Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsAuditingUnitIV 1-382 Cabrera

AuditingUnitIV 1-382 Cabrera

Uploaded by

Rhea Jane ParconCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit ReportDocument3 pagesAudit ReportRhea Jane ParconNo ratings yet

- 561 600Document13 pages561 600Rhea Jane ParconNo ratings yet

- Module 3. Direct Finance Lease Lessor AccountingDocument4 pagesModule 3. Direct Finance Lease Lessor AccountingRhea Jane ParconNo ratings yet

- UnitV CabreraDocument14 pagesUnitV CabreraRhea Jane ParconNo ratings yet

- Audit Salosagcol 2018 Answer KeyDocument8 pagesAudit Salosagcol 2018 Answer KeyRhea Jane ParconNo ratings yet

- UnitVII-CUS Cabrera EditedDocument38 pagesUnitVII-CUS Cabrera EditedRhea Jane ParconNo ratings yet

- Partnership-2 0Document2 pagesPartnership-2 0Rhea Jane ParconNo ratings yet

- Obligations of The Partners - 0Document18 pagesObligations of The Partners - 0Rhea Jane ParconNo ratings yet

- Share Option SARDocument48 pagesShare Option SARRhea Jane ParconNo ratings yet

- Depreciation-Functions - BlankDocument3 pagesDepreciation-Functions - BlankRhea Jane ParconNo ratings yet

- Quiper Quiz Relevant CostingDocument15 pagesQuiper Quiz Relevant CostingRhea Jane ParconNo ratings yet

- Tagalog - Tree BrochureDocument2 pagesTagalog - Tree BrochureRhea Jane ParconNo ratings yet

- PFRS For SMEs and SEs Transition ProvisionsDocument18 pagesPFRS For SMEs and SEs Transition ProvisionsRhea Jane ParconNo ratings yet

- Feasibility Study - 0Document4 pagesFeasibility Study - 0Rhea Jane ParconNo ratings yet

- Working CapitalAnswerkeyDocument52 pagesWorking CapitalAnswerkeyRhea Jane ParconNo ratings yet

- Partnership Notes 5Document4 pagesPartnership Notes 5Rhea Jane ParconNo ratings yet

- Partnership-1 0Document5 pagesPartnership-1 0Rhea Jane ParconNo ratings yet

- Partnership Notes-6Document3 pagesPartnership Notes-6Rhea Jane ParconNo ratings yet

- Partnership Notes 4Document4 pagesPartnership Notes 4Rhea Jane ParconNo ratings yet

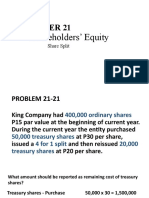

- Prob 21 21Document4 pagesProb 21 21Rhea Jane ParconNo ratings yet

AuditingUnitIV 1-382 Cabrera

AuditingUnitIV 1-382 Cabrera

Uploaded by

Rhea Jane Parcon0 ratings0% found this document useful (0 votes)

18 views100 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

18 views100 pagesAuditingUnitIV 1-382 Cabrera

AuditingUnitIV 1-382 Cabrera

Uploaded by

Rhea Jane ParconCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 100

UNIT Iv

AUDIT OBJECTIVES

y PROCEDuREs,

EVIDENCES AND pi

OCUMENTATION

Coverage

» Nature and significance

> Evidential matters

> Audit procedures/techniques

> Audit working papers

AUDIT OBJECTIVES, EVIDENCES AND DOCUMENTATION

1, The objective of the ordinary examination by the independent

auditor is the expression of an opinion on

a. the accuracy of the financial statements.

b. the balance sheet and income statement.

¢. the-fairness of the financial statements.

d. the annual report.

The auditor has considerable res;

whether or not the statements a

_ Fesponsibility imposes upon the

a._be an insurer of the fairness in the statements.

b. bea guarantor of the fairness in the statements,

¢. be equally responsible with management for the preparation

Of the financial statements.

d. provide reas6nable assurance tha‘

will be detected.

Ponsibility for notifying users as to

re properly stated. This

auditor a duty to

it material misstatements

The responsibility for adopting sound accounting policies,

Nn aintaining an adequate internal control structure,

Presentations in the financial statements rests

_ 2. withmanagement,

With the independent auditor.

“qually with management and the auditor.

with the internal audit department.

and making fair

b,

C.

4,

V-1

Unit IV.

"The auditor should not assume that management is dishonest, but

the possibility of dishonesty must be considered". This is an example

of 3

a. unprofessional behavior. ae

b. an aftittde of professional skepticism.

c. due diligence.

d. arule in the Code of Ethics for Professional Accountants,

5. If the auditor were responsible for making certain that all the

assertions of management in the statements were correct.

a. bankruptcies could no longer occur.

b. bankruptcies would be reduced to a very small number.

c. audits would be much easier to complete.

d. audits wauld not be economically feasible.

. The auditor's best defense when immaterial misstatements in the

financial statements are not uncovered in the audit is that

a. the auditwas conducted in accordance with financial

reporting standards.

. client is guilty of contributory negligence.

- the audit was conducted in accordance with standards on

auditing.

. the financial statements are client's responsibility.

|. The factor which distinguishes an error from an irregularity is

a. materiality.

b. intent.

¢. whether itis a Peso amount or a process.

d. whether it is a caused by the auditor or the client.

Which of the following statements is true?

a. It is usually easier for the auditor to uncover irregularities

than errors,

[tis usually easier for the auditor to uncover errors than

irregularities,

b.

Iv-2

Audit Objectives, Procedures, Evidences and Documentation

¢. Itis usually equally difficult for the auditor to uncover errors

or irregularities.

d, Usually, none of the above statements is true.

4 fraudulent financial reporting is often called

"4, management fraud.

b. theft of assets.

c. defalcation.

d. employee fraud.

40. In distinguishing between the detection of a material management

fraud and an equally material error, audits

a. should be expected to provide the same degree of assurance.

b. cannot be-expected to provide the same degree of assurance.

c. provide an assurance of detecting either.

d. should provide complete assurance of detection.

11, Should the auditor uncover circumstances during the audit that may

cause suspicions of management fraud, the auditor must

a. issue an adverse opinion.

b. issue a disclaimer.

©. evaterrte-their implications and consider the need to modify

audit evidence.

d. withdraw from the engagement.

2 ihn comparing the auditors responsibility for detecting employee

Maud and for detecting errors, the profession has placed the

"sponsibility

3 more on discovering errors than emp!

- More on discovering employee fraud

> €qually on discovering either one.

" onthe senior auditor for detecting errors

detecting employee fraud.

loyee fraud.

than fraud.

and on the manager

IV-3

—<

Unit IV.

43. If there is fraud involving the collusion of several employees that

includes the falsification of documents, the chance that such a fraud

would be uncovered in a normal audit is

a. zero.

b. untikély.

c, 50-50.

d. very high.

14. Auditing standards regarding the detection of illegal acts clearly state

that the auditor provides

a. no.assuranee+that they will be detected.

b. the same reasonable assurance provided for other items.

¢. assurance that they will be detected, if material.”

d. assurance they will be detected, if highly material.

15. When planning the audit, if the auditor has no reason to believe that

illegal acts exist, the auditor should

a. make inquiries of management regarding their policies and

regarding their knowledge of violations, and then rely on

normal audit procedures to detect errors, irregularities, and

illegalities. ,

b. still include some audit procedures designed specifically to

uncover illegalities.

Cc. ignore the topic.

d. include audit procedures which have a strong probability of

detecting illegal acts,

16. When the auditor believes an illegal act may have occurred, its

necessary to

inquire of management, at a level above those likely t9 *

involved with the illegality.

consult with the client's legal counsel.

Su : nell

consider accumulating additional evidence to determine!

there is actually an illegal act.

4. do all three of the above,

b.

c.

IV-4

Audit Objectives, Procedures, Evidences and Documentation

yy.when the auditor knows that an illegal act has occurred, the auditor

must

issue an adverse opinion.

b. withdraw-from the engagement.

c. consider the effects on the financial statements, including the

adequacy of disclosure.

d. report it to the proper governmental authorities.

48, The cycle approach to segmenting an audit requires that

a. the client's natural business cycle or year be the primary

consideration in planning the audit.

b. closelrelated transactions and account balances be kept in

the same segment.

c. every account balance on the financial statements must be

treated as a separate segment.

d. two different audit teams will cycle between assignments to

ensure that the firm has an unbiased view of the client's

records.

‘18.In describing the Cycle Approach to segmenting an audit, which of

the following statements is not true?

a. All general ledger accounts an

once.

b. Some journals and general led

More than one cycle.

d journals are included at least

ger accounts are included in

repayment” cycle is closely

_ © The "capital acquisition and

f goods and services and

__ felated to the "acquisition ©

Payment" cycle.

pve "inventory and warehousin|

ime during the engagement sin

Je may be audited at any

ted to the other

1g" cycl

ce it is unrela

Unit IV

20. The most important general ledger account included in and

affecting several cycles is the

a.

b.

c

d.

generakcash account.

inventory account.

income tax expense and liability accounts.

retained earnings account.

21. When using the cycle approach to segmenting the audit, the reason

for treating capital acquisition and repayment separately from the

acquisition of goods and services is that

a.

9

d.

the transactions are related to financing a company rather

than to its operations.

.. Most capital acquisition and repayment cycle accounts involve

few transactions, but each is often highly material and

therefore should be audited extensively.

both“a*nd "b" above.

neither "a" nor "b" above.

22. Transaction cycles begin and end

b,

c

d.

at the beginning and end of the fiscal period.

. at the balance sheet date.

at January 1 and December 31.

. at the origin and final disposition of the company.

23. For the most part, auditors treat each transaction cycle

a.

b.

c.

d

separately as the audit is being performed.

as an interrelated unit with the other cycles throughout the

entire audit.

as a separate business unit with different audit teams.

as a joint venture with other clients in the same industy:

24. Management assertions are

a.

b.

stated in the footnotes to the financial statements.

implied-or-expressed representations about the ac

the financial statements.

IV-6

Audit Objectives, Procedures,

explicitly expressed representations about the financial

statements.

d. provided to the auditor in the Assertions Letter, but are not

disclosed on the financial statements.

c

ement assertions are

a. directly related to standards on auditing.

b. directly Teteted to financial reporting standards.

cs

d.

95. ManaB'

indirectly related to standards on auditing.

indirectly related to financial reporting standards.

26. Which of the following statements is not correct?

a, It woatehbe a violation of the completeness assertion if

management would record a sale that did not take place.

b. The completeness assertion deals with matters opposite from

those of the existence/occurrence assertion.

c. The completeness assertion is concerned with the possibility

of omitting items from the financial stateménts that should

have been included.

d. The existence/occurrence assertion is concerned with

inclusion of amount that should not have been.

4. Which of the following statements is not true?

a. An example of a completeness assertion would be that notes

Payable in the balance sheet includes all such obligations of

the entity.

b. An example of an existence/occurrence asse!

that sales in the income statement represent exchanges of

800dS or services that actually took place.

© An example of a rights/obligations assertion woul

amounts capitalized for leases in the balance she

the cost of the entity's rights to leased property.

* An exai f a valuation/allocation assertion would be that

: Property, plant, and equipment is recorded at current market

tion would be

Id be that

et represent

IV-7

Evidences and Documentation

BRE S=

Unit IV.

i is true?

i following statements is

he ciel objectives follow and are closely related to

a. ;

management assertions.

b. Management's assertions follow and are closely related to the

auditor's objectives. Rite

c. The auditor's primary responsibility is to find and disclose

fraudulent management assertions.

d. Assertions about presentation and disclosure deal with

whether the accounts have been included in the financial.

statements at appropriate amounts.

29. Which of the following statements is true?

a. The evidence which the auditor accumulates remains the

same from audit to audit, but the general audit objectives

vary, depending on the circumstances.

b. Sens audit objectives remain the same from audit to

audit, butthe evidence varies, depending on the

circumstances.

The circumstances may vary from audit to audit, but the

evidence accumulated remains the same.

. The general audit objectives may vary from audit to audit, but

the circumstance remain the same.

30. A distinction must be made between general audit objectives and

specific audit objectives for each account balance.

a. The-gereral audit objectives are applicable to every account

balance on the financial statements. at

b. The specific audit objectives are applicable to every accou

balance on the financial statements. J to

The general audit objectives are stated in terms tailor®

the engagement,

; ilored

The specific audit objectives are stated in terms tailor

the agreement,

34. The general audit objectives of validity and completeness emphasize

opposite audit concerns.

validity-eeals with potential overstatement and completeness

deals with understatement.

b. validity deals with potential understatement and

completeness deals with overstatement.

c. validity and completeness may each deal with overstatements

or understatements, but not in the same transaction.

D. validity always deals with overstatements but completeness

may deal with either over or understatements.

32. Which of the following is not a proper match of auditor's objective

with management's assertion?

a. validity matches with existence/occurrence.

b. completeness matches with completeness.

c. ownership matches with rights and obligations.

d. classification matches with presentation.

33. In testing for cutoff, the objective is to determine

a. whether all of the current period's transactions are recorded.

b. that no transactions from the prior period are included in the

current period’s balances. ;

c. that no transactions of the current period have been delayed

and recorded ina future period.

d whethertransactions are recorded in the proper period.

accuracy objective is no}

ce

Jated subsidiary ledger amounts.

ly disclosed, in accordance with PFRS.

i i balance.

+ to the total in the account

eer ith the total in the general ledger.

e mechanical t concerned that the details

in the account balan

agree with re!

r pjective is concerned that

count balance is properly presented on the financial

WV-9

b.

&

d.

disclosure-requirements are properly presented on the

financial statements and in the footnotes.

both "a" and "b" above.

none of the above.

36. After the general objectives are understood, specific objectives

for each account balance on the financial statements can be

developed.

a.

Threresirould be at least one specific objective for each

relevant general objective.

. There will be only one specific objective for each relevant

general objective. ay

There will be many specific objectives developed for each

relevant general objective.

. There must be one specific objective for each general

objective.

37. Which of the following is not one of the four phases in the audit

process?

a.

b.

c.

d.

Plan and design an audit approach. :

Test controls and transactions.

‘form client of any adjustments or corrections to be madeto

the financial statements.

Complete the audit and issue the report.

38. Which of the following statements is not correct?

b.

¢. The cost of

d.

There are many ways an auditor can accumulate evidence to

meet the overall audit objectives. t

Sufficient competent evidence must be accumulated t mes

the auditor's professional responsibility. F

accumulating the evidence should be min!

Gathering evidence and minimizing costs are equally dito"

important considerations that affect the approach the 2

selects,

mized:

Audit Objectives, Procedur.

vidences and Documentation

9, To adequately plan the appropriate audit evidence to gather, the

philippine Standards on Auditing require the auditor to gain an

understanding of

a. the internal control structure,

b, client's organization charts.

c, Client's procedural manuals.

d. all of the above.

"40. Where the auditor has assessed control risk of a particular area at a

reduced level, he or she will then

a. eliminate the need to gather evidence in that area.

b. test the’ effectiveness of the controls in that area.

¢. proceed to expand the sample sizes in that area.

d. negotiate with management to determine which controls will

be tested in that area.

commonly referred to as

a. teStsGf transactions.

b. tests of documentation.

¢. tests of balances.

d. tests of analytical procedures.

#2, Analytical procedures are those that

a. evaluate the accuracy of the accoun

b, assese-the overall reasonableness of transa

balances,

©. review the effectiveness of interna

4. analyze the effect of management

accounting system.

it balances.

ctions and

| control procedures.

procedures on the

ific procedures intended to

| control system:

oF detail and balances are spec!

ial balances are classified

tify the details on the interna

ve that the accounts with mater

IV-11

Unit IV

c. test formofietary errors in the financial statements.

d. prove that the trial balance is in balance.

4A. \f the auditor has obtained a reasonable level of assurance about the

fair presentation of the financial statements through understanding

the internal control structure, assessing control risk, testing controls,

and analytical procedures, then the auditor

a. can issue an unqualified opinion.

b. needs to do additional tests of controls so that the assurance —

level can be increased.

c. can write the engagement letter.

d. cansignificantly reduce the test of details.

45. After the auditor has completed all the procedures, it is necessary to”

combine the information obtained to reach an overall conclusion as

to whether the financial statements are fairly presented. This isa

highly subjective process that relies heavily on

a. standards on auditing.

b. the Code of Ethics for Professional Accountants.

c. financial reporting standards.

d. the aweliter's professional judgment.

46. Which of the following factors is most important concerning an

auditor's responsibility to detect errors and irregularities?

a. The susceptibility of the accounting records to intentional

manipulations, alterations, and the misapplication of

accounting principles.

b. The probability that unreasonable accounting estimates 'é

from unintentional bias or intentional attempts to misstate-

the financial statements.

c. The possibility that management fraud, defalcations, and ul

misappropriation of assets may indicate the existence of

illegal acts.

d. The risk that-mistakes, falsifications, and omissions may ©

the financial statements to contain material misstatemen™

IV-12

Audit Objectives, Procedures, Evidences and Documentation

Qn. When is the auditor responsible for detecting fraud?

a, When the fraud did not result from collusion.

Bb: When third parties are likely to rely on the client's financial

4 statements.

c. When the client's system of internal control is judged by the

auditor to be inadequate.

d. When theanplication of standards on auditing would have

uncovered the fraud.

48. An auditor should recognize that the application of auditing

procedures may produce evidential matter indicating the possibility

of errors or irregularities and therefore should

a. design audit tests to detect unrecorded transactions.

b. extend the work to audit most recorded transactions and

records of an entity.

plan and-perform the engagement with an attitude of

professional skepticism.

d. not depend on internal accounting control features that are

designed to prevent or detect errors or irregularities.

c

When a CPA has concluded that action should be taken to prevent

future reliance on his report, he should

a. advisehis client to make appropriate disclosure of the newly

discovered facts and their impact on the financial statements

are known to be currently relying or who are

and the related

to persons who

likely rely on the financial statements

auditor's report.

“recall the financial statements and is

nd include an appropriate opinion.

lvise the client and others do not rely on the financial

tements and make appropriate disclosure of the correction

statements of a subsequent period.

ecall the financial statements and issue a disclaimer of

n which should generally be followed by revised

ments and a qualified opinion.

1V-13

sue revised statements

Unit IV

50. Which of the following statements best describes the auditor's

responsibility with respect to illegal acts that do not havea Materia

effect on the client's financial statements? é

a. Generally, the auditor is under no obligation t > notify Parties

other than personnel within the client's orgar ization,

b. Generally, the auditor is under an obligation 1 > see that

stockholders are notified. c ;

c. Generally, the auditor is obligated to disclose the relevant

facts in the auditor's report.

d. Generally, the auditor is expected to compe the client to

adhere to requirements of the Foreign Corr pt Practices Act.

51. When an independent auditor's examination of fir incial statements

discloses special circumstances that make the aud :or suspect that

fraud may exist, the auditor's initial course of acti: n should be to

a. recommend that the client pursue the sus vected fraud to

conclusion that is agreeable to the audito’ ,

. extend normal audit procedures in an att+ mpt to detect the

full extent of the suspected fraud,

reach an understanding with the proper client representative

as to whether the auditor or the client is to make the

investigation necessary to determine if a fraud has in fact

occurred.

—t_decide whether the fraud, if in fact it should exist, might be

such a magnitude as to affect the auditor's reportonthe

financial statements.

52. Which of the following statements best describes the auditor's

responsibility regarding the detection of fraud? ‘

a. The auditor is responsible for the failure to detect fraud only.

when such failure clearly results from nonperformance of 1

| audit procedures specifically described in the engagement

letter,

b. The auditor must extend auditing procedures to actively

! Search for evidence of fraud in all situations.

IV-14

wee er £ FOC ‘es, Evidences and Documentation

c The 3 ee as extend auditing procedures to actively

F evidence of fraud where the examination indi

ee ee a om xamination indicates

d. The auditor is responsible for the failure to detect fraud only

when an unqualified Opinion is issued.

53. When engaged to prepare unaudited financial statements the CPA's

responsibility to detect fraud

a.~is limited to informing the client of any matters that come to

the auditor's attention which cause the auditor to believe that

an irregularity exists.

b. is the same as the responsibility that exists when the CPA is

engaged to perform an audit of financial statements in

accordance with standards on auditing.

¢. arises out of the CPA's obligation to apply procedures which

are designed to bring to light indications that a fraud or

defalcation may have occurred.

d. does not exist unless an engagement letter is prepared.

54. When the auditor's regular examination leading to an opinion on

financial statements discloses specific circumstances that make him

suspect that fraud may exist and he concludes that the results of

such fraud, if any, could not be so material as to affect his opinion, he

should

a. make a note in his working papers of the possibility of a fraud

of immaterial amount so as to pursue the matter next year.

. reach an understanding with the client as to whether the

auditor or the client, subject to the auditor's review, is to

make the investigation necessary to determine whether fraud

has occurred and, if so, the amount thereof.

refor-the matter to the appropriate representatives of the

client with the recommendations that is to be pursued to a

conclusion. 3 fees

immediately extend his audit procedures to determine if

fraud has occurred and, if so, the amount thereof.

Iv-15

Unit IV.

55, If an auditor is engaged to discover errors ori ees ee and the

; auditor performed extensive detail work, which of the following

could the auditor be expected to detect?

ispostings of recorded transactions.

b. Unrecorded transactions.

c. Counterfeit signatures on paid checks.

d. Collusive fraud.

56. The essence of the attest function is to

a. detect fraud. *

b. examine individual transactions so that the auditor may

certify as to their validity.

detezmine whether the client's financial statements are fairly

stated.

|. assure the consistent application of correct accounting

procedures.

57. The accuracy of information included in footnotes that accompany

the audited financial statements of a company whose shares are

traded on a stock exchange is the primary responsibility of

a. the stock exchange officials,

b. the independent auditor.

¢. the company's management.

d. the Securities and Exchange Commission.

58. Ohce satisfied that the balance sheet and income statement are

fairly presented 'n accordance with generally accepted accounting

Principles, an auditor who is examining the statement of cash flows

would be

pe Most concerned with details of transactions in

a. inventory,

b. notes.taceivables,

ics salaries expense,

d.

income tax expense.

IV-16

Audit Objectives, Procedures, Evidences and. | Documentation

<9, The primary difference between an audit of the balance sheet and

an audit of the income statement lies in the fact that the audit of

the income statement deals with the verification of

a. trarrsactions.

b. authorizations.

c. costs.

d. cutoffs.

‘60. The Philippine Standards on Auditing require the auditor's report to

either contain an expression of opinion regarding the financial

statements, taken as a whole, or an assertion to the effect that an

opinion cannot be expressed. The objective of the standard is to

"prevent

a. the CPA from reporting on one basic financial statement and

not the others.

b. the CPA from expressing different opinions on each of the

basic financial statements.

C. misinterpretations regarding the degree of responsibility the

auditor is assuming.

d. management from reducing its final responsibility for the

basic financial statements.

Which of the following forms of evidence would be least persuasive

Mforming the auditor's opinion?

_ 3. The auditor's count of marketable securities.

>. Correspondence with a stock broker regarding the quantity of

client's investments held in street name by the broker.

Minutes of the board of directors authorizing the purchase of

a Stock as an investment. :

' Responses to auditor's questions by the President and

Controller regarding the investments account.

IV-17

-

determining the quantity and quality of evidence to gather

e aici he satis dd whah these he

a. irrefutable.

b. conclusive.

(£. highly persuasive.

d. completely convincing.

63. "The detailed instructions for the collection of a particular type of

audit evidence that is to be obtained at some time during the aujy

is the definition of a(n)

a. sampling plan.

+. audit procedure.

c audit plan.

d. audit program.

64. Which of the following statements is not correct?

@. Its possible to vary the sample size from one unit to 100%

the items in the population.

J. Thedecision of how many items to test will not be

by the increased costs of performing the additional tests.

© The decision of how many items to test must be made by

auditor for each audit procedure.

|. The sample size for any given procedure is likely to vary

audit to audit.

Procedure, which of the following methods can be used by the

auditor to select the 200 items?

a. Select one week and examine the first 200 items.

b. Select the 200 items with the largest peso amounts

c Select the 200 items randomly,

de Any combination of the above three methods.

66. Audit procedures are normally

Performed

a. early in the accounting period being examined.

b. throughout the accounting period being examine’ ™

‘emphasis on the transactions near the end-

ee Wg

‘ ae 2 otf

Audit Objectives, Procedures, Evidences and Documentation

c. within one to three months after the close of the accounting

period.

a durmg all three of the above periods,

“gp. 'The detailed description of the results of the four evidence decisions

for a specific audit" is called an

a, audit procedure. e ad@itprogram.

b. audit plan. d. audit guide.

68, The audit program usually states all four of the choices below, but it

always includes the

A, audit procedures.

b. sample sizes.

c. particular items to select.

d. timing of the tests.

69, Which of the following is not one of the four determinants of the

persuasiveness of evidence?

a. competence. c. relevance.

br physicalexamination. d. _ sufficiency.

|. Which one of the following statements is true?

__ 4. Evidence must pertain to the objective the auditor is testing

before it can be persuasive.

b. Relevance can only be considered in terms of specific audit

objectives.

¢. Evidence may be relevant to one objective but not for a

different objective.

__ 4: Aitthree of the above statements are true.

term which is synonymous with competence is

@. relevance,

. réttability of evidence.

© sufficient.

4 all three of the above.

Iv-19

» hill

-

a

statements about the competence of

of the following

72. Which

evidence is not correct?

a. competence deals only with t i

ib “Gompetence can be ny with ie ecng Ee

Z ger sample

Size.

Cc. Competence can be improved by selecting audit procedures

that contain 4 higher quality of the characteristics sought.

g. Competence ‘cannot be improve’ py selecting different

population items to include in the sample size:

he characteristics of

PP eS ee

Audit Objectives, Procedures, Evidences and Documentation

c. Computat

d. Inquiry.

itor calculates the gross margin as a percent of sales and

46. ifthe auditor c F

it with previous periods, the evidence gathered would be

* compares I

classified as

a. physical examination.

b. computation.

c. observation.

Be inquiry.

nen the auditor is gathering evidence, he/she will conclude that if

77.Wi

tion is independent, the evidence will

the source of informa

a, be reliable.

b. not be reliable.

¢. be reliable if the provider has no reason to be biased.

ye notshe.reliable unless the provider is qualified to do so.

“78. Evidence obtained directly by the auditor will not be reliable if

a. itis provided by client's attorney.

- the.auditor lacks the qualifications to evaluate

¢. itis impossible for the auditor to obtain additional

corroboratory evidence.

d. client denies its veracity-

the evidence.

able than evidence that requires

mine whether it is correct. Which of

»f objective evidence?

| Objective evidence is more reli

considerable judgment to deter

the following is not an example o'

& Confirmation of accounts receivable.

b. Confirmation of bank balances.

E?; Confirmation by client's attorney

outstanding lawsuits against client.

4. Adding alist of accounts payable to determine if it the same

. ps the balance in the general ledger.

f the likely outcome of

Iv-21

& ail

Saas

3

==

™D

Unit IV

80. For a given audit procedure, the evidence obtained from a sample of

200 would ordinarily be

aC ‘more sufficient than from a sample of one hundred.

b. less sufficient than from a sample of one hundred.

c. more competent than from a sample of one hundred,

d. less competent than from a sample of one hundred.

81. Evidence is usually more persuasive for balance sheet accounts when

itis obtained

a. from various times throughout the client's year.

b. only from transactions occurring on the balance sheet date,

i asclase to the balance sheet date as possible.

d. from the time period when transactions in that account were

most numerous during the fiscal period.

82. For income statement accounts, evidence is more persuasive if there

isa sample from

3c the entire period under audit.

b. the period closest to the end of the fiscal period.

c. at least three months of the fiscal year.

d. December, since this would include large holiday sales.

83. Which of the following statements is not true? 3

a. Alarge sample of highly competent evidence is not persuas!

unless it is relevant to the objective being tested.

b. Alarge sample of evidence that is neither competent 1

timely is not persuasive.

c. Asmall sample of only one or two pieces of releval

competent, and timely evidence lacks persuasiveness

d,Ahe perseasiveness of evidence can be evaluated after

considering its competence and its sufficiency:

nt,

Iv-22

> able

Audit Objectives, Procedures, Evidences and Documentation

Inmaking decisions about evidence for a given audit, the auditor's

| is to obtain a sufficient amount of timely, reliable evidence that

js relevant to the information being verified, and to do so

a. no matter what the cost involved in obtaining such evidence.

b. only if the cost is reasonable.

at the lowest possible total cost.

d. at any cost because the costs are billed to the client.

Physical examination is the inspection or count by the auditor of

assets such as

a. cash or inventory only.

b. cash, inventory, canceled checks, and sales documents.

& cash, inventory, securities, notes receivable, and tangible fixed

assets.

d. cash, inventory canceled checks, and tangible fixed assets.

Physical examination of assets is not a sufficient form of evidence

_ when the auditor wants to determine the

a. existence of the asset.

b. quantity and description of the asset.

¢. condition or quality of the asset.

o: ownershiproftte asset.

7. Traditionally, confirmations are used to verify

a. individual transactions between organizations, such as sales

transactions.

__ }. fixed asset additions.

_ £, banlebelances and accounts receivables.

_ 4. all three of the above.

le PSAs requires that, whenever practical and reasonable, the CPA

ust confirm a sample of

. accountsreceivable.

- accounts payable.

- both accounts receivable and payable.

» Client's bank accounts.

IV-23

, plea

=-=S=sCc

~o SS Ss

Unit IV

89. When comparing the reliability of external versus internal

documents, the external documents are generally considered

morereteble.

less reliable.

equally reliable.

unreliable.

aoow

90. When the auditor examines the client's documents and records to

substantiate the information‘on the financial statements, itis

commonly referred to as

a. inquiry.

b. confirmation.

is vouthing.

d. physical examination.

“Me:

7

91. Documentation is a form of evidence

(A. usetthier every financial statement audit.

b. used in most financial statement audits.

used on the rare occasions when it is both readily available

and less costly than other procedures.

d. used when nothing is available that is more competent.

92. A document which the auditor receives from the client, but which

was prepared by someone outside the client's organization, is a(n)

a. confirmation.

b. internal document.

-e- extermral document.

d. inquiry.

Ge

" idence

93. Which one of the following statements is not true? "The evidence

gathering technique of observation

a. is useful in most parts of the audit”.

b. is rarely sufficient by itself".

is limited to what the auditor sees."

d. requires the gathering of corroborative evidence

IV-24

Audit Objectives, Procedures, Evidences and Documentation

, Which of the following statements is not true? "The evidence

gathering technique of inquiry

a. cannot be regarded as conclusive."

b. requires the gathering of corroborative evidence."

.c._ is the-ewdifor's principle method of evaluating the client's

internal control structure."

d. does not provide evidence from an independent source.”

5, Which of the following, when performed by the auditor, is not a test

of mechanical accuracy?

a. Extending sales invoices.

b. Adding journals and ledgers.

c. Tracing amounts from journals to ledgers.

‘d. Calculating treturrent ratio. ~

ae Analytiea-procedures use comparisons = relationships to

determine which account balances are in error.

b. For certain immaterial accounts, analytical procedures may be

the only evidence needed.

c. Insome instances, other types of evidence may be reduced

when analytical procedures indicate that an account balance

_ appears reasonable.

d. Analytical procedures are used to isolate accounts or

transactions that should be investigated more extensively.

|. Analytical procedures are one form of test of balances (substantive

_ test), and their performance should begin

b. after the tests of controls (compliance testing) have been

completed.

after the internal control system is reviewed but before it is

tested and evaluated.

_ after all compliance testing and other substantive testing has

been concluded.

1-25

2 esha

>a

~~ SSS

Unit IV

98. Which one of the following types of evidence does Not aid in

achieving the audit objective of determining ownership?

3 Arfatytical procedures. c. Documentation,

b. Confirmation. d. Inquiries of client,

99. Which one of the following types of evidence will aid in achieving the

audit objective of determining mechanical accuracy?

a. Confirmation.

b-Reeomputation.

c. Physical examination.

d. Inquiries of client.

100. Which of the following statements is not correct?

a. The effectiveness of client's internal control structure hasa

significant effect on the reliability of most types of evidence.

+b. Sineethe auditor performs the analytical procedures, they will

be competent evidence even if the internal control structure q

provides inaccurate data.

¢. Both physical examination and mechanical accuracy are likely

to be highly reliable if the internal control structure is

effective.

d. A specific type of evidence is rarely sufficient by itself to

provide competent evidence to satisfy any audit objective.

101. Which of the following would not be included in the auditor's

working papers?

a. A time budget for the various audit areas.

b. The results of the preceding year's audit. ue

¢. Descriptive information about the internal control stru

4 The™actounting manual.

102. The working papers are

a. the Property of client. i

fientsscae

b. property of the auditor although prepared by yequat® audit

Sc the-primary means for documenting that an i auditing:

was conducted in accordance with standards

IV-26

Audit Objectives, Procedures, Evidences and Documentation

d. use primarily as a basis for the partners to review and reward

the work of the managers, seniors, and staff.

403. Which of the following items would not normally be included, in

whole or in part, in the auditor's permanent file on a client?

. The Articles of Incorporation and By-laws.

. Analyses of accounts such as long-term debt and stockholders

equity.

. Organization charts and internal control questionnaires.

|. The auditpregram.

104. An example of a reclassification entry would be an entry

a. to reduce inventory when client failed to write-down its

obsolete raw materials.

+, to change material credit balances in accounts receivable

accounts to accounts payable accounts.

¢. to increase the Allowance for Doubtful Accounts when it was

discovered that a customer had filed far bankruptcy.

d. toincrease the Income Tax Liability account when it was

discovered that client would be in a higher tax bracket than

originally estimated.

105. Each of the following might, by itself, form a valid basis for an

auditor to decide to omit a test except for the

4. diffreaity and expense involved in testing a particular item.

degree of reliance on the relevant internal controls.

relative risk involved.

; relationship between the cost of obtaining evidence and its

. usefulness,

b.

Boe

Bid.

» When Using the work of a specialist, an auditor may refer to and

©mify the specialist in the auditor's report if the

_. auditor wishes to indicate a division of responsibility.

~ *P8cialist's work provides the auditor greater assurance of

_teliability.

W-27

4 ahha

=—-Ssc

~~ NSS

Unit IV

7 auditor expresses an adverse opinion as a result of the

specialist's findings.

d. specialist is not independent of the client.

107. Negative confirmation of accounts receivable is less effective than

positive confirmation of accounts receivable because

a. a majority of recipients usually lack the willingness to respond

objectively.

b. some recipients may report incorrect balances that require

extensive follow-up.

& theaaditor can not infer that all non-respondents have

verified their account information.

d. negative confirmations do not produce evidential matter that

is statistically quantifiable.

108. The independent auditor selects several transactions in each

functional area and traces them through the entire system, paying

special attention to evidence about whether or not the control

features are in operation. This is an example of a(n)

a. application test.

pb: testsefa control.

c. substantive test.

d. test of a function.

h different degrees

109. Audit evidence can come in different forms wit!

least persuasive

of persuasiveness. Which of the following is the |

of evidence?

a. Bank statement obtained from the client.

b. Computations made by the auditor.

i Prerrambered client sales invoices.

d. Vendor's invoice.

P of

110. Which of the following statements relating to the competence®

evidential matter is always true?

a. Evidential matter gathered by an au

enterprise is reliable.

\ditor from outside a

IV-28

P osfafia

entation

Audit Objectives, Procedures, Evidences and Docums

_p. Accounting data developed under satisfactory conditions of

internal control are more relevant than data developed under

unsatisfactory internal control conditions.

c. Oral representations made by management are not valid

evidence.

Evidence gathered by auditors must be both valid and

relevant to be considered competent.

An entity's financial statements were misstated over a period of

years due to large amounts of revenue being recorded in journal

that involved debits and credits to an illogical combination of

accounts. The auditor could most likely have been alerted to this

‘irregularity by

"a, scanning-the general journal for unusual entries.

'b. performing a revenue cut-off test at year end.

c. tracing a sample of journal entries to the general ledger.

d. examining documentary evidence of sales returns and

allowances recorded after year end.

>=

a

). In the context of an audit of financial statements, substantive tests

dit procedures that

a. may be eliminated under certain conditions.

b. are designed to discover significant subsequent events.

¢. may-beeither tests of transactions, direct tests of financial

balances, or analytical tests.

|. will increase proportionately wit

~~

h the auditor's reliance on

s papers ordinarily would not include

itials of the in-charge auditor indicating review of the staff

eceived directly from the banks.

‘bark statements I

scril rnal control structure.

jing the inte!

.t inventory count sheets.

Unit IV.

114. The current file of the auditor's working papers generally should

include

a. a flowchart of the internal controls.

b. organization charts.

c. acopyofthe financial statements.

d. copies of bond and note indentures.

115. An audit working paper that reflects the major components of an

amount reported in the financial statements is referred to as a(an)

a. lead schedule.

b. supporting schedule.

c. audit control account.

d. wofkigtrial balance.

116. Which of the following eliminates voluminous details from the

auditor's working trial balance by classifying and summarizing similar

or related items?

a. Account analyses.

b. Supporting schedules.

c. Control accounts.

d. Leadesthedules.

117. The following statements were made in a discussion of audit

evidence between two CPAs. Which statement is not valid

concerning evidential matter?

a. "lam seldom convinced beyond all doubt with respect toal

aspects of the statements being examined.

b. +4+would not undertake that procedure because at bes

results would only be persuasive and I'm looking for

convincing evidence."

c. "levaluate the degree of risk involved in deciding t!

evidence | will gather."

d. "Il evaluate the usefulness of the evidence | can 0!

the cost to obtain it."

st the

he kind

tain 8:

IV-30

nae a Os i Ae

Audit Objectives, Procedures, Evidences and Documentation

18. An auditor would be least likely to use confirmations in connection

with the examination of

a. inventories.

b. long-term debt.

property, plant, and equipment.

d, stockholders' equity.

419. The Philippine Standards on Auditing state that sufficient

competent evidential matter may, in part, be obtained through

inspection, observation, inquiries, and confirmations to afford a

reasonable basis of an opinion regarding the financial statements

under examination. The evidential matter required by this standard

may, in part, be obtained through

a. auditor working papers.

b. proper planning of the audit engagement.

¢. analytical review procedures.

d. review of the system of internal control.

120. With respect to records in a CPA's possession, rules of conduct

Provide that

4. copies of client records incorporated into audit working

Papers must be returned to the client upon request.

b, worksheet’ in lieu of a general ledger belong to the auditor

and need not be furnished to the client upon request.

© an extensive analysis of inventory prepared by the client at

the auditor's request are working papers that belong to the

auditor and need not be furnished to the client upon request.

d. the auditor who returns copies of client records must return

the original records upon request.

Procedures specifically outlined in an audit program are

“rll designed to

Prevent litigations.

‘Setect errors or irregularities,

Stinternal systems,

eather evidence,

IV-31

Unit IV

122. Evidential matter is generally considered sufficient when

a. itis competent.

b. thereis enough of it to afford ar

opinion on financial statements.

¢. it has the qualities of being relevant, objective, and free from

known bias.

d. it has been obtained by ran

easonable basis for an

dom selection.

123. Evidential matter is generally considered competent when

a. it Hasttre qualities of being relevant, objective, and free from

known bias.

b. there is enough of it to afford a reasonal

opinion on financial statements.

it has been obtained by random sel

d. it consists of written statements mai

enterprise under audit.

ble basis for an

jection.

de by managers of the

9

124. The sufficiency and competency of evidential matter ultimately is

based on the

a. availability of corroborating data.

b. standards-en auditing.

c. pertinence of the evidence.

d, judgment of the auditor.

125. Evidential matter supporting the financial statements consists 0!

underlying accounting data and all corroborating information

available to the auditor. Which of the following is an example of

corroborating information?

a. Minutesof meetings.

b. General and subsidiary ledgers.

c. Accounting manuals.

d. Worksheets supporting cost allocations.

|

|

IV-32

borating evide;

except

Nuals,

b. written client representations,

¢. vendor invoices,

d.

minutes of board Meetings.

includes all of the following a

a. clientaccounting mai

"127. The strongest criticism of the reliabili it evi

itor physically observes is that ee ea evidence that the

a. the client may conceal i

. the auditormay not be qualified to evaluate the items which

he or she is observing,

» such evidence is too cost

|, the observation must occ

difficult to arrange.

items from the auditor,

ly in relation to its reliability.

ur at a specific time, which is often

During the course of an audit en

_ accumulates audit workin,

” Working papers is to

4 . aid the auditor in adequately planning the work.

. Provide a point of reference for future audit engagements.

» Support the underlying concepts included in the preparation

Of the basic financial statements.

» SUBPOFt the auditor's opinion.

\gagement an auditor Prepares and

8 Papers. The primary Purpose of the audit

The permanent section of the auditor's working papers generally

Ould include

time and expense reports. nee

b. names and addresses of all audit staff personnel on

__ engagement. :

4, 7COPY of key customer confirmations.

. q “opy OF the engagement letter.

IV-33

——

™

130. Which of the following statements relating to the competence a

evidential matter is always true?

a. Evidential matter gathered by an auditor from outside an

enterprise is reliable.

, b. Accounting data developed under satisfactory Conditions of

internal control are more relevant than data developed Under

Ty unsatisfactory internal control conditions.

c. Oral representations made by management are not valid

evidence.

d. Evidence gathered by auditors must be both valid and

relevant to be considered competent.

131. To be competent, evidence must be both

a. timely and substantial.

b. reliable and documented.

c. valid-ard relevant.

d. useful and objective.

aE ee

132. Theoretically, which of the following would not have an effect on

the amount of audit evidence gathered by the auditor?

a. The type of opinion to be issued.

b. The auditor's evaluation of internal control.

c. The types of audit evidence available to the auditor.

d. Whether or not the client reports to the Securities and

Exchange Commission.

aren rk

133. In planning an audit engagement, which of the following is a factor

that affects the independent auditor's judgment as to the quantity

type, and content of working papers?

a. The estimated occurrence rate of attributes.

b. The preliminary evaluation based upon initial substantive

testing.

c. The content of the client's representation letter.

d. Th€ anticipated nature of the auditor's report.

IV-34

Audit Objectives, Procedures, Evidences and Documentation

¥ which of the following is generally included or shown in the

E auditor's working papers?

a, The procedures used by the auditor to verify the personal

financial status of members of the client's management team.

p. Analyses that are designed to be part of, or a substitute for,

the client's accounting records. :

Excerptstronrauthoritative pronouncements that support the

underlying financial reporting standards used in preparing the

financial statements.

d. The manner in which exceptions and unusual matters

disclosed by the auditor's procedures were resolved or

treated.

435, Although the validity of evidential matter is dependent on the

circumstances under which it is obtained, there are three general

presumptions which have some usefulness. The situations given

below indicate the relative reliability a CPA has placed on two types

of evidence obtained in different situations. Which of these is an

exception to one of the general presumptions?

liance on the balance in the scrap sales

a. The Se rel

account at plant A where the CPA has made limited tests of

transactions because of good internal control than at plant B

where the CPA has made extensive tests of transactions

because of poor internal control.

b. The CPA places more reliance on the CPA's computation of

interest payable on outstanding bonds than on the amount

confirmed by the trustee.

c. The CPA places more reliance on the report of an expert on an

inventory of precious gems than on the CPA's physical

observation of the gems. 3

d. The CPA places more reliance 0 4 schedule of insurance

coverage obtained from the company's insurance agent than

on one prepared by the internal audit staff.

I-35

a zs ==

Unit IV.

136. The major reason an independent auditor gathers audit CVidence ,

is

to

a. feem.an opinion on the financial statements,

b. detect fraud.

c. evaluate management.

d. evaluate internal control.

137. The Philippine Standards on Auditing require that due Professionaj

care be exercised in the performance of the examination and the

Preparation of the report. The matter of due professional care deals

with what is done by the independent auditor and how well itis

done. For example, due care in the matter of working papers

requires that working paper

a. format be neat and orderly and include both a permanent file

and a general file.

b. content be sufficient to provide support for the auditor's

report, including the auditor's representation as to

compliance with auditing standards.

ownership be determined by the legal statutes of the state

where the auditor practices.

preparation be the responsibility of assistant accountants

whose work is reviewed by senior accountants, managers, and

partners.

138. Which of the following is not a factor affecting the independent

auditor's judgment as to the quantity, type, and content of audit

working papers? © i

a. The needs in the particular circumstances for supervision 2"

| review of the work performed by any assistants. é :

b. The nature and condition of the client's records and inter

| controls. oe

c—Hre-expertise of client personnel and their expected aU

participation.

d. The type of the financial statements, schedules, or othe"

information upon which the auditor is reporting.

IV-36,

Audit Objectives, Procedures, Evidences and Documentation

whieh of the following is not a factor that affects the independent

quditor's judgment as to the quantity, type, and.content of working

papers?

goretime and the number of personnel to be assigned to the

engagement.

b. The nature of the financial statements, schedules, or other

information upon with the auditor is reporting.

c. The need for supervision of the engagement.

|. The nature of the auditor's report.

auditor's judgment as to the quantity, type, and content of working

papers desirable for a particular engagement?

a. Nature of the auditor's report.

b. Nature of the financial statements, schedules, or other

information upon which the auditor is reporting.

c. Need for supervision and review.

d,_ Number of personnel assigned to the audit.

An auditor's working papers will generally be least likely to include

aocumentation showing how the

. =cifént's schedules were prepared.

. engagement had been planned.

\ 3 client's system of internal control had been reviewed and

evaluated.

Unusual matters were resolved.

compared to the auditor of fifty years ago, today's auditor

emination of documentary support.

Erall tests of ratios and trends.

sical observation.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Audit ReportDocument3 pagesAudit ReportRhea Jane ParconNo ratings yet

- 561 600Document13 pages561 600Rhea Jane ParconNo ratings yet

- Module 3. Direct Finance Lease Lessor AccountingDocument4 pagesModule 3. Direct Finance Lease Lessor AccountingRhea Jane ParconNo ratings yet

- UnitV CabreraDocument14 pagesUnitV CabreraRhea Jane ParconNo ratings yet

- Audit Salosagcol 2018 Answer KeyDocument8 pagesAudit Salosagcol 2018 Answer KeyRhea Jane ParconNo ratings yet

- UnitVII-CUS Cabrera EditedDocument38 pagesUnitVII-CUS Cabrera EditedRhea Jane ParconNo ratings yet

- Partnership-2 0Document2 pagesPartnership-2 0Rhea Jane ParconNo ratings yet

- Obligations of The Partners - 0Document18 pagesObligations of The Partners - 0Rhea Jane ParconNo ratings yet

- Share Option SARDocument48 pagesShare Option SARRhea Jane ParconNo ratings yet

- Depreciation-Functions - BlankDocument3 pagesDepreciation-Functions - BlankRhea Jane ParconNo ratings yet

- Quiper Quiz Relevant CostingDocument15 pagesQuiper Quiz Relevant CostingRhea Jane ParconNo ratings yet

- Tagalog - Tree BrochureDocument2 pagesTagalog - Tree BrochureRhea Jane ParconNo ratings yet

- PFRS For SMEs and SEs Transition ProvisionsDocument18 pagesPFRS For SMEs and SEs Transition ProvisionsRhea Jane ParconNo ratings yet

- Feasibility Study - 0Document4 pagesFeasibility Study - 0Rhea Jane ParconNo ratings yet

- Working CapitalAnswerkeyDocument52 pagesWorking CapitalAnswerkeyRhea Jane ParconNo ratings yet

- Partnership Notes 5Document4 pagesPartnership Notes 5Rhea Jane ParconNo ratings yet

- Partnership-1 0Document5 pagesPartnership-1 0Rhea Jane ParconNo ratings yet

- Partnership Notes-6Document3 pagesPartnership Notes-6Rhea Jane ParconNo ratings yet

- Partnership Notes 4Document4 pagesPartnership Notes 4Rhea Jane ParconNo ratings yet

- Prob 21 21Document4 pagesProb 21 21Rhea Jane ParconNo ratings yet