Professional Documents

Culture Documents

Illovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022

Illovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022

Uploaded by

Mallak Alhabsi0 ratings0% found this document useful (0 votes)

18 views1 pageThe document contains extracts from the audited financial statements of Illovo Sugar (Malawi) plc for the year ended 31 August 2022. It summarizes key financial figures including revenue, gross profit, expenses, net profit, and cash flows. It also discusses challenges faced by the company during the period such as currency devaluation and sugar demand pressures, and the company's strategies to prioritize the domestic sugar market and maintain quality and customer satisfaction.

Original Description:

Original Title

Illovo Sugar (Malawi) Plc - Final Results - 31 Aug 2022

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains extracts from the audited financial statements of Illovo Sugar (Malawi) plc for the year ended 31 August 2022. It summarizes key financial figures including revenue, gross profit, expenses, net profit, and cash flows. It also discusses challenges faced by the company during the period such as currency devaluation and sugar demand pressures, and the company's strategies to prioritize the domestic sugar market and maintain quality and customer satisfaction.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageIllovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022

Illovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022

Uploaded by

Mallak AlhabsiThe document contains extracts from the audited financial statements of Illovo Sugar (Malawi) plc for the year ended 31 August 2022. It summarizes key financial figures including revenue, gross profit, expenses, net profit, and cash flows. It also discusses challenges faced by the company during the period such as currency devaluation and sugar demand pressures, and the company's strategies to prioritize the domestic sugar market and maintain quality and customer satisfaction.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

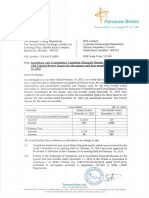

(Incorporated in Malawi on 31 May 1965 under registration number 839)

EXTRACTS FROM THE AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 AUGUST 2022

further supporting the Route to Consumer initiative aimed at delivering

GROUP COMPANY GROUP COMPANY sugar to the last mile customer. To support and meet the country's demand

Report of the Independent Auditor on the

FINANCIAL PERFORMANCE 31-Aug-22 31-Aug-21 31-Aug-22 31-Aug-21 31-Aug-22 31-Aug-21 31-Aug-22 31-Aug-21 for sugar, the group decided to deprioritise sugar exports until the domestic Condensed Consolidated and Separate

market was fully supplied, The Malawi Kwacha depreciated in the period and

was then devalued by twenty-five percent on 27 May 2022, against the US

Financial Statements of Illovo Sugar

Condensed consolidated and separate Condensed consolidated and separate Dollar and other major trading currencies. This increased our operating costs (Malawi) plc

statements of comprehensive income K'm K'm K'm K'm statements of cash flows K'm K'm K'm K'm significantly, most notable being the prices for fertilizer and chemicals. The

dynamics on currency price arbitrage at the borders between Malawi and

Revenue 186,642 163,259 102,480 98,217 Cash generated from operations before its neighbouring countries resulted in illegal outflow of sugar into those

working capital changes 40,707 34,671 18,835 21,915

Gross Profit 65,316 57,831 30,545 35,070 countries, which further contributed to pressure on the stocks allocated for

Working capital requirements 14,006 3,588 25,728 8,312 domestic sales. We voluntarily suspended sugar exports to ensure adequate

Other Administration Expenses (25,811) (25,889) (14,050) (15,115)

sugar availability in Malawi, but long term we remain committed to export

Operating profit 39,505 31,941 16,496 19,954 Finance costs and taxation (9,261) (5,544) (4,729) (1,868) sugar to the deep water and regional markets and therefore contribute to

Dividend income 60 71 - - Net cash flows from operating activities 45,452 32,715 - 39,834 28,359 the country's foreign currency generation.

Net finance cost (1,087) (2,674) (292) (1,354)

The group welcomed the huge decline in COVID-19 infections across the

Profit before taxation 38,478 29,338 16,204 18,600

Net cash flows used in investing activities (16,479) (8,453) (11,754) (5,584) world and accelerated efforts to ensure normal operations and achieve Opinion

Taxation (11,848) (8,869) (5,079) (7,774) further efficiency and growth in business. Revenue and profit growth, cost

reduction, and operational excellence remain primary focus areas for the The condensed consolidated and separate financial statements, which comprise the

Net profit for the year 26,630 20,469 11,125 10,826 Net cash flows before financing activities 28,973 24,262 - 28,080 22,775 business. The endeavour to maintain trusted quality in all product formats condensed statements of financial position as at 31st August 2022, the condensed

Other comprehensive income/(losses) 89 109 (23) 124 and pack sizes and achievement of ultimate customer satisfaction continue statement of profit or loss and other comprehensive income, condensed statements

Total comprehensive income 26,719 20,578 11,102 10,949 Cash flows used in financing activities (14,235) (22,597) (13,343) (21,110) to drive the passion that underlies and sustains the Illovo brand promise. of changes in equity and condensed statements of cash flows for the year then

ended, and related notes, are derived from the audited consolidated and separate

Adjusted for:

The group commits to continue contributing to the development of financial statements of Illovo Sugar (Malawi) plc for the year ended 31st August

Other comprehensive losses (89) (109) 23 (124) Increase in cash and cash equivalents 14,738 1,665 14,737 1,665 2022.

the country through significant employment, trade opportunities, tax

Headline earnings 26,630 20,469 11,125 10,826 contributions, and various statutory payments apart from the noteworthy

In our opinion, the accompanying condensed consolidated and separate financial

` creating shared value' investments.

statements are consistent, in all material respects, with the audited consolidated and

Number of shares in issue (`000) 713,444 713,444 Condensed consolidated and separate

separate financial statements, in accordance with International Financial Reporting

statements of changes in equity

Weighted average number of shares on Standards and in compliance with the Companies Act, 2013.

which net profit per share is based (`000) 713,444 713,444 Share capital and premium PROSPECTS

Balance at beginning and end of the year 782 782 782 782 Condensed Consolidated and Separate

It is expected that better weather patterns and a return to normal power

Net profit per share (tambala) 3,733 2,869 Retained earnings generation by the Electricity Generation Company Limited (EGENCO) will

Financial Statements

Headline earnings per share (tambala) 3,733 2,869

Dividend per share (tambala) 1,956 600 Balance at beginning of the year 87,035 70,847 21,043 14,498 improve the output from the agricultural operations, and therefore positively The condensed consolidated and separate financial statements do not contain all the

Net profit for the year 26,630 20,469 11,125 10,826 impact production efficiency and factory throughput. More efforts on drip disclosures required by International Financial Reporting Standards and requirements

irrigation and other elements of the agricultural recovery plan replete of the Companies Act, 2013. Reading the condensed consolidated and separate

Quality of earnings statement

Dividends declared (13,955) (4,281) (13,955) (4,281) financial statements and the auditor's report thereon, therefore, is not a substitute for

Operating profit 39,505 31,941 with excellent agronomic practices, continued grower support, a proactive

reading the audited consolidated and separate financial statements and the auditor's

Adjust for: Balance at end of the year 99,710 87,035 - 18,213 21,043 approach at plant maintenance and efficient production initiatives and report thereon. The condensed consolidated and separate financial statements and

Change in fair value of growing cane (8,298) (6,034) embedding of the overall performance improvement initiatives throughout audited consolidated and separate financial statements do not reflect the effects of

events that occurred subsequent to the date of our report on the audited consolidated

Operating profit excluding fair value changes 31,207 25,907 the entire business value chain should result in even further growth in the

and separate financial statements.

group results.

Business segmental analysis

Non-distributable reserve

The Audited Consolidated and Separate

The group will continue pursuing various initiatives in commercial and

Revenue Balance as at beginning of the year 354 245 23 (101) logistical operations, that are expected to contribute to better delivery of

Financial Statements and Our Report

Sugar production 109,089 92,321

Cash flow hedges (23) 124 (23) 124

excellent quality product pack sizes at affordable prices to the ultimate Thereon

Cane growing 77,553 70,938 consumer. Efforts at growth will also be engaged further in the export

Fair value gain on revaluation of investment 112 (15) We expressed an unmodified audit opinion on the audited consolidated and separate

186,642 163,259 markets to assist us counter the impact on the business of the scarcity of

financial statements in our report dated 25th November 2022. That report also

Balance at end of year 443 354 - - 23 foreign currency, and further ensure maximisation of the value from every includes communication of other key audit matters. Key audit matters are those

Operating profit ton of sugar sold. matters that, in our professional judgement were of most significance in our audit of

Sugar production 29,434 24,782 Shareholders' equity 100,935 88,171 - 18,995 21,848 the consolidated and separate financial statements of the current period.

Cane growing 9,963 7,159 Depreciating exchange rates for the Malawi Kwacha against major

39,397 31,941 trading currencies, increasing inflation and interest rates, the scarcity of Directors' Responsibility for the

Condensed consolidated and separate

foreign currency and fuel continue to militate against the delivery of cost Condensed Consolidated and Separate

statements of financial position Overview optimisation efforts for the business. The group will therefore continue Financial Statements

to actively engage significant effort at cost reduction, improvement of

The fiscal year ended 31st August 2022 presented various challenges The two factories planned to start production mid-April 2022 but could Directors are responsible for the preparation of the condensed consolidated and

ASSETS operational efficiency, export revenue enhancement, and domestic market

and opportunities which the group embraced as further discussed below, not successfully achieve this due to the muddy cane, especially at Nchalo, separate financial statements in accordance with International Financial Reporting

Property, plant and equipment which impacted the results as depicted in the financial report. growth to drive delivery of good results for the business and all stakeholders

and general plant downtime. Both factories eventually commenced Standards and in compliance with the Companies Act, 2013; and for such internal

(including Right of use - assets) 76,980 67,648 51,346 45,641 production initially at low throughput rates particularly in the first week into the foreseeable future. control as the directors determine is necessary to enable the preparation of the

Investment 740 604 324 324 The group achieved 14 per cent growth in turnover to K186.6 billion, of May 2022. Factory throughput was affected by plant mechanical condensed consolidated and separate financial statements that are free from

24 per cent growth in operating profit to K39.5 billion and 31 per cent problems resulting from the poor quality of the cane. Continuous material misstatements, whether due to fraud or error.

Non-current assets 77,720 68,252 51,670 45,965

growth in profit before tax to K38.4 billion over the prior year. The group mitigating initiatives were deployed to improve output from the factory DIVIDENDS

Current assets 119,670 96,273 56,867 79,930 experienced significant growth in domestic market and sold 213 550 as a result of which production improved slowly but progressively over Auditor's Responsibility

tonnes from 172 578 tonnes in the prior period. The group contributed to time. Significant rainfall continued in the period from May to July 2022, In view of the business performance for the year ended 31st August 2022,

Total Assets 197,390 164,525 108,537 125,895 the Malawi fiscus by paying and collecting tax on behalf of government which affected delivery of both group-produced and grower produced the Directors are pleased to declare a second interim dividend of K10.00 Our responsibility is to express an opinion on whether the condensed consolidated

amounting to K28.2 billion (2021: K16.8 billion). The group also cane and therefore significantly undermined achievement of production and separate financial statements are consistent, in all material respects, with the

per share, on top of the first interim dividend of K5.56 per share. A final

managed to fully repay its debt and achieve a net cash position in the targets. The rain breaks provided opportunity for factory maintenance audited consolidated and separate financial statements based on our procedures,

dividend of K5.44 per share will be presented to the Shareholders at the

SHAREHOLDERS' EQUITY AND LIABILITIES year despite the challenges it faced. to ensure better plant performance when the cane fields dried out. The

which were conducted in accordance with International Standards on Auditing (ISA)

AGM for their approval by Directors and will be paid in March 2023. This will 810 (Revised), Engagements to report on Summary Financial Statements.

Shareholders© equity 100,935 88,171 18,995 21,848 group continues to invest in major capital projects in all operational

The country experienced cyclones Ana and Gombe, that came along with bring the total dividend for the year to K21.00 per share against the prior

Taxation 26,792 21,273 18,484 15,008 areas to ensure improved efficiency and growth in business. Grower

heavy rains and subsequent flooding in the first quarter of the calendar year full dividend of K18 per share.

support remains another key focus area for the group.

Non-current liabilities 7,094 8,146 3,301 3,595 year 2022. This delayed commencement of cane crushing for the 2022

Current liabilities 62,569 46,935 67,757 85,444 season by a few weeks as the wet fields could not be accessed for cane Chartered Accountants (Malawi)

Domestic sales continued to register growth despite the reduced Gavin Dalgleish Lekani Katandula

harvesting and haulage. The persistent rainfall negatively impacted inventory levels in the period from late March to mid-May 2022 Chairman Managing Director Chiwemi Chihana

cane quality and sucrose content in the sugarcane, and this manifested resulting from the delayed crushing of cane as explained above. The

Total shareholders© quity

E and Liabilities 197,390 164,525 108,537 125,895 Registered Practicing Accountant

through lower sucrose recoveries and high ash content which caused Iponyeleninso Kwakuya, Every-Day Chef and other sales activation

plant mechanical problems resulting in high incidences of downtime. initiatives contributed to further growth in domestic sales volumes, 25th November 2022

Depreciation 9,586 9,120

Capital expenditure 16,618 8,873

You might also like

- Understanding Expanded Net Present Value - TEST1Document1 pageUnderstanding Expanded Net Present Value - TEST1juanNo ratings yet

- NCFM Test Pattern.. With PapersDocument10 pagesNCFM Test Pattern.. With Papersshubh198612345100% (7)

- Co Op Bank Group Full 2022 FinancialsDocument1 pageCo Op Bank Group Full 2022 Financialscarolm790No ratings yet

- Riozim Half Year June 2022 ResultsDocument3 pagesRiozim Half Year June 2022 ResultsClemmy MupembaNo ratings yet

- Portfolio Activity Unit 2Document4 pagesPortfolio Activity Unit 2Kelvin kikanaeNo ratings yet

- Hindustan Petroleum Corporation Limited Annual Report 2020 - 2021Document320 pagesHindustan Petroleum Corporation Limited Annual Report 2020 - 2021Sushil KumarNo ratings yet

- Annex E Changes in Equity 2020Document1 pageAnnex E Changes in Equity 2020EunicaNo ratings yet

- BRDR - ZW Q1 Trading UpdateDocument1 pageBRDR - ZW Q1 Trading UpdateaddyNo ratings yet

- CHAMBLFERT 19052022210352 InvestorPresentation310322Document30 pagesCHAMBLFERT 19052022210352 InvestorPresentation310322bradburywillsNo ratings yet

- Q3Document24 pagesQ3Mohamed HamedNo ratings yet

- Liyu - 2021 G.CDocument8 pagesLiyu - 2021 G.CElias Abubeker AhmedNo ratings yet

- UBL Annual Report 2018-155Document1 pageUBL Annual Report 2018-155IFRS LabNo ratings yet

- Fundamentals: The Strength ofDocument32 pagesFundamentals: The Strength ofkasun witharanaNo ratings yet

- Welcorp q2 Business UpdatesDocument8 pagesWelcorp q2 Business UpdatesVivek AnandNo ratings yet

- Sample Audcom Presentation - 2QDocument32 pagesSample Audcom Presentation - 2Qsohail shalabyNo ratings yet

- National Tyre Services Limited: Abridged Audited Financial Results For The Year Ended 31 March 2018Document2 pagesNational Tyre Services Limited: Abridged Audited Financial Results For The Year Ended 31 March 2018Absai MausaNo ratings yet

- Cottco H1 2015 ResultsDocument2 pagesCottco H1 2015 ResultsaddyNo ratings yet

- 1Q - FY2023 Quarterly Results Briefing - 1Document18 pages1Q - FY2023 Quarterly Results Briefing - 1RidtwanNo ratings yet

- Econet Wireless Zimbabwe Limited Audited Abridged Consolidated Financial ResultsDocument2 pagesEconet Wireless Zimbabwe Limited Audited Abridged Consolidated Financial ResultsVincentDenhereNo ratings yet

- Uba Annual Report Accounts 2022Document286 pagesUba Annual Report Accounts 2022G mbawalaNo ratings yet

- Homeboyz FR2022Document1 pageHomeboyz FR2022Zidane GimigaNo ratings yet

- CelcomDigi Bursa Q1 2024Document25 pagesCelcomDigi Bursa Q1 2024seeme55runNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- NB Annual Report 2023Document72 pagesNB Annual Report 2023mad eye moodyNo ratings yet

- Cottco FY 2015 ResultsDocument2 pagesCottco FY 2015 ResultsaddyNo ratings yet

- Equity Group Holdings PLC Financial Statements For The Year Ended 31st December 2022Document1 pageEquity Group Holdings PLC Financial Statements For The Year Ended 31st December 2022shadehdavNo ratings yet

- PublicDisclosure 1660281762Document48 pagesPublicDisclosure 1660281762mantoo kumarNo ratings yet

- Actiuni 2019Document1 pageActiuni 2019Blanche RyNo ratings yet

- AFDS - ZW 2022 HY Results Audit ReviewDocument5 pagesAFDS - ZW 2022 HY Results Audit ReviewmutaurwaannetteNo ratings yet

- Audi Quarterly Update q2 2022Document31 pagesAudi Quarterly Update q2 2022Alejandrina Salazar gonzalesNo ratings yet

- BudgetBrief 2015 PDFDocument85 pagesBudgetBrief 2015 PDFFarukh MalikNo ratings yet

- Directors' ReportDocument9 pagesDirectors' Reportabdul ohabNo ratings yet

- ActiuniDocument1 pageActiuniBlanche RyNo ratings yet

- The Next 500: Most ValuableDocument6 pagesThe Next 500: Most Valuablesreejit nairNo ratings yet

- UBL Annual Report 2018-100Document1 pageUBL Annual Report 2018-100IFRS LabNo ratings yet

- Ceylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021Document14 pagesCeylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021hvalolaNo ratings yet

- State Bank of Pakistan: 6,537,933 5,742,771 12,280,704 Total AssetsDocument2 pagesState Bank of Pakistan: 6,537,933 5,742,771 12,280,704 Total Assetssm_1234567No ratings yet

- J K Cement LTD - Axis Annual Analysis - 20-09-2021 - 08Document26 pagesJ K Cement LTD - Axis Annual Analysis - 20-09-2021 - 08Equity NestNo ratings yet

- Milkfood Annual Report 2021Document108 pagesMilkfood Annual Report 2021Kamalapati BeheraNo ratings yet

- 1390-Monthly Fiscal Bulletin 7Document16 pages1390-Monthly Fiscal Bulletin 7Macro Fiscal PerformanceNo ratings yet

- 2023-07-13 - Energevo Renewables Limited 2022-12 Ye Accounts CT - B-Ene211-Signed-CertificateDocument45 pages2023-07-13 - Energevo Renewables Limited 2022-12 Ye Accounts CT - B-Ene211-Signed-Certificatesameer.karwalNo ratings yet

- Scaling New Horizons: Key Performance IndicatorsDocument1 pageScaling New Horizons: Key Performance IndicatorsPapu SahooNo ratings yet

- Sharjah Cement 2016Document35 pagesSharjah Cement 2016NotesfreeBookNo ratings yet

- Australian Securities Exchange Notice: Half Year Results To 30 June 2020Document4 pagesAustralian Securities Exchange Notice: Half Year Results To 30 June 2020TimBarrowsNo ratings yet

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Document3 pagesNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7No ratings yet

- 500 1000 Imo Result 20230215Document12 pages500 1000 Imo Result 20230215Contra Value BetsNo ratings yet

- Financial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Document10 pagesFinancial Results With Results Press Release & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderNo ratings yet

- AnnexurePpart I 1Document51 pagesAnnexurePpart I 1mangeshNo ratings yet

- Albemarle Benchmark Minerals Presentation Dec. 10 V - ApprovedDocument16 pagesAlbemarle Benchmark Minerals Presentation Dec. 10 V - ApprovedLuis Rolando SirpaNo ratings yet

- Annual Report of IOCL 116Document1 pageAnnual Report of IOCL 116Nikunj ParmarNo ratings yet

- GH SCB Ghana Full Year Financial Statement For Year 2021Document1 pageGH SCB Ghana Full Year Financial Statement For Year 2021Fuaad DodooNo ratings yet

- EGH PLC Financial Statements For The Period Ended 31st March 2022Document2 pagesEGH PLC Financial Statements For The Period Ended 31st March 2022Saeedullah KhosoNo ratings yet

- Board'S Report: To The Members, Review of OperationsDocument74 pagesBoard'S Report: To The Members, Review of OperationsSudha Swayam PravaNo ratings yet

- Other ReceivablesDocument14 pagesOther ReceivablesShaikh Muhammad Talha 1883095No ratings yet

- Mkombozi Commercial Bank - Financial Statement Dec - 2019 PDFDocument1 pageMkombozi Commercial Bank - Financial Statement Dec - 2019 PDFMsuyaNo ratings yet

- Document Incorporated by Reference EBI F Cial Statements 2007 2009-08-17Document80 pagesDocument Incorporated by Reference EBI F Cial Statements 2007 2009-08-17Megan KosNo ratings yet

- ZB2010 Annual Report ZBGDocument60 pagesZB2010 Annual Report ZBGNella GarnettNo ratings yet

- Barclays Results q1 2014Document2 pagesBarclays Results q1 2014Manil UniqueNo ratings yet

- Enfs Q322Document29 pagesEnfs Q322xen101No ratings yet

- Financial StatementsDocument72 pagesFinancial StatementsPranav TrivediNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Lease Financing 10042020 103707pmDocument11 pagesLease Financing 10042020 103707pmMuhammad FarooqNo ratings yet

- Facebook IPODocument4 pagesFacebook IPOvaibhavNo ratings yet

- Soal Percentage Completion MethodDocument7 pagesSoal Percentage Completion Method30 Novita Kusuma WardhaniNo ratings yet

- 2019 Annual Focus Media CHNDocument118 pages2019 Annual Focus Media CHNHarold PaidNo ratings yet

- Integrated Problem CH 2Document30 pagesIntegrated Problem CH 2paula100% (1)

- SKRIPSI Manufacturing CompaniesDocument22 pagesSKRIPSI Manufacturing CompaniesnovianaNo ratings yet

- Sangrose Laboratories PVT LTDDocument68 pagesSangrose Laboratories PVT LTDsreeharivzm_74762363100% (1)

- Asset Allocation SpreadsheetDocument2 pagesAsset Allocation SpreadsheetGodwin J. SobinNo ratings yet

- SMKL - Annual Report 2019Document172 pagesSMKL - Annual Report 2019muniya altezaNo ratings yet

- Variable and Absorption CostingDocument52 pagesVariable and Absorption CostingcruzchristophertangaNo ratings yet

- Amadeus RefundsDocument10 pagesAmadeus RefundsAHMED ALRADAEENo ratings yet

- BL 2 - Quiz On Corp.Document2 pagesBL 2 - Quiz On Corp.Janna Mari FriasNo ratings yet

- Intermediate Financial Accounting II 1 1Document146 pagesIntermediate Financial Accounting II 1 1natinaelbahiru74No ratings yet

- Exercise 4Document7 pagesExercise 4Tania MaharaniNo ratings yet

- C - S4FTR - 2021 3setsDocument53 pagesC - S4FTR - 2021 3setsDIGITAL TELUGUNo ratings yet

- Cash Flow Statement of AmulDocument6 pagesCash Flow Statement of AmulArav Sarin60% (5)

- 6883 - Statement of Financial PositionDocument2 pages6883 - Statement of Financial PositionMaximusNo ratings yet

- Accounting 1 ReviewerDocument3 pagesAccounting 1 ReviewerCortez, Charish BSAIS 1210 - BULACANNo ratings yet

- Session 5 - Students'Document3 pagesSession 5 - Students'erica lamsenNo ratings yet

- Forms of Business OrganisationsDocument4 pagesForms of Business Organisationsshanaski spencerNo ratings yet

- The Good Companies Project Version 2Document294 pagesThe Good Companies Project Version 2MaheswarReddy SathelaNo ratings yet

- MAS.06 Drill Short-Term Budgeting, AFN and ForecastingDocument4 pagesMAS.06 Drill Short-Term Budgeting, AFN and Forecastingace ender zeroNo ratings yet

- Assignment 3Document2 pagesAssignment 3Lili GuloNo ratings yet

- vAJ1-DCF Spreadsheet FreeDocument6 pagesvAJ1-DCF Spreadsheet FreesumanNo ratings yet

- MFRS 1Document42 pagesMFRS 1hyraldNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- Lecture 6 - Dev An Effective Business ModelDocument22 pagesLecture 6 - Dev An Effective Business ModelWasay HanifNo ratings yet

- FAR 2 - HandoutsDocument8 pagesFAR 2 - HandoutsKyle RonquilloNo ratings yet