Professional Documents

Culture Documents

TAXN Module 4

TAXN Module 4

Uploaded by

Brandon VicarmeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TAXN Module 4

TAXN Module 4

Uploaded by

Brandon VicarmeCopyright:

Available Formats

SCHOOL OF EDUCATION, ARTS and SCIENCES

Second Semester

A.Y. 2021-2022

CORRESPONDENCE LEARNING MODULE

TAXN 1013 - Taxation

Prepared by:

CYREANE FAITH N. CARAG, MAEd

Course Instructor

Reviewed by:

RENZ MARION C. GAVINO, MP

General Education Coordinator

Recommended by:

VENUS I. GUYOS, Ph.D.

Academic Dean

Approved by:

EMMANUEL JAMES P. PATTAGUAN, Ph.D.

Vice President for Academics

No part of this E-module/LMS Content can be reproduced, transported or shared with others without permission from the

University. Unauthorized use of the materials, other than personal learning use, will be penalized.

TAXN 1013 – Taxation (Module 4)| 1

UNIVERSITY PRAYER

O God, wellspring of goodness and blessings, we give you thanks and praise as one Louisian

community. The graces You incessantly grant upon us and Your divine providence have sustained

our beloved University throughout the years of mission and excellence.

Having been founded by the Congregation of the Immaculate Heart of Mary, we pray that You keep

us committed and dedicated to our mission and identity to serve the Church and the society as we

become living witnesses to the Gospel values proclaimed by Jesus. For if we are steadfast in our

good and beautiful mission, our works will bring success not only to ourselves but also to those

whom we are bound to love and serve.

Inspired by St. Louis our Patron Saint, who was filled with a noble spirit that stirred him to love You

above all things, may we also live believing that we are born for a greater purpose and mission as

we dwell in Your presence all the days of our life.

Grant all these supplications through the intercession of

Mother Mary and through Christ our Lord. Amen.

No part of this E-module/LMS Content can be reproduced, transported or shared with others without permission from the

University. Unauthorized use of the materials, other than personal learning use, will be penalized.

TAXN 1013 – Taxation (Module 4)| 2

Academic Intellectual Property Rights: This module and the materials posted over NEO-LMS

are the properties of USL and the Facilitators. Students are not allowed to share it to any third-

party individuals not part of the class without any permission from the owners

CORRESPONDENCE LEARNING MODULE

TAXN 1013 - Taxation

AY 2021-2022

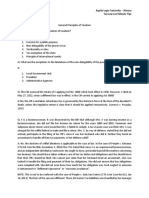

Lesson 1: General Principles of Taxation

Topics: Double Taxation

Forms of Escape from Taxation

Learning Outcomes: At the end of this module, you are expected to:

At the end of this learning module, the student is expected to:

a. Define Double Taxation;

b. enumerate kinds of Double Taxation;

c. distinguish which is prohibited or not in Double Taxation;

d. differentiate the two forms of escape from taxation; and

e. explain the Willful Blindess Doctrine.

Weekly Timetable

Date Topic Activities or Tasks

Peruse on the readings/modules assigned

• Double Taxation

February 14 – • Forms of Escape from

18, 2022 Discussion

Taxation

Completion of learning tasks

Recitation on the provisions and case digests

Double Taxation

There are two kinds of double taxation:

o Direct double taxation, and

o Indirect double taxation.

It is direct double taxation which is prohibited. To constitute direct double

taxation, the following requisites must be present.

o The same property must be taxed twice;

o Both taxes must be imposed:

On the same property or subject matter,

For the same purpose,

No part of this E-module/LMS Content can be reproduced, transported or shared with others without permission from the

University. Unauthorized use of the materials, other than personal learning use, will be penalized.

TAXN 1013 – Taxation (Module 4)| 3

By the same State, Government, or taxing authority,

Within the same jurisdiction,

During the same taxing period, and

The two taxes are of the same king or character. (Villanueva v. City

of Iloilo, G.R.No. L-26251, December 28,1968)

Imposition of a penalty and a tax on one taxpayer does not amount to double

taxation. (Republic Bank v. Court of Tax Appeals, G.R.No.62554, September

2,1992)

Indirect double taxation simply means that there are two or more pecuniary

impositions on a subject matter. It is not prohibited by the Constitution.

Forms of Escape from Taxation

Tax avoidance and tax evasion are the common devices wherein the taxpayer

can escape from the effects of taxation.

Tax avoidance is legal. It involves saving on taxes using legal means.

o Estate planning is legal manner to minimize taxes. (Delpher Trades

Corporation v. Intermediate Appellate Court, G.R.No. L-69259,

January 26,1988)

Tax evasion is illegal and can land you in jail. It involves the use of forbidden

and illegal devices to lessen and minimize tax.

o It connotes the integration of three factors:

The end to be achieved, i.e., payment of less than that known

by the taxpayer to be legally due, or the non-payment of tax

when it is shown that a tax is due,

State of mind which is “evil”, in “bad faith”, “willful”, or

“deliberate and not accidental,” and

Course of action or failure of action that is unlawful. (CIR v.

Estate of BenignoToda, G.R.No.147188, September 14,2004)

Willful blindness doctrine: a taxpayer can no longer raise the defense that

the error on their tax returns is not their responsibility or that it is the fault of

the accountants they hired.

o Intent to defraud need not to show for a conviction of tax evasion.

o The only thing that needs to be proven is that the taxpayer was aware

of this obligation to file the tax return but he nevertheless voluntarily,

knowingly, and intentionally failed to file the required returns.

(People v. Kintanar, C.T.A. E.B. No.006, December 3,2010, affirmed by

the Supreme Court in G.R. No.196340)

No part of this E-module/LMS Content can be reproduced, transported or shared with others without permission from the

University. Unauthorized use of the materials, other than personal learning use, will be penalized.

TAXN 1013 – Taxation (Module 4)| 4

REFERENCES:

Books:

Ingles, M.D. (2018), Tax Made Less Taxing: A Reviewer with Codals and Cases, Rex Book

Store, Manila PH

Dimaampao, J. (2011), Tax Principles and Remedies, Rex Book Store, Manila PH

Online References (on Jurisprudence):

https://www.chanrobles.com/

https://central.com.ph/escra/

No part of this E-module/LMS Content can be reproduced, transported or shared with others without permission from the

University. Unauthorized use of the materials, other than personal learning use, will be penalized.

TAXN 1013 – Taxation (Module 4)| 5

You might also like

- Opposition To AttorneyDocument15 pagesOpposition To AttorneyHollyRustonNo ratings yet

- SSSForm Affidavit Separation From EmploymentDocument1 pageSSSForm Affidavit Separation From Employmentfpmaypa67% (6)

- Tax Avoidance and Tax EvasionDocument14 pagesTax Avoidance and Tax EvasionKRISHNA GATTANI100% (1)

- Atty. MORENO On Quasi Judicial FunctionsDocument42 pagesAtty. MORENO On Quasi Judicial FunctionsAngela Canares100% (1)

- Taxation Modules 1-4Document36 pagesTaxation Modules 1-4Matthew WatersNo ratings yet

- TAXN Module 3Document14 pagesTAXN Module 3Brandon VicarmeNo ratings yet

- Income Taxation Module (Mid-Term)Document32 pagesIncome Taxation Module (Mid-Term)Joseph Anthony RomeroNo ratings yet

- History of Taxation in The Philippines 2023Document69 pagesHistory of Taxation in The Philippines 2023Jennie Rose ZamoraNo ratings yet

- A Study On Filing of Return of Tax Deducted at SourceDocument65 pagesA Study On Filing of Return of Tax Deducted at SourceyopoNo ratings yet

- Module3 AE26 ITDocument6 pagesModule3 AE26 ITJemalyn PiliNo ratings yet

- Mater Dei College, Tubigon, Bohol: Applied EconomicsDocument12 pagesMater Dei College, Tubigon, Bohol: Applied EconomicsNatasha Mae PadilloNo ratings yet

- CLWNTAXN - K37 NotesDocument36 pagesCLWNTAXN - K37 NotesJaan GanaNo ratings yet

- C AE26 MODULE 1 Introduction To TaxationDocument16 pagesC AE26 MODULE 1 Introduction To TaxationBaek hyunNo ratings yet

- Pa 103 Philippine Administrative Thoughts and Institutions Module 4 MidtermDocument14 pagesPa 103 Philippine Administrative Thoughts and Institutions Module 4 MidtermLö Räine AñascoNo ratings yet

- TAXATION LAW Project 2020Document18 pagesTAXATION LAW Project 2020shiwaniNo ratings yet

- FABM2 Q2 Mod14Document26 pagesFABM2 Q2 Mod14Fretty Mae AbuboNo ratings yet

- Note 04 Definition of Tax and Features or Characteristics or Elements of A TaxDocument2 pagesNote 04 Definition of Tax and Features or Characteristics or Elements of A TaxSumit BainNo ratings yet

- Income Tax Part 1Document16 pagesIncome Tax Part 1mary jhoyNo ratings yet

- Module 1. Topic 1Document5 pagesModule 1. Topic 1John Nathan KinglyNo ratings yet

- Module 2 - CAT Level 3 (Material #1)Document4 pagesModule 2 - CAT Level 3 (Material #1)UFO CatcherNo ratings yet

- Module 1Document9 pagesModule 1ᜊ᜔ᜎᜀᜈ᜔ᜃ᜔ ᜃᜈ᜔ᜊᜐ᜔No ratings yet

- Week 1 Course Material For Income TaxationDocument18 pagesWeek 1 Course Material For Income TaxationMitchie FaustinoNo ratings yet

- Module in Income Taxation by Jewelyn C. Espares-CioconDocument33 pagesModule in Income Taxation by Jewelyn C. Espares-CioconmarkbagzNo ratings yet

- BAM 031 Part 1 - HandoutDocument25 pagesBAM 031 Part 1 - HandoutEuli Mae SomeraNo ratings yet

- J.I 4Document6 pagesJ.I 4Nurul MutiaraNo ratings yet

- Inc Tax - 1Document18 pagesInc Tax - 1Rosalie Colarte LangbayNo ratings yet

- Income Taxation - ModuleDocument15 pagesIncome Taxation - ModuleJuniper Murro BayawaNo ratings yet

- Module2 AE26 ITDocument7 pagesModule2 AE26 ITJemalyn PiliNo ratings yet

- Black Book PDFDocument69 pagesBlack Book PDFdhwani100% (1)

- TaxationDocument42 pagesTaxationKhiks ArcherNo ratings yet

- Module 1 - Part 2Document4 pagesModule 1 - Part 2trixie maeNo ratings yet

- Taxation Module IVDocument7 pagesTaxation Module IVJulius A. MuicoNo ratings yet

- Abm 11 - Fabm2 2ND Semester Finals Module 3 (Pielago)Document13 pagesAbm 11 - Fabm2 2ND Semester Finals Module 3 (Pielago)edjay.mercado85No ratings yet

- Legal & Ethical Dimension of Tax EvasionDocument12 pagesLegal & Ethical Dimension of Tax EvasionshehabkhankulawNo ratings yet

- MODULE 2 Taxes 02.02.24Document6 pagesMODULE 2 Taxes 02.02.24karlaloise.torrefrancaNo ratings yet

- Module 1 - TaxationDocument9 pagesModule 1 - TaxationYan DelfinNo ratings yet

- Adzu Tax02 A Course OutlineDocument3 pagesAdzu Tax02 A Course OutlineJustine Paul Pangasi-anNo ratings yet

- Htm121-Module 3-Obligations and ContractsDocument8 pagesHtm121-Module 3-Obligations and ContractshuawieeschoolNo ratings yet

- Lecture 4 TaxationDocument3 pagesLecture 4 Taxationhridoymahmud1017No ratings yet

- Local Media3823239190132283137Document6 pagesLocal Media3823239190132283137Kezia GwynethNo ratings yet

- Chapter 3 - TAXDocument8 pagesChapter 3 - TAXSirhc AicnelavNo ratings yet

- Income Taxation - MODULE 1Document13 pagesIncome Taxation - MODULE 1Joe P PokaranNo ratings yet

- Personal Income Tax in NigeriaDocument118 pagesPersonal Income Tax in NigeriaOsho Olumide100% (9)

- AETAX1 Module 1Document20 pagesAETAX1 Module 1Jerome CatalinoNo ratings yet

- Chapter 4&5 (Public Economics)Document30 pagesChapter 4&5 (Public Economics)sakibecon47No ratings yet

- Taxation VonDocument2 pagesTaxation VonMa Yvonne M. VillojanNo ratings yet

- Tax Notes RevisedDocument7 pagesTax Notes RevisedAnonymous FBDGfUqHENo ratings yet

- Calina - JustinB - TaxModule 1 and 2 PDFDocument8 pagesCalina - JustinB - TaxModule 1 and 2 PDFkakimog738No ratings yet

- TaxssdakcnsaDocument164 pagesTaxssdakcnsaLouisse Marie CatipayNo ratings yet

- informe de ingles tributacion entregableDocument8 pagesinforme de ingles tributacion entregableAngie H.No ratings yet

- Tax 3 Midterm ReviewerDocument6 pagesTax 3 Midterm ReviewerLustrous VisionsNo ratings yet

- Chapter 12Document13 pagesChapter 12Aaron GayongaNo ratings yet

- Tax Law LMT Aquila Legis FraternityDocument17 pagesTax Law LMT Aquila Legis FraternityWilbert ChongNo ratings yet

- Ch01 Introduction To TaxationDocument51 pagesCh01 Introduction To TaxationwasaayedhibaayeNo ratings yet

- Income Tax 1 NotesDocument20 pagesIncome Tax 1 NotesAysha Rubi CKNo ratings yet

- Taxation CourseworkDocument5 pagesTaxation Courseworkbcqxqha3100% (2)

- Taxation - Defined - August 22, 2013Document93 pagesTaxation - Defined - August 22, 2013Asdqwe ZaqwsxNo ratings yet

- WFH#1 OnegoDocument4 pagesWFH#1 OnegoJoselito OñegoNo ratings yet

- Reviewer Chapter-3-TAXDocument7 pagesReviewer Chapter-3-TAXCarla January OngNo ratings yet

- Final Module 1 TaxationDocument15 pagesFinal Module 1 TaxationMichael LacasandileNo ratings yet

- Tax Law Lecture NotesDocument6 pagesTax Law Lecture NotesZulu MasukuNo ratings yet

- IM ACCO 20173 Business and Transfer Taxes Module 2 PDFDocument52 pagesIM ACCO 20173 Business and Transfer Taxes Module 2 PDFJames ScoldNo ratings yet

- In The High Court of Calcutta: I.P. Mukerji and Md. Nizamuddin, JJDocument4 pagesIn The High Court of Calcutta: I.P. Mukerji and Md. Nizamuddin, JJsid tiwariNo ratings yet

- EC Call For Application For EU Crowdfunding GroupDocument5 pagesEC Call For Application For EU Crowdfunding GroupCrowdfundInsiderNo ratings yet

- Cdi 103Document3 pagesCdi 103ytv4mfjdccNo ratings yet

- CR30-X 2nd CR30-Xm Installation ProcedureDocument89 pagesCR30-X 2nd CR30-Xm Installation Procedurealeseb.service100% (2)

- Sandakan Crocodile Farm SDN BHD V Sagajuta (Sabah) SDN BHD (2016) 7 MLJcon 73Document19 pagesSandakan Crocodile Farm SDN BHD V Sagajuta (Sabah) SDN BHD (2016) 7 MLJcon 73haqimNo ratings yet

- The Sun Classified/Legal AdsDocument1 pageThe Sun Classified/Legal AdsMarcus MitchellNo ratings yet

- W.P. No. 1805-2023 638388407670901804Document7 pagesW.P. No. 1805-2023 638388407670901804Mehreen AnsariNo ratings yet

- Motion For Leave of Court To File Demurrer To Evidence (Criminal Case)Document4 pagesMotion For Leave of Court To File Demurrer To Evidence (Criminal Case)L ProfesorNo ratings yet

- Sanctions SchoolDocument2 pagesSanctions SchoolTijana DoberšekNo ratings yet

- Umvoti Standing Rules and Orders By-LawsDocument32 pagesUmvoti Standing Rules and Orders By-Lawsminenhle dlongoloNo ratings yet

- CivRev - 201 - Gayon V GayonDocument1 pageCivRev - 201 - Gayon V GayonSzsNo ratings yet

- Scope of Legitimate Expectation in IndiaDocument54 pagesScope of Legitimate Expectation in IndiaRewant MehraNo ratings yet

- Experiment No: 6 Verification of Illumination LawsDocument3 pagesExperiment No: 6 Verification of Illumination LawsKunal TanwarNo ratings yet

- Topic:: Panjab UniversityDocument16 pagesTopic:: Panjab UniversityShubhamNo ratings yet

- Memorandum in Opposition To Motion For in Camera Review and Protective OrderDocument54 pagesMemorandum in Opposition To Motion For in Camera Review and Protective OrderFinney Law Firm, LLCNo ratings yet

- Pre-Bid Meeting Minute - RFQ-2023-47273 - Moz 116 - 20 June 2023Document3 pagesPre-Bid Meeting Minute - RFQ-2023-47273 - Moz 116 - 20 June 2023devisguibsonNo ratings yet

- Power of A Partner As An AgentDocument4 pagesPower of A Partner As An AgentChristianNo ratings yet

- Military Mandate TRO Denial Florida (Doe v. Austin)Document32 pagesMilitary Mandate TRO Denial Florida (Doe v. Austin)David FoleyNo ratings yet

- Salient Features of The Rules For Small Claims CasesDocument3 pagesSalient Features of The Rules For Small Claims CasesERVIN SAGUNNo ratings yet

- ABSLI Assured Income Plus V04 - PresentationDocument22 pagesABSLI Assured Income Plus V04 - Presentationshreeya akNo ratings yet

- Ordered PairsDocument1 pageOrdered PairsInti WijayatiNo ratings yet

- Magno v. FrancisoDocument3 pagesMagno v. FrancisoLance LagmanNo ratings yet

- Copyright Infringement & Remedies AvailableDocument3 pagesCopyright Infringement & Remedies AvailableRishi DubeyNo ratings yet

- Compounding More Than Once A YearDocument24 pagesCompounding More Than Once A Yeargachaacc335No ratings yet

- Republic Versus VillasorDocument7 pagesRepublic Versus VillasorSample BakeshopNo ratings yet

- WESTCHESTER FIRE INSURANCE COMPANY v. CM CONSULTING GROUP Et Al DocketDocument2 pagesWESTCHESTER FIRE INSURANCE COMPANY v. CM CONSULTING GROUP Et Al DocketACELitigationWatchNo ratings yet

- Cep Training v1Document75 pagesCep Training v1FLORITA SERRANONo ratings yet