Professional Documents

Culture Documents

Different Types of Sales Incentive Payout Curves Explained - Aurochs Solutions

Different Types of Sales Incentive Payout Curves Explained - Aurochs Solutions

Uploaded by

ReeteyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Different Types of Sales Incentive Payout Curves Explained - Aurochs Solutions

Different Types of Sales Incentive Payout Curves Explained - Aurochs Solutions

Uploaded by

ReeteyCopyright:

Available Formats

+1 302 468 6969

info@aurochssolutions.com

REQUEST DEMO

September 11, 2020

Di#erent types of

sales incentive

payout curves

explained

Written by : Amit Jain No Comments

As an extension to our learning and

application of Payout Curves, here is last

one of the series. We started with

learning about fundamentals of payout

curve followed by best practices in

designing payout curves. With this article

we will learn about di?erent type of

payout curves that are used widely in the

pharma industry, and when to use them.

Di#erent types of incentive plans

There are two basic incentive schemes

that deAne all the di?erent incentive

plans – Commission and Bonus.

Commissions are a set percentage of

sales generated in the territory paid to

sales personnel. The commission rates

are determined on the gross margin of

the product and how much the company

is willing to share the revenue with the

sales personnel. If the sales are

generated solely from the e?ort the sales

personnel make, the commission is set to

a higher rate. If there are other market

factors involved, the commission rates

may be reduced. Commission plans are

preferred if the territories have similar

potential and the sales cycle are less than

90 days.

On the other hand, bonus structure

generally pays the sales personnel a

percentage of sales achievement or

speciAc objective. Bonus plans may also

pay a Axed dollar instead of a percentage

of incentive target when the sales

personnel achieve a predeAned

milestone. These plans work best when

the territories have uneven potential or if

the sales cycle is longer than 90 days.

Some Arms may also use a mix of bonus

and commission plans to iron out the

inconsistencies in territory potential and

to also motivate the sales personnel to

generate higher revenue.

Linear Payout Curves

Linear payout curves pay the salespeople

on a linear curve where each percentage

achievement corresponds to a speciAc

payout. The payout could be a

percentage of the product or portfolio

target or may be a speciAc dollar

amount.

The Linear curve can have a constant,

progressive, regressive or mixed

relationship with the payouts.

A constant linear curve will pay the

salespeople on a particular rate

regardless of the sales achievement.

Although this method prevents

undesired sales timing behavior, but it is

not motivating enough for the

salespeople to strive for sales beyond

their objectives.

Progressive curves solve this problem by

introducing a higher rate of payouts

above target, where the rewards for

making sales suddenly jumps if the sales

are made above quota. This rewards

your top performers and motivates them

to achieve greater sales. On the other

hand, it also brings its share of

challenges of setting the correct quota

for each territory, managing sales timing,

managing disproportionate e?ort to

boost sales of product where quota is

met and preventing windfall sales when

forecasts are too conservative.

Regressive curves tend to reduce the rate

of payouts once a certain benchmark is

achieved. This is the least popular

method among salesperson as it hinders

their capacity to earn high incentives.

Such curves are used mostly when there

are serious production/logistic limitations

and when the product sales are under

forecast.

Mixed linear curves combine the

progressive curves and the regressive

curves to make the best out of

motivating the salespeople to achieve

more than their quota and provide

protections of cost when the forecasts

are uncertain. The challenge for such

curves is to administer as it may become

complex and to set accurate goals across

territories to manage fairness.

Step Curves

Step curves are mostly used in tiered

plans where each tier has a di?erent

commission rate or bonus amount. Step

curves would be beneAcial in scenarios

where the market is unstable and the

forecasts are not accurate, but you want

your salespeople to just put some

additional e?orts to reach the higher tier

and earn additional income. Such curves

help the company keep a tight control on

the costs and they usually set the step

ranges where they are sure that the

return on the sales would be good.

Step curves are the norm for ranks plans,

as each rank or a group of ranks may be

paid a certain percentage of target or Pat

amount as incentives. Following are few

examples

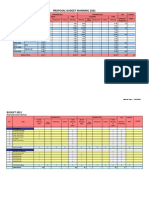

Matrix Payout

When you want to have multiple

measure to determine the payout for a

product, you can use the matrix curve

approach. The sales strategy and the

quality/measurability of data may vary

across products and channels. In such

scenarios, the management may choose

to rely on multiple metrics to determine

the payout. For example, the

management may want to tie the payout

to sales achievement as well as sales

growth to determine the product payout.

On the other hand, the management

may want to put qualiAers of a di?erent

metric to on the achievement for a

salesperson to earn incentives on one

product.

Payout matrix can either be additive or

synergistic. Two or more metrics may

keep adding incentives for a product

based on di?erent criteria or may be

plotted on a matrix to produce a singular

payout.

We will explore them in the below

graphs.

Conclusion

With the availability of multiple types of

curves and the thousands of

permutations and combinations, these

curves should be able to cover almost all

payout scenarios. A company may

choose one or more metric, one or

multiple curves or a combination of curve

types, to cater to di?erent products and

segments. A company should understand

its product and the market, the culture of

the salesforce and what they want it to

be, and the company’s strategic goals, to

be able to design an e?ective payout

curve.

Share :

Amit Jain

Leave a Reply

Your email address will not be published.

Required Aelds are marked *

Comment *

Name *

Email *

Website

Save my name, email, and website in this browser

for the next time I comment.

POST COMMENT

Latest Post

Why do spreadsheets for

calculating incentives miss the

mark

September 26, 2022 -- No

Comments

Management by Objective

(MBO)

August 4, 2022 -- No Comments

Best Incentive Compensation

Strategies for Pharma Sales

Teams

August 3, 2022 -- No Comments

Safety & Hygiene Essentials for

Incentive Operations

May 23, 2022 -- No Comments

It’s time to revolutionize the

way you manage your

incentives; upscale your

Incentive Management

May 6, 2022 -- No Comments

The Unexpected BeneSts of

Being a Sales Compensation

Software User

February 1, 2022 -- No Comments

A business-ready Incentive Compensation

solution that supports implementations and

changes in half the time at a third of the cost.

Company

Blog

About

Careers

Team

Platforms

Incentive Manager

Reporting & Communication Manager

Quota Manager

MBO Manager

Incentive Health Tracker

Roster Manager

Support

Contact Us

Data Security and Compliance

Portfolio

Privacy Policy

Get in Touch

3 Germay Dr, Unit 4 #1947 Wilmington DE

19804

City Vista, Oace #14A, 15 & 15A, 3rd Floor,

A-wing, Ashoka Nagar, Fountain road,

Kharadi, Pune, Maharashtra, India 411014

info@aurochssolutions.com

+1 302 468 6969

Copyright © 2022 Aurochs, All rights reserved.

You might also like

- 2nd Quarter Module Business MathematicsDocument49 pages2nd Quarter Module Business MathematicsNiejay Arcullo Llagas88% (16)

- SM: Red Batch-Group 9Document20 pagesSM: Red Batch-Group 9anandhuNo ratings yet

- PGMP Complete Reference SampleDocument45 pagesPGMP Complete Reference Samplemhamrawy100% (3)

- C Planning Campaigns - April 2021Document23 pagesC Planning Campaigns - April 2021George Osolo100% (3)

- Consumer Behavior Assignment On WiproDocument10 pagesConsumer Behavior Assignment On WiproHaris Naved Ahmed100% (1)

- JD Edwards - Advance PricingDocument186 pagesJD Edwards - Advance PricingToronto_ScorpionsNo ratings yet

- MODULE 4 Project-Quality-Management TDocument54 pagesMODULE 4 Project-Quality-Management TTewodros TadesseNo ratings yet

- CASE STUDY 2-3 University of GhanaDocument2 pagesCASE STUDY 2-3 University of GhanaEwura Esi Eyram Aboagyewaa67% (9)

- Anaplan Navigating Change Ebook v2Document8 pagesAnaplan Navigating Change Ebook v2Gopii GopiNo ratings yet

- Quotas the Sales Forecast and the Sales BudgetDocument3 pagesQuotas the Sales Forecast and the Sales Budgetiamaniketmaur.pcNo ratings yet

- 6 Secrets To Improve InsuranceDocument5 pages6 Secrets To Improve InsurancehenrydeeNo ratings yet

- The Promotions Growth FrameworkDocument15 pagesThe Promotions Growth FrameworkJosé SantosNo ratings yet

- HR Chapter 12Document4 pagesHR Chapter 12Gwenn PosoNo ratings yet

- Secrets For Sales Performance Success in InsuranceDocument6 pagesSecrets For Sales Performance Success in InsuranceRajula Gurva ReddyNo ratings yet

- Sales QuotaDocument6 pagesSales QuotaNisha NaazNo ratings yet

- Kelly A. Mcguire, Sas Institute Inc., Cary, NC Steve Pinchuk, Sas Institute Inc., Cary, NCDocument5 pagesKelly A. Mcguire, Sas Institute Inc., Cary, NC Steve Pinchuk, Sas Institute Inc., Cary, NCKamalNo ratings yet

- Jariatu MGMT AssignDocument10 pagesJariatu MGMT AssignHenry Bobson SesayNo ratings yet

- Sales Quotas, Budgeting & ControlDocument12 pagesSales Quotas, Budgeting & ControlAbhishek SisodiaNo ratings yet

- Sales ManagementDocument9 pagesSales ManagementSANJAY RATHINo ratings yet

- Allocating Sales Effort and QuotaDocument23 pagesAllocating Sales Effort and QuotaPrashant DubeyNo ratings yet

- Sales QuotasDocument3 pagesSales QuotasShreyas RiderNo ratings yet

- Sales Manage Ment FinalDocument9 pagesSales Manage Ment FinalVinisha MantriNo ratings yet

- Strategic ManagementDocument11 pagesStrategic ManagementTeena RawatNo ratings yet

- Five Actions To Boost Your Sales ResilienceDocument4 pagesFive Actions To Boost Your Sales ResilienceDwi RendraNo ratings yet

- Electric Model 3Document5 pagesElectric Model 3rezikaabdulkadirNo ratings yet

- Budgeting Approaches by DR MpsinghDocument26 pagesBudgeting Approaches by DR MpsinghNishant AnandNo ratings yet

- Bioba Hardware LTD.: Presented byDocument15 pagesBioba Hardware LTD.: Presented byTripti SinghNo ratings yet

- CapabilityBrief Salesforce Channel EffectivenessDocument4 pagesCapabilityBrief Salesforce Channel Effectiveness66 zhaoNo ratings yet

- Individual AssigmentDocument14 pagesIndividual AssigmentTamara AkmadzicNo ratings yet

- Module 15: Designing Compensation and Incentive ProgrammesDocument13 pagesModule 15: Designing Compensation and Incentive ProgrammesMostafaAhmedNo ratings yet

- RevSure White Paper Unlocking The Power of Marketing Using AI MLDocument20 pagesRevSure White Paper Unlocking The Power of Marketing Using AI MLfamiliafirmianoNo ratings yet

- Taguig City University: College of Business Management Pricing and CostingDocument27 pagesTaguig City University: College of Business Management Pricing and CostingLeigh MarianoNo ratings yet

- Sales Management 1 2Document2 pagesSales Management 1 2Srishti DhamijaNo ratings yet

- L4.2. Loshin & Reifer. Chap 2 The Value of Costomer Centricity-1Document8 pagesL4.2. Loshin & Reifer. Chap 2 The Value of Costomer Centricity-1Segundo VillenaNo ratings yet

- Sales Strategy - A Strategic Decision Area: 1. Classification of AccountsDocument7 pagesSales Strategy - A Strategic Decision Area: 1. Classification of AccountsALYZA ANGELA ORNEDONo ratings yet

- Unit-15 Sales Forecasting and Sales Quotas PDFDocument8 pagesUnit-15 Sales Forecasting and Sales Quotas PDFbhar4tp100% (1)

- Multiple Choice Questions: This Activity Contains 15 QuestionsDocument4 pagesMultiple Choice Questions: This Activity Contains 15 QuestionsRaman Kulkarni100% (1)

- Daily Wear: Business Management and StrategyDocument7 pagesDaily Wear: Business Management and StrategyMuhammad ArslanNo ratings yet

- Jari Managerial Accounting AssignmentDocument8 pagesJari Managerial Accounting AssignmentHenry Bobson SesayNo ratings yet

- Assignment Marketing ManagementDocument14 pagesAssignment Marketing ManagementAkash BawariyaNo ratings yet

- Techologys Impact On Optimizing Sales Coaching FinalDocument2 pagesTechologys Impact On Optimizing Sales Coaching FinalAdriana VillegasNo ratings yet

- Aberdeen Sales Effectiveness StudyDocument19 pagesAberdeen Sales Effectiveness StudykritiNo ratings yet

- Developing Sales Compensation Plan: Presented By: Raouf Hussain Roll No. 40Document19 pagesDeveloping Sales Compensation Plan: Presented By: Raouf Hussain Roll No. 40Sayima HabibNo ratings yet

- Sales Management. JunDocument7 pagesSales Management. Junshubham sawantNo ratings yet

- Effective Sales Comp Plans Q 42004Document11 pagesEffective Sales Comp Plans Q 42004Preeti SadhwaniNo ratings yet

- Revenue Management: What Is It and How Does It Work?Document9 pagesRevenue Management: What Is It and How Does It Work?prembhatia1No ratings yet

- Quota-Based Compensation Plans For Multi-Territory Heterogeneous Sales-ForcesDocument13 pagesQuota-Based Compensation Plans For Multi-Territory Heterogeneous Sales-ForcesMaria Paula Robles BulaNo ratings yet

- "Maximize Your Commission: Proven Strategies for Sales Success"From Everand"Maximize Your Commission: Proven Strategies for Sales Success"No ratings yet

- HBS BalanceScorecardDocument2 pagesHBS BalanceScorecardAhmad Jam50% (2)

- Sales QuotaDocument8 pagesSales QuotaKiran S RaoNo ratings yet

- Unit 8Document13 pagesUnit 8Zarin LaskerNo ratings yet

- Ma Unit 3Document18 pagesMa Unit 3Aastha SainiNo ratings yet

- Assignment On Sales and Distribution Management: Saintgits Institute of Management KottayamDocument4 pagesAssignment On Sales and Distribution Management: Saintgits Institute of Management KottayamKAILAS S NATH MBA19-21No ratings yet

- 13 Managing Sales PromotionDocument10 pages13 Managing Sales Promotionhii_bhartiNo ratings yet

- What Is Sales ForecastingDocument7 pagesWhat Is Sales Forecastingshahryarahmad017No ratings yet

- An Innovative Step in Loyalty programs-LOYESYSDocument18 pagesAn Innovative Step in Loyalty programs-LOYESYSJason MullerNo ratings yet

- Sales QuotasDocument10 pagesSales QuotasbubbyindiaNo ratings yet

- Solution Brochure - Solutions For SAP - Incentive CompensationDocument4 pagesSolution Brochure - Solutions For SAP - Incentive CompensationmilenaNo ratings yet

- Performance Management4Document13 pagesPerformance Management4s dNo ratings yet

- Part 3Document89 pagesPart 3mohammad iqbal aminNo ratings yet

- TVSRAO @ 2Document12 pagesTVSRAO @ 2vasantharaoNo ratings yet

- COMExam HandbookDocument260 pagesCOMExam HandbookRabiya SajjadNo ratings yet

- Pricing Strategy - AssignmentDocument19 pagesPricing Strategy - AssignmentHitesh PatniNo ratings yet

- Tips For Acquiring and Retaining Customers Through Economic ChangeDocument16 pagesTips For Acquiring and Retaining Customers Through Economic Changebshirley2No ratings yet

- Doha and Bali PackageDocument4 pagesDoha and Bali PackageSami ullah khan BabarNo ratings yet

- Idea Bridge - 100 Success Plan For Crisis Recovery & New CeoDocument6 pagesIdea Bridge - 100 Success Plan For Crisis Recovery & New CeoJairo H Pinzón CastroNo ratings yet

- Construction Project Planning and Scheduling Using Microsoft Project 73rd Intake (13, 15, 17, 21, 22 & 24 May 2019)Document2 pagesConstruction Project Planning and Scheduling Using Microsoft Project 73rd Intake (13, 15, 17, 21, 22 & 24 May 2019)Jinxian Xu0% (1)

- Chapter-1: 1.1 Introduction of Small BusinessDocument23 pagesChapter-1: 1.1 Introduction of Small Businesssonia_dahal2336No ratings yet

- Blue Ocean Strategy at HenkelDocument7 pagesBlue Ocean Strategy at HenkelNoviatni Dwi UtamiNo ratings yet

- Angie Saunders Resume 10Document2 pagesAngie Saunders Resume 10api-248028750No ratings yet

- C 19233 EntryDocument2 pagesC 19233 EntryFredrickNo ratings yet

- Marketing Strategy of HCL Infosystem LTDDocument2 pagesMarketing Strategy of HCL Infosystem LTDjadeja indravijaysinhNo ratings yet

- RCM vs. FMEA - There Is A Distinct Difference!: RCM - Reliability Centered MaintenanceDocument4 pagesRCM vs. FMEA - There Is A Distinct Difference!: RCM - Reliability Centered Maintenanceg_viegasNo ratings yet

- What Is CRM?: Chapter # 3Document11 pagesWhat Is CRM?: Chapter # 3Sunaina ZakiNo ratings yet

- Model Canevas 3Document10 pagesModel Canevas 3Hind Nia BenbrahimNo ratings yet

- Enterprise Security Risk Management: Data Is PotentialDocument15 pagesEnterprise Security Risk Management: Data Is PotentialKampeephorn SantipojchanaNo ratings yet

- Glossary of Tax Terms - OECDDocument30 pagesGlossary of Tax Terms - OECDKhalil El AssaadNo ratings yet

- CHAPTER 9 Written ReportDocument17 pagesCHAPTER 9 Written ReportSharina Mhyca SamonteNo ratings yet

- SCM SlidesDocument15 pagesSCM SlidesAmna NoorNo ratings yet

- MGT305 Ass1Document5 pagesMGT305 Ass1Trần Phước Diễm TrangNo ratings yet

- Pharma Analytics: SFE (Sales Force Effectiveness) Sales Analytics, Incentive Compensation & Reporting CapabilitiesDocument94 pagesPharma Analytics: SFE (Sales Force Effectiveness) Sales Analytics, Incentive Compensation & Reporting CapabilitiesDinesh IitmNo ratings yet

- Case Study & Marketing Strategies of Axis Bank: Tolani College of CommerceDocument56 pagesCase Study & Marketing Strategies of Axis Bank: Tolani College of Commerce2kd Termanito100% (1)

- Quiz No. 1 Discount SeriesDocument2 pagesQuiz No. 1 Discount SeriesAngelicaHermoParas100% (1)

- MOA With ARBOs, CLAAPDocument24 pagesMOA With ARBOs, CLAAPMaita GuanzonNo ratings yet

- Budget Manning 2022 V01Document13 pagesBudget Manning 2022 V01Marnhy SNo ratings yet

- Law of Comparative AdvantageDocument11 pagesLaw of Comparative Advantage12jaya21No ratings yet

- EntryDocument6 pagesEntryadomniteimiki2No ratings yet

- Doing Deals in PEDocument139 pagesDoing Deals in PEHarjot SinghNo ratings yet

- Application-Company Corporate Credit Card PDFDocument2 pagesApplication-Company Corporate Credit Card PDFsantoshkumarNo ratings yet

- Best Practices For Work-At-Home (WAH) Operations: Webinar SeriesDocument24 pagesBest Practices For Work-At-Home (WAH) Operations: Webinar SeriesHsekum AtpakNo ratings yet