Professional Documents

Culture Documents

EA Form SEP 2023

EA Form SEP 2023

Uploaded by

boyssss88Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EA Form SEP 2023

EA Form SEP 2023

Uploaded by

boyssss88Copyright:

Available Formats

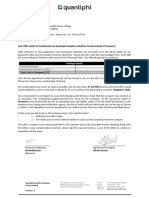

PRIVATE SECTOR Employee's

(C.P. 8A - Pin. 2022) MALAYSIA

null INCOME TAX

Statement of Remuneration EA

Employee’s Tax Identification No. (TIN)

Serial No. C00001 STATEMENT OF REMUNERATION FROM EMPLOYMENT SG25767822000

Employer's No. E 9112359300 FOR THE YEAR ENDED 31 DECEMBER 2023 LHDNM Branch Government

THIS FORM EA MUST BE PREPARED AND PROVIDED TO THE EMPLOYEE FOR INCOME TAX PURPOSE

A PARTICULARS OF EMPLOYEE

1. Full Name of Employee/Pensioner (Mr./Miss/Madam) MANH QUAN DAO

2. Job Designation Senior Process Executive 3. Staff No./Payroll No. 2194508

4. New I.C. No. 5. Passport No. B9093644

6. EPF No. 7. SOCSO No. 202202097157

8. Number Of Children 9. If the period of employment is less than a year, please state:

Qualified For Tax Relief 0 (a) Date of commencement

(b) Date of cessation 29/09/2023

B EMPLOYMENT INCOME, BENEFITS AND LIVING ACCOMMODATION

(Excluding Tax Exempt Allowances/Perquisites/Gifts/Benefits) RM

1. (a) Gross salary, wages or leave pay (including overtime pay) 41265.90

(b) Fees (including director fees), commissions or bonus 0.00

(c) Gross tips, perquisites, awards/rewards or other allowances (Details of payment: ) 6596.44

(d) Income Tax borne by the Employer in respect of his Employee 0.00

(e) Employee Share Option Scheme (ESOS) benefit 0.00

(f) Gratuity for the period from to 0.00

2. Details of arrears and others for preceding years paid in the current year

Type of income (a)

(b) 0.00

3. Benefits in kind ( Specify: Basic amenities ) 128.58

4. Value of living accommodation provided (Address: ) 0.00

5. Refund from unapproved Provident/Pension Fund 0.00

6. Compensation for loss of employment 0.00

C PENSION AND OTHERS

1. Pension 0.00

2. Annuities or other Periodical Payments 0.00

TOTAL 47990.92

D TOTAL DEDUCTION

1. Monthly Tax Deductions (MTD) remitted to LHDNM 1379.05

2. CP 38 Deductions 0.00

3. Zakat paid via salary deduction 0.00

4. Approved donations/ gifts/ donations paid through salary deduction 0.00

5. Total claim for deduction by employee via Form TP1 in respect of:

(a) Relief RM

(b) Zakat other than that paid via monthly salary deduction RM

6. Total qualifying child relief 0.00

E CONTRIBUTIONS PAID BY EMPLOYEE TO APPROVED PROVIDENT/PENSION FUND AND SOCSO

1. Name of Provident Fund KUMPULAN WANG SIMPANAN PEKERJA (K.W.S.P.)

Amount of compulsory contribution paid (state the employee's share of contribution only) RM 0.00

2. SOCSO : Amount of compulsory contribution paid (state the employee's share of contribution only) RM 0.00

F TOTAL TAX EXEMPT ALLOWANCES / PERQUISITES / GIFTS / BENEFITS RM 1793.33

Name of Officer Siti Rosehaida Binti Shikh Wahid

Designation Sr. Manager

Name and Address of Employer COGDEV MALAYSIA SDN BHD

Level 30, Menara Shell 211 Jalan Tun Sambathan 50470 Kuala

Lumpur.

Date 12/09/2023

Employer's Telephone No. 0327839292

You might also like

- BSBLDR523 Student Assessment Tasks 04-03-21Document18 pagesBSBLDR523 Student Assessment Tasks 04-03-21Dibyendu Karmakar33% (3)

- Royal Ottawa Health Care Group Case StudyDocument14 pagesRoyal Ottawa Health Care Group Case StudyZubeen ShahNo ratings yet

- A History of Ikorodu From Earliest TimesDocument84 pagesA History of Ikorodu From Earliest TimesAbimbola Oyarinu100% (4)

- Legal Due DiligenceDocument4 pagesLegal Due Diligencezeeshanshahbaz50% (2)

- 2.1 TOEFL - Reading.Strategy - Updated PDFDocument4 pages2.1 TOEFL - Reading.Strategy - Updated PDFboyssss88No ratings yet

- 2.5 Basic-List-Of-Word-Roots PDFDocument3 pages2.5 Basic-List-Of-Word-Roots PDFboyssss88No ratings yet

- Ei 1585Document8 pagesEi 1585Hai0% (1)

- Apple California Labor Code Class Action Suit - Amended Complaint 4Document23 pagesApple California Labor Code Class Action Suit - Amended Complaint 4Mikey CampbellNo ratings yet

- EA Form 2023Document2 pagesEA Form 2023jadenacnhlunarisNo ratings yet

- Ministry of Economy: CNPJ/CPF Copany Name/NameDocument2 pagesMinistry of Economy: CNPJ/CPF Copany Name/NameJuliana Kelly FlorêncioNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Tax Template HCCI FY20-21FinalDocument16 pagesTax Template HCCI FY20-21FinalBaba FakhruddinNo ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- PFNFDocument3 pagesPFNFLoga NathanNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- Draft Return For ReviewDocument4 pagesDraft Return For ReviewsajjadNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Informe de Rendimentos Anderson - AprosilvaDocument2 pagesInforme de Rendimentos Anderson - AprosilvaPatriciaNo ratings yet

- 101, Part-III, G.I.D.C.Estate, Sector-28, Gandhinagar-382028 Salary Slip For The Month of November2023Document1 page101, Part-III, G.I.D.C.Estate, Sector-28, Gandhinagar-382028 Salary Slip For The Month of November2023ralesh694No ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Gty Working SheetDocument2 pagesGty Working SheetRajat SharmaNo ratings yet

- Payslip Tax 9 2022 UnlockedDocument4 pagesPayslip Tax 9 2022 UnlockedDhruvNo ratings yet

- Bharat Heavy Electricals Limited: 06290981 Shivam GuptaDocument1 pageBharat Heavy Electricals Limited: 06290981 Shivam GuptaMr. Shivam GuptaNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- ReceiptDocument1 pageReceiptKipronoNo ratings yet

- Dasharath Kumar Sah - OfF319 - 2324 2Document2 pagesDasharath Kumar Sah - OfF319 - 2324 2eng.dasharath1996No ratings yet

- Dasharath Kumar Sah - OFF319 - 2324Document2 pagesDasharath Kumar Sah - OFF319 - 2324eng.dasharath1996No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Wa0005Document1 pageWa0005Ravi KumarNo ratings yet

- Pdf&rendition 1 PDFDocument1 pagePdf&rendition 1 PDFainaa batrisyiaNo ratings yet

- MediaAgility 2019 Form16Document1 pageMediaAgility 2019 Form16SiddharthNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Provisional FNFDocument3 pagesProvisional FNFrakxnachandran96No ratings yet

- House No. A-900/102, Workshop Road, GHARIBABAD, Dadu, Dadu. Ali Ahmed BhattiDocument3 pagesHouse No. A-900/102, Workshop Road, GHARIBABAD, Dadu, Dadu. Ali Ahmed BhattiMohsin Ali Shaikh vlogsNo ratings yet

- Shoeb - Form 16 PARTB - 2022-23Document3 pagesShoeb - Form 16 PARTB - 2022-23Sourabh PunshiNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - August 2023Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - August 2023Wasim KhanNo ratings yet

- Form No. 16: Part BDocument3 pagesForm No. 16: Part Bsanjay chauhanNo ratings yet

- Atppn7354l Partb 2020 21 PDFDocument3 pagesAtppn7354l Partb 2020 21 PDFPratik MeswaniyaNo ratings yet

- AlfredDocument4 pagesAlfredAbhijeet SinghNo ratings yet

- Biapg2824f - Partb - 2019-20 Sameer PDFDocument3 pagesBiapg2824f - Partb - 2019-20 Sameer PDFGanesh LohakareNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- Gazato B SHEET 22 PDFDocument7 pagesGazato B SHEET 22 PDFShardul DiwanNo ratings yet

- BIR 2316 UPDATED 2023 DEGUZMAN SignedDocument1 pageBIR 2316 UPDATED 2023 DEGUZMAN Signedmikel bautistaNo ratings yet

- Harsh 22-24Document2 pagesHarsh 22-24sanghviharsh202No ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- 2021 IK Return WDocument6 pages2021 IK Return Wali razaNo ratings yet

- Debosmita Sarkar - 121328 - Settlement Payslip - RerunDocument3 pagesDebosmita Sarkar - 121328 - Settlement Payslip - RerunMajumdar VijayNo ratings yet

- Form No. 16: Part BDocument4 pagesForm No. 16: Part Bvirajsonawane22No ratings yet

- Receipt 5Document1 pageReceipt 5Anonymous ZzCE3tlNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- Payslip 10105020 12-2021 2022-01-28 20 36 58 61f4069221c44Document1 pagePayslip 10105020 12-2021 2022-01-28 20 36 58 61f4069221c44ginizoneNo ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Form 16 Data 1 PDFDocument5 pagesForm 16 Data 1 PDFRISHABH JAINNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- Form No. 16: Part BDocument3 pagesForm No. 16: Part BAjay AjNo ratings yet

- Wa0000.Document2 pagesWa0000.anpro1299No ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Receipt - 2024-06-17T101630.252Document1 pageReceipt - 2024-06-17T101630.252MARENDE CYBERNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- MiCare Panel Network GP Clinic ListDocument140 pagesMiCare Panel Network GP Clinic Listboyssss88No ratings yet

- Electronic Ticket Receipt, September 29 For MR DAO MANH QUANDocument2 pagesElectronic Ticket Receipt, September 29 For MR DAO MANH QUANboyssss88No ratings yet

- 18.1 Integrated - Essay.TemplateMaster - Document.All - ScriptsDocument6 pages18.1 Integrated - Essay.TemplateMaster - Document.All - Scriptsboyssss88No ratings yet

- 17.1 Integrated Framework Essay Hi ScoreDocument2 pages17.1 Integrated Framework Essay Hi Scoreboyssss88No ratings yet

- Robber Hunters - The Steel Shield of Ho Chi Minh CityDocument4 pagesRobber Hunters - The Steel Shield of Ho Chi Minh Cityboyssss88No ratings yet

- NTV Toeic Speaking - Answer Key PDFDocument104 pagesNTV Toeic Speaking - Answer Key PDFboyssss88No ratings yet

- One-week-Lesson-Plan. SULEMAN MAMUDADocument4 pagesOne-week-Lesson-Plan. SULEMAN MAMUDAboyssss88No ratings yet

- Teaching Purpose: I Grew Up in A Developing Country. English Was An Advantage at That TimeDocument2 pagesTeaching Purpose: I Grew Up in A Developing Country. English Was An Advantage at That Timeboyssss88No ratings yet

- Instructor: DAO MANH QUAN Course: GRAMMMAR TextbookDocument10 pagesInstructor: DAO MANH QUAN Course: GRAMMMAR Textbookboyssss88No ratings yet

- Cirriculumn Vitae: Full Name: Address: P303 I4 Phuong Mai ApartmentDocument3 pagesCirriculumn Vitae: Full Name: Address: P303 I4 Phuong Mai Apartmentboyssss88No ratings yet

- Research Assignment 7Document3 pagesResearch Assignment 7Nomad1971No ratings yet

- Traditional Correspondence: Memos and LettersDocument9 pagesTraditional Correspondence: Memos and LettersHala Tawfik MakladNo ratings yet

- Payment of Wages Act 1936 PDFDocument27 pagesPayment of Wages Act 1936 PDFrameez.amex5067No ratings yet

- 16 Life Saving Rules 2015 2016Document72 pages16 Life Saving Rules 2015 2016awfahNo ratings yet

- Hills Like White Elephants EssaysDocument5 pagesHills Like White Elephants Essaysd3gn731z100% (2)

- Job Evaluation Methods - Study MaterialDocument10 pagesJob Evaluation Methods - Study Materialjyothi vaishnavNo ratings yet

- Performance Appraisal Literature ReviewDocument6 pagesPerformance Appraisal Literature ReviewVinoth Kumar67% (9)

- Work Life Balance Among Women Teachers in Autonomous Colleges With Special Reference To Thrissur District"Document74 pagesWork Life Balance Among Women Teachers in Autonomous Colleges With Special Reference To Thrissur District"RAM PAV100% (1)

- Task Performance in Macro Pre FinalDocument3 pagesTask Performance in Macro Pre FinalAngelica MotayNo ratings yet

- 01 General HSE RulesDocument7 pages01 General HSE Rulesjrod915No ratings yet

- Lecture 6 Government Intervention in International Business and Regional Economic IntegrationDocument26 pagesLecture 6 Government Intervention in International Business and Regional Economic IntegrationUmer ZindaniNo ratings yet

- Collaborative Assessment For Employment Planning: TransitionDocument8 pagesCollaborative Assessment For Employment Planning: TransitionRizha KrisnawardhaniNo ratings yet

- The Production Sharing ContractsDocument2 pagesThe Production Sharing ContractsErnest First GroupNo ratings yet

- Problems of Software Developers in BangladeshDocument5 pagesProblems of Software Developers in BangladeshSagir HossainNo ratings yet

- #19 SY Vs CA Case DigestDocument1 page#19 SY Vs CA Case DigestJunna Rose PascoNo ratings yet

- IND51207Document26 pagesIND51207Revathy MohanNo ratings yet

- Accenture COVID19 ReinventingDocument33 pagesAccenture COVID19 ReinventingAkshay ShahNo ratings yet

- Deed of Quitclaim and WaiverDocument2 pagesDeed of Quitclaim and WaivermaryNo ratings yet

- CHAPTER VI - Socio-Economic AspectDocument4 pagesCHAPTER VI - Socio-Economic AspectJun RecuerdoNo ratings yet

- Case #5 Wendy'sDocument12 pagesCase #5 Wendy'sPaulina Naranjo0% (1)

- Annex A - Application Form (Part A) Insteadof Project V26mehmet Cemal ACARDocument18 pagesAnnex A - Application Form (Part A) Insteadof Project V26mehmet Cemal ACARDem babalarNo ratings yet

- Fifth Schedule (See Rule 79 (1) ) Abstracts of The ActDocument7 pagesFifth Schedule (See Rule 79 (1) ) Abstracts of The ActRehal JandialNo ratings yet

- Universal Robina CaseDocument9 pagesUniversal Robina Casehermione_granger10No ratings yet

- Botswana College of Distance and Open LearningDocument53 pagesBotswana College of Distance and Open LearningVictor UgoslyNo ratings yet