Professional Documents

Culture Documents

02 Quiz On Topic 2 With Answer Key

02 Quiz On Topic 2 With Answer Key

Uploaded by

Nye NyeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

02 Quiz On Topic 2 With Answer Key

02 Quiz On Topic 2 With Answer Key

Uploaded by

Nye NyeCopyright:

Available Formats

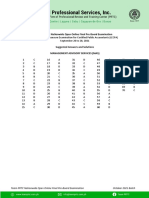

AUDITING & ASSURANCE PRINCPLES SCORE

QUIZ # 2

TOPIC(s) COVERED: AT 02 – INTRODUCTION TO FINANCIAL STATEMENTS AUDIT

NAME:__________________________ YEAR & SECTION:__________ DATE:____________

INSTRUCTIONS: FROM THE FOLLOWING MULTIPLE CHOICE QUESTIONS BELOW, CHOOSE THE LETTER OF

THE BEST ANSWER BY SHADING IT TO A SEPARATE ANSWER SHEET PROVIDED.

1. An external auditor is conducting an audit of the financial statements of Camden

Corporation under PSAs. The external auditor is expected to

A. Express an opinion as to the attractiveness of Camden for investment

purposes.

B. Critique the wisdom and legality of Camden’s business decisions

C. Express an opinion as to the fairness of Camden’ financial statements

D. Certify the correctness of Camden’s financial statements

2. The term refers to the risk that the client’s financial statements may be

materially false and/or misleading

A. Business risk C. Client risk

B. Information risk D. Risk assessment

3. The primary reason for an audit by an external audit firm is

A. To satisfy governmental regulatory requirements.

B. To guarantee that there are no misstatements in the financial statements.

C. To provide increased assurance to users as to the fairness of the financial

statements.

D. To ensure that any fraud will be discovered.

4. Which of the following is not part of the Theoretical Framework for Auditing?

I. The use of testing

II. Short-term conflicts may arise between the auditors and preparers of

Financials Statements

III. Audit benefits the Public

A. I only C. II only

B. I and II D. I, II and III

5. Absolute assurance is not possible because of: K

Sampling risks Employment of Judgment Conclusive nature of evidence

A. Yes Yes Yes

B. No Yes Yes

C. Yes No Yes

D. No No No

E. Yes Yes No

6. I. Assertions about account balances at the period end includes completeness,

rights and obligation and accuracy

II. If the company is auditing an expense account, an auditor mainly considers

the occurrence of transactions rather than completeness, in designing its

audit procedures.

A. True, true C. False, true

B. True, false D. False, false

7. Professional judgment is not used in decisions regarding:

I. Materiality

II. Nature, timing and extent of clients accounting works

III. Audit risk and its components

A. I only D. I and II

B. II only E. II and III

C. III only

8. In performing a financial statement audit, which of the following would an auditor

least likely consider?

A. Internal control.

B. Compliance with GAAP.

C. Quality of managements' business decisions.

D. Fairness of the financial statement amounts.

Auditing & Assurance Principles by Karim G. Abitago, CPA Page 1

Aim…Believe..Claim

9. Assumptions of an effective conduct of an audit include all of the following,

except:

I. An audit benefits those charged with governance

II. Not all data to be audited is verifiable

III. Short-term conflicts between the auditor and responsible party may arise

during the audit

A. I and II D. I, II and III

B. II and III E. None from A, B, C and D K

C. I and III

10. Which one of the following is not a part of the attest process?

A. gathering evidence about assertions

B. proving the accuracy of the books and records

C. evaluating evidence against objective criteria

D. communicating the conclusions reached

11. I. Assertions does not guide the auditor in the performance of auditor

procedures in obtaining audit evidence, it is professional judgment.

II. If an auditor is auditing the accrued expense account, the assertion that he

is primarily concerned to its completeness rather than existence.

A. True, true C. False, true

B. True, false D. False, false

12. Which of the following best describes the reason why independent auditors reports

on financial statements?

A. A management fraud may exist and it is more likely to be detected by

independent auditors.

B. Different interests may exist between the company preparing the statements

and the persons using the statements.

C. A misstatement of account balances may exist and is generally corrected as

the result of the independent auditor’s work.

D. Poorly designed internal control may be in existence.

13. Management is not responsible for

A. Preparing spreadsheets for the auditor

B. The auditor’s report

C. Compliance with laws and regulations

D. The audited financial statements

14. The independent auditor’s opinion helps establish the credibility of the financial

statements

The independent auditor’s opinion is an assurance as to the efficiency or

effectiveness with which management has conducted the affairs of the entity

A. The first statement is false, the second statement is true.

B. The first statement is true, the second statement is true.

C. The first statement is false, the second statement is false.

D. The first statement is true, the second statement is false.

15. Auditing is important in a free market society because

A. The public requires CPAs functioning as divisions of regulatory bodies

B. Auditors detect all errors and fraud made by company employees

C. It provides reliable information based upon which to judge economic

performance

D. The auditor is an amiable insurance policy for investors

16. Auditors cannot usually provide absolute assurance because:

I. Often, the auditor examines only a sample of the items constituting the

entire population.

II. Of the inherent limitations of internal controls.

III. Evidence is conclusive rather than persuasive.

A. I and II D. I, II and III

B. II and III E. Answer not given

C. I and III

17. Which of the following criteria is unique to the independent auditor's attest

function?

A. General competence.

B. Familiarity with the particular industry of each client.

C. Due professional care.

D. Independence.

Auditing & Assurance Principles by Karim G. Abitago, CPA Page 2

Aim…Believe..Claim

18. Which of the following best describes an auditor's professional skepticism?

A. Auditors must remember that they will be responsible for the financial

statements once they are audited.

B. Auditors should treat all management representations with suspicion until

they are proven.

C. Auditors should make a critical assessment, with an inquisitive mind, of the

sufficiency and appropriateness of audit evidence obtained.

D. Auditors should expect that there will be material misstatements in the

financial records being audited.

19. The highest level of assurance that may be provided by the practitioner is

reasonable assurance (less than absolute) as a result of the following factors,

except:

A. Less than 100% testing C. Conclusive evidence

B. Human error D. Imperfect internal control

20. Which of the following is included within the “Theoretical Framework of Auditing”?

I. All data are verifiable.

II. Short-term conflicts between the auditor and the client may arise.

III. An audit benefits a specified group of persons.

A. I and II D. I, II and III

B. II and III E. Answer not given

C. I and III

21. Professional skepticism is known as the hallmark of auditing.

Professional judgment is known as the best method in detecting fraud and error.

A. True, false C. False, false

B. False, true D. True, true

22. Assertions about classes of transactions and events do not include:

A. Completeness C. Valuation and allocation

B. Classification D. Accuracy

23. Assertions are representations of management that are embodied in financial

statement components. They can be either explicit or implicit. Which of these

assertions is not about valuation or allocation?

A. Property is recorded at historical cost.

B. Trade accounts receivable in the balance sheet are stated at net realizable

value’

C. Notes payable in the balance sheet include all such obligations of the

entity.

D. Property cost is systematically allocated to appropriate accounting period.

24. Minimizing the risk of being associated to clients with questioned integrity are

done under which stage of the audit process?

A. Evidence gathering stage. C. Preliminary engagement stage

B. Reporting stage D. Post-audit stage

25. Professional judgment is necessary in

I. Establishing materiality

II. Evaluation of evidence gathered

A. I only C. Both I and II

B. II only D. Neither I nor II

`- END OF EXAMINATION -

Auditing & Assurance Principles by Karim G. Abitago, CPA Page 3

Aim…Believe..Claim

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Audit Testbank-Bobadilla PDFDocument560 pagesAudit Testbank-Bobadilla PDFNir Noel Aquino100% (12)

- Taxation SituationalDocument113 pagesTaxation SituationalDaryl Mae Mansay100% (1)

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- AUD B41 First Pre Board Exams Questions Answers SolutionsDocument18 pagesAUD B41 First Pre Board Exams Questions Answers SolutionsJerome Madrigal100% (1)

- IR Quiz 3 Final Answer KeyDocument5 pagesIR Quiz 3 Final Answer KeyAna LengNo ratings yet

- 01 Quiz On Topic 1 With Answer KeyDocument3 pages01 Quiz On Topic 1 With Answer KeyNye NyeNo ratings yet

- AUDDocument47 pagesAUDfajardocamille168No ratings yet

- At - Quizzers - Part 1Document9 pagesAt - Quizzers - Part 1Katherine MagpantayNo ratings yet

- AuditingDocument5 pagesAuditingMariel Jane EngracialNo ratings yet

- Auditing Theory ReviewerDocument19 pagesAuditing Theory ReviewerNathalie PadillaNo ratings yet

- AT 2nd Monthly AssessmentDocument4 pagesAT 2nd Monthly AssessmentreymarkgalasinaoNo ratings yet

- ReviewerDocument19 pagesReviewerJustcoldish 01No ratings yet

- Auditing Theory-250 Questions - 2016Document24 pagesAuditing Theory-250 Questions - 2016Philip CastroNo ratings yet

- AT 2nd Monthly AssessmentDocument8 pagesAT 2nd Monthly AssessmentCiena Mae AsasNo ratings yet

- Auditing Theory Prelim QuizDocument6 pagesAuditing Theory Prelim QuizLeinell Sta. MariaNo ratings yet

- Auditing Theory 250 QuestionsDocument29 pagesAuditing Theory 250 QuestionsmelodyNo ratings yet

- C. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A Private CompanyDocument14 pagesC. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A Private CompanyNoro100% (1)

- Ilovepdf MergedDocument688 pagesIlovepdf MergedSpade XNo ratings yet

- 5 Audit PlanningDocument53 pages5 Audit PlanningrogealynNo ratings yet

- Auditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersDocument3 pagesAuditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersJoana Lyn BuqueronNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersCharilyn RemigioNo ratings yet

- AT-07 (FS Audit Process - Audit Planning)Document4 pagesAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNo ratings yet

- Chapter 13 Property Plant and EquiDocument43 pagesChapter 13 Property Plant and EquiMary MariaNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument50 pagesAuditing Theory Mcqs by Salosagcol With AnswersAnthony Koko CarlobosNo ratings yet

- AT101Document41 pagesAT101fanchasticommsNo ratings yet

- 04 Audit Evidence and Audit DocumentationDocument6 pages04 Audit Evidence and Audit DocumentationChristine Joyce MagoteNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocument7 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoHhhhhNo ratings yet

- Chapter 1-Assurance, Auditing and Related ServicesDocument17 pagesChapter 1-Assurance, Auditing and Related Servicesneo14No ratings yet

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 QuestionskokomirieaNo ratings yet

- Auditing Theory 250 QuestionsDocument41 pagesAuditing Theory 250 Questionscjbmanalo.jyt2No ratings yet

- ACT631 Assurance Principles, Professional Ethics and Good Governance PDFDocument6 pagesACT631 Assurance Principles, Professional Ethics and Good Governance PDFMarnelli CatalanNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersLeonard Cañamo100% (1)

- Auditing TheoryDocument59 pagesAuditing TheoryJenn DajaoNo ratings yet

- Act 631 Auditing - CompressDocument6 pagesAct 631 Auditing - CompressNanika FrenzNo ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- C. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A PrivateDocument13 pagesC. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A PrivateNoroNo ratings yet

- Assurance GiangDocument75 pagesAssurance Gianghvu65291No ratings yet

- At 05 Preliminary Engagement Activities PDFDocument4 pagesAt 05 Preliminary Engagement Activities PDFMadelyn Jane IgnacioNo ratings yet

- Auditing Principles CW4-Chapter-1-MCDocument5 pagesAuditing Principles CW4-Chapter-1-MCLorie RoncalNo ratings yet

- Chapter 4 Auditing Theory 15 16 RoqueDocument22 pagesChapter 4 Auditing Theory 15 16 RoquenicoleNo ratings yet

- Module 1 Auditing ConceptsDocument21 pagesModule 1 Auditing ConceptsDura LexNo ratings yet

- AP Quiz No. 1 Auditing and The Audit ProcessDocument12 pagesAP Quiz No. 1 Auditing and The Audit ProcessJeremiah MadlangsakayNo ratings yet

- Auditing Concepts Psa Based QuestionsDocument665 pagesAuditing Concepts Psa Based QuestionsMae Danica CalunsagNo ratings yet

- Udd Pre01 Auditing and Assurance Principle Midterm ExaminationDocument9 pagesUdd Pre01 Auditing and Assurance Principle Midterm ExaminationCamille Baguio FajardoNo ratings yet

- Pre Test 4 SET ADocument13 pagesPre Test 4 SET AMotchi RockyNo ratings yet

- Test For AuditDocument9 pagesTest For AudittimathewosdawitNo ratings yet

- Introduction To Financial Statements AuditDocument6 pagesIntroduction To Financial Statements AuditMadelyn Jane IgnacioNo ratings yet

- AUD B41 Final Pre-Board Exam (Questions - Answers)Document13 pagesAUD B41 Final Pre-Board Exam (Questions - Answers)Joanna MalubayNo ratings yet

- AUD Review 10234Document4 pagesAUD Review 10234PachiNo ratings yet

- Auditing Theory Multiple Choice Questions: Compiled By: Marilou E. Malquisto, Cpa, RcaDocument14 pagesAuditing Theory Multiple Choice Questions: Compiled By: Marilou E. Malquisto, Cpa, RcaQueen LeeNo ratings yet

- RevisionDocument238 pagesRevision21070286 Dương Thùy AnhNo ratings yet

- Aud TheoDocument23 pagesAud TheoKenneth Simon PidoNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Auditing Theory Mcqs by Salosagcol With Answers CompressDocument37 pagesAuditing Theory Mcqs by Salosagcol With Answers CompressShaina BustosNo ratings yet

- At 07 FS Audit Process Audit Planning 1Document4 pagesAt 07 FS Audit Process Audit Planning 1Michael Oliver ApolongNo ratings yet

- Auditing Theory ReviewerDocument3 pagesAuditing Theory ReviewerZtrick 1234No ratings yet

- Auditing Reviewer QuizDocument13 pagesAuditing Reviewer QuizAlexandria SomethingNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- CISA Exam-Testing Concept-Knowledge of Risk AssessmentFrom EverandCISA Exam-Testing Concept-Knowledge of Risk AssessmentRating: 2.5 out of 5 stars2.5/5 (4)

- 04 Quiz On Topic 03 Auditing Problems With Answer KeyDocument6 pages04 Quiz On Topic 03 Auditing Problems With Answer KeyNye NyeNo ratings yet

- 05 Quiz On Topic 5 With Answer KeyDocument3 pages05 Quiz On Topic 5 With Answer KeyNye NyeNo ratings yet

- 04 Quiz On Topic 4 With Answer KeyDocument4 pages04 Quiz On Topic 4 With Answer KeyNye NyeNo ratings yet

- 03 Quiz On Topic 3 With Answer KeyDocument3 pages03 Quiz On Topic 3 With Answer KeyNye NyeNo ratings yet

- Home Office and Branch Accounting H1Document3 pagesHome Office and Branch Accounting H1Nye NyeNo ratings yet

- 01 Quiz On Topic 01 With Answer KeyDocument5 pages01 Quiz On Topic 01 With Answer KeyNye NyeNo ratings yet

- 3 ITF-Exchange Risk ManagementDocument16 pages3 ITF-Exchange Risk ManagementParvesh AghiNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument3 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRush YuviencoNo ratings yet

- NRO Vs NREDocument3 pagesNRO Vs NREsushantNo ratings yet

- Message 1Document7 pagesMessage 1Zyad UziNo ratings yet

- Tips For The Toppers ComDocument55 pagesTips For The Toppers ComAkshat KumarNo ratings yet

- WAKA PLC Budget SummaryDocument1 pageWAKA PLC Budget Summarygetachew kumeraNo ratings yet

- T10 Government Accounting PDFDocument9 pagesT10 Government Accounting PDFnicahNo ratings yet

- EBRSDocument20 pagesEBRSRaju BothraNo ratings yet

- PFRS 9 - Financial InstrumentDocument3 pagesPFRS 9 - Financial InstrumentErika Panit ReyesNo ratings yet

- O'Level Accounting-Syllabus PDFDocument23 pagesO'Level Accounting-Syllabus PDFSumaia MariamNo ratings yet

- PRTC-FINAL PB - Answer Key 10.21 PDFDocument38 pagesPRTC-FINAL PB - Answer Key 10.21 PDFLuna VNo ratings yet

- Galgotias University: Bba+Llb (Hons) Section-B Semester-VthDocument11 pagesGalgotias University: Bba+Llb (Hons) Section-B Semester-VthTannu guptaNo ratings yet

- Ra 6552 Maceda LawDocument9 pagesRa 6552 Maceda Lawjmr constructionNo ratings yet

- Irish CorporationDocument3 pagesIrish CorporationAngeline RamirezNo ratings yet

- Chapter 4 9eDocument59 pagesChapter 4 9eRahil VermaNo ratings yet

- Matching of Indian Accounting Standard With International AccountingDocument21 pagesMatching of Indian Accounting Standard With International AccountingSwati Rawat25% (4)

- Afzal Hussein - CV TemplateDocument2 pagesAfzal Hussein - CV TemplatecaiohnielsenNo ratings yet

- Partnership Agreement Between Two Limited CompaniesDocument7 pagesPartnership Agreement Between Two Limited CompaniesSam Ta0% (1)

- Level I of The CFA ProgramDocument8 pagesLevel I of The CFA ProgramSachinNo ratings yet

- Case StudyDocument3 pagesCase StudyNoona FreeNo ratings yet

- Mudarabah ContractDocument26 pagesMudarabah ContractChirdchai Chantarat100% (2)

- Multiple Choice Questions 1 The Random Walk Theory Suggests ADocument2 pagesMultiple Choice Questions 1 The Random Walk Theory Suggests Atrilocksp SinghNo ratings yet

- Financial Projections and BudgetsDocument53 pagesFinancial Projections and BudgetsRaquel Sibal RodriguezNo ratings yet

- Business Environment-Monetary & Fiscal PolicyDocument10 pagesBusiness Environment-Monetary & Fiscal Policymanavazhagan0% (1)

- Notice of Vacancy Seconded National Experts: Form DG.1 (EN)Document1 pageNotice of Vacancy Seconded National Experts: Form DG.1 (EN)ClaudiaIonitaNo ratings yet

- Netowrth CertificateDocument3 pagesNetowrth CertificateSai Charan GvNo ratings yet

- 2799-Article Text-13347-1-10-20220701Document13 pages2799-Article Text-13347-1-10-20220701Firas Taqiyyah Al FakhirahNo ratings yet

- Credit TransactionsDocument241 pagesCredit TransactionsJoeffrey PagdangananNo ratings yet

- Invoice CT-2237144Document2 pagesInvoice CT-2237144ABALUNo ratings yet