Professional Documents

Culture Documents

Dokumen - Tips - For Analysis of Rate of Part A Work Sector 1 Civil For Analysis of Rate of Part A

Dokumen - Tips - For Analysis of Rate of Part A Work Sector 1 Civil For Analysis of Rate of Part A

Uploaded by

shivacivil2124Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dokumen - Tips - For Analysis of Rate of Part A Work Sector 1 Civil For Analysis of Rate of Part A

Dokumen - Tips - For Analysis of Rate of Part A Work Sector 1 Civil For Analysis of Rate of Part A

Uploaded by

shivacivil2124Copyright:

Available Formats

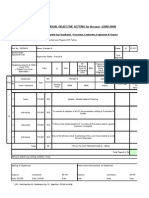

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-1 (CIVIL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 18,333.00 2,383.29 870.82 21,587.11

2 Plumber SK 6 27 617.00 99,954.00 0 99,954.00 12,994.02 4,747.82 1,17,695.84

3 Carpenter SSK 2 27 527.00 28,458.00 0 28,458.00 3,699.54 1,351.76 33,509.30

4 Fitter SK 2 27 617.00 33,318.00 0 33,318.00 4,331.34 1,582.61 39,231.95

5 Sweeper SSK 1 27 527.00 14,229.00 0 14,229.00 1,849.77 675.88 16,754.65

6 Helper USK 9 27 466.00 1,13,238.00 0 1,13,238.00 14,720.94 5,378.81 1,33,337.75

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-2 (CIVIL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Plumber SK 6 27 617.00 99,954.00 0 - 99,954.00 12,994.02 4,747.82 1,17,695.84

3 Carpenter SSK 2 27 527.00 28,458.00 0 - 28,458.00 3,699.54 1,351.76 33,509.30

4 Fitter SK 2 27 617.00 33,318.00 0 - 33,318.00 4,331.34 1,582.61 39,231.95

5 Sweeper SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

6 Helper USK 9 27 466.00 1,13,238.00 0 - 1,13,238.00 14,720.94 5,378.81 1,33,337.75

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the Contractor

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-3 (CIVIL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Plumber SK 7 27 617.00 1,16,613.00 0 - 1,16,613.00 15,159.69 5,539.12 1,37,311.81

3 Carpenter SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

4 Fitter SK 1 27 617.00 16,659.00 0 - 16,659.00 2,165.67 791.30 19,615.97

5 Sweeper SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

6 Helper USK 10 27 466.00 1,25,820.00 0 - 1,25,820.00 16,356.60 5,976.45 1,48,153.05

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the Contractor

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-4 (CIVIL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Plumber SK 5 27 617.00 83,295.00 0 - 83,295.00 10,828.35 3,956.51 98,079.86

3 Carpenter SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

4 Fitter SK 1 27 617.00 16,659.00 0 - 16,659.00 2,165.67 791.30 19,615.97

5 Sweeper SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

6 Helper USK 9 27 466.00 1,13,238.00 0 - 1,13,238.00 14,720.94 5,378.81 1,33,337.75

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-5 (CIVIL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 2 27 679.00 36,666.00 0 - 36,666.00 4,766.58 1,741.64 43,174.22

2 Plumber SK 7 27 617.00 1,16,613.00 0 - 1,16,613.00 15,159.69 5,539.12 1,37,311.81

3 Carpenter SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

4 Fitter SK 1 27 617.00 16,659.00 0 - 16,659.00 2,165.67 791.30 19,615.97

5 Sweeper SSK 1 27 527.00 14,229.00 0 - 14,229.00 1,849.77 675.88 16,754.65

6 Helper USK 11 27 466.00 1,38,402.00 0 - 1,38,402.00 17,992.26 6,574.10 1,62,968.36

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-1 (ELECTRICAL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

No of days worked

Category of labour

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Electrician SK 6 27 617.00 99,954.00 0 - 99,954.00 12,994.02 4,747.82 1,17,695.84

3 Electrician SSK 5 27 527.00 71,145.00 0 - 71,145.00 9,248.85 3,379.39 83,773.24

4 Helper USK 2 27 466.00 25,164.00 0 - 25,164.00 3,271.32 1,195.29 29,630.61

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the Contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-2 (ELECTRICAL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Electrician SK 14 27 617.00 2,33,226.00 0 - 2,33,226.00 30,319.38 11,078.24 2,74,623.62

3 Electrician SSK 12 27 527.00 1,70,748.00 0 - 1,70,748.00 22,197.24 8,110.53 2,01,055.77

4 Helper USK 6 27 466.00 75,492.00 0 - 75,492.00 9,813.96 3,585.87 88,891.83

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-3 (ELECTRICAL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Electrician SK 10 27 617.00 1,66,590.00 0 - 1,66,590.00 21,656.70 7,913.03 1,96,159.73

3 Electrician SSK 8 27 527.00 1,13,832.00 0 - 1,13,832.00 14,798.16 5,407.02 1,34,037.18

4 Helper USK 4 27 466.00 50,328.00 0 - 50,328.00 6,542.64 2,390.58 59,261.22

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-4 (ELECTRICAL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 4x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

special

Sl no

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Electrician SK 10 27 617.00 1,66,590.00 0 - 1,66,590.00 21,656.70 7,913.03 1,96,159.73

3 Electrician SSK 4 27 527.00 56,916.00 0 - 56,916.00 7,399.08 2,703.51 67,018.59

4 Helper USK 2 27 466.00 25,164.00 0 - 25,164.00 3,271.32 1,195.29 29,630.61

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

FOR ANALYSIS OF RATE OF PART-A WORK

SECTOR-5 (ELECTRICAL)

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Wages (col 2x col 5 x col 6) (in Rs.)

Rate of wages (Basic wages+VDA)

PF/EDLI and other admin charges

for employer contribution (13.% of

Gross total (col 7+ col 10) (in Rs.)

Gross total amount paid (col 11 +

Overtime earnings (col 9x col 10)

as per latest circular (in Rs.) for

Overtime rate of wages (in Rs.)

gross total wages in col 11) (in

should not be less than as per

No of worker (the no of labour

ESI contribution @4.75% of

clause 1.2.3 (Part B-1) of

wages in col 7) (in Rs.)

Total overtime worked

col 12+ col13) (in Rs.)

condition of contract

Category of labour

No of days worked

Designation

Remarks

this area

Sl no

special

Rs.)

1 Supervisor HSK 1 27 679.00 18,333.00 0 - 18,333.00 2,383.29 870.82 21,587.11

2 Electrician SK 8 27 617.00 1,33,272.00 0 - 1,33,272.00 17,325.36 6,330.42 1,56,927.78

3 Electrician SSK 6 27 527.00 85,374.00 0 - 85,374.00 11,098.62 4,055.27 1,00,527.89

4 Helper USK 3 27 466.00 37,746.00 0 - 37,746.00 4,906.98 1,792.94 44,445.92

Total cost per month = (A)

Add tools, tackles etc (@ %) of (A)=

Total=

Add overhead and contractors' profit @ % of (A)=

Total =(B)

GST @ 12 % of (B)=

Total=

Add cess @1% of (B)=

Total cost of maintenance per month for Part A of the BOQ=

N.B.: The bonus will be reimbursed by the Institute to the contractor.

You might also like

- Bangaluru ZoneDocument16 pagesBangaluru ZoneASHIN SHAJI GEORGE 1960119No ratings yet

- Persuasive EssayDocument4 pagesPersuasive Essayapi-332227957100% (1)

- Annotated BibliographyDocument8 pagesAnnotated Bibliographyapi-242378836100% (1)

- 1604C Alphalist Format Jan 2018 Final2Document2 pages1604C Alphalist Format Jan 2018 Final2Mikho RaquelNo ratings yet

- Form For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Document4 pagesForm For Furnishing Details of Income Under Section 192 (2) For The Year Ending 31 March, 2017Dilip KumarNo ratings yet

- Inclusion and Exclusion of GIDocument14 pagesInclusion and Exclusion of GIRoxanne Dela Cruz100% (1)

- Blank Performa Convence Bill Neveen 3Document15 pagesBlank Performa Convence Bill Neveen 3ACSFZRNo ratings yet

- 21-Feb-2019 To, The Managing Director, AP Technology Services LTD., 3rd Floor, R&B Building, Opp Indira Gandhi Municipal Stadium, M G Road, Vijayawada - 520 010 Respected SirDocument1 page21-Feb-2019 To, The Managing Director, AP Technology Services LTD., 3rd Floor, R&B Building, Opp Indira Gandhi Municipal Stadium, M G Road, Vijayawada - 520 010 Respected SirsagarNo ratings yet

- Form XVII Register of WagesDocument3 pagesForm XVII Register of WagesBalakrishna HNo ratings yet

- FormsContractLabourAct FormXVIIIDocument1 pageFormsContractLabourAct FormXVIIIs n reddyNo ratings yet

- INDOREDocument4 pagesINDORElapreeservicesNo ratings yet

- Mohan MandirDocument2 pagesMohan MandirRoopesh ChaudharyNo ratings yet

- Pune-I CompaniesDocument9 pagesPune-I CompaniesTPO RCOEMNo ratings yet

- Copie de Financial - TemplatesDocument4 pagesCopie de Financial - TemplatesfaznourNo ratings yet

- DT 0108a Employer Annual Tax Deduction Schedule v1 2Document1 pageDT 0108a Employer Annual Tax Deduction Schedule v1 2joseph borketeyNo ratings yet

- Form No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningDocument3 pagesForm No. 12B: 2022 Name and Address of The Employee: Permanent Account No.: Residential Status: Date of JoiningSantosh Kumar JaiswalNo ratings yet

- Udayour EleDocument18 pagesUdayour EleJoshuaNo ratings yet

- Salary SheetDocument2 pagesSalary SheetgopaljaipurNo ratings yet

- Form-6 Register of EmployeesDocument3 pagesForm-6 Register of EmployeessandilyavikasNo ratings yet

- Performance Status of Pos As On 28Th February'2015: Name of Po: Employee Sales Customer Return vs. ResaleDocument1 pagePerformance Status of Pos As On 28Th February'2015: Name of Po: Employee Sales Customer Return vs. ResaleAntora HoqueNo ratings yet

- Item Wise Boq: GST Registration No.Document17 pagesItem Wise Boq: GST Registration No.jweremaNo ratings yet

- Utilization Report Form 1Document4 pagesUtilization Report Form 1auhsoj raluigaNo ratings yet

- Form 16Document6 pagesForm 16balaramappana2No ratings yet

- Schedule 1 - Alphalist of Employees (Declared and Certified Using BIR Form No. 2316) P R E S E N T E M P L O Y E RDocument2 pagesSchedule 1 - Alphalist of Employees (Declared and Certified Using BIR Form No. 2316) P R E S E N T E M P L O Y E RJoanne Pauline Tenedero - RuelaNo ratings yet

- Target Setting - Unit IIDocument8 pagesTarget Setting - Unit IIprakash_rps2003No ratings yet

- Form 16Document3 pagesForm 16Vikas PandyaNo ratings yet

- IT hardware requirment 2024 mergedDocument16 pagesIT hardware requirment 2024 mergedprl upletaitiNo ratings yet

- Form Xviii Rule 78 (1) (A) (I) ) Form of Register of Wages-cum-Muster RollDocument1 pageForm Xviii Rule 78 (1) (A) (I) ) Form of Register of Wages-cum-Muster RollRaviNo ratings yet

- Form ADocument6 pagesForm Akapil4uNo ratings yet

- Form No 16Document2 pagesForm No 16saran2rasuNo ratings yet

- P.F Jan-2023Document4 pagesP.F Jan-2023kishore.hanNo ratings yet

- Computation SHEET DBP LoansDocument2 pagesComputation SHEET DBP LoansKRYSTEL JUMANOYNo ratings yet

- RMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Document2 pagesRMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Leo R.No ratings yet

- Form 16Document4 pagesForm 16Ashutosh MudgalNo ratings yet

- O&M 21-22 Adilabad Div Estimate - 10.05.2021 - Final (After Modification) @ 17.7.2021Document71 pagesO&M 21-22 Adilabad Div Estimate - 10.05.2021 - Final (After Modification) @ 17.7.2021Mahesh ChetpelliNo ratings yet

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- Instructions To Use Tax CalculatorDocument5 pagesInstructions To Use Tax Calculatormadhuri priyankaNo ratings yet

- Vadodara ZoneDocument30 pagesVadodara ZoneSurajPandeyNo ratings yet

- Truck Refrigration Import Duty CostDocument1 pageTruck Refrigration Import Duty Costsrk1066997No ratings yet

- NoidaDocument6 pagesNoidaAvnish KumarNo ratings yet

- Form VIII - BOCWDocument1 pageForm VIII - BOCWrectsw3No ratings yet

- Business MathDocument4 pagesBusiness MathAislinn Sheen AcasioNo ratings yet

- RMC No. 160-2022 AttachmentOriginalDocument2 pagesRMC No. 160-2022 AttachmentOriginalJoseph SaloNo ratings yet

- Digitally Signed by DINESH MOHAN: (Refer Annexure)Document3 pagesDigitally Signed by DINESH MOHAN: (Refer Annexure)Er Mayank UppalNo ratings yet

- IT FormDocument4 pagesIT FormVimal PatelNo ratings yet

- I T R-1-Ver1 (2pages)Document4 pagesI T R-1-Ver1 (2pages)mohan6789No ratings yet

- Standalone Financial Results For December 31, 2016 (Result)Document4 pagesStandalone Financial Results For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Hyderabad IDocument5 pagesHyderabad IGaju ArchanaNo ratings yet

- Sample Microsoft Salary Certificate TemplateDocument1 pageSample Microsoft Salary Certificate TemplateDani StanisorNo ratings yet

- FormXVII 202404 T436Document1 pageFormXVII 202404 T436santoshgirijsr13No ratings yet

- Form 15 - Register of Leave With WagesDocument2 pagesForm 15 - Register of Leave With WagesHi IamNo ratings yet

- Financial Projection For Re-Org 2020 & 2021Document32 pagesFinancial Projection For Re-Org 2020 & 2021Mitchie Binarao BaylonNo ratings yet

- Solarwinds - Apr'22 - Form WDocument1 pageSolarwinds - Apr'22 - Form WPragnaa ShreeNo ratings yet

- Sas Gold and Metals CDocument1 pageSas Gold and Metals CedenrealtyNo ratings yet

- Classification of Taxpayers (For Income Tax Purposes)Document2 pagesClassification of Taxpayers (For Income Tax Purposes)Jasmin Abigail MoradasNo ratings yet

- Wage Account November 2020M HN-1Document12 pagesWage Account November 2020M HN-1Pavel ViktorNo ratings yet

- Bangalore 1Document7 pagesBangalore 1Leads guruNo ratings yet

- GrtituttyDocument2 pagesGrtituttyNiranjani Duvva Jakkula100% (2)

- Minimum Wage ActDocument6 pagesMinimum Wage ActIvan FrancNo ratings yet

- 4.5 Wellington Investment Vs Trajano 2 PDFDocument2 pages4.5 Wellington Investment Vs Trajano 2 PDFAcqua Di GioNo ratings yet

- Chapter 05Document36 pagesChapter 05Sonny Jim100% (1)

- Atok-Big Wedge Mutual Benefit AssociationDocument3 pagesAtok-Big Wedge Mutual Benefit AssociationArmstrong BosantogNo ratings yet

- Compensation ManagementDocument64 pagesCompensation ManagementNagireddy KalluriNo ratings yet

- Labor 1 - Digests - 092215Document9 pagesLabor 1 - Digests - 092215Karla BeeNo ratings yet

- Assignment 1-4 Labor LawDocument16 pagesAssignment 1-4 Labor LawLuis NovenarioNo ratings yet

- Explain The Basic Principles of Compensation Policies and Its ObjectivesDocument4 pagesExplain The Basic Principles of Compensation Policies and Its ObjectivesASIFNo ratings yet

- Chrysler UAW Tentative Agreement DetailsDocument20 pagesChrysler UAW Tentative Agreement DetailsDetroit Free PressNo ratings yet

- 3.2 Occupations and Earnings: Wages Wage Rate × The Amount of Time The Employee Has WorkedDocument6 pages3.2 Occupations and Earnings: Wages Wage Rate × The Amount of Time The Employee Has WorkedMay Ei PhyuNo ratings yet

- Chapter-2 - Sources of LawDocument20 pagesChapter-2 - Sources of LawNikki PanesNo ratings yet

- Management Unit 5 MCQDocument4 pagesManagement Unit 5 MCQPranav MhatreNo ratings yet

- QB-MBM 457 New PDFDocument3 pagesQB-MBM 457 New PDFSurabhi SumanNo ratings yet

- Payment of Gratuity Act, 1972Document56 pagesPayment of Gratuity Act, 1972profkalpeshNo ratings yet

- Human Resource ManagementDocument53 pagesHuman Resource ManagementShrividhya Venkata PrasathNo ratings yet

- Salaries and Wages Administration As A Tool For Improving Employee's PerformanceDocument88 pagesSalaries and Wages Administration As A Tool For Improving Employee's Performancepoonam l maruchNo ratings yet

- Detachment With A1 Form in RomaniaDocument4 pagesDetachment With A1 Form in RomaniafrjacobsNo ratings yet

- CMS Report 2Document301 pagesCMS Report 2RecordTrac - City of OaklandNo ratings yet

- Labour Problems in Safety Match Industry in Aruppukottai in Virudhunagar DistrictDocument11 pagesLabour Problems in Safety Match Industry in Aruppukottai in Virudhunagar DistrictAilen Mae PatriaNo ratings yet

- Wage Order - RB1 21Document3 pagesWage Order - RB1 21Jovie Ann SamoranosNo ratings yet

- Template Laporan BulananDocument13 pagesTemplate Laporan BulananKopi PahitNo ratings yet

- Final - C5 and C6 de Leon - Concepts in The Law On Public OfficersDocument27 pagesFinal - C5 and C6 de Leon - Concepts in The Law On Public OfficersTep DomingoNo ratings yet

- Labor LawDocument58 pagesLabor LawPrincessNo ratings yet

- NPK Notes Roshan Desai Sir 4 Industrial Safety and Legislative ActDocument24 pagesNPK Notes Roshan Desai Sir 4 Industrial Safety and Legislative ActOmkar ShindeNo ratings yet

- Labour Act: Laws of Guyana Cap. 98:01Document32 pagesLabour Act: Laws of Guyana Cap. 98:01Nazaline NoonaNo ratings yet

- Industrial Engineering Basics - John DeereDocument319 pagesIndustrial Engineering Basics - John DeereAlpha Excellence consulting100% (1)