Professional Documents

Culture Documents

Statement of Financial Position: Accounting 2

Statement of Financial Position: Accounting 2

Uploaded by

SHARMAINE JOY FULGARCopyright:

Available Formats

You might also like

- Essential Oils Business PlanDocument35 pagesEssential Oils Business PlanSwagat R Pyakurel73% (15)

- Full Solution Manual Accounting 8th Edition by John Hoggett SLW1014Document68 pagesFull Solution Manual Accounting 8th Edition by John Hoggett SLW1014Sm Help80% (5)

- Employee Final SettlementDocument1 pageEmployee Final SettlementZeeshan Mirza50% (2)

- FABM 2 - Chapter 1-2Document34 pagesFABM 2 - Chapter 1-2wild lunaNo ratings yet

- Fabm2 Week 1 HandoutsDocument6 pagesFabm2 Week 1 HandoutsDane J. CayabyabNo ratings yet

- Basic Accounting-Made EasyDocument20 pagesBasic Accounting-Made EasyRoy Kenneth Lingat100% (1)

- Fabm - Q 1 - Week 1Document11 pagesFabm - Q 1 - Week 1Liam Aleccis Obrero CabanitNo ratings yet

- Module 2 Accounting For Service Business PDFDocument20 pagesModule 2 Accounting For Service Business PDFKem Paulo Que67% (3)

- Fabm 2Document5 pagesFabm 2Robillos FaithNo ratings yet

- INTACC1 Chap 1 9Document14 pagesINTACC1 Chap 1 9Rommel estrellado100% (1)

- FABM2 1st Half of 1st Quarter Reviewer ACRSDocument2 pagesFABM2 1st Half of 1st Quarter Reviewer ACRSAfeiyha Czarina SantiagoNo ratings yet

- FABM1 Module C2Document11 pagesFABM1 Module C2Nathan CapsaNo ratings yet

- Acca101 SGDocument4 pagesAcca101 SGBeatrice Dominique C. PepinoNo ratings yet

- FABM2 - Statement of Financial PositionDocument36 pagesFABM2 - Statement of Financial PositionVron Blatz100% (6)

- Basic Accounting ModuleDocument4 pagesBasic Accounting ModuleHazel Joy Batocail100% (1)

- Conceptual Framework and Theoretical Structure of Financial Accounting and Reporting, Part IIDocument16 pagesConceptual Framework and Theoretical Structure of Financial Accounting and Reporting, Part IIJi BaltazarNo ratings yet

- Module 2 Accounting For Service BusinessDocument20 pagesModule 2 Accounting For Service Businessmariella ellaNo ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- Basic Accounting ReviewDocument75 pagesBasic Accounting ReviewSofie SergioNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (2)

- Fabm2 Module-1-Week-1Document11 pagesFabm2 Module-1-Week-1Cha Eun WooNo ratings yet

- Understanding Business Assets and LiabilitiesDocument12 pagesUnderstanding Business Assets and LiabilitiesBP Samonte IINo ratings yet

- Accounting Fundamentals: The Accounting Equation and The Double-Entry SystemDocument70 pagesAccounting Fundamentals: The Accounting Equation and The Double-Entry SystemAllana Mier100% (1)

- Conceptual Framework For Financial ReportingDocument2 pagesConceptual Framework For Financial ReportingNahanni EllamaNo ratings yet

- Balance SheetDocument20 pagesBalance SheetJust Some Guy without a MustacheNo ratings yet

- Further Sub Classifications of The Line Items Shall Be Disclosed Either Directly in The Statement ofDocument8 pagesFurther Sub Classifications of The Line Items Shall Be Disclosed Either Directly in The Statement ofMichael AquinoNo ratings yet

- Accounting Policy Frameworks Asset Accounting FrameworkDocument38 pagesAccounting Policy Frameworks Asset Accounting Frameworkcole_sg100% (1)

- Lesson 1 The Statement of Financial PositionDocument11 pagesLesson 1 The Statement of Financial PositionFranchesca Calma100% (1)

- ABM 2 - Statement of Financial PositionDocument19 pagesABM 2 - Statement of Financial PositionMarlou Chester BendañoNo ratings yet

- Intermediate Accounting 3 (Reviewer)Document6 pagesIntermediate Accounting 3 (Reviewer)Eury Zin GalvezNo ratings yet

- Week 5 Financial Statement and The Reporting Entity Part 1Document7 pagesWeek 5 Financial Statement and The Reporting Entity Part 1Roshane Deil PascualNo ratings yet

- Bsac 306 - Govacc Seatwork 1 Overview of Govt Acctg-Student Copy - RoldanDocument6 pagesBsac 306 - Govacc Seatwork 1 Overview of Govt Acctg-Student Copy - RoldanJheraldinemae RoldanNo ratings yet

- Cfas Notes Salisid: Chapter 02: Conceptual FrameworkDocument5 pagesCfas Notes Salisid: Chapter 02: Conceptual FrameworkBerdel PascoNo ratings yet

- Ifrs For SMEsDocument104 pagesIfrs For SMEsApril AcboNo ratings yet

- FABM 2 Third Quarter Test ReviewerDocument5 pagesFABM 2 Third Quarter Test ReviewergracehelenNo ratings yet

- Cieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Document10 pagesCieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Venus Frias-Antonio100% (1)

- Pas 36: Impairment of Assets: ObjectiveDocument6 pagesPas 36: Impairment of Assets: ObjectiveLEIGHANNE ZYRIL SANTOSNo ratings yet

- Conceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBADocument46 pagesConceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBACarmela BuluranNo ratings yet

- Basic Financial StatementsDocument11 pagesBasic Financial StatementsOmaYr RatherNo ratings yet

- Bus 505 - Final Exam Assignment - Umama Alam - 2125119660Document22 pagesBus 505 - Final Exam Assignment - Umama Alam - 2125119660Shiny StarNo ratings yet

- Ch2 Measuring & Evaluating Financial Position & PerformanceDocument5 pagesCh2 Measuring & Evaluating Financial Position & PerformanceheyNo ratings yet

- Unit 1 External Financial Statements and Revenue RecognitionDocument31 pagesUnit 1 External Financial Statements and Revenue Recognitionestihdaf استهدافNo ratings yet

- Financial Management Part 1Document44 pagesFinancial Management Part 1Neil VillasNo ratings yet

- Financial Management-Part 1Document44 pagesFinancial Management-Part 1Papa KingNo ratings yet

- FA1-01 - Accounting Framework - 2013 Edition - PortraitDocument5 pagesFA1-01 - Accounting Framework - 2013 Edition - PortraitFloyd Alexis RafananNo ratings yet

- Accounting Midterms ReviwerDocument5 pagesAccounting Midterms ReviwermariaNo ratings yet

- 1 SFPDocument29 pages1 SFPRocky BassigNo ratings yet

- Fundamentals of Accounting, Business and Management 2: Quarter 1-Module 1: Statement of Financial Position (SFP)Document20 pagesFundamentals of Accounting, Business and Management 2: Quarter 1-Module 1: Statement of Financial Position (SFP)Arvin Salazar Llaneta100% (1)

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionAgatha ApolinarioNo ratings yet

- Intermediate Accounting 2: Carmela L. PeducheDocument9 pagesIntermediate Accounting 2: Carmela L. PeducheJohn Matthew Del RosarioNo ratings yet

- Urdaneta City University: Owned and Operated by The City Government of UrdanetaDocument5 pagesUrdaneta City University: Owned and Operated by The City Government of UrdanetaBen Vallecer Espiritu Jr.No ratings yet

- Balance SheetDocument29 pagesBalance SheetKoo TaehyungNo ratings yet

- IAS 36 NotesDocument5 pagesIAS 36 NotesArsalan AliNo ratings yet

- Acc CountingDocument37 pagesAcc CountingJessalyn Sarmiento TancioNo ratings yet

- Accounting 2 1st ModuleDocument23 pagesAccounting 2 1st ModuleJessalyn Sarmiento TancioNo ratings yet

- ACCOUNTiNG PPT For DEMODocument15 pagesACCOUNTiNG PPT For DEMOJINKY TOLENTINONo ratings yet

- Week 2 FABM2 1Document28 pagesWeek 2 FABM2 1Jeremy SolomonNo ratings yet

- Pas 21-The Effects of Changes in Foreign Exchange RatesDocument3 pagesPas 21-The Effects of Changes in Foreign Exchange RatesAryan LeeNo ratings yet

- Business Finance Chapter 3Document42 pagesBusiness Finance Chapter 3chloe frostNo ratings yet

- Intermediate Accounting 3 Chapter 1Document3 pagesIntermediate Accounting 3 Chapter 1Lea EndayaNo ratings yet

- Mary Joy L. Amigos Rice Store Notes To The Financial StatementsDocument5 pagesMary Joy L. Amigos Rice Store Notes To The Financial StatementsLizanne GauranaNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- FS and FS AnalysisDocument47 pagesFS and FS AnalysisSHARMAINE JOY FULGARNo ratings yet

- FS & Fin - AnalysisDocument40 pagesFS & Fin - AnalysisSHARMAINE JOY FULGARNo ratings yet

- Statement of Cash FlowDocument19 pagesStatement of Cash FlowSHARMAINE JOY FULGARNo ratings yet

- The Statement of Changes in EquityDocument21 pagesThe Statement of Changes in EquitySHARMAINE JOY FULGARNo ratings yet

- Filipino Value SystemDocument7 pagesFilipino Value SystemSHARMAINE JOY FULGARNo ratings yet

- Actual Based Costing vs. Traditional ApproachDocument4 pagesActual Based Costing vs. Traditional ApproachSHARMAINE JOY FULGARNo ratings yet

- Fortuitous (ABC) TRADITIONAL COSTING & ACTUAL-BASED COSTINGDocument6 pagesFortuitous (ABC) TRADITIONAL COSTING & ACTUAL-BASED COSTINGSHARMAINE JOY FULGARNo ratings yet

- Las q2 Fabm 2 Week 4Document10 pagesLas q2 Fabm 2 Week 4Mahika BatumbakalNo ratings yet

- ''Assignment 3 SOLUTIONDocument7 pages''Assignment 3 SOLUTIONFega AbrahamNo ratings yet

- Co-Ownership, Estates and TrustsDocument13 pagesCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Income Tax On CorporationsDocument8 pagesIncome Tax On CorporationsDevonNo ratings yet

- Succession Planning and Strategies For Harvesting and Ending The VentureDocument17 pagesSuccession Planning and Strategies For Harvesting and Ending The VentureFarihaNo ratings yet

- Cost Management and Corporate Performance in Quoted Manufacturing Companies in NigeriaDocument7 pagesCost Management and Corporate Performance in Quoted Manufacturing Companies in NigeriaThe IjbmtNo ratings yet

- Original Principles of Managerial Finance Brief 8Th Edition by Chad J Zutter Full ChapterDocument41 pagesOriginal Principles of Managerial Finance Brief 8Th Edition by Chad J Zutter Full Chapteralton.hopper106100% (21)

- Marketing Metrics: Ts. Lê Thùy Hương Khoa MarketingDocument23 pagesMarketing Metrics: Ts. Lê Thùy Hương Khoa MarketingDuy TrầnNo ratings yet

- Valuation of SharesDocument24 pagesValuation of Sharesshalini0703No ratings yet

- Powerpoint Business PlanDocument19 pagesPowerpoint Business PlanMoslimahNo ratings yet

- Examples Group Strucre ChangeDocument8 pagesExamples Group Strucre ChangeAMNA T.ZNo ratings yet

- Accounting 101 - Final Exam Part 4Document15 pagesAccounting 101 - Final Exam Part 4AuroraNo ratings yet

- MGT 303Document14 pagesMGT 303JD dOlMa YouNo ratings yet

- Workshop 5 QsDocument7 pagesWorkshop 5 QsNaresh SehdevNo ratings yet

- YatharthDocument8 pagesYatharthCp918315No ratings yet

- Working Capital Kesoram FinanceDocument56 pagesWorking Capital Kesoram FinanceRamana GNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument45 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORTitan KNo ratings yet

- 8 Production, Costs, ProfitDocument23 pages8 Production, Costs, Profittiellenfonseca2012No ratings yet

- Name: - Date: - QuizDocument4 pagesName: - Date: - QuizKatrine Clarisse BlanquiscoNo ratings yet

- Monthly Salary & Other Income Statement: 2008-09Document26 pagesMonthly Salary & Other Income Statement: 2008-09api-26910047No ratings yet

- RGGLV BrochureDocument8 pagesRGGLV Brochurerajiv11juneNo ratings yet

- CROMBONDS Memory Aid (Case Digests)Document31 pagesCROMBONDS Memory Aid (Case Digests)Juan Samuel IsmaelNo ratings yet

- FA of SPDocument8 pagesFA of SPShivangi AggarwalNo ratings yet

- CA Assignment 2Document13 pagesCA Assignment 2Methly MorenoNo ratings yet

- Cross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameDocument7 pagesCross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameRebecca Fady El-hajjNo ratings yet

- REO - Auditing 1st Preboard May 2022Document15 pagesREO - Auditing 1st Preboard May 2022Marielle GonzalvoNo ratings yet

- Trias Sentosa AR & Sustainability Report 2020 - NewDocument196 pagesTrias Sentosa AR & Sustainability Report 2020 - NewSentosa DunamisNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument33 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoonNo ratings yet

Statement of Financial Position: Accounting 2

Statement of Financial Position: Accounting 2

Uploaded by

SHARMAINE JOY FULGAROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Financial Position: Accounting 2

Statement of Financial Position: Accounting 2

Uploaded by

SHARMAINE JOY FULGARCopyright:

Available Formats

ACCOUNTING 2

STATEMENT OF

FINANCIAL POSITION

SHS-ACCTG 2 | Ms. Maine Fulgar

Objectives:

Identify the elements of the SFP and describe each of

item

Classify the elements of the SFP into current and non-

current items

Prepare the SFP for Sole Proprietorship

Prepare an SFP using the report form and the account

form with proper classification of items as current

and non-current.

SHS-ACCTG 2 | Ms. Maine Fulgar

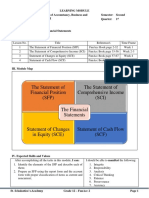

FINANCIAL

STATEMENT

SHS-ACCTG 2 | Ms. Maine Fulgar

A structured representations of the

financial position and financial

FINANCIAL performance of the entity. The

STATEMENT objective of financial statements is to

provide information about the financial

position, financial performance, and

cash flows of an entity that is useful to a

wide range of users in making proper

economic decisions.

SHS-ACCTG 2 | Ms. Maine Fulgar

FINANCIAL STATEMENT

Financial Statement also show the results of the management

stewardship of the resources entrusted to it. To meet this objective,

financial statements provide information about an entity’s;

1. Assets

2. Liabilities

3. Equity

4. Income and Expenses, including gains and losses.

5. Contributions by and Contributions to Owners in

their capacity as owners.

6. Cash Flow

SHS-ACCTG 2 | Ms. Maine Fulgar

Also known as the balance sheet.

This statement includes the

STATEMENT amounts of the company’s total

OF FINANCIAL assets, liabilities, and owner’s

equity which in totality provides

POSITION the condition of the company on a

specific date.

SHS-ACCTG 2 | Ms. Maine Fulgar

Review of Balance Sheet Elements

Assets resources owned by an entity. as a result of past

events and from which future economic benefits are

expected to flow to the entity

Liabilities is a present obligation of the entity arising from past

events, the settlement of which is expected to result

in an outflow from the entity of resources embodying

economic benefits

Equity is the residual interest in the assets of the entity after

deducting all its liabilities.

SHS-ACCTG 2 | Ms. Maine Fulgar

The Accounting Equation

Liabilities

ASSETS

Owner's

Equity

SHS-ACCTG 2 | Ms. Maine Fulgar

The Accounting Equation

CURRENT

LIABILITIES

NONCURRENT

CURRENT

LIABILITIES

ASSETS

NONCURRENT

ASSETS

EQUITY

SHS-ACCTG 2 | Ms. Maine Fulgar

The SFP also shows us the very basic formula in

accounting:

Assets = Liabilities + Equity

or

ALE

Thus, assets should always equal to the sum of

liabilities and capital. SFP is called Balance Sheet as it

shows sheet where two sides are always equal or

balance.

SHS-ACCTG 2 | Ms. Maine Fulgar

Elements of the Statement of Financial Position

CURRENT ASSETS

It expects to realize the asset, or intend to sell or consume it, in its normal operating

cycle.

It holds the asset primarily for the purpose of trading.

It expects to realize asset within the twelve months after the reporting period;

The Asset is cash or cash equivalent , unless the asset is restricted from being

exchanged or used to settle a liability for at least 12 months after the reporting period.

1. Cash and Cash Equivalents

2. Accounts Receivable

3. Inventories

4. Prepaid Expenses

5. Marketable Equity Securities

6. Office and Store Supplies SHS-ACCTG 2 | Ms. Maine Fulgar

Elements of the Statement of Financial Position

NONCURRENT ASSETS

Assets that cannot be realized(collected, sold, used up) one year after

year- end date.

1. Property, Plant and Equipment

2. Machinery

3. Land Improvements

4. Intangible Assets

SHS-ACCTG 2 | Ms. Maine Fulgar

Elements of the Statement of Financial Position

CURRENT LIABILITIES

·It expects to settle the liability in its normal operating cycle

·It holds the liability primarily for the purpose of trading

·The liability is due to be settled within 12 months after the reporting period;

·It does not have an unconditional right to defer settlement of the liability for at

least 12months after the reporting period.

1. Trade Account Payable

2. Accrued Expenses (Utilities &

Salaries)

3. Unearned Income

4. Current Income Tax Payable

SHS-ACCTG 2 | Ms. Maine Fulgar

Elements of the Statement of Financial Position

NONCURRENT LIABILITIES

Liabilities that do not fall due (paid, recognized as revenue) within

one year after the year-end date.

1. Loans Payable

2. Mortgage Payable

SHS-ACCTG 2 | Ms. Maine Fulgar

Elements of the Statement of Financial Position

Equity

Equity is the excess of assets over liabilities. Hence, equity is the

net assets of the business. This represents capital contributed by

the owners.It will increase due to accumulated income and

additional investments; It will decrease because of accumulated

loss and owner’s withdrawals.

SHS-ACCTG 2 | Ms. Maine Fulgar

KNOWLEDGE CHECK

Determine if the following are Current Assets, Current

Liabilities, Noncurrent assets, or Noncurrent Liabilities:

1. Salaries and wages payable

SHS-ACCTG 2 | Ms. Maine Fulgar

KNOWLEDGE CHECK

Determine if the following are Current Assets, Current

Liabilities, Noncurrent assets, or Noncurrent Liabilities:

1. Salaries and wages payable

2. Property, Plant and Equipment

SHS-ACCTG 2 | Ms. Maine Fulgar

KNOWLEDGE CHECK

Determine if the following are Current Assets, Current

Liabilities, Noncurrent assets, or Noncurrent Liabilities:

1. Salaries and wages payable

2. Property, Plant and Equipment

3. Cash and Cash Equivalent

SHS-ACCTG 2 | Ms. Maine Fulgar

KNOWLEDGE CHECK

Determine if the following are Current Assets, Current

Liabilities, Noncurrent assets, or Noncurrent Liabilities:

1. Salaries and wages payable

2. Property, Plant and Equipment

3. Cash and Cash Equivalent

4. Loans Payable

SHS-ACCTG 2 | Ms. Maine Fulgar

KNOWLEDGE CHECK

Determine if the following are Current Assets, Current

Liabilities, Noncurrent assets, or Noncurrent Liabilities:

1. Salaries and wages payable

2. Property, Plant and Equipment

3. Cash and Cash Equivalent

4. Loans Payable

5. Trade Accounts Payable

SHS-ACCTG 2 | Ms. Maine Fulgar

Debit Side Credit Side

Assets Liabilities

Current Assets Current Liabilities

Accounts Receivable Accounts Payable

Accrued Income Accrued Expenses

Inventory Unearned Income

Prepaid Expenses Notes Payable

Noncurrent Assets Noncurrent Liabilities

Long Term Investments Mortgage Payable

Intangible Assets Loans Payable

Property, Plant and Equipment

Owner’s Equity

SHS-ACCTG 2 | Ms. Maine Fulgar

How to create

Statement of Financial Position

(SFP)?

A. Heading

Name of the Company

Name of the Statement

Date of preparation (emphasis on the wording – “as of”)

SHS-ACCTG 2 | Ms. Maine Fulgar

Account Form Format

Growth in Demand

Re

po

rt

Fo

rm

Fo

rm

at

Preparation of Statement of Financial Position

SFP is prepared from the Trial balance.

In the Trial balance, Assets are usually at the top, followed by Liabilities, Equity,

Revenue and Expenses. Take note that balance sheet consists of Assets, Liabilities

and Equity only.

The easiest way to prepare a balance sheet is to identify the account if it an asset,

liability or equity. Before you prepare the Balance Sheet.

Assets

Debit Credit

(Dr) (Cr)

SHS-ACCTG 2 | Ms. Maine Fulgar

Sample questions:

Learning is Fun Company generated revenues amounting to

Php 100,000. Expenses for the year totaled Php 76,000. How

much is the company’s net income for the year?

SHS-ACCTG 2 | Ms. Maine Fulgar

Sample questions:

Happy Selling’s had the following accounts at year end: Cash-

250,000, Accounts Payable-70,000, Prepaid Expense-15,000.

Compute for the company’s current assets.

SHS-ACCTG 2 | Ms. Maine Fulgar

Using the following information, prepare a properly classified Statement of Financial Position for

Graduation Company as at December 31, 20X1 under:

a. Report form

b. Account form

SHS-ACCTG 2 | Ms. Maine Fulgar

You might also like

- Essential Oils Business PlanDocument35 pagesEssential Oils Business PlanSwagat R Pyakurel73% (15)

- Full Solution Manual Accounting 8th Edition by John Hoggett SLW1014Document68 pagesFull Solution Manual Accounting 8th Edition by John Hoggett SLW1014Sm Help80% (5)

- Employee Final SettlementDocument1 pageEmployee Final SettlementZeeshan Mirza50% (2)

- FABM 2 - Chapter 1-2Document34 pagesFABM 2 - Chapter 1-2wild lunaNo ratings yet

- Fabm2 Week 1 HandoutsDocument6 pagesFabm2 Week 1 HandoutsDane J. CayabyabNo ratings yet

- Basic Accounting-Made EasyDocument20 pagesBasic Accounting-Made EasyRoy Kenneth Lingat100% (1)

- Fabm - Q 1 - Week 1Document11 pagesFabm - Q 1 - Week 1Liam Aleccis Obrero CabanitNo ratings yet

- Module 2 Accounting For Service Business PDFDocument20 pagesModule 2 Accounting For Service Business PDFKem Paulo Que67% (3)

- Fabm 2Document5 pagesFabm 2Robillos FaithNo ratings yet

- INTACC1 Chap 1 9Document14 pagesINTACC1 Chap 1 9Rommel estrellado100% (1)

- FABM2 1st Half of 1st Quarter Reviewer ACRSDocument2 pagesFABM2 1st Half of 1st Quarter Reviewer ACRSAfeiyha Czarina SantiagoNo ratings yet

- FABM1 Module C2Document11 pagesFABM1 Module C2Nathan CapsaNo ratings yet

- Acca101 SGDocument4 pagesAcca101 SGBeatrice Dominique C. PepinoNo ratings yet

- FABM2 - Statement of Financial PositionDocument36 pagesFABM2 - Statement of Financial PositionVron Blatz100% (6)

- Basic Accounting ModuleDocument4 pagesBasic Accounting ModuleHazel Joy Batocail100% (1)

- Conceptual Framework and Theoretical Structure of Financial Accounting and Reporting, Part IIDocument16 pagesConceptual Framework and Theoretical Structure of Financial Accounting and Reporting, Part IIJi BaltazarNo ratings yet

- Module 2 Accounting For Service BusinessDocument20 pagesModule 2 Accounting For Service Businessmariella ellaNo ratings yet

- Accounting C2 Lesson 1 PDFDocument5 pagesAccounting C2 Lesson 1 PDFJake ShimNo ratings yet

- Basic Accounting ReviewDocument75 pagesBasic Accounting ReviewSofie SergioNo ratings yet

- Financial StatementsDocument27 pagesFinancial StatementsIrish Castillo100% (2)

- Fabm2 Module-1-Week-1Document11 pagesFabm2 Module-1-Week-1Cha Eun WooNo ratings yet

- Understanding Business Assets and LiabilitiesDocument12 pagesUnderstanding Business Assets and LiabilitiesBP Samonte IINo ratings yet

- Accounting Fundamentals: The Accounting Equation and The Double-Entry SystemDocument70 pagesAccounting Fundamentals: The Accounting Equation and The Double-Entry SystemAllana Mier100% (1)

- Conceptual Framework For Financial ReportingDocument2 pagesConceptual Framework For Financial ReportingNahanni EllamaNo ratings yet

- Balance SheetDocument20 pagesBalance SheetJust Some Guy without a MustacheNo ratings yet

- Further Sub Classifications of The Line Items Shall Be Disclosed Either Directly in The Statement ofDocument8 pagesFurther Sub Classifications of The Line Items Shall Be Disclosed Either Directly in The Statement ofMichael AquinoNo ratings yet

- Accounting Policy Frameworks Asset Accounting FrameworkDocument38 pagesAccounting Policy Frameworks Asset Accounting Frameworkcole_sg100% (1)

- Lesson 1 The Statement of Financial PositionDocument11 pagesLesson 1 The Statement of Financial PositionFranchesca Calma100% (1)

- ABM 2 - Statement of Financial PositionDocument19 pagesABM 2 - Statement of Financial PositionMarlou Chester BendañoNo ratings yet

- Intermediate Accounting 3 (Reviewer)Document6 pagesIntermediate Accounting 3 (Reviewer)Eury Zin GalvezNo ratings yet

- Week 5 Financial Statement and The Reporting Entity Part 1Document7 pagesWeek 5 Financial Statement and The Reporting Entity Part 1Roshane Deil PascualNo ratings yet

- Bsac 306 - Govacc Seatwork 1 Overview of Govt Acctg-Student Copy - RoldanDocument6 pagesBsac 306 - Govacc Seatwork 1 Overview of Govt Acctg-Student Copy - RoldanJheraldinemae RoldanNo ratings yet

- Cfas Notes Salisid: Chapter 02: Conceptual FrameworkDocument5 pagesCfas Notes Salisid: Chapter 02: Conceptual FrameworkBerdel PascoNo ratings yet

- Ifrs For SMEsDocument104 pagesIfrs For SMEsApril AcboNo ratings yet

- FABM 2 Third Quarter Test ReviewerDocument5 pagesFABM 2 Third Quarter Test ReviewergracehelenNo ratings yet

- Cieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Document10 pagesCieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Venus Frias-Antonio100% (1)

- Pas 36: Impairment of Assets: ObjectiveDocument6 pagesPas 36: Impairment of Assets: ObjectiveLEIGHANNE ZYRIL SANTOSNo ratings yet

- Conceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBADocument46 pagesConceptual Framew Ork and Accountin G Standards: Justiniano L. Santos, CPA, MBACarmela BuluranNo ratings yet

- Basic Financial StatementsDocument11 pagesBasic Financial StatementsOmaYr RatherNo ratings yet

- Bus 505 - Final Exam Assignment - Umama Alam - 2125119660Document22 pagesBus 505 - Final Exam Assignment - Umama Alam - 2125119660Shiny StarNo ratings yet

- Ch2 Measuring & Evaluating Financial Position & PerformanceDocument5 pagesCh2 Measuring & Evaluating Financial Position & PerformanceheyNo ratings yet

- Unit 1 External Financial Statements and Revenue RecognitionDocument31 pagesUnit 1 External Financial Statements and Revenue Recognitionestihdaf استهدافNo ratings yet

- Financial Management Part 1Document44 pagesFinancial Management Part 1Neil VillasNo ratings yet

- Financial Management-Part 1Document44 pagesFinancial Management-Part 1Papa KingNo ratings yet

- FA1-01 - Accounting Framework - 2013 Edition - PortraitDocument5 pagesFA1-01 - Accounting Framework - 2013 Edition - PortraitFloyd Alexis RafananNo ratings yet

- Accounting Midterms ReviwerDocument5 pagesAccounting Midterms ReviwermariaNo ratings yet

- 1 SFPDocument29 pages1 SFPRocky BassigNo ratings yet

- Fundamentals of Accounting, Business and Management 2: Quarter 1-Module 1: Statement of Financial Position (SFP)Document20 pagesFundamentals of Accounting, Business and Management 2: Quarter 1-Module 1: Statement of Financial Position (SFP)Arvin Salazar Llaneta100% (1)

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionAgatha ApolinarioNo ratings yet

- Intermediate Accounting 2: Carmela L. PeducheDocument9 pagesIntermediate Accounting 2: Carmela L. PeducheJohn Matthew Del RosarioNo ratings yet

- Urdaneta City University: Owned and Operated by The City Government of UrdanetaDocument5 pagesUrdaneta City University: Owned and Operated by The City Government of UrdanetaBen Vallecer Espiritu Jr.No ratings yet

- Balance SheetDocument29 pagesBalance SheetKoo TaehyungNo ratings yet

- IAS 36 NotesDocument5 pagesIAS 36 NotesArsalan AliNo ratings yet

- Acc CountingDocument37 pagesAcc CountingJessalyn Sarmiento TancioNo ratings yet

- Accounting 2 1st ModuleDocument23 pagesAccounting 2 1st ModuleJessalyn Sarmiento TancioNo ratings yet

- ACCOUNTiNG PPT For DEMODocument15 pagesACCOUNTiNG PPT For DEMOJINKY TOLENTINONo ratings yet

- Week 2 FABM2 1Document28 pagesWeek 2 FABM2 1Jeremy SolomonNo ratings yet

- Pas 21-The Effects of Changes in Foreign Exchange RatesDocument3 pagesPas 21-The Effects of Changes in Foreign Exchange RatesAryan LeeNo ratings yet

- Business Finance Chapter 3Document42 pagesBusiness Finance Chapter 3chloe frostNo ratings yet

- Intermediate Accounting 3 Chapter 1Document3 pagesIntermediate Accounting 3 Chapter 1Lea EndayaNo ratings yet

- Mary Joy L. Amigos Rice Store Notes To The Financial StatementsDocument5 pagesMary Joy L. Amigos Rice Store Notes To The Financial StatementsLizanne GauranaNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- FS and FS AnalysisDocument47 pagesFS and FS AnalysisSHARMAINE JOY FULGARNo ratings yet

- FS & Fin - AnalysisDocument40 pagesFS & Fin - AnalysisSHARMAINE JOY FULGARNo ratings yet

- Statement of Cash FlowDocument19 pagesStatement of Cash FlowSHARMAINE JOY FULGARNo ratings yet

- The Statement of Changes in EquityDocument21 pagesThe Statement of Changes in EquitySHARMAINE JOY FULGARNo ratings yet

- Filipino Value SystemDocument7 pagesFilipino Value SystemSHARMAINE JOY FULGARNo ratings yet

- Actual Based Costing vs. Traditional ApproachDocument4 pagesActual Based Costing vs. Traditional ApproachSHARMAINE JOY FULGARNo ratings yet

- Fortuitous (ABC) TRADITIONAL COSTING & ACTUAL-BASED COSTINGDocument6 pagesFortuitous (ABC) TRADITIONAL COSTING & ACTUAL-BASED COSTINGSHARMAINE JOY FULGARNo ratings yet

- Las q2 Fabm 2 Week 4Document10 pagesLas q2 Fabm 2 Week 4Mahika BatumbakalNo ratings yet

- ''Assignment 3 SOLUTIONDocument7 pages''Assignment 3 SOLUTIONFega AbrahamNo ratings yet

- Co-Ownership, Estates and TrustsDocument13 pagesCo-Ownership, Estates and TrustsRoronoa Zoro100% (1)

- Income Tax On CorporationsDocument8 pagesIncome Tax On CorporationsDevonNo ratings yet

- Succession Planning and Strategies For Harvesting and Ending The VentureDocument17 pagesSuccession Planning and Strategies For Harvesting and Ending The VentureFarihaNo ratings yet

- Cost Management and Corporate Performance in Quoted Manufacturing Companies in NigeriaDocument7 pagesCost Management and Corporate Performance in Quoted Manufacturing Companies in NigeriaThe IjbmtNo ratings yet

- Original Principles of Managerial Finance Brief 8Th Edition by Chad J Zutter Full ChapterDocument41 pagesOriginal Principles of Managerial Finance Brief 8Th Edition by Chad J Zutter Full Chapteralton.hopper106100% (21)

- Marketing Metrics: Ts. Lê Thùy Hương Khoa MarketingDocument23 pagesMarketing Metrics: Ts. Lê Thùy Hương Khoa MarketingDuy TrầnNo ratings yet

- Valuation of SharesDocument24 pagesValuation of Sharesshalini0703No ratings yet

- Powerpoint Business PlanDocument19 pagesPowerpoint Business PlanMoslimahNo ratings yet

- Examples Group Strucre ChangeDocument8 pagesExamples Group Strucre ChangeAMNA T.ZNo ratings yet

- Accounting 101 - Final Exam Part 4Document15 pagesAccounting 101 - Final Exam Part 4AuroraNo ratings yet

- MGT 303Document14 pagesMGT 303JD dOlMa YouNo ratings yet

- Workshop 5 QsDocument7 pagesWorkshop 5 QsNaresh SehdevNo ratings yet

- YatharthDocument8 pagesYatharthCp918315No ratings yet

- Working Capital Kesoram FinanceDocument56 pagesWorking Capital Kesoram FinanceRamana GNo ratings yet

- Amendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORDocument45 pagesAmendment To: Specification For Monthly Tax Deduction (MTD) Calculations Using Computerised Calculation FORTitan KNo ratings yet

- 8 Production, Costs, ProfitDocument23 pages8 Production, Costs, Profittiellenfonseca2012No ratings yet

- Name: - Date: - QuizDocument4 pagesName: - Date: - QuizKatrine Clarisse BlanquiscoNo ratings yet

- Monthly Salary & Other Income Statement: 2008-09Document26 pagesMonthly Salary & Other Income Statement: 2008-09api-26910047No ratings yet

- RGGLV BrochureDocument8 pagesRGGLV Brochurerajiv11juneNo ratings yet

- CROMBONDS Memory Aid (Case Digests)Document31 pagesCROMBONDS Memory Aid (Case Digests)Juan Samuel IsmaelNo ratings yet

- FA of SPDocument8 pagesFA of SPShivangi AggarwalNo ratings yet

- CA Assignment 2Document13 pagesCA Assignment 2Methly MorenoNo ratings yet

- Cross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameDocument7 pagesCross-Sectional (Comparative) Comparisons Are Made by Comparing Similar Ratios For Firms Within The SameRebecca Fady El-hajjNo ratings yet

- REO - Auditing 1st Preboard May 2022Document15 pagesREO - Auditing 1st Preboard May 2022Marielle GonzalvoNo ratings yet

- Trias Sentosa AR & Sustainability Report 2020 - NewDocument196 pagesTrias Sentosa AR & Sustainability Report 2020 - NewSentosa DunamisNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument33 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoonNo ratings yet