Professional Documents

Culture Documents

FA7e Ch12 Solutions 081922

FA7e Ch12 Solutions 081922

Uploaded by

Asif Al HyeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FA7e Ch12 Solutions 081922

FA7e Ch12 Solutions 081922

Uploaded by

Asif Al HyeCopyright:

Available Formats

Chapter 12

Reporting and Analyzing

Financial Investments

Learning Objectives – coverage by question

Mini- Cases

Exercises Problems

Exercises and Projects

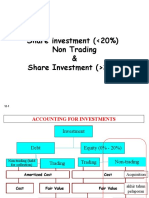

LO1 – Explain and interpret the three

28-31, 33,

levels of investor influence over an

11 34, 41-43, 59, 61, 62 63-67

investee – passive, significant, and

45-50

controlling.

LO2 – Describe the term “fair value”

14 49 59, 61 66, 67

and the fair value hierarchy.

28-31, 33,

LO3 – Describe and analyze accounting

12, 13, 21-26 34, 36, 41- 59, 61 63-67

for passive investments.

43, 45-49

LO4 – Explain and analyze

accounting for investments with 15-17, 20 37-42, 49, 50 61, 62, 64 65-67

significant influence.

LO5 – Describe and analyze

32, 35, 44,

accounting for investments with 18-20, 27 60, 62 66

55, 56

control.

LO6 – Appendix 12A – Illustrate and

analyze accounting mechanics for 57 62

equity method investments.

LO7 – Appendix 12B – Apply

51-54, 56 60, 62

consolidation accounting mechanics.

LO8 – Appendix 12C – Discuss the

58

reporting of derivative securities.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-1

QUESTIONS

Q12-1. (a) Trading securities are reported at their fair value in the balance sheet. (b)

Available-for-sale securities are reported at their fair value in the balance sheet.

(c) Held-to-maturity securities are reported at their amortized cost in the

balance sheet.

Q12-2. An unrealized holding gain (loss) is an increase (decrease) in the fair value of

an asset (in this case, an investment security) that is still owned. Investments

in equity securities should be reported at their fair value on the balance sheet,

with unrealized holding gains and losses reported in income in the period that

they occur. There is a provision for non-marketable securities to use when the

cost of estimating fair value is prohibitively expensive.

Q12-3. Unrealized holding gains and losses related to trading securities are reported in

the current-year income statement (and also retained earnings). Unrealized

holding gains and losses related to available-for-sale debt securities are

reported as a separate component of stockholders' equity called Other

Comprehensive Income (OCI).

Q12-4. Significant influence gives the owner of the stock the ability to significantly

influence the operating and financing activities of the company whose stock is

owned. Normally, this is accomplished with a 20% through 50% ownership of

the company's voting stock.

The equity method is used to account for investments with significant influence.

Such an investment is initially recorded at cost; the investment is increased by

the proportionate share of the investee company's net income, and equity

income is reported in the income statement; the investment account is

decreased by dividends received on the investment; and the investment

account is reported in the balance sheet at its book value. Unrealized

appreciation in the market value of the investment is not recognized.

Q12-5. Yetman Company's investment in Livnat Company is an investment with

significant influence, and should, therefore, be accounted for using the equity

method. At year-end, the investment should be reported in the balance sheet at

$206,400 [$200,000 + (40% $64,000) - (40% x $48,000)].

Q12-6. A stock investment representing more than 50% of the investee company's

voting stock is generally viewed as conferring “control” over the investee

company. The investor and investee companies must be consolidated for

financial reporting purposes.

Q12-7. Consolidated financial statements attempt to portray the financial position,

operating results, and cash flows of affiliated companies as a single economic

unit so that the scope of the entire (whole) entity is more realistically conveyed.

©Cambridge Business Publishers, 2023

12-2 Financial Accounting, 7th Edition

Q12-8. The $600,000 investment in Murray Company appearing in Finn Company's

balance sheet and the $240,000 common stock and $360,000 retained

earnings appearing on Murray Company's balance sheet are eliminated. The

two balance sheets (less the accounts eliminated) are then summed to yield the

consolidated balance sheet.

Q12-9.B The $150,000 accounts payable on Dee's balance sheet and the $150,000

accounts receivable on Bradshaw's balance sheet are eliminated. In a

consolidation, all intercompany items are eliminated so that the consolidated

statements show only the interests of outsiders.

Q12-10. Limitations of consolidated statements include the possibility that the

performances of poor companies in a group are "masked" in consolidation.

Likewise, rates of return, other ratios, and percentages calculated from

consolidated statements might prove deceptive because they are composites.

Consolidated statements also eliminate detail about product lines, divisional

operations, and the relative profitability of various business segments. (Some of

this information is likely to be available in the note disclosures relating to the

business segments of certain public firms.) Finally, shareholders and creditors

of subsidiary companies find it difficult to isolate amounts related to their legal

rights by inspecting only consolidated statements.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-3

MINI EXERCISES

M12-11. (10 minutes)

LO 1

a. SI Griffin owns > 20% of Wright.

b. P Bond investments are always classified as passive.

c. P 2,000 shares of Alphabet is well below the number necessary to exert

influence

d. C Watts owns more than half of Zimmerman stock

e. SI Even though Shevlin owns less than 20% of Bowen, the fact that it buys 60%

of Bowen’s output means it is capable of exercising significant influence. This

is a case where the facts and circumstances override the guidance based on

strict percentage ownership.

M12-12. (10 minutes)

LO 3

a. Available-for-sale securities are reported at fair value on the balance sheet. For

2020, this is equal to the amortized cost ($17,163 million) plus unrealized gains

($454 million) and less unrealized losses ($7 million), or $17,610 million.

b. Unrealized gains (and losses) on available-for-sale debt securities are reported as a

component of Accumulated Other Comprehensive Income (AOCI) in the

shareholders’ equity section of the balance sheet.

M12-13. (15 minutes)

LO 3

Investments in equity securities must be reported at fair value, with all gains and losses

(realized and unrealized) recognized in income. Wu will report $11,050 of dividend

income plus income relating to the increase in the market price of the stock of $8,500

($13 - $12 price increase for 8,500 shares). Total investment income is $19,550.

©Cambridge Business Publishers, 2023

12-4 Financial Accounting, 7th Edition

M12-14. (10 minutes)

LO 2

a. All of these investments are marked to fair value, but the determination differs. Level

1 fair values are determined by reference to an active market where identical assets

are traded. Level 2 fair values are determined by using a model (discounted cash

flow, prices of similar assets, etc.) for which the inputs and assumptions can be found

from observable value. Level 3 fair values are also determined by using a model, but

the inputs and assumptions are not observable except to the reporting company.

b. All are marked-to-fair-value, but only Level 1 investments are marked-to-market, the

others are marked-to-model. Level 1 values would be the most objective since they

come from an active market. Level 3 would be most subjective because they depend

significantly on management’s judgments.

c. Level 1 assets are most liquid, because they are traded in active markets. Level 3

assets are likely to be least liquid because their value depends significantly on

information that is not publicly available.

M12-15. (15 minutes)

LO 4

a. Given the 30% ownership, “significant influence” is presumed and the investment

must be accounted for using the equity method. The year-end balance of the

investment account is computed as follows:

Beginning balance........................ $1,500,000

% Lang income earned................ 45,000 ($150,000 0.3)

% Dividends received................... (18,000) ($60,000 0.3)

Ending balance............................. $1,527,000

b. $45,000 ($150,000 0.3) - Equity earnings are computed as the reported net income

of the investee (Lang Company) multiplied by the percentage of the outstanding

common stock owned.

c. (1) In contrast to the market method, the equity method of accounting does not report

investments at market value. The unrealized gain of $300,000 is not reflected in

either the balance sheet or the income statement.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-5

d.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

Purchase -1,500,000 +1,500,000 = - =

stock in Lang Cash Investment

Company.

Recognize +45,000 = +45,000 +45,000 - = +45,000

share of Lang Investment Retained Investment

income. Earnings Income

Receive +18,000 -18,000 = - =

dividend from Cash Investment

Lang.

M12-16. (10 minutes)

LO 4

a.

1. Investment in Lang Company (+A) .................................................... 1,500,000

Cash (-A) ........................................................................................... 1,500,000

2. Investment in Lang Company (+A) ....................................................

45,000

Investment income (+R, +SE) ........................................................... 45,000

3. Cash (+A) ..........................................................................................

18,000

Investment in Lang Company (-A) .................................................... 18,000

b.

+ Cash (A) - - Investment Income (R) +

1,500,000 1. 45,000 2.

3. 18,000

+ Investment in Lang Company (A) -

1. 1,500,000

2. 45,000

18,000 3.

©Cambridge Business Publishers, 2023

12-6 Financial Accounting, 7th Edition

M12-17. (10 minutes)

LO 4

Equity income on this investment is computed as the investee company (Penno)

earnings multiplied by the percentage of the company owned. In this case, equity

earnings equal:

$720,000 40% = $288,000

Note that dividends are treated as a return of investment (reduce the investment

balance by $96,000, computed as $240,000 40%), and not as income. Also, the

investment is recorded at adjusted cost, not at market value, and unrealized gains

(losses) are neither recognized on the balance sheet nor in the income statement.

M12-18. (10 minutes)

LO 5

The $480,000 investment in Hirst Company appearing on Philipich Company's balance

sheet and the $240,000 common stock and $360,000 retained earnings of Hirst

Company would be eliminated.

In addition, a $120,000 noncontrolling interest [20% of ($240,000 + $360,000)] would

appear on the consolidated balance sheet as part of shareholders equity.

M12-19. (10 minutes)

LO 5

Benartzi Company consolidated net income............................. $1,050,000

Less: net income attributable to noncontrolling interests........... 21,000

Net income attributable to Benartzi Company shareholders...... $1,029,000

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-7

M12-19. (20 minutes)

LO 4, 5

a. If DeFond purchases 100% of Verduzco’s common stock, then it must produce

consolidated reports.

DeFond

Company DeFond DeFond

(before Company Verduzco Eliminating Company

investment) (after investment) Company Entries (Consolidated)

Current assets $ 1,000 $ 625 $ 125 $ 750

Investment – 375 – (375) –

Noncurrent assets 2,500 2,500 1,125 3,625

Liabilities 2,750 2,750 875 3,625

Shareholders’ 750 750 375 (375) 750

Equity

b. If DeFond purchases 50% of the common stock of Lin Company, it uses the equity

method.

DeFond Company DeFond Company Lin

(before investment) (after investment) Company

Current assets $ 1,000 $ 625 $ 250

Investment – 375 –

Noncurrent assets 2,500 2,500 2,250

Liabilities 2,750 2,750 1,750

Shareholders’ Equity 750 750 750

c. If we compare DeFond’s consolidated balance sheet to the equity method balance

sheet, we can see that the total assets are higher and the liabilities are higher.

DeFond’s stockholders’ equity accounts are the same. So, the Debt-to-Equity ratio

will be higher if DeFond purchases the subsidiary rather than investing in the joint

venture. If reported profits are the same under either scenario, then purchasing the

subsidiary would produce a lower Return on Assets than the joint venture. Other

ratios would change as well (like the Current Ratio), but not in a predictable

direction.

©Cambridge Business Publishers, 2023

12-8 Financial Accounting, 7th Edition

M12-21. (20 minutes)

LO 3

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

10/1/YR1 -874,800 + 874,800 = - =

Purchase Cash Investment

$500,000 of

Skyline bonds

at 97.

12/31/YR1 +15,750 = +15,750 +15,750 - = +15,750

Recognize Interest Retained Interest

interest Receivable Earnings Revenue

revenue.

12/31/YR1 +7,200 = +7,200 +7,200 - = +7,200

Record Investment Retained Unrealized

unrealized Earnings Gain

gain.

3/31/ +31,500 -15,750 = +15,750 +15,750 - = +15,750

YR2Recognize Cash Interest Retained Interest

interest Receivable Earnings Revenue

income.

4/1/YR2 +886,140 -882,000 = +4,140 +4,140 - = +4,140

Sold Skyline Cash Investment Retained Realized

investment. Earnings Gain

M12-22. (30 minutes)

LO 3

a. Year 1

10/1 Investment in Skyline, Inc. (+A) ........................................................

874,800

Cash (-A) .....................................................................................874,800

12/31 Interest receivable (+A) .....................................................................

15,750

Interest revenue (+R, +SE) ......................................................... 15,750

12/31 Investment in Skyline, Inc. (+A) ........................................................

7,200

Unrealized gain (+R, +SE) .......................................................... 7,200

Year 2

3/31 Cash (+A) ........................................................................................

31,500

Interest receivable (-A) ................................................................ 15,750

Interest revenue (+R, +SE) ......................................................... 15,750

4/1 Cash (+A) ........................................................................................

886,140

Realized gain (+R, +SE) ............................................................. 4,140

Investment in Skyline, Inc. (-A) .................................................... 882,000

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-9

b. Assuming the firm’s fiscal year ends 12/31, the unrealized gain of $7,200 in Skyline

Inc. bonds is closed to retained earnings in Year 1 increasing net income and

retained earnings.

+ Cash (A) - - Interest Revenue (R)

+

874,800 10/1/YR1 15,750 12/31/YR1

3/31/YR2 31,500 15,750 3/31/YR2

4/1/YR2 886,140

+ Investment in Skyline Bonds (A) - - Unrealized Gain (R)

+

10/1/YR1 874,800 7,200 12/31/YR1

12/31/YR1 7,200 882,000 4/1/YR2

+ Interest Receivable (A) - - Realized Gain (R)

+

12/31/YR2 15,750 15,750 3/31/YR2 4,140 4/1/YR2

M12-23. (20 minutes)

LO 3

Balance Sheet Income Statement

Cash Noncash Liabil Contrib. Earned Net

Transaction Asset + Assets = -ities + Capital + Capital Revenues - Expenses = Income

11/15 -256,800 +256,800 = =

Purchase Cash Investment

10,000 shares

of Lane Inc

common.

12/22 +15,000 = +15,000 +15,000 = +15,000

Dividend Cash Retained Divdend

income. Earnings Income

12/31 -24,300 = -24,300 +24,300 = -24,300

Decrease in Investment Retained Unrealized

Investment. Earnings Loss

1/20 +225,000 -232,500 = -7,500 +7,500 = -7,500

Sale of Lane Cash Investment Retained Realized

common. Earnings Loss

©Cambridge Business Publishers, 2023

12-10 Financial Accounting, 7th Edition

M12-24. (20 minutes)

LO 3

a. Year 1

11/15 Investment in Lane, Inc. (+A) .................................................. 256,800

Cash (-A) ................................................................................. 256,800

12/22 Cash (+A) ................................................................................15,000

Dividend income (+R, +SE) ..................................................... 15,000

12/31 Unrealized loss (+E, -SE) ........................................................24,300

Investment in Lane, Inc. (-A) ................................................... 24,300

Year 2

1/20 Cash (+A) ..........................................................................................

225,000

Loss on sale of investment in Lane, Inc. (+E, -SE) ........................... 7,500

Investment in Lane, Inc. (-A) ............................................................. 232,

500

b. Assuming the firm’s fiscal year ends 12/31, the unrealized loss of $24,300 is closed

to the income summary in Year 1, reducing net income and retained earnings.

+ Cash (A) - + Investment in Lane Inc (A) -

12/22 15,000 256,800 11/15 11/15 256,800 24,300 12/31

1/20 225,000 232,500 1/20

+ Loss (E) -

1/20 7,500

+ Unrealized Loss (E) - - Dividend Income (R) +

12/31 24,300 15,000 12/22

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-11

M12-25. (20 minutes)

LO 3

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

10/1/YR1 -874,800 + 874,800 = - =

Purchase Cash Investment

$900,000 of

Skyline bonds

at 97.

12/31/YR1 +15,750 = +15,750 +15,750 - = +15,750

Recognize Interest Retained Interest

interest Receivable Earnings Revenue

revenue.

12/31/YR1 +7,200 = +7,200 - =

Record Investment Unrealized

unrealized Gain-

gain. AOCI

3/31/YR2 +31,500 -15,750 = +15,750 +15,750 - = +15,750

Recognize Cash Interest Retained Interest

interest Receivable Earnings Revenue

income.

4/1/YR2 +886,140 -882,000 = +11,340 +11,340 - = +11,340

Sold Skyline Cash Investment Retained Realized

investment. Earnings Gain

-7,200

Unrealized

Gain-

AOCI

©Cambridge Business Publishers, 2023

12-12 Financial Accounting, 7th Edition

M12-26. (20 minutes)

LO 3

The main effect is to defer the gain in value experienced in Year 1 to the year Year 2.

a. Year 1

10/1 Investment in Skyline, Inc. (+A) ........................................................

874,800

Cash (-A) .....................................................................................874,800

12/31 Interest receivable (+A) .....................................................................

15,750

Interest revenue (+R, +SE) ......................................................... 15,750

12/31 Investment in Skyline, Inc. (+A) ........................................................

7,200

Unrealized gain AOCI (+SE) ....................................................... 7,200

Year 2

3/31 Cash (+A) ........................................................................................

31,500

Interest receivable (-A) ................................................................ 15,750

Interest revenue (+R, +SE) ......................................................... 15,750

4/1 Cash (+A) ........................................................................................

886,140

Unrealized gain – AOCI (-SE) 7,200

Realized gain (+R, +SE) ............................................................. 11,340

Investment in Skyline, Inc. (-A) .................................................... 882,000

b. Assuming the firm’s fiscal year ends 12/31, the unrealized gain of $7,200 in Skyline

Inc. bonds is closed to retained earnings in Year 1 increasing net income and

retained earnings.

+ Cash (A) - - Interest Revenue (R) +

874,800 10/1/ 15,750 12/31/YR1

YR1

3/31/YR2 31,500 15,750 3/31/YR2

4/1/YR2 886,140

+ Investment in Skyline Bonds (A) - - Unrealized Gain (AOCI) +

10/1/YR1 874,800 7,200 12/31/YR1

12/31/YR1 7,200 882,000 4/1/YR2 4/1/YR2 7,200

+ Interest Receivable (A) - - Realized Gain (R) +

12/31/YR1 15,750 15,750 3/31/ 11,340 4/1/YR2

YR2

Note that most of the gain occurred in Year 1, but was not recognized on the income

statement until management decided to sell the securities in Year 2.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-13

M12-27. (10 minutes)

LO 5

Halen Inc. now owns all of Jolson. The company reports will be consolidated. The total

in the consolidated stockholder’s equity section on 1/1 is the stockholders’ equity

section of the parent company, determined as follows:

Common stock $480,000

Retained earnings 248,000

Total Equity $728,000

Jolson’s equity accounts are eliminated in the consolidation process.

©Cambridge Business Publishers, 2023

12-14 Financial Accounting, 7th Edition

EXERCISES

E12-28. (30 minutes)

LO 1, 3

a.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Purchase bonds for -610,000 +610,000 = =

$610,000 Cash Investment

2. Receive interest +12,000 = +12,000 +12,000 = +12,000

payment of $12,000 Cash Retained Interest

Earnings Income

3. Year-end market +6,000 = +6,000 +6,000 = +6,000

price of bonds is Investment Retained Unrealized

$616,000 Earnings Holding

Gain

4a. Receive interest +12,000 = +12,000 +12,000 = +12,000

payment of $12,000 Cash Retained Interest

Earnings Income

4b. Sell bonds for +612,000 -616,000 = -4,000 +4,000 = -4,000

$612,000 Cash Investment Retained Realized

Earnings Holding

Loss

b.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Purchase bonds -610,000 +610,000 = =

for $610,000 Cash Investment

+12,000

2. Receive interest +12,000 = +12,000 = +12,000

Retained

payment of Cash Interest

Earnings

$12,000 Income

+6,000

3. Year-end +6,000 = =

AOCI

market price of Investment

bonds is

$616,000

+12,000

4a. Receive +12,000 = +12,000 = +12,000

Retained

interest Cash Interest

Earnings

payment of Income

$12,000

+2,000

4b. Sell bonds for +612,000 -616,000 = +2,000 = +2,000

Retained

$612,000 Cash Investment Realized

Earnings

Holding

-6,000 Gain

AOCI

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-15

E12-29. (30 minutes)

LO 1, 3

a. Trading securities

(i.)

1. Investment in US Treasury bonds (+A) ......................................... 610,000

Cash (-A) ...................................................................................... 610,000

2. Cash (+A) ......................................................................................12,000

Interest income (+R, +SE) ............................................................ 12,000

3. Investment in US Treasury bonds.................................................. 6,000

Unrealized holding gain (+R, +SE) ............................................... 6,000

4a Cash (+A) ......................................................................................12,000

.

Interest income (+R, +SE)............................................................. 12,000

4b Cash (+A) ......................................................................................

612,000

.

Realized loss on sale of investment (+E, -SE) ..............................

4,000

Investment in US Treasury bonds (-A)...........................................616,000

(ii.)

+ Cash (A) - + Investment in US T. Bonds (A) -

2. 12,000 610,000 1. 1. 610,000

4a. 12,000 3. 6,000 616,000 4b.

4b 612,000

- Interest Income (R) +

12,000 2.

12,000 4a.

+ Unrealized Gain (R) - + Realized Loss on Sale (E) -

3. 6,000 4b. 4,000

©Cambridge Business Publishers, 2023

12-16 Financial Accounting, 7th Edition

b. Available-for-Sale Securities

(i.)

1. Investment in US Treasury bonds (+A) 610,000

Cash (-A) 610,000

2. Cash (+A) 12,000

Interest income (+R, +SE) 12,000

3. Investment in US Treasury bonds 6,000

Unrealized holding gain - AOCI (+SE) 6,000

4a. Cash (+A) 12,000

Interest income (+R, +SE) 12,000

4b. Cash (+A) 612,000

Unrealized holding gain – AOCI (-SE) 6,000

Investment in US Treasury bonds (-A) 616,000

Realized holding gain (+R, +SE) 2,000

(ii.)

+ Cash (A) - + Investment in US T. Bonds (A) -

2. 12,000 610,000 1. 1. 610,000

4a. 12,000 3. 6,000 616,000 4b.

4b. 612,000

- Interest Income (R) +

12,000 2.

12,000 4a.

- Unrealized Gain AOCI (SE) + - Realized Gain (R) +

4b. 6,000 6,000 3. 2,000 4b.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-17

E12-30. (20 minutes)

LO 1, 3

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Ohlson Co. -96,000 +96,000 = - =

purchases 6,000 Cash Investment

common shares

of Freeman Co.

at $16 cash per

share.

2. Ohlson Co. +7,500 = +7,500 +7,500 - = +7,500

receives a cash Cash Retained Dividend

dividend of Earnings Income

$1.25 per

common share

from Freeman.

3. Year-end market +9,000 = +9,000 +9,000 - = +9,000

price of Freeman Investment Retained Unrealized

common stock is Earnings Gain

$17.50 per share.

4. Ohlson Co. sells +103,680 -105,000 = + -1,320 - +1,320 = -1,320

all 6,000 common Cash Investment Retained Loss

shares of Earnings

Freeman for

$103,680 cash.

E12-31. (20 minutes)

LO 1, 3

a. Equity investments measured at fair value, with all gains/losses recognized in

income.

1. Investment in Freeman, Co. (+A) ............................................96,000

Cash (-A) ................................................................................. 96,000

2. Cash (+A) ................................................................................ 7,500

Dividend income (+R, +SE) ..................................................... 7,500

3. Investment in Freeman, Co. (+A) ............................................ 9,000

Unrealized gain (+R, +SE) ....................................................... 9,000

4. Cash (+A) ................................................................................

103,680

Loss on sale of investment (+E, -SE) ...................................... 1,320

Investment in Freeman, Co. (-A).................................... 105,000

©Cambridge Business Publishers, 2023

12-18 Financial Accounting, 7th Edition

b.

+ Cash (A) - + Investment in Freeman (A) -

2. 7,500 96,000 1. 1. 96,000

4. 103,680 3. 9,000 96,000 4.

- Dividend Income (R) +

7,500 2.

- Unrealized Gain (R) + + Loss on Sale (E) -

9,000 3. 4. 1,320

E12-32. (15 minutes)

LO 5

a. The annual growth rates in revenues are (110,360/96,571)-1 = 14.3% for 2018 and

(96,571/91,154)-1 = 5.9% for 2017. The cumulative average growth rate (CAGR) is

(110,360/91,154)^0.5 - 1 = 10.0%.

b. Microsoft’s acquisition of LinkedIn was completed in December 2016, and it was at

that point that Microsoft began to include LinkedIn’s revenues in its income

statement. Let’s say December 31, 2016 just to be concrete. As a result, 2016’s

revenue included a full year of Microsoft’s revenues, 2017’s revenues included a full

year of Microsoft’s revenues plus a half year of LinkedIn’s revenues, and 2018’s

revenues included a full year of each of Microsoft’s and LinkedIn’ revenues.

As a result, the growth trends over this period intermix the “organic growth” of these

companies with the “acquisition growth.” The former is likely to continue, while the

latter is dependent on acquisitions of other companies.

c. The disclosure information provides revenues for 2016 and 2017 as if Microsoft and

LinkedIn had been one organization over this period. That is, the “acquisition

growth” can be set aside to focus on the “organic growth.” In this case, the revised

growth rates would be the following:

The annual growth rates in revenues are (110,360/98,291)-1 = 12.3% for 2018 and

(98,291/94,490)-1 = 4.0% for 2017. The cumulative average growth rate (CAGR) is

((110,360/94,490)^0.5) - 1 = 8.1%. So “acquisition growth” added about 2% to the

growth pattern in reported revenue.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-19

E12-33. (20 minutes)

LO 1, 3

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

11/1 -511,500 +511,500 = - =

Buy $500,000 Cash Investment

Joos bonds

@102.

12/31 +7,500 = +7,500 +7,500 - = +7,500

Accrue Interest Retained Interest

interest. Receivable Earnings Revenue

12/31 -9,000 = -9,000 - +9,000 = -9,000

Recognize Investment Retained Unrealized

decline in Earnings Loss

value of

bonds.

4/30 +22,500 -7,500 = +15,000 +15,000 - = +15,000

Receive Cash Interest Retained Interest

interest. Receivable Earnings Revenue

5/1 Sold +501,500 -502,500 = -1,000 - +1,000 = -1,000

Joos bonds. Cash Investment Retained Loss

Earnings

E12-34. (20 minutes)

LO 1, 3

a. Year 1

11/1 Investment in Joos, Inc. (+A) ............................................... 511,500

Cash (-A) ............................................................................. 511,500

12/31 Interest receivable (+A) ....................................................... 7,500

Interest revenue (+R, +SE) ................................................. 7,500

12/31 Unrealized loss (+E, -SE) .................................................... 9,000

Investment in Joos, Inc. (-A) ................................................ 9,000

Year 2

4/30 Cash (+A) ............................................................................ 22,500

Interest receivable (-A) ........................................................ 7,500

Interest revenue (+R, +SE) ................................................. 15,000

5/1 Cash (+A) ............................................................................ 501,500

Loss on sale of investments (+E, -SE) ................................ 1,000

Investment in Joos, Inc. (-A)................................................. 502,500

©Cambridge Business Publishers, 2023

12-20 Financial Accounting, 7th Edition

b.

+ Cash (A) - + Investment in Joos Inc. (A) -

4/30 22,500 511,500 11/1 11/1 511,500 9,000 12/31

5/1 501,500 502,500 5/1

+ Unrealized Loss (E) - + Interest Receivable (A) -

12/31 9,000 12/31 7,500 7,500 4/30

- Interest Revenue (R) + + Loss on Sale of Investments (E) -

7,500 12/31 5/1 1,000

15,000 4/30

E12-35. (10 minutes)

LO 5

Baylor Company now owns 75% of Reed. The company reports will be consolidated. The

total in the consolidated stockholders’ equity section on 1/1 is determined as follows:

Common stock………………………………………… 720,000

Retained earnings………………………………….…. 352,000

Baylor Company shareholders’ equity $1,072,000

Noncontrolling interests 160,000

Total equity $1,232,000

E12-36. (15 minutes)

LO 3

a. The fixed-maturity (debt) investment portfolio is reported in the balance sheet at its

current fair value of $44,631 million. The cost of the portfolio is $38,953 million, there

are $5,795 million in unrealized gains, $77 million of unrealized losses, and $40 in the

allowance for credit losses.

b. For the fixed-maturity (debt) investments accounted for as available-for-sale,

unrealized gains (losses) on investments are reported in Accumulated Other

Comprehensive Income (AOCI), rather than current income. The investments are

reported on the balance sheet at current market value on the statement date. Note that

there are no unrealized gains or losses related to the fixed maturity securities classified

as trading for CNA Financial. However, if there were unrealized gains or losses

reported, they would be recognized in current income.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-21

c. An allowance for credit losses has been established on fixed maturity securities that

reduces the value of the investment on the balance sheet. Changes in the allowance

are reflected in current income. Gains and losses realized from the sale of securities

are recognized in current income. A reclassification adjustment is required in Other

Comprehensive Income. Because the gains and losses from the sale of securities will

be recognized in current income (and retained earnings), they need to be removed

from AOCI to avoid double-counting the gains and losses in stockholders’ equity.

E12-37. (15 minutes)

LO 4

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Buy 30% of -162,000 +162,000 = - =

Barth stock. Cash Investment

2. Receive +22,500 -22,500 = - =

dividend. Cash Investment

3. Recognize +36,000 = +36,000 +36,000 - = +36,000

share of net Investment Retained Investment

income of Earnings Income

Barth.

4. Sold Barth +180,500 -175,500 = +5,000 +5,000 - = +5,000

investment. Cash Investment Retained Gain

Earnings

E12-38. (15 minutes)

LO 4

a Investment in Barth Co. (+A) .............................................................

162,000

. 1.

Cash (-A) ...........................................................................................162,000

2. Cash (+A) ..........................................................................................

22,500

Investment in Barth Co. (-A) .............................................................. 22,500

3. Investment in Barth Co. (+A) .............................................................

36,000

Investment income (+R, +SE) ........................................................... 36,000

4. Cash (+A) ..........................................................................................

180,500

Gain on sale of investment (+R, +SE) ............................................... 5,000

Investment in Barth Co. (-A) ..............................................................175,500

©Cambridge Business Publishers, 2023

12-22 Financial Accounting, 7th Edition

b.

+ Cash (A) - + Investment in Barth (A) -

2. 22,500 162,000 1. 1. 162,000 22,500 2.

4. 180,500 3. 36,000 175,500 4.

- Gain (R) + - Investment Income (R) +

5,000 4. 36,000 3.

E12-39. (15 minutes)

LO 4

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Buy 25% -240,000 +240,000 = - =

of Palepu Cash Investment

stock.

2. Receive +24,000 -24,000 = - =

dividend. Cash Investment

3. Recognize +60,000 = +60,000 +60,000 - = +60,000

share of Investment Retained Investment

net income Earnings Income

of Palepu.

4. Sold +280,000 -276,000 = +4,000 +4,000 - = +4,000

Palepu Cash Investment Retained Gain

investment. Earnings

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-23

E12-40. (15 minutes)

LO 4

a.

1 Investment in Palepu Co. (+A) ..................................................

240,000

.

Cash (-A) ................................................................................... 240,000

2 Cash (+A) ..................................................................................24,000

.

Investment in Palepu Co. (-A) ................................................... 24,000

3 Investment in Palepu Co. (+A) ..................................................60,000

.

Investment income (+R, +SE) ................................................... 60,000

4 Cash (+A) ..................................................................................

280,000

.

Gain on sale of investment (+R, +SE) ....................................... 4,000

Investment in Palepu Co. (-A) ................................................... 276,000

b.

+ Cash (A) - + Investment in Palepu (A) -

2. 24,000 240,000 1. 1. 240,000 24,000 2.

4. 280000 3. 60,000 276,000 4.

- Gain (R) + - Investment Income (R) +

4,000 4. 60,000 3.

©Cambridge Business Publishers, 2023

12-24 Financial Accounting, 7th Edition

E12-41. (30 minutes)

LO 1, 3, 4

a.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Purchase -75,000 +75,000 = - =

Common Cash Investment

shares.

2. No entry. = - =

3. Received +5,500 = +5,500 +5,500 - = +5,500

a cash Cash Retained Dividend

dividend of Earnings Income

$1.10 per

common

share.

4. Recognize +20,000 = +20,000 +20,000 - = +20,000

increase in Investment Retained Unrealized

investment Earnings Gain

value at

year end .

b.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1. Purchase -75,000 +75,000 = - =

Common Cash Investment

shares.

2. Recognize +12,000 = +12,000 +12,000 - = +12,000

30% Investment Retained Investment

portion of Earnings Income

Leftwich

net

income.

3. Received +5,500 -5,500 = - =

a cash Cash Investment

dividend

of $1.10

per

common

share.

4. No entry. = - =

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-25

E12-42. (30 minutes)

LO 1, 3, 4

a. Fair Value Method

i.

1. Investment in Leftwich Co. (+A) ..................................... 75,000

Cash (-A) ........................................................................ 75,000

2. No entry

3. Cash (+A)........................................................................ 5,500

Dividend income (+R, +SE) ........................................... 5,500

4. Investment in Leftwich Co. (+A) ..................................... 20,000

Unrealized gain (+R, +SE) ............................................. 20,000

ii.

+ Cash (A) - + Investment in Leftwich (A) -

3. 5,500 75,000 1. 1. 75,000

4. 20,000

- Unrealized Gain (R) + - Dividend Income (R) +

20,000 4. 5,500 3.

b. Equity Value Method

i.

1. Investment in Leftwich Co. (+A) ..................................................................

75,000

Cash (-A) .....................................................................................................

75,000

2. Investment in Leftwich Co. (+A) ..................................................................

12,000

Investment income (+R, +SE) .....................................................................

12,000

3. Cash (+A) ....................................................................................................

5,500

Investment in Leftwich Co. (-A) ...................................................................5,500

4. No entry

ii.

+ Cash (A) - + Investment in Leftwich (A) -

3. 5,500 75,000 1. 1. 75,000 5,500 3.

2. 12,000

- Investment Income (R) +

12,000 2.

©Cambridge Business Publishers, 2023

12-26 Financial Accounting, 7th Edition

E12-43. (15 minutes)

LO 1, 3

a. The amounts reported for all these separately-identifiable assets and liabilities must

be fair values at the date of the acquisition. So, any property, plant and equipment

would be reported at what we would expect to get for it, rather than historical cost.

Any financial liabilities would be estimated at the value required to discharge them at

the date of the acquisition. In the fair value hierarchy, most of these amounts will be

determined using Level 2 or Level 3 approaches.

b. Goodwill is equal to the amount of consideration given for the transaction minus the

fair value of the net assets acquired. Other than goodwill, the asset fair value is

$8,432 million and the fair value of liabilities is $3,970 million. So, the fair value of

separately-identifiable net assets is $4,462 million (= $8,432 million - $3,970 million).

As a result, the goodwill is $9,501 million (= $13,963 million - $4,462 million). This

amount would not be amortized in the future, but Amazon would have to assess its

value annually for impairment. If the goodwill value is impaired, the goodwill asset is

reduced and a charge is recognized in income.

c. Investors are likely to prefer acquisitions of identifiable net assets (even if

intangible), rather than vaguely-defined “synergy effects.” When the acquired

company goes to the highest bidder, there is a real risk that the highest bidder was

the one that most overestimated the potential for future synergies. When purchase

price allocations are disclosed subsequent to the acquisition, stock prices respond

favorably (unfavorably) to the disclosure that less (more) goodwill was acquired

E12-44. (25 minutes)

LO 5

a. The amounts reported for all these separately-identifiable assets and liabilities must

be fair values at the date of the acquisition. So, any inventory would be reported at

what we would expect to get for it, rather than historical cost. Any financial liabilities

would be estimated at the value required to discharge them at the date of the

acquisition. In the fair value hierarchy, most of these amounts will be determined

using Level 2 or Level 3 approaches. Indeed, Gilead states that the Liability Related

to Future Royalties in this instance is computed using the real options method and

that the inputs used for valuation are unobservable and considered Level 3 under

the fair value measurement and disclosure guidance.

b. Goodwill is equal to the amount of consideration given for the transaction minus the

fair value of the net assets acquired. In this case, the acquisition price is $20.6

billion and the identifiable assets are $16.6 billion so the Goodwill is $4 billion. Under

current GAAP, this amount would not be amortized in the future, but Gilead would

have to assess its value annually for impairment. If the goodwill value is impaired,

the goodwill asset is reduced and a charge is recognized in income.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-27

c. Investors are likely to prefer acquisitions of identifiable net assets (even if

intangible), rather than vaguely-defined “synergy effects.” When the acquired

company goes to the highest bidder, there is a real risk that the highest bidder was

the one that most overestimated the potential for future synergies. When purchase

price allocations are disclosed subsequent to the acquisition, stock prices respond

favorably (unfavorably) to the disclosure that less (more) goodwill was acquired.

E12-45. (15 minutes)

LO 1, 3

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

11/15 -121,350 +121,350 = =

Purchase Cash Investment

7,500 shares

of Core Inc

common.

12/22 +9,375 = +9,375 +9,375 = +9,375

Dividend Cash Retained Dividend

income. Earnings Income

12/31 +9,900 = +9,900 +9,900 = +9,900

Increase in Investment Retained Unrealized

Investment. Earnings Gain

1/20 +129,600 -131,250 = -1,650 +1,650 = -1,650

Sale of Core Cash Investment Retained Loss

common. Earnings on Sale

©Cambridge Business Publishers, 2023

12-28 Financial Accounting, 7th Edition

E12-46. (15 minutes)

LO 1, 3

a. Year 1:

11/15 Investment in Core, Inc. (+A) ................................................ 121,35

0

Cash (-A) .............................................................................. 121,350

12/22 Cash (+A) .............................................................................9,375

Dividend income (+R, +SE) .................................................. 9,375

12/31 Investment in Core, Inc. (+A) ................................................9,900

Unrealized gain (+R, +SE) .................................................... 9,900

Year

2:

1/20 Cash (+A) .............................................................................

129,60

0

Loss on sale of investment (+E, -SE) ...................................1,650

Investment in Core, Inc. (-A) ................................................. 131,250

b. Assuming the firm’s fiscal year ends 12/31, the unrealized gain of 9,900 increases

net income and retained earnings in Year 1.

+ Cash (A) - + Investment in Core Inc (A) -

12/22/YR1 9,375 121,350 11/15/YR1 11/15/YR1 121,350

1/20/YR2 129,600 12/31/YR1 9,900 131,250 1/20/YR2

+ Loss on Sale of Investment (E) -

1/20/YR2 1,650

- Unrealized Gain (R) + - Dividend Income (R) +

9,900 12/31/YR1 9,375 12/22/YR1

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-29

E12-47 (30 minutes)

LO 1, 3

a.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

11/15

Purchase

-121,350 +121,350

7,500 shares = - =

Cash Investment

of Core Inc

common.

12/20 +9,375 +9,375

+9,375

Dividend = Retained Dividend - = +9,375

Cash

income. Earnings Income

12/31

+9,900 +9,900

Increase in = - =

Investment AOCI

Investment.

1/20 +129,600 -131,250 = -1,650 - =

Sale of Core Cash Investment AOCI

common.

b. Some companies complained that marking equity investments to fair value and

reporting fair value changes in the income statement did not fit their business model.

They wanted to make smaller investments in companies with whom they had a

strategic relationship or a continuing interest, but falling short of the significant

influence needed for the equity method. These companies said that they were not

interested in the possible holding gains that they might achieve. So, the IASB

allowed IFRS companies to make an irrevocable choice at the time of investment. If

they chose FVOCI, all holding gains and losses will end up in AOCI and never go

through the income statement.

©Cambridge Business Publishers, 2023

12-30 Financial Accounting, 7th Edition

E12-48 (20 minutes)

LO 1, 3

a. Year 1:

11/15 Investment in Core, Inc. (+A) ................................................ 121,35

0

Cash (-A) .............................................................................. 121,350

12/22 Cash (+A) .............................................................................9,375

Dividend income (+R, +SE) .................................................. 9,375

12/31 Investment in Core, Inc. (+A) ................................................9,900

AOCI (+SE) .......................................................................... 9,900

Year 2:

1/20 Cash (+A) .............................................................................

129,60

0

AOCI (-SE) ……………………………………….. 1,650

Investment in Core, Inc. (-A) ................................................. 131,250

b.

+ Cash (A) - + Investment in Core Inc (A) -

12/22/YR1 9,375 121,350 11/15/YR1 11/15/YR1 121,350

1/20/YR2 129,600 12/31/YR1 9,900 131,250 1/20/YR2

- AOCI + - Dividend Income (R) +

1/20/YR2 1,650 9,900 12/31/YR1 9,375 12/22/YR1

E12-49. (30 minutes)

LO 1, 2, 3, 4

a. The trading stock investments will be reported at $337,950. This amount is computed

using their market values at year-end; specifically, $97,950 + $240,000, or $337,950.

b. The available-for-sale debt investments will be reported at $520,050. This amount is

computed using their market values at year-end; specifically, $288,000 + 232,050, or

$520,050.

c. The equity method stock investments will be reported at $354,000. This amount is

computed using their equity method value at year-end; specifically, $150,000 +

$204,000, or $354,000.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-31

d. Unrealized holding losses of $7,800 will appear in the income statement. These losses

relate to the trading securities; specifically— Barth: $102,000 - $97,950 = $4,050;

Foster: $243,750 - $240,000 = $3,750; total of $4,050 + $3,750 = $7,800.

e. Unrealized holding losses of $10,950 will appear in the stockholders' equity section of

the December 31 balance sheet under other comprehensive income. These losses

relate to the available-for-sale debt securities; specifically— 30-Year Treasury Bond:

$295,500 - $288,000 = $7,500; 10-Year Treasury Note: $235,500 - $232,050 = $3,450;

total of $7,500 + $3,450 = $10,950.

E12-50. (30 minutes)

LO 1, 4

(Entries in $ millions)

a. Record share of income:

Investment in affiliates (+A)……………………………. 95

Income from affiliates (+R, +SE)…………... 95

b. Record receipt of cash dividends:

Cash (+A)………………………………………………… 133

Investment in affiliates (-A)…………………… 133

c. The ending balance should be $3,695 million + $95 million - $133 million = $3,657

million. The actual balance, $1,780 million, was $1,877 million lower. The

difference could be due to dispositions (offset by additional investments), foreign

currency changes, impairments, or other adjustments besides the ones described

above.

©Cambridge Business Publishers, 2023

12-32 Financial Accounting, 7th Edition

E12-51.B (30 minutes)

LO 7

1. & 2.

Consolidating

Healy Miller Adjustments Consolidated

Current assets $1,360,000 $96,000 $ 1,456,000

Investment in Miller 400,000 $(400,000) 0

Plant assets............................... 2,400,000 328,000 12,000 2,740,000

Goodwill..................................... _________ ________ 36,000 36,000

Total assets................................ $4,160,000 $424,000 $ 4,232,000

Liabilities.................................... $ 560,000 $ 72,000 $632,000

Contributed capital..................... 2,800,000 320,000 (320,000) 2,800,000

Retained earnings...................... 800,000 32,000 (32,000) 800,000

Total liabilities & stockholders’

equity...................................... $ 4,160,000 $ 424,000 $4,232,000

3.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1/1 -400,000 = -320,000 - =

To consolidate Investment Miller

Healy & Miller. in Miller Contributed

+36,000 Capital

Goodwill -32,000

+12,000 Miller

Plant Retained

Assets Earnings

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-33

E12-52.B (40 minutes)

LO 7

a. Miller contributed capital (-SE) ............................................................

320,000

Miller retained earnings (-SE)..............................................................

32,000

Plant assets (+A) ................................................................................

12,000

Goodwill (+A) ......................................................................................

36,000

Investment in Miller Co. (-A) .............................................................. 400,000

b.

+ Investment in Miller Co. (A) - + Goodwill (A) -

400,000 1/1 1/1 36,000

- Miller Contributed Capital (SE) +

1/1 320,000

+ Plant Assets (A) - - Miller Retained Earnings (SE) +

1/1 12,000 1/1 32,000

E12-53.B (30 minutes)

LO 7

1. & 2.

Rayburn Company purchased all of Kanodia Company's common stock for cash on

January 1, after which the separate balance sheets of the two corporations appeared

as follows:

Consolidating

Rayburn Kanodia Adjustments Consolidated

Investment in Kanodia................ $ 480,000 (480,000) $ 0

Other assets............................... 1,840,000 $560,000 16,000 2,416,000

Goodwill..................................... . . 32,000 32,000

Total assets................................ $2,320,000 $560,000 $2,448,000

Liabilities.................................... $ 720,000 $128,000 $848,000

Contributed capital..................... 1,120,000 240,000 (240,000) 1,120,000

Retained earnings...................... 480,000 192,000 (192,000) 480,000

Total liabilities & stockholders’

equity...................................... $2,320,000 $560,000 $2,448,000

©Cambridge Business Publishers, 2023

12-34 Financial Accounting, 7th Edition

3.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1/1 -480,000 = -240,000 =

To Investment in Kanodia

consolidate Kanodia Contributed

Rayburn & +32,000 Capital

Kanodia. Goodwill -192,000

+16,000 Kanodia

Other Assets Retained

Earnings

E12-54.B (30 minutes)

LO 7

a. Kanodia contributed capital (-SE) .......................................................

240,000

Kanodia retained earnings (-SE) ........................................................

192,000

Other assets (+A) ...............................................................................

16,000

Goodwill (+A) ......................................................................................

32,000

Investment in Kanodia Co. (-A)..........................................................480,000

b.

+ Investment in Kanodia Inc. (A) - + Goodwill (A) -

480,000 1/1 1/1 32,000

- Kanodia Contributed Capital (SE) +

1/1 240,000

+ Other Assets (A) - - Kanodia Retained Earnings (SE) +

1/1 16,000 1/1 192,000

E12-55. (20 minutes)

LO 5

a. The investment is initially recorded on Engel’s balance sheet at the purchase price of

$23.5 million, including $9.2 million of goodwill. Because the fair value of Ball is less

than the carrying amount of the investment on Engel’s balance sheet, the goodwill is

deemed to be impaired. To determine impairment, the imputed value of the goodwill is

determined to be 17.5 million - $14.3 million = $3.2 million.

b. Goodwill must be written down by $6.0 ($23.5 - $17.5) million. The write-down will

reduce the carrying amount of goodwill by this amount, and the write-down will be

recorded as a loss in Engel’s consolidated income statement, thereby reducing

retained earnings by that amount.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-35

E12-56B (60 minutes)

LO 5, 7

a.

Cash paid........................................................................... $252,000

Fair market value of shares issued.................................... 216,000

Purchase price.................................................................. 468,000

Less: Book value of Harris................................................. 336,000

Excess payment................................................................. $132,000

Excess payment assigned to specific accounts based on fair market value:

Buildings............................................................................ 48,000

Patent................................................................................ 36,000

Goodwill............................................................................. $ 48,000

$132,000

b.

Consolidation Consolidated

Accounts Easton Company Harris Co. Entries Totals

Cash $100,800 $48,000 148,800

Receivables 192,000 108,000 300,000

Inventory 264,000 156,000 420,000

Investment in Harris 468,000 [S] $(336,000) -

[A] (132,000)

Land 120,000 72,000 192,000

Buildings, net 480,000 132,000 [A] 48,000 660,000

Equipment, net 144,000 60,000 204,000

Patent 0 --- [A] 36,000 36,000

Goodwill - -- [A] 48,000 48,000

Totals $1,768,800 $576,000 $2,008,800

Accounts payable $192,000 $36,000 $ 228,000

Long-term liabilities 456,000 204,000 660,000

Common stock 600,000 48,000 [S] (48,000) 600,000

Additional paid-in capital 88,800 - 88,800

Retained earnings 432,000 288,000 [S] (288,000) 432,000

Totals $1,768,800 $ 576,000 $2,008,800

c. The tangible assets are accounted for just like any other acquired asset. The

receivables are removed when collected, inventories affect future cost of goods sold,

and depreciable assets are depreciated over their estimated useful lives. Intangible

assets with a determinable life are amortized (depreciated) over that useful life. Finally,

intangible assets with an indeterminate useful life (such as goodwill) are not amortized,

but are either tested annually for impairment, or more often if circumstances require.

(However, note, FASB is re-considering the post-acquisition treatment of goodwill and

may move to an amortization with impairment method in the future.)

©Cambridge Business Publishers, 2023

12-36 Financial Accounting, 7th Edition

E12-57.A (20 minutes)

LO 6

a. Investment in Harris Company (+A) ....................................................

34,560

Equity in earnings of Harris Company (-SE) ....................................... 34,560

The equity in earnings of Harris Company is calculated as follows:

40% x [$96,000 – ($48,000 20) – ($36,000 5)] = $34,560

b. $187,200 + $34,560 – 40% x $48,000 = $202,560.

E12-58.C (20 minutes)

LO 8

a. Companies use derivative securities in order to mitigate risks, such as commodity price

risks, risks relating to foreign exchange fluctuations, or risks relating to fluctuations in

interest rates.

b. Derivatives are reported on the balance sheet as are the assets or liabilities to which

they relate. Generally, derivatives and the related assets/liabilities are reported on the

balance sheet at their fair market value.

c. The unrealized gains (losses) on HPE’s derivatives are reported in the Accumulated

Other Comprehensive Income section of its stockholders’ equity. This reporting

indicates that the underlying item being hedged has not yet affected HPE’s profits.

Once the underlying item appears in income, these unrealized gains (losses) will be

removed from AOCI and transferred into current income.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-37

PROBLEMS

P12-59. (50 minutes)

LO 1, 2, 3

a. Available-for-sale investments are reported at market value on the balance sheet.

Thus, Met Life’s bond investments are reported at:

$354,809 million as of 2020

$327,820 million as of 2019

b. Net unrealized gains (losses) at the end of 2020 are:

$44,079 million ($45,519 million - $1,440 million)

Net unrealized gains (losses) at the end of 2019 are:

$30,132 million ($31,812 million - $1,680 million)

Because the investments are accounted for as available-for-sale, these unrealized

gains (losses) did not affect reported income for 2020 and 2019. (Note: Had these

investments been accounted for as trading securities, those unrealized gains

(losses) would have affected reported income.)

c. Realized gains (losses) are gains (losses) that occur as a result of sales of

securities. These are reported in the income statement and affect reported income.

Unrealized gains (losses) reflect the difference between the current market price of

the security and its acquisition cost. Only unrealized gains (losses) from trading

securities are reported in income. If MetLife had sold all of the AFS securities on

which it had gains, its pre-tax income would have increased by $45,519 million.

d. The evaluation of investment performance is difficult as companies have discretion

over the timing of realized investment gains (losses) and can, thereby, affect

reported income. By including unrealized gains (losses) in the analysis, we are able

to get a clearer picture of overall investment performance—albeit, with an

understanding that these gains and losses are not yet realized. These returns could

then be compared with those of competitors and market rates in general for

investments of comparable risk. We believe this reporting metric provides useful

insights as noted.

©Cambridge Business Publishers, 2023

12-38 Financial Accounting, 7th Edition

P12-60.B (30 minutes)

Consolidating

Gem Alpine Adjustments Consolidated

Current assets............................ $322,500 $200,000 $ 522,500

Investment in Alpine................... 490,000 - $(490,000) -

Plant assets (net) ...................... 331,250 575,000 906,250

Total assets................................ $1,143,750 $775,000 $ 1,428,750

Liabilities.................................... $62,500 $75,000 137,500

Common stock........................... 875,000 525,000 (525,000) 875,000

Retained earnings...................... 206,250 175,000 (175,000) 206,250

Noncontrolling interest............... 210,000 210,000

Total liabilities & stockholders’

equity...................................... $1,143,750 $775,000 $1,428,750

P12-61. (40 minutes)

LO 1, 2, 3, 4

a. The trading security investments will be reported at $562,950. This value is computed

using their market values at year-end; specifically, $157,950 + $405,000.

b. The available-for-sale investments will be reported at $538,500. This value is

computed using their market values at year-end; specifically, $298,500 + $240,000.

c. The held-to-maturity bond investments will be reported at $355,800. This value is

computed using their amortized cost value at year-end; specifically, $151,800 +

$204,000.

d. Unrealized holding gains of $15,600 will appear in the income statement. These gains

relate to the trading securities; specifically— Ling: $157,950 - $153,600 = $4,350 gain;

Wren: $405,000 - $393,750 = $11,250; total of $4,350 + $11,250 = $15,600. The

calculation is only possible because this is the first year the bonds have been held.

Therefore, the entire price difference occurred this year.

e. Unrealized holding gains of $12,000 will appear in the stockholders' equity section

of the December 31 balance sheet under accumulated other comprehensive

income (AOCI). These losses relate to the available-for-sale securities; specifically

— Olanamic: $298,500 - $295,500 = $3,000; Fossil: $240,000 - $231,000 = $9,000;

total of $3,000 + $9,000 = $12,000.

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-39

P12-62.A,B (60 minutes)

LO 1, 4, 5, 6, 7

a. Yes, each individual company (e.g., parent and subsidiary) maintains its own

financial statements (and their own underlying books and records). This approach is

necessary to identify and maintain a record of the activities of the individual units

and to report to the respective stakeholders of each unit (division heads, minority

owners, etc).

The purpose of consolidation is to combine these separate statements to more

clearly reflect the operations and financial condition of the combined (whole) entity

and after eliminating intercompany transactions.

b. The Investment in Financial Services is reported on the parent’s (Equipment

Operations) balance sheet at $5,345 million.

This amount is the same balance as reported for stockholders’ equity of the

Financial Services subsidiary.

This relation will always exist when the investment is organic, meaning that the

parent created and funded the subsidiary.

c. The consolidated balance sheet more clearly reflects the actual assets and liabilities

of the combined company relative to the information revealed by the equity method

of accounting. That is, it better reflects operations as one entity as far as investors

and creditors are concerned.

The equity method of accounting that is used by the parent company to account for

its investment in a subsidiary reflects only its proportionate share of the investee

company stockholders’ equity and does not report the individual assets and liabilities

comprising that equity.

d. The consolidating adjustments generally accomplish three objectives:

(i) They eliminate the equity method investment on the parent’s balance sheet and

replace it with the actual assets and liabilities of the investee company to which it

relates.

(ii) They record any additional assets that are included in the investment balance

that may not be reflected on the subsidiary’s balance sheet, like goodwill, for

example.

(iii) They eliminate any intercompany sales and receivables/payables.

©Cambridge Business Publishers, 2023

12-40 Financial Accounting, 7th Edition

e. The consolidated stockholders’ equity and the stockholders’ equity of the parent

company are equal. This equality will always be the case. The consolidation process

replaces the investment account with the assets and liabilities to which it relates.

Thus, stockholders’ equity remains unaffected.

f. Consolidated net income will equal the net income of the parent company. The

reason for this result is that the parent reflects the income of the subsidiary via the

equity method of accounting for its investment. The consolidation process merely

replaces the equity income account with the actual and individual sales and

expenses to which it relates. Net income is unaffected.

g. The equity method of accounting reports investments at adjusted cost (beginning

balance plus equity earnings and less dividends received)—this contrasts with the

market method. Unrealized gains for a subsidiary are, therefore, not reflected on the

consolidated balance sheet and income statement. Instead, the subsidiary is

reflected on the balance sheet at its purchase price net of depreciation and

amortization, just like any other asset. The consolidation process merely replaces

the investment account with the actual assets and liabilities to which it relates. Thus,

there can exist substantial unrealized gains subsequent to the acquisition that are

not reflected in the consolidated financial statements when consolidation is required

(nor when using the equity method of accounting at the parent company).

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-41

CASES

C12-63. (60 minutes)

LO 1, 3

a. Return on assets:

$57,411 + (1 – 0.25)*$2,873

ROA = = 0.180 or 18.0%

($323,888 + $338,516)/2

b. Return on net operating assets

$57,411 – ($803 x (1 – 0.25))

RNOA = = 1.736 or 173.6%

($23,961 + $41,481)/2

RNOA above 174% is a very high number. One factor contributing to this return is

Apple’s well-known use of contract manufacturers. Apple concentrates on the product

design, but they let other companies do much of the manufacturing. This means there

are relatively fewer assets on the balance sheet. Another factor is that Apple develops

much of its intellectual property in-house, which means that it doesn’t show up on the

balance sheet. Apple reports no goodwill asset in its balance sheet and no intangible

assets., This reduces the company’s reported assets. Finally, Apple has issued a

non-trivial amount of debt (borrowed money) over time. All of these factors yield a

relatively low net asset amount in the denominator of the RNOA ratio. The small

denominator results in a higher ratio, that is a higher RNOA. In other words, Apple

earns a high return per dollar of net operating asset employed.

c. Apple is using the available-for-sale method to account for its fixed-income

investments. The value that will be used on the balance sheet is the fair value at the

end of the fiscal year. The unrealized gains and losses are reported in the

accumulated other comprehensive income section of the shareholders’ equity.

d. Return on financial assets: The return on financial assets is measured as the income

from interest and dividends divided by the average balance of financial assets (which

Apple refers to as marketable securities).

(1 – 0.25) x $3,763

Return on Financial Assets = = 0.0182 or 1.82%

($153,814 + $157,054)/2

Apple’s return on its financial assets is much lower than its return on its operating

assets. This differential is reasonable because interest rates are low and also Apple

earns very high returns on its products. However, the interest and dividend income in

the income statement do not tell the whole story because these are available-for-sale

assets and thus the unrealized holding gains and losses are not in the income

statement but in AOCI. Apple’s disclosures show that they have net unrealized gains

of $3,320 million as well (but again, these are unrealized).

©Cambridge Business Publishers, 2023

12-42 Financial Accounting, 7th Edition

C12-64. (40 minutes)

LO 1, 3, 4

a.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1/2/22 -588,000 +588,000 = - =

Buy 28,000 Cash Investment

shares of

Dye.

12/31/22 +22,400 = +22,400 +22,400 - = +22,400

Declare Dividend Retained Dividend

dividend Receivable Earnings Income

$.8/share.

12/31/22 -84,000 = -84,000 - +84,000 = -84,000

Recognize Investment Retained Unrealized

decline in Earnings Loss

investment.

1/18/23 +22,400 -22,400 = - =

Receipt of Cash Dividend

dividend. Receivabl

e

b.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Net

Transaction Asset + Assets = ities + Capital + Capital Revenues - Expenses = Income

1/2/22 -588,000 +588,000 = - =

Buy 20,000 Cash Investment

shares of

Dye.

12/31/22 +22,400 = - =

Declare Dividend

dividend Receivable

$.8/share.

-22,400

Investment

12/31/22 +156,800 = +156,800 +156,800 - = +156,800

Recognize Investment Retained Investment

income from Earnings Income

investment.

1/18/23 +22,400 -22,400 = - =

Receipt of Cash Dividend

dividend. Receivabl

e

©Cambridge Business Publishers, 2023

Solutions Manual, Chapter 12 12-43

C12-65. (40 minutes)

LO 1, 3, 4

a.

i. Year 1:

1/2 Investment in Dye, Inc. (+A) ..............................................................

588,000

Cash (-A) ...........................................................................................

588,000

12/31 Dividend receivable (+A) ...................................................................

22,400

Dividend income (+R, +SE) ...............................................................

22,400

12/31 Unrealized loss (+E, -SE) ..................................................................

84,000

Investment in Dye, Inc. (-A) ...............................................................

84,000

Year

2:

1/18 Cash (+A) ..........................................................................................

22,400

Dividend receivable (-A) .................................................................... 22,400

ii.

+ Cash (A) - + Investment in Dye Inc. (A) -

1/18/23 22,400 588,000 1/2/22 1/2/22 588,000 84,000 12/31/22

+ Dividend Receivable (A) -

12/31/22 22,400 22,400 1/18/23

+ Unrealized Loss (E) - - Dividend Income (R) +

12/31/22 84,000 22,400 12/31/22

©Cambridge Business Publishers, 2023

12-44 Financial Accounting, 7th Edition

b.

i. 2022:

1/2 Investment in Dye, Inc. (+A) ..............................................................

588,000

Cash (-A) ...........................................................................................

588,000

12/31 Dividend receivable (+A) ...................................................................

22,400

Investment in Dye, Inc. (-A) ...............................................................22,400

12/31 Investment in Dye, Inc. (+A) ..............................................................

156,800

Investment income (+R, +SE) ...........................................................156,800

2023:

1/18 Cash (+A) ..........................................................................................

22,400

Dividend receivable (-A) ....................................................................22,400

ii.

+ Cash (A) - + Investment in Dye Inc. (A) -

1/18/23 22,400 588,000 1/2/22 1/2/22 588,000

12/31/22 156,800 22,400 12/31/22

- Investment Income (R) + + Dividend Receivable (A) -