Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

6 viewsProblems For Assignment On FIN642

Problems For Assignment On FIN642

Uploaded by

jesin.estiana09This document lists assignment problems from different pages of a textbook or workbook. On page 33, problems 2, 5, 6, and 8 are assigned. On page 56, problems 4 and 8 are assigned. On page 71, problems 4, 6, and 8 are assigned. On page 92, problems 3, 5, 6 are assigned. On page 107, problems 5, 6, and 7 are assigned. On page 123, problems 2, 4, and 6 are assigned. On page 141, problems 4, 5, and 7 are assigned. On page 154, problems 4, 6, 7, 8, and 10 are assigned.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Web Homework 1.1 - Math 130, Section 70856, Fall 2021 - WebAssignDocument22 pagesWeb Homework 1.1 - Math 130, Section 70856, Fall 2021 - WebAssignJoel LigayonNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul Shukor33% (3)

- Four Quad Graphing PuzzleDocument2 pagesFour Quad Graphing PuzzleVictor Manuel Jurado MejiaNo ratings yet

- CORMAT2 Mini Task 1 Pineda Aniela Sabalburo Edreen 11 CamposDocument8 pagesCORMAT2 Mini Task 1 Pineda Aniela Sabalburo Edreen 11 CamposDump ChristopherNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul ShukorNo ratings yet

- WorksheetWorks Coordinate Picture 1Document2 pagesWorksheetWorks Coordinate Picture 1Adib MashuriNo ratings yet

- Grade 9 WorkbookDocument44 pagesGrade 9 WorkbookMaria Russeneth Joy NaloNo ratings yet

- Frequencies: FREQUENCIES VARIABLES Pengetahuan Dukungan Keberhasilan SE - Pre SE - Post /order AnalysisDocument6 pagesFrequencies: FREQUENCIES VARIABLES Pengetahuan Dukungan Keberhasilan SE - Pre SE - Post /order AnalysisLisnasari PutriNo ratings yet

- Matric Pairing Scheme 2024 Ambitious Academy-1Document12 pagesMatric Pairing Scheme 2024 Ambitious Academy-1Muhammad Rashid0% (1)

- 4thQ Assignment-CelisDocument4 pages4thQ Assignment-Celismeinhard celisNo ratings yet

- Section 9.3: #1 Points Possible: 1. Total Attempts: 2Document6 pagesSection 9.3: #1 Points Possible: 1. Total Attempts: 2Matt FerrariNo ratings yet

- Engineering Project Management: Tutorial 3 2017/2018Document10 pagesEngineering Project Management: Tutorial 3 2017/2018Mohamed SadekNo ratings yet

- C2A May 2005 Solution PDFDocument29 pagesC2A May 2005 Solution PDFJeff GundyNo ratings yet

- Activity 7, Assessment 7Document10 pagesActivity 7, Assessment 7Shey FuentesNo ratings yet

- Assignment Exercise 1 2 HijadaDocument4 pagesAssignment Exercise 1 2 HijadaJeanette HijadaNo ratings yet

- 34 - Alberta Math Grade 7 Unit 8 Geometry Lesson 7 Graphing RotationsDocument15 pages34 - Alberta Math Grade 7 Unit 8 Geometry Lesson 7 Graphing RotationsTanya KapurNo ratings yet

- Step # Activity To Crash # of Weeks To Crash Total Crash Cost ($) Incremental Cost Path:"1,2,3,5, 9,13" Path:"1,2,4,5, 9,13"Document4 pagesStep # Activity To Crash # of Weeks To Crash Total Crash Cost ($) Incremental Cost Path:"1,2,3,5, 9,13" Path:"1,2,4,5, 9,13"Justin NewellNo ratings yet

- SPSSDocument3 pagesSPSSjuril jrhielNo ratings yet

- Pilot StudyDocument5 pagesPilot StudyVaibhav JainNo ratings yet

- DIN 79 - Agujeros y Ejes CuadradosDocument1 pageDIN 79 - Agujeros y Ejes CuadradosNachoNo ratings yet

- StatiskaDocument3 pagesStatiskaiksanzulkarnaen01No ratings yet

- QuestionsDocument5 pagesQuestionshuzaifa mirzaNo ratings yet

- Nama: Ridha Laelatul Silvi Nim: 18031095 Kelas: 2J/D3 Akuntansi Tugas: Praktikum StatistikaDocument3 pagesNama: Ridha Laelatul Silvi Nim: 18031095 Kelas: 2J/D3 Akuntansi Tugas: Praktikum StatistikaLaela SlvNo ratings yet

- CPT7 - Reliability Analysis - Aug. 12, 2005Document171 pagesCPT7 - Reliability Analysis - Aug. 12, 2005Franz Xyrlo Ibarra TobiasNo ratings yet

- Les 29-5Document16 pagesLes 29-5Michael PitoyNo ratings yet

- Act 4Document6 pagesAct 4Lorenz Joy EstayaniNo ratings yet

- Practice: FunctionsDocument14 pagesPractice: FunctionsZhang SaNo ratings yet

- 04_CAIE8_Math_T2_Rev Sheet 2 HDDocument7 pages04_CAIE8_Math_T2_Rev Sheet 2 HDbhis PuneNo ratings yet

- Stem and Leaf - ConstructingDocument2 pagesStem and Leaf - ConstructingAnthony DavidNo ratings yet

- Evaluasi PembelajaranDocument27 pagesEvaluasi PembelajaranYesiNo ratings yet

- Solution HW 1Document9 pagesSolution HW 1Nixon PatelNo ratings yet

- Translations HomeworkDocument5 pagesTranslations Homeworkapi-297021169No ratings yet

- Spearman Rho: Education DepartmentDocument7 pagesSpearman Rho: Education DepartmentLeo Cordel Jr.No ratings yet

- Coordinate PictureDocument2 pagesCoordinate PictureAdib MashuriNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul ShukorNo ratings yet

- LaboratoryDocument19 pagesLaboratoryelvin toledoNo ratings yet

- WorksheetWorks Coordinate Picture 2Document2 pagesWorksheetWorks Coordinate Picture 2Ivis HerazoNo ratings yet

- 2019-May - CEO-325 - 313 CPM AND PERTDocument2 pages2019-May - CEO-325 - 313 CPM AND PERTSahil SoodNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul ShukorNo ratings yet

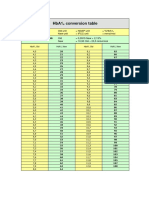

- Hba1 Conversion Table: DefinitionsDocument1 pageHba1 Conversion Table: DefinitionsWidya Astri LinteraNo ratings yet

- HbA1cConversionTable PDFDocument1 pageHbA1cConversionTable PDFDarkoMaxNo ratings yet

- Robot GraphDocument2 pagesRobot Graphapi-302577842No ratings yet

- Rezultatele Cercetarii Analiza Si Interpretarea Statistica A Rezultatelor M (Mean) SD (Standard Deviation (Tot Dar Fara Gen)Document2 pagesRezultatele Cercetarii Analiza Si Interpretarea Statistica A Rezultatelor M (Mean) SD (Standard Deviation (Tot Dar Fara Gen)Loredana PredunaNo ratings yet

- 3B6 Load Moment Indicator (Lmi) FOR Telescopic HandlersDocument33 pages3B6 Load Moment Indicator (Lmi) FOR Telescopic HandlersStefan RzepkaNo ratings yet

- Assign4 Solutions 2014 05 26Document6 pagesAssign4 Solutions 2014 05 26Harold LuNo ratings yet

- IE-431, Assignment-6, TEAM-10Document26 pagesIE-431, Assignment-6, TEAM-10Mohammad KashifNo ratings yet

- Summer Final ExaminationsDocument12 pagesSummer Final Examinationsjessica untalascoNo ratings yet

- Activity No 2 StatDocument5 pagesActivity No 2 StatIdris HermanNo ratings yet

- Lesson 6: Correlation and Linear RegressionDocument39 pagesLesson 6: Correlation and Linear RegressionCham RosarioNo ratings yet

- 2,2T 7,1/12,2M 6,3X6,4M 8,1-25,3M: TDKV - KrantechnikonDocument4 pages2,2T 7,1/12,2M 6,3X6,4M 8,1-25,3M: TDKV - KrantechnikonM RefaiNo ratings yet

- Lesson Notes Systems of Linear InequalitiesDocument3 pagesLesson Notes Systems of Linear InequalitiesLeslie CameronNo ratings yet

- His To GramaDocument2 pagesHis To GramaAmilcar CorreiaNo ratings yet

- Assignment 6 AnswerDocument17 pagesAssignment 6 Answerd092184No ratings yet

- Puppy GraphDocument2 pagesPuppy Graphapi-302577842No ratings yet

- Stage 11 BDocument7 pagesStage 11 Btanakazara1No ratings yet

- Statistical Models of Horse Racing Outcomes Using R: DR Alun Owen, Coventry University, UK Aa5845@coventry - Ac.ukDocument21 pagesStatistical Models of Horse Racing Outcomes Using R: DR Alun Owen, Coventry University, UK Aa5845@coventry - Ac.ukJason O Connor100% (1)

- Gantt ChartDocument4 pagesGantt ChartLEE SUE ANNNo ratings yet

- Grade 6 Greatest Common Factor GCF 2 Numbers 2 50 DDocument2 pagesGrade 6 Greatest Common Factor GCF 2 Numbers 2 50 Dmilkiasbelay131No ratings yet

- Ib Math SL 1133 f1367c15 (All Year)Document5 pagesIb Math SL 1133 f1367c15 (All Year)Mark WisniewskiNo ratings yet

Problems For Assignment On FIN642

Problems For Assignment On FIN642

Uploaded by

jesin.estiana090 ratings0% found this document useful (0 votes)

6 views1 pageThis document lists assignment problems from different pages of a textbook or workbook. On page 33, problems 2, 5, 6, and 8 are assigned. On page 56, problems 4 and 8 are assigned. On page 71, problems 4, 6, and 8 are assigned. On page 92, problems 3, 5, 6 are assigned. On page 107, problems 5, 6, and 7 are assigned. On page 123, problems 2, 4, and 6 are assigned. On page 141, problems 4, 5, and 7 are assigned. On page 154, problems 4, 6, 7, 8, and 10 are assigned.

Original Description:

Financial Markets and Institutions

Original Title

Problems for Assignment on FIN642

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists assignment problems from different pages of a textbook or workbook. On page 33, problems 2, 5, 6, and 8 are assigned. On page 56, problems 4 and 8 are assigned. On page 71, problems 4, 6, and 8 are assigned. On page 92, problems 3, 5, 6 are assigned. On page 107, problems 5, 6, and 7 are assigned. On page 123, problems 2, 4, and 6 are assigned. On page 141, problems 4, 5, and 7 are assigned. On page 154, problems 4, 6, 7, 8, and 10 are assigned.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageProblems For Assignment On FIN642

Problems For Assignment On FIN642

Uploaded by

jesin.estiana09This document lists assignment problems from different pages of a textbook or workbook. On page 33, problems 2, 5, 6, and 8 are assigned. On page 56, problems 4 and 8 are assigned. On page 71, problems 4, 6, and 8 are assigned. On page 92, problems 3, 5, 6 are assigned. On page 107, problems 5, 6, and 7 are assigned. On page 123, problems 2, 4, and 6 are assigned. On page 141, problems 4, 5, and 7 are assigned. On page 154, problems 4, 6, 7, 8, and 10 are assigned.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

Problems for Assignment

Page # Problem/Question # Page # Problem/Question #

33 2, 5, 6, 8 107 5, 6, 7

56 4, 8 123 2, 4, 6

71 4, 6, 8 141 4, 5, 7

92 3, 5, 6 154 4, 6, 7, 8, 10

27. You are considering two assets with the following characteristics:

E(R1) =0.15 σ1 = 0.10 W1= 0.45

E(R2) = 0.20 σ2 = 0.23 W2= 0.55

Compute the mean and standard deviation of two portfolios if r1,2 = -0.60

28. Consider asset X as risk free where 35% of total fund is allocated and asset Y risky where

remaining fund is allocated. The rate of return of asset X is 7% and of asset Y is 13% with standard

deviation of 8%. What is the rate of rate and level of risk of this portfolio?

You might also like

- Web Homework 1.1 - Math 130, Section 70856, Fall 2021 - WebAssignDocument22 pagesWeb Homework 1.1 - Math 130, Section 70856, Fall 2021 - WebAssignJoel LigayonNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul Shukor33% (3)

- Four Quad Graphing PuzzleDocument2 pagesFour Quad Graphing PuzzleVictor Manuel Jurado MejiaNo ratings yet

- CORMAT2 Mini Task 1 Pineda Aniela Sabalburo Edreen 11 CamposDocument8 pagesCORMAT2 Mini Task 1 Pineda Aniela Sabalburo Edreen 11 CamposDump ChristopherNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul ShukorNo ratings yet

- WorksheetWorks Coordinate Picture 1Document2 pagesWorksheetWorks Coordinate Picture 1Adib MashuriNo ratings yet

- Grade 9 WorkbookDocument44 pagesGrade 9 WorkbookMaria Russeneth Joy NaloNo ratings yet

- Frequencies: FREQUENCIES VARIABLES Pengetahuan Dukungan Keberhasilan SE - Pre SE - Post /order AnalysisDocument6 pagesFrequencies: FREQUENCIES VARIABLES Pengetahuan Dukungan Keberhasilan SE - Pre SE - Post /order AnalysisLisnasari PutriNo ratings yet

- Matric Pairing Scheme 2024 Ambitious Academy-1Document12 pagesMatric Pairing Scheme 2024 Ambitious Academy-1Muhammad Rashid0% (1)

- 4thQ Assignment-CelisDocument4 pages4thQ Assignment-Celismeinhard celisNo ratings yet

- Section 9.3: #1 Points Possible: 1. Total Attempts: 2Document6 pagesSection 9.3: #1 Points Possible: 1. Total Attempts: 2Matt FerrariNo ratings yet

- Engineering Project Management: Tutorial 3 2017/2018Document10 pagesEngineering Project Management: Tutorial 3 2017/2018Mohamed SadekNo ratings yet

- C2A May 2005 Solution PDFDocument29 pagesC2A May 2005 Solution PDFJeff GundyNo ratings yet

- Activity 7, Assessment 7Document10 pagesActivity 7, Assessment 7Shey FuentesNo ratings yet

- Assignment Exercise 1 2 HijadaDocument4 pagesAssignment Exercise 1 2 HijadaJeanette HijadaNo ratings yet

- 34 - Alberta Math Grade 7 Unit 8 Geometry Lesson 7 Graphing RotationsDocument15 pages34 - Alberta Math Grade 7 Unit 8 Geometry Lesson 7 Graphing RotationsTanya KapurNo ratings yet

- Step # Activity To Crash # of Weeks To Crash Total Crash Cost ($) Incremental Cost Path:"1,2,3,5, 9,13" Path:"1,2,4,5, 9,13"Document4 pagesStep # Activity To Crash # of Weeks To Crash Total Crash Cost ($) Incremental Cost Path:"1,2,3,5, 9,13" Path:"1,2,4,5, 9,13"Justin NewellNo ratings yet

- SPSSDocument3 pagesSPSSjuril jrhielNo ratings yet

- Pilot StudyDocument5 pagesPilot StudyVaibhav JainNo ratings yet

- DIN 79 - Agujeros y Ejes CuadradosDocument1 pageDIN 79 - Agujeros y Ejes CuadradosNachoNo ratings yet

- StatiskaDocument3 pagesStatiskaiksanzulkarnaen01No ratings yet

- QuestionsDocument5 pagesQuestionshuzaifa mirzaNo ratings yet

- Nama: Ridha Laelatul Silvi Nim: 18031095 Kelas: 2J/D3 Akuntansi Tugas: Praktikum StatistikaDocument3 pagesNama: Ridha Laelatul Silvi Nim: 18031095 Kelas: 2J/D3 Akuntansi Tugas: Praktikum StatistikaLaela SlvNo ratings yet

- CPT7 - Reliability Analysis - Aug. 12, 2005Document171 pagesCPT7 - Reliability Analysis - Aug. 12, 2005Franz Xyrlo Ibarra TobiasNo ratings yet

- Les 29-5Document16 pagesLes 29-5Michael PitoyNo ratings yet

- Act 4Document6 pagesAct 4Lorenz Joy EstayaniNo ratings yet

- Practice: FunctionsDocument14 pagesPractice: FunctionsZhang SaNo ratings yet

- 04_CAIE8_Math_T2_Rev Sheet 2 HDDocument7 pages04_CAIE8_Math_T2_Rev Sheet 2 HDbhis PuneNo ratings yet

- Stem and Leaf - ConstructingDocument2 pagesStem and Leaf - ConstructingAnthony DavidNo ratings yet

- Evaluasi PembelajaranDocument27 pagesEvaluasi PembelajaranYesiNo ratings yet

- Solution HW 1Document9 pagesSolution HW 1Nixon PatelNo ratings yet

- Translations HomeworkDocument5 pagesTranslations Homeworkapi-297021169No ratings yet

- Spearman Rho: Education DepartmentDocument7 pagesSpearman Rho: Education DepartmentLeo Cordel Jr.No ratings yet

- Coordinate PictureDocument2 pagesCoordinate PictureAdib MashuriNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul ShukorNo ratings yet

- LaboratoryDocument19 pagesLaboratoryelvin toledoNo ratings yet

- WorksheetWorks Coordinate Picture 2Document2 pagesWorksheetWorks Coordinate Picture 2Ivis HerazoNo ratings yet

- 2019-May - CEO-325 - 313 CPM AND PERTDocument2 pages2019-May - CEO-325 - 313 CPM AND PERTSahil SoodNo ratings yet

- Graphing Four Ordered Puzzle PDFDocument2 pagesGraphing Four Ordered Puzzle PDFNorazah Abdul ShukorNo ratings yet

- Hba1 Conversion Table: DefinitionsDocument1 pageHba1 Conversion Table: DefinitionsWidya Astri LinteraNo ratings yet

- HbA1cConversionTable PDFDocument1 pageHbA1cConversionTable PDFDarkoMaxNo ratings yet

- Robot GraphDocument2 pagesRobot Graphapi-302577842No ratings yet

- Rezultatele Cercetarii Analiza Si Interpretarea Statistica A Rezultatelor M (Mean) SD (Standard Deviation (Tot Dar Fara Gen)Document2 pagesRezultatele Cercetarii Analiza Si Interpretarea Statistica A Rezultatelor M (Mean) SD (Standard Deviation (Tot Dar Fara Gen)Loredana PredunaNo ratings yet

- 3B6 Load Moment Indicator (Lmi) FOR Telescopic HandlersDocument33 pages3B6 Load Moment Indicator (Lmi) FOR Telescopic HandlersStefan RzepkaNo ratings yet

- Assign4 Solutions 2014 05 26Document6 pagesAssign4 Solutions 2014 05 26Harold LuNo ratings yet

- IE-431, Assignment-6, TEAM-10Document26 pagesIE-431, Assignment-6, TEAM-10Mohammad KashifNo ratings yet

- Summer Final ExaminationsDocument12 pagesSummer Final Examinationsjessica untalascoNo ratings yet

- Activity No 2 StatDocument5 pagesActivity No 2 StatIdris HermanNo ratings yet

- Lesson 6: Correlation and Linear RegressionDocument39 pagesLesson 6: Correlation and Linear RegressionCham RosarioNo ratings yet

- 2,2T 7,1/12,2M 6,3X6,4M 8,1-25,3M: TDKV - KrantechnikonDocument4 pages2,2T 7,1/12,2M 6,3X6,4M 8,1-25,3M: TDKV - KrantechnikonM RefaiNo ratings yet

- Lesson Notes Systems of Linear InequalitiesDocument3 pagesLesson Notes Systems of Linear InequalitiesLeslie CameronNo ratings yet

- His To GramaDocument2 pagesHis To GramaAmilcar CorreiaNo ratings yet

- Assignment 6 AnswerDocument17 pagesAssignment 6 Answerd092184No ratings yet

- Puppy GraphDocument2 pagesPuppy Graphapi-302577842No ratings yet

- Stage 11 BDocument7 pagesStage 11 Btanakazara1No ratings yet

- Statistical Models of Horse Racing Outcomes Using R: DR Alun Owen, Coventry University, UK Aa5845@coventry - Ac.ukDocument21 pagesStatistical Models of Horse Racing Outcomes Using R: DR Alun Owen, Coventry University, UK Aa5845@coventry - Ac.ukJason O Connor100% (1)

- Gantt ChartDocument4 pagesGantt ChartLEE SUE ANNNo ratings yet

- Grade 6 Greatest Common Factor GCF 2 Numbers 2 50 DDocument2 pagesGrade 6 Greatest Common Factor GCF 2 Numbers 2 50 Dmilkiasbelay131No ratings yet

- Ib Math SL 1133 f1367c15 (All Year)Document5 pagesIb Math SL 1133 f1367c15 (All Year)Mark WisniewskiNo ratings yet