Professional Documents

Culture Documents

Form 10B - Filed Form AY 21-22

Form 10B - Filed Form AY 21-22

Uploaded by

SHIKHA SHARMACopyright:

Available Formats

You might also like

- Mergers and Acquisitions: A Step-by-Step Legal and Practical GuideFrom EverandMergers and Acquisitions: A Step-by-Step Legal and Practical GuideNo ratings yet

- Working Paper TemplatesDocument9 pagesWorking Paper TemplatesTroisNo ratings yet

- Pacific Guardian Life Policy Change FormDocument2 pagesPacific Guardian Life Policy Change FormharjsandhuNo ratings yet

- 2019form RevGIS StockDocument13 pages2019form RevGIS StockMae De GuzmanNo ratings yet

- Audit Planning QuestionsDocument12 pagesAudit Planning QuestionsMaster50% (2)

- Bangalore University - Provisional Examination ResultsDocument2 pagesBangalore University - Provisional Examination ResultsSowmya Somanna100% (1)

- Form 10B - Filed FormDocument4 pagesForm 10B - Filed FormcakhaleelassociateshydNo ratings yet

- 10B 4 Year PDFDocument8 pages10B 4 Year PDFKumar UditNo ratings yet

- Form No. 10BDocument3 pagesForm No. 10BLalit PardasaniNo ratings yet

- Form No.10bDocument4 pagesForm No.10bKeith RobbinsNo ratings yet

- Form 10BDocument4 pagesForm 10BCA Vishal ThakkarNo ratings yet

- Form 10B - 2018Document3 pagesForm 10B - 2018Harsh sainiNo ratings yet

- 9 B. S. F.Y. 2014 15Document14 pages9 B. S. F.Y. 2014 15prescongoa.ikigaiNo ratings yet

- LifeFoundation AuditorReport2006Document10 pagesLifeFoundation AuditorReport2006cachandhiranNo ratings yet

- India Sudar TaxFile 2006-07Document9 pagesIndia Sudar TaxFile 2006-07India Sudar Educational and Charitable TrustNo ratings yet

- CARO 2020 ReportDocument7 pagesCARO 2020 ReportranjitNo ratings yet

- f1024 PDFDocument22 pagesf1024 PDFMonica GradyNo ratings yet

- Due Diligence Checklist NGODocument3 pagesDue Diligence Checklist NGOHydragreens FoundationNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormMAHALAKSHMI NAGESH BUDDHANo ratings yet

- CARO2020Document8 pagesCARO2020CA Paramesh HemanathNo ratings yet

- FATCA Non IndividualDocument6 pagesFATCA Non IndividualMarneni Yallamanda RaoNo ratings yet

- Supplier Questionnaire & Code of Conduct - For ENTITIE2Document7 pagesSupplier Questionnaire & Code of Conduct - For ENTITIE2Zubair ChishtiNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormSandeep AgrawalNo ratings yet

- Head Office Application For Empanelment of ValuersDocument8 pagesHead Office Application For Empanelment of ValuersShaishav KumarNo ratings yet

- US Internal Revenue Service: f2350 - 2001Document3 pagesUS Internal Revenue Service: f2350 - 2001IRSNo ratings yet

- UCAA Primary and Expansion Application Form 8Document8 pagesUCAA Primary and Expansion Application Form 8Estefania RiveraNo ratings yet

- IC Application For Insurance Agents License - FILLINDocument4 pagesIC Application For Insurance Agents License - FILLINrgortegaivNo ratings yet

- Application For Registration: (For Certain Excise Tax Activities)Document6 pagesApplication For Registration: (For Certain Excise Tax Activities)douglas jonesNo ratings yet

- Pursuant To Section 70 of The Companies Act, 1956Document13 pagesPursuant To Section 70 of The Companies Act, 1956Basit KhanNo ratings yet

- Form No. 55Document2 pagesForm No. 55busuuuNo ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document11 pagesStock Corporation General Instructions:: General Information Sheet (Gis)Law LawNo ratings yet

- Draft Offer Letter PAS 4Document12 pagesDraft Offer Letter PAS 4binodgstpNo ratings yet

- Sav 1048Document7 pagesSav 1048Michael100% (2)

- SIDBI Trader Finance Scheme Loan Application Form: A. Business InformationDocument15 pagesSIDBI Trader Finance Scheme Loan Application Form: A. Business InformationJaveed TajiNo ratings yet

- 2109162701MCID1Document4 pages2109162701MCID1AmulyaRajbharNo ratings yet

- 5652 20220918150556 SCH III New Requirements Checklist FormatDocument10 pages5652 20220918150556 SCH III New Requirements Checklist FormatDsp VarmaNo ratings yet

- Substituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019Document5 pagesSubstituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019dpfsopfopsfhopNo ratings yet

- US Internal Revenue Service: f2350 - 2003Document3 pagesUS Internal Revenue Service: f2350 - 2003IRSNo ratings yet

- Multiple Support Declaration: 114 Attach To Form 1040 or Form 1040ADocument1 pageMultiple Support Declaration: 114 Attach To Form 1040 or Form 1040AIRSNo ratings yet

- Agent RequirementsDocument5 pagesAgent RequirementsamericaategaNo ratings yet

- US Internal Revenue Service: f2350 - 1999Document2 pagesUS Internal Revenue Service: f2350 - 1999IRSNo ratings yet

- US Internal Revenue Service: f2350 - 2002Document3 pagesUS Internal Revenue Service: f2350 - 2002IRSNo ratings yet

- Customer Declaration Form Entity 1Document3 pagesCustomer Declaration Form Entity 1KjNo ratings yet

- Professional Liability Proposal Form - EditableDocument4 pagesProfessional Liability Proposal Form - EditableJun FalconNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormSandeep AgrawalNo ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document12 pagesStock Corporation General Instructions:: General Information Sheet (Gis)JonJon MivNo ratings yet

- Caro 2020Document9 pagesCaro 2020surjitNo ratings yet

- Form 1023.non ProfitDocument28 pagesForm 1023.non ProfitLawrence BolindNo ratings yet

- Application Form For Financial Assistance Under The New Entrepreneurship - Cum-Enterprise Development Scheme (Needs)Document8 pagesApplication Form For Financial Assistance Under The New Entrepreneurship - Cum-Enterprise Development Scheme (Needs)Vinoth Kumar RajagopalNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormMudassirNo ratings yet

- CA APP Blank FormDocument4 pagesCA APP Blank FormChristine Irish GoyenaNo ratings yet

- 2019form GIS NonStockDocument6 pages2019form GIS NonStockLeonardo DanagNo ratings yet

- Fax Numbers For Filing Form 2553 Have ChangedDocument5 pagesFax Numbers For Filing Form 2553 Have ChangedMichael ZambitoNo ratings yet

- 2022 - Policy Amendment Request Form For Corporate - Entity PO FILLABLE v2Document6 pages2022 - Policy Amendment Request Form For Corporate - Entity PO FILLABLE v2FEBBY TONGAANNo ratings yet

- 2019form RevGIS Stock UpdatedDocument12 pages2019form RevGIS Stock Updatededgar sean galvezNo ratings yet

- JK Lasser's New Rules for Estate, Retirement, and Tax PlanningFrom EverandJK Lasser's New Rules for Estate, Retirement, and Tax PlanningNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Federal Accounting Handbook: Policies, Standards, Procedures, PracticesFrom EverandFederal Accounting Handbook: Policies, Standards, Procedures, PracticesNo ratings yet

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 31122021Document12 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 31122021SHIKHA SHARMANo ratings yet

- Audit Report 2019 20Document18 pagesAudit Report 2019 20SHIKHA SHARMANo ratings yet

- IKIGAI Goa Phase II BrochureDocument8 pagesIKIGAI Goa Phase II BrochureSHIKHA SHARMANo ratings yet

- Audited Financials FY 2013-2014Document9 pagesAudited Financials FY 2013-2014SHIKHA SHARMANo ratings yet

- BS and Audit Report 2018 2019Document19 pagesBS and Audit Report 2018 2019SHIKHA SHARMANo ratings yet

- Approval Letter For Extension of AGM - 31122021Document2 pagesApproval Letter For Extension of AGM - 31122021SHIKHA SHARMANo ratings yet

- Altered Memorandum of Association-18122017Document4 pagesAltered Memorandum of Association-18122017SHIKHA SHARMANo ratings yet

- Written Consent Given by Auditor-29012021Document1 pageWritten Consent Given by Auditor-29012021SHIKHA SHARMANo ratings yet

- FCRA - Funds Received During F.Y. 2015 16Document11 pagesFCRA - Funds Received During F.Y. 2015 16SHIKHA SHARMANo ratings yet

- Form MGT-7-18112022Document1 pageForm MGT-7-18112022SHIKHA SHARMANo ratings yet

- Written Consent Given by Auditor-30092020Document1 pageWritten Consent Given by Auditor-30092020SHIKHA SHARMANo ratings yet

- Form GNL 2 26112022 SignedDocument1 pageForm GNL 2 26112022 SignedSHIKHA SHARMANo ratings yet

- Phfi Annual Audited Accounts For2019-20Document8 pagesPhfi Annual Audited Accounts For2019-20SHIKHA SHARMANo ratings yet

- FCRA Financials FY 2018 19Document11 pagesFCRA Financials FY 2018 19SHIKHA SHARMANo ratings yet

- Phfi Annual Audited Accounts For2016-17Document7 pagesPhfi Annual Audited Accounts For2016-17SHIKHA SHARMANo ratings yet

- FCRA Financials FY 2017 18Document12 pagesFCRA Financials FY 2017 18SHIKHA SHARMANo ratings yet

- FCRA Financials FY 2015 16Document11 pagesFCRA Financials FY 2015 16SHIKHA SHARMANo ratings yet

- Phfi Annual Audited Accounts For2015-16Document7 pagesPhfi Annual Audited Accounts For2015-16SHIKHA SHARMANo ratings yet

- SAP-transactions and Corresponding ABAP ProgramsDocument69 pagesSAP-transactions and Corresponding ABAP Programspa1sharmarNo ratings yet

- Inspection Process Improvement BreakthroughDocument11 pagesInspection Process Improvement Breakthroughponnivalavans_994423100% (1)

- Golden BearDocument2 pagesGolden BearNiaDkwNo ratings yet

- RF 2022 (Jan) v6Document3 pagesRF 2022 (Jan) v6mozha pradityaNo ratings yet

- The Impact of IFRS On Financial StatementsDocument84 pagesThe Impact of IFRS On Financial StatementsPrithviNo ratings yet

- Monthly Progress Report - Nov 2023Document61 pagesMonthly Progress Report - Nov 2023amulya.c.partnerNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- Annual Report EnglishDocument17 pagesAnnual Report EnglishAhmed FoudaNo ratings yet

- Overview of Financial Modeling and ForecastingDocument22 pagesOverview of Financial Modeling and ForecastingogambadelvinNo ratings yet

- Policy Manual Lions ClubDocument450 pagesPolicy Manual Lions Clubkath rynNo ratings yet

- Risk Based AuditingDocument38 pagesRisk Based AuditingHamza Sharif AdamNo ratings yet

- Operational Risk MGT TrainingDocument84 pagesOperational Risk MGT TrainingAB Zed100% (1)

- 10 Settlement of Audit ObjectionsDocument39 pages10 Settlement of Audit Objectionsabdul majid khawajaNo ratings yet

- BA7012 Retail ManagementDocument11 pagesBA7012 Retail ManagementAnonymous uHT7dDNo ratings yet

- 2.8 WBSDocument3 pages2.8 WBSHasan BisriNo ratings yet

- SSC Finals ExaminationDocument8 pagesSSC Finals ExaminationSonia RamosNo ratings yet

- Important Topics of For CS Executive December - 2020 ExamsDocument8 pagesImportant Topics of For CS Executive December - 2020 ExamsJanani PriyaNo ratings yet

- Auditing Payroll CycleDocument14 pagesAuditing Payroll CycleVernadette De GuzmanNo ratings yet

- Cac 100 Fundamental of Accounting 1 AccoDocument147 pagesCac 100 Fundamental of Accounting 1 AccoAna Marie AlpasNo ratings yet

- CPA Journal-Continuous AuditingDocument3 pagesCPA Journal-Continuous AuditingPaul Ryan BalonNo ratings yet

- RR 12 - 99 DigestDocument5 pagesRR 12 - 99 DigestrodolfoverdidajrNo ratings yet

- Corporate Governance and Performance of State-Owned Enterprises in GhanaDocument13 pagesCorporate Governance and Performance of State-Owned Enterprises in GhanaMuhammad SetiawanNo ratings yet

- Low Interest Loan - Business Support For NYSC Graduates - BOIDocument5 pagesLow Interest Loan - Business Support For NYSC Graduates - BOIsamuel olasupoNo ratings yet

- Public Notice No 1874 - A Guide To Customs AuditDocument3 pagesPublic Notice No 1874 - A Guide To Customs AuditDaris Purnomo JatiNo ratings yet

- T6 Employment Part 1 2016 StudentDocument2 pagesT6 Employment Part 1 2016 StudentVeenesha MuralidharanNo ratings yet

- Aui3701 2021 ExamDocument9 pagesAui3701 2021 ExamtinyikodiscussNo ratings yet

- Sheri Sherman - Accounts Payable ClerkDocument2 pagesSheri Sherman - Accounts Payable ClerkSheri SheriNo ratings yet

Form 10B - Filed Form AY 21-22

Form 10B - Filed Form AY 21-22

Uploaded by

SHIKHA SHARMAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 10B - Filed Form AY 21-22

Form 10B - Filed Form AY 21-22

Uploaded by

SHIKHA SHARMACopyright:

Available Formats

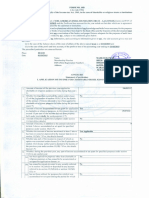

FORM NO.

10B [See rule 17B]

Audit report under section 12A(b) of the Income-tax Act, 1961, in the

case of charitable or religious trusts or institutions

We have examined the balance sheet of ISB ALUMNI ASSOCIATION AAAAI6331B [name of the trust or

institution] as at 31st March 2021 and the Profit and loss account for the year ended on that date which are in

agreement with the books of account maintained by the said Trust or institution

We have obtained all the information and explanations which to the best of our knowledge and belief were

necessary for the purposes of the audit. Inour opinion, proper books of account have been kept by the head

office and the branches of the abovenamed Institution visited by us so far as appears from our examination of

the books, and proper Returns adequate for the purposes of audit have been received from branches not visited

by us, subject to the comments given below: --

In our opinion and to the best of our information, and according to information given to us, the said accounts

give a true and fair view-

(i) in the case of the balance sheet, of the state of affairs of the above named Institution as at 31st March

2021 and

(ii) in the case of the profit and loss account, of the profit or loss of its accounting year ending on 31st March

2021

The prescribed particulars are annexed hereto.

Name KISHORE CHILAKAMARRI

Membership Number 215029

Firm Registration Number 007397S

Date of Audit Report 31-Mar-2022

Place 122.175.119.114

Date 31-Mar-2022

ANNEXURE

STATEMENT OF PARTICULARS

I. APPLICATION OF INCOME FOR CHARITABLE OR RELIGIOUS PURPOSES

1. Amount of income of the previous year applied to charitable or ₹ 46,25,223

religious purposes in India during that year

2. Whether the Institution has exercised the option under clause (2) of No, -

the Explanation to section 11(1) ? If so, the details of the amount of

income deemed to have been applied to charitable or religious

purposes in India during the previous year.

3. Amount of incomeaccumulated or set apart for application to ₹ 14,25,113

charitable or religious purposes, to the extent it does not exceed 15

per cent of the income derived from property held under trust wholly

for such purposes.

4. Amount of income eligible for exemption under section 11(1)(c) (Give No

details)

Sl. No. Details Amount

No Records Added

5. Amount of income, in addition to the amount referred to in item 3 ₹ 34,50,416

above, accumulated or set apart for specified purposes under

section 11(2)

6. Whether the amount of income mentioned in item 5 above has been No, -

invested or deposited in the manner laid down in section 11(2)(b) ?

If so, the details thereof

7. Whether any part of the income in respect of which an option was No, -, -

exercised under clause (2) of the Explanation to section 11(1) in any

earlier year is deemed to be income of the previous year under

section 11(1B) ? If so, the details thereof

8. Whether, during the previous year, any part of income accumulated

or set apart for specified purposes under section 11(2) in any earlier

year-

(a) has been applied for purposes other than charitable or religious No, -, -

purposes or has ceased to be accumulated or set apart for

application thereto, or

(b) has ceased to remain invested in any security referred to in No, -, -

section 11(2)(b)(i) or deposited in any account referred to in

section 11(2)(b)(ii) or section 11(2)(b)(iii), or

(c) has not been utilised for purposes for which it was accumulated No, -, -

or set apart during the period for which it was to be

accumulated or set apart, or in the year immediately following

the expiry thereof? If so, the details thereof

II. APPLICATION OR USE OF INCOME OR PROPERTY FOR THE BENEFIT OF

PERSONS REFERRED TO IN SECTION 13(3)

1. Whether any part of the income or property of the Institution was No

lent, or continues to be lent, in the previous year to any person

referred to in section 13(3) (hereinafter referred to in this Annexure

as such person)? If so, give details of the amount, rate of interest

charged and the nature of security, if any

Sl. No. Amount Rate of interest Nature of security, if Remarks

charged (%) any.

No Records

Added

2. Whether any land, building or other property of the Institution was No

made, or continued to be made, available for the use of any such

person during the previous year? If so, give details of the property

and the amount of rent or compensation charged, if any

Sl. No. Details of property Amount of rent or compensation

charged

No Records Added

3. Whether any payment was made to any such person during the No

previous year by way of salary, allowance or otherwise? If so, give

details

Sl. No. Detail Amount

No Records Added

4. Whether the services of the Institution were made available to any No

such person during the previous year? If so, give details thereof

together with remuneration or compensation received, if any

Sl. No. Name of the Person Amount of Remuneration/ Remarks

Compensation

No Records Added

5. Whether any share, security or other property was purchased by or No

on behalf of the Institution during the previous year from any such

person? If so, give details thereof together with the consideration

paid

Sl. No. Name of the Person Amount of Consideration Remarks

paid

No Records Added

6. Whether any share, security or other property was sold by or on No

behalf of the Institution during the previous year to any such

person? If so, give details thereof together with the consideration

received

Sl. No. Name of the Person Amount of Consideration Remarks

received

No Records Added

7. Whether any income or property of the Institution was diverted No

during the previous year in favour of any such person? If so, give

details thereof together with the amount of income or value of

property so diverted

Sl. No. Name of the Person Income or value of Remarks

property diverted

No Records Added

8. Whether the income or property of theInstitution was used or No

applied during the previous year for the benefit of any such person

in any other manner? If so, give details

Sl. No. Name of the Person Amount Remarks

No Records Added

III. INVESTMENTS HELD AT ANY TIME DURING THE PREVIOUS YEAR(S) IN

CONCERNS IN WHICH PERSONS

REFERRED TO IN SECTION 13(3) HAVE A SUBSTANTIAL INTEREST

Sl. No. Name of Address Where Number Number Number Nominal Income Whether

the of the the of Equity of of Sweat value of from the the

concern concern concern Shares Preferenti Equity the investme amount

is a al Shares Shares investme nt in col. 5

company nt exceeded

5 per

cent of

the

capital of

the

concern

during

the

previous

year

No

Records

Added

Total (Nominal value of the investment) 0

Total (Income from the investment) 0

Place 122.175.119.114

Date 31-Mar-2022

You might also like

- Mergers and Acquisitions: A Step-by-Step Legal and Practical GuideFrom EverandMergers and Acquisitions: A Step-by-Step Legal and Practical GuideNo ratings yet

- Working Paper TemplatesDocument9 pagesWorking Paper TemplatesTroisNo ratings yet

- Pacific Guardian Life Policy Change FormDocument2 pagesPacific Guardian Life Policy Change FormharjsandhuNo ratings yet

- 2019form RevGIS StockDocument13 pages2019form RevGIS StockMae De GuzmanNo ratings yet

- Audit Planning QuestionsDocument12 pagesAudit Planning QuestionsMaster50% (2)

- Bangalore University - Provisional Examination ResultsDocument2 pagesBangalore University - Provisional Examination ResultsSowmya Somanna100% (1)

- Form 10B - Filed FormDocument4 pagesForm 10B - Filed FormcakhaleelassociateshydNo ratings yet

- 10B 4 Year PDFDocument8 pages10B 4 Year PDFKumar UditNo ratings yet

- Form No. 10BDocument3 pagesForm No. 10BLalit PardasaniNo ratings yet

- Form No.10bDocument4 pagesForm No.10bKeith RobbinsNo ratings yet

- Form 10BDocument4 pagesForm 10BCA Vishal ThakkarNo ratings yet

- Form 10B - 2018Document3 pagesForm 10B - 2018Harsh sainiNo ratings yet

- 9 B. S. F.Y. 2014 15Document14 pages9 B. S. F.Y. 2014 15prescongoa.ikigaiNo ratings yet

- LifeFoundation AuditorReport2006Document10 pagesLifeFoundation AuditorReport2006cachandhiranNo ratings yet

- India Sudar TaxFile 2006-07Document9 pagesIndia Sudar TaxFile 2006-07India Sudar Educational and Charitable TrustNo ratings yet

- CARO 2020 ReportDocument7 pagesCARO 2020 ReportranjitNo ratings yet

- f1024 PDFDocument22 pagesf1024 PDFMonica GradyNo ratings yet

- Due Diligence Checklist NGODocument3 pagesDue Diligence Checklist NGOHydragreens FoundationNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormMAHALAKSHMI NAGESH BUDDHANo ratings yet

- CARO2020Document8 pagesCARO2020CA Paramesh HemanathNo ratings yet

- FATCA Non IndividualDocument6 pagesFATCA Non IndividualMarneni Yallamanda RaoNo ratings yet

- Supplier Questionnaire & Code of Conduct - For ENTITIE2Document7 pagesSupplier Questionnaire & Code of Conduct - For ENTITIE2Zubair ChishtiNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormSandeep AgrawalNo ratings yet

- Head Office Application For Empanelment of ValuersDocument8 pagesHead Office Application For Empanelment of ValuersShaishav KumarNo ratings yet

- US Internal Revenue Service: f2350 - 2001Document3 pagesUS Internal Revenue Service: f2350 - 2001IRSNo ratings yet

- UCAA Primary and Expansion Application Form 8Document8 pagesUCAA Primary and Expansion Application Form 8Estefania RiveraNo ratings yet

- IC Application For Insurance Agents License - FILLINDocument4 pagesIC Application For Insurance Agents License - FILLINrgortegaivNo ratings yet

- Application For Registration: (For Certain Excise Tax Activities)Document6 pagesApplication For Registration: (For Certain Excise Tax Activities)douglas jonesNo ratings yet

- Pursuant To Section 70 of The Companies Act, 1956Document13 pagesPursuant To Section 70 of The Companies Act, 1956Basit KhanNo ratings yet

- Form No. 55Document2 pagesForm No. 55busuuuNo ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document11 pagesStock Corporation General Instructions:: General Information Sheet (Gis)Law LawNo ratings yet

- Draft Offer Letter PAS 4Document12 pagesDraft Offer Letter PAS 4binodgstpNo ratings yet

- Sav 1048Document7 pagesSav 1048Michael100% (2)

- SIDBI Trader Finance Scheme Loan Application Form: A. Business InformationDocument15 pagesSIDBI Trader Finance Scheme Loan Application Form: A. Business InformationJaveed TajiNo ratings yet

- 2109162701MCID1Document4 pages2109162701MCID1AmulyaRajbharNo ratings yet

- 5652 20220918150556 SCH III New Requirements Checklist FormatDocument10 pages5652 20220918150556 SCH III New Requirements Checklist FormatDsp VarmaNo ratings yet

- Substituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019Document5 pagesSubstituted by The Income-Tax (6th Amendment) Rule, 2019, W.E.F. 5-11-2019dpfsopfopsfhopNo ratings yet

- US Internal Revenue Service: f2350 - 2003Document3 pagesUS Internal Revenue Service: f2350 - 2003IRSNo ratings yet

- Multiple Support Declaration: 114 Attach To Form 1040 or Form 1040ADocument1 pageMultiple Support Declaration: 114 Attach To Form 1040 or Form 1040AIRSNo ratings yet

- Agent RequirementsDocument5 pagesAgent RequirementsamericaategaNo ratings yet

- US Internal Revenue Service: f2350 - 1999Document2 pagesUS Internal Revenue Service: f2350 - 1999IRSNo ratings yet

- US Internal Revenue Service: f2350 - 2002Document3 pagesUS Internal Revenue Service: f2350 - 2002IRSNo ratings yet

- Customer Declaration Form Entity 1Document3 pagesCustomer Declaration Form Entity 1KjNo ratings yet

- Professional Liability Proposal Form - EditableDocument4 pagesProfessional Liability Proposal Form - EditableJun FalconNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormSandeep AgrawalNo ratings yet

- Stock Corporation General Instructions:: General Information Sheet (Gis)Document12 pagesStock Corporation General Instructions:: General Information Sheet (Gis)JonJon MivNo ratings yet

- Caro 2020Document9 pagesCaro 2020surjitNo ratings yet

- Form 1023.non ProfitDocument28 pagesForm 1023.non ProfitLawrence BolindNo ratings yet

- Application Form For Financial Assistance Under The New Entrepreneurship - Cum-Enterprise Development Scheme (Needs)Document8 pagesApplication Form For Financial Assistance Under The New Entrepreneurship - Cum-Enterprise Development Scheme (Needs)Vinoth Kumar RajagopalNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormMudassirNo ratings yet

- CA APP Blank FormDocument4 pagesCA APP Blank FormChristine Irish GoyenaNo ratings yet

- 2019form GIS NonStockDocument6 pages2019form GIS NonStockLeonardo DanagNo ratings yet

- Fax Numbers For Filing Form 2553 Have ChangedDocument5 pagesFax Numbers For Filing Form 2553 Have ChangedMichael ZambitoNo ratings yet

- 2022 - Policy Amendment Request Form For Corporate - Entity PO FILLABLE v2Document6 pages2022 - Policy Amendment Request Form For Corporate - Entity PO FILLABLE v2FEBBY TONGAANNo ratings yet

- 2019form RevGIS Stock UpdatedDocument12 pages2019form RevGIS Stock Updatededgar sean galvezNo ratings yet

- JK Lasser's New Rules for Estate, Retirement, and Tax PlanningFrom EverandJK Lasser's New Rules for Estate, Retirement, and Tax PlanningNo ratings yet

- 2018 Commercial & Industrial Common Interest Development ActFrom Everand2018 Commercial & Industrial Common Interest Development ActNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Federal Accounting Handbook: Policies, Standards, Procedures, PracticesFrom EverandFederal Accounting Handbook: Policies, Standards, Procedures, PracticesNo ratings yet

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 31122021Document12 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 31122021SHIKHA SHARMANo ratings yet

- Audit Report 2019 20Document18 pagesAudit Report 2019 20SHIKHA SHARMANo ratings yet

- IKIGAI Goa Phase II BrochureDocument8 pagesIKIGAI Goa Phase II BrochureSHIKHA SHARMANo ratings yet

- Audited Financials FY 2013-2014Document9 pagesAudited Financials FY 2013-2014SHIKHA SHARMANo ratings yet

- BS and Audit Report 2018 2019Document19 pagesBS and Audit Report 2018 2019SHIKHA SHARMANo ratings yet

- Approval Letter For Extension of AGM - 31122021Document2 pagesApproval Letter For Extension of AGM - 31122021SHIKHA SHARMANo ratings yet

- Altered Memorandum of Association-18122017Document4 pagesAltered Memorandum of Association-18122017SHIKHA SHARMANo ratings yet

- Written Consent Given by Auditor-29012021Document1 pageWritten Consent Given by Auditor-29012021SHIKHA SHARMANo ratings yet

- FCRA - Funds Received During F.Y. 2015 16Document11 pagesFCRA - Funds Received During F.Y. 2015 16SHIKHA SHARMANo ratings yet

- Form MGT-7-18112022Document1 pageForm MGT-7-18112022SHIKHA SHARMANo ratings yet

- Written Consent Given by Auditor-30092020Document1 pageWritten Consent Given by Auditor-30092020SHIKHA SHARMANo ratings yet

- Form GNL 2 26112022 SignedDocument1 pageForm GNL 2 26112022 SignedSHIKHA SHARMANo ratings yet

- Phfi Annual Audited Accounts For2019-20Document8 pagesPhfi Annual Audited Accounts For2019-20SHIKHA SHARMANo ratings yet

- FCRA Financials FY 2018 19Document11 pagesFCRA Financials FY 2018 19SHIKHA SHARMANo ratings yet

- Phfi Annual Audited Accounts For2016-17Document7 pagesPhfi Annual Audited Accounts For2016-17SHIKHA SHARMANo ratings yet

- FCRA Financials FY 2017 18Document12 pagesFCRA Financials FY 2017 18SHIKHA SHARMANo ratings yet

- FCRA Financials FY 2015 16Document11 pagesFCRA Financials FY 2015 16SHIKHA SHARMANo ratings yet

- Phfi Annual Audited Accounts For2015-16Document7 pagesPhfi Annual Audited Accounts For2015-16SHIKHA SHARMANo ratings yet

- SAP-transactions and Corresponding ABAP ProgramsDocument69 pagesSAP-transactions and Corresponding ABAP Programspa1sharmarNo ratings yet

- Inspection Process Improvement BreakthroughDocument11 pagesInspection Process Improvement Breakthroughponnivalavans_994423100% (1)

- Golden BearDocument2 pagesGolden BearNiaDkwNo ratings yet

- RF 2022 (Jan) v6Document3 pagesRF 2022 (Jan) v6mozha pradityaNo ratings yet

- The Impact of IFRS On Financial StatementsDocument84 pagesThe Impact of IFRS On Financial StatementsPrithviNo ratings yet

- Monthly Progress Report - Nov 2023Document61 pagesMonthly Progress Report - Nov 2023amulya.c.partnerNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruVikas MahorNo ratings yet

- Annual Report EnglishDocument17 pagesAnnual Report EnglishAhmed FoudaNo ratings yet

- Overview of Financial Modeling and ForecastingDocument22 pagesOverview of Financial Modeling and ForecastingogambadelvinNo ratings yet

- Policy Manual Lions ClubDocument450 pagesPolicy Manual Lions Clubkath rynNo ratings yet

- Risk Based AuditingDocument38 pagesRisk Based AuditingHamza Sharif AdamNo ratings yet

- Operational Risk MGT TrainingDocument84 pagesOperational Risk MGT TrainingAB Zed100% (1)

- 10 Settlement of Audit ObjectionsDocument39 pages10 Settlement of Audit Objectionsabdul majid khawajaNo ratings yet

- BA7012 Retail ManagementDocument11 pagesBA7012 Retail ManagementAnonymous uHT7dDNo ratings yet

- 2.8 WBSDocument3 pages2.8 WBSHasan BisriNo ratings yet

- SSC Finals ExaminationDocument8 pagesSSC Finals ExaminationSonia RamosNo ratings yet

- Important Topics of For CS Executive December - 2020 ExamsDocument8 pagesImportant Topics of For CS Executive December - 2020 ExamsJanani PriyaNo ratings yet

- Auditing Payroll CycleDocument14 pagesAuditing Payroll CycleVernadette De GuzmanNo ratings yet

- Cac 100 Fundamental of Accounting 1 AccoDocument147 pagesCac 100 Fundamental of Accounting 1 AccoAna Marie AlpasNo ratings yet

- CPA Journal-Continuous AuditingDocument3 pagesCPA Journal-Continuous AuditingPaul Ryan BalonNo ratings yet

- RR 12 - 99 DigestDocument5 pagesRR 12 - 99 DigestrodolfoverdidajrNo ratings yet

- Corporate Governance and Performance of State-Owned Enterprises in GhanaDocument13 pagesCorporate Governance and Performance of State-Owned Enterprises in GhanaMuhammad SetiawanNo ratings yet

- Low Interest Loan - Business Support For NYSC Graduates - BOIDocument5 pagesLow Interest Loan - Business Support For NYSC Graduates - BOIsamuel olasupoNo ratings yet

- Public Notice No 1874 - A Guide To Customs AuditDocument3 pagesPublic Notice No 1874 - A Guide To Customs AuditDaris Purnomo JatiNo ratings yet

- T6 Employment Part 1 2016 StudentDocument2 pagesT6 Employment Part 1 2016 StudentVeenesha MuralidharanNo ratings yet

- Aui3701 2021 ExamDocument9 pagesAui3701 2021 ExamtinyikodiscussNo ratings yet

- Sheri Sherman - Accounts Payable ClerkDocument2 pagesSheri Sherman - Accounts Payable ClerkSheri SheriNo ratings yet