Professional Documents

Culture Documents

Stock Research Report For Webmd Health CP WBMD As of 9/22/11 - Chaikin Power Tools

Stock Research Report For Webmd Health CP WBMD As of 9/22/11 - Chaikin Power Tools

Uploaded by

Chaikin Analytics, LLCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Research Report For Webmd Health CP WBMD As of 9/22/11 - Chaikin Power Tools

Stock Research Report For Webmd Health CP WBMD As of 9/22/11 - Chaikin Power Tools

Uploaded by

Chaikin Analytics, LLCCopyright:

Available Formats

Webmd Health Cp (WBMD)

Industry: Computer Software-Services

WBMD

Webmd Health Cp

Price: $30.01

Chaikin Power Gauge Report | Generated: Thu Sep 22 16:07 EDT 2011

$30.01

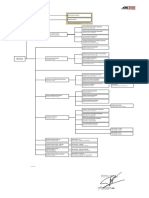

Power Gauge Rating

WBMD - Very Bearish

The Chaikin Power Gauge Rating for WBMD is very bearish due to very bearish price/volume activity, very negative expert opinions and weak earnings performance. Price and volume activity for WBMD is very bearish which is indicated by its relative weakness versus the market and negative Chaikin money flow.

TM

Financial Metrics

Earnings Performance

Price/Volume Activity

Expert Opinions

News Sentiment Rating

Neutral

WBMD Webmd Health.. September 12, 2011

Chaikin Sentiment Gauge for WBMD is neutral. Stories concerning WBMD have a balanced or neutral sentiment.

TM

News Sentiment :Neutral

Power Trend - 5 Year Chart

The Power Gauge distills a 20 factor model into a concise picture of a stock's potential.

High Potential

Neutral

Low Potential

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Financials & Earnings

Financial Metrics

Financial Metrics Rating

LT Debt/Equity Ratio

Neutral

WBMD's financial metrics are neutral. The company generates high free cash flow relative to market capitalization and is carrying too much long term debt. The rank is based on a high long term debt to equity ratio, high price to book value ratio, high price to sales ratio and relatively high cash flow.

Price to Book Value

Return on Equity

Price to Sales Ratio

Business Value

Assets and Liabilities

Ratio Current Ratio LT Debt/Equity TTM 8.25 0.00

Valuation

Ratio Price/Book Price/Sales TTM 2.54 3.29

Returns

Ratio Return on Invest Return on Equity TTM 6.3% 10.2%

Earnings Performance

Earnings Performance Rating

Earnings Growth

Bearish

WBMD's earnings performance has been weak. The company has not met analysts' earnings estimates and is priced relatively high compared to next year's projected EPS. The rank is based on high earnings growth over the past 3-5 years, worse than expected earnings in recent quarters, a relatively high projected P/E ratio and inconsistent earnings over the past 5 years.

Earnings Surprise

Earnings Trend

Projected P/E Ratio

Earnings Consistency

5 Year Revenue and Earnings Growth

12/06 Revenue(M) Rev % Growth EPS EPS % Growth 253.88 50.28% $0.08 -46.67% 12/07 331.95 30.75% $1.15 1,337.50% 12/08 382.78 15.31% $0.46 -60.00% 12/09 438.54 14.57% $2.45 432.61% 12/10 534.52 21.89% $0.97 -60.41%

EPS Estimates

Factor Quarterly EPS Yearly EPS Factor 3-5 year EPS Actual EPS Prev $0.23 $0.97 Actual EPS Growth 26.56% EST EPS Current $0.17 $1.24 Est EPS Growth 19.00% Change -0.06 +0.27 Change -7.56

EPS Surprise

Estimate Latest Qtr 1 Qtr Ago 2 Qtr Ago 3 Qtr Ago $0.21 $0.15 $0.43 $0.22 Actual $0.21 $0.19 $0.47 $0.24 Difference $0.00 $0.04 $0.04 $0.02 % Difference 0.00 26.67 9.30 9.09

EPS Quarterly Results

FY 12/09 12/10 12/11 Qtr 1 $0.05 $-0.07 $0.33 Qtr 2 $0.04 $0.14 $0.37 Qtr 3 $0.22 $0.23 Qtr 4 $1.84 $0.63 Total $2.15 $0.93 -

Fiscal Year End Month is December.

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

Price Trend & Expert Opinions

Price/Volume Activity

Price/Volume Activity Rating

Relative Strength vs Market

Very Bearish

Price and volume activity for WBMD is very bearish. WBMD has underperformed the S&P 500 over 26 weeks and is experiencing sustained selling. The rank for WBMD is based on its relative weakness versus the market, negative Chaikin money flow, a negative Chaikin price trend, a positive Chaikin price trend ROC and a decreasing volume trend.

Chaikin Money Flow

Price Trend

Price Trend ROC

Volume Trend

Relative Strength vs S&P500 Index

Chaikin Money Flow

Chart shows whether WBMD is performing better or worse than the market.

Chaikin Money Flow analyzes supply and demand for a company's stock.

Price Activity

Factor 52 Week High 52 Week Low % Change YTD Rel S&P 500 Value 58.17 30.00 -34.72%

Price Activity

Factor % Change Price - 4 Weeks % Change Price - 24 Weeks % Change Price - 4 Wks Rel to S&P % Change Price - 24 Wks Rel to S&P Value -10.85% -41.00% -10.02% -32.47%

Volume Activity

Factor Average Volume 20 Days Average Volume 90 Days Chaikin Money Flow Persistency Value 689,970 1,182,338 29%

Expert Opinions

Expert Opinions

Earnings Estimate Revisions

Very Bearish

Expert opinions about WBMD are very negative. Analysts are lowering their EPS estimates for WBMD and insiders are not net buyers of WBMD's stock. The rank for WBMD is based on analysts revising earnings estimates downward, insiders not purchasing significant amounts of stock, optimistic analyst opinions and relative weakness of the stock versus the Computer Software-Services industry group.

Short Interest

Insider Activity

Analyst Opinions

Relative Strength vs Industry

Earnings Estimate Revisions

Current Current Qtr Next Qtr 0.17 0.44 Current Current FY 1.24 7 Days Ago % Change 0.16 0.44 +6.25% 0.00%

Analyst Recommendations

Factor Mean this Week Mean Last Week Change Mean 5 Weeks Ago Value Buy Buy +0.39 Buy

EPS Estimates Revision Summary

Last Week Up Curr Qtr Curr Yr Next Qtr 0 0 0 0 Down 0 0 0 0 Last 4 Weeks Up 0 0 0 0 Down 1 1 1 1

30 Days Ago % Change 1.26 -0.02

Next Yr

I want to receive special offers about trading stocks with your brokerage partner, optionsXpress. Click here

www.chaikinpowertools.com

The Company & Its Competitors

WBMD's Competitors in Computer Software-Services

Company WBMD PWRD SNDA CHINA GAME NTES CYOU SINA Power Gauge Historic EPS growth 26.56% 63.76% 32.28% 7.11% -3.38% 32.40% 22.26% 17.01% Projected EPS growth 19.00% 15.17% 15.12% 10.38% 15.45% 17.61% 22.01% Profit Margin 15.83% 33.46% 5.11% -16.38% 26.40% 44.81% 52.75% -9.99% PEG 1.28 0.28 2.07 0.66 0.79 0.44 5.68 PE 26.55 5.03 41.62 7.07 13.22 8.56 72.02 Revenue(M) 535 374 846 318 680 834 327 403

News Headlines for WBMD WebMD Announces $75 Million Stock Repurchase Program - Aug 15, 2011 WebMD Announces $75 Million Stock Repurchase Program - Aug 15, 2011 WebMD Launches Leading Consumer Health App for Android - May 10, 2011 WebMD expects 1Q results to beat expectations - Apr 12, 2011 WebMD to buy back convertible notes - Dec 14, 2010

Company Details WEBMD HEALTH CP 111 EIGHTH AVE. NEW YORK, NY 10011 USA Phone: 212-624-3700 Fax: 212-624-3800 Website: http://www.webmd.com Full Time Employees: 1,630 Sector: Computer and Technology

Company Profile WebMD announced today that is has signed an agreement to acquire Conceptis Technologies Inc., a Montreal-based provider of online and offline medical education and promotion aimed at physicians and other healthcare professionals. Conceptis has been successful in developing a strong online presence in the cardiology community and is highly respected for the depth and breadth of content contained on its flagship. With the combination of two of the leading cardiology channels on the Internet, Medscape Cardiology and www.theheart.org, WebMD is well positioned to further its lead and penetration in this high value segment of medical marketing.

Power Gauge Ratings are created using a relative ranking system that assigns a rank of 0 to 100 (100 being the highest) to each stock in the universe. Rank is calculated by evaluating each of the stocks factors and combining them into a single number using a weighting formula. A stock's rank ranges from 100-0, where 100 is the strongest, and a rank of 95 indicates the stock is better than 95% of the stocks in the universe. Chaikin Stock Research(CSR) is not registered as a securities broker dealer or investment advisor with either the U.S. Securities and Exchange Commission or with any state securities regulatory authority. CSR is not responsible for trades executed by users of this research report, our web site or mobile app based on the information included herein. The information presented in this report does not represent a recommendation to buy or sell stocks or any financial instrument nor is it intended as an endorsement of any security or investment. The information in this report is generic by nature and is not personalized to the specific financial situation of any individual. The user bears complete responsibility for their own investment research and should seek the advice of a qualified investment professional before making any investment decisions. Copyright (c) 1978-(Present) by ZACKS Investment Research, Inc ("ZACKS"). The information, data, analyses and opinions contained herein (1) includes the confidential and proprietary information of ZACKS, (2) may not be copied or redistributed, for any purpose, (3) does not constitute investment advice offered by ZACKS, (4) are provided solely for informational purposes, and (5) are not warranted or represented to be correct, complete, accurate or timely. ZACKS shall not be responsible for investment decisions, damages or other losses resulting from, or related to, use of this information, data, analyses or opinions. Past performance is no guarantee of future performance. ZACKS is not affiliated with Chaikin Power Tools. This report from Chaikin Power Tools is for informational purposes only and is not a recommendation to buy or sell securities.

LM 2.3 DS 3.0 LS 2.1

Data Provided by ZACKS Investment Research, Inc., www.zacks.com

Special offers to trade stocks from optionsXpress: www.chaikinpowertools.com

You might also like

- PROBLEMS IN PARTNERSHIP DISSOLUTION AnswersDocument5 pagesPROBLEMS IN PARTNERSHIP DISSOLUTION Answersajeje50% (4)

- Rachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsDocument26 pagesRachel Fox: Short-Term Trading Tips and Strategies With Chaikin AnalyticsChaikin Analytics, LLC0% (1)

- Reading 37 - Case Study in Portfolio Management InstitutionalDocument2 pagesReading 37 - Case Study in Portfolio Management InstitutionalHieu NgNo ratings yet

- Stock Research Report For Brookdale Senr BKD As of 9/22/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Brookdale Senr BKD As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For BAC As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For BAC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For MA As of 7/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For MA As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Cooper Inds PLC CBE As of 9/22/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Cooper Inds PLC CBE As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For CMCSA As of 9/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For CMCSA As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For TW As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For TW As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report CSCO 29feb2012Document4 pagesChaikin Power Gauge Report CSCO 29feb2012Chaikin Analytics, LLCNo ratings yet

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For MRK As of 9/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For MRK As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For DD As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For DD As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report CVS 29feb2012Document4 pagesChaikin Power Gauge Report CVS 29feb2012Chaikin Analytics, LLCNo ratings yet

- Stock Research Report For DISH As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For DISH As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For EMC As of 7/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For EMC As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For MSFT As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WFC As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For WFC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report JPM 08sep2011Document4 pagesChaikin Power Gauge Report JPM 08sep2011Chaikin Analytics, LLC100% (2)

- Stock Research Report For BBBY As of 7/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For BBBY As of 7/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For ACN As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For ACN As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For HBC As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For HBC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For GS As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For GS As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For GOOG As of 6/23/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For GOOG As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For GIB As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For GIB As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report GMCR 29feb2012Document4 pagesChaikin Power Gauge Report GMCR 29feb2012Chaikin Analytics, LLCNo ratings yet

- Stock Research Report For Manulife Finl MFC As of 9/22/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Manulife Finl MFC As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For AXP As of 6/23/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For AXP As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc CF As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc CF As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc ATI As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc ATI As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For AIG As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For AIG As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc CYH As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc CYH As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report GILD 29feb2012Document4 pagesChaikin Power Gauge Report GILD 29feb2012Chaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For URBN As of 6/23/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For URBN As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For PNC As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For PNC As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For AXP As of 8/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For AXP As of 8/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For T As of 9/8/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For T As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc BIG As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc BIG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For RIMM As of 6/23/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For RIMM As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Research Report For ARG As of 6/23/11 - Chaikin Power ToolsDocument4 pagesResearch Report For ARG As of 6/23/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Amer Finl Group AFG As of 9/22/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Amer Finl Group AFG As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc AGCO As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc AGCO As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc ETR As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc ETR As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report AAPL 22jan2012Document4 pagesChaikin Power Gauge Report AAPL 22jan2012GM CapitalNo ratings yet

- Stock Research Report For Yamana Gold Inc AUY As of 9/22/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc AUY As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc EPD As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc EPD As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For UNH As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For UNH As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Curing Corporate Short-Termism: Future Growth vs. Current EarningsFrom EverandCuring Corporate Short-Termism: Future Growth vs. Current EarningsNo ratings yet

- Pick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsDocument14 pagesPick Bullish Stocks and Avoid The Bearish With Chaikin AnalyticsChaikin Analytics, LLCNo ratings yet

- Stock Market Tips From Marc ChaikinDocument4 pagesStock Market Tips From Marc ChaikinChaikin Analytics, LLCNo ratings yet

- 5 Simple Steps For Investing SmarterDocument66 pages5 Simple Steps For Investing SmarterChaikin Analytics, LLCNo ratings yet

- Stock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For MYL As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For WFC As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For WLT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For GM As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For ASNA As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For INTC As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For WYNN As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsDocument4 pagesStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report GMCR 29feb2012Document4 pagesChaikin Power Gauge Report GMCR 29feb2012Chaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report CVS 29feb2012Document4 pagesChaikin Power Gauge Report CVS 29feb2012Chaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report GILD 29feb2012Document4 pagesChaikin Power Gauge Report GILD 29feb2012Chaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc MMM As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Chaikin Power Gauge Report CSCO 29feb2012Document4 pagesChaikin Power Gauge Report CSCO 29feb2012Chaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc ITW As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc TSN As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Stock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc GAS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCNo ratings yet

- Derecognition of Financial InstrumentsDocument3 pagesDerecognition of Financial InstrumentsMinh TuệNo ratings yet

- INVESTMENTS With AnswersDocument3 pagesINVESTMENTS With AnswersShaira BugayongNo ratings yet

- Prima Plastics Initiating Coverage IDBI CapitalDocument12 pagesPrima Plastics Initiating Coverage IDBI CapitalAkhil ParekhNo ratings yet

- Rey Ocampo Online! FAR: Cash and Cash EquivalentsDocument3 pagesRey Ocampo Online! FAR: Cash and Cash EquivalentsMacy SantosNo ratings yet

- FM11 CH 07 Mini CaseDocument12 pagesFM11 CH 07 Mini CaseMariam Sharif100% (2)

- Capital Budgeting Cibg.Document36 pagesCapital Budgeting Cibg.Frederick Gbli100% (1)

- Case Study #6 - Hamilton Park VIII v1.0Document3 pagesCase Study #6 - Hamilton Park VIII v1.0Hari JNo ratings yet

- Institutional CapitalDocument4 pagesInstitutional Capitalkamideus100% (1)

- Financial Statement DoneDocument44 pagesFinancial Statement DoneRaisa Bint ZamanNo ratings yet

- Pamantasan NG CabuyaoDocument2 pagesPamantasan NG CabuyaoHhhhhNo ratings yet

- Garcia Vs Boi GR No. 92024Document2 pagesGarcia Vs Boi GR No. 92024JayMichaelAquinoMarquezNo ratings yet

- HG PresentationDocument31 pagesHG Presentationmrp1515No ratings yet

- Moneylife 26 October 2017Document68 pagesMoneylife 26 October 2017ADNo ratings yet

- Update Terbaru Struktur Organisasi Agt2022Document2 pagesUpdate Terbaru Struktur Organisasi Agt2022fmanggraNo ratings yet

- Capital Budgeting Project Selection MethodsDocument14 pagesCapital Budgeting Project Selection MethodsKazi HasanNo ratings yet

- MCQ - Financial ServicesDocument22 pagesMCQ - Financial ServicesRamees KpNo ratings yet

- Assignment On Private Company Vs Public Company in eDocument5 pagesAssignment On Private Company Vs Public Company in eSaravanagsNo ratings yet

- The Impact of Enterprise Systems On Corporate PerformanceDocument18 pagesThe Impact of Enterprise Systems On Corporate Performancemeetooa jeeveeshaNo ratings yet

- Orporations: Share Capital, Retained Earnings, and Financial ReportingDocument10 pagesOrporations: Share Capital, Retained Earnings, and Financial ReportingkakaoNo ratings yet

- MGMT E-2030 - Syllabus - Fall 2014 - 8 - 1 - 14Document20 pagesMGMT E-2030 - Syllabus - Fall 2014 - 8 - 1 - 14smey0% (1)

- Account TestDocument2 pagesAccount Testajay chaudhary0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument4 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencerahulNo ratings yet

- Tc-Ab Client Presentation 2020g1Document22 pagesTc-Ab Client Presentation 2020g1api-457482687No ratings yet

- Business and Finance Solution FinalDocument8 pagesBusiness and Finance Solution FinalRashid Ali JatoiNo ratings yet

- Problem 2-1: Pagador, Janelyne CDocument6 pagesProblem 2-1: Pagador, Janelyne CBhosx KimNo ratings yet

- Financial Management Theory and Practice Brigham 13th Edition Test Bank DownloadDocument33 pagesFinancial Management Theory and Practice Brigham 13th Edition Test Bank Downloadelainecannonjgzifkyxbe100% (26)

- Ejercicio Nro 8 SolucionnnnnnDocument9 pagesEjercicio Nro 8 SolucionnnnnnSugar Leonardo Herrera CoaquiraNo ratings yet

- Swiggy One Pager-3Document2 pagesSwiggy One Pager-3pratikvajaNo ratings yet