Professional Documents

Culture Documents

Resource 5 (Brand Equity)

Resource 5 (Brand Equity)

Uploaded by

golfingboss0 ratings0% found this document useful (0 votes)

3 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesResource 5 (Brand Equity)

Resource 5 (Brand Equity)

Uploaded by

golfingbossCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

Resource 5 (Brand Equity)

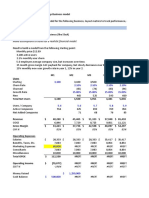

Question 1

VROP Inc. is considering acquiring a brand (Brand AB) for $300,000. The management

has requested your assistance is gauging the feasibility of this move. The following

information was supplied:

$ The estimated sales (units):-

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5

Sales (units) est. 75,000 80,000 90,000 100,000 120,000

$ Price per unit: $15

Unit cost: $10

$ Projected development costs are $1,000,000

$ Cost of capital: 15%

$ The Present Value Interest Factors (PVIF) based on a 15% cost of capital:

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5

PVIF (15%) 0.870 0.756 0.658 0.572 0.497

$ Additional cost information:-

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5

Marketing ($) 40,000 60,000 80,000 85,000 90,000

Depreciation 12,000 12,000 14,600 14,600 15,700

Overheads ($) 50,000 55,000 60,000 75,000 80,000

Other 2,500 3,000 3,500 4,000 4,500

$ The company capital charge: 10%

$ Role of Branding Index: 79%

$ After year 5 earnings are expected to experience constant growth of 7%

$ The relevant tax rate is 34%

Yr 1 Yr 2 Yr 3 Yr 4 Yr 5

Capital employed 80,000 85,700 90,600 100,000 105,000

Calculate brand equity for Brand AB and hence advise VROP Inc.

You might also like

- Matheson ElectronicsDocument2 pagesMatheson ElectronicsReg Lagarteja80% (5)

- FINAN204-21A - Tutorial 7 Week 10Document6 pagesFINAN204-21A - Tutorial 7 Week 10Danae YangNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Lady MDocument2 pagesLady MMəhəmməd Əli HəzizadəNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument3 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatNo ratings yet

- Practice Quesions Fin Planning ForecastingDocument19 pagesPractice Quesions Fin Planning ForecastingAli HussainNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- 05 Park ISM ch05 PDFDocument39 pages05 Park ISM ch05 PDFBenn DoucetNo ratings yet

- Assignment 1 (Perot, Ikea, CPM)Document8 pagesAssignment 1 (Perot, Ikea, CPM)Aditya WibisanaNo ratings yet

- LECTURE 5 (Brand Equity)Document3 pagesLECTURE 5 (Brand Equity)golfingbossNo ratings yet

- 2Document1 page2bomzterNo ratings yet

- Midterm Exam - Saeful Aziz (29118389) PDFDocument44 pagesMidterm Exam - Saeful Aziz (29118389) PDFSaeful AzizNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- Solutions Nss NC 17Document13 pagesSolutions Nss NC 17lethiphuongdan50% (2)

- Quiz: Lab. Modeling Finance Saturday, 22 June 2019: QuestionsDocument2 pagesQuiz: Lab. Modeling Finance Saturday, 22 June 2019: QuestionsWilliam SuryadharmaNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Questions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectDocument6 pagesQuestions Chapter 3 No.11: PEROT CORPORATION - Patay2 Chip ProjectddNo ratings yet

- Presentación User Valuation DamodaranDocument42 pagesPresentación User Valuation Damodaranfrank bautistaNo ratings yet

- Developing Financial InsightsDocument3 pagesDeveloping Financial InsightsRahma Putri HapsariNo ratings yet

- Group Project - Finance For Supply ChainDocument3 pagesGroup Project - Finance For Supply ChainArmin SibrianNo ratings yet

- VCMQ1Document11 pagesVCMQ1Daniella Dhanice CanoNo ratings yet

- Sample Financial ModelDocument69 pagesSample Financial ModelfoosaaNo ratings yet

- Revision Questions - Q&ADocument3 pagesRevision Questions - Q&Arosario correiaNo ratings yet

- FF AssignmentDocument8 pagesFF Assignmentjeaner2008No ratings yet

- Pom447 HW Chapter 1 4Document6 pagesPom447 HW Chapter 1 4Anonymous 5WuaKVJNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Word 1514edDocument13 pagesCH 11 - CF Estimation Mini Case Sols Word 1514edHari CahyoNo ratings yet

- CMKT 300 Fall 2020 Product Line Extension ROI and CAGR Conjoint UpdateDocument12 pagesCMKT 300 Fall 2020 Product Line Extension ROI and CAGR Conjoint UpdateMit DaveNo ratings yet

- Financial Planning and Forecasting - Solved Q&ADocument6 pagesFinancial Planning and Forecasting - Solved Q&ARex CalibreNo ratings yet

- Vyaderm Pharmaceuticals - SpreadsheetDocument5 pagesVyaderm Pharmaceuticals - SpreadsheetDeepti MhatreNo ratings yet

- CH 456Document8 pagesCH 456Syed TabrezNo ratings yet

- Finance Case Study For Tech Startup Video.01Document10 pagesFinance Case Study For Tech Startup Video.01koenigNo ratings yet

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzNo ratings yet

- Alternative Example 8Document4 pagesAlternative Example 8attiqueNo ratings yet

- (TUBONG) Module 3 - Activity 1Document9 pages(TUBONG) Module 3 - Activity 1CristopherNo ratings yet

- VC Port Co Tear SheetDocument1 pageVC Port Co Tear SheetVik LNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138No ratings yet

- Numbers Sheet Name Numbers Table NameDocument4 pagesNumbers Sheet Name Numbers Table NameWilliam O OkolotuNo ratings yet

- New Subscriber Commissions Bonus Commission For Above YTD Sales Objective AchievementDocument14 pagesNew Subscriber Commissions Bonus Commission For Above YTD Sales Objective Achievementmjeffers22No ratings yet

- Final Exam CorporateDocument4 pagesFinal Exam CorporateCiptawan CenNo ratings yet

- Excel Drill Exercise 1 MDLDocument16 pagesExcel Drill Exercise 1 MDLEugine AmadoNo ratings yet

- FCFFSTDocument10 pagesFCFFSTapi-3701114No ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- Waterfall Raising Capital PowerPointDocument8 pagesWaterfall Raising Capital PowerPointToto ヅ GarmontoNo ratings yet

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- Year Cash FlowDocument2 pagesYear Cash FlowSiddhant DwivediNo ratings yet

- Financial Planning and Control: AFN, Leverage and Break Even Point Additional Fund NeededDocument6 pagesFinancial Planning and Control: AFN, Leverage and Break Even Point Additional Fund NeededCalistaNo ratings yet

- Bab-Mk Afn1Document6 pagesBab-Mk Afn1CalistaNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- David Ruiz Tarea 12-13Document33 pagesDavid Ruiz Tarea 12-131006110950No ratings yet

- Capital Budgeting Part One May 2003Document22 pagesCapital Budgeting Part One May 2003Sudiman SanexNo ratings yet

- Amazon ValuationDocument22 pagesAmazon ValuationDr Sakshi SharmaNo ratings yet

- Year Geico Dividend Per Share in $ Total Dividend To Berkshire Hathaway in $ MillionDocument8 pagesYear Geico Dividend Per Share in $ Total Dividend To Berkshire Hathaway in $ MillionIshan KakkarNo ratings yet

- Company: Apple, Inc. Ticker: Aapl Date: 7/31/2018Document14 pagesCompany: Apple, Inc. Ticker: Aapl Date: 7/31/2018januarNo ratings yet

- FM PQDocument3 pagesFM PQOmer Zahid100% (1)

- Example FinancialsDocument177 pagesExample FinancialsNavpreet SinghNo ratings yet

- Investment CaseDocument7 pagesInvestment Caseafif12No ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Aid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentFrom EverandAid for Trade in Asia and the Pacific: Promoting Connectivity for Inclusive DevelopmentNo ratings yet