoisonboxNo ratings yet

- Massif Capital Pitch DeckDocument18 pagesMassif Capital Pitch DecksidjhaNo ratings yet

- Invesco Global Sovereign Asset Management Study 2021Document56 pagesInvesco Global Sovereign Asset Management Study 2021Lingyun XiaNo ratings yet

- Mutual Fund in Rural Area.: K.C.collegeDocument12 pagesMutual Fund in Rural Area.: K.C.collegeNisha ShettyNo ratings yet

- Ponzi Scheme - EditedDocument4 pagesPonzi Scheme - EditedGifted MaggieNo ratings yet

- Yuvraj Scope of Capital Market in IndiaDocument59 pagesYuvraj Scope of Capital Market in IndiaNeha ChafeNo ratings yet

- Retail Investors Are The New Stars in India's $479B Mutual Fund ShowDocument24 pagesRetail Investors Are The New Stars in India's $479B Mutual Fund ShowVaibhav MittalNo ratings yet

- Em .226 - Raj Chauhan SybfmDocument17 pagesEm .226 - Raj Chauhan SybfmULTRA RAJNo ratings yet

- Protecting Legacy The Value of A Family OfficeDocument25 pagesProtecting Legacy The Value of A Family OfficeRavi BabuNo ratings yet

- FinanceDocument17 pagesFinancejackie555No ratings yet

- NISM Series VII SORM Workbook - August 2022Document200 pagesNISM Series VII SORM Workbook - August 2022atul0576No ratings yet