Professional Documents

Culture Documents

Trial Balance Completed

Trial Balance Completed

Uploaded by

apachemono0 ratings0% found this document useful (0 votes)

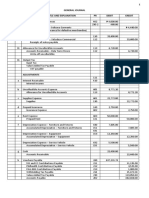

11 views1 pageThe trial balance is an internal document used to verify that total debits equal total credits in the general ledger. It lists each account and its balance in the debit or credit column. The trial balance for Jones General Services as of June 30, 2022 shows total debits of $34,382.54 equal to total credits, proving the equality of debits and credits.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe trial balance is an internal document used to verify that total debits equal total credits in the general ledger. It lists each account and its balance in the debit or credit column. The trial balance for Jones General Services as of June 30, 2022 shows total debits of $34,382.54 equal to total credits, proving the equality of debits and credits.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageTrial Balance Completed

Trial Balance Completed

Uploaded by

apachemonoThe trial balance is an internal document used to verify that total debits equal total credits in the general ledger. It lists each account and its balance in the debit or credit column. The trial balance for Jones General Services as of June 30, 2022 shows total debits of $34,382.54 equal to total credits, proving the equality of debits and credits.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

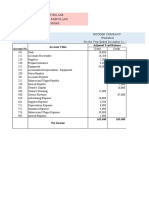

Trial Balance © AccountingCoach.

com - Filled-In Form G20

A trial balance is an internal document (not a financial statement) which is used to prove that the total amount

of debits in the general ledger is equal to the total amount of credits in the general ledger. This is done by

listing each account and then placing the account balance in the appropriate Debit or Credit column.

Name of Company or Organization: _____Jones General Services______

Trial Balance

As of this date: ____June 30, 2022_____

Account Account Balance

Number Account Title Debit Credit

1010 Cash 600.00

1200 Accounts receivable 4,956.44

1400 Supplies 900.00

1500 Prepaid insurance 600.00

1620 Equipment 19,500.00

1790 Accumulated depreciation 4,500.00

2010 Notes payable 6,000.00

2020 Accounts payable 3,554.25

2100 Interest payable 300.00

2300 Unearned revenues 1,000.00

2800 J. Owner, capital 6,228.29

3100 Service revenues 12,800.00

4200 Rent expense 3,000.00

4220 Utilities expense 795.55

4250 Insurance expense 130.55

5210 Advertising expense 625.00

5290 Depreciation expense 1,800.00

5400 Travel expense 400.00

6100 Professional fees 850.00

7100 Interest expense 225.00

Totals $ 34,382.54 $ 34,382.54

Note: The total of the debit column must be equal to the total of the credit column.

For a blank form see G20.

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- School - of - Finance - - - 101 - Questions ответыDocument98 pagesSchool - of - Finance - - - 101 - Questions ответыКирик ЕвченкоNo ratings yet

- Tata Motors Dupont and Altman Z-Score AnalysisDocument4 pagesTata Motors Dupont and Altman Z-Score AnalysisLAKHAN TRIVEDINo ratings yet

- Vincent Fabella 1Document29 pagesVincent Fabella 1James Sy67% (3)

- Assignment 4 - Financial Accounting - February 11Document4 pagesAssignment 4 - Financial Accounting - February 11Ednalyn PascualNo ratings yet

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Project On Ias Vs Ifrs Accounting StandardsDocument40 pagesProject On Ias Vs Ifrs Accounting Standardsakchourasia70950% (4)

- Nptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)Document3 pagesNptel Course Financial Management Assignment Ii: Liabilities Rs. (Million) Asset Rs. (Million)yogeshgharpureNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- Review Answer SheetDocument13 pagesReview Answer SheetKeycee Rhaye RivasNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Worksheet ProcedureDocument28 pagesWorksheet Procedurescryx bloodNo ratings yet

- Chapter 5Document11 pagesChapter 5Your NameNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Assignment 9 FARDocument23 pagesAssignment 9 FARcha618717No ratings yet

- INCOTAXDocument4 pagesINCOTAXnicole bancoroNo ratings yet

- GJS, TBS, and FSsDocument15 pagesGJS, TBS, and FSsNoro100% (1)

- AACONAPPS2 A433 - Audit of ReceivablesDocument23 pagesAACONAPPS2 A433 - Audit of ReceivablesDawson Dela CruzNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- Finals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaDocument6 pagesFinals Activity No .2 Completing THE Accounting Cycle: Palad, Nica C. Mr. Alfred BautistaMica Mae CorreaNo ratings yet

- Pa Revision For FinalsDocument9 pagesPa Revision For FinalsKhải Hưng NguyễnNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Income Statement & Balance SheetDocument1 pageIncome Statement & Balance SheetzZl3Ul2NNINGZzNo ratings yet

- Laboratoy Exercise Chapter 9Document3 pagesLaboratoy Exercise Chapter 9Ruthchell CiriacoNo ratings yet

- Bacc210 Assig 1Document6 pagesBacc210 Assig 1TarusengaNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Financial Statement AnalysisDocument2 pagesFinancial Statement Analysissmallvin62No ratings yet

- Project Income CalculatorDocument4 pagesProject Income CalculatorMahmoud ElmohamdyNo ratings yet

- ACCT1200 (20) Additional P&L Account and Balance Sheet QuestionDocument2 pagesACCT1200 (20) Additional P&L Account and Balance Sheet QuestionTaleh HasanzadaNo ratings yet

- LembarDocument26 pagesLembarIbnu Kamajaya75% (4)

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- Trial BalanceDocument1 pageTrial BalanceDaniyal ShahbazNo ratings yet

- Acc106 Assignment 2 Tie Beauty Enterprise FinalDocument15 pagesAcc106 Assignment 2 Tie Beauty Enterprise Finalnur anisNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- Trial Balance NewDocument1 pageTrial Balance NewridzuaannnnNo ratings yet

- Book 1Document6 pagesBook 1chrstncstlljNo ratings yet

- Profit After Tax: Revenue 25% Contribution Margin (% Change From Last y - 2%Document29 pagesProfit After Tax: Revenue 25% Contribution Margin (% Change From Last y - 2%Henry TranNo ratings yet

- Trial Balance Report: Kaplan FinancialDocument1 pageTrial Balance Report: Kaplan FinancialJenW12No ratings yet

- Collections:: Less: DisbursementDocument5 pagesCollections:: Less: DisbursementMukul KadyanNo ratings yet

- 1Document20 pages1Denver AcenasNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptDocument4 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash ReceiptFred WilsonNo ratings yet

- Beg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleDocument12 pagesBeg. Balance Sales Journal Voucher Registry Check Register Cash Receipt Account TitleFred WilsonNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 2 - Accounting Changes and ErrorsDocument5 pagesViray, Nhicole S. Asynchronous Quiz 2 - Accounting Changes and ErrorsZeeNo ratings yet

- Servicing SetSquid Game TradersDocument17 pagesServicing SetSquid Game TradersRona Mae AnteroNo ratings yet

- Poa 2012 Jan p.2.q.1 1Document4 pagesPoa 2012 Jan p.2.q.1 1RealGenius (Carl)No ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- United Finance Company SoagDocument1 pageUnited Finance Company SoagMohamed RaghebNo ratings yet

- Financial Statemtents ShortDocument7 pagesFinancial Statemtents Shortgk concepcionNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- QuestionsDocument13 pagesQuestionsAriaNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- 07 - Activity - 1 PMI CHARTDocument2 pages07 - Activity - 1 PMI CHARTLorielyn Arnaiz CaringalNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Trial Balance and Adjustments CompletedDocument1 pageTrial Balance and Adjustments CompletedapachemonoNo ratings yet

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ack The Inimitable BirbalDocument29 pagesAck The Inimitable BirbalapachemonoNo ratings yet

- Summary - Online Claim SubmissionDocument3 pagesSummary - Online Claim SubmissionapachemonoNo ratings yet

- Multiplication and Division Word ProblemsDocument2 pagesMultiplication and Division Word Problemsapachemono0% (1)

- Grade 5 Word Problems Decimals FDocument3 pagesGrade 5 Word Problems Decimals FapachemonoNo ratings yet

- Test 1Document7 pagesTest 1getcultured69No ratings yet

- The Principles of InvestmentDocument29 pagesThe Principles of InvestmentsimilikitiawokwokNo ratings yet

- Capital Budgeting AssignmentDocument6 pagesCapital Budgeting AssignmentAdnan SethiNo ratings yet

- Zee Entertainment Detailed Financial Analysis - Part 2Document13 pagesZee Entertainment Detailed Financial Analysis - Part 2Nikhil GuptaNo ratings yet

- BSA - Balmes Paolo Gabriel Et - Al. 10 Page ResearchDocument9 pagesBSA - Balmes Paolo Gabriel Et - Al. 10 Page ResearchChryshelle LontokNo ratings yet

- Genmath LoansDocument22 pagesGenmath LoansninjarkNo ratings yet

- 1 Points: Incorrect/Not AnsweredDocument7 pages1 Points: Incorrect/Not AnsweredTroisNo ratings yet

- MODULE 6A Home Office and Branch AccountingDocument14 pagesMODULE 6A Home Office and Branch AccountingmcespressoblendNo ratings yet

- Test Financial AcountingDocument12 pagesTest Financial Acountingtouria100% (1)

- Important Yt LinksDocument3 pagesImportant Yt Linksrosesingh00610No ratings yet

- FM-I Risk Return Analysis Project AssignmentDocument5 pagesFM-I Risk Return Analysis Project AssignmentSIDDHARTH GAUTAMNo ratings yet

- Questions With SolutionsDocument4 pagesQuestions With SolutionsArshad UllahNo ratings yet

- PhonePe Statement Feb2024 Mar2024Document56 pagesPhonePe Statement Feb2024 Mar2024fq0908063No ratings yet

- Module 4 Exercises - JFCDocument10 pagesModule 4 Exercises - JFCJARED DARREN ONGNo ratings yet

- 2 Sem - Bcom - Advanced Financial AccountingDocument39 pages2 Sem - Bcom - Advanced Financial AccountingpradeepNo ratings yet

- Factors Affecting Dividend Policy SeminorDocument2 pagesFactors Affecting Dividend Policy SeminorChetan Kumar ChinttuNo ratings yet

- Learning Objectives-Auditing LiabDocument3 pagesLearning Objectives-Auditing Liabadrian eboraNo ratings yet

- ACCOUNTING FOR CORPORATIONS-Share CapitalDocument57 pagesACCOUNTING FOR CORPORATIONS-Share CapitalMarriel Fate Cullano75% (8)

- YeloDocument2 pagesYeloSugeng NugrohoNo ratings yet

- Capital Gains Charts - May 2024 & June 2024Document10 pagesCapital Gains Charts - May 2024 & June 2024CA Tushar GuptaNo ratings yet

- Accounting For Shareholders EquityDocument6 pagesAccounting For Shareholders EquityCamille BacaresNo ratings yet

- Global Business - Unit 4Document86 pagesGlobal Business - Unit 4GauravTiwariNo ratings yet

- Grade 9update9learnersampleDocument11 pagesGrade 9update9learnersampleJohanet NawrattelNo ratings yet

- Dombivli Shikshan Prasarak Mandal'S K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Document17 pagesDombivli Shikshan Prasarak Mandal'S K. V. Pendharkar College of Arts, Science and Commerce (Autonomous)Nayna PanigrahiNo ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- Payback Method - Payback Period Formula - AccountingToolsDocument5 pagesPayback Method - Payback Period Formula - AccountingToolsFriedeagle OilNo ratings yet