Professional Documents

Culture Documents

GEM Invoice

GEM Invoice

Uploaded by

sadeeskumar.dOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GEM Invoice

GEM Invoice

Uploaded by

sadeeskumar.dCopyright:

Available Formats

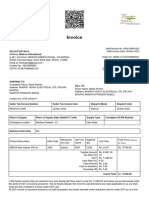

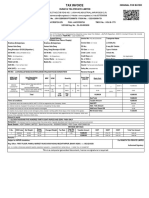

Invoice

GeM Invoice No: GEM-35644690

SELLER DETAILS: GeM Invoice Date: 17-Oct-2023

Address: DYNATECH ENGINEERS

B-22, NEW SIYAGANJ, NEW SIYAGANJ, INDORE, INDORE, Order No: GEMC-511687781357291

MADHYA PRADESH, 452001 Order Date: 11-Oct-2023

Email Id: shishir.dynatech@gmail.com

Contact No : 07566046464

GSTIN: 23AANPT5954B1ZK Click here to download seller invoice

SHIPPING TO:

Consignee Name: Rajaprakash Karuppasamy

BILL TO:

Address: MATERIALS MANAGEMENT, IV FLOOR, BUILDING

Buyer Name: Rajaprakash Karuppasamy

-24, HIGH PRESSURE BOILER PLANT, BHARAT HEAVY

Address: MATERIALS MANAGEMENT, IV FLOOR, BUILDING

ELECTRICALS LIMITED, TIRUCHIRAPPALLI 14

-24, HIGH PRESSURE BOILER PLANT, BHARAT HEAVY

TIRUCHIRAPPALLI

ELECTRICALS LIMITED, TIRUCHIRAPPALLI 14

TAMIL NADU 620014

TIRUCHIRAPPALLI TAMIL NADU 620014

Contact No: 0431-2577826-

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

DE/2023-24/4377 14-Oct-2023 Courier 17-Oct-2023

Type of Transport Tracking No Tracking URL Type & No of Packages

- CI095679081IN, CI095678965IN Click here for tracking Box 2

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Tamil Nadu / 33 Inter-State

Delivery Instruction NA

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

EPCOS 20 8532 pieces 8 Rs. 2940.00 Rs. 23520.00

Taxable Amount Rs. 19932.20

Tax Rate (%) 18

IGST Rs. 3587.80

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.00

Grand Total Rs. 23520.00

I /We hereby declarethatour firm/company has been specifically excluded from the requirement to comply with GST e-invoicing

provisions vide Notification number 13/2020-Central Tax dated 21 March 2020, as amended up to date. Accordingly, at present,

we are not covered under the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made

applicable to us, we shall issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- GR03755 PrakashDocument2 pagesGR03755 Prakashsaniyasteel786No ratings yet

- 60009TG220033816Document3 pages60009TG220033816Swathi PriyaNo ratings yet

- InvoiceDocument1 pageInvoiceSaurav AgrawalNo ratings yet

- Urban Orchards PVT LTD Pro Forma Invoice: Bill To: Ship ToDocument1 pageUrban Orchards PVT LTD Pro Forma Invoice: Bill To: Ship ToRuby SethiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Srinath YadavNo ratings yet

- True ValueDocument1 pageTrue ValueTonya SmithNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceApoorv SrivastavaNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFAkhilesh B.MNo ratings yet

- Invoice: Click Here To Download Seller Tax InvoiceDocument2 pagesInvoice: Click Here To Download Seller Tax InvoiceRaghavendra Rao GNo ratings yet

- InvoiceDocument1 pageInvoicePrince DasNo ratings yet

- OneplusDocument1 pageOneplusAakanksha ParasharNo ratings yet

- Mobile Invoice ICSDocument1 pageMobile Invoice ICSchetanNo ratings yet

- Boat CableDocument1 pageBoat CablehshsgNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Preetam SundarayNo ratings yet

- InvoiceDocument2 pagesInvoiceSasi Kesanasetty KiranNo ratings yet

- Invoice FormatDocument1 pageInvoice Formatshreyash nakhawaNo ratings yet

- InvoiceDocument4 pagesInvoicezakaria.ragab13No ratings yet

- Chandra (Format) ..... Electricals Tax InvoiceDocument2 pagesChandra (Format) ..... Electricals Tax InvoiceyaswanthNo ratings yet

- Tax Invoice: Sidhauli Indane Gas AGENCY (0000155797)Document2 pagesTax Invoice: Sidhauli Indane Gas AGENCY (0000155797)Deepak SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rimpa SenapatiNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailssenthilkumarNo ratings yet

- Printed InvoiceDocument1 pagePrinted InvoiceVivek Pandey0% (1)

- Carrier: Xpressbees: Deliver To FromDocument1 pageCarrier: Xpressbees: Deliver To FromVIGHNESH AIYANo ratings yet

- Invoice: SGPPL Karachi Sales OfficeDocument1 pageInvoice: SGPPL Karachi Sales Officeapi-19903489No ratings yet

- Tax Invoice: B6b33bda3afb1851Document2 pagesTax Invoice: B6b33bda3afb1851Rrconstructions constructions1996No ratings yet

- InvoiceDocument1 pageInvoicerahul034615No ratings yet

- 181320250 (2)Document1 page181320250 (2)Maharshi DattaNo ratings yet

- AVARI CrdownloadDocument1 pageAVARI Crdownloadfalosay704No ratings yet

- Invoice (Al Noor)Document1 pageInvoice (Al Noor)Nazia AnsariNo ratings yet

- Tax Invoice: Duplicate For BuyerDocument1 pageTax Invoice: Duplicate For BuyerakhlaquemdNo ratings yet

- Invoice TemplateDocument1 pageInvoice TemplatesanjeevisfathernowNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jyoti MorkundeNo ratings yet

- Vinay Sagar BillDocument1 pageVinay Sagar BillVinaysagar KakkurlaNo ratings yet

- Invoice 1031Document1 pageInvoice 1031Imran KarimNo ratings yet

- Accounting VoucherDocument2 pagesAccounting VoucherAbhishek ChoudharyNo ratings yet

- 7832 EdvannaparaDocument1 page7832 EdvannaparaSafalsha BabuNo ratings yet

- InvoiceDocument1 pageInvoiceDakoji LaxmiNo ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- Cost Estimate: Datum TechnologiesDocument1 pageCost Estimate: Datum Technologiesraj rajNo ratings yet

- Invoice Cum Bill of Supply: FNP E Retail Private LimitedDocument1 pageInvoice Cum Bill of Supply: FNP E Retail Private LimitedVishNo ratings yet

- Please Note This Is A Digitally Signed Invoice.: Original For RecipientDocument1 pagePlease Note This Is A Digitally Signed Invoice.: Original For RecipientRajnish JainNo ratings yet

- Sales Invoice Report New-4Document1 pageSales Invoice Report New-4NRJ PANDITNo ratings yet

- Vision Invoice INV556Document1 pageVision Invoice INV556Rahul MagareNo ratings yet

- InvoiceDocument2 pagesInvoicersengunthar1No ratings yet

- InvoiceDocument1 pageInvoiceHemant YadavNo ratings yet

- InvoiceDocument1 pageInvoiceMAHESH SATAPATHY100% (1)

- GST 1056 2019 20. Ckecp Mohali P&M and IrDocument1 pageGST 1056 2019 20. Ckecp Mohali P&M and IrEntertainment AbhiNo ratings yet

- InvoiceDocument1 pageInvoiceraviwagh22No ratings yet

- Tax Invoice: IXIFT00002223962: Fare (Incl of All Taxes) 3457.00 Net Other Service Charges & Fees (A) 0.00Document1 pageTax Invoice: IXIFT00002223962: Fare (Incl of All Taxes) 3457.00 Net Other Service Charges & Fees (A) 0.00Gaurav SinghNo ratings yet

- Invoice 2Document47 pagesInvoice 2Kamal PashaNo ratings yet

- Items Previously Shipped: Thank YouDocument1 pageItems Previously Shipped: Thank YouSelina González HerreraNo ratings yet

- HOTEL BillDocument1 pageHOTEL BillHimani ChaudharyNo ratings yet

- Tax Invoice: Bill ToDocument2 pagesTax Invoice: Bill ToSai CharanNo ratings yet

- Marathon's InvoiceDocument1 pageMarathon's InvoiceLily HuzdupNo ratings yet

- Rashid Jawad-431 PDFDocument1 pageRashid Jawad-431 PDFKhyati KamdarNo ratings yet

- Mivi 6ft Nylon Braided 1.8 M Micro USB Cable: Grand Total 129.00Document1 pageMivi 6ft Nylon Braided 1.8 M Micro USB Cable: Grand Total 129.00Jayanta MazumdarNo ratings yet

- Details of Receiver (Billed To) Details of Consignee (Shipped To)Document2 pagesDetails of Receiver (Billed To) Details of Consignee (Shipped To)shubhNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Navneet SharmaNo ratings yet

- Salient Features and Provisions of Indian ConstitutionDocument14 pagesSalient Features and Provisions of Indian Constitutionsadeeskumar.dNo ratings yet

- Incentive SC SupervisorDocument4 pagesIncentive SC Supervisorsadeeskumar.dNo ratings yet

- Presentation SDHB PDFDocument8 pagesPresentation SDHB PDFsadeeskumar.dNo ratings yet

- Dynatech InvoiceDocument1 pageDynatech Invoicesadeeskumar.dNo ratings yet

- Partial Discharge Testing For Power Transformers: Diagnostics and Condition AssessmentDocument2 pagesPartial Discharge Testing For Power Transformers: Diagnostics and Condition Assessmentsadeeskumar.dNo ratings yet

- Null 2Document46 pagesNull 2sadeeskumar.dNo ratings yet

- Partial Discharge TestDocument9 pagesPartial Discharge Testsadeeskumar.d100% (1)

- MR LAKSHMANAN PDFDocument1 pageMR LAKSHMANAN PDFsadeeskumar.dNo ratings yet

- GATE PreparationDocument4 pagesGATE Preparationsadeeskumar.dNo ratings yet

- SHM NDT 2018 Paper 49Document10 pagesSHM NDT 2018 Paper 49sadeeskumar.dNo ratings yet

- Inter Unit Transfer RequestDocument2 pagesInter Unit Transfer Requestsadeeskumar.dNo ratings yet

- TD Power Systems Limited: The Anchor Investors Bidding Date Was One Day Prior To The Bid/Issue Opening DateDocument345 pagesTD Power Systems Limited: The Anchor Investors Bidding Date Was One Day Prior To The Bid/Issue Opening Datesadeeskumar.dNo ratings yet

- Partial Discharge - 02Document4 pagesPartial Discharge - 02sadeeskumar.dNo ratings yet

- Magnetics High DC Bias XFlux BulletinDocument2 pagesMagnetics High DC Bias XFlux Bulletinsadeeskumar.dNo ratings yet

- Two Day Training: Why Training On "Evaluation of Cables and Accessories"?Document2 pagesTwo Day Training: Why Training On "Evaluation of Cables and Accessories"?sadeeskumar.dNo ratings yet

- Bharat Heavy Electricals Limited: Personal ParticularsDocument2 pagesBharat Heavy Electricals Limited: Personal Particularssadeeskumar.dNo ratings yet

- Signed Request Letter From GM With Medical ReportDocument6 pagesSigned Request Letter From GM With Medical Reportsadeeskumar.dNo ratings yet

- Faculty Vitae 1. Name: C.TamilselviDocument2 pagesFaculty Vitae 1. Name: C.Tamilselvisadeeskumar.dNo ratings yet

- 21 January, 2022 (2:00 PM To 5:00 PM)Document3 pages21 January, 2022 (2:00 PM To 5:00 PM)sadeeskumar.dNo ratings yet