Professional Documents

Culture Documents

Withholding

Withholding

Uploaded by

Yasir Hussain0 ratings0% found this document useful (0 votes)

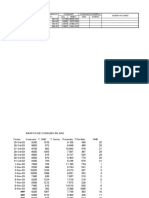

8 views3 pagesThe document contains details of 33 tax transactions between January 2022 and September 2023, including the transaction date, tax year, description, taxable amount, and tax amount. The majority of the transactions are for salary income under section 149 and profit on debt under section 151, with a few others related to remitting amounts abroad, property purchase, and surcharge.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains details of 33 tax transactions between January 2022 and September 2023, including the transaction date, tax year, description, taxable amount, and tax amount. The majority of the transactions are for salary income under section 149 and profit on debt under section 151, with a few others related to remitting amounts abroad, property purchase, and surcharge.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesWithholding

Withholding

Uploaded by

Yasir HussainThe document contains details of 33 tax transactions between January 2022 and September 2023, including the transaction date, tax year, description, taxable amount, and tax amount. The majority of the transactions are for salary income under section 149 and profit on debt under section 151, with a few others related to remitting amounts abroad, property purchase, and surcharge.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 3

Sr.

Transaction Date Tax Year

1 28-Sep-2023 2024

2 27-Sep-2023 2024

3 13-Sep-2023 2024

4 24-Aug-2023 2024

5 24-Aug-2023 2024

6 11-Aug-2023 2024

7 26-Jul-2023 2023

8 26-Jul-2023 2023

9 25-Jul-2023 2023

10 14-Jul-2023 2024

11 16-Jun-2023 2023

12 09-Jun-2023 2023

13 20-May-2023 2023

14 15-May-2023 2023

15 08-May-2023 2023

16 05-May-2023 2023

17 28-Apr-2023 2023

18 26-Apr-2023 2023

19 07-Apr-2023 2023

20 04-Apr-2023 2022

21 31-Mar-2023 2023

22 10-Mar-2023 2023

23 24-Feb-2023 2023

24 10-Feb-2023 2023

25 27-Jan-2023 2023

26 12-Jan-2023 2023

27 13-Dec-2022 2023

28 11-Nov-2022 2023

29 18-Oct-2022 2023

30 26-Sep-2022 2023

31 30-Aug-2022 2022

32 19-Jul-2022 2022

33 24-Jun-2022 2022

Description

64151905-Tax on remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64020004-Salary of Other Employees u/s 149

64040052-Profit on Debt u/s 151 from Bank Accounts / Deposits

64020004-Salary of Other Employees u/s 149

64040052-Profit on Debt u/s 151 from Bank Accounts / Deposits

64151905-Tax on remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64151905-Tax on remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64151905-Advance tax on persons remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64151101-Purchase / Transfer of Immovable Property u/s 236K (ATL @ 1% / Non-ATL @ 2%)

64020004-Salary of Employees u/s 149

64151905-Advance tax on persons remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64020004-Salary of Employees u/s 149

64151905-Advance tax on persons remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

920601-Surcharge for ATL

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64151905-Advance tax on persons remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64151905-Advance tax on persons remitting amounts abroad through credit / debit / prepaid cards u/s 236Y

64040052-Profit on Debt u/s 151 (15% Profit exceeding 5 lac) (Non-ATL rate is 30%)

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

64020004-Salary of Employees u/s 149

Value / Taxable Amount Tax Amount

1280 64

56256 124

127 19

53256 101

168 25

200 10

82093 1699

91434 804

190 29

40 2

72 11

100 1

119 18

1780954 35619

70333 63

100 1

13 4

46200 4

100 2

0 1000

264 79

100 2

348 105

100 2

258 78

44200 27

46450 28

68333 20

48700 20

44950 9

69083 7

44950 197

66600 160

You might also like

- Gown Rental Agreement For Out of Chapel WeddingsDocument3 pagesGown Rental Agreement For Out of Chapel WeddingsBambi Buna Depasucat100% (3)

- 5.17 Attachment F - Model ExamDocument36 pages5.17 Attachment F - Model ExamNilesh Tak91% (11)

- BSBFIM501 Manage Budgets and Financial Plans: Assessment Cover SheetDocument19 pagesBSBFIM501 Manage Budgets and Financial Plans: Assessment Cover SheetKimberly Dyanne100% (1)

- CIBILDocument14 pagesCIBILGaurav RajNo ratings yet

- Project On AtmDocument51 pagesProject On Atmashwin_nakman77% (53)

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S Chargesrakesh JoshiNo ratings yet

- Trading Actitivites (22 Jan To 23 Feb 2024)Document14 pagesTrading Actitivites (22 Jan To 23 Feb 2024)imrankhan4088No ratings yet

- IndiVivah - RFM Data SetDocument7 pagesIndiVivah - RFM Data SetTushar NegiNo ratings yet

- DataDocument5 pagesDataKaushal GangradeNo ratings yet

- Sr. Transaction Date Tax Year SectionDocument3 pagesSr. Transaction Date Tax Year SectionramzansajidjhangNo ratings yet

- Rs.750 Draw 97 (15-01-2024)Document7 pagesRs.750 Draw 97 (15-01-2024)Amir AbbasiNo ratings yet

- DataDocument5 pagesDataKaushal GangradeNo ratings yet

- PointsDocument5 pagesPointsroulNo ratings yet

- Taxpnl EMS991Document34 pagesTaxpnl EMS991sagar yadavNo ratings yet

- OctoberDocument24 pagesOctobergermandiagnostic2023No ratings yet

- Lottery A1004 2Document4 pagesLottery A1004 2stavrosteeNo ratings yet

- BIMIVET SAS ExpoDocument41 pagesBIMIVET SAS ExpoDanilo ArévaloNo ratings yet

- Report Pods Weekly Creative Performance Arsyad 3 9 AprDocument8 pagesReport Pods Weekly Creative Performance Arsyad 3 9 Aprars 0001bNo ratings yet

- RoadDocument9 pagesRoadAnil GuptaNo ratings yet

- DL220320 PDFDocument1 pageDL220320 PDFSoumyadeep BaratNo ratings yet

- TraassDocument297 pagesTraassBrian Zuñagua FloresNo ratings yet

- Rs.750 Draw 93 (16-01-2023)Document7 pagesRs.750 Draw 93 (16-01-2023)Malik AbNo ratings yet

- ML150320Document1 pageML150320Soumyadeep BaratNo ratings yet

- EPF Contribution Impact Ceiling Limit For Balance ServceDocument6 pagesEPF Contribution Impact Ceiling Limit For Balance Servcekiran sNo ratings yet

- Capacity BaselineDocument10 pagesCapacity BaselineLouis Stephen ComendadorNo ratings yet

- Chittagong Port AuthorityDocument9 pagesChittagong Port AuthorityAseef AmeenNo ratings yet

- Taxpnl UV7068 2023 - 2024 Q1 Q4Document40 pagesTaxpnl UV7068 2023 - 2024 Q1 Q4Panthi PanthiNo ratings yet

- Enter Data in Yellow Fields Workings: 723,658 Slab Amount (Old)Document9 pagesEnter Data in Yellow Fields Workings: 723,658 Slab Amount (Old)HarryNo ratings yet

- Part No. Per Day TargetDocument21 pagesPart No. Per Day Targetmechtek 20No ratings yet

- 945-Jeevan UmangDocument6 pages945-Jeevan Umangmaddy7023No ratings yet

- Balajikrupa Projects PVT LTD Project: Date: Petrol & DieselDocument52 pagesBalajikrupa Projects PVT LTD Project: Date: Petrol & Dieselyashas sNo ratings yet

- REGRESIONDocument7 pagesREGRESIONYeffren Yasir SotoNo ratings yet

- REGRESIONDocument7 pagesREGRESIONYeffren Yasir SotoNo ratings yet

- REGRESIONDocument7 pagesREGRESIONYeffren Yasir SotoNo ratings yet

- Warranty 30-06-2021Document17 pagesWarranty 30-06-2021Lorenzo ODDONo ratings yet

- Revised-Installment-of-all-Scheme - 14-05-2020Document3 pagesRevised-Installment-of-all-Scheme - 14-05-2020Toufiqur Rahman SiamNo ratings yet

- Daily DCR ReportsDocument6 pagesDaily DCR Reportsraja MNo ratings yet

- Base FinalDocument72 pagesBase FinalalvaroNo ratings yet

- Tugas3 PE1 101317059Document7 pagesTugas3 PE1 101317059Vini Nandi RahmaNo ratings yet

- BD Oet644f470ac9e77c00014858fbDocument5 pagesBD Oet644f470ac9e77c00014858fbDiana PinanditaNo ratings yet

- Plan de Afaceri - Mirică Irina-MariaDocument80 pagesPlan de Afaceri - Mirică Irina-MariaTheodor BondocNo ratings yet

- VaR Calculation ModelDocument9 pagesVaR Calculation ModelatpugajoopNo ratings yet

- RoadDocument9 pagesRoadAnil GuptaNo ratings yet

- Report Pods Weekly Creative Performance Arsyad 10 16 AprDocument8 pagesReport Pods Weekly Creative Performance Arsyad 10 16 Aprars 0001bNo ratings yet

- Consumo GasDocument6 pagesConsumo GasJORGE LEONARDO CAICEDO REINANo ratings yet

- Latestnews L070o5i203dz1vxb 1597820690 PDFDocument1 pageLatestnews L070o5i203dz1vxb 1597820690 PDFJyotirmoy SenguptaNo ratings yet

- Chapter 9Document27 pagesChapter 9Tess CoaryNo ratings yet

- Pematang Panggang I-Sbbk-23 February 2021Document8 pagesPematang Panggang I-Sbbk-23 February 2021Noviana Kurnia AmbarwatiNo ratings yet

- Long Straddle BacktestDocument6 pagesLong Straddle BacktestVishnu ViswanathNo ratings yet

- DL210320 PDFDocument1 pageDL210320 PDFSoumyadeep BaratNo ratings yet

- PNL WBG200Document10 pagesPNL WBG200pallavikamble0903No ratings yet

- COBADocument4 pagesCOBA121890920No ratings yet

- Taxpnl YMW551 2022 - 2023 Q1 Q4Document40 pagesTaxpnl YMW551 2022 - 2023 Q1 Q4jwzcrh5rndNo ratings yet

- Session 6Document9 pagesSession 6dhruv mahashayNo ratings yet

- Burundi ImportDocument9 pagesBurundi Importkeyurmangnani2015No ratings yet

- Taxpnl ID8087 2022 - 2023 Q1 Q4Document34 pagesTaxpnl ID8087 2022 - 2023 Q1 Q4Ritesh KadukarNo ratings yet

- Cálculos Muestra37-S3 200 080515Document798 pagesCálculos Muestra37-S3 200 080515Laura_Cruz_GilNo ratings yet

- Tabla de Clotoide Unitaria (Istt-2017) PDFDocument4 pagesTabla de Clotoide Unitaria (Istt-2017) PDFMaria Victoria Andara CabreraNo ratings yet

- Emi Cal.Document6 pagesEmi Cal.atulgosainNo ratings yet

- Drop Table Msdlive - SRF - 23000 - Temp - 32246 ERROR at Line 1: ORA-00942: Table or View Does Not ExistDocument24 pagesDrop Table Msdlive - SRF - 23000 - Temp - 32246 ERROR at Line 1: ORA-00942: Table or View Does Not ExistAbhi AbhiNo ratings yet

- Claudia VasquezDocument6 pagesClaudia VasquezSandriitoLopezzNo ratings yet

- Brijesh Hisab Finel 13-09-2022Document10 pagesBrijesh Hisab Finel 13-09-2022Maulik PatelNo ratings yet

- CM1B TemplateDocument12 pagesCM1B TemplateRahul IyerNo ratings yet

- Maxi AoDocument13 pagesMaxi Aosasongko utomoNo ratings yet

- Cars Periodic Maintenance20240220113534Document12 pagesCars Periodic Maintenance20240220113534phengNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Anoop JhaNo ratings yet

- Investment BankingDocument74 pagesInvestment BankingNoel Angeles InfanteNo ratings yet

- 10 - Chapter 3 KVB ShodhgangaDocument50 pages10 - Chapter 3 KVB ShodhgangaPankaj SinghNo ratings yet

- Official GR 12 Accounting P2 Eng MemoDocument13 pagesOfficial GR 12 Accounting P2 Eng MemoLISA LUFUSONo ratings yet

- Superlite Cash Loan - ADA FormDocument2 pagesSuperlite Cash Loan - ADA Formvangie3339515No ratings yet

- Splash 14: Light & Color (Splash: The Best of Watercolor) : Hardcover - July 19, 2013Document4 pagesSplash 14: Light & Color (Splash: The Best of Watercolor) : Hardcover - July 19, 2013lopez1001No ratings yet

- Nikita Green BankingDocument51 pagesNikita Green BankingAbdul Rasheed100% (1)

- ARB XML-guideDocument22 pagesARB XML-guidepraveenk100% (8)

- Waterline Tech Catalog XDocument32 pagesWaterline Tech Catalog Xlbarragan8698No ratings yet

- Accenture Driving The Future of Payments 10 Mega TrendsDocument16 pagesAccenture Driving The Future of Payments 10 Mega TrendsRaj BhatiNo ratings yet

- CPHQ Cert HandbookDocument26 pagesCPHQ Cert HandbookRichu PaliNo ratings yet

- Request Letter For Bank CertificateDocument6 pagesRequest Letter For Bank Certificatef5dthdcd100% (2)

- 2020 TaxReturnDocument132 pages2020 TaxReturnJose Hernandez100% (1)

- Explanatory Notes (IOW2)Document3 pagesExplanatory Notes (IOW2)Amirah IdrusNo ratings yet

- AirtelPaymentsBank XXXXXX9727Document2 pagesAirtelPaymentsBank XXXXXX9727Fiesta For FunNo ratings yet

- 001 - Dent HC Nonmetallic Post ClassIII Lic AppDocument9 pages001 - Dent HC Nonmetallic Post ClassIII Lic AppPomelo PinkNo ratings yet

- The Era of Buy Now Pay LaterDocument11 pagesThe Era of Buy Now Pay LaterAstha ShuklaNo ratings yet

- Kathmandu University School of ManagementDocument152 pagesKathmandu University School of Managementram binod yadavNo ratings yet

- Statement of Account: Smartsaver Credit CardDocument4 pagesStatement of Account: Smartsaver Credit CardP Singh Karki100% (2)

- Grand Videoke TKR-373MP SongbookDocument2 pagesGrand Videoke TKR-373MP Songbooktikki0219No ratings yet

- Confirmation 3920438271 PDFDocument2 pagesConfirmation 3920438271 PDFAlsyifa MaharaniNo ratings yet

- NVLTDocument46 pagesNVLTTrang TrươngNo ratings yet

- Declaration of Conditions of Employment: Part A - Employee Information (Please Print)Document3 pagesDeclaration of Conditions of Employment: Part A - Employee Information (Please Print)cat vargasNo ratings yet

- Business Model and Sustainability AnalysisDocument11 pagesBusiness Model and Sustainability AnalysisAseem GargNo ratings yet