Professional Documents

Culture Documents

BIR ITR 2306 - Castillo

BIR ITR 2306 - Castillo

Uploaded by

Bernadine CastilloCopyright:

Available Formats

You might also like

- Crisis Assessment Intervention and Prevention 2nd Edition Cherry Test BankDocument22 pagesCrisis Assessment Intervention and Prevention 2nd Edition Cherry Test Bankdolium.technic.1i5d67100% (36)

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- Img20220216 11142252Document1 pageImg20220216 11142252Graciel AbarcaNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316Kaye ApostolNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Caringal 477712081Document1 pageCaringal 477712081Jennifer LambinoNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- Cruz 413519429 122022Document1 pageCruz 413519429 122022Rhea C CabillanNo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- 2316 PepitoDocument1 page2316 PepitoRiezel PepitoNo ratings yet

- Bir Form 2316Document1 pageBir Form 2316edenestoleros27No ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadDocument1 pageCertificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadJeffree Lann AlvarezNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- 2316 (1) 1 Sangrades, SchechinaDocument1 page2316 (1) 1 Sangrades, SchechinaLeo GasminNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Certificate of Compensation Payment/ Tax Withheld: Il/ll:lqooDocument1 pageCertificate of Compensation Payment/ Tax Withheld: Il/ll:lqooFrancis Ruelo TassiatNo ratings yet

- Laetitia Kalunga - Payslip February 2021Document1 pageLaetitia Kalunga - Payslip February 2021officialteeyaNo ratings yet

- Delector, Regine - Bir 2316Document2 pagesDelector, Regine - Bir 2316Marienhela MeriñoNo ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument2 pages1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationJa'maine ManguerraNo ratings yet

- XR 80Document1 pageXR 80ncanellosNo ratings yet

- 1601-C July For ApprovalDocument1 page1601-C July For ApprovalJa'maine ManguerraNo ratings yet

- Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageDelgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- 9lso 2006 Jun ADocument4 pages9lso 2006 Jun ALucio Indiana WalazaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- Nomina Enero de 2024 2Document2 pagesNomina Enero de 2024 2martitaclaracalataNo ratings yet

- 01.dcreative 1601c Jan2019 FinalDocument2 pages01.dcreative 1601c Jan2019 FinalChristopher John CarmenNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- Ízf3Tè9Â Makatiâfinanceâco Âââ Â Ç, Â, 6hî Makati Finance CorpDocument2 pagesÍzf3Tè9Â Makatiâfinanceâco Âââ Â Ç, Â, 6hî Makati Finance CorpFelipe SorianoNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Mancom Q1 2022 DilgDocument20 pagesMancom Q1 2022 DilgLyka GuilengNo ratings yet

- MST347. QSD. Billing CELS Rental (TC315000058) - 2024 06 11Document50 pagesMST347. QSD. Billing CELS Rental (TC315000058) - 2024 06 11EVA bdcNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- India Water Crisis and Its SolDocument2 pagesIndia Water Crisis and Its SolKanishk KatareNo ratings yet

- 2005 02 25 - DR1Document1 page2005 02 25 - DR1Zach EdwardsNo ratings yet

- Critical Analysis of Transgender Persons (Protection of Rights) Act, 2019Document16 pagesCritical Analysis of Transgender Persons (Protection of Rights) Act, 2019Alethea JoelleNo ratings yet

- Morality and The Politics of Shakespeare's: MacbethDocument9 pagesMorality and The Politics of Shakespeare's: Macbethlegit dudeNo ratings yet

- JointTradesMATSLetter FinalDocument4 pagesJointTradesMATSLetter FinaljeffbradynprNo ratings yet

- Story 2Document2 pagesStory 2TESL3-0618 Humaira Husna Binti GhazaliNo ratings yet

- Celestion Guitar Loudspeakers Brochure PDFDocument20 pagesCelestion Guitar Loudspeakers Brochure PDFAndrei ZamfirNo ratings yet

- RFI - IT Application Development and ServicesDocument24 pagesRFI - IT Application Development and ServicesSaikumar RoithNo ratings yet

- Chapter 6Document19 pagesChapter 6Naveed SultanNo ratings yet

- Ivylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0Document4 pagesIvylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0ivy loraine enriquezNo ratings yet

- PC 1 2022Document92 pagesPC 1 2022Dea Rose Jacinto Amat-MallorcaNo ratings yet

- PF Enomination Job AidDocument9 pagesPF Enomination Job Aidashritha prakashNo ratings yet

- Shavonne Blades, Et Al., v. City and County of Denver, Et Al.Document51 pagesShavonne Blades, Et Al., v. City and County of Denver, Et Al.Michael_Roberts2019No ratings yet

- Book ReviewDocument4 pagesBook Reviewananya sinhaNo ratings yet

- VedicReport SRDocument1 pageVedicReport SRDeepakNo ratings yet

- Integration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsDocument1 pageIntegration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsVladan KuzmanovicNo ratings yet

- Amit Varma NoticeDocument3 pagesAmit Varma NoticeparbatarvindNo ratings yet

- External & Internal Communication: Standard Operating ProcedureDocument12 pagesExternal & Internal Communication: Standard Operating ProcedureAby FNo ratings yet

- Teaching Note Archer Daniels Midland Company: Case OverviewDocument7 pagesTeaching Note Archer Daniels Midland Company: Case OverviewRoyAlexanderWujatsonNo ratings yet

- Gerunds With Likes + DislikesDocument2 pagesGerunds With Likes + DislikesrobertoNo ratings yet

- Mission Possible-Drama Skit PDFDocument3 pagesMission Possible-Drama Skit PDFCheska AnianaNo ratings yet

- Penology 2Document10 pagesPenology 2Anand maratheNo ratings yet

- Entrepreneurial Journey of Richard BransonDocument7 pagesEntrepreneurial Journey of Richard Bransondolly saggarNo ratings yet

- Decoding A Term SheetDocument1 pageDecoding A Term Sheetsantosh kumar pandaNo ratings yet

- Arens14e ch20 PPTDocument30 pagesArens14e ch20 PPTkabirakhan2007No ratings yet

- Risk Management and Internal Control System - Reference Framework PDFDocument42 pagesRisk Management and Internal Control System - Reference Framework PDFChinh Lê Đình100% (1)

- 65 263 1 PBDocument11 pages65 263 1 PBChinedu Martins OranefoNo ratings yet

- Cadenas Drives USA PDFDocument238 pagesCadenas Drives USA PDFCamilo Araya ArayaNo ratings yet

- Historias GibraltarDocument95 pagesHistorias Gibraltarjocifa100% (1)

BIR ITR 2306 - Castillo

BIR ITR 2306 - Castillo

Uploaded by

Bernadine CastilloOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR ITR 2306 - Castillo

BIR ITR 2306 - Castillo

Uploaded by

Bernadine CastilloCopyright:

Available Formats

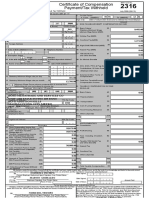

Republic Ofthe Philippines

ecst Department of Finance

Item:

Form No.

Certificate of Compensation

2316

nua 2018 (ENCS) Payment/Tax Withheld

For the Year

Pa

2 o 2 3 For the Period

0101 0907

TIN

940 9 5 4 o O o o A. ØNPENSATtON INCOME

5 27 Basic Salary (including the exempt

Castillo, Amold, Pizana or MieStatutory MinimumWage Of the MWE

ae Pay (MWE)

29 Overtime Pay (MWE)

30 Night Shift Differential (MWE)

31 Hazard Pay (MWE)

7 32 13th Month Pay and Other Benefits

62,681.51

03061983 33 De MinlmisBenefits

000)

43,737.10

9 MinimumWage per day

34 SSS, GSIS, PHIC & PAG-IBIG Contributions

10 Statutory MinimumWage rate per monti andUnionDues (Employee share only)

MinimumWage Earner (MWE)whose compensation IS exempt

from

35 Salaries and Other Forms of Compensation 0.00

36 Total Non-TaxableÆxemptCompatsation

Part 11- E 126,213.81

12TIN 205 366

Infonnadon

921 •o oo o Income tsum

B. TAXABLE COMPENSATIONINCOME REGULAR

35)

CONCENTRIX CVG PHILIPPINES, INC. 37 Basic Salary 305,138.06

i4A ZIP code

15 Type of Enwoyer X Main Employer Secondary Employer

Part 111

-E Information evious 40 Cost of Living Allowance (COLA)

16 TIN

41 Fixed Housing Allowance

42 Others

GF 14thto 25th Fir 6798 Ayal 42B

Part SUPPLEMENTARY

-S

19 Gross Compensaäon Income from Present 43 Commission

431,351.88

E*yer tan

20 Less: TOW Cornpensation 44 Profit Sharing

126,213.81

Incorne from Pæsent Employer 36)

21 Taxable IncomefromPres-ent 45 Fees Including Directors Fees

305,138.06

Employer 20)(fian 50)

22 Add: Taxable Compensation from

46 Taxable MonthBenefits 0.00

Previous if applicable

0.00

23 Gross Taxable Compensation Incorne 47 Hazard Pay

305,138.06

48 Overtime Pay

24 TaxDue 8,270.71

49 Others

25 Amountof Taxes Withheld 8,270.71

25A present Employer 49A OTHER TAXABLE INCOME 0.00

25B PreviousEmployer,if aplicabte 0.00

26 Total Amount of Taxes Wtthheld as

8,270.71 50 Total Taxable CompensaUon Income

(sum rems and25B) 305,138.06

IdWedeclare, the of perjury that this certificate has made in faith, verified by me/us, and to the bwt of my/our knowle#-e arW beE€, is Oue

me of the Nationd Internal Revenue Code. as arrwWed, and correct. purswrt to

issæd authoriw thereof. Furüer, Ifwe give consent to my/our

51 EDENREY os Date Signed

Present Employer/Authoriz Agen re over Printed Name

CONFORME:

52 Castil Arnol izana Date Signed

Employee ignature Printed Name

CTCNalid ID No. Arnm.ant

paE. if CrC

Place of

fllln

I uMer ofFriury that irtorrrutimIEeln nted ar

I of perjurythat I am

reported under BIR Form NO. 1604-C which has been filed with the Bureau of (BIRFarm i7@), SinceI Income Tax Return

Purdy incMbetrun in the Phili*nes

Internal Revenue. for yur; that have my (tax

Form No. ISN-C by my

EDENREY RAMOS Fmrn 2316 theMme NR

my tax return:

pursW1tto Olenvwms

Of Revane (RA) NO. 3-2002.

Present Employer/Authorized Agent Signature over Printed Name

(Head of Accounting/Human Resource or Authorized Representative) 54 ast 10Arn Pizana

*NOTE; The BIR Data Privacy is jn the BIR website (www.bir.gov.ph)

You might also like

- Crisis Assessment Intervention and Prevention 2nd Edition Cherry Test BankDocument22 pagesCrisis Assessment Intervention and Prevention 2nd Edition Cherry Test Bankdolium.technic.1i5d67100% (36)

- 2316 (1) 2Document2 pages2316 (1) 2jeniffer pamplona100% (2)

- Jai2316 Sep 2021 ENCS - Final - CorrectedDocument2 pagesJai2316 Sep 2021 ENCS - Final - Correctedmariefe.wvillacoraNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: Rivera St. San Francisco, Red-V, Ibabang Dupay, Lucena CityACYATAN & CO., CPAs 2020No ratings yet

- Adobe Scan Jun 27, 2023Document1 pageAdobe Scan Jun 27, 2023Lalyn PasaholNo ratings yet

- 1 ZDS Bir 2316 2023Document2 pages1 ZDS Bir 2316 2023Cheny RojoNo ratings yet

- Img20220216 11142252Document1 pageImg20220216 11142252Graciel AbarcaNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316Kaye ApostolNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityDocument2 pagesCertificate of Compensation Payment/Tax Withheld: 106 Ilang Ilang ST Zaballero Subd Brgy Gulang Gulang Lucena CityMaria Cristina TuazonNo ratings yet

- 2022 BIR Form 2316 - 2013650Document1 page2022 BIR Form 2316 - 2013650erik skiNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Maria Cristina TuazonNo ratings yet

- 2316 (1) 1 Manilyn Nervar 2023Document1 page2316 (1) 1 Manilyn Nervar 2023Beng moralesNo ratings yet

- Ferrer 0000 12312022Document1 pageFerrer 0000 12312022Vincent FerrerNo ratings yet

- De gUIADocument3 pagesDe gUIAjeffrey s. lebatiqueNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument1 pageCertificate of Compensation Payment/Tax WithheldKimberly IgbalicNo ratings yet

- Caringal 477712081Document1 pageCaringal 477712081Jennifer LambinoNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- Cruz 413519429 122022Document1 pageCruz 413519429 122022Rhea C CabillanNo ratings yet

- Bayani, JeniferDocument1 pageBayani, JenifergeekerytimeNo ratings yet

- 2316 PepitoDocument1 page2316 PepitoRiezel PepitoNo ratings yet

- Bir Form 2316Document1 pageBir Form 2316edenestoleros27No ratings yet

- Amc 2316 2022Document14 pagesAmc 2316 2022Boracay BeachAthonNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadDocument1 pageCertificate of Compensation Payment/Tax Withheld: Abao, Cherry Ann DadJeffree Lann AlvarezNo ratings yet

- Aclon 4726323910000 12312023Document1 pageAclon 4726323910000 12312023Jeanne D. GozoNo ratings yet

- 2316 Jan 2018 ENCSDocument262 pages2316 Jan 2018 ENCSAndrea BuenoNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Part I - Employee InformationDocument1 pageCertificate of Compensation Payment/Tax Withheld: Part I - Employee InformationIvy Baarde AlmarioNo ratings yet

- 2316 (1) 1 Sangrades, SchechinaDocument1 page2316 (1) 1 Sangrades, SchechinaLeo GasminNo ratings yet

- Bir 16385 16382Document1 pageBir 16385 16382Ryzen LlameNo ratings yet

- Eoyt 2020Document1 pageEoyt 2020Izza Joy MartinezNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldJane Tricia Dela penaNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigDocument1 pageCertificate of Compensation Payment/Tax Withheld: B 149 L 34 Helgen Havn Delvo Street Central Bicutan TaguigJay De LeonNo ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument26 pagesCertificate of Compensation Payment/Tax WithheldLalai SaflorNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityDocument46 pagesCertificate of Compensation Payment/Tax Withheld: Co, Eugenio Cho Fatima Homes Karuhatan Valenzuela CityMariluz GregorioNo ratings yet

- Certificate of Compensation Payment/Tax Withheld: (Present)Document2 pagesCertificate of Compensation Payment/Tax Withheld: (Present)Charles C. ArsolonNo ratings yet

- 2022 Bir2316Document1 page2022 Bir2316CalyxNo ratings yet

- CARDOITRFINALNA!2316Document1 pageCARDOITRFINALNA!2316كيمبرلي ماري إنريكيز100% (1)

- Certificate of Compensation Payment/ Tax Withheld: Il/ll:lqooDocument1 pageCertificate of Compensation Payment/ Tax Withheld: Il/ll:lqooFrancis Ruelo TassiatNo ratings yet

- Laetitia Kalunga - Payslip February 2021Document1 pageLaetitia Kalunga - Payslip February 2021officialteeyaNo ratings yet

- Delector, Regine - Bir 2316Document2 pagesDelector, Regine - Bir 2316Marienhela MeriñoNo ratings yet

- Bir Docx XXXXXXDocument1 pageBir Docx XXXXXXRyzen LlameNo ratings yet

- Statement of Earnings and Deductions: Payment Date: Pay End DateDocument1 pageStatement of Earnings and Deductions: Payment Date: Pay End Datewebmaroc 2020No ratings yet

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDocument2 pages1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationJa'maine ManguerraNo ratings yet

- XR 80Document1 pageXR 80ncanellosNo ratings yet

- 1601-C July For ApprovalDocument1 page1601-C July For ApprovalJa'maine ManguerraNo ratings yet

- Delgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageDelgado, Julius Marantal: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldACYATAN & CO., CPAs 2020No ratings yet

- Certificate of Compensation Payment/Tax WithheldDocument2 pagesCertificate of Compensation Payment/Tax WithheldKyrel Ann B. MadriagaNo ratings yet

- 9lso 2006 Jun ADocument4 pages9lso 2006 Jun ALucio Indiana WalazaNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument1 pageKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAlvin AbilleNo ratings yet

- Form 2316 Eb Member RegularDocument1 pageForm 2316 Eb Member Regularmha anneNo ratings yet

- Nomina Enero de 2024 2Document2 pagesNomina Enero de 2024 2martitaclaracalataNo ratings yet

- 01.dcreative 1601c Jan2019 FinalDocument2 pages01.dcreative 1601c Jan2019 FinalChristopher John CarmenNo ratings yet

- ITR2015Document1 pageITR2015Drizza FerrerNo ratings yet

- Ízf3Tè9Â Makatiâfinanceâco Âââ Â Ç, Â, 6hî Makati Finance CorpDocument2 pagesÍzf3Tè9Â Makatiâfinanceâco Âââ Â Ç, Â, 6hî Makati Finance CorpFelipe SorianoNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- Grimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesGrimaldo, Marvin: Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldFranc Anthony GalaoNo ratings yet

- Kawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldDocument2 pagesKawanihan NG Rentas Internas For Compensation Payment With or Without Tax WithheldAnonymous kouBRirs7vNo ratings yet

- Mancom Q1 2022 DilgDocument20 pagesMancom Q1 2022 DilgLyka GuilengNo ratings yet

- MST347. QSD. Billing CELS Rental (TC315000058) - 2024 06 11Document50 pagesMST347. QSD. Billing CELS Rental (TC315000058) - 2024 06 11EVA bdcNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- India Water Crisis and Its SolDocument2 pagesIndia Water Crisis and Its SolKanishk KatareNo ratings yet

- 2005 02 25 - DR1Document1 page2005 02 25 - DR1Zach EdwardsNo ratings yet

- Critical Analysis of Transgender Persons (Protection of Rights) Act, 2019Document16 pagesCritical Analysis of Transgender Persons (Protection of Rights) Act, 2019Alethea JoelleNo ratings yet

- Morality and The Politics of Shakespeare's: MacbethDocument9 pagesMorality and The Politics of Shakespeare's: Macbethlegit dudeNo ratings yet

- JointTradesMATSLetter FinalDocument4 pagesJointTradesMATSLetter FinaljeffbradynprNo ratings yet

- Story 2Document2 pagesStory 2TESL3-0618 Humaira Husna Binti GhazaliNo ratings yet

- Celestion Guitar Loudspeakers Brochure PDFDocument20 pagesCelestion Guitar Loudspeakers Brochure PDFAndrei ZamfirNo ratings yet

- RFI - IT Application Development and ServicesDocument24 pagesRFI - IT Application Development and ServicesSaikumar RoithNo ratings yet

- Chapter 6Document19 pagesChapter 6Naveed SultanNo ratings yet

- Ivylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0Document4 pagesIvylorainepenriquez: Page1of4 248brgymaahas 0 9 1 9 - 2 8 2 5 - 1 7 Lagunalosbanos 4 0 3 0ivy loraine enriquezNo ratings yet

- PC 1 2022Document92 pagesPC 1 2022Dea Rose Jacinto Amat-MallorcaNo ratings yet

- PF Enomination Job AidDocument9 pagesPF Enomination Job Aidashritha prakashNo ratings yet

- Shavonne Blades, Et Al., v. City and County of Denver, Et Al.Document51 pagesShavonne Blades, Et Al., v. City and County of Denver, Et Al.Michael_Roberts2019No ratings yet

- Book ReviewDocument4 pagesBook Reviewananya sinhaNo ratings yet

- VedicReport SRDocument1 pageVedicReport SRDeepakNo ratings yet

- Integration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsDocument1 pageIntegration of Circular Economy in The Surf Industry - A Vision Aligned With The Sustainable Development GoalsVladan KuzmanovicNo ratings yet

- Amit Varma NoticeDocument3 pagesAmit Varma NoticeparbatarvindNo ratings yet

- External & Internal Communication: Standard Operating ProcedureDocument12 pagesExternal & Internal Communication: Standard Operating ProcedureAby FNo ratings yet

- Teaching Note Archer Daniels Midland Company: Case OverviewDocument7 pagesTeaching Note Archer Daniels Midland Company: Case OverviewRoyAlexanderWujatsonNo ratings yet

- Gerunds With Likes + DislikesDocument2 pagesGerunds With Likes + DislikesrobertoNo ratings yet

- Mission Possible-Drama Skit PDFDocument3 pagesMission Possible-Drama Skit PDFCheska AnianaNo ratings yet

- Penology 2Document10 pagesPenology 2Anand maratheNo ratings yet

- Entrepreneurial Journey of Richard BransonDocument7 pagesEntrepreneurial Journey of Richard Bransondolly saggarNo ratings yet

- Decoding A Term SheetDocument1 pageDecoding A Term Sheetsantosh kumar pandaNo ratings yet

- Arens14e ch20 PPTDocument30 pagesArens14e ch20 PPTkabirakhan2007No ratings yet

- Risk Management and Internal Control System - Reference Framework PDFDocument42 pagesRisk Management and Internal Control System - Reference Framework PDFChinh Lê Đình100% (1)

- 65 263 1 PBDocument11 pages65 263 1 PBChinedu Martins OranefoNo ratings yet

- Cadenas Drives USA PDFDocument238 pagesCadenas Drives USA PDFCamilo Araya ArayaNo ratings yet

- Historias GibraltarDocument95 pagesHistorias Gibraltarjocifa100% (1)