Professional Documents

Culture Documents

Companies Act Acomparision

Companies Act Acomparision

Uploaded by

Siddharth BhargavaCopyright:

Available Formats

You might also like

- Stage Gate ScorecardDocument5 pagesStage Gate ScorecarddayalumeNo ratings yet

- Company Profile - IzinkanyeziDocument8 pagesCompany Profile - Izinkanyeziapi-320288199100% (1)

- Class 23-26Document45 pagesClass 23-26Prasenjit RoyNo ratings yet

- Indian Companies Act UPSC NotesDocument3 pagesIndian Companies Act UPSC NotesAvik PodderNo ratings yet

- by AZB & PARTNERS Companies Act, 2013 and Draft Rules Mr-Ajay-BahlDocument12 pagesby AZB & PARTNERS Companies Act, 2013 and Draft Rules Mr-Ajay-Bahlm_jain_ca100% (1)

- BMR PresentationDocument20 pagesBMR PresentationHimanshu NazkaniNo ratings yet

- Cra Xtra NotesDocument6 pagesCra Xtra NotesJibin BinnyNo ratings yet

- Day 6Document42 pagesDay 6Vivek MishraNo ratings yet

- Regulatory Framework of Corporate GovernanceDocument21 pagesRegulatory Framework of Corporate GovernanceKEVAL SHAHNo ratings yet

- Cla Chap 1Document9 pagesCla Chap 1mmmmNo ratings yet

- Companies ActDocument26 pagesCompanies ActAngad SinghNo ratings yet

- Company Law FinalDocument83 pagesCompany Law Finalmuffin muffinNo ratings yet

- CH 2 Legal Frameworkfor Corporate GovernanceDocument23 pagesCH 2 Legal Frameworkfor Corporate GovernanceKhushali OzaNo ratings yet

- Companies Act 2013Document145 pagesCompanies Act 2013rockpd100% (1)

- Presentation One Person Company: Submitted To-Assistant Professor Eisha VashishthaDocument16 pagesPresentation One Person Company: Submitted To-Assistant Professor Eisha Vashishthakratika tewariNo ratings yet

- Course MaterialDocument30 pagesCourse Materialnnitinsharma87No ratings yet

- Salient Features of Companies Act 2013Document4 pagesSalient Features of Companies Act 2013Ananya SaxenaNo ratings yet

- Ayushi Singh 5061Document14 pagesAyushi Singh 50612022pbm5054No ratings yet

- Companies (Amendment) Bill 2016Document29 pagesCompanies (Amendment) Bill 2016REETIKANo ratings yet

- Companys ActDocument11 pagesCompanys ActSimp MlbbNo ratings yet

- Companies Bill 2012: Presented by Ca Pratik AroraDocument40 pagesCompanies Bill 2012: Presented by Ca Pratik Arorababy0310No ratings yet

- MRL2601-notes 2015 RELIABLEDocument38 pagesMRL2601-notes 2015 RELIABLEKhanyisani ZitumaneNo ratings yet

- Meaning & Formaton of A Company: Legal Aspects of Business (Lab) Project Presentatation 26/02/2011 Section F / Group-1Document36 pagesMeaning & Formaton of A Company: Legal Aspects of Business (Lab) Project Presentatation 26/02/2011 Section F / Group-1sharad_bajajNo ratings yet

- COMPANY LAW UpDocument95 pagesCOMPANY LAW UpAshesh DasNo ratings yet

- Company Law UpDocument95 pagesCompany Law UpAshesh DasNo ratings yet

- Companies Act GovernanceDocument16 pagesCompanies Act GovernanceSourabh GargNo ratings yet

- Highlights of New Company Law by Karan SirDocument4 pagesHighlights of New Company Law by Karan SirRajshri DesaiNo ratings yet

- Company Law 1956 - NMMDocument11 pagesCompany Law 1956 - NMMShruti PedamkarNo ratings yet

- Privileges of A Private CompanyDocument5 pagesPrivileges of A Private CompanySargun KaurNo ratings yet

- MGT109DrBusrPr - 3CG - Dr. PLPDocument15 pagesMGT109DrBusrPr - 3CG - Dr. PLPNainish MishraNo ratings yet

- Regulatory Framework For Corporate Governance in India M COM II 17-4Document9 pagesRegulatory Framework For Corporate Governance in India M COM II 17-4Monika ShaileshNo ratings yet

- 2-Company Law PPT - 02 Unit - 1Document40 pages2-Company Law PPT - 02 Unit - 1Aakanksha SinghNo ratings yet

- New Concepts in Companies Act 2013Document44 pagesNew Concepts in Companies Act 2013Himanshu SachdevaNo ratings yet

- Companies Act, 2013: An Analysis of Key Rules: (Kumar, 2014)Document1 pageCompanies Act, 2013: An Analysis of Key Rules: (Kumar, 2014)anujjalansNo ratings yet

- Companies Act 2013Document6 pagesCompanies Act 2013brightlight1989No ratings yet

- Accountancy PresentationDocument20 pagesAccountancy PresentationArmaan GuptaNo ratings yet

- Types of Co HighlightedDocument60 pagesTypes of Co Highlighteddivyakarda23No ratings yet

- JJ Irani Committee RecommendationsDocument3 pagesJJ Irani Committee Recommendationsmuffin muffinNo ratings yet

- The New Ethiopian Commercial Code A Highlight of Major ChangesDocument5 pagesThe New Ethiopian Commercial Code A Highlight of Major ChangesBooruuNo ratings yet

- Companies Bill, 2012: One Person CompanyDocument5 pagesCompanies Bill, 2012: One Person CompanyRagavendra RagsNo ratings yet

- Assignment - CG & BEDocument4 pagesAssignment - CG & BErajesh laddhaNo ratings yet

- Company Law Assignment by Mehul RojhDocument6 pagesCompany Law Assignment by Mehul RojhMR VIDEOSNo ratings yet

- Structural Comparison: Companies Act 1956 Companies Act 2013Document52 pagesStructural Comparison: Companies Act 1956 Companies Act 2013Sudhaker PandeyNo ratings yet

- ED Unit 5Document47 pagesED Unit 5sg.2312002No ratings yet

- Various Types of Companies Under Companies Act, 1956-11Document54 pagesVarious Types of Companies Under Companies Act, 1956-11Upneet Sethi67% (3)

- Incorporating A CompanyDocument35 pagesIncorporating A CompanyXiuling Grace ZhangNo ratings yet

- Corporate Governance 4aDocument5 pagesCorporate Governance 4asilvernitrate1953No ratings yet

- Unit-2 LawDocument62 pagesUnit-2 LawNaman JainNo ratings yet

- Becg Unit 3Document43 pagesBecg Unit 3boosNo ratings yet

- Lab Mba Sem 1Document6 pagesLab Mba Sem 1Gunjan LalwaniNo ratings yet

- Unit-IV StudentDocument68 pagesUnit-IV StudentMonish RaniNo ratings yet

- Group Assignment Company's Act, 2013 Was Modified To Enhance Corporate Governance in IndiaDocument11 pagesGroup Assignment Company's Act, 2013 Was Modified To Enhance Corporate Governance in IndiaANKITA GOOMERNo ratings yet

- Unit 5: The Companies Act, 2013Document47 pagesUnit 5: The Companies Act, 2013Shubhendu RanjanNo ratings yet

- Merger and Acquisition Practise PaperDocument9 pagesMerger and Acquisition Practise PaperRicha KhatriNo ratings yet

- 3.new Concepts in Co's Act 2013Document31 pages3.new Concepts in Co's Act 2013Sai PhaniNo ratings yet

- Company Meaning and FeaturesDocument9 pagesCompany Meaning and FeaturesRahulNo ratings yet

- Business Registration Reforms in Pakistan: Background Paper Prepared For The World Development Report 2005Document29 pagesBusiness Registration Reforms in Pakistan: Background Paper Prepared For The World Development Report 2005iftikharhassanNo ratings yet

- COMPANY LAW NOTES Part1Document58 pagesCOMPANY LAW NOTES Part1Satish PatelNo ratings yet

- Comparison of The New & Old Company Law: By: Saugata PalitDocument47 pagesComparison of The New & Old Company Law: By: Saugata PalitDavid WrightNo ratings yet

- Chairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Document26 pagesChairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Faizan MotiwalaNo ratings yet

- Scra 14Document53 pagesScra 14AshokMlNo ratings yet

- Chief Executive Officer (C.E.O.) and Their Appointment Under The Companies Act 2013Document14 pagesChief Executive Officer (C.E.O.) and Their Appointment Under The Companies Act 2013Siddharth BhargavaNo ratings yet

- Theories of CSRDocument15 pagesTheories of CSRSiddharth BhargavaNo ratings yet

- CSR TheoriesDocument24 pagesCSR TheoriesSiddharth BhargavaNo ratings yet

- History CSRDocument5 pagesHistory CSRSiddharth BhargavaNo ratings yet

- Types of CompaniesDocument24 pagesTypes of CompaniesSiddharth BhargavaNo ratings yet

- Bodie 11e PPT Ch11Document34 pagesBodie 11e PPT Ch11Siddharth BhargavaNo ratings yet

- Qualitative Research Nature & ApproachesDocument83 pagesQualitative Research Nature & ApproachesSiddharth BhargavaNo ratings yet

- Infosys BPM Limited Annual Report 2021-22Document160 pagesInfosys BPM Limited Annual Report 2021-22Siddharth BhargavaNo ratings yet

- Bodie 11e PPT Ch14Document36 pagesBodie 11e PPT Ch14Siddharth BhargavaNo ratings yet

- NptelDocument2 pagesNptelSiddharth BhargavaNo ratings yet

- Google CaseDocument6 pagesGoogle CaseSiddharth BhargavaNo ratings yet

- Value Analysis/Value EngineeringDocument10 pagesValue Analysis/Value EngineeringSiddharth BhargavaNo ratings yet

- Experimental Research DesignDocument29 pagesExperimental Research DesignSiddharth BhargavaNo ratings yet

- NptelDocument2 pagesNptelSiddharth BhargavaNo ratings yet

- FMDocument5 pagesFMSiddharth BhargavaNo ratings yet

- BRM Class NotesDocument65 pagesBRM Class NotesSiddharth BhargavaNo ratings yet

- Franchising in Retail: NptelDocument95 pagesFranchising in Retail: NptelSiddharth BhargavaNo ratings yet

- Category Management and Merchandise Planning: NptelDocument183 pagesCategory Management and Merchandise Planning: NptelSiddharth BhargavaNo ratings yet

- UntitledDocument25 pagesUntitledSiddharth BhargavaNo ratings yet

- GHGGDocument15 pagesGHGGSiddharth BhargavaNo ratings yet

- Final BC AssignDocument17 pagesFinal BC AssignSiddharth BhargavaNo ratings yet

- P&G Case Study SolutionDocument11 pagesP&G Case Study SolutionSiddharth BhargavaNo ratings yet

- Sales Forecasting & MethodsDocument49 pagesSales Forecasting & MethodsSiddharth BhargavaNo ratings yet

- Labour Laws& PracticeDocument546 pagesLabour Laws& PracticeSiddharth BhargavaNo ratings yet

- LAP 16 Aug 22Document19 pagesLAP 16 Aug 22Siddharth BhargavaNo ratings yet

- Solution Manual For Financial Reporting and Analysis, 8th Edition, Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt Leonard SofferDocument56 pagesSolution Manual For Financial Reporting and Analysis, 8th Edition, Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt Leonard Sofferbrezecgordts100% (4)

- Carta de PasantiaDocument2 pagesCarta de PasantiaGertrudis PiñaNo ratings yet

- Chapter 19 ReportDocument16 pagesChapter 19 ReportAmira SawadjaanNo ratings yet

- Notes PartF 2 PDFDocument1 pageNotes PartF 2 PDFMohd Nor UzairNo ratings yet

- Master Distributor Stock Components: Bulletin HY14-2700/USDocument72 pagesMaster Distributor Stock Components: Bulletin HY14-2700/USYuriPasenkoNo ratings yet

- Ocm For DummiesDocument76 pagesOcm For Dummiesbertan dağıstanlı50% (2)

- Intl Tender Jute Bags 2019 PDFDocument35 pagesIntl Tender Jute Bags 2019 PDFshazuNo ratings yet

- Aud Module 1-5Document23 pagesAud Module 1-5yaanvinaNo ratings yet

- World: Cucumbers and Gherkins - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Cucumbers and Gherkins - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Smart Investment English Issue No. 13Document48 pagesSmart Investment English Issue No. 13Maruthee SharmaNo ratings yet

- PDP Project ReportDocument35 pagesPDP Project Reportbharatpurasharma100% (5)

- Courses Listed: From Search On 'TS4F01' Filtered By: Financial Accounting, Colombia, SAP S/4HANADocument5 pagesCourses Listed: From Search On 'TS4F01' Filtered By: Financial Accounting, Colombia, SAP S/4HANAmiguel veraNo ratings yet

- On Job AnalysisDocument17 pagesOn Job AnalysisSunny TrehanNo ratings yet

- Digital Technology: Implementation Challenges and Strategies in Agri-Food Supply ChainDocument14 pagesDigital Technology: Implementation Challenges and Strategies in Agri-Food Supply ChainHakim TahirNo ratings yet

- C.V Niyi And22Document4 pagesC.V Niyi And22NIYINo ratings yet

- Guidewire Upgrade FactoryDocument12 pagesGuidewire Upgrade FactoryVenkatesh Venky DabbaraNo ratings yet

- Banking Transaction Financial Accounting Entries - SAP Account Posting - FICO (Financial Accounting and Controlling) - STechiesDocument5 pagesBanking Transaction Financial Accounting Entries - SAP Account Posting - FICO (Financial Accounting and Controlling) - STechiesAnandNo ratings yet

- SparkLabs Global Ventures' Technology and Internet Market Bi-Monthly Review 0728 2014Document10 pagesSparkLabs Global Ventures' Technology and Internet Market Bi-Monthly Review 0728 2014SparkLabs Global VenturesNo ratings yet

- S&P Treatmentg of Pensions, Operating Leases ETCDocument107 pagesS&P Treatmentg of Pensions, Operating Leases ETCAndrew RosenbergNo ratings yet

- Concept Restaurant Feasibility SOWDocument8 pagesConcept Restaurant Feasibility SOWAllwyn MendoncaNo ratings yet

- En Re Preneur ShipDocument21 pagesEn Re Preneur ShipisabelaNo ratings yet

- Philmay Property, Inc.: RemindersDocument8 pagesPhilmay Property, Inc.: RemindersMai LoNo ratings yet

- Ehs FinalmanualDocument229 pagesEhs FinalmanualrishiNo ratings yet

- Western Railways (Survey & Construction) : Request For Proposal (RFP)Document155 pagesWestern Railways (Survey & Construction) : Request For Proposal (RFP)Ramesh KumarNo ratings yet

- Youth Entrepreneurship in Eastern Partnership Countries The Way ForwardDocument44 pagesYouth Entrepreneurship in Eastern Partnership Countries The Way ForwardEaP CSFNo ratings yet

- Social Responsibility of BusinessDocument4 pagesSocial Responsibility of BusinessShubhamNo ratings yet

- PNL November 2021Document19 pagesPNL November 2021putripandeanNo ratings yet

- WsCube Tech Paid-Ads-CourseDocument4 pagesWsCube Tech Paid-Ads-CourseProf.Mustansar HussainNo ratings yet

Companies Act Acomparision

Companies Act Acomparision

Uploaded by

Siddharth BhargavaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Companies Act Acomparision

Companies Act Acomparision

Uploaded by

Siddharth BhargavaCopyright:

Available Formats

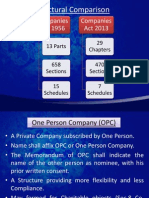

Comparison of Companies Act 2013

and Companies Act 1956

Companies Act 2013 Highlights

• The major highlights of the 2013 Act are given

below:

• The maximum number of shareholders for a

private company is 200 (the previous cap was

at 50).

• The concept of a one-person company.

• Company Law Appellate Tribunal & Company

Law Tribunal

• CSR made mandatory

Salient Features of the Companies Act

2013

• It has introduced the concept of ‘Dormant Companies’.

Dormant companies are those that have not engaged in

business for two years consecutively.

• It introduced the National Company Law Tribunal. It is a

quasi-judicial body in India adjudicating issues concerning

companies. It replaced the Company Law Board.

• It provides for self-regulation concerning disclosures and

transparency rather than having a government-approval

based regime.

• Documents have to be maintained in electronic form.

• Official liquidators have adjudicatory powers for companies

having net assets of up to Rs.1 crore.

• The procedure for mergers and amalgamations have

been made faster and simpler.

• Cross-border mergers are allowed by this Act (foreign

company merging with an Indian company and reverse)

but with the permission of the Reserve Bank of India.

• The concept of a one-person company has been

introduced. This is a new type of private company

which may have only one director and one shareholder.

The 1956 Act required at least two directors and two

shareholders for a private company.

• Having independent directors has been made a

statutory requirement for public companies.

• For a prescribed class of companies, women directors are

mandatory.

• All companies should have at least one director who has been a

resident of India for not less than 182 days in the last calendar year.

• The Act provides for entrenchment (apply extra-legal safeguards) of

the articles of association.

• The Act mandates at least 7 days of notice for calling board

meetings.

• In this Act, the duties of a Director has been defined. It has also

defined the duties of ‘Key Managerial Personnel’ and ‘Promoter’.

• For public companies, there should be a rotation of audit firms and

auditors. The Act also prevents auditors from performing non-audit

services to the company. In case of non-compliance, there is

substantial criminal and civil liability for an auditor.

• The whole process of rehabilitation and liquidation of

the companies in the case of the financial crisis has

been made time-bound.

• The Act makes it mandatory for companies to form CSR

committees, and formulate CSR policies. For certain

companies, mandatory disclosures have been made

with regard to CSR.

• Listed companies ought to have one director to

represent small shareholders as well.

• There is provision for search and seizure of documents,

during the investigation, without an order from a

magistrate

• Norms have been made stringent for accepting

deposits from the public.

• Setting up of the National Financial Reporting

Authority (NFRA) has been provided for. It

engages in the establishment and enforcement of

accounting and auditing standards and oversight

of the work of auditors. (Due to notification of

NFRA, India is now eligible for membership of the

International Forum of Independent Audit

Regulators (IFIAR).)

• The Act bans key managerial personnel and

directors from purchasing call and put options

of shares of the company if such person is

reasonably expected to have access to price-

sensitive information.

• The Act offers more power to shareholders in

that it provides for shareholders’ approval for

many major transactions.

Companies (Amendment) Act, 2019

• This Act was passed by the Parliament in July 2019. The changes

recommended under the latest amendment to the Companies Act

are as follows:

• Companies will have to keep an unspent amount into a special

account for the purpose of CSR.

• This amount, if left unspent after a period of 3 years, will be moved

into a fund specified in Schedule VII of the Act. This could even be

the Prime Minister’s Relief Fund.

• Under this Act, the Registrar of Companies can initiate action for

the removal of the company’s name from the Register of

Companies if it is not conducting business or operation as per the

Company Law.

• 16 minor offences mentioned in the Act have been decriminalised

(made civil defaults)

You might also like

- Stage Gate ScorecardDocument5 pagesStage Gate ScorecarddayalumeNo ratings yet

- Company Profile - IzinkanyeziDocument8 pagesCompany Profile - Izinkanyeziapi-320288199100% (1)

- Class 23-26Document45 pagesClass 23-26Prasenjit RoyNo ratings yet

- Indian Companies Act UPSC NotesDocument3 pagesIndian Companies Act UPSC NotesAvik PodderNo ratings yet

- by AZB & PARTNERS Companies Act, 2013 and Draft Rules Mr-Ajay-BahlDocument12 pagesby AZB & PARTNERS Companies Act, 2013 and Draft Rules Mr-Ajay-Bahlm_jain_ca100% (1)

- BMR PresentationDocument20 pagesBMR PresentationHimanshu NazkaniNo ratings yet

- Cra Xtra NotesDocument6 pagesCra Xtra NotesJibin BinnyNo ratings yet

- Day 6Document42 pagesDay 6Vivek MishraNo ratings yet

- Regulatory Framework of Corporate GovernanceDocument21 pagesRegulatory Framework of Corporate GovernanceKEVAL SHAHNo ratings yet

- Cla Chap 1Document9 pagesCla Chap 1mmmmNo ratings yet

- Companies ActDocument26 pagesCompanies ActAngad SinghNo ratings yet

- Company Law FinalDocument83 pagesCompany Law Finalmuffin muffinNo ratings yet

- CH 2 Legal Frameworkfor Corporate GovernanceDocument23 pagesCH 2 Legal Frameworkfor Corporate GovernanceKhushali OzaNo ratings yet

- Companies Act 2013Document145 pagesCompanies Act 2013rockpd100% (1)

- Presentation One Person Company: Submitted To-Assistant Professor Eisha VashishthaDocument16 pagesPresentation One Person Company: Submitted To-Assistant Professor Eisha Vashishthakratika tewariNo ratings yet

- Course MaterialDocument30 pagesCourse Materialnnitinsharma87No ratings yet

- Salient Features of Companies Act 2013Document4 pagesSalient Features of Companies Act 2013Ananya SaxenaNo ratings yet

- Ayushi Singh 5061Document14 pagesAyushi Singh 50612022pbm5054No ratings yet

- Companies (Amendment) Bill 2016Document29 pagesCompanies (Amendment) Bill 2016REETIKANo ratings yet

- Companys ActDocument11 pagesCompanys ActSimp MlbbNo ratings yet

- Companies Bill 2012: Presented by Ca Pratik AroraDocument40 pagesCompanies Bill 2012: Presented by Ca Pratik Arorababy0310No ratings yet

- MRL2601-notes 2015 RELIABLEDocument38 pagesMRL2601-notes 2015 RELIABLEKhanyisani ZitumaneNo ratings yet

- Meaning & Formaton of A Company: Legal Aspects of Business (Lab) Project Presentatation 26/02/2011 Section F / Group-1Document36 pagesMeaning & Formaton of A Company: Legal Aspects of Business (Lab) Project Presentatation 26/02/2011 Section F / Group-1sharad_bajajNo ratings yet

- COMPANY LAW UpDocument95 pagesCOMPANY LAW UpAshesh DasNo ratings yet

- Company Law UpDocument95 pagesCompany Law UpAshesh DasNo ratings yet

- Companies Act GovernanceDocument16 pagesCompanies Act GovernanceSourabh GargNo ratings yet

- Highlights of New Company Law by Karan SirDocument4 pagesHighlights of New Company Law by Karan SirRajshri DesaiNo ratings yet

- Company Law 1956 - NMMDocument11 pagesCompany Law 1956 - NMMShruti PedamkarNo ratings yet

- Privileges of A Private CompanyDocument5 pagesPrivileges of A Private CompanySargun KaurNo ratings yet

- MGT109DrBusrPr - 3CG - Dr. PLPDocument15 pagesMGT109DrBusrPr - 3CG - Dr. PLPNainish MishraNo ratings yet

- Regulatory Framework For Corporate Governance in India M COM II 17-4Document9 pagesRegulatory Framework For Corporate Governance in India M COM II 17-4Monika ShaileshNo ratings yet

- 2-Company Law PPT - 02 Unit - 1Document40 pages2-Company Law PPT - 02 Unit - 1Aakanksha SinghNo ratings yet

- New Concepts in Companies Act 2013Document44 pagesNew Concepts in Companies Act 2013Himanshu SachdevaNo ratings yet

- Companies Act, 2013: An Analysis of Key Rules: (Kumar, 2014)Document1 pageCompanies Act, 2013: An Analysis of Key Rules: (Kumar, 2014)anujjalansNo ratings yet

- Companies Act 2013Document6 pagesCompanies Act 2013brightlight1989No ratings yet

- Accountancy PresentationDocument20 pagesAccountancy PresentationArmaan GuptaNo ratings yet

- Types of Co HighlightedDocument60 pagesTypes of Co Highlighteddivyakarda23No ratings yet

- JJ Irani Committee RecommendationsDocument3 pagesJJ Irani Committee Recommendationsmuffin muffinNo ratings yet

- The New Ethiopian Commercial Code A Highlight of Major ChangesDocument5 pagesThe New Ethiopian Commercial Code A Highlight of Major ChangesBooruuNo ratings yet

- Companies Bill, 2012: One Person CompanyDocument5 pagesCompanies Bill, 2012: One Person CompanyRagavendra RagsNo ratings yet

- Assignment - CG & BEDocument4 pagesAssignment - CG & BErajesh laddhaNo ratings yet

- Company Law Assignment by Mehul RojhDocument6 pagesCompany Law Assignment by Mehul RojhMR VIDEOSNo ratings yet

- Structural Comparison: Companies Act 1956 Companies Act 2013Document52 pagesStructural Comparison: Companies Act 1956 Companies Act 2013Sudhaker PandeyNo ratings yet

- ED Unit 5Document47 pagesED Unit 5sg.2312002No ratings yet

- Various Types of Companies Under Companies Act, 1956-11Document54 pagesVarious Types of Companies Under Companies Act, 1956-11Upneet Sethi67% (3)

- Incorporating A CompanyDocument35 pagesIncorporating A CompanyXiuling Grace ZhangNo ratings yet

- Corporate Governance 4aDocument5 pagesCorporate Governance 4asilvernitrate1953No ratings yet

- Unit-2 LawDocument62 pagesUnit-2 LawNaman JainNo ratings yet

- Becg Unit 3Document43 pagesBecg Unit 3boosNo ratings yet

- Lab Mba Sem 1Document6 pagesLab Mba Sem 1Gunjan LalwaniNo ratings yet

- Unit-IV StudentDocument68 pagesUnit-IV StudentMonish RaniNo ratings yet

- Group Assignment Company's Act, 2013 Was Modified To Enhance Corporate Governance in IndiaDocument11 pagesGroup Assignment Company's Act, 2013 Was Modified To Enhance Corporate Governance in IndiaANKITA GOOMERNo ratings yet

- Unit 5: The Companies Act, 2013Document47 pagesUnit 5: The Companies Act, 2013Shubhendu RanjanNo ratings yet

- Merger and Acquisition Practise PaperDocument9 pagesMerger and Acquisition Practise PaperRicha KhatriNo ratings yet

- 3.new Concepts in Co's Act 2013Document31 pages3.new Concepts in Co's Act 2013Sai PhaniNo ratings yet

- Company Meaning and FeaturesDocument9 pagesCompany Meaning and FeaturesRahulNo ratings yet

- Business Registration Reforms in Pakistan: Background Paper Prepared For The World Development Report 2005Document29 pagesBusiness Registration Reforms in Pakistan: Background Paper Prepared For The World Development Report 2005iftikharhassanNo ratings yet

- COMPANY LAW NOTES Part1Document58 pagesCOMPANY LAW NOTES Part1Satish PatelNo ratings yet

- Comparison of The New & Old Company Law: By: Saugata PalitDocument47 pagesComparison of The New & Old Company Law: By: Saugata PalitDavid WrightNo ratings yet

- Chairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Document26 pagesChairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Faizan MotiwalaNo ratings yet

- Scra 14Document53 pagesScra 14AshokMlNo ratings yet

- Chief Executive Officer (C.E.O.) and Their Appointment Under The Companies Act 2013Document14 pagesChief Executive Officer (C.E.O.) and Their Appointment Under The Companies Act 2013Siddharth BhargavaNo ratings yet

- Theories of CSRDocument15 pagesTheories of CSRSiddharth BhargavaNo ratings yet

- CSR TheoriesDocument24 pagesCSR TheoriesSiddharth BhargavaNo ratings yet

- History CSRDocument5 pagesHistory CSRSiddharth BhargavaNo ratings yet

- Types of CompaniesDocument24 pagesTypes of CompaniesSiddharth BhargavaNo ratings yet

- Bodie 11e PPT Ch11Document34 pagesBodie 11e PPT Ch11Siddharth BhargavaNo ratings yet

- Qualitative Research Nature & ApproachesDocument83 pagesQualitative Research Nature & ApproachesSiddharth BhargavaNo ratings yet

- Infosys BPM Limited Annual Report 2021-22Document160 pagesInfosys BPM Limited Annual Report 2021-22Siddharth BhargavaNo ratings yet

- Bodie 11e PPT Ch14Document36 pagesBodie 11e PPT Ch14Siddharth BhargavaNo ratings yet

- NptelDocument2 pagesNptelSiddharth BhargavaNo ratings yet

- Google CaseDocument6 pagesGoogle CaseSiddharth BhargavaNo ratings yet

- Value Analysis/Value EngineeringDocument10 pagesValue Analysis/Value EngineeringSiddharth BhargavaNo ratings yet

- Experimental Research DesignDocument29 pagesExperimental Research DesignSiddharth BhargavaNo ratings yet

- NptelDocument2 pagesNptelSiddharth BhargavaNo ratings yet

- FMDocument5 pagesFMSiddharth BhargavaNo ratings yet

- BRM Class NotesDocument65 pagesBRM Class NotesSiddharth BhargavaNo ratings yet

- Franchising in Retail: NptelDocument95 pagesFranchising in Retail: NptelSiddharth BhargavaNo ratings yet

- Category Management and Merchandise Planning: NptelDocument183 pagesCategory Management and Merchandise Planning: NptelSiddharth BhargavaNo ratings yet

- UntitledDocument25 pagesUntitledSiddharth BhargavaNo ratings yet

- GHGGDocument15 pagesGHGGSiddharth BhargavaNo ratings yet

- Final BC AssignDocument17 pagesFinal BC AssignSiddharth BhargavaNo ratings yet

- P&G Case Study SolutionDocument11 pagesP&G Case Study SolutionSiddharth BhargavaNo ratings yet

- Sales Forecasting & MethodsDocument49 pagesSales Forecasting & MethodsSiddharth BhargavaNo ratings yet

- Labour Laws& PracticeDocument546 pagesLabour Laws& PracticeSiddharth BhargavaNo ratings yet

- LAP 16 Aug 22Document19 pagesLAP 16 Aug 22Siddharth BhargavaNo ratings yet

- Solution Manual For Financial Reporting and Analysis, 8th Edition, Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt Leonard SofferDocument56 pagesSolution Manual For Financial Reporting and Analysis, 8th Edition, Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt Leonard Sofferbrezecgordts100% (4)

- Carta de PasantiaDocument2 pagesCarta de PasantiaGertrudis PiñaNo ratings yet

- Chapter 19 ReportDocument16 pagesChapter 19 ReportAmira SawadjaanNo ratings yet

- Notes PartF 2 PDFDocument1 pageNotes PartF 2 PDFMohd Nor UzairNo ratings yet

- Master Distributor Stock Components: Bulletin HY14-2700/USDocument72 pagesMaster Distributor Stock Components: Bulletin HY14-2700/USYuriPasenkoNo ratings yet

- Ocm For DummiesDocument76 pagesOcm For Dummiesbertan dağıstanlı50% (2)

- Intl Tender Jute Bags 2019 PDFDocument35 pagesIntl Tender Jute Bags 2019 PDFshazuNo ratings yet

- Aud Module 1-5Document23 pagesAud Module 1-5yaanvinaNo ratings yet

- World: Cucumbers and Gherkins - Market Report. Analysis and Forecast To 2020Document7 pagesWorld: Cucumbers and Gherkins - Market Report. Analysis and Forecast To 2020IndexBox MarketingNo ratings yet

- Smart Investment English Issue No. 13Document48 pagesSmart Investment English Issue No. 13Maruthee SharmaNo ratings yet

- PDP Project ReportDocument35 pagesPDP Project Reportbharatpurasharma100% (5)

- Courses Listed: From Search On 'TS4F01' Filtered By: Financial Accounting, Colombia, SAP S/4HANADocument5 pagesCourses Listed: From Search On 'TS4F01' Filtered By: Financial Accounting, Colombia, SAP S/4HANAmiguel veraNo ratings yet

- On Job AnalysisDocument17 pagesOn Job AnalysisSunny TrehanNo ratings yet

- Digital Technology: Implementation Challenges and Strategies in Agri-Food Supply ChainDocument14 pagesDigital Technology: Implementation Challenges and Strategies in Agri-Food Supply ChainHakim TahirNo ratings yet

- C.V Niyi And22Document4 pagesC.V Niyi And22NIYINo ratings yet

- Guidewire Upgrade FactoryDocument12 pagesGuidewire Upgrade FactoryVenkatesh Venky DabbaraNo ratings yet

- Banking Transaction Financial Accounting Entries - SAP Account Posting - FICO (Financial Accounting and Controlling) - STechiesDocument5 pagesBanking Transaction Financial Accounting Entries - SAP Account Posting - FICO (Financial Accounting and Controlling) - STechiesAnandNo ratings yet

- SparkLabs Global Ventures' Technology and Internet Market Bi-Monthly Review 0728 2014Document10 pagesSparkLabs Global Ventures' Technology and Internet Market Bi-Monthly Review 0728 2014SparkLabs Global VenturesNo ratings yet

- S&P Treatmentg of Pensions, Operating Leases ETCDocument107 pagesS&P Treatmentg of Pensions, Operating Leases ETCAndrew RosenbergNo ratings yet

- Concept Restaurant Feasibility SOWDocument8 pagesConcept Restaurant Feasibility SOWAllwyn MendoncaNo ratings yet

- En Re Preneur ShipDocument21 pagesEn Re Preneur ShipisabelaNo ratings yet

- Philmay Property, Inc.: RemindersDocument8 pagesPhilmay Property, Inc.: RemindersMai LoNo ratings yet

- Ehs FinalmanualDocument229 pagesEhs FinalmanualrishiNo ratings yet

- Western Railways (Survey & Construction) : Request For Proposal (RFP)Document155 pagesWestern Railways (Survey & Construction) : Request For Proposal (RFP)Ramesh KumarNo ratings yet

- Youth Entrepreneurship in Eastern Partnership Countries The Way ForwardDocument44 pagesYouth Entrepreneurship in Eastern Partnership Countries The Way ForwardEaP CSFNo ratings yet

- Social Responsibility of BusinessDocument4 pagesSocial Responsibility of BusinessShubhamNo ratings yet

- PNL November 2021Document19 pagesPNL November 2021putripandeanNo ratings yet

- WsCube Tech Paid-Ads-CourseDocument4 pagesWsCube Tech Paid-Ads-CourseProf.Mustansar HussainNo ratings yet