Professional Documents

Culture Documents

03 Steppe Cement - Simple Spread - 2018

03 Steppe Cement - Simple Spread - 2018

Uploaded by

Phạm Thanh HuyềnCopyright:

Available Formats

You might also like

- Statement of Financial Position Sci: Adjustement To Reconcile Net Income To Net Cash Provided by Operating ActivitiesDocument6 pagesStatement of Financial Position Sci: Adjustement To Reconcile Net Income To Net Cash Provided by Operating ActivitiesSai RillNo ratings yet

- Long Term Construction ContractsDocument16 pagesLong Term Construction ContractsLorena Joy Aggabao100% (3)

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Understanding FSexerciseDocument14 pagesUnderstanding FSexerciseheyzzupNo ratings yet

- TUI AG Financial Statements 2018 WebDocument48 pagesTUI AG Financial Statements 2018 WebgoggsNo ratings yet

- DV QuestionsDocument24 pagesDV QuestionsevitaveigasNo ratings yet

- Ratio AnalysisDocument5 pagesRatio Analysisvini2710No ratings yet

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờNo ratings yet

- TUI AG Bericht 2019 ENDocument48 pagesTUI AG Bericht 2019 ENgoggsNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNo ratings yet

- Running Finance ExerciseDocument11 pagesRunning Finance Exercisew_fibNo ratings yet

- BNL Stores - Solution - Cash Flow StatementDocument1 pageBNL Stores - Solution - Cash Flow StatementShareceNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Statement of Cash FlowsDocument1 pageStatement of Cash FlowsAllan BatiancilaNo ratings yet

- Financial Statements 2018 Adidas Ag eDocument86 pagesFinancial Statements 2018 Adidas Ag ewaskithaNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- FibDocument39 pagesFibHana MokhlessNo ratings yet

- Financial Ratios of Home Depot and Lowe'sDocument30 pagesFinancial Ratios of Home Depot and Lowe'sM UmarNo ratings yet

- Solutions Worksheets - Chapt 3Document35 pagesSolutions Worksheets - Chapt 3Nam PhươngNo ratings yet

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- The Catholic Syrian Bank LimitedDocument2 pagesThe Catholic Syrian Bank Limitedsaravanan aNo ratings yet

- Eng EngDocument2 pagesEng Engnourima98No ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Nilupul BasnayakeNo ratings yet

- Spyder Student ExcelDocument21 pagesSpyder Student ExcelNatasha PerryNo ratings yet

- Case 9Document11 pagesCase 9Nguyễn Thanh PhongNo ratings yet

- Cash Flow For Apple Inc (AAPL) From MorningstarDocument2 pagesCash Flow For Apple Inc (AAPL) From MorningstarAswin P SubhashNo ratings yet

- Fy2023 Analysis of Revenue and ExpenditureDocument24 pagesFy2023 Analysis of Revenue and ExpenditurePutri AgustinNo ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Document13 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Nilupul BasnayakeNo ratings yet

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- Financial Statement 2017 - 2019Document14 pagesFinancial Statement 2017 - 2019Audi Imam LazuardiNo ratings yet

- UploadDocument83 pagesUploadAli BMSNo ratings yet

- Q3 FY 2024 Metrics FileDocument11 pagesQ3 FY 2024 Metrics Filevighneshsputta2No ratings yet

- Saudi Aramco 9m 2019 Summary Financials PDFDocument4 pagesSaudi Aramco 9m 2019 Summary Financials PDFakshay_kapNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Historical Data Dec19Document9 pagesHistorical Data Dec19WilsonNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Statements of Dunkin DonutsDocument4 pagesStatements of Dunkin DonutsMariamiNo ratings yet

- Balance Sheet of Maple Leaf: AssetsDocument12 pagesBalance Sheet of Maple Leaf: Assets01290101002675No ratings yet

- Business Valuation Model (Template)Document16 pagesBusiness Valuation Model (Template)m.qunees99No ratings yet

- UCrest Bhd-Q4 Financial Result Ended 31.5.2022Document8 pagesUCrest Bhd-Q4 Financial Result Ended 31.5.2022Jeff WongNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- 2016 Fullyear Cash Flow StatementDocument1 page2016 Fullyear Cash Flow StatementSilvana ElenaNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Consolidated 11-Year Summary: Financial / Data SectionDocument60 pagesConsolidated 11-Year Summary: Financial / Data SectionMUHAMMAD ISMAILNo ratings yet

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st MarchDocument4 pagesIncome Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st MarchSab KeelsNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- Research For OBUDocument14 pagesResearch For OBUM Burhan SafiNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Aftr Uts - MK 2 - KreditDocument22 pagesAftr Uts - MK 2 - KreditamoyyNo ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- 14 x11 Financial Management B-1Document9 pages14 x11 Financial Management B-1amirNo ratings yet

- Answers To Problem Sets: Financial AnalysisDocument11 pagesAnswers To Problem Sets: Financial AnalysisLakshya KumarNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksNo ratings yet

- Objective of Financial StatementsDocument11 pagesObjective of Financial StatementsAnne Mel BariquitNo ratings yet

- 3.4 Final AccountsDocument114 pages3.4 Final AccountsMinh Thu NguyenNo ratings yet

- Portfolio For Personal FinanceDocument7 pagesPortfolio For Personal FinanceSharon SagerNo ratings yet

- Unit Two: Branch AccountingDocument17 pagesUnit Two: Branch Accountingtemedebere100% (2)

- Financial RatioDocument25 pagesFinancial Ratiohaname4No ratings yet

- Accounting For JULLYDocument20 pagesAccounting For JULLYAjay SahooNo ratings yet

- Quiz 3Document5 pagesQuiz 3Iryna VerbovaNo ratings yet

- Lecture BB Bussiness Management & Application To ArchitectureDocument15 pagesLecture BB Bussiness Management & Application To ArchitectureLANCENo ratings yet

- Unit 7 Audit of IntangiblesDocument10 pagesUnit 7 Audit of IntangiblesVianca Isabel PagsibiganNo ratings yet

- 7.30.22 Am Investments-In-Debt-InstrumentsDocument6 pages7.30.22 Am Investments-In-Debt-InstrumentsAether SkywardNo ratings yet

- GR 11 Accounting P1 (English) November 2022 Answer BookDocument9 pagesGR 11 Accounting P1 (English) November 2022 Answer BookDoryson CzzleNo ratings yet

- 11 ACC CH 6.11 To 6.16 MemosDocument19 pages11 ACC CH 6.11 To 6.16 Memosora mashaNo ratings yet

- Assign 8 Chapter 11 Addressing Working Capital Policies and Management Cabrera 2019-2020Document6 pagesAssign 8 Chapter 11 Addressing Working Capital Policies and Management Cabrera 2019-2020mhikeedelantarNo ratings yet

- Chapter 2 Plant Asset and Intangible AssetDocument18 pagesChapter 2 Plant Asset and Intangible AssetasnfkasNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- Problem 07-18 Requirement 1: Minden Company: Correct!Document3 pagesProblem 07-18 Requirement 1: Minden Company: Correct!foxstupidfoxNo ratings yet

- BaboyDocument1 pageBaboyGrace Mae OliverosNo ratings yet

- Last Name, Given Name, Middle NameDocument3 pagesLast Name, Given Name, Middle NameDe chavez, John carlo R.No ratings yet

- ICAI EAC Opinion October-2021-Accounting Treatment of Government GrantsDocument12 pagesICAI EAC Opinion October-2021-Accounting Treatment of Government GrantschandraNo ratings yet

- Sak Case 20.3Document14 pagesSak Case 20.3Kemala Putri AyundaNo ratings yet

- Ycoa Accdet Docu MXDocument76 pagesYcoa Accdet Docu MXEnrique MarquezNo ratings yet

- Solution Manual For Accounting 25th EditionDocument24 pagesSolution Manual For Accounting 25th EditionGregoryGreenqpgcm100% (39)

- Assignment 1 BCAC 321 TestDocument5 pagesAssignment 1 BCAC 321 TestMarwan AlsaidiNo ratings yet

- BMGT 220 Accounting Principles ExamDocument9 pagesBMGT 220 Accounting Principles ExamPrinciples of Accounting0% (1)

03 Steppe Cement - Simple Spread - 2018

03 Steppe Cement - Simple Spread - 2018

Uploaded by

Phạm Thanh HuyềnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 Steppe Cement - Simple Spread - 2018

03 Steppe Cement - Simple Spread - 2018

Uploaded by

Phạm Thanh HuyềnCopyright:

Available Formats

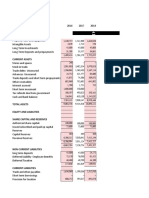

Financial Accounts

Steppe Cement Ltd

PROFIT/LOSS YE 31 Dec 2014 2015 2016 2017 2018 CASH FLOW 2014 2015 2016 2017 2018

USD thousands

Sales 116,635 93,633 52,479 65,855 82,185 Profit before Tax (8,095) (8,815) 682 1,935 10,669

Cost of Goods Sold (80,926) (60,383) (36,871) (45,212) (46,871) Non-Cash Adjustments 27,640 30,623 8,776 9,495 10,659

Gross Profit 35,709 33,249 15,609 20,644 35,314 Funds from Operations 19,545 21,808 9,457 11,430 21,328

SG and A Expenses (31,291) (21,120) (13,127) (17,065) (21,839) Changes in Net Working Capital 270 525 187 784 (2,657)

Other Operating items Operating Cash Flow (before I and T) 19,815 22,333 9,645 12,214 18,671

EBIT (Operating Profit) 4,418 12,130 2,481 3,579 13,474 Total Interest Expense (4,807) (4,073) (2,755) (2,236) (1,650)

Non-operating Items (3,382) (298) 0 (206) (1,787) Total Tax Paid (1,449) (399) (107) 0 (151)

Total Interest Expense (4,788) (4,215) (2,783) (2,237) (1,638) Operating Cash Flow (after I and T) 13,559 17,861 6,783 9,978 16,870

Interest income and other financial Income / expenses (4,344) (16,431) 984 798 619 Purchases Fixed assets (21,835) (1,832) (4,808) (2,104) (3,138)

Profit before Tax (8,095) (8,815) 682 1,935 10,669 Disposals Fixed Intangible assets 477

Taxation 154 5,433 (506) (703) (1,745) Purchases Intangible assets

Profit after Tax (7,941) (3,382) 176 1,231 8,925 Disposals Intangible assets

Interest, Dividend and FX results 8 41 5 62 43

For info (included in operating profit) Acquisitions , Investments net of Divestments (356) (26) (49) (68) (26)

Depreciation (12,240) (10,686) (6,834) (7,266) (7,272) Cash Flow before Financing (8,624) 16,044 1,931 8,343 13,749

Amortisation (32) (6) Total Dividend Paid (3,576) 0 0 0 (2,959)

Impairments Net Debt Drawings / Repayments 17,791 (18,669) (3,318) (6,327) (7,369)

Operating Leases Share Issues / Repurchases (596) (4,264) 4 0 0

EBITDA 16,658 22,816 9,315 10,877 20,753 Net Cash Flow 4,996 (6,889) (1,383) 2,016 3,420

EBITDAR 16,658 22,816 9,315 10,877 20,753

BALANCE SHEET 2014 2015 2016 2017 2018 RATIOS 2014 2015 2016 2017 2018

Cash and Marketable Securities 9,295 2,406 1,023 3,045 5,720 Business Risk:

Trade Debtors (Accounts Receivable) 465 352 1,017 2,775 2,765 Gross Profit / Sales 31% 36% 30% 31% 43%

Stock (Inventory) 22,113 13,320 16,163 13,014 13,381 EBITDA / Sales 14% 24% 18% 17% 25%

Other debtors and other assets 14,282 8,182 5,679 5,687 5,618 FFO / Sales 17% 23% 18% 17% 26%

Investments and assets for sale 0 0 0 0 0 Trade Debtors days on hand 1 1 7 15 12

Net Fixed Assets 151,696 71,787 71,887 67,359 54,612 Inventory days on hand 100 81 160 105 104

Intangible Assets Trade Creditor days on hand 34 27 75 62 51

Assets 197,850 96,047 95,769 91,880 82,096 Net Working Capital / Sales 8% 7% 16% 9% 8%

Sales / Net Fixed Assets 0.8 1.3 0.7 1.0 1.5

Trade Creditors (Accounts Payabl e) 7,649 4,484 7,558 7,651 6,589 Gross Capex Tang and Intang Assets / Depr and Amort 178% 17% 70% 29% 43%

Accrued Expenses 5,279 2,212 1,231 2,229 2,683 Gross Capital Expenditure / Sales 19% 2% 9% 3% 4%

Other Creditors and Provisions 9,779 1,945 2,521 2,258 3,775

Tax Payable 0 0 0 196 1,268 Financial Risk:

Short Term Debt* 27,089 15,822 10,964 10,195 5,217 Debt / Equity 49% 54% 46% 34% 21%

Existing Long Term Debt and Financial Leases 30,363 14,857 15,453 9,835 6,607 Equity / Total Liabilities 147% 144% 154% 184% 214%

Minority Interest Debt / EBITDA 3.4 1.3 2.8 1.8 0.6

Total Debt 57,452 30,679 26,417 20,029 11,824 Adj Debt / EBITDAR * 3.4 1.3 2.8 1.8 0.6

Total Liabilities 80,159 39,321 37,728 32,363 26,139 Adj Debt / FFO adj for interest and Lease payments 2.4 1.2 2.2 1.5 0.5

Share Capital and Reserves 27,188 (30,920) (30,163) (30,300) (40,156) Total Debt / CFO after I,T and minus Capex (6.9) 1.9 13.4 2.5 0.9

Retained Earnings 90,503 87,646 88,203 89,817 96,113 Total Debt / CFO after I,T and minus Maint Capex** 43.6 4.3 (516.0) 7.4 1.2

EBIT / Interest Expense 0.9 3.0 0.9 1.6 8.2

Liabilities and Equity 197,850 96,047 95,769 91,880 82,096 EBITDA / Interest Expense 3.5 5.6 3.4 4.9 12.6

Cross check 0.0 0.0 0.0 0.0 0.0 Debt Service Coverage Ratio*** 1.3 2.7 1.0 0.7 6.8

* Including Current Portion of Long Term Debt 89 48 4,477 * Debt adjusted for op lease by 8x annual op lease expense

** Maintenance capex assumed to be in line with depreciation

***(Operating Cash Flow -Tax - Depreciation, Amortisation) / (Interest paid + CPLTD due)

Steppe Cement_simple spread_ 2018 Copyright: FitchLearning

You might also like

- Statement of Financial Position Sci: Adjustement To Reconcile Net Income To Net Cash Provided by Operating ActivitiesDocument6 pagesStatement of Financial Position Sci: Adjustement To Reconcile Net Income To Net Cash Provided by Operating ActivitiesSai RillNo ratings yet

- Long Term Construction ContractsDocument16 pagesLong Term Construction ContractsLorena Joy Aggabao100% (3)

- 3rd Quarter Report 2018Document1 page3rd Quarter Report 2018Tanzir HasanNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsKartik SharmaNo ratings yet

- Understanding FSexerciseDocument14 pagesUnderstanding FSexerciseheyzzupNo ratings yet

- TUI AG Financial Statements 2018 WebDocument48 pagesTUI AG Financial Statements 2018 WebgoggsNo ratings yet

- DV QuestionsDocument24 pagesDV QuestionsevitaveigasNo ratings yet

- Ratio AnalysisDocument5 pagesRatio Analysisvini2710No ratings yet

- 3 Statement Financial Analysis TemplateDocument14 pages3 Statement Financial Analysis TemplateCười Vê LờNo ratings yet

- TUI AG Bericht 2019 ENDocument48 pagesTUI AG Bericht 2019 ENgoggsNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNo ratings yet

- Running Finance ExerciseDocument11 pagesRunning Finance Exercisew_fibNo ratings yet

- BNL Stores - Solution - Cash Flow StatementDocument1 pageBNL Stores - Solution - Cash Flow StatementShareceNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Statement of Cash FlowsDocument1 pageStatement of Cash FlowsAllan BatiancilaNo ratings yet

- Financial Statements 2018 Adidas Ag eDocument86 pagesFinancial Statements 2018 Adidas Ag ewaskithaNo ratings yet

- COMPANY 1 - SupaFood Financial Statements - 240102 - 143648Document5 pagesCOMPANY 1 - SupaFood Financial Statements - 240102 - 143648Marcel JonathanNo ratings yet

- FibDocument39 pagesFibHana MokhlessNo ratings yet

- Financial Ratios of Home Depot and Lowe'sDocument30 pagesFinancial Ratios of Home Depot and Lowe'sM UmarNo ratings yet

- Solutions Worksheets - Chapt 3Document35 pagesSolutions Worksheets - Chapt 3Nam PhươngNo ratings yet

- Financial MStatements Ceres MGardening MCompanyDocument11 pagesFinancial MStatements Ceres MGardening MCompanyRodnix MablungNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- The Catholic Syrian Bank LimitedDocument2 pagesThe Catholic Syrian Bank Limitedsaravanan aNo ratings yet

- Eng EngDocument2 pagesEng Engnourima98No ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- 3rd Quarter 2021Document19 pages3rd Quarter 2021sakib9949No ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Nilupul BasnayakeNo ratings yet

- Spyder Student ExcelDocument21 pagesSpyder Student ExcelNatasha PerryNo ratings yet

- Case 9Document11 pagesCase 9Nguyễn Thanh PhongNo ratings yet

- Cash Flow For Apple Inc (AAPL) From MorningstarDocument2 pagesCash Flow For Apple Inc (AAPL) From MorningstarAswin P SubhashNo ratings yet

- Fy2023 Analysis of Revenue and ExpenditureDocument24 pagesFy2023 Analysis of Revenue and ExpenditurePutri AgustinNo ratings yet

- Financial Report 2017Document106 pagesFinancial Report 2017Le Phong100% (1)

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Document13 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 June 2019Nilupul BasnayakeNo ratings yet

- Teikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016Document1 pageTeikoku Electric Mfg. Co., LTD.: Consolidated Statement of Cash Flows Year Ended March 31, 2016LymeParkNo ratings yet

- Financial Statement 2017 - 2019Document14 pagesFinancial Statement 2017 - 2019Audi Imam LazuardiNo ratings yet

- UploadDocument83 pagesUploadAli BMSNo ratings yet

- Q3 FY 2024 Metrics FileDocument11 pagesQ3 FY 2024 Metrics Filevighneshsputta2No ratings yet

- Saudi Aramco 9m 2019 Summary Financials PDFDocument4 pagesSaudi Aramco 9m 2019 Summary Financials PDFakshay_kapNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- 7-E Fin Statement 2022Document4 pages7-E Fin Statement 20222021892056No ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Historical Data Dec19Document9 pagesHistorical Data Dec19WilsonNo ratings yet

- Final 2021 CBG Summary Fs 2021 SignedDocument2 pagesFinal 2021 CBG Summary Fs 2021 SignedFuaad DodooNo ratings yet

- Masteel 4Q 2023Document12 pagesMasteel 4Q 2023GZHNo ratings yet

- Statements of Dunkin DonutsDocument4 pagesStatements of Dunkin DonutsMariamiNo ratings yet

- Balance Sheet of Maple Leaf: AssetsDocument12 pagesBalance Sheet of Maple Leaf: Assets01290101002675No ratings yet

- Business Valuation Model (Template)Document16 pagesBusiness Valuation Model (Template)m.qunees99No ratings yet

- UCrest Bhd-Q4 Financial Result Ended 31.5.2022Document8 pagesUCrest Bhd-Q4 Financial Result Ended 31.5.2022Jeff WongNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- 2016 Fullyear Cash Flow StatementDocument1 page2016 Fullyear Cash Flow StatementSilvana ElenaNo ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Consolidated 11-Year Summary: Financial / Data SectionDocument60 pagesConsolidated 11-Year Summary: Financial / Data SectionMUHAMMAD ISMAILNo ratings yet

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- Income Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st MarchDocument4 pagesIncome Statements: (Amounts Expressed in Sri Lankan Rs. '000) For The Year Ended 31st MarchSab KeelsNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- Research For OBUDocument14 pagesResearch For OBUM Burhan SafiNo ratings yet

- Consolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsDocument2 pagesConsolidated Bank (Ghana) Limited: Unaudited Summary Financial StatementsFuaad DodooNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Aftr Uts - MK 2 - KreditDocument22 pagesAftr Uts - MK 2 - KreditamoyyNo ratings yet

- AHM Chapter 1 - SolutionsDocument26 pagesAHM Chapter 1 - SolutionsNitin KhareNo ratings yet

- 14 x11 Financial Management B-1Document9 pages14 x11 Financial Management B-1amirNo ratings yet

- Answers To Problem Sets: Financial AnalysisDocument11 pagesAnswers To Problem Sets: Financial AnalysisLakshya KumarNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersDocument8 pages2023 Grade 11 Provincial Examination Accounting P1 (English) June 2023 Possible AnswersChantelle IsaksNo ratings yet

- Objective of Financial StatementsDocument11 pagesObjective of Financial StatementsAnne Mel BariquitNo ratings yet

- 3.4 Final AccountsDocument114 pages3.4 Final AccountsMinh Thu NguyenNo ratings yet

- Portfolio For Personal FinanceDocument7 pagesPortfolio For Personal FinanceSharon SagerNo ratings yet

- Unit Two: Branch AccountingDocument17 pagesUnit Two: Branch Accountingtemedebere100% (2)

- Financial RatioDocument25 pagesFinancial Ratiohaname4No ratings yet

- Accounting For JULLYDocument20 pagesAccounting For JULLYAjay SahooNo ratings yet

- Quiz 3Document5 pagesQuiz 3Iryna VerbovaNo ratings yet

- Lecture BB Bussiness Management & Application To ArchitectureDocument15 pagesLecture BB Bussiness Management & Application To ArchitectureLANCENo ratings yet

- Unit 7 Audit of IntangiblesDocument10 pagesUnit 7 Audit of IntangiblesVianca Isabel PagsibiganNo ratings yet

- 7.30.22 Am Investments-In-Debt-InstrumentsDocument6 pages7.30.22 Am Investments-In-Debt-InstrumentsAether SkywardNo ratings yet

- GR 11 Accounting P1 (English) November 2022 Answer BookDocument9 pagesGR 11 Accounting P1 (English) November 2022 Answer BookDoryson CzzleNo ratings yet

- 11 ACC CH 6.11 To 6.16 MemosDocument19 pages11 ACC CH 6.11 To 6.16 Memosora mashaNo ratings yet

- Assign 8 Chapter 11 Addressing Working Capital Policies and Management Cabrera 2019-2020Document6 pagesAssign 8 Chapter 11 Addressing Working Capital Policies and Management Cabrera 2019-2020mhikeedelantarNo ratings yet

- Chapter 2 Plant Asset and Intangible AssetDocument18 pagesChapter 2 Plant Asset and Intangible AssetasnfkasNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument133 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFLote Marcellano71% (14)

- Problem 07-18 Requirement 1: Minden Company: Correct!Document3 pagesProblem 07-18 Requirement 1: Minden Company: Correct!foxstupidfoxNo ratings yet

- BaboyDocument1 pageBaboyGrace Mae OliverosNo ratings yet

- Last Name, Given Name, Middle NameDocument3 pagesLast Name, Given Name, Middle NameDe chavez, John carlo R.No ratings yet

- ICAI EAC Opinion October-2021-Accounting Treatment of Government GrantsDocument12 pagesICAI EAC Opinion October-2021-Accounting Treatment of Government GrantschandraNo ratings yet

- Sak Case 20.3Document14 pagesSak Case 20.3Kemala Putri AyundaNo ratings yet

- Ycoa Accdet Docu MXDocument76 pagesYcoa Accdet Docu MXEnrique MarquezNo ratings yet

- Solution Manual For Accounting 25th EditionDocument24 pagesSolution Manual For Accounting 25th EditionGregoryGreenqpgcm100% (39)

- Assignment 1 BCAC 321 TestDocument5 pagesAssignment 1 BCAC 321 TestMarwan AlsaidiNo ratings yet

- BMGT 220 Accounting Principles ExamDocument9 pagesBMGT 220 Accounting Principles ExamPrinciples of Accounting0% (1)