Professional Documents

Culture Documents

Verizon Communications Inc. (VZ) / /: 67 Basic Information

Verizon Communications Inc. (VZ) / /: 67 Basic Information

Uploaded by

moneshnarineCopyright:

Available Formats

You might also like

- Long and Short of ItDocument41 pagesLong and Short of ItStephen Pirrie100% (1)

- Paycheck StubDocument1 pagePaycheck Stubsara100% (4)

- The Law Society Conditions of Sale 2015 PDFDocument39 pagesThe Law Society Conditions of Sale 2015 PDFAnonymous sId0uhkEIV50% (2)

- Group 4 Team 6: Area of Benchmarking Kpi Mcdonald'S KFCDocument1 pageGroup 4 Team 6: Area of Benchmarking Kpi Mcdonald'S KFCbala pandian0% (1)

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Microeconomics Notes (Advanced)Document98 pagesMicroeconomics Notes (Advanced)rafay010100% (1)

- Adani Wilmar Ltd. Share Price - NSE - BSEDocument5 pagesAdani Wilmar Ltd. Share Price - NSE - BSEUser UnknownNo ratings yet

- Data Overview: Wireless EquipmentDocument11 pagesData Overview: Wireless Equipmentderek_2010No ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- IDFC FIRST Bank Investor Presentation Q3 FY22 FinalDocument88 pagesIDFC FIRST Bank Investor Presentation Q3 FY22 FinalUtkarshNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- Next Era Energy 1 PagerDocument1 pageNext Era Energy 1 PagerNikos DiakogiannisNo ratings yet

- Frequency Table: Upaya - Pencegahan - NarkobaDocument5 pagesFrequency Table: Upaya - Pencegahan - NarkobaMalikul MizanNo ratings yet

- Investor Presentation FY-2021-22-February-2022Document38 pagesInvestor Presentation FY-2021-22-February-2022Shivang AsharNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100SumitNo ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Grameenphone LTD.: C-31531 (652) /96 2 Quarter 2019 Business HighlightsDocument3 pagesGrameenphone LTD.: C-31531 (652) /96 2 Quarter 2019 Business HighlightsTanzir HasanNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- Pampa Energia S.A.: Price, Consensus & SurpriseDocument1 pagePampa Energia S.A.: Price, Consensus & SurpriseoaperuchenaNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Researchreport 513374Document18 pagesResearchreport 513374manjunathmsNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- KHAICHEM StockReport 20230829 2208Document12 pagesKHAICHEM StockReport 20230829 2208rajbus lessNo ratings yet

- ICICI Prudential Opportunities FundDocument18 pagesICICI Prudential Opportunities FundArmstrong CapitalNo ratings yet

- Vijaya_Investor-Presentation-Nov-2021Document39 pagesVijaya_Investor-Presentation-Nov-2021Abhishek GavandeNo ratings yet

- ProsharesfactsheettqqqDocument2 pagesProsharesfactsheettqqqaefqobdomNo ratings yet

- Pepsico: Visual Financials (BETA)Document4 pagesPepsico: Visual Financials (BETA)gyanadasNo ratings yet

- Trendrating - Emerging Markets - AmericasDocument3 pagesTrendrating - Emerging Markets - Americasg.bloebaum89No ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50aditya_kavangalNo ratings yet

- ABSLI NiftyAlpha50 FundDocument2 pagesABSLI NiftyAlpha50 FundAbhinav SinghNo ratings yet

- Factsheet 1710581747733Document1 pageFactsheet 1710581747733mvkulkarni5No ratings yet

- Mirae Asset Global X Artificial Intelligence & Technology ETF Fund of FundDocument16 pagesMirae Asset Global X Artificial Intelligence & Technology ETF Fund of FundArmstrong CapitalNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50S SinghNo ratings yet

- Nifty100 Quality30Document2 pagesNifty100 Quality30sujay.gorain.76No ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Data Presentation and Description: by DR Asma HyderDocument33 pagesData Presentation and Description: by DR Asma HyderAsadullah QureshiNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Tmbthanachart PCL Buy: Fair Price: Bt1.98 Upside (Downside)Document5 pagesTmbthanachart PCL Buy: Fair Price: Bt1.98 Upside (Downside)ธรรม จักษ์No ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Anil Kumar RanjanNo ratings yet

- PIMCO PIMS Credit Opportunities Bond Fund INST QIRDocument12 pagesPIMCO PIMS Credit Opportunities Bond Fund INST QIRaditya.d.chakrabortyNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Page 1 of 2 Assessment of Working Capital Requirements Name: M/S S K Auto PartsDocument2 pagesPage 1 of 2 Assessment of Working Capital Requirements Name: M/S S K Auto PartsAnsari JiNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- AMZNDocument12 pagesAMZNLazo1 Lazo1No ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50badasserytechNo ratings yet

- ZacksEquityReport Z2280134059Document10 pagesZacksEquityReport Z2280134059infoNo ratings yet

- Ind Nifty Divid Opp50Document2 pagesInd Nifty Divid Opp50santosh kumarNo ratings yet

- The TJX Companies, Inc.: Data OverviewDocument9 pagesThe TJX Companies, Inc.: Data Overviewderek_2010No ratings yet

- Kload 2Document3 pagesKload 2Jay OsloNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- Q1 2023 Shareholder Letter - Final - v3Document13 pagesQ1 2023 Shareholder Letter - Final - v3bhuvaneshNo ratings yet

- Researchreport 275976Document20 pagesResearchreport 275976faekkonto.co.inNo ratings yet

- Exp. F. Date: Designation Stakeholder Names Phases Dur (M) Start Date Finish DateDocument1 pageExp. F. Date: Designation Stakeholder Names Phases Dur (M) Start Date Finish DateSameh Alihassn100% (1)

- BMRNDocument9 pagesBMRNderek_2010No ratings yet

- NVDA Pro Rating ReportDocument20 pagesNVDA Pro Rating ReportMikeNo ratings yet

- FinalDocument3 pagesFinalOsama MuradNo ratings yet

- Daily Guide To The Markets (5-13)Document19 pagesDaily Guide To The Markets (5-13)Mike KaplanNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- MB0041 Financial and Management AccountingDocument8 pagesMB0041 Financial and Management Accountingarunavo22100% (1)

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

- BTCL IPO Prospectus (Latest) 06 01 16Document252 pagesBTCL IPO Prospectus (Latest) 06 01 16Nako Yaga NkukuNo ratings yet

- Fringe Benefits - HRM ProjectDocument37 pagesFringe Benefits - HRM Projectsunny_panchal3697100% (2)

- Job Aid For Taxpayers - How To Fill Up 1702-MX Version 2013Document35 pagesJob Aid For Taxpayers - How To Fill Up 1702-MX Version 2013matthew02012010No ratings yet

- Statement - January 2024Document1 pageStatement - January 2024KARTERMANLLC100% (1)

- Research Report On Purchasing of Sport ShoesDocument57 pagesResearch Report On Purchasing of Sport Shoesdheerajkumariimt73600% (1)

- Investment Decision Rule For ItDocument2 pagesInvestment Decision Rule For ItIzzahIkramIllahiNo ratings yet

- Finance Module 03 - Week 3Document16 pagesFinance Module 03 - Week 3Christian ZebuaNo ratings yet

- Final MGMT X2 f09Document3 pagesFinal MGMT X2 f09Asif BashirNo ratings yet

- Partnership DigestedDocument12 pagesPartnership DigestedJaniceNo ratings yet

- Ikea PPP MacroDocument56 pagesIkea PPP MacroSaira BanuNo ratings yet

- 7-Eleven AR 2018 - As of 071519 - Optimized PDFDocument44 pages7-Eleven AR 2018 - As of 071519 - Optimized PDFLeviNo ratings yet

- Hotel ProjectDocument47 pagesHotel ProjectAkshay RautNo ratings yet

- Costing NotesDocument227 pagesCosting Noteschitkarashelly100% (1)

- ESOP PresentationDocument19 pagesESOP Presentationneha_bahadurNo ratings yet

- 16-1 Hospital Supply IncDocument4 pages16-1 Hospital Supply IncFrancisco Marvin100% (1)

- RosewoodDocument9 pagesRosewoodAbhishek KakraliaNo ratings yet

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate GaroNo ratings yet

- School of Business & Management: Course Outline & Accompanying Teaching & Learning PlanDocument6 pagesSchool of Business & Management: Course Outline & Accompanying Teaching & Learning PlanGurmanjot KaurNo ratings yet

- Profit CentersDocument13 pagesProfit CentersRuturaj SawantNo ratings yet

- Charting A Company'S Direction: Its Vision, Mission, Objectives, and StrategyDocument35 pagesCharting A Company'S Direction: Its Vision, Mission, Objectives, and StrategyNewaz SamiNo ratings yet

- Dalal Street Investment Journal May 28 2017Document69 pagesDalal Street Investment Journal May 28 2017sharkl123No ratings yet

- NSF GRFP Fellow GuideDocument24 pagesNSF GRFP Fellow GuidenkpreketesNo ratings yet

- Project Cash FlowsDocument35 pagesProject Cash FlowsshajibayliNo ratings yet

- Oracler12 Employee Self Service User GuideDocument43 pagesOracler12 Employee Self Service User Guidehoangthuhuyen100% (1)

Verizon Communications Inc. (VZ) / /: 67 Basic Information

Verizon Communications Inc. (VZ) / /: 67 Basic Information

Uploaded by

moneshnarineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Verizon Communications Inc. (VZ) / /: 67 Basic Information

Verizon Communications Inc. (VZ) / /: 67 Basic Information

Uploaded by

moneshnarineCopyright:

Available Formats

info@boursepanel.com www.boursepanel.

com

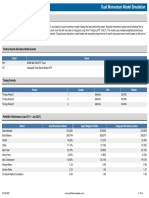

Verizon Communications Inc. (VZ) 34.08 / -0.56 / (-1.62%) Sector: Communication Services Industry: Telecom Services

Basic Information

Stock Health and Score (Short Term) Total Score: 67

Market Capital 145.63B

Total Shares outstanding (MRQ) 4.2B

Fair Value: 43.48

Avg. Vol. (10 days) 21.08M

Margin of Safety: 26% Beta 0.35

Value Score: 65 Earnings Date N/A

Growth Score: 65 Day Range 33.95 - 34.50

Quality Score: 75 52 Weeks Range 33.72 - 51.17

Technical Score: 66 Performance

1 Day % Change -1.62%

Trade Orders Information (Short Term) ( BUY ) 1 Weeks % Change -3.51%

1 Month % Change -3.05%

Order No. Entry Price Take Profit Invest % Exp. Payoff % Target Exp. Days

3 Months % Change -11.68%

1 34.41 35.87 50% 4.24% 17

1 Year % Change -31.39%

2 33.07 35.87 50% 8.47% 33

YTD % Change -10.74%

Key Ratios

Stock Checklist (Short Term)

Trailing P/E 6.74

Positive Negative Data Awaiting Forward P/E 7.39

15 13 0 PEG N/A

53.57% 46.43% 0.00% P/S (TTM) 1.07

P/B 1.57

Book Value 22.09

Company has earning growth in last 4 quaters ? Company has earnings growth in previous quater ?

Current Ratio 0.75

Company has Revenue growth in last 4 quarters ? Company has Revenue growth in previous quater ?

Debt to Equity Ratio 1.98

Company is efficient using equity capital ? Company is efficiently using it's assets ?

P/FCF 13.37

Company has ability to generate additional revenue ? Company is generating reasonable net profit ?

Financials

Company offers dividend returns ? Company has Low debt ?

Total Revenue (TTM) 136.19B

Company has ability to cover its short-term liabilities ? Company is in the top 10 list of its sectors ?

Net Income (TTM) 21.59B

Company is in the top 10 list of its industry ? Company's ROE is in the top 10 list of industry ?

Gross Profit (TTM) 77.7B

Company's ROA is in the top 10 list of industry ? Net Profit Margin is in the top 10 list of industry ?

Profit Margin 15.85%

Earning Growth (yoy) is in the top 10 list of industry ? Revenue Growth (yoy) is in the top 10 list of industry ?

Free Cash Flow 10.89B

Company's PE is in the top 10 list of industry ? Price has grown more than 5% in the last year ?

Basic EPS (TTM) 5.14

Stock price is under fair value ? Price is discounted more than 23% from 52 weeks high ?

Forward EPS 4.69

Price discounted more than 10% from previous month ? Stock price is oversold (Stochistics) ?

Dividend Rate ( Forward ) 2.61

Stock price is oversold (RSI) ? Stock price is below the lower bollinger band ?

Dividend Yield ( Forward ) 7.49%

Stock has over performed the index in the last month ? Stock has over performed the index in the last quarter ?

ROE (TTM) 24.59%

ROA (TTM) 5.20%

Support and Resistance Pivot Points

Earning Growth (yoy) 7.20%

Short Term Time Period Pivot Distance Trend Revenue Growth (yoy) N/A

3rd Resistance Point 35.87 Daily 34.64 -0.56 Bearish Technical Snapshot (Daily)

2nd Resistance Point 35.59

Weekly 35.18 -1.10 Bearish Indicator Value Signal Remarks

Monthly 35.75 -1.67 Bearish STOCH 9 Over Sold

1st Resistance Point 35.28

RSI 35 Neutral

Last Settled Price 34.64 Average True Range (ATR)

BBAND 34.08 Over Sold

1st Support Level 34.41 Time Period ATR Moved Remaining

ATR 0.59 Volatility Down

2nd Support Level 33.07 Daily 0.59 0.44 0.15

MACD -0.23 Below Zero

3rd Support Level 31.95 Weekly 1.71 1.25 0.46

SAR 37.21 Above Price

Monthly 4.09 2.97 1.12

SMA20 36.14 Above Price

SMA50 36.16 Above Price

Similar Stocks Expert Picks SMA100 37.21 Above Price

Fair Trade Value Growth Quality Technical Total SMA200 37.97 Above Price

Ticker Company Price Change Change %

Value Signal Score Score Score Score Score

Revenue and Income

FOX Fox Corporation 31.15 -0.47 (-1.49%) 51.50 WAIT 73 58 70 55 62

Quater Revenue Income

AdTheorent Holding Company,

ADTH

Inc.

1.39 0.08 (6.11%) 1.81 WAIT 73 53 78 53 62 2022-06-30 33.79B 5.20B

2022-09-30 34.24B 4.90B

LTRPB Liberty TripAdvisor Holdings, Inc. 40.00 -0.89 (-2.18%) 53.40 BUY 70 60 53 64 62

2022-12-31 35.25B 6.58B

UONEK Urban One, Inc. 5.45 -0.36 (-6.20%) 7.55 WAIT 68 68 58 55 61

2023-03-31 0.00K 0.00K

UONE Urban One, Inc. 5.63 -0.26 (-4.50%) 7.66 WAIT 68 68 58 54 60 Recent Earnings

Quarter Estimate Actual

Disclaimer: Bourse Panel is a research and analysis platform. It is not intended to provide any trading or investing 2Q2022 1.32 1.31

advice. The platform provides the assistance to make your trading decisions and does not recommend buying or selling 3Q2022 1.29 1.32

an instrument in any way. The research and analysis including the market data provided to boursepanel users are

believed to be reliable but not guaranteed. For more information please read our Terms of Services, Client Contract, 4Q2022 1.19 1.19

and Market Data Disclaimer. Invest wisely and always research before trading or investing in the Financial Markets. 1Q2023 1.20 1.20

14/07/2023 - 18:19 pm (UTC) © 2023 Bourse Panel. All Rights Reserved. Page 1 of 1

You might also like

- Long and Short of ItDocument41 pagesLong and Short of ItStephen Pirrie100% (1)

- Paycheck StubDocument1 pagePaycheck Stubsara100% (4)

- The Law Society Conditions of Sale 2015 PDFDocument39 pagesThe Law Society Conditions of Sale 2015 PDFAnonymous sId0uhkEIV50% (2)

- Group 4 Team 6: Area of Benchmarking Kpi Mcdonald'S KFCDocument1 pageGroup 4 Team 6: Area of Benchmarking Kpi Mcdonald'S KFCbala pandian0% (1)

- C19a Rio's SpreadsheetDocument8 pagesC19a Rio's SpreadsheetaluiscgNo ratings yet

- Microeconomics Notes (Advanced)Document98 pagesMicroeconomics Notes (Advanced)rafay010100% (1)

- Adani Wilmar Ltd. Share Price - NSE - BSEDocument5 pagesAdani Wilmar Ltd. Share Price - NSE - BSEUser UnknownNo ratings yet

- Data Overview: Wireless EquipmentDocument11 pagesData Overview: Wireless Equipmentderek_2010No ratings yet

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyNo ratings yet

- IDFC FIRST Bank Investor Presentation Q3 FY22 FinalDocument88 pagesIDFC FIRST Bank Investor Presentation Q3 FY22 FinalUtkarshNo ratings yet

- SBI Large & Midcap FundDocument1 pageSBI Large & Midcap FundGaurav RajNo ratings yet

- Next Era Energy 1 PagerDocument1 pageNext Era Energy 1 PagerNikos DiakogiannisNo ratings yet

- Frequency Table: Upaya - Pencegahan - NarkobaDocument5 pagesFrequency Table: Upaya - Pencegahan - NarkobaMalikul MizanNo ratings yet

- Investor Presentation FY-2021-22-February-2022Document38 pagesInvestor Presentation FY-2021-22-February-2022Shivang AsharNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100SumitNo ratings yet

- HDFC Momentum150 FundDocument2 pagesHDFC Momentum150 Fundkrishnakumar kichaNo ratings yet

- Grameenphone LTD.: C-31531 (652) /96 2 Quarter 2019 Business HighlightsDocument3 pagesGrameenphone LTD.: C-31531 (652) /96 2 Quarter 2019 Business HighlightsTanzir HasanNo ratings yet

- Model Description: Ticker NameDocument14 pagesModel Description: Ticker NameOleg KondratenkoNo ratings yet

- Pampa Energia S.A.: Price, Consensus & SurpriseDocument1 pagePampa Energia S.A.: Price, Consensus & SurpriseoaperuchenaNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Researchreport 513374Document18 pagesResearchreport 513374manjunathmsNo ratings yet

- MF COMPARISON - Large & Mid 2Document3 pagesMF COMPARISON - Large & Mid 2Rajkumar GNo ratings yet

- Ashmore Investment Management Limited Asian High Yield Debt Class ZDocument3 pagesAshmore Investment Management Limited Asian High Yield Debt Class Zcena1987No ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- KHAICHEM StockReport 20230829 2208Document12 pagesKHAICHEM StockReport 20230829 2208rajbus lessNo ratings yet

- ICICI Prudential Opportunities FundDocument18 pagesICICI Prudential Opportunities FundArmstrong CapitalNo ratings yet

- Vijaya_Investor-Presentation-Nov-2021Document39 pagesVijaya_Investor-Presentation-Nov-2021Abhishek GavandeNo ratings yet

- ProsharesfactsheettqqqDocument2 pagesProsharesfactsheettqqqaefqobdomNo ratings yet

- Pepsico: Visual Financials (BETA)Document4 pagesPepsico: Visual Financials (BETA)gyanadasNo ratings yet

- Trendrating - Emerging Markets - AmericasDocument3 pagesTrendrating - Emerging Markets - Americasg.bloebaum89No ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50aditya_kavangalNo ratings yet

- ABSLI NiftyAlpha50 FundDocument2 pagesABSLI NiftyAlpha50 FundAbhinav SinghNo ratings yet

- Factsheet 1710581747733Document1 pageFactsheet 1710581747733mvkulkarni5No ratings yet

- Mirae Asset Global X Artificial Intelligence & Technology ETF Fund of FundDocument16 pagesMirae Asset Global X Artificial Intelligence & Technology ETF Fund of FundArmstrong CapitalNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50S SinghNo ratings yet

- Nifty100 Quality30Document2 pagesNifty100 Quality30sujay.gorain.76No ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Data Presentation and Description: by DR Asma HyderDocument33 pagesData Presentation and Description: by DR Asma HyderAsadullah QureshiNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Tmbthanachart PCL Buy: Fair Price: Bt1.98 Upside (Downside)Document5 pagesTmbthanachart PCL Buy: Fair Price: Bt1.98 Upside (Downside)ธรรม จักษ์No ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Anil Kumar RanjanNo ratings yet

- PIMCO PIMS Credit Opportunities Bond Fund INST QIRDocument12 pagesPIMCO PIMS Credit Opportunities Bond Fund INST QIRaditya.d.chakrabortyNo ratings yet

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Page 1 of 2 Assessment of Working Capital Requirements Name: M/S S K Auto PartsDocument2 pagesPage 1 of 2 Assessment of Working Capital Requirements Name: M/S S K Auto PartsAnsari JiNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- AMZNDocument12 pagesAMZNLazo1 Lazo1No ratings yet

- Discovery DecDocument1 pageDiscovery DecGauravNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50badasserytechNo ratings yet

- ZacksEquityReport Z2280134059Document10 pagesZacksEquityReport Z2280134059infoNo ratings yet

- Ind Nifty Divid Opp50Document2 pagesInd Nifty Divid Opp50santosh kumarNo ratings yet

- The TJX Companies, Inc.: Data OverviewDocument9 pagesThe TJX Companies, Inc.: Data Overviewderek_2010No ratings yet

- Kload 2Document3 pagesKload 2Jay OsloNo ratings yet

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaNo ratings yet

- Q1 2023 Shareholder Letter - Final - v3Document13 pagesQ1 2023 Shareholder Letter - Final - v3bhuvaneshNo ratings yet

- Researchreport 275976Document20 pagesResearchreport 275976faekkonto.co.inNo ratings yet

- Exp. F. Date: Designation Stakeholder Names Phases Dur (M) Start Date Finish DateDocument1 pageExp. F. Date: Designation Stakeholder Names Phases Dur (M) Start Date Finish DateSameh Alihassn100% (1)

- BMRNDocument9 pagesBMRNderek_2010No ratings yet

- NVDA Pro Rating ReportDocument20 pagesNVDA Pro Rating ReportMikeNo ratings yet

- FinalDocument3 pagesFinalOsama MuradNo ratings yet

- Daily Guide To The Markets (5-13)Document19 pagesDaily Guide To The Markets (5-13)Mike KaplanNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- MB0041 Financial and Management AccountingDocument8 pagesMB0041 Financial and Management Accountingarunavo22100% (1)

- Answers, Solutions and Clarifications FileDocument3 pagesAnswers, Solutions and Clarifications FileAnnie LindNo ratings yet

- BTCL IPO Prospectus (Latest) 06 01 16Document252 pagesBTCL IPO Prospectus (Latest) 06 01 16Nako Yaga NkukuNo ratings yet

- Fringe Benefits - HRM ProjectDocument37 pagesFringe Benefits - HRM Projectsunny_panchal3697100% (2)

- Job Aid For Taxpayers - How To Fill Up 1702-MX Version 2013Document35 pagesJob Aid For Taxpayers - How To Fill Up 1702-MX Version 2013matthew02012010No ratings yet

- Statement - January 2024Document1 pageStatement - January 2024KARTERMANLLC100% (1)

- Research Report On Purchasing of Sport ShoesDocument57 pagesResearch Report On Purchasing of Sport Shoesdheerajkumariimt73600% (1)

- Investment Decision Rule For ItDocument2 pagesInvestment Decision Rule For ItIzzahIkramIllahiNo ratings yet

- Finance Module 03 - Week 3Document16 pagesFinance Module 03 - Week 3Christian ZebuaNo ratings yet

- Final MGMT X2 f09Document3 pagesFinal MGMT X2 f09Asif BashirNo ratings yet

- Partnership DigestedDocument12 pagesPartnership DigestedJaniceNo ratings yet

- Ikea PPP MacroDocument56 pagesIkea PPP MacroSaira BanuNo ratings yet

- 7-Eleven AR 2018 - As of 071519 - Optimized PDFDocument44 pages7-Eleven AR 2018 - As of 071519 - Optimized PDFLeviNo ratings yet

- Hotel ProjectDocument47 pagesHotel ProjectAkshay RautNo ratings yet

- Costing NotesDocument227 pagesCosting Noteschitkarashelly100% (1)

- ESOP PresentationDocument19 pagesESOP Presentationneha_bahadurNo ratings yet

- 16-1 Hospital Supply IncDocument4 pages16-1 Hospital Supply IncFrancisco Marvin100% (1)

- RosewoodDocument9 pagesRosewoodAbhishek KakraliaNo ratings yet

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate GaroNo ratings yet

- School of Business & Management: Course Outline & Accompanying Teaching & Learning PlanDocument6 pagesSchool of Business & Management: Course Outline & Accompanying Teaching & Learning PlanGurmanjot KaurNo ratings yet

- Profit CentersDocument13 pagesProfit CentersRuturaj SawantNo ratings yet

- Charting A Company'S Direction: Its Vision, Mission, Objectives, and StrategyDocument35 pagesCharting A Company'S Direction: Its Vision, Mission, Objectives, and StrategyNewaz SamiNo ratings yet

- Dalal Street Investment Journal May 28 2017Document69 pagesDalal Street Investment Journal May 28 2017sharkl123No ratings yet

- NSF GRFP Fellow GuideDocument24 pagesNSF GRFP Fellow GuidenkpreketesNo ratings yet

- Project Cash FlowsDocument35 pagesProject Cash FlowsshajibayliNo ratings yet

- Oracler12 Employee Self Service User GuideDocument43 pagesOracler12 Employee Self Service User Guidehoangthuhuyen100% (1)