Professional Documents

Culture Documents

Aditya One Pager STDBL

Aditya One Pager STDBL

Uploaded by

Ashwani KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aditya One Pager STDBL

Aditya One Pager STDBL

Uploaded by

Ashwani KumarCopyright:

Available Formats

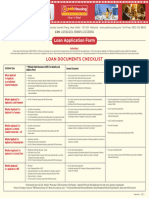

Small Ticket Digital Business Loan

Pre-qualifiers Norm

Constitution Sole Props / Individuals

Bureau score >650

Business Vintage >1 Years

Age 21-65

Serviceable Pin Code List 7000+ ABFL Locations

Product Options Bureau upto Re 2 Lac & Banking/ITR/GST/ Upto Re 10 Lac

• UDYAM Registration has been added as legal and address proof

S. No Basic Checklist

1 Business vintage should be greater than( 1-2 is Amber) 2 years with valid document proof

2 CIBIL score of the business owner should be greater than 650

3 Age of the business owner should be more than 21 and less than 65 years. ( 21 to 23 is amber)

4 Customer should not be ABFL existing BL customer for Top up

5 Customer should have No EMI Cheque Bounce, Loan Settlement in last six months

6 Customer’s Bank account average balance of 10k or above. ( minus loan credit)

7 Customer should own at least one property

Banking Checkist

8 Bank account type should be Current Account or Savings Account only

9 Bank account cannot be in Co-operative or RRB.

10 Minimum 6 months of bank statement is required.

11 Credited amount in bank A/c should be greater than Rs. 5 lakhs in 6 months

12 There should be at least 2 transaction per month in the last 6 months

GST Checkist

14 If OTP is not received, please ask customer to enable APIs by going to their GST portal

15 Business volume should be greater than Rs. 5 Lakhs per month.

16 There should not be any de-growth in consecutive quarters in the GST turnover.

17 Customer should pay GST regularly for last 24 months.

ITR Checkist

18 Only ITR 3 & ITR 4 is allowed for consideration

19 ITR should be greater than Rs. 7.5 lac

20 ITR data can be submitted only via User ID and Password

21 https://eportal.incometax.gov.in/iec/foservices/#/login.

You might also like

- All Bank Policy HL & LapDocument25 pagesAll Bank Policy HL & LapmadirajunaveenNo ratings yet

- Dsa Handbook2018Document19 pagesDsa Handbook2018Dayalan A100% (3)

- CIBILDocument14 pagesCIBILGaurav RajNo ratings yet

- One Pager STDBLDocument1 pageOne Pager STDBLnrdcs2017No ratings yet

- Loan TFSDocument9 pagesLoan TFSvishnu RasaaliNo ratings yet

- Business Loan PolicyDocument7 pagesBusiness Loan Policyniteshparewa372No ratings yet

- RB Chapter 2 - Current DepositsDocument6 pagesRB Chapter 2 - Current DepositsHarish YadavNo ratings yet

- SBI Business LoanDocument12 pagesSBI Business LoanAjit SamalNo ratings yet

- Final Presentation On: Presented To: Sir Ejaz MustafaDocument59 pagesFinal Presentation On: Presented To: Sir Ejaz Mustafashehzaib sunnyNo ratings yet

- Chapter 1 IntroDocument10 pagesChapter 1 IntrosanyakathuriaNo ratings yet

- Business - Account Services: Minimum Average Credit BalanceDocument6 pagesBusiness - Account Services: Minimum Average Credit BalanceSameer NooraniNo ratings yet

- Kotak Mahindra BankDocument15 pagesKotak Mahindra BankEr Dipankar SaikiaNo ratings yet

- Deposits ProductsDocument21 pagesDeposits ProductsthinkingvishalNo ratings yet

- Faircent PL&BL PolicyDocument2 pagesFaircent PL&BL Policymanoj.sharma110045No ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Business Installment Loan: FeaturesDocument6 pagesBusiness Installment Loan: FeaturesMd.Azam KhanNo ratings yet

- IDFC FIRST Bank Statement As of 06 MAY 2019 PDFDocument1 pageIDFC FIRST Bank Statement As of 06 MAY 2019 PDFEkta BaroniaNo ratings yet

- Gurpreet Singh Cibil ReportDocument13 pagesGurpreet Singh Cibil Reportmahalbarinder77No ratings yet

- Legal Notice 6085881 C022122501014704 16022024111451Document2 pagesLegal Notice 6085881 C022122501014704 16022024111451wasimride9No ratings yet

- Banking & InsuranceDocument44 pagesBanking & InsuranceBhurabhai MaliNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Aditya Birla Udyog Plus Business Loan PolicyDocument2 pagesAditya Birla Udyog Plus Business Loan Policyprnali.vflNo ratings yet

- Revision of Fund Transfer Limit For E-BankingDocument2 pagesRevision of Fund Transfer Limit For E-BankingVaibhav GuptaNo ratings yet

- Casa PresentationDocument25 pagesCasa PresentationGupta Bhawna GuptaNo ratings yet

- Modified Financial Products- NotesDocument13 pagesModified Financial Products- NotesmupidiraviNo ratings yet

- Concepts of GSTDocument17 pagesConcepts of GSTChandan KumarNo ratings yet

- KYC Guide - Biz2Credit India PDFDocument9 pagesKYC Guide - Biz2Credit India PDFAnonymous QRtom4No ratings yet

- Saransh PDFDocument344 pagesSaransh PDFAmitNo ratings yet

- Personal Current Acc App SoleDocument7 pagesPersonal Current Acc App Soleaiss.ay.moussNo ratings yet

- (Government of India Undertaking) : सम्मान आपके विश्िास काHONOURS YOUR TRUSTDocument5 pages(Government of India Undertaking) : सम्मान आपके विश्िास काHONOURS YOUR TRUSTBiswajit DasNo ratings yet

- Selected Cases in Banking-64-70Document7 pagesSelected Cases in Banking-64-70Amit KumarNo ratings yet

- HBL Islamic Homefinance: Key FeaturesDocument6 pagesHBL Islamic Homefinance: Key FeaturesaftabNo ratings yet

- Assignment 1 - Banking OperationDocument72 pagesAssignment 1 - Banking OperationRAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Customer Account Information Form: Landicho Ian Jansen LonoDocument2 pagesCustomer Account Information Form: Landicho Ian Jansen LonoIan Jansen L. LandichoNo ratings yet

- Dukandar Overdraft ProgramDocument18 pagesDukandar Overdraft Programkumar maniNo ratings yet

- Faq RetailDocument3 pagesFaq Retailshiv2108No ratings yet

- CP Associates Bullet PointsDocument13 pagesCP Associates Bullet PointsvikashvacNo ratings yet

- K Series 01-20Document11 pagesK Series 01-20Raghunadh Tirumani TNo ratings yet

- BOP Asaan Current AccountDocument2 pagesBOP Asaan Current AccountAhmad CssNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- KioskDocument21 pagesKioskgollamandalaappaiahNo ratings yet

- KFS Current ACDocument23 pagesKFS Current ACFakharNo ratings yet

- Module A Unit 3 Operation Aspects OF KYC (Ambitious Baba) - 15125519 - 2024 - 01 - 31 - 17 - 37Document11 pagesModule A Unit 3 Operation Aspects OF KYC (Ambitious Baba) - 15125519 - 2024 - 01 - 31 - 17 - 37arifmp3adNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- 41 New Products of SBI (As On 30.09.2010)Document10 pages41 New Products of SBI (As On 30.09.2010)Abhinav SaraswatNo ratings yet

- Nism Questions-26 GDocument14 pagesNism Questions-26 GabhishekNo ratings yet

- 20208-SME FinancingDocument18 pages20208-SME FinancingAbdullah FazalNo ratings yet

- BASIC APPLICATION REQUIREMENTS AND DOCUMENTS REQUIRED - OdsDocument2 pagesBASIC APPLICATION REQUIREMENTS AND DOCUMENTS REQUIRED - OdsRuby VillanuevaNo ratings yet

- All About Credit NoteDocument12 pagesAll About Credit Notekuldeep singhNo ratings yet

- Business ApplicationDocument33 pagesBusiness ApplicationBlake WeberNo ratings yet

- Presentation Of: Allied Bank LimitedDocument21 pagesPresentation Of: Allied Bank LimitedRiaz MirzaNo ratings yet

- CHR Report - 10 September 2023Document37 pagesCHR Report - 10 September 2023RR PatelNo ratings yet

- 4.5 Types of Products of IFB in DBDocument11 pages4.5 Types of Products of IFB in DBSamson DamtewNo ratings yet

- Loan SCDocument2 pagesLoan SCABHISHEK KUMARNo ratings yet

- MBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit SchemesDocument68 pagesMBA (Comparison of Retail Loan of J&K Banks With Other Banks and Deposit Schemeszargar100% (1)

- Application Form To Acquire PB CertificateDocument2 pagesApplication Form To Acquire PB CertificateMubashir ZiaNo ratings yet

- NPPL Project Report 50Cr 2022Document76 pagesNPPL Project Report 50Cr 2022Ashwani KumarNo ratings yet

- NPPL Catalog Cable TrayDocument4 pagesNPPL Catalog Cable TrayAshwani KumarNo ratings yet

- 16 Land Allotment RIICODocument10 pages16 Land Allotment RIICOAshwani KumarNo ratings yet

- 7 Audit Report 2020-21Document18 pages7 Audit Report 2020-21Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun ContactsDocument2 pagesVikas Bhawan Dehradun ContactsAshwani KumarNo ratings yet

- NPPL Catalog ScaffoldingDocument12 pagesNPPL Catalog ScaffoldingAshwani KumarNo ratings yet

- Central Bank Branch List Pan IndiaDocument549 pagesCentral Bank Branch List Pan IndiaAshwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 3Document6 pagesVikas Bhawan Dehradun Contacts 3Ashwani KumarNo ratings yet

- 20230109130503Document6 pages20230109130503Ashwani KumarNo ratings yet

- Vikas Bhawan Dehradun Contacts 2Document4 pagesVikas Bhawan Dehradun Contacts 2Ashwani KumarNo ratings yet

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarNo ratings yet

- Ubl PolicyDocument28 pagesUbl PolicyAshwani KumarNo ratings yet

- Unlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedDocument6 pagesUnlocked 3 Months Statement - OCT2023 - 148346525 (1) - UnlockedAshwani KumarNo ratings yet

- DBS PL LatestDocument160 pagesDBS PL LatestAshwani KumarNo ratings yet

- Products ListDocument2 pagesProducts ListAshwani KumarNo ratings yet

- All Serviceable Pincodes nonGL-Version20 BL&PLDocument717 pagesAll Serviceable Pincodes nonGL-Version20 BL&PLAshwani KumarNo ratings yet

- Banking ...Document8 pagesBanking ...Ashwani KumarNo ratings yet

- Commector Payout Claim DataDocument3 pagesCommector Payout Claim DataAshwani KumarNo ratings yet

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument17 pagesPost Date Value Date Narration Cheque Details Debit Credit BalanceAshwani KumarNo ratings yet

- CASHe LoansDocument7 pagesCASHe LoansAshwani KumarNo ratings yet

- Aditya Birla Udyog New Pdated Pin Code ListDocument459 pagesAditya Birla Udyog New Pdated Pin Code ListAshwani KumarNo ratings yet

- Aadhar CardDocument2 pagesAadhar CardAshwani KumarNo ratings yet

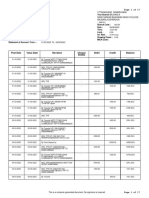

- Axis Repayment ScheduleDocument4 pagesAxis Repayment ScheduleAshwani KumarNo ratings yet

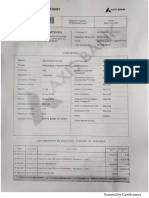

- ITR AY 22-23 Narinder BhatiaDocument1 pageITR AY 22-23 Narinder BhatiaAshwani KumarNo ratings yet

- ITR AY 20-21 Narinder Bhatia 20Document1 pageITR AY 20-21 Narinder Bhatia 20Ashwani KumarNo ratings yet

- Narinder Bhatia 6 Months Bank StatementDocument19 pagesNarinder Bhatia 6 Months Bank StatementAshwani KumarNo ratings yet

- AllottmentLetterDocument1 pageAllottmentLetterAshwani KumarNo ratings yet

- College Details For Education LoanDocument7 pagesCollege Details For Education LoanAshwani KumarNo ratings yet

- Balance SHEETSDocument9 pagesBalance SHEETSAshwani KumarNo ratings yet

- Addmission Letter BaksonDocument1 pageAddmission Letter BaksonAshwani KumarNo ratings yet