Professional Documents

Culture Documents

Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017

Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017

Uploaded by

Makanaka MutandariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017

Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017

Uploaded by

Makanaka MutandariCopyright:

Available Formats

Cambridge Assessment International Education

Cambridge Ordinary Level

PRINCIPLES OF ACCOUNTS 7110/22

Paper 2 Structured October/November 2017

MARK SCHEME

Maximum Mark: 120

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge International will not enter into discussions about these mark schemes.

Cambridge International is publishing the mark schemes for the October/November 2017 series for most

Cambridge IGCSE®, Cambridge International A and AS Level components and some Cambridge O Level

components.

® IGCSE is a registered trademark.

This document consists of 13 printed pages.

© UCLES 2017 [Turn over

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

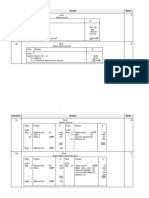

1(a) Cash Book (extract) 7

Date Details Discount Bank Date Details Discount Bank

$ $ $ $

2017 2017

Sept 1 Balance b/d 1900 Sept 8 General 725

expenses

5 Cello 20 830 (1) 26 Tansley 70 3430 (1)

14 Francis 60 1940 (1) 29 Alice 300 (1)

23 Alice 300 (1) 30 Balance c/d 515

80 (1)of 4 970 70 4970

Oct 1 Balance b/d 515 (1)OF

1(b) Discount Received account 3

Date Details $ Date Details $

2017 2017

Sept 30 Income statement 345 (1)OF Sept 1 Balance b/d 275 (1)

30 Cash Book 70 (1)OF

345 345

1(c) Sub-division 2

Discount allowed General/Nominal(1)

Tansley Purchases (1)

© UCLES 2017 Page 2 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

1(d) $ 3

Trial balance before year end adjustment 3600 (1)

Income statement 2500 (1)

Statement of financial position at 1100 (1)

30 September 2017

1(e) Document 3

A written acknowledgement of money Receipt (1)

received

A demand for payment Invoice (1)

A summary of transactions for a period Statement of

issued to a customer account (1)

1(f)(i) Running balance account (1) 1

1(f)(ii) The balance of the account is always available (1) 1

Easily understood by non-specialists (1)

Max 1

Accept other valid points

© UCLES 2017 Page 3 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

2(a) General journal 7

Dr Cr

$ $

Suspense 4900 }

Rent payable 4900 (1)

Suspense 4900 } (1)

Rent receivable 4900 (1)

Suspense 900 (1)

General expenses 900 (1)

Purchases 3400 (1)

Suspense 3400 (1)

2(b) Suspense account 4

Details $ Details $

Rent payable 4 900 } (1) Original difference 7 300 (1)OF

Rent receivable 4 900 } Purchases 3 400 (1)

General expenses 900 (1)

10 700 10 700

© UCLES 2017 Page 4 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

2(c) Revision of profit 5

$

Draft profit for the year 15 600

Increase Decrease

$ $

1. Rent receivable, $4900 4 900 (1)

had been debited to the 4 900 (1)

Rent payable account.

2. General expenses paid of 900 (1)

$1200 had been correctly

entered in the cash book

but had been recorded in

the general expenses

account as $2100.

3. No debit entry had been 3400 (1)

made for purchases,

$3400, on credit from D.

Ploy

10 700 3 400 7 300

Revised profit for the year 22 900 (1)OF

2(d) 1 Commission is an error of posting in the same class/type of account. (1) 4

Principle is an error of posting to a different class/type of account. (1)

2 Compensation is the result of more than one error in posting which compensate each other. (1)

Reversal occurs where both the entries are reversed for a single error. (1)

© UCLES 2017 Page 5 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

3(a) Subscriptions account 6

Date Details $ Date Details $

2016 2016

Oct 1 Balance b/d 200 Oct 1 Balance b/d 320

2017 2017 Bank 7600 (1)

Sept 30 Income and 7800 (1)OF Sept 30 Irrecoverable/Bad 200 (1)

expenditure(1) debts

30 Balance c/d 400 30 Balance c/d 280

8400 8400

Oct 1 Balance b/d 280 (1) Oct 1 Balance b/d 400 (1)

3(b) Max 4

Receipts and payments account Income and expenditure account

Contains an opening and closing balance (1) No balances surplus/deficit at end is transferred

to the accumulated fund (1)

Contains only cash receipts or payments (1) Contains non-cash items such as depreciation (1)

Contains only actual cash receipts or payments Adjusted for accruals and prepayments (1)

(1)

Contains both capital and revenue expenditure (1) Does not contain capital expenditure (1)

© UCLES 2017 Page 6 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

3(c) Puxton Social Club 8

Statement of Financial Position at 30 September 2017

$ $

Non-current assets

Equipment and fixtures (valuation) 5800 (1)

Current assets

Inventory of refreshments 350

Subscriptions in arrears 280 (1)

Other receivables 30 (1)

Bank 170

830

Total assets 6630

Accumulated fund

Opening balance 2250 (1)OF

Plus Surplus 150

2400 (1)OF

Non-current liability

8% bank loan (repayable 31 December 2019) 3500 (1)

Current liabilities

Trade payables 80

Subscriptions in advance 400 (1)

Other payables 250 (1)

730

Total liabilities 6 630

© UCLES 2017 Page 7 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

3(d) A more realistic depreciation expense used is charged to income statement/income and expenditure account (1) 2

Value in statement of financial position is realistic market value (1)

It is simple and straight forward to use (1)

Avoids the need for keeping detailed records. (1)

Max 2

Other valid answers accepted

Question Answer Marks

4(a)(i) 100 2

Revenue 240 000 × (1) = 320 000 (1)

75

4(a)(ii) Purchases 240 000 + (33 500 – 19 700) = 253 800 (1) 2

(1)

4(a)(iii) Profit for the year 80 000 (1) – 65 000 = 15 000 (1) 2

4(b) Workings 31 July 31 July 6

2017 2016

Profit margin (profit for the year 15 000 ×100 =

to revenue) 4.69% (1)OF 2.31%

320 000 (1)OF

Return on capital employed 15 000 OF

(ROCE) × 100 12.50% (1)OF 20.00%

70 000 + 50 000 (1)

Working capital ratio (current 33 500 + 50 500

ratio) (1) 2.10:1 (1) 1.25:1

25 000

© UCLES 2017 Page 8 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

4(c) The profit margin has improved/increased (1) OF 4

This may be due to increasing prices (1), change in product mix (1), controlling expenses (1), cheaper suppliers/lower cost of

sales (1) OF

Return on capital employed has deteriorated (1) of

This may be due to an increase in the capital employed (1) OF such as the bank loan (1) OF

Profit reduced (1) OF This may be due to decrease in profit for the year due to loan interest (1) OF

Max 2 points x (2 marks)

(1 mark) for stating and (1 mark) for development

Own figures apply.

Other valid answers accepted

4(d) The working capital ratio is sufficient (1) OF 2

It is slightly above the recommended level of 2:1 (1) OF

4(e) Introduce more capital in cash 2

Obtain a further long-term loan

Reduce drawings

Reduce expenses

Sale of non-current assets

Other acceptable answers accepted

2 points x (1 mark)

© UCLES 2017 Page 9 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

5(a) Jian and Shen 19

Income Statement and Appropriation Account for the year ended 30 June 2017

$ $

Revenue 520 000

Returns ( 10 300)

509 700 (1)

Inventory at 1 July 2016 37 800

Purchases 314 000

351 800

Returns (8 200) (1)

343 600

Carriage inwards 3 000

346 600

Inventory at 30 June 2017 (42 900)

Cost of sales (303 700) (1) OF

Gross profit 206 000

Carriage outwards 9 550 (1)

Wages and salaries (87 500 – 5 000) 82 500 (1)

Electricity and water (8 450 + 1150) 9 600 (1)

General expenses 28 850 (1)

Motor vehicle expenses (19 100 – 200) 18 900 (1)

Bank loan interest (2 500 + 1 500) 4 000 (1)

Bad debt 3 500 (1)

Increase in provision for doubtful debts 3 000 (1)

Provisions for depreciation –

Leasehold buildings 6 000 (1)

Motor vehicles 7 500 (1)

Office fixtures 1 600 (1)

(175 000)

Profit for the year 31 000

© UCLES 2017 Page 10 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

5(a) Interest on drawings:

Jian 800

Shen 600

} (1)

1 400

32 400

Interest on capital:

Jian 3 500

Shen 2 500

} (1)

(6 000)

26 400

Salary Shen (5 000) (1)

21 400

Share of profit:

Jian 16 050 (1) OF

Shen 5 350 (1) OF

21 400

5(b) Current accounts 6

Jian Shen Jian Shen

$ $ $ $

Balance b/d 500 900 Interest on capital 3 500 2 500 (1)OF

Drawings 8 000 6 000 (1) Salary 5 000

Drawings (salary) 5 000 (1) Share of profit 16 050 5 350 (1)OF

Interest on 800 600 (1)OF

drawings

Balance c/d 10 250 350

19 550 12 850 19 550 12 850

Balance b/d 10 250 350 (1)OF

© UCLES 2017 Page 11 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

5(c) Jian and Shen 15

Statement of Financial Position at 30 June 2017

Non-current assets Accumulated Net book

Cost

depreciation value

$ $ $

Leasehold buildings 120 000 36 000 84 000 (1)

Motor vehicles 40 000 17 500 22 500 (1)

Office fixtures 16 000 (1) 4 100 11 900

176 000 57 600 118 400

Current assets

Inventory 42 900 (1)

Trade receivables (63 500 – 3 500) 60 000 (1)

provision for doubtful debts (5 000)

55 000 (1)OF

Other receivables 200 (1)

98 100

Total assets 216 500

Capital accounts:

Jian 70 000

Shen 50 000

} (1)

120 000

Current accounts:

Jian 10 250

Shen 350

} (1) OF

10 600

130 600

Non-current liabilities

8% loan (repayable 2025) 50 000 (1)

© UCLES 2017 Page 12 of 13

7110/22 Cambridge O Level – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

5(c) Current liabilities

Trade payables 23 150 (1)

Other payables (1 150(1) + 1 500(1)) 2 650

Bank overdraft (10 600(1) – 500(1)) 10 100

35 900

Total capital and liabilities 216 500

Suitable alternative layouts accepted

© UCLES 2017 Page 13 of 13

You might also like

- ASE20093 Mark Scheme November 2019Document16 pagesASE20093 Mark Scheme November 2019Myomin Htay100% (4)

- Body Memory ArchitectureDocument1 pageBody Memory ArchitecturethisisthemanNo ratings yet

- Part 2 PreludeDocument51 pagesPart 2 PreludeTraian ProdanovNo ratings yet

- 2019dec - MEC551Document9 pages2019dec - MEC551Aina Najwa Binti ShamsuddinNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Document12 pagesCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716No ratings yet

- Cambridge International Examinations: Principles of Accounts 7110/22 May/June 2017Document13 pagesCambridge International Examinations: Principles of Accounts 7110/22 May/June 2017Phiri AgnesNo ratings yet

- Cambridge Assessment International Education: Accounting 0452/21 October/November 2017Document9 pagesCambridge Assessment International Education: Accounting 0452/21 October/November 20171234No ratings yet

- Cambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Document9 pagesCambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Taha AhmedNo ratings yet

- Cambridge International Examinations: Accounting 0452/22 March 2017Document13 pagesCambridge International Examinations: Accounting 0452/22 March 2017Mike ChindaNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/23 October/November 2017Document8 pagesCambridge Assessment International Education: Accounting 9706/23 October/November 2017ASHITA AGARWAL-01841No ratings yet

- 0452 m17 Ms 22Document13 pages0452 m17 Ms 22Mohammed MaGdyNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/32 October/November 2017Document11 pagesCambridge Assessment International Education: Accounting 9706/32 October/November 2017Phiri Arah RachelNo ratings yet

- 9706 m17 Ms 32Document16 pages9706 m17 Ms 32FarrukhsgNo ratings yet

- Cambridge Assessment International Education: Accounting 9706/31 October/November 2017Document14 pagesCambridge Assessment International Education: Accounting 9706/31 October/November 2017Phiri Arah RachelNo ratings yet

- 7110 w15 Ms 22 PDFDocument9 pages7110 w15 Ms 22 PDFRachel RAMSAMYNo ratings yet

- Accounting Nov 2017 AddendumDocument16 pagesAccounting Nov 2017 Addendumkwanele andiswaNo ratings yet

- IGCSE Accounting All Mark Scheme 2002 Summer 2018Document1,453 pagesIGCSE Accounting All Mark Scheme 2002 Summer 2018Muhammad Arif100% (3)

- Zodeq Vision - Accounting LedgersDocument24 pagesZodeq Vision - Accounting LedgerskeemorodriquezNo ratings yet

- 0452 s17 Ms 23Document12 pages0452 s17 Ms 23Vyakt MehtaNo ratings yet

- Accruals Q1 AnswerDocument2 pagesAccruals Q1 AnswerRiyu RimmyNo ratings yet

- Test I Accounts MSDocument10 pagesTest I Accounts MSDhrisha GadaNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/22 March 2020Document7 pagesCambridge International AS & A Level: Accounting 9706/22 March 2020Javed MushtaqNo ratings yet

- Cambridge O Level: Accounting 7707/23 October/November 2020Document14 pagesCambridge O Level: Accounting 7707/23 October/November 2020ImanNo ratings yet

- Mark Scheme: Extra Assessment Material For First Teaching September 2017Document13 pagesMark Scheme: Extra Assessment Material For First Teaching September 2017shamNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2015 SeriesDocument8 pages9706 Accounting: MARK SCHEME For The October/November 2015 Seriestecho2345No ratings yet

- n560 - Financial Accounting n5 Memo June 2019 - AdallDocument9 pagesn560 - Financial Accounting n5 Memo June 2019 - AdallemgnNo ratings yet

- 03 0452 12 MS Final ScorisDocument10 pages03 0452 12 MS Final ScorisFarman FaheemNo ratings yet

- Test Ii Accounts MSDocument10 pagesTest Ii Accounts MSDhrisha GadaNo ratings yet

- Cambridge International Examinations Cambridge International General Certificate of Secondary EducationDocument11 pagesCambridge International Examinations Cambridge International General Certificate of Secondary EducationputtytrishNo ratings yet

- Cambridge International Examinations: Accounting 0452/11 May/June 2017Document11 pagesCambridge International Examinations: Accounting 0452/11 May/June 2017Ayman ZarifNo ratings yet

- P3-5a, p3-2b William 6081901032 FDocument13 pagesP3-5a, p3-2b William 6081901032 FWilliam Wihardja0% (1)

- Acctg Books - Subsidiary Ledgers IllustrationDocument9 pagesAcctg Books - Subsidiary Ledgers IllustrationCorn SaladNo ratings yet

- 0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Document26 pages0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Divya SinghNo ratings yet

- Journals To Trial Balance/lembar Jwban Test 2 Journal To TBDocument5 pagesJournals To Trial Balance/lembar Jwban Test 2 Journal To TBirma febianNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/22 May/June 2020Document10 pagesCambridge International AS & A Level: Accounting 9706/22 May/June 2020Bora BoraNo ratings yet

- Cambridge International Examinations: Accounting 0452/12 March 2017Document8 pagesCambridge International Examinations: Accounting 0452/12 March 2017Mike ChindaNo ratings yet

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The October/November 2013 SeriestarunyadavfutureNo ratings yet

- Accruals Q2 AnswerDocument1 pageAccruals Q2 AnswerRiyu RimmyNo ratings yet

- 7110 w13 Ms 22Document10 pages7110 w13 Ms 22Muhammad UmairNo ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDocument5 pages9706 Accounting: MARK SCHEME For The May/June 2014 SeriesMateeh-ur -rehmanNo ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- 7110 w14 Ms 21Document11 pages7110 w14 Ms 21Muhammad Umair100% (1)

- Accounting II-1Document151 pagesAccounting II-1Adnan KanwalNo ratings yet

- Slides Lect 4Document11 pagesSlides Lect 4Stephen SogahNo ratings yet

- 7110 s19 Ms 21 PDFDocument15 pages7110 s19 Ms 21 PDFkazamNo ratings yet

- Accrual & PrepaymentsDocument4 pagesAccrual & PrepaymentsronstarcaristaNo ratings yet

- GR 8 November Exam 2023 MEMO AccountingDocument7 pagesGR 8 November Exam 2023 MEMO AccountingRolandi ViljoenNo ratings yet

- Big BuildersDocument3 pagesBig Buildersrethaxaba82No ratings yet

- Cambridge Assessment International Education: This Document Consists of 19 Printed PagesDocument19 pagesCambridge Assessment International Education: This Document Consists of 19 Printed Pagestecho2345No ratings yet

- BAFS Mock Paper 2A Set 8 Ans EngDocument9 pagesBAFS Mock Paper 2A Set 8 Ans Enghannahho0723No ratings yet

- Grade 10 T2Revision Material - 2023Document14 pagesGrade 10 T2Revision Material - 2023ryalepillay09No ratings yet

- Chapter 8Document6 pagesChapter 8swaroopcharmiNo ratings yet

- Agbanlog Ae121 Fa2 MidtermsDocument28 pagesAgbanlog Ae121 Fa2 MidtermsMariette Alex AgbanlogNo ratings yet

- CH 4: Apply Your Knowledge Decision Case 4-1: Accounting 9/e Solutions Manual 392Document15 pagesCH 4: Apply Your Knowledge Decision Case 4-1: Accounting 9/e Solutions Manual 392Loany Martinez100% (1)

- Cambridge International Examinations: Accounting 9706/33 May/June 2017Document16 pagesCambridge International Examinations: Accounting 9706/33 May/June 2017Malik AliNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument9 pagesCambridge International General Certificate of Secondary Educationcheah_chinNo ratings yet

- 2016 Jan MS 4ac0Document14 pages2016 Jan MS 4ac0Syeda Malika AnjumNo ratings yet

- Cambridge IGCSE™: Accounting 0452/23 October/November 2020Document14 pagesCambridge IGCSE™: Accounting 0452/23 October/November 2020ATTIQ UR REHMANNo ratings yet

- 4AC0 01 MSC 20150305 PDFDocument14 pages4AC0 01 MSC 20150305 PDFSabsNo ratings yet

- Cambridge O Level: Accounting 7707/22 October/November 2020Document14 pagesCambridge O Level: Accounting 7707/22 October/November 2020Iman100% (1)

- O Level Agriculture Notes 2020 Teachers Copy-1Document158 pagesO Level Agriculture Notes 2020 Teachers Copy-1Makanaka MutandariNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument16 pagesCambridge International General Certificate of Secondary EducationMakanaka MutandariNo ratings yet

- Farm BuildingsDocument5 pagesFarm BuildingsMakanaka MutandariNo ratings yet

- Reserve (Argumentative) 2Document4 pagesReserve (Argumentative) 2Makanaka MutandariNo ratings yet

- Valdez V Dabon (Digest)Document2 pagesValdez V Dabon (Digest)GM AlfonsoNo ratings yet

- Headbangers Kitchen PDFDocument2 pagesHeadbangers Kitchen PDFNimmi NimsNo ratings yet

- Portrait So The Events Had To Be Sketchy With The Aim ofDocument8 pagesPortrait So The Events Had To Be Sketchy With The Aim ofvademecumdevallyNo ratings yet

- Embryo Root Shoot. Food Store Grow Germinate Seed CoatDocument66 pagesEmbryo Root Shoot. Food Store Grow Germinate Seed CoathgNo ratings yet

- The Most Amazing Structure On EarthDocument2 pagesThe Most Amazing Structure On EarthStrafalogea SerbanNo ratings yet

- Occupations: Lesson Plan Prathom 5Document11 pagesOccupations: Lesson Plan Prathom 5Raymond RainMan DizonNo ratings yet

- Psychology 4th Edition Schacter Test BankDocument22 pagesPsychology 4th Edition Schacter Test BankWilliamBeckymce100% (43)

- CH05Document23 pagesCH05Stephen FortisNo ratings yet

- Decimal Series: 1 Naya Paisa Copper Nickle IssueDocument8 pagesDecimal Series: 1 Naya Paisa Copper Nickle IssueSeshadri VenkatNo ratings yet

- Macys Inc Store ListingDocument57 pagesMacys Inc Store ListingSurya NarayananNo ratings yet

- Fetal Skull: Badeea Seliem Soliman Assistant Prof. of Gynecology and Obstetrics Zagazig UniversityDocument107 pagesFetal Skull: Badeea Seliem Soliman Assistant Prof. of Gynecology and Obstetrics Zagazig UniversityBharat Thapa50% (2)

- Remote Natural EnvironmentDocument2 pagesRemote Natural EnvironmentAn TruongNo ratings yet

- Chapter 1 Toxins - Kill The Primates, Rule The World. Or: Don't Turn Your Back On A Fungus!Document9 pagesChapter 1 Toxins - Kill The Primates, Rule The World. Or: Don't Turn Your Back On A Fungus!Eved1981 superrito.comNo ratings yet

- A Literary Analysis and Criticism of George Orwell "Nineteen Eighty-Four (1984) " Using Socio-Logical ApproachDocument7 pagesA Literary Analysis and Criticism of George Orwell "Nineteen Eighty-Four (1984) " Using Socio-Logical ApproachFrancis FranciscoNo ratings yet

- 2021 Florida Complex League Schedule - REVISED 6.3.21Document4 pages2021 Florida Complex League Schedule - REVISED 6.3.21Josh Norris100% (1)

- Articles of Association SIDCLDocument19 pagesArticles of Association SIDCLdavidNo ratings yet

- VERSINI 2018 - A Distributed Modelling Approach To Assess The Use of Blue and GreenInfrastructures To Ful L Stormwater Management RequirementsDocument4 pagesVERSINI 2018 - A Distributed Modelling Approach To Assess The Use of Blue and GreenInfrastructures To Ful L Stormwater Management RequirementscoutohahaNo ratings yet

- Liquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesDocument1 pageLiquid Marijuana Cocktail Recipe - How To Make A Liquid Marijuana Cocktail - Drink Lab Cocktail & Drink RecipesJazymine WrightNo ratings yet

- Arts10 Q4 Mod1Document8 pagesArts10 Q4 Mod1Merjie A. NunezNo ratings yet

- PW Select October 2016Document22 pagesPW Select October 2016Publishers WeeklyNo ratings yet

- Physics DPP 5Document3 pagesPhysics DPP 5Hitesh KumarNo ratings yet

- Soal Usbn Bahasa Inggris K 2006Document12 pagesSoal Usbn Bahasa Inggris K 2006Jhon SadinNo ratings yet

- 3rd Simposium On SCCDocument11 pages3rd Simposium On SCCNuno FerreiraNo ratings yet

- Assignment Project Planning ADocument4 pagesAssignment Project Planning ATatenda MarwodziNo ratings yet

- BSP Bhilai Steel Plant Training ProjectDocument31 pagesBSP Bhilai Steel Plant Training ProjectAysha Rahman100% (1)

- How Did Peter Pan Grow Up Into A Children's StoryDocument140 pagesHow Did Peter Pan Grow Up Into A Children's StoryTatiana Mihaela100% (1)