Professional Documents

Culture Documents

07 Eng

07 Eng

Uploaded by

Yours YoursOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Eng

07 Eng

Uploaded by

Yours YoursCopyright:

Available Formats

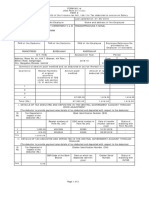

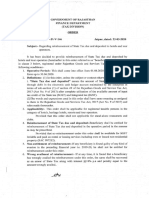

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-

SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS

NOTIFICATION

NO. 07/2023 – CENTRAL TAX

New Delhi, dated the 31st March, 2023

S.O......(E).– In exercise of the powers conferred by section 128 of the Central Goods and Services Tax Act, 2017 (12

of 2017) (hereinafter referred to as the said Act), the Central Government, on the recommendations of the Council,

hereby waives the amount of late fee referred to in section 47 of the said Act in respect of the return to be furnished

under section 44 of the said Act for the financial year 2022-23 onwards, which is in excess of amount as specified in

Column (3) of the Table below, for the classes of registered persons mentioned in the corresponding entry in Column

(2) of the Table below, who fails to furnish the return by the due date, namely:—

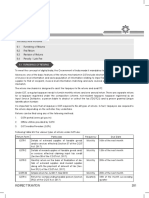

Table

Serial Class of registered persons Amount

Number

(1) (2) (3)

1. Registered persons having an aggregate turnover Twenty-five rupees per day, subject to a

of up to five crore rupees in the relevant financial maximum of an amount calculated at 0.02 per

year. cent. of turnover in the State or Union territory.

2. Registered persons having an aggregate turnover Fifty rupees per day, subject to a maximum of an

of more than five crores rupees and up to twenty amount calculated at 0.02 per cent. of turnover

crore rupees in the relevant financial year. in the State or Union territory.

Provided that for the registered persons who fail to furnish the return under section 44 of the said Act by the

due date for any of the financial years 2017-18, 2018-19, 2019-20, 2020-21 or 2021-22, but furnish the said return

between the period from the 1st day of April, 2023 to the 30th day of June, 2023, the total amount of late fee under

section 47 of the said Act payable in respect of the said return, shall stand waived which is in excess of ten thousand

rupees.

[F. No. CBIC-20013/1/2023-GST]

(Alok Kumar)

Director

You might also like

- ASE20091 June 2021 Mark SchemeDocument16 pagesASE20091 June 2021 Mark SchemeMusthari KhanNo ratings yet

- Stocking Agreement RJR 3-24-00Document2 pagesStocking Agreement RJR 3-24-00api-26225233No ratings yet

- Research MethodologyDocument46 pagesResearch Methodologyنور شهبره فانوت100% (6)

- Notfctn 74 Central Tax English 2020Document1 pageNotfctn 74 Central Tax English 2020cadeepaksingh4No ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- GST CT 07 2024Document1 pageGST CT 07 2024krishanNo ratings yet

- GST CT 37 2023 1Document1 pageGST CT 37 2023 1cadeepaksingh4No ratings yet

- GST CT 32 2023 2Document1 pageGST CT 32 2023 2cadeepaksingh4No ratings yet

- GST CT 53 2023Document2 pagesGST CT 53 2023raunakyadav009No ratings yet

- Central-Tax-09 2024 Eng 150424Document1 pageCentral-Tax-09 2024 Eng 150424dggigrouppNo ratings yet

- Notfctn 78 Central Tax English 2020Document2 pagesNotfctn 78 Central Tax English 2020Ashish Yadav & AssociatesNo ratings yet

- G.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andDocument1 pageG.S.R (E) :-In Exercise of The Powers Conferred by Section 168 of The Central Goods andkumar45caNo ratings yet

- GST CT 28 2023 5Document1 pageGST CT 28 2023 5cadeepaksingh4No ratings yet

- GST CT 13 2023Document1 pageGST CT 13 2023Naga Obul ReddyNo ratings yet

- GST CT 14 2023Document1 pageGST CT 14 2023sridharanNo ratings yet

- Amendment Recruitment Rules 11092023Document3 pagesAmendment Recruitment Rules 110920238793160048ajayNo ratings yet

- Amendment Recruitment Rules 24082023Document3 pagesAmendment Recruitment Rules 24082023Dilip BannerjiNo ratings yet

- GST CT 31 2023 3Document1 pageGST CT 31 2023 3cadeepaksingh4No ratings yet

- csnt23 2022Document1 pagecsnt23 2022nitin DRINo ratings yet

- 08 of 2020Document2 pages08 of 2020TELI TARIQ AZIZNo ratings yet

- Notfctn 7 2019 CGST Rate EnglishDocument2 pagesNotfctn 7 2019 CGST Rate EnglishRamprakash vishwakarmaNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- Notificaiton 5Document3 pagesNotificaiton 5Parmeet NainNo ratings yet

- Notfctn 10 Central Tax English 2021Document2 pagesNotfctn 10 Central Tax English 2021cadeepaksingh4No ratings yet

- Csadd01 2023 453274Document1 pageCsadd01 2023 453274Manish DahiyaNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- 05 2024 CT EngDocument1 page05 2024 CT EngArun_ecNo ratings yet

- Notification No. 35-2021 - Central TaxDocument4 pagesNotification No. 35-2021 - Central TaxSIR GNo ratings yet

- Clean Energy Cess Notn.Document11 pagesClean Energy Cess Notn.Aditya SairamNo ratings yet

- Notfctn 22 2021 CGST Rate 1Document1 pageNotfctn 22 2021 CGST Rate 1GST ACADEMY OF EXCELLENCE ERODE 73737 16648No ratings yet

- 01 2023 CT EngDocument1 page01 2023 CT Engcadeepaksingh4No ratings yet

- Cess Old Car 1 DT 25.1.18Document1 pageCess Old Car 1 DT 25.1.18ashim1No ratings yet

- GST CT 16 2023Document1 pageGST CT 16 2023sridharanNo ratings yet

- 10 2023 CTR EngDocument1 page10 2023 CTR EngMaheswar MajiNo ratings yet

- Notification No. 15/2021-Central Tax (Rate)Document2 pagesNotification No. 15/2021-Central Tax (Rate)santanu sanyalNo ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- Appropriation Act, 2018Document2 pagesAppropriation Act, 2018Latest Laws TeamNo ratings yet

- Notfctn 48 Central Tax English 2019Document2 pagesNotfctn 48 Central Tax English 2019CA Keshav MadaanNo ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- Notification 89 2023Document1 pageNotification 89 2023sarvagya.mishra448No ratings yet

- Finance Act 2023Document105 pagesFinance Act 2023sgacrewariNo ratings yet

- Notification 35and39Document3 pagesNotification 35and39varunnamin1992No ratings yet

- Ministry of Finance (Department of Revenue) NotificationDocument1 pageMinistry of Finance (Department of Revenue) NotificationKittuNo ratings yet

- Notfctn 02 2021 2020 CGST RateDocument2 pagesNotfctn 02 2021 2020 CGST RateJatinMittalNo ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- Import Gatt DeclarationDocument2 pagesImport Gatt Declarationishan guptaNo ratings yet

- Microsoft Word - NN - 46 - 2023 - EngDocument1 pageMicrosoft Word - NN - 46 - 2023 - Engcadeepaksingh4No ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Finance Act 2021Document191 pagesFinance Act 2021Raj_Kumar_FCANo ratings yet

- Notfctn 8 Central Tax English PDFDocument2 pagesNotfctn 8 Central Tax English PDFrgurvareddyNo ratings yet

- Aino Communique 111th Edition Jan 2023 PDFDocument14 pagesAino Communique 111th Edition Jan 2023 PDFSwathi JainNo ratings yet

- (Falling Under Section 28 (9) (B) of The)Document1 page(Falling Under Section 28 (9) (B) of The)Anonymous Gg6z0u9IBzNo ratings yet

- GSTNTF65Document1 pageGSTNTF65JGVNo ratings yet

- Central Goods and Services Tax (CGST) Rules, 2017 Part - A (Rules)Document163 pagesCentral Goods and Services Tax (CGST) Rules, 2017 Part - A (Rules)Rakshit AgarwalNo ratings yet

- 30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document164 pages30.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Dost BhawanaNo ratings yet

- Notfctn 02 2020 CGST Rate EnglishDocument1 pageNotfctn 02 2020 CGST Rate Englishdinesh kasnNo ratings yet

- 01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)Document163 pages01.07.2020 - CGST Rules, 2017 - (Part-A - Rules)rdabliNo ratings yet

- IDT Corrigendum For Nov 22 ExamsDocument8 pagesIDT Corrigendum For Nov 22 Examspreeti sinhaNo ratings yet

- Notification No.09/2013 - Service TaxDocument2 pagesNotification No.09/2013 - Service Taxmaahi7No ratings yet

- Compensation Cess02 2021 Rate EngDocument1 pageCompensation Cess02 2021 Rate EngHemant SinhmarNo ratings yet

- How To File GST ITC-01 and FAQsDocument15 pagesHow To File GST ITC-01 and FAQsYours YoursNo ratings yet

- SGST ReimbursmentDocument2 pagesSGST ReimbursmentYours YoursNo ratings yet

- NIC Einvoicing HighlightsDocument14 pagesNIC Einvoicing HighlightsYours YoursNo ratings yet

- GST eInvoiceSystemDetailedOverviewDocument12 pagesGST eInvoiceSystemDetailedOverviewYours YoursNo ratings yet

- Aigwanak Org Project ReportDocument45 pagesAigwanak Org Project ReportTaylor “Vloggs” KingsNo ratings yet

- Marketing Intelligence & Swot AnalysisDocument8 pagesMarketing Intelligence & Swot AnalysisArslan AyubNo ratings yet

- Audit Objectives Techniques Assertions Procedures and TestsDocument14 pagesAudit Objectives Techniques Assertions Procedures and TestsNieza Marie MirandaNo ratings yet

- Andhra Paper AR2022 23 20 07 2023 1Document196 pagesAndhra Paper AR2022 23 20 07 2023 1sai pawanismNo ratings yet

- Job Description: Elovi Vietnam Joint Stock Company (Morinaga Milk Group)Document2 pagesJob Description: Elovi Vietnam Joint Stock Company (Morinaga Milk Group)Minh AnhNo ratings yet

- Review Questions and Problems Chapter 7Document5 pagesReview Questions and Problems Chapter 7Chelle HullezaNo ratings yet

- Chapter 4 MC QuestionsDocument5 pagesChapter 4 MC QuestionsjessicaNo ratings yet

- Action Work Sheet 1-10 The Entrepreneurial MindsDocument56 pagesAction Work Sheet 1-10 The Entrepreneurial MindsjHen LunasNo ratings yet

- Capital BudgetingDocument35 pagesCapital Budgetinggkvimal nathan100% (3)

- Development of An Advertising Program: Afjal Hossain, Associate Professor, Marketing, PSTUDocument13 pagesDevelopment of An Advertising Program: Afjal Hossain, Associate Professor, Marketing, PSTUTanvir BadhonNo ratings yet

- Introduction To Front Office Operations Unit 1Document15 pagesIntroduction To Front Office Operations Unit 1Stef GBNo ratings yet

- Chapter 21 The Theory of Consumer ChoiceDocument41 pagesChapter 21 The Theory of Consumer ChoiceThanh NguyenNo ratings yet

- ILO - ASEAN Transformation - Electrical and Electronics On and Off The GridDocument52 pagesILO - ASEAN Transformation - Electrical and Electronics On and Off The GridThiru YoNo ratings yet

- Chapter - Issue of Share For CPTDocument8 pagesChapter - Issue of Share For CPTCacptCoachingNo ratings yet

- parle G PresentationDocument23 pagesparle G Presentationakj1992No ratings yet

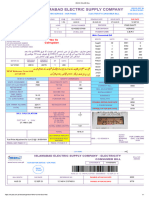

- Flat No. 2 Iesco BillDocument1 pageFlat No. 2 Iesco BillGamers CrewNo ratings yet

- REFERENCESDocument3 pagesREFERENCESmamamo ghorlNo ratings yet

- Case 14-1 DiscussionDocument4 pagesCase 14-1 DiscussionSandhya SharmaNo ratings yet

- STR Op BB OkDocument18 pagesSTR Op BB OkriddhmarketingNo ratings yet

- Group 4 Debt ManagementDocument31 pagesGroup 4 Debt ManagementVellaNo ratings yet

- Strategic Management ProjectDocument3 pagesStrategic Management ProjectZubaidahNo ratings yet

- BRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches VizDocument5 pagesBRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches Vizsohansharma75No ratings yet

- Affirmative Constructive SpeechDocument8 pagesAffirmative Constructive SpeechMahatma Kristine DinglasaNo ratings yet

- Leave Policy English PDFDocument20 pagesLeave Policy English PDFdopvisionNo ratings yet

- Chapter 02 Locating FacilitiesDocument63 pagesChapter 02 Locating FacilitiesVy TrầnNo ratings yet

- Quiz 1 AnswersDocument3 pagesQuiz 1 AnswersAlia MazouzNo ratings yet

- CFO-Forum EEV Principles and Guidance April 2016Document22 pagesCFO-Forum EEV Principles and Guidance April 2016apluNo ratings yet