Professional Documents

Culture Documents

Trial Balance and Adjustments Completed

Trial Balance and Adjustments Completed

Uploaded by

apachemonoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Trial Balance and Adjustments Completed

Trial Balance and Adjustments Completed

Uploaded by

apachemonoCopyright:

Available Formats

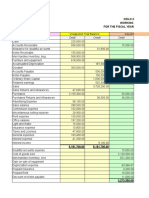

Worksheet: Trial Balance & Adjustments © AccountingCoach.

com - Filled-In Form G21

Worksheet for the following company or entity: _______Jones General Services_____

For the time period having the following beginning and ending dates: ___January 1, 2022 through June 30, 2022___

Trial Balance (unadjusted) Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Account Title Debit Credit Debit Credit Debit Credit Debit Credit Debit Credit

Cash 600.00 600.00 600.00

Accounts receivable 4,956.44 4,956.44 4,956.44

Supplies 900.00 300.00 600.00 600.00

Prepaid insurance 600.00 100.00 500.00 500.00

Equipment 19,500.00 19,500.00 19,500.00

Accumulated depreciation 4,500.00 250.00 4,750.00 4,750.00

Notes payable 6,000.00 6,000.00 6,000.00

Accounts payable 3,554.25 3,554.25 3,554.25

Interest payable 300.00 300.00 300.00

Unearned revenues 1,000.00 400.00 600.00 600.00

J. Owner, capital 6,228.29 6,228.29 6,228.29

Service revenues 12,800.00 400.00 13,200.00 13,200.00

Rent expense 3,000.00 3,000.00 3,000.00

Utilities expense 795.55 795.55 795.55

Insurance expense 130.55 100.00 230.55 230.55

Advertising expense 625.00 625.00 625.00

Depreciation expense 1,800.00 250.00 2,050.00 2,050.00

Travel expense 400.00 400.00 400.00

Professional fees 850.00 850.00 850.00

Interest expense 225.00 225.00 225.00

Other: ________________

Other: ________________

Totals: 34,382.54 34,382.54

New: Supplies Expense 300.00 300.00 300.00

New:_________________

New:_________________

Totals: 1,050.00 1,050.00 34,632.54 34,632.54 8,476.10 13,200.00 26,156.44 21,432.54

Net Income or Loss*: 4,723.90 4,723.90

Totals: 13,200.00 13,200.00 26,156.44 26,156.44

For a blank form see Form G21. *In this example there is Net Income (revenues exceeded expenses by 4,723.90) and that will require a credit to capital.

You might also like

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- Practice Set FinalDocument44 pagesPractice Set Finaldan100% (1)

- Parables AssignmentDocument5 pagesParables Assignmentangel_grrl6827No ratings yet

- Completing The Accounting CycleDocument11 pagesCompleting The Accounting CycleRaymond RocoNo ratings yet

- X201 Midterm Exam Worksheet 2021Document1 pageX201 Midterm Exam Worksheet 2021Kharen PadlanNo ratings yet

- The Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Document19 pagesThe Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Allondra DapengNo ratings yet

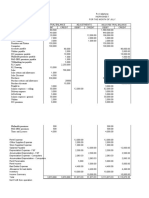

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- Nayan StoreDocument4 pagesNayan StoreBeatriz Cabrera100% (1)

- Drew SicatDocument1 pageDrew SicatShaine Cabualan SeroyNo ratings yet

- ABC Company Worksheet For The Year Ended December 31, 2019Document1 pageABC Company Worksheet For The Year Ended December 31, 2019Rosemarie VillanuevaNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- Final Worksheet Trial BalanceDocument2 pagesFinal Worksheet Trial BalanceLhara GallendoNo ratings yet

- U4A5 PracExerciseDocument7 pagesU4A5 PracExerciseDrippy SnowflakeNo ratings yet

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Assignment Ex 21-22Document9 pagesAssignment Ex 21-22charmvielNo ratings yet

- Individual Assignment - IIDocument6 pagesIndividual Assignment - IIfikrumersha47No ratings yet

- FABM1 11 Quarter 4 Week 6 Las 3Document4 pagesFABM1 11 Quarter 4 Week 6 Las 3Janna PleteNo ratings yet

- Activity (Worksheet Preparation)Document3 pagesActivity (Worksheet Preparation)Lehnard Delos Reyes GellorNo ratings yet

- Accounts Worksheet For TanDocument3 pagesAccounts Worksheet For TanTan ArrowNo ratings yet

- Fabm 1 Las April 082024Document12 pagesFabm 1 Las April 082024gwynethpolia11No ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- Answer Sheet Work RelatedDocument41 pagesAnswer Sheet Work RelatedjoyhhazelNo ratings yet

- Practice Problem SolutionDocument15 pagesPractice Problem SolutionTherese Noelle R. ARMADA100% (1)

- Kashato ShirtsDocument20 pagesKashato ShirtsLaica Cardenio100% (5)

- Toaz - Info Cleaners Worksheet PRDocument1 pageToaz - Info Cleaners Worksheet PRStacie BravoNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetSeijuro AkashiNo ratings yet

- Cleaners WorksheetDocument1 pageCleaners WorksheetCracklings Gacuma100% (3)

- Cleaners WorksheetDocument1 pageCleaners WorksheetSeijuro Akashi100% (1)

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- QuizPeriodic 3Document48 pagesQuizPeriodic 3morNo ratings yet

- U4A5PracExercise Answer KeyDocument16 pagesU4A5PracExercise Answer KeyDrippy SnowflakeNo ratings yet

- Problem 11 1Document8 pagesProblem 11 1Sheen CaválidaNo ratings yet

- Acc. No.: Boulton's Toy EmporiumDocument4 pagesAcc. No.: Boulton's Toy EmporiumMisty TranquilNo ratings yet

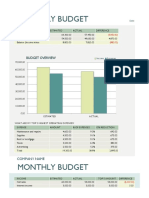

- Monthly Business BudgetDocument4 pagesMonthly Business BudgetOkasha HafeezNo ratings yet

- Kashato-Shirts Compress PDFDocument20 pagesKashato-Shirts Compress PDFApril Joy Tamayo100% (2)

- Yllana Bayview College Inc Fundamentals of Accountancy, Business and Management IIDocument1 pageYllana Bayview College Inc Fundamentals of Accountancy, Business and Management IIRalph Christer MaderazoNo ratings yet

- ACCTG - Worksheet Quality AutoDocument1 pageACCTG - Worksheet Quality AutoCab Vic100% (1)

- ABC 10-ColumnDocument1 pageABC 10-Columnpor wansNo ratings yet

- Basic Accounting Semestral Exam 2022Document6 pagesBasic Accounting Semestral Exam 2022Angie M. DelgadoNo ratings yet

- LoadingDocument1 pageLoadingmonopolygoplusNo ratings yet

- WAC - Corpo Acco - Good Hope CorporationDocument30 pagesWAC - Corpo Acco - Good Hope CorporationJasmine Acta100% (1)

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

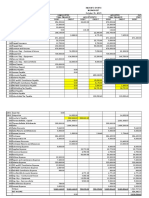

- Itax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Document13 pagesItax Solutions Philippines Income Statement Working Paper No. of Client Ave. Rate Per Client Frequency /year 2023 449,000.00Rose CastilloNo ratings yet

- Monthly Budget: Company NameDocument2 pagesMonthly Budget: Company NameMalleshNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- Particulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRDocument9 pagesParticulars Trial Balance Adjustments Adjusted Trial Balance DR CR DR CR DR CRasdfNo ratings yet

- Accounting RefresherDocument2 pagesAccounting RefresherAlbert MorenoNo ratings yet

- Trial BalDocument1 pageTrial Balvihanjangid223No ratings yet

- (Loss) - 197,037.76 - 142,192.76: ProfitDocument7 pages(Loss) - 197,037.76 - 142,192.76: ProfitJulious Capricho GerodiasNo ratings yet

- Monthly Budget Test: Company NameDocument4 pagesMonthly Budget Test: Company NameveeraaaNo ratings yet

- Pajak Rizki Rahmat Putra - 20AP2Document9 pagesPajak Rizki Rahmat Putra - 20AP2Alviana RenoNo ratings yet

- Seatwork 2 Worksheet Income Statemet Changes in Equity and Balance SheetDocument7 pagesSeatwork 2 Worksheet Income Statemet Changes in Equity and Balance Sheetjohn vincent de leonNo ratings yet

- 10 Column Heavy BombersDocument3 pages10 Column Heavy BombersVince Ferdinand Pajanustan100% (1)

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Accounting1 Hannah Travel and ToursDocument5 pagesAccounting1 Hannah Travel and ToursMarielle Mae Burbos100% (1)

- Abay General TRDocument2 pagesAbay General TRbereketNo ratings yet

- Example For Chapter 2 (FABM2)Document10 pagesExample For Chapter 2 (FABM2)Althea BañaciaNo ratings yet

- Balance Comprob (Youtube)Document5 pagesBalance Comprob (Youtube)luisNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ack The Inimitable BirbalDocument29 pagesAck The Inimitable BirbalapachemonoNo ratings yet

- Summary - Online Claim SubmissionDocument3 pagesSummary - Online Claim SubmissionapachemonoNo ratings yet

- Multiplication and Division Word ProblemsDocument2 pagesMultiplication and Division Word Problemsapachemono0% (1)

- Grade 5 Word Problems Decimals FDocument3 pagesGrade 5 Word Problems Decimals FapachemonoNo ratings yet

- Bank of IndiaDocument63 pagesBank of IndiaArmaan ChhaprooNo ratings yet

- E-Health Care Management Project ReportDocument41 pagesE-Health Care Management Project Reportvikas guptaNo ratings yet

- Case Study (The Flaundering Expatriate)Document9 pagesCase Study (The Flaundering Expatriate)Pratima SrivastavaNo ratings yet

- Mindmap For Hands Held HighDocument1 pageMindmap For Hands Held Highapi-523333030No ratings yet

- BAC 200 Accounting For AssetsDocument90 pagesBAC 200 Accounting For AssetsFaith Ondieki100% (3)

- Dragon Capital 200906Document38 pagesDragon Capital 200906anraidNo ratings yet

- Chelsea Vs Newcastle - Google SearchDocument1 pageChelsea Vs Newcastle - Google SearchfortniteplayerzerobuildNo ratings yet

- Binge Eating Disorder Relapse Prevention PlanDocument2 pagesBinge Eating Disorder Relapse Prevention PlanAntonia NicolaeNo ratings yet

- Module 24Document140 pagesModule 24api-278516771No ratings yet

- English File 4e Elementary TG PCM Comm 5ADocument1 pageEnglish File 4e Elementary TG PCM Comm 5ARaffael NuñezNo ratings yet

- Assignment Business LawDocument4 pagesAssignment Business LawAkash NathwaniNo ratings yet

- Law of Succession CATDocument11 pagesLaw of Succession CATSancho SanchezNo ratings yet

- Philippine Wildlife Species Profile ActivityDocument1 pagePhilippine Wildlife Species Profile ActivitymicahNo ratings yet

- How To Test SMTP Services Manually in Windows ServerDocument14 pagesHow To Test SMTP Services Manually in Windows ServerHaftamu HailuNo ratings yet

- Ethics SyllabusDocument5 pagesEthics SyllabusprincessNo ratings yet

- LabRel 1st 2014 TSNDocument126 pagesLabRel 1st 2014 TSNJose Gerfel GeraldeNo ratings yet

- Raw ScoreDocument2 pagesRaw ScoreDemi Nodado-JamirNo ratings yet

- Building The Divided City - Class, Race and Housing in Inner London 1945-1997Document31 pagesBuilding The Divided City - Class, Race and Housing in Inner London 1945-1997Harold Carter100% (1)

- B.A (English) Dec 2015Document32 pagesB.A (English) Dec 2015Bala SVDNo ratings yet

- MTC Routes: Route StartDocument188 pagesMTC Routes: Route StartNikhil NandeeshNo ratings yet

- CivilPro Cases 37 and 38 Full Texts - AyingDocument15 pagesCivilPro Cases 37 and 38 Full Texts - Ayingvienuell ayingNo ratings yet

- Iris Yessenia Reyes-Zavala, A206 775 262 (BIA March 22, 2016)Document7 pagesIris Yessenia Reyes-Zavala, A206 775 262 (BIA March 22, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Bimco - FPD Booklet 2012Document32 pagesBimco - FPD Booklet 2012Reda HmrNo ratings yet

- Bahasa Indonesia SMA Kelas XI (Bahasa) - Nurita Bayu Kusmayati-2009Document290 pagesBahasa Indonesia SMA Kelas XI (Bahasa) - Nurita Bayu Kusmayati-2009Deasy Murdiana100% (1)

- Ifma Fmpv3-0 F-B Ch2Document87 pagesIfma Fmpv3-0 F-B Ch2Mohamed IbrahimNo ratings yet

- Staffing & RecruitmentDocument80 pagesStaffing & Recruitmentsuganthi rajesh kannaNo ratings yet

- Cadila HealthcareDocument3 pagesCadila Healthcarenenu_b2048961No ratings yet

- Bpme1013 Group B Introduction To Entrepreneurship (Full)Document27 pagesBpme1013 Group B Introduction To Entrepreneurship (Full)Randa RamadhanNo ratings yet

- Holy Rosary - Sorrowful MysteriesDocument43 pagesHoly Rosary - Sorrowful MysteriesRhea AvilaNo ratings yet