Professional Documents

Culture Documents

Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0

Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0

Uploaded by

Rhea Jane ParconCopyright:

Available Formats

You might also like

- ACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8Document28 pagesACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8rodell pabloNo ratings yet

- 2 PDFDocument67 pages2 PDFMarcus MonocayNo ratings yet

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- AFAR SimulationDocument111 pagesAFAR SimulationLloyd Sonica100% (1)

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)MABI ESPENIDONo ratings yet

- Consolidated FsDocument7 pagesConsolidated FsfreyawonderlandNo ratings yet

- Lecture 2 Business Combination Subsequent DateDocument8 pagesLecture 2 Business Combination Subsequent DateKristine Joy SaavedraNo ratings yet

- CPAR - AFAR - Final PB - Batch89Document18 pagesCPAR - AFAR - Final PB - Batch89MellaniNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- Quiz 3 UploadDocument6 pagesQuiz 3 UploadandreamrieNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- SDOADocument2 pagesSDOAassoc.uls2324No ratings yet

- Midterm Quiz in ACCTG2215Document17 pagesMidterm Quiz in ACCTG2215guess who100% (1)

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- Solidated Financial Statements Intercompany TransactionsDocument2 pagesSolidated Financial Statements Intercompany TransactionsDarlyn DalidaNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- Afar 2019Document9 pagesAfar 2019TakuriNo ratings yet

- S5a FINANCIAL RATIO ANALYSIS ASSIGNMENT QUESTIONSDocument16 pagesS5a FINANCIAL RATIO ANALYSIS ASSIGNMENT QUESTIONSSYED ANEES ALINo ratings yet

- Tugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- SEPARATE and CONSOLIDATED STATEMENTSDocument4 pagesSEPARATE and CONSOLIDATED STATEMENTSCha EsguerraNo ratings yet

- Midterm Examination - ABCDocument5 pagesMidterm Examination - ABCMaria DyNo ratings yet

- AccountingDocument9 pagesAccountingTakuriNo ratings yet

- 16 Consolidation Subsequent To The Date of AcquisitionDocument3 pages16 Consolidation Subsequent To The Date of AcquisitionMila Casandra CastañedaNo ratings yet

- Investment in Associate 2022Document3 pagesInvestment in Associate 2022lirva cantonaNo ratings yet

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- I. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsDocument4 pagesI. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsRoxell CaibogNo ratings yet

- Indicate Whether The Statement Is True or FalseDocument11 pagesIndicate Whether The Statement Is True or Falseryan rosalesNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 InvestmentKim JisooNo ratings yet

- Ugbs CR 2023 Ia 1 PDDocument8 pagesUgbs CR 2023 Ia 1 PDkelvinflafe974No ratings yet

- Cup-Advanced Financial Accounting and ReportingDocument7 pagesCup-Advanced Financial Accounting and ReportingJerauld Bucol100% (1)

- Key Quiz 2 2022 2023Document4 pagesKey Quiz 2 2022 2023Leslie Mae Vargas ZafeNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet

- Financial Reporting: Specimen Exam Applicable From September 2016Document25 pagesFinancial Reporting: Specimen Exam Applicable From September 2016Jodlike bolteNo ratings yet

- 94 - Final Preaboard AFAR - UnlockedDocument17 pages94 - Final Preaboard AFAR - UnlockedJessaNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- Prelim ExamDocument13 pagesPrelim ExamNah HamzaNo ratings yet

- Practice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Document5 pagesPractice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Will Emmanuel A PinoyNo ratings yet

- FAR AssessmentDocument4 pagesFAR AssessmentLuna VNo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HareNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 Investmenttite ko'y malake100% (1)

- BADVAC1X - MOD 2 Conso FS Date of AcqDocument6 pagesBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezNo ratings yet

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- TOPIC 2 - Topic 2 - Consolidated and Separate Financial StatementsDocument6 pagesTOPIC 2 - Topic 2 - Consolidated and Separate Financial Statementsduguitjinky20.svcNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- Financial Reporting: Specimen Exam Applicable From September 2016Document25 pagesFinancial Reporting: Specimen Exam Applicable From September 2016Hari RamNo ratings yet

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- CFR 1 Quiz 1Document7 pagesCFR 1 Quiz 1Ahmed SamadNo ratings yet

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizNo ratings yet

- Usc Part 2020 (Far) - RetakeDocument25 pagesUsc Part 2020 (Far) - RetakeVince AbabonNo ratings yet

- ADV ACC TBch04Document21 pagesADV ACC TBch04hassan nassereddine100% (2)

- College of Business, Entrepreneurship and AccountancyDocument8 pagesCollege of Business, Entrepreneurship and AccountancyCherry Ann RoblesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 561 600Document13 pages561 600Rhea Jane ParconNo ratings yet

- Audit ReportDocument3 pagesAudit ReportRhea Jane ParconNo ratings yet

- UnitV CabreraDocument14 pagesUnitV CabreraRhea Jane ParconNo ratings yet

- Partnership-2 0Document2 pagesPartnership-2 0Rhea Jane ParconNo ratings yet

- Share Option SARDocument48 pagesShare Option SARRhea Jane ParconNo ratings yet

- Module 3. Direct Finance Lease Lessor AccountingDocument4 pagesModule 3. Direct Finance Lease Lessor AccountingRhea Jane ParconNo ratings yet

- Depreciation-Functions - BlankDocument3 pagesDepreciation-Functions - BlankRhea Jane ParconNo ratings yet

- Working CapitalAnswerkeyDocument52 pagesWorking CapitalAnswerkeyRhea Jane ParconNo ratings yet

- Quiper Quiz Relevant CostingDocument15 pagesQuiper Quiz Relevant CostingRhea Jane ParconNo ratings yet

- PFRS For SMEs and SEs Transition ProvisionsDocument18 pagesPFRS For SMEs and SEs Transition ProvisionsRhea Jane ParconNo ratings yet

- Partnership Notes-6Document3 pagesPartnership Notes-6Rhea Jane ParconNo ratings yet

- Partnership Notes 4Document4 pagesPartnership Notes 4Rhea Jane ParconNo ratings yet

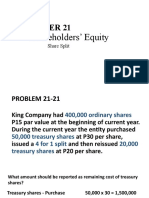

- Prob 21 21Document4 pagesProb 21 21Rhea Jane ParconNo ratings yet

- Partnership Notes 5Document4 pagesPartnership Notes 5Rhea Jane ParconNo ratings yet

- Partnership-1 0Document5 pagesPartnership-1 0Rhea Jane ParconNo ratings yet

- Feasibility Study - 0Document4 pagesFeasibility Study - 0Rhea Jane ParconNo ratings yet

- KLBF Fy2022Document178 pagesKLBF Fy2022Ayu WandiraNo ratings yet

- CHAPTER5Document8 pagesCHAPTER5Anjelika ViescaNo ratings yet

- ACT 1301 L S CommonDocument97 pagesACT 1301 L S CommonSadia AkterNo ratings yet

- Resume Prabesh Chandra AdhikariDocument2 pagesResume Prabesh Chandra AdhikariSrirama SrinivasanNo ratings yet

- Single Entry SystemDocument6 pagesSingle Entry SystemShruti JoseNo ratings yet

- Financial & Managerial Accounting Mbas: Oanhnguyenth231Document64 pagesFinancial & Managerial Accounting Mbas: Oanhnguyenth231Hồng LongNo ratings yet

- Comparative Statement Analysis of Vijaya DairyDocument51 pagesComparative Statement Analysis of Vijaya DairyRajkamalChicha50% (4)

- Public Sector Accounting Developments and Conceptual FrameworkDocument24 pagesPublic Sector Accounting Developments and Conceptual FrameworkREJAY89No ratings yet

- Textbook Managerial Accounting Ray H Garrison Ebook All Chapter PDFDocument53 pagesTextbook Managerial Accounting Ray H Garrison Ebook All Chapter PDFmary.pauling946100% (11)

- Management Discussion and AnalysisDocument11 pagesManagement Discussion and AnalysishihiNo ratings yet

- Toaz - Info Auditing Theory Test Bank PRDocument8 pagesToaz - Info Auditing Theory Test Bank PRChriz VillasNo ratings yet

- Period End Processing - Summary The Following Outlines:: PayablesDocument3 pagesPeriod End Processing - Summary The Following Outlines:: Payablesbritesprite2000No ratings yet

- 03-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesDocument56 pages03-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesThanh ThùyNo ratings yet

- Admas University: Course OutlineDocument5 pagesAdmas University: Course Outlinerediet solomonNo ratings yet

- Adani Bs MergedDocument10 pagesAdani Bs MergedRishabhNo ratings yet

- 2.principles of AuditingDocument114 pages2.principles of AuditingGokul.S 20BCP0010No ratings yet

- Structure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4Document39 pagesStructure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4amyNo ratings yet

- Unit 3 - Bookkeping-1-2Document2 pagesUnit 3 - Bookkeping-1-2JHON ALEJANDRO GALLEGO GALINDONo ratings yet

- Lecture 1 - Accounting in ActionDocument71 pagesLecture 1 - Accounting in Actionarman islamNo ratings yet

- Circular No. 20 (Holiday Homework of Class Xii)Document43 pagesCircular No. 20 (Holiday Homework of Class Xii)rishu ashiNo ratings yet

- Chapter 01 - Intercorporate Acquisitions and Investments in Other EntitiesDocument21 pagesChapter 01 - Intercorporate Acquisitions and Investments in Other Entitiesdella salsabilaNo ratings yet

- FAU Session 3 Audit Evidence, Materiality and Procedure 2Document16 pagesFAU Session 3 Audit Evidence, Materiality and Procedure 2BuntheaNo ratings yet

- 12 SSDDDDocument3 pages12 SSDDDAlvira FajriNo ratings yet

- Incf 2017-2Document90 pagesIncf 2017-2RimaNo ratings yet

- B326: Advance Accounting B326 Course Structure: Chapter 5: Intercompany Transaction - InventoryDocument20 pagesB326: Advance Accounting B326 Course Structure: Chapter 5: Intercompany Transaction - InventoryAyeshaNo ratings yet

- IAS-40 Investment PropertyDocument5 pagesIAS-40 Investment Propertymanvi jainNo ratings yet

- Audit Evidence - Unit TwoDocument28 pagesAudit Evidence - Unit TwoKananelo MOSENANo ratings yet

- Level 4 Thoery-1Document25 pagesLevel 4 Thoery-1EdomNo ratings yet

- CA Final PARAM Question Bank Vol-2 Colour (10 MB)Document262 pagesCA Final PARAM Question Bank Vol-2 Colour (10 MB)Pooja DewanNo ratings yet

Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0

Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0

Uploaded by

Rhea Jane ParconOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0

Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0

Uploaded by

Rhea Jane ParconCopyright:

Available Formats

ACP 312 – Accounting for Business Combinations – Handout 5.

0

Topic: Consolidated Financial Statements Subsequent to Date of Acquisition – Stock Acquisition

Instructor: Leenuel M. Bernarte, CPA

Source: MAY2020-AFAR-06-DISCUSSION NOTES-Brian Christian S. Villaluz

CONSOLIDATION PERIOD

➢ Consolidation begins from the date the investor obtains control of the investee and ceases when

the investor loses control of the investee.

Examples:

✓ If an investor obtains control of an investee on July 1, 2019, the group’s consolidated financial

statements for the year ended December 31, 2019 shall include only the investee’s results of

operations from July 1 to December 31, 2019.

✓ If a parent loses control over its subsidiary on August 31, 2020, the group’s consolidated financial

statements for the year ended December 31, 20200 shall include only the investee’s results of

operations from January 1 to August 31, 2020.

MEASUREMENT

1. Income and expenses

➢ For purposes of presenting items in the consolidated financial statements, income and

expenses of the subsidiary are based on the amounts of the assets and liabilities recognized

in the consolidated financial statements at the acquisition date (i.e., depreciation expense in

the consolidated financial statements is based on the related asset’s fair value on the date of

acquisition rather that its carrying amount in the subsidiary’s accounting records.

2. Investment in subsidiary

➢ Investment in subsidiary are accounted for in the parent’s separate financial statements either:

a. At cost;

b. In accordance with IFRS 9 Financial Instruments; or

c. Using the equity method

Measurement at cost

✓ INITIAL MEASUREMENT: The value assigned to the consideration transferred at the acquisition

date.

✓ SUBSEQUENT MEASUREMENT: The value assigned to the consideration transferred at the

acquisition date unless the investment becomes impaired.

Measurement in accordance with IFRS 9 Financial Instruments

✓ INITIAL MEASUREMENT: The value assigned to the consideration transferred at the acquisition

date.

✓ SUBSEQUENT MEASUREMENT: Fair value every year-end

Measurement using the equity method

✓ INITIAL MEASUREMENT: The value assigned to the consideration transferred at the acquisition

date.

✓ SUBSEQUENT MEASUREMENT: Carrying value adjusted for the investor’s share in the changes

in the investee’s equity.

NON-CONTROLLING INTERESTS (NCI)

1. NCI in the net assets of the subsidiary

✓ Presented in the consolidated financial statement of financial position within equity,

separately from the equity of the owners of the parent.

✓ It consists of:

a. The amount determined at the acquisition date in accordance with IFRS 3 Business

Combinations; and

b. The NCI’s share of changes in equity since the acquisition date.

2. NCI in the comprehensive income

✓ The profit or loss and each component of OCI in the consolidated financial statement of

comprehensive income are attributed to the following:

a. Owners of the parent

b. Non-controlling interests

✓ Total comprehensive income is attributed to the owners of the parent and NCI even if the

results int the non-controlling interests having a deficit balance.

ACP 312 – Handout 5.0 Page 1 of 3

ILLUSTRATIVE PROBLEM NO. 1

Subsequent to Date of Acquisition

On January 1, 2019, Powell Company acquires 80% of the common stock of Scarlett Company for P372,000.

At that time, Scarlett Company’s shareholders’ equity is composed of common stock (P10 par), P240,000

and retained earnings, P120,000. On the other hand, Powell Company’s shareholders’ equity is composed

of common stock (P10 par), P600,000 and retained earnings, P360,000. Also, the fair value of the non-

controlling interest is P98,200. On the same date, the following assets of Scarlett Company had carrying

values that were different from their respective fair values:

(6,000)

Carrying value Fair value

Inventory 24,000 30,000

Land 48,000 55,200 (7,000)

Equipment, net

Building, net

84,000

168,000

180,000

144,000 (96,000)

24,000

Other assets and all liabilities of Scarlett Company had carrying values approximately equal to their

respective fair values.

On January 1, 2019, the equipment and building had a remaining life of 8 and 4 years, respectively. The

inventories on January 1, 2019 were all sold during 2019 and FIFO inventory costing is used. Goodwill, if

any, is impaired by P5,000 during 2019. No goodwill impairment occurred during 2020. The investment is to

be accounted for using the cost method.

The net income and dividends paid for 2019 and 2020 are as follows:

POWELL COMPANY SCARLETT COMPANY

2019 2020 2019 2020

Net income 196,800 234,200 60,000 60,000

Dividends paid 72,000 72,000 36,000 48,000

REQUIREMENT

Determine the following:

1. Goodwill arising from business combination on January 1, 2019 is

2. How much of the goodwill is attributable to the parent and non-controlling interest, respectively?

3. How much is the consolidated net income for the year 2019?

4. How much of the 2019 consolidated net income is attributable to the parent and non-controlling

interest, respectively?

5. What amount of retained earnings shall be presented on the consolidated statement of financial

position on December 31, 2019?

6. What amount of non-controlling interest shall be presented on the (1) separate statement of financial

position and (2) consolidated statement of financial position on December 31, 2019?

7. How much is the consolidated net income for the year 2020?

8. How much of the 2020 consolidated net income is attributable to the parent and non-controlling

interest, respectively?

9. What amount the retained earnings shall be presented on the consolidated statement of financial

position on December 31, 2020?

10. What amount of non-controlling interest shall be presented on the consolidated statement of financial

position on December 31, 2020?

INDEPENDENT ASSUMPTION: Non-controlling interest is to be measured at its proportionate share basis.

11. Goodwill arising from business combination on January 1, 2019 is

12. How much of the goodwill is attributable to the parent and non-controlling interest, respectively?

13. How much of the 2019 consolidated net income is attributable to the parent and non-controlling

interest, respectively?

14. What amount of retained earnings shall be presented on the consolidated statement of financial

position on December 31, 2019?

15. What amount of non-controlling interest shall be presented on the consolidated statement of financial

position on December 31, 2019?

ACP 312 – Handout 5.0 – Bernarte Page 2 of 3

ILLUSTRATIVE PROBLEM NO. 2

PAZZO Corporation acquired 75% of the outstanding shares of SCHNEIDER Company on January 2, 2020

for a consideration transferred of P8,640,000. The price paid includes a control premium amounting to

P240,000. On January 2, 2020, SCHNEIDER Company’s stockholders’ equity accounts were common stock,

P11,400,000 and retained earnings, P3,720,000. An appraisal of the acquired company’s assets and

liabilities on the date of acquisition revealed that there were assets with book values different from their fair

values. The merchandise inventory of SCHNEIDER is overstated by P360,000; land, which was undervalued

by P1,800,000; equipment, which was overvalued by P1,440,000 and patent was undervalued by

P1,080,000. Inventories were all sold in 2020. The equipment had a remaining life of 8 years while patent

had a remaining life of 5 years.

For the year ended 2020, the following were reported by Pazzo and Schneider:

PAZZO Corporation SCHNEIDER Company

Reported net income 7,500,000 4,680,000

Dividends paid 2,000,000 750,000

1. How much is the consolidated net income for the year ended is attributable to the parent?

A. 10,690,500

B. 11,941,500

C. 14,200,500

D. 15,421,500

2. How much is the non-controlling interest in the net assets of subsidiary on December 31, 2020?

A. 3,863,500

B. 4,051,000

C. 5,113,500

D. 5,301,000

---END OF HANDOUT 5.0---

ACP 312 – Handout 5.0 – Bernarte Page 3 of 3

You might also like

- ACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8Document28 pagesACFrOgBKylWIFKqvQUoX2Yag018eml8V2evCY-xyBCergd9v5HXZoTbU3Q8kgtUcNC 5mafD1Hk933Hbe5goLmzsLjTjnum6IB4inPQsm6vrTPgbDppndlBKfMysfn8rodell pabloNo ratings yet

- 2 PDFDocument67 pages2 PDFMarcus MonocayNo ratings yet

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDocument4 pagesPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- AFAR SimulationDocument111 pagesAFAR SimulationLloyd Sonica100% (1)

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)MABI ESPENIDONo ratings yet

- Consolidated FsDocument7 pagesConsolidated FsfreyawonderlandNo ratings yet

- Lecture 2 Business Combination Subsequent DateDocument8 pagesLecture 2 Business Combination Subsequent DateKristine Joy SaavedraNo ratings yet

- CPAR - AFAR - Final PB - Batch89Document18 pagesCPAR - AFAR - Final PB - Batch89MellaniNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- Quiz 3 UploadDocument6 pagesQuiz 3 UploadandreamrieNo ratings yet

- ASSET 2019 Mock Boards - AFARDocument8 pagesASSET 2019 Mock Boards - AFARKenneth Christian Wilbur0% (1)

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- SDOADocument2 pagesSDOAassoc.uls2324No ratings yet

- Midterm Quiz in ACCTG2215Document17 pagesMidterm Quiz in ACCTG2215guess who100% (1)

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- Solidated Financial Statements Intercompany TransactionsDocument2 pagesSolidated Financial Statements Intercompany TransactionsDarlyn DalidaNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- Afar 2019Document9 pagesAfar 2019TakuriNo ratings yet

- S5a FINANCIAL RATIO ANALYSIS ASSIGNMENT QUESTIONSDocument16 pagesS5a FINANCIAL RATIO ANALYSIS ASSIGNMENT QUESTIONSSYED ANEES ALINo ratings yet

- Tugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 4 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- SEPARATE and CONSOLIDATED STATEMENTSDocument4 pagesSEPARATE and CONSOLIDATED STATEMENTSCha EsguerraNo ratings yet

- Midterm Examination - ABCDocument5 pagesMidterm Examination - ABCMaria DyNo ratings yet

- AccountingDocument9 pagesAccountingTakuriNo ratings yet

- 16 Consolidation Subsequent To The Date of AcquisitionDocument3 pages16 Consolidation Subsequent To The Date of AcquisitionMila Casandra CastañedaNo ratings yet

- Investment in Associate 2022Document3 pagesInvestment in Associate 2022lirva cantonaNo ratings yet

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- I. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsDocument4 pagesI. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsRoxell CaibogNo ratings yet

- Indicate Whether The Statement Is True or FalseDocument11 pagesIndicate Whether The Statement Is True or Falseryan rosalesNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 InvestmentKim JisooNo ratings yet

- Ugbs CR 2023 Ia 1 PDDocument8 pagesUgbs CR 2023 Ia 1 PDkelvinflafe974No ratings yet

- Cup-Advanced Financial Accounting and ReportingDocument7 pagesCup-Advanced Financial Accounting and ReportingJerauld Bucol100% (1)

- Key Quiz 2 2022 2023Document4 pagesKey Quiz 2 2022 2023Leslie Mae Vargas ZafeNo ratings yet

- Practice Actp 4 SubsDocument4 pagesPractice Actp 4 SubsWisley GamuzaNo ratings yet

- Financial Reporting: Specimen Exam Applicable From September 2016Document25 pagesFinancial Reporting: Specimen Exam Applicable From September 2016Jodlike bolteNo ratings yet

- 94 - Final Preaboard AFAR - UnlockedDocument17 pages94 - Final Preaboard AFAR - UnlockedJessaNo ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- PART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDocument7 pagesPART 1-THEORIES (1pt. Each) "A" If TRUE, "B" If FALSEDrew BanlutaNo ratings yet

- IA2 Finals ReviewerDocument6 pagesIA2 Finals ReviewerJoana MarieNo ratings yet

- Prelim ExamDocument13 pagesPrelim ExamNah HamzaNo ratings yet

- Practice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Document5 pagesPractice Problems: C. The Consolidated Total Assets After The Combination Is P6,116,250Will Emmanuel A PinoyNo ratings yet

- FAR AssessmentDocument4 pagesFAR AssessmentLuna VNo ratings yet

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HareNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 Investmenttite ko'y malake100% (1)

- BADVAC1X - MOD 2 Conso FS Date of AcqDocument6 pagesBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezNo ratings yet

- Audit of InvestmentsDocument3 pagesAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- TOPIC 2 - Topic 2 - Consolidated and Separate Financial StatementsDocument6 pagesTOPIC 2 - Topic 2 - Consolidated and Separate Financial Statementsduguitjinky20.svcNo ratings yet

- Investments: Problem 1Document4 pagesInvestments: Problem 1Frederick AbellaNo ratings yet

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- Financial Reporting: Specimen Exam Applicable From September 2016Document25 pagesFinancial Reporting: Specimen Exam Applicable From September 2016Hari RamNo ratings yet

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- ACCExpanded Opportunity Part 1Document4 pagesACCExpanded Opportunity Part 1Hilarie JeanNo ratings yet

- CFR 1 Quiz 1Document7 pagesCFR 1 Quiz 1Ahmed SamadNo ratings yet

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizNo ratings yet

- Usc Part 2020 (Far) - RetakeDocument25 pagesUsc Part 2020 (Far) - RetakeVince AbabonNo ratings yet

- ADV ACC TBch04Document21 pagesADV ACC TBch04hassan nassereddine100% (2)

- College of Business, Entrepreneurship and AccountancyDocument8 pagesCollege of Business, Entrepreneurship and AccountancyCherry Ann RoblesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 561 600Document13 pages561 600Rhea Jane ParconNo ratings yet

- Audit ReportDocument3 pagesAudit ReportRhea Jane ParconNo ratings yet

- UnitV CabreraDocument14 pagesUnitV CabreraRhea Jane ParconNo ratings yet

- Partnership-2 0Document2 pagesPartnership-2 0Rhea Jane ParconNo ratings yet

- Share Option SARDocument48 pagesShare Option SARRhea Jane ParconNo ratings yet

- Module 3. Direct Finance Lease Lessor AccountingDocument4 pagesModule 3. Direct Finance Lease Lessor AccountingRhea Jane ParconNo ratings yet

- Depreciation-Functions - BlankDocument3 pagesDepreciation-Functions - BlankRhea Jane ParconNo ratings yet

- Working CapitalAnswerkeyDocument52 pagesWorking CapitalAnswerkeyRhea Jane ParconNo ratings yet

- Quiper Quiz Relevant CostingDocument15 pagesQuiper Quiz Relevant CostingRhea Jane ParconNo ratings yet

- PFRS For SMEs and SEs Transition ProvisionsDocument18 pagesPFRS For SMEs and SEs Transition ProvisionsRhea Jane ParconNo ratings yet

- Partnership Notes-6Document3 pagesPartnership Notes-6Rhea Jane ParconNo ratings yet

- Partnership Notes 4Document4 pagesPartnership Notes 4Rhea Jane ParconNo ratings yet

- Prob 21 21Document4 pagesProb 21 21Rhea Jane ParconNo ratings yet

- Partnership Notes 5Document4 pagesPartnership Notes 5Rhea Jane ParconNo ratings yet

- Partnership-1 0Document5 pagesPartnership-1 0Rhea Jane ParconNo ratings yet

- Feasibility Study - 0Document4 pagesFeasibility Study - 0Rhea Jane ParconNo ratings yet

- KLBF Fy2022Document178 pagesKLBF Fy2022Ayu WandiraNo ratings yet

- CHAPTER5Document8 pagesCHAPTER5Anjelika ViescaNo ratings yet

- ACT 1301 L S CommonDocument97 pagesACT 1301 L S CommonSadia AkterNo ratings yet

- Resume Prabesh Chandra AdhikariDocument2 pagesResume Prabesh Chandra AdhikariSrirama SrinivasanNo ratings yet

- Single Entry SystemDocument6 pagesSingle Entry SystemShruti JoseNo ratings yet

- Financial & Managerial Accounting Mbas: Oanhnguyenth231Document64 pagesFinancial & Managerial Accounting Mbas: Oanhnguyenth231Hồng LongNo ratings yet

- Comparative Statement Analysis of Vijaya DairyDocument51 pagesComparative Statement Analysis of Vijaya DairyRajkamalChicha50% (4)

- Public Sector Accounting Developments and Conceptual FrameworkDocument24 pagesPublic Sector Accounting Developments and Conceptual FrameworkREJAY89No ratings yet

- Textbook Managerial Accounting Ray H Garrison Ebook All Chapter PDFDocument53 pagesTextbook Managerial Accounting Ray H Garrison Ebook All Chapter PDFmary.pauling946100% (11)

- Management Discussion and AnalysisDocument11 pagesManagement Discussion and AnalysishihiNo ratings yet

- Toaz - Info Auditing Theory Test Bank PRDocument8 pagesToaz - Info Auditing Theory Test Bank PRChriz VillasNo ratings yet

- Period End Processing - Summary The Following Outlines:: PayablesDocument3 pagesPeriod End Processing - Summary The Following Outlines:: Payablesbritesprite2000No ratings yet

- 03-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesDocument56 pages03-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesThanh ThùyNo ratings yet

- Admas University: Course OutlineDocument5 pagesAdmas University: Course Outlinerediet solomonNo ratings yet

- Adani Bs MergedDocument10 pagesAdani Bs MergedRishabhNo ratings yet

- 2.principles of AuditingDocument114 pages2.principles of AuditingGokul.S 20BCP0010No ratings yet

- Structure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4Document39 pagesStructure of The Balance Sheet and Statement of Cash Flows: Revsine/Collins/Johnson/Mittelstaedt/Soffer: Chapter 4amyNo ratings yet

- Unit 3 - Bookkeping-1-2Document2 pagesUnit 3 - Bookkeping-1-2JHON ALEJANDRO GALLEGO GALINDONo ratings yet

- Lecture 1 - Accounting in ActionDocument71 pagesLecture 1 - Accounting in Actionarman islamNo ratings yet

- Circular No. 20 (Holiday Homework of Class Xii)Document43 pagesCircular No. 20 (Holiday Homework of Class Xii)rishu ashiNo ratings yet

- Chapter 01 - Intercorporate Acquisitions and Investments in Other EntitiesDocument21 pagesChapter 01 - Intercorporate Acquisitions and Investments in Other Entitiesdella salsabilaNo ratings yet

- FAU Session 3 Audit Evidence, Materiality and Procedure 2Document16 pagesFAU Session 3 Audit Evidence, Materiality and Procedure 2BuntheaNo ratings yet

- 12 SSDDDDocument3 pages12 SSDDDAlvira FajriNo ratings yet

- Incf 2017-2Document90 pagesIncf 2017-2RimaNo ratings yet

- B326: Advance Accounting B326 Course Structure: Chapter 5: Intercompany Transaction - InventoryDocument20 pagesB326: Advance Accounting B326 Course Structure: Chapter 5: Intercompany Transaction - InventoryAyeshaNo ratings yet

- IAS-40 Investment PropertyDocument5 pagesIAS-40 Investment Propertymanvi jainNo ratings yet

- Audit Evidence - Unit TwoDocument28 pagesAudit Evidence - Unit TwoKananelo MOSENANo ratings yet

- Level 4 Thoery-1Document25 pagesLevel 4 Thoery-1EdomNo ratings yet

- CA Final PARAM Question Bank Vol-2 Colour (10 MB)Document262 pagesCA Final PARAM Question Bank Vol-2 Colour (10 MB)Pooja DewanNo ratings yet