Professional Documents

Culture Documents

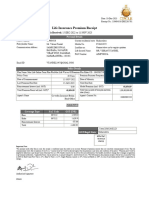

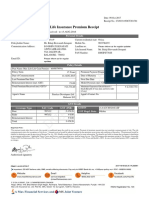

Consolidated Receipt

Consolidated Receipt

Uploaded by

digital.arun999Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Receipt

Consolidated Receipt

Uploaded by

digital.arun999Copyright:

Available Formats

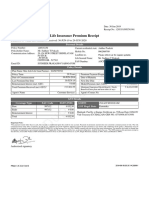

Date: 29-Jul-2023

Premium Paid Certificate

Duration For Which the Premium is Received: 01/04/2022 to 31/03/2023

Personal Details

Policy Number: 354275919 Current residential state: Uttar Pradesh

Policyholder Name: Mr. Shivaksh Kumar Mobile No. 8874435536

Commuinication Address: 4/274 Landline no. Please inform us for regular updates

RANI GHAT, GAUSHALA Life Insured Name: Mr. Shivaksh Kumar

PURANA KANPUR PAN Number: EKFPK2225E

KATARIJIYORA NAWAB

GANJ KHEORA,KANPUR

NAGAR

Kanpur - 208002

Email ID: shivakshkhan@gmail.com

Policy Details

Plan Name: Max Life Smart Wealth Plan - 104N116V03

Policy Term 11 Years Premium Payment Frequency Annual

Date of Commencement 28-JAN-2021 Date of Maturity 28-JAN-2032

Last Premium Due Date 28-JAN-2023 Next Due Date 28-JAN-2024

Reinstatement Interest (incl. ` 0.00 Model Premium (incl. GST) ` 2,04,500.00

GST/S.Tax)

Total Premium Received (incl. ` 2,04,500.00 Minimum Guaranteed Death Benefit / ` 22,00,000.00

GST/S.Tax)* Death Benefit of base plan and term rider

(if any)

Agent's Name Mr. Puneet Kumar Singh Agent's Contact No. 8953238713

GST Details

Coverage Type SAC Code CGST/SGST/ GSTIN 09AACCM3201E1Z1

S.Tax (INR) GST Regd. State Uttar Pradesh

Base 997132 ` 4,500.00

Rider 997132 ` 0.00

Reinstatement Interest ` 0.00

Total ` 4,500.00

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premiums may be

eligible for tax benefits under section 80C/80CCC/80D/37(1) of the Income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification. GST shall comprise of CGST, SGST/UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable

taxes, cesses and levies, as per prevailing laws, shall be borne by you. *For GST purposes ,this premium receipt is Tax Invoice. Assessable Value in GST for Endowment First Year

is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%. *Supply meant for Export under Letter of Undertaking without payment of Integrated

Tax. *whether the tax is payable on reverse charge basis - No.

I/We hereby declare that though our turnover is more than the turnover notified under sub-rule (4) of rule 48, we are not required to prepare an invoice in terms of the said sub-rule.

PRM23 V3.0 19012023

Authorised signatory

PRM23 V3.0 19012023

You might also like

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Consolidatedreceipt PDFDocument1 pageConsolidatedreceipt PDFSuyash MishraNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Maxlife SRMDocument1 pageMaxlife SRMnrcagroNo ratings yet

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Insurance 1premiumDocument1 pageInsurance 1premiumBharathNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Policy NN012203163316 PrintNewDocument22 pagesPolicy NN012203163316 PrintNewPrabhakar bhaleraoNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptssudheer prakashNo ratings yet

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- Saw G Payment ReceiptDocument1 pageSaw G Payment ReceiptrinkukjanNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptVijayNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- PS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital CompanyDocument1 pagePS/Consolidated Premium Statement /ver 2.1/jan 2021: A Reliance Capital Companyshubh1910No ratings yet

- Reliance Premium Receipt y M D GDocument1 pageReliance Premium Receipt y M D Gyadavravindranath57No ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Term Insurance Premium Receipt: Personal DetailsDocument1 pageTerm Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificatevictoryNo ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Ghulam Mohi U Din Tax CeDocument1 pageGhulam Mohi U Din Tax Cesinghgurmanan7No ratings yet

- Policy Certificate 14820393Document6 pagesPolicy Certificate 14820393LuckyGoyalNo ratings yet

- Premium Paid Certificate: Service tax/GST & Other Applicable SurchargesDocument1 pagePremium Paid Certificate: Service tax/GST & Other Applicable Surchargeshimmatbanna93No ratings yet

- CombinepdfDocument3 pagesCombinepdfAnant KumarNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificatevictoryNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVijay KumarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Max Term Insurance - TejkumarDocument1 pageMax Term Insurance - Tejkumarkokkanti tejkumarNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- BOB Foreign Inward Remittance Application FormDocument4 pagesBOB Foreign Inward Remittance Application Formdigital.arun999No ratings yet

- Schemathics Affiliates - IO - Shivam SoniDocument6 pagesSchemathics Affiliates - IO - Shivam Sonidigital.arun999No ratings yet

- British Gas Example Bill 1Document1 pageBritish Gas Example Bill 1digital.arun999No ratings yet

- Invoice # 1Document2 pagesInvoice # 1digital.arun999No ratings yet

- LeadNetwork IODocument3 pagesLeadNetwork IOdigital.arun999No ratings yet

- DataDocument2 pagesDatadigital.arun999No ratings yet