Professional Documents

Culture Documents

Form16 W0000000 GS164200X 2021 20211

Form16 W0000000 GS164200X 2021 20211

Uploaded by

gaganOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form16 W0000000 GS164200X 2021 20211

Form16 W0000000 GS164200X 2021 20211

Uploaded by

gaganCopyright:

Available Formats

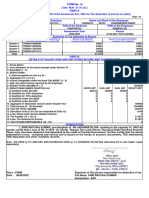

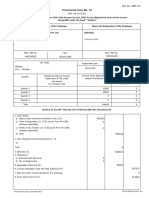

FORM No.

16

[ See Rule 31 (1) (a) ]

PART-A

Certificate under Section 203 of the Income-tax Act, 1961 for Tax deducted at source on salary

Page 1 of 1

Name and Address of the Employer Name and Rank of the Employee

PAO(GREF)PUNE HQ 14 BRTF L0140000 5 GS164200 SKT SATISH KUMAR CHOUHAN

PAN of the Deductor TAN of the Deductor PAN of the Employee

PNEP09676C AHHPC7944B

CIT(TDS) Address Assessment Year Period

PAO GREF,PUNE 2021-2022 01/04/2020 TO 31/03/2021

Summary of Tax deducted at Source

Quarter Receipt Numbers of original statements of Amount of tax deducted Amount of tax deducted/remitted

TDS under sub-section(3) of section 200 in respect of the employee in respect of the employee

Quarter 1 FXHJBINP 0 0

Quarter 2 FXIOOMYD 0 0

Quarter 3 FXIQMQMY 0 0

Quarter 4 FXIXEZQW 31562 31562

Total 31562 31562

PART-B

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

` ` ` `

1. Gross Salary 681610

2. Less Allowance to the extent exempt under Section 10 13200

3. BALANCE (1 - 2) 668410

4. DEDUCTIONS :

a. Interest payable on loan u/s 24 : 0

5. Aggregate of 4 ( a to b ) 0

6. Income chargeable under the Head 'SALARIES' (3 - 5) 668410

7. Add: Any other income reported by the employee 0

8. GROSS TOTAL INCOME (6 + 7) 668410

9. DEDUCTIONS UNDER CHAPTER VI-A GROSS AMT QUAL AMT QUAL AMT DEDUCT AMT

a) Qualified under Sec.80C 27920 27920 27920

b) Qualified for 100% deduction 1250 1250 1250

c) Qualified for 50% deduction 0 0 0

d) Qualified under Sec.80DD 0 0 0

e) Qualified under Sec.80U 0 0 0

10. Aggregate of deductible amount under Chapter VI-A 29170

11. Total Income (8 - 10) Rounded 589240

12. TAX ON TOTAL INCOME 30348

13. Education Cess @ 3% (on tax computed at Sl.No.12) 1214

14. Less: Relief under Section 89(attch Details) 0

15. Tax Payable (12 + 13)-14 31562

16. Less: Tax Deducted at Source 31562

17. TAX PAYABLE/REFUNDABLE (15 - 16) 0

VERIFICATION

I, CHANDRIKA PRASAD, son/daughter of RAMKISAN SAO working in the capacity of AAO do hereby

certify that a sum of Rs. 31562 (in words) Rupees Thirty One Thousand Five Hundred Sixty Two only. has been

deducted and deposited to the credit of Central Government. I further certify that the above information is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and

other available records.

Note : ED CESS @ 2% AND SEC AND HIGHER ED CESS @ 1% CHARGED ON INCTAX (Rounded off to next higher rupee

separately)

Place : PUNE Signature of the person responsible for deduction of tax

Date : 11/06/2021 Full Name CHANDRIKA PRASAD

Designation AAO

You might also like

- Agreement For Providing Permanent Alternate Accommodation To The Tenant On Ownership Basis in Lieu of Tenanted Premises by A DeveloperDocument8 pagesAgreement For Providing Permanent Alternate Accommodation To The Tenant On Ownership Basis in Lieu of Tenanted Premises by A DeveloperSiddharth ShahNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Form16 1945007 JC570193L 2020 2021Document2 pagesForm16 1945007 JC570193L 2020 2021Ranjeet RajputNo ratings yet

- Form 1615072023 161901Document2 pagesForm 1615072023 161901Steve BurnsNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Form 1621052023 115217Document2 pagesForm 1621052023 115217sandeep kumarNo ratings yet

- Form 1625062023 043026Document2 pagesForm 1625062023 043026SHIV BHAJANNo ratings yet

- Form 1622072023 022228Document2 pagesForm 1622072023 022228Kajal RandiveNo ratings yet

- Form 1607062022 182100Document2 pagesForm 1607062022 182100Manveer Rori AlaNo ratings yet

- Form 1606032021 195902Document3 pagesForm 1606032021 195902Kalyan KumarNo ratings yet

- Form 1619042024 085917Document3 pagesForm 1619042024 085917SODHI SINGHNo ratings yet

- Form 1609042024 112352Document3 pagesForm 1609042024 112352rs3071029No ratings yet

- Form 1601012023 101258Document3 pagesForm 1601012023 101258Bhura SinghNo ratings yet

- Form16 W0000000 GO004610X 2022 20221Document1 pageForm16 W0000000 GO004610X 2022 20221Dharamveer SinghNo ratings yet

- Form16 1951051 17631 04570193K 2021 2022Document2 pagesForm16 1951051 17631 04570193K 2021 2022Ranjeet RajputNo ratings yet

- Form 1622052023 130017Document3 pagesForm 1622052023 130017Amit Singh NegiNo ratings yet

- Form 1617052024 112840Document3 pagesForm 1617052024 112840sandeep kumarNo ratings yet

- Form 1629042024 151129Document2 pagesForm 1629042024 151129UtkarshNo ratings yet

- Form 1615052023 141937Document3 pagesForm 1615052023 141937Pawan KumarNo ratings yet

- Booklet of Forms For House Building AdvanceDocument2 pagesBooklet of Forms For House Building AdvanceJITHU MNo ratings yet

- Form 1626042024 112515Document2 pagesForm 1626042024 112515harshkaliramna2007.hkNo ratings yet

- Form 1602102023 160124Document3 pagesForm 1602102023 160124isantbasnet3561No ratings yet

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet

- Form 1617072023 211241Document2 pagesForm 1617072023 211241Steve BurnsNo ratings yet

- Form16 W0000000 GS186523X 2021 20211Document1 pageForm16 W0000000 GS186523X 2021 20211Raman OjhaNo ratings yet

- Form 1617082023 112227Document2 pagesForm 1617082023 112227rinsha.sherinNo ratings yet

- Wa0000.Document2 pagesWa0000.anpro1299No ratings yet

- Form 1621032023 201318 PDFDocument3 pagesForm 1621032023 201318 PDFManvendraNo ratings yet

- Form 1615012023 135230 PDFDocument3 pagesForm 1615012023 135230 PDFSahil ThakurNo ratings yet

- Matekar PDFDocument1 pageMatekar PDFdharmveer singhNo ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryKrishna Chaitanya JonnalagaddaNo ratings yet

- Form 1607022022 205546Document2 pagesForm 1607022022 205546Mahesh VayiboyinaNo ratings yet

- HDFC Bank Limited: Dear Mr. Vijay Anand A.Document5 pagesHDFC Bank Limited: Dear Mr. Vijay Anand A.A Vijay AnandNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesForm No. 16 (See Rule 31 (1) (A) ) Part B: Details of Salary Paid and Any Other Income and Tax Deductedrahul patidarNo ratings yet

- Form16 10-11Document4 pagesForm16 10-11voiceofindia811No ratings yet

- Form 1613062024 094217Document3 pagesForm 1613062024 094217santoshamrute0711No ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryR S RatanNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Res FormDocument1,320 pagesRes FormAnonymous pKsr5vNo ratings yet

- Anil Ganvir Form 16 (21 22)Document3 pagesAnil Ganvir Form 16 (21 22)DrAndrew WillingtonNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Form 16 - BLMPB2218K - 2019-20 - Part B PDFDocument6 pagesForm 16 - BLMPB2218K - 2019-20 - Part B PDFUmair BaigNo ratings yet

- 2017-18 - Part B - 1Document4 pages2017-18 - Part B - 1getajaykaushalNo ratings yet

- (C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Document2 pages(C) Profits in Lieu of Salary Under Section 17 (3) (As Per Form No.12BA, Wherever Applicable)Yashwant KumarNo ratings yet

- Sudhir Jagannath Belose 23-24Document3 pagesSudhir Jagannath Belose 23-24pankajyadav7410No ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)Anushka PoddarNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)P v v RaoNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- Adobe Scan Sep 09, 2023Document2 pagesAdobe Scan Sep 09, 2023krampravesh199No ratings yet

- Form16 (2021-2022)Document2 pagesForm16 (2021-2022)COMMON SERVICE CENTERNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- Abhishek - Provisional Form 16Document2 pagesAbhishek - Provisional Form 16hrrecruiter.vhtbsNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Form16 16 2015-16Document4 pagesForm16 16 2015-16BDO KhandalaNo ratings yet

- Form16_PDF2023-2024-2Document2 pagesForm16_PDF2023-2024-2akamitfearless71No ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Personocratia 10 Themes.Document10 pagesPersonocratia 10 Themes.negreibsNo ratings yet

- Federal ReserveDocument29 pagesFederal ReserveTheknower OfitallNo ratings yet

- CRM ER DiagramDocument2 pagesCRM ER DiagramGobardhan NaikNo ratings yet

- Pag Ibig Fpf060Document2 pagesPag Ibig Fpf060Socorro AcordaNo ratings yet

- PESTEL Analysis of The Macro-EnvironmentDocument5 pagesPESTEL Analysis of The Macro-EnvironmentAna ParaschivNo ratings yet

- Agenda: Shoreline City Council Special Workshop Dinner MeetingDocument13 pagesAgenda: Shoreline City Council Special Workshop Dinner MeetingNeal McNamaraNo ratings yet

- Economic GrowthDocument56 pagesEconomic GrowthJayani UmeshaNo ratings yet

- Petitioner vs. vs. Respondent: Second DivisionDocument13 pagesPetitioner vs. vs. Respondent: Second DivisionRNJNo ratings yet

- RDO No. 8 Baguio CityDocument257 pagesRDO No. 8 Baguio CityJaylordPataotaoNo ratings yet

- Chapter 30-Money Growth and Inflation-PDocument43 pagesChapter 30-Money Growth and Inflation-PHuy TranNo ratings yet

- Lifewood Airbnb PresentationDocument14 pagesLifewood Airbnb PresentationChristian Gilvin MendinaNo ratings yet

- Taxation On Real Estate TransactionsDocument3 pagesTaxation On Real Estate TransactionsGlynda ChanNo ratings yet

- Full Download Test Bank For Principles of Taxation For Business and Investment Planning 2018 Edition 21st Edition by Jones PDF Full ChapterDocument35 pagesFull Download Test Bank For Principles of Taxation For Business and Investment Planning 2018 Edition 21st Edition by Jones PDF Full Chaptertenebraeaslakef0q6tz100% (24)

- Suriname PDFDocument78 pagesSuriname PDFmuradinasrufNo ratings yet

- Customs Declaration For Private CustomersDocument3 pagesCustoms Declaration For Private CustomersTúryGergelyNo ratings yet

- Management of Occupational Health and Safety Canadian 7Th Edition Kelloway Test Bank Full Chapter PDFDocument35 pagesManagement of Occupational Health and Safety Canadian 7Th Edition Kelloway Test Bank Full Chapter PDFveneratedemesnew1klx100% (14)

- Vietnam - WTO CommitmentDocument27 pagesVietnam - WTO CommitmentNhi NguyễnNo ratings yet

- Harvard Midha Sanjeev Aff Frshirley Round4Document52 pagesHarvard Midha Sanjeev Aff Frshirley Round4MetelitswagNo ratings yet

- Chapter 13Document11 pagesChapter 13Avox EverdeenNo ratings yet

- Notes On Tax Remedies of The Government and TaxpayersDocument74 pagesNotes On Tax Remedies of The Government and TaxpayersMakoy Bixenman100% (1)

- 21 Lorenzo vs. PosadasDocument3 pages21 Lorenzo vs. PosadasAnonymous AUdGvYNo ratings yet

- Alejandro Ty v. Hon. TrampeDocument13 pagesAlejandro Ty v. Hon. TrampeChristian Joe QuimioNo ratings yet

- IFRS in Practice Accounting For Convertible Notes (Dec 2013)Document24 pagesIFRS in Practice Accounting For Convertible Notes (Dec 2013)dkishore28No ratings yet

- CIR v. Wyeth Suaco Lab.Document3 pagesCIR v. Wyeth Suaco Lab.Angelique Padilla UgayNo ratings yet

- Antim Prahar 2024 Financial Planning and Tax ManagementDocument41 pagesAntim Prahar 2024 Financial Planning and Tax Managementyipej24216No ratings yet

- Jackson vs. Macalino (G.R. No. 139255, November 24, 2003)Document3 pagesJackson vs. Macalino (G.R. No. 139255, November 24, 2003)Kenny BesarioNo ratings yet

- PAk Suzuki Motors PresentationDocument41 pagesPAk Suzuki Motors PresentationAZAM WAQASNo ratings yet

- Withholding Tax On Wages: Ruther N. Martinez Tax Reporting and Operations Group (TROG)Document183 pagesWithholding Tax On Wages: Ruther N. Martinez Tax Reporting and Operations Group (TROG)Johnallen MarillaNo ratings yet

- ILLUSTRATIVE PROBLEM For Analyses of Business TransactionsDocument6 pagesILLUSTRATIVE PROBLEM For Analyses of Business TransactionsRich Angelie MuñezNo ratings yet