Professional Documents

Culture Documents

Multiple Choice Questions Accounting

Multiple Choice Questions Accounting

Uploaded by

ScribdTranslations0 ratings0% found this document useful (0 votes)

15 views2 pagesThe key documents needed to understand a company's financial situation and profit/loss are the balance sheet and profit and loss statement. The types of accounts that make up these documents include assets, liabilities, equity, debtors and creditors. These accounts track the assets, debts, obligations, profits and losses of the business. In accounting, the debit side of an account records charges or debits, while the credit side records payments or credits. The balance of an account is the difference between total debits and total credits.

Original Description:

Multiple Choice Questions Accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe key documents needed to understand a company's financial situation and profit/loss are the balance sheet and profit and loss statement. The types of accounts that make up these documents include assets, liabilities, equity, debtors and creditors. These accounts track the assets, debts, obligations, profits and losses of the business. In accounting, the debit side of an account records charges or debits, while the credit side records payments or credits. The balance of an account is the difference between total debits and total credits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views2 pagesMultiple Choice Questions Accounting

Multiple Choice Questions Accounting

Uploaded by

ScribdTranslationsThe key documents needed to understand a company's financial situation and profit/loss are the balance sheet and profit and loss statement. The types of accounts that make up these documents include assets, liabilities, equity, debtors and creditors. These accounts track the assets, debts, obligations, profits and losses of the business. In accounting, the debit side of an account records charges or debits, while the credit side records payments or credits. The balance of an account is the difference between total debits and total credits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

What documents are necessary to formulate in order to know the financial

situation and the net profit or loss of the company?

a) Balance Sheet and Profit and Loss Statement.

b) Balance Sheet and Capital Accounts

c) Asset and Liability Accounts

Are they types of accounts?

a) Debtor and creditor

b) Assets, liabilities and equity

c) Profit and loss

Are these accounts controlling the assets and rights owned by the company?

a) Active

b) Creditor

c) Capital

Are these the accounts that control the debts and obligations of the entity?

a) Debtor

b) Losses

c) Liabilities

Are the accounts controlling both the profits as well as the losses of the

business?

a) Balance sheet

b) Capital

c) Earnings

What is the column on the left side of an accounting account?

a) You must

b) See

c) Charge or debit

What is the column on the right-hand side of an accounting account?

a) Pay or credit

b) Charge or debit

c) See

It is the entry of an amount in the debit side of an account.

a) Charge or debit

b) Pay or credit

c) See

It is to credit an amount to an account.

a) Charge or debit

b) Pay or credit

c) You must

What do we use to represent the account to explain the movements and

balances?

a) Account schema or G/L schema

b) Accounting scheme

c) Financial Schematic

Name that receives the sum of the charges on an account?

a) Debit movement

b) Credit movement

c) Balance

Name that receives the sum of the credits to an account?

a) Debit movement

b) Credit movement

c) Balance

It is the difference between the debit and the credit movement.

a) Payment

b) Capital

c) Balance

It is when the movements in an account are the same

a) Account settled or closed

b) Equalization account

c) Profit and loss statement

It is when the credit movement in an account is greater than the debit

movement.

a) Debit balance.

b) Credit balance

c) Assets

You might also like

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiShahid NaikNo ratings yet

- QuickbooksDocument54 pagesQuickbooksyes1nth100% (2)

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessRodNo ratings yet

- Toa.m-1402. Review of The Accounting ProcessDocument5 pagesToa.m-1402. Review of The Accounting ProcessLINDIE MARIE RABENo ratings yet

- REVIEWERDocument9 pagesREVIEWERHanns Lexter PadillaNo ratings yet

- Acctng ProcessDocument4 pagesAcctng ProcessElaine YapNo ratings yet

- E 14-6 Acquisition-Excess Allocation and Amortization EffectDocument13 pagesE 14-6 Acquisition-Excess Allocation and Amortization EffectRizkina MoelNo ratings yet

- PlatinumDocument4 pagesPlatinumJOHNNo ratings yet

- Eleina Bea Bernardo - Analyzing Transaction-ExercisesDocument8 pagesEleina Bea Bernardo - Analyzing Transaction-ExercisesEleina Bea BernardoNo ratings yet

- Accounting Process-QuestionnairesDocument7 pagesAccounting Process-QuestionnairesJennifer ArcadioNo ratings yet

- MCQDocument20 pagesMCQSujeet GuptaNo ratings yet

- SET LedgerDocument5 pagesSET LedgerHifzaNo ratings yet

- Accountant TestDocument7 pagesAccountant TestZeeshan PervaizNo ratings yet

- Mcs QDocument52 pagesMcs QNabeel GondalNo ratings yet

- C3 Accounting & Information SystemDocument22 pagesC3 Accounting & Information SystemSteeeeeeeephNo ratings yet

- QuizDocument4 pagesQuizSaad mubeenNo ratings yet

- Accounting MCQDocument26 pagesAccounting MCQharshagambhir2706No ratings yet

- Non-Profit Organisations Accounts MCQS: A) B) C) D)Document5 pagesNon-Profit Organisations Accounts MCQS: A) B) C) D)Anonymous EZxKXzNo ratings yet

- Transaction AnalysisDocument16 pagesTransaction AnalysisNicolas ErnestoNo ratings yet

- Acc101-FinalRevnew 001yDocument26 pagesAcc101-FinalRevnew 001yJollybelleann MarcosNo ratings yet

- ExercisesDocument2 pagesExercisesATBNo ratings yet

- ACC 280 Final ExamDocument4 pagesACC 280 Final Examanon_624482436No ratings yet

- MCQ For IntroDocument52 pagesMCQ For IntroJahanzaib ButtNo ratings yet

- View Answer Correct Answer: (A) Convention of ConservatismDocument145 pagesView Answer Correct Answer: (A) Convention of ConservatismChinmay Sirasiya (che3kuu)No ratings yet

- MCQs Cost and Financial AccountingDocument10 pagesMCQs Cost and Financial Accountingkhalida khanNo ratings yet

- Fabm Review-QuizDocument1 pageFabm Review-QuizASSET MPCNo ratings yet

- ACCTG 1 - CHAP 8, 9 and 10 PDFDocument10 pagesACCTG 1 - CHAP 8, 9 and 10 PDFHassleBustNo ratings yet

- Midterm Exam QuestionsDocument42 pagesMidterm Exam QuestionsElgun ElgunNo ratings yet

- Financial AccountingDocument85 pagesFinancial Accountingsushainkapoor photoNo ratings yet

- Model Question Paper AccountingDocument8 pagesModel Question Paper AccountingHanith CgNo ratings yet

- Fabm2121 Week 11 19Document40 pagesFabm2121 Week 11 19Mikhaela CoronelNo ratings yet

- Multiple Choice Questions: B. C. D. EDocument18 pagesMultiple Choice Questions: B. C. D. ETsania AmbarNo ratings yet

- An Explanation of Debits and CreditsDocument4 pagesAn Explanation of Debits and Creditskishorepatil8887100% (1)

- Grade 11 POA Diagnostic TestDocument3 pagesGrade 11 POA Diagnostic TestracolliecoburnNo ratings yet

- Which of The Following Forms of Business Organizations Exists As A Legal Entity?Document5 pagesWhich of The Following Forms of Business Organizations Exists As A Legal Entity?Amin MNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiArroNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple Choice Questions Subject: Accountancy Class: XiDocument4 pagesMultiple Choice Questions Subject: Accountancy Class: XiAli HassanNo ratings yet

- Multiple-Choice 06052024Document9 pagesMultiple-Choice 06052024quejotemaryclaireNo ratings yet

- The Type of Account With A Normal Credit Balance Is?: Mcqs 1 To 10Document7 pagesThe Type of Account With A Normal Credit Balance Is?: Mcqs 1 To 10asfandiyarNo ratings yet

- 35 Basic Accounting Test QuestionsDocument9 pages35 Basic Accounting Test QuestionsDenny OctavianoNo ratings yet

- MCQs Financial Accounting BSCSDocument11 pagesMCQs Financial Accounting BSCSPervaiz Shahid100% (2)

- Balance Sheet & P&L Related ConceptsDocument33 pagesBalance Sheet & P&L Related Conceptsritu_gnimsNo ratings yet

- Accounting Staff Written AnswerDocument2 pagesAccounting Staff Written Answercla manpowerservices100% (1)

- Model Exit Exam - Fundamentals of Accounting IDocument9 pagesModel Exit Exam - Fundamentals of Accounting Inatnael0224No ratings yet

- Chapter-2 Theory - 1-21 - Financial AccountingDocument8 pagesChapter-2 Theory - 1-21 - Financial AccountingOmor FarukNo ratings yet

- Armando Ordinanza ChallengeDocument8 pagesArmando Ordinanza ChallengeChristian John de LeonNo ratings yet

- Fundametals of Accounting I 50 MC QuestionsDocument9 pagesFundametals of Accounting I 50 MC QuestionsFasiko AsmaroNo ratings yet

- Accounting Principles 10e Chapter 2 NotesDocument18 pagesAccounting Principles 10e Chapter 2 NotesallthefreakypeopleNo ratings yet

- 11th-Accountancy-Book-Back-One-Mark-Study-Materials-English-Medium - 2 PDFDocument6 pages11th-Accountancy-Book-Back-One-Mark-Study-Materials-English-Medium - 2 PDFSuresh GNo ratings yet

- MCQDocument25 pagesMCQAnith PillaiNo ratings yet

- 35 Basic Accounting Test QuestionsDocument14 pages35 Basic Accounting Test QuestionsShimelisNo ratings yet

- FA MCQ On PrinciplesDocument9 pagesFA MCQ On Principlestiwariarad100% (1)

- Acconting For Managers - 2Document6 pagesAcconting For Managers - 2akm.mhs20No ratings yet

- Multiple Choice QuestionsDocument12 pagesMultiple Choice QuestionsNguyen Thanh Thao (K16 HCM)No ratings yet

- Sa110 Notes 2016Document6 pagesSa110 Notes 2016coolmanzNo ratings yet

- CHOICE4Document4 pagesCHOICE4Aminadab TewhiboNo ratings yet

- Midterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BDocument6 pagesMidterm - Financial Acctg & Reporting First Sem (Sy2021 2022) BLENNETH MONESNo ratings yet

- Amoni Edome Coc Sample Exam-Level LLLDocument13 pagesAmoni Edome Coc Sample Exam-Level LLLAmoni EdomeNo ratings yet

- 6951 Accounting ProcessDocument4 pages6951 Accounting Processjohn paulNo ratings yet

- Auditing.: A. B. C. DDocument12 pagesAuditing.: A. B. C. DbiniamNo ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Application of Copper Sulfate in AquacultureDocument2 pagesApplication of Copper Sulfate in AquacultureScribdTranslationsNo ratings yet

- Natural History of Parkinson's DiseaseDocument49 pagesNatural History of Parkinson's DiseaseScribdTranslationsNo ratings yet

- Abbreviated File-Process Case 01 Marco A. and CounterclaimDocument25 pagesAbbreviated File-Process Case 01 Marco A. and CounterclaimScribdTranslationsNo ratings yet

- Retirement Instructions Unemployment PorvenirDocument6 pagesRetirement Instructions Unemployment PorvenirScribdTranslationsNo ratings yet

- SYLLABUS Mechanical Drawing 2Document7 pagesSYLLABUS Mechanical Drawing 2ScribdTranslationsNo ratings yet

- Chapter X. Precision Shooting From Naval Air PlatformsDocument24 pagesChapter X. Precision Shooting From Naval Air PlatformsScribdTranslationsNo ratings yet

- History and Evolution of Reciprocating MotorsDocument32 pagesHistory and Evolution of Reciprocating MotorsScribdTranslationsNo ratings yet

- Ethnicity, Language and IdentityDocument4 pagesEthnicity, Language and IdentityScribdTranslationsNo ratings yet

- Musical Instruments of EuropeDocument3 pagesMusical Instruments of EuropeScribdTranslationsNo ratings yet

- Boxing PDFDocument49 pagesBoxing PDFScribdTranslationsNo ratings yet

- Practical Work The Familiar PDFDocument1 pagePractical Work The Familiar PDFScribdTranslationsNo ratings yet

- Comparative Table of Rationalism and EmpiricismDocument7 pagesComparative Table of Rationalism and EmpiricismScribdTranslationsNo ratings yet

- Tourist PlanningDocument39 pagesTourist PlanningScribdTranslationsNo ratings yet

- Chemistry Laboratory Report 1Document14 pagesChemistry Laboratory Report 1ScribdTranslationsNo ratings yet

- Reading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.Document5 pagesReading Comprehension and Contextual Vocabulary Exercises 4th Middle #8.ScribdTranslationsNo ratings yet

- PH Portfolio Recovery ProposalDocument3 pagesPH Portfolio Recovery ProposalScribdTranslationsNo ratings yet

- Sixth Grade Reading Comprehension AssessmentDocument8 pagesSixth Grade Reading Comprehension AssessmentScribdTranslationsNo ratings yet

- Application of Regulations in The Financial SystemDocument74 pagesApplication of Regulations in The Financial SystemScribdTranslationsNo ratings yet

- 5th Grade Plan - Block 4 GeographyDocument12 pages5th Grade Plan - Block 4 GeographyScribdTranslationsNo ratings yet

- iTEP in - House PDFDocument12 pagesiTEP in - House PDFScribdTranslationsNo ratings yet

- Types of Banks Based On OwnershipDocument2 pagesTypes of Banks Based On OwnershipScribdTranslationsNo ratings yet

- Expo22 Daily ExperienceDocument6 pagesExpo22 Daily ExperienceScribdTranslationsNo ratings yet

- Driver's Manual in TexasDocument109 pagesDriver's Manual in TexasScribdTranslationsNo ratings yet

- Legal Aspects GuatemalaDocument20 pagesLegal Aspects GuatemalaScribdTranslationsNo ratings yet

- Project On Electricity For ChildrenDocument13 pagesProject On Electricity For ChildrenScribdTranslationsNo ratings yet

- Security of Accounting Information SystemsDocument2 pagesSecurity of Accounting Information SystemsScribdTranslationsNo ratings yet

- Applied StatisticsDocument209 pagesApplied StatisticsScribdTranslationsNo ratings yet

- Examples of Operant ConditioningDocument1 pageExamples of Operant ConditioningScribdTranslationsNo ratings yet

- Vibrational Sound Therapy ManualDocument12 pagesVibrational Sound Therapy ManualScribdTranslationsNo ratings yet

- Event Security ProtocolDocument7 pagesEvent Security ProtocolScribdTranslationsNo ratings yet

- Plagiarism Declaration Form (T-DF)Document8 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- EMI CalculatorDocument12 pagesEMI CalculatorLipu MohapatraNo ratings yet

- NTCC Final Report by Riya JainDocument16 pagesNTCC Final Report by Riya Jainriya jainNo ratings yet

- Certificates Forming Part of CRS March 2018Document48 pagesCertificates Forming Part of CRS March 2018Venkat UppalapatiNo ratings yet

- Jonathon Clements Long NSMDocument7 pagesJonathon Clements Long NSMValueWalkNo ratings yet

- Do You Have A: SavingsDocument34 pagesDo You Have A: SavingsLee TeukNo ratings yet

- BBP Form 1Document3 pagesBBP Form 1Umalo Libmanan Camarines SurNo ratings yet

- Name: Auwal Ibrahim Wallet Number: 8139996597Document47 pagesName: Auwal Ibrahim Wallet Number: 8139996597smileboyvibes2No ratings yet

- 1031 Exchange Administrator Resume SampleDocument2 pages1031 Exchange Administrator Resume Sampleresume7.com100% (1)

- Cryptocurrenc Y: The Technology Behind Cryptocurrency and How It Is Used Now and in The Near FutureDocument5 pagesCryptocurrenc Y: The Technology Behind Cryptocurrency and How It Is Used Now and in The Near FutureRaja Amir Khan100% (1)

- Cambridge O Level: Accounting 7707/01Document10 pagesCambridge O Level: Accounting 7707/01Syed AsharNo ratings yet

- 914010001051417 (3)Document3 pages914010001051417 (3)ShawnDhineshNo ratings yet

- Commission StructureDocument11 pagesCommission Structuredreamz unfulfilledNo ratings yet

- GaapDocument18 pagesGaapsujan BhandariNo ratings yet

- Financial Analysis Modeling CFIDocument13 pagesFinancial Analysis Modeling CFImike110*100% (1)

- Zambia - An Ethnological Analysis of The Influence of Mobile MoneyDocument25 pagesZambia - An Ethnological Analysis of The Influence of Mobile MoneyFitzmaurice SimaanyaNo ratings yet

- Fixed Deposit Account Opening FormDocument10 pagesFixed Deposit Account Opening FormSandeepReddyNo ratings yet

- Toyota Silang Cavite Inc.: Principal Borrower Co-BorrowerDocument1 pageToyota Silang Cavite Inc.: Principal Borrower Co-BorrowerAllyson BautistaNo ratings yet

- Chapter 10 IFDocument25 pagesChapter 10 IFcuteserese roseNo ratings yet

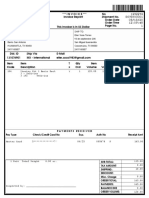

- Inv 2272 10272020Document1 pageInv 2272 10272020Ab Mejía VargasNo ratings yet

- Transaction Statement1626153268Document2 pagesTransaction Statement1626153268Rohit PalNo ratings yet

- International ParityDocument5 pagesInternational ParitySumit GuptaNo ratings yet

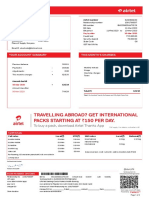

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesBASHARAT KHANNo ratings yet

- The Other Face of Managerial AccountingDocument20 pagesThe Other Face of Managerial AccountingModar AlzaiemNo ratings yet

- Colgate Financial Model SolvedDocument1 pageColgate Financial Model SolveddurgeshnarkarNo ratings yet

- Nondeliverable Forward enDocument2 pagesNondeliverable Forward enPushpraj Singh BaghelNo ratings yet

- Banking - and - Insurance NMIMS Assignment - Dec - 2022Document7 pagesBanking - and - Insurance NMIMS Assignment - Dec - 2022ChahelNo ratings yet