Professional Documents

Culture Documents

Topic 3 BFIN 313

Topic 3 BFIN 313

Uploaded by

Shaina LimCopyright:

Available Formats

You might also like

- Excell File (Thompson Asset Management)Document78 pagesExcell File (Thompson Asset Management)Shaubhik Das0% (1)

- Ogl 260 Module 3 - UpdatedDocument5 pagesOgl 260 Module 3 - Updatedapi-538745701No ratings yet

- Case-1 QuestionsDocument2 pagesCase-1 QuestionsadeshlNo ratings yet

- AP.105 Audit of InvestmentsDocument8 pagesAP.105 Audit of InvestmentsJonathan FestinNo ratings yet

- Calhoun ADX Breakout ScanDocument5 pagesCalhoun ADX Breakout Scanedsnake80% (5)

- Hedging Illiquid AssetsDocument16 pagesHedging Illiquid Assetspenfoul29No ratings yet

- Ebook Vince Secrets To Smart TradingDocument18 pagesEbook Vince Secrets To Smart TradingMujitha Manorathna100% (1)

- How To Calculate Machine Hour RateDocument4 pagesHow To Calculate Machine Hour Rateprasad_kcpNo ratings yet

- Topic 5 Bfin 313Document18 pagesTopic 5 Bfin 313Shaina LimNo ratings yet

- Topic 7 BFIN 313Document16 pagesTopic 7 BFIN 313Shaina LimNo ratings yet

- Topic 4 BFIN 313Document18 pagesTopic 4 BFIN 313Shaina LimNo ratings yet

- Topic 8 BFIN 313Document20 pagesTopic 8 BFIN 313Shaina LimNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- FAR Lesson 1 65Document38 pagesFAR Lesson 1 65Janine Charmie Manongsong OlivarNo ratings yet

- Topic 2 BFIN 313Document18 pagesTopic 2 BFIN 313Shaina LimNo ratings yet

- Topic 10 BFIN 313Document15 pagesTopic 10 BFIN 313Shaina LimNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )PNDNo ratings yet

- Topic 9 BFIN 313Document14 pagesTopic 9 BFIN 313Shaina LimNo ratings yet

- Topic 1 BFIN 313Document16 pagesTopic 1 BFIN 313Shaina LimNo ratings yet

- BSAIS-SBA 313 Information Sheet 4Document18 pagesBSAIS-SBA 313 Information Sheet 4jeraldtorressantos0626No ratings yet

- Fin 1a Module 5Document22 pagesFin 1a Module 5Lumbay, Jolly MaeNo ratings yet

- Course Title: Financial Statement Analysis Course Code: FIN4233 Assignment No.1Document2 pagesCourse Title: Financial Statement Analysis Course Code: FIN4233 Assignment No.1ھاشم عمران واھلہNo ratings yet

- FM ReportDocument45 pagesFM ReportPurvesh TaheliyaniNo ratings yet

- Informe en Ingles Financial TraducidoDocument8 pagesInforme en Ingles Financial TraducidoMARIA OLGA PINEDO VILCHEZNo ratings yet

- Module 2 Financial StatementsDocument17 pagesModule 2 Financial StatementsRoss JorgensenNo ratings yet

- Assessment 1 Career Interest ReportDocument12 pagesAssessment 1 Career Interest Reportapi-586476688No ratings yet

- A Project On: Roll No. 332 Submitted ToDocument19 pagesA Project On: Roll No. 332 Submitted ToSagarNo ratings yet

- DU Finance BBA Course PlanDocument31 pagesDU Finance BBA Course PlanToxicant GamerNo ratings yet

- 11 MODULE 3 For AE 19 PDFDocument25 pages11 MODULE 3 For AE 19 PDFCJ GranadaNo ratings yet

- FMCG Comparative PerformanceDocument50 pagesFMCG Comparative Performanceavinash singhNo ratings yet

- 026 Amarjyot Singh PDFDocument48 pages026 Amarjyot Singh PDFJuzarNo ratings yet

- Synopsis 1Document6 pagesSynopsis 1Yogesh MalpathakNo ratings yet

- Abm Fujiya BHD Abmf Swot Analysis BacDocument13 pagesAbm Fujiya BHD Abmf Swot Analysis BacFauzi Al nassarNo ratings yet

- FinMan Financial ControlDocument16 pagesFinMan Financial ControlKezzi Ervin UngayNo ratings yet

- TIRUMALA DIARY PRJ Modified by Working CapitalDocument94 pagesTIRUMALA DIARY PRJ Modified by Working CapitalVamsi SakhamuriNo ratings yet

- WS 16 GRAND Strategy MatrixDocument6 pagesWS 16 GRAND Strategy MatrixTherese PascuaNo ratings yet

- 11 MODULE 3 For AE 19Document26 pages11 MODULE 3 For AE 19Yvonne Marie DavilaNo ratings yet

- Role of Financial Reporting and Financial Intermediaries in Capital Market Module 1 (Class 2and 3)Document32 pagesRole of Financial Reporting and Financial Intermediaries in Capital Market Module 1 (Class 2and 3)RajdeepNo ratings yet

- Module 6 Ratio Analysis and InterpretationDocument9 pagesModule 6 Ratio Analysis and InterpretationHeart MacedaNo ratings yet

- Information Sheet 1 - Introduction To Business EthicsDocument9 pagesInformation Sheet 1 - Introduction To Business EthicsJun Martine SalcedoNo ratings yet

- Shipra Kumari - PGFC2041Document50 pagesShipra Kumari - PGFC2041akashbro675No ratings yet

- Cost AccountingDocument25 pagesCost AccountingRizan MohamedNo ratings yet

- You Can Do This Ange Trust HimDocument74 pagesYou Can Do This Ange Trust Himjuzzcam.14No ratings yet

- Course Introduction To Accounting Introduction To AccountingDocument3 pagesCourse Introduction To Accounting Introduction To Accountingabooody1027No ratings yet

- Business Economics and Analysis - VirangaDocument15 pagesBusiness Economics and Analysis - VirangadrakipdNo ratings yet

- Bdo - Industryanalysis PaperDocument12 pagesBdo - Industryanalysis PaperJohn Michael Dela CruzNo ratings yet

- End Term Papers - CIF NewDocument11 pagesEnd Term Papers - CIF NewAdarsh JalanNo ratings yet

- G Love ProjectDocument54 pagesG Love Projectadebowale adejengbeNo ratings yet

- Finance Module 1 Intro To FinanceDocument8 pagesFinance Module 1 Intro To FinanceJOHN PAUL LAGAONo ratings yet

- CostAccounting PDFDocument25 pagesCostAccounting PDFAliza Ishra100% (1)

- Financial Management Project ReportDocument14 pagesFinancial Management Project ReportApoorva Pattnaik0% (1)

- Instructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocument14 pagesInstructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaMary JhoyNo ratings yet

- The Case of The Unit Investment Trust Fund (UITF) Research StudyDocument45 pagesThe Case of The Unit Investment Trust Fund (UITF) Research StudyRohit BadaveNo ratings yet

- Cruz, Aiyana Gabrielle - CFAS 04Document3 pagesCruz, Aiyana Gabrielle - CFAS 04Misha Laine de LeonNo ratings yet

- A Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.vijiDocument6 pagesA Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.vijiInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investment Banking Interview PrepDocument56 pagesInvestment Banking Interview PrepNeil Grigg100% (3)

- 2013-ADB ASEI IB Country Study Philippines PDFDocument135 pages2013-ADB ASEI IB Country Study Philippines PDFTin Ampol Kris LiboonNo ratings yet

- Bwff6013 Group Assignment Class Discussant Group 3Document12 pagesBwff6013 Group Assignment Class Discussant Group 3Hamdiya SaladNo ratings yet

- Project PortfolioBSBCRT611 Project PortfolioDocument14 pagesProject PortfolioBSBCRT611 Project PortfolioParth PrajapatiNo ratings yet

- Assignment March 2020 Semester: Advance Financial AccountingDocument13 pagesAssignment March 2020 Semester: Advance Financial AccountingPrabavathi KarunanithiNo ratings yet

- RBI GR B 2019 Solution and Analysis FM Lyst7772Document81 pagesRBI GR B 2019 Solution and Analysis FM Lyst7772venshmasuslaNo ratings yet

- Econ F315 1923 20240111123625Document5 pagesEcon F315 1923 20240111123625TIRTH ANAND TRIVEDINo ratings yet

- Assignment Group - PortfolioDocument63 pagesAssignment Group - PortfolioSharmila DeviNo ratings yet

- ACC102 Module4 1206 1207 1208Document18 pagesACC102 Module4 1206 1207 1208Kylene MagtibayNo ratings yet

- 04 - Activity 1 - GROUP 5 - BSBA4.1ADocument3 pages04 - Activity 1 - GROUP 5 - BSBA4.1Avincelatayan04No ratings yet

- Reviewer 7Document2 pagesReviewer 7Shaina LimNo ratings yet

- INFOSHEET - SCI313-4 - Evolution and DiversityDocument17 pagesINFOSHEET - SCI313-4 - Evolution and DiversityShaina LimNo ratings yet

- INFOSHEET - SCI313-1 - The Nature of Science and Biological ProcessDocument10 pagesINFOSHEET - SCI313-1 - The Nature of Science and Biological ProcessShaina LimNo ratings yet

- Lesson 6Document4 pagesLesson 6Shaina LimNo ratings yet

- Trends in Stock MarketDocument28 pagesTrends in Stock MarketHarshraj ShahNo ratings yet

- BSP & Money Notes 9Document16 pagesBSP & Money Notes 9Michael VxchoricNo ratings yet

- Lab Siak Sap: Nama: Nugraha Aditya Pradana NPM: 1406623316 Kelas: SIAK ADocument19 pagesLab Siak Sap: Nama: Nugraha Aditya Pradana NPM: 1406623316 Kelas: SIAK AambarNo ratings yet

- CSC 1Document10 pagesCSC 1Nguyen Thi Hai YenNo ratings yet

- Country Risk AnalysisDocument29 pagesCountry Risk AnalysisBilal Raja100% (2)

- Little Book of Common Sense Investing WorkingDocument20 pagesLittle Book of Common Sense Investing WorkingUmesh AgrawalNo ratings yet

- Foundations of Financial Management: Stanley B. BlockDocument9 pagesFoundations of Financial Management: Stanley B. BlockElvis169No ratings yet

- Euro Currency MarketDocument6 pagesEuro Currency MarketHarsh JainNo ratings yet

- AsdasdasdasdDocument112 pagesAsdasdasdasdTan Wei ShengNo ratings yet

- CH 14 Var Vs Abs CostingDocument60 pagesCH 14 Var Vs Abs CostingShannon BánañasNo ratings yet

- Pavan Project On Equity Derivatives 2222222222222222222222222222Document55 pagesPavan Project On Equity Derivatives 2222222222222222222222222222ravan vlogsNo ratings yet

- AssignmentDocument14 pagesAssignmentAhmed HassanNo ratings yet

- FLSB-Topic 3-Discussion Questions On Contract LawDocument4 pagesFLSB-Topic 3-Discussion Questions On Contract LawAlois Trancy0% (1)

- The Grandmother With Faith in Indian StocksDocument3 pagesThe Grandmother With Faith in Indian Stockssac_divakarNo ratings yet

- Syailendra Sharia Money Market Fund - Mei - 2022Document1 pageSyailendra Sharia Money Market Fund - Mei - 2022Moslem CompanyNo ratings yet

- Comparative Analysis of Mutual FundsDocument101 pagesComparative Analysis of Mutual FundsSubhash BajajNo ratings yet

- BankMobile Full Fee Schedules PDFDocument2 pagesBankMobile Full Fee Schedules PDFminipower50No ratings yet

- Mint Money 1 For WEBDocument17 pagesMint Money 1 For WEBRoshan KumarNo ratings yet

- Analysis of Corporate Valuation Theories and A Valuation of ISSDocument112 pagesAnalysis of Corporate Valuation Theories and A Valuation of ISSJacob Bar100% (2)

- Shibanda Proposal 31-8-2021 (400) FinalDocument42 pagesShibanda Proposal 31-8-2021 (400) FinalDigichange AgronomistsNo ratings yet

- Nptel: Infrastructure Finance - Video CourseDocument3 pagesNptel: Infrastructure Finance - Video CourseGaneshNo ratings yet

- An Introduction To DTCC: Guide To Clearance & SettlementDocument36 pagesAn Introduction To DTCC: Guide To Clearance & Settlementmona2009pooja100% (3)

- Swot and ProductDocument5 pagesSwot and ProductavinishNo ratings yet

- Navjeet Singh SobtiDocument18 pagesNavjeet Singh SobtiShreyans GirathNo ratings yet

Topic 3 BFIN 313

Topic 3 BFIN 313

Uploaded by

Shaina LimCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Topic 3 BFIN 313

Topic 3 BFIN 313

Uploaded by

Shaina LimCopyright:

Available Formats

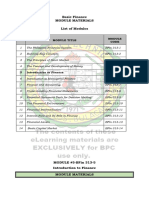

Basic Finance

MODULE MATERIALS

List of Modules

No. MODULE

MODULE TITLE

CODE

1 The Philippine Financial System BFin 313-1

2 Banking Key Concepts BFin 313-2

3 The Principles of Stock Market BFin 313-3

4 The Concept and Development of Money BFin 313-4

5 Introduction to Finance BFin 313-5

6 Introduction to Managerial Finance BFin 313-6

7 Finance and Accounting BFin 313-7

8 Understanding Financial Statements BFin 313-8

9 Financial Statement Tools for Decision Making BFin 313-9

10 The Financial Environment BFin 313-10

11 Financial Intermediation BFin 313-11

12 Interest Rate and Its Role in Finance BFin 313-12

13 Financial Assets BFin 313-13

14 Basic Capital Market BFin 313-14

MODULE #3-BFin 313-3

The Principles of Stock Market

MODULE MATERIALS

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 36 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

THE PRINCIPLES

OF

STOCK MARKET

(BFIN 313-3)

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 37 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

MODULE CONTENT

COURSE TITLE: Basic Finance

MODULE TITLE The Principles of Stock Market

NOMINAL DURATION: 3 Hours

SPECIFIC LEARNING OBJECTIVES:

At the end of this module you MUST be able to:

1. Familiarize with the concept of Philippine stock markets.

2. Have an understanding of the basics of capital markets

3. Identify the stock market rules and conventions.

4. Apply stock analysis in real life situation.

5. Understand and solve stock simulations and applications.

TOPICS: (Sub-Topics)

1. Definition and Nature of Stock Market

2. Definition of Stocks

3. How Does Stock Market Trading Work?

4. The Rise and Fall of Stock Prices: Is it risky?

5. Basics of Capital Markets

6. Stock Market Rules and Conventions

7. Stock Analysis

8. Simulations and Applications

ASSESSMENT METHOD/S:

Quiz-Multiple Choice

REFERENCE/S:

1. Leuterio, M.M. & Estepa, C.B.

Banking Theory & Practice (Revised Edition), 2018

Pasig City: Anvil Publishing, Inc.

2. Fajardo, Feliciano R. & Manansala, Manuel M.

Money, Credit and Banking 4th Edition, 2018

Mandaluyong City: National Book Store

3. A) Mejorada, N.D.

Introduction to Management Accounting, 2018 Edition

Makati City: Goodwill Trading Co., Inc.

B) Edlagan and Mercado

Management Advisory Services (Concepts, Methods and

Applications) Volume 1, 2017 Edition

Makati City: Goodwill Trading Co., Inc.

4. Shapiro, A.C.

Foundations of Multinational Financial Management, 2008

Edition

New York: John Wiley & Sons

5. A) Sollenberger and Schneider

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 38 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

Managerial Accounting, 9th Edition 2016

Hoboken, New Jersey, USA: John Wiley and Sons

B) Homgren, Sundem and Stratton

Introduction to Management Accounting 10th Edition, 2017

Upper Saddle River, New Jersey, USA: Pearson Prentice Hall

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 39 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

Information Sheet BFIN 313-3

The Principles of Stock Market

Learning Objectives:

After reading this INFORMATION SHEET, YOU MUST be able to:

1. Discuss the principles and nature of stock market.

2. Have thorough knowledge on how to invest in stock market.

3. Apply the simple applications in making decision in the investment of

stock.

INTRODUCTION

Due to financial literacy programs and campaigns in the country, Pinoys

are now getting more interested and curious about stock market. You may

have heard about it from your friends, your boss, or your classmates. It is not

unusual for a person in his or her 20s to have a background in the stock

market. For those who feel that they are late in jumping on the bandwagon,

this module makes you easy to understand guide on the basics of the

Philippine Stock Market.

DEFINITION OF STOCK MARKET

➢ A place where stocks are bought and sold.

➢ The goal of trading in the stock market is to buy a stock, hold it for a

desired time, and then sell the stock for more than what you initially

paid for it

WHAT ARE STOCKS?

➢ Units of ownership in a company

➢ Companies sell stocks to the public for more funding to create new

products, expand their business, and improve current products.

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 40 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

HOW DOES STOCK MARKET TRADING WORK?

➢ When you buy a stock, you own a share in the company. For example,

when you buy a stock of Jollibee, you have a claim on the company’s

earnings. This makes you a shareholder of Jollibee. It Jollibee’s profits

go up, so does your stock price. If it falls, then the price of your stock

also falls.

THE RISE AND FALL OF STOCK PRICES: IS IT RISKY?

➢ Every investment has a risk. In the stock market, the prices of stock rise

and fall every day. For example, Jollibee’s stocks could rise today and

fall tomorrow. Remember #ChickenSad? That may have caused a fall in

Jollibee’s profits, hence a fall in their stock price. But what if Jollibee

releases a series of marketing campaigns that will tug the heartstrings

and cause you to buy more Yum burgers? They already did that with

#Kwentong Jollibee. If the campaign is effective, then Jollibee’s profits

will rise and so does the price of your stock.

➢ If you sell your stock on the day when the price of that stock is less than

what you paid for it, then you lose money. The goal of investing in the

stock market is buying a stock with the hopes that over the years you

can sell your stock for a profit.

CAN YOU PREDICT WHEN THE STOCK PRICES GO UP OR DOWN?

➢ No, unless you have superpowers. That is why most financial advisers

recommend investing in the stock market for long term-that is 10 years

or more.

➢ It is also important to make sure that you buy stocks from good and

stable companies. You will be sharing in the profit or loss of those

companies.

➢ If you’re ready to invest in the stock market, buy and sell in the

Philippine Stock Market, we need to have a broker. There are already

certified online brokers in the Philippines such as COL Financial, BPI

Trade and First Metro.

➢ Signing up for an account in one of these brokers is just a first step.

Learning which stocks to buy is the challenging part. Educate yourself by

reading books or articles on investing online, so you can be a SMART

investor. With numerous financial tools at your disposal, you can make

wiser decisions with finances.

THE BASICS OF CAPITAL MARKETS

FINANCIAL MARKETS

➢ Awareness of the environment where the business operate provides a

better perspective to the one making decisions relating to the finance

function. An important concern refers to financial markets which

perform a vital role in the operation of the overall financial system

including business finance.

WHAT ARE FINANCIAL MARKETS?

Firms who need for funds are greater than their current incomes.

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 41 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

Individuals and firms who want to borrow money are brought

together with those who want to lend in the financial markets.

Diagram of Financial Markets

Primary Market

• A financial market in which newly issued primary and secondary

securities are traded for the first time.

Secondary Market

• A Financial market through which existing financial securities are

traded.

Capital Market

• A portion of the financial market where trading is undertaken for

securities with maturity of more than one year. Banks that bid for two-

year Treasury bonds are considered part of the capital market.

The capital market is subdivided into three parts:

1. Bond market;

2. Stock market; and

3. Mortgage market.

Bond Market

• The market for debt instruments of any kind is called the bond market

• It operates through a system of dealers using a telecommunications

network, rather than in a single physical location for trading.

Stock Market

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 42 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

• The financial market where the common and preferred stocks issued by

corporations are traded.

• It has two components:

1. Organized exchange;

2. Less formal Over-the-Counter Markets.

• There are many organized exchanges throughout the world like the New

York and the London Stock Exchanges. The companies whose stocks are

traded in the Philippine Stock Exchange are classified into the following

categories;

1. Banks

2. Financial service

3. Communication

4. Power and energy

5. Transportation services

6. Constructions and other related products

7. Food, beverages, and tobacco

8. Holding firms

9. Manufacturing, distribution, and trading

10. Hotels, recreations, and other services

11. Bonds, preferred stocks, and warrants

12. Others

STOCK MARKET RULES AND CONVENTIONS

What you need to know about the Philippine Stock Market?

Rule No.1: Stock investment is not just an abstract idea with prices go up

and down. Buying stocks is buying a part of the company.

Rule No.2: The price of the stocks goes up and down whether you like it or

not.

Rule No. 3: The price of the stocks is independent of the profitability of the

company.

Rule No. 4: There are 3 major players in the Philippine stock market. There

are winners, middle men and losers.

Rule No. 5: Philippine stock market is risky but risk can be managed when

you know what you are doing.

Rule No. 6: You only win (or lost) when you participate in the market.

STOCK ANALYSIS

STOCK

❖ a share of the value of a company which can be bought, sold, or

traded as an investment.

STOCK ANALYSIS

❖ is a term that refers to the evaluation of a particular trading instrument,

an investment sector or the market as a whole.

❖ Stock analysis attempt to determine the future activity of an instrument,

sector or market.

Two Basic Types of Stock Analysis

1. Fundamental Analysis

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 43 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

❖ Concentrates on data from sources including financial records,

economic reports, company assets and market share.

❖ Study the cause

❖ Supply-demand

❖ Government interventions

2. Technical Analysis

❖ Focuses on the study of past market action to predict future price

movement

❖ Study the effect of movement

❖ Charts, price, volume, trend

SIMULATION AND APPLICATION

Simulation

❖ the imitation of the operation of a real-world process or system over time.

❖ can be used to show the eventual real effects of alternative conditions

and courses of action, or it is being designed but not yet built, or it may

simply not exist

❖ key issues in simulation include acquisition of valid source information

about the relevant selection of key characteristics and behaviors, the use

of simplifying approximations and assumptions within the simulation,

and fidelity and validity of the simulation outcomes.

Simulations in Finance

❖ In finance simulations are often used for scenario planning. Risk-

adjusted net present value, for example, is computed from well-defined

but not always known (or fixed) inputs. By imitating the performance of

the project under evaluation,

❖ Simulations are frequently used in financial training to engage

participants in experiencing various historical as well as fictional

situations. There are stock market simulations, portfolio simulations,

risk management simulations or models and forex simulations. Such

simulations are typically based on stochastic asset models. Using these

simulations in a training program allows for the application of theory into

a something akin to real life. As with other industries, the use of

simulations can be technology or case-study driven.

Stock Market Simulation

❖ Among numerous investment strategies in the stock market, this stock

market simulation focused on the conservative strategy of John Bogle,

which states that stock trading is a losing game and investment in index

funds is a more profitable strategy

❖ A stock market simulator is a program or application that attempts to

reproduce or duplicate some or all features of a live stock market on a

computer so that a player may practice trading stocks without financial

risk.

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 44 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

APPLICATIONS

❖ action of putting something into operation

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 45 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

Diagram of What Stock Market Simulation Is and How It Works

Simulation imitation of the real world

operation process obtained/acquire relevant,

valid, approximate source of information.

Application

Stock Market Simulator an

apps/application of a real world livestock.

Bachelor of Science in Date Developed:

Accounting Information Bulacan Polytechnic June 2020

Page 46 of 204

College Date Revised:

System

July 2020

Basic Finance Document No. Developed by:

Eugene A. Ruano Revision # 02

BFIN 313 40-BFIN 313

You might also like

- Excell File (Thompson Asset Management)Document78 pagesExcell File (Thompson Asset Management)Shaubhik Das0% (1)

- Ogl 260 Module 3 - UpdatedDocument5 pagesOgl 260 Module 3 - Updatedapi-538745701No ratings yet

- Case-1 QuestionsDocument2 pagesCase-1 QuestionsadeshlNo ratings yet

- AP.105 Audit of InvestmentsDocument8 pagesAP.105 Audit of InvestmentsJonathan FestinNo ratings yet

- Calhoun ADX Breakout ScanDocument5 pagesCalhoun ADX Breakout Scanedsnake80% (5)

- Hedging Illiquid AssetsDocument16 pagesHedging Illiquid Assetspenfoul29No ratings yet

- Ebook Vince Secrets To Smart TradingDocument18 pagesEbook Vince Secrets To Smart TradingMujitha Manorathna100% (1)

- How To Calculate Machine Hour RateDocument4 pagesHow To Calculate Machine Hour Rateprasad_kcpNo ratings yet

- Topic 5 Bfin 313Document18 pagesTopic 5 Bfin 313Shaina LimNo ratings yet

- Topic 7 BFIN 313Document16 pagesTopic 7 BFIN 313Shaina LimNo ratings yet

- Topic 4 BFIN 313Document18 pagesTopic 4 BFIN 313Shaina LimNo ratings yet

- Topic 8 BFIN 313Document20 pagesTopic 8 BFIN 313Shaina LimNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- FAR Lesson 1 65Document38 pagesFAR Lesson 1 65Janine Charmie Manongsong OlivarNo ratings yet

- Topic 2 BFIN 313Document18 pagesTopic 2 BFIN 313Shaina LimNo ratings yet

- Topic 10 BFIN 313Document15 pagesTopic 10 BFIN 313Shaina LimNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document5 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )PNDNo ratings yet

- Topic 9 BFIN 313Document14 pagesTopic 9 BFIN 313Shaina LimNo ratings yet

- Topic 1 BFIN 313Document16 pagesTopic 1 BFIN 313Shaina LimNo ratings yet

- BSAIS-SBA 313 Information Sheet 4Document18 pagesBSAIS-SBA 313 Information Sheet 4jeraldtorressantos0626No ratings yet

- Fin 1a Module 5Document22 pagesFin 1a Module 5Lumbay, Jolly MaeNo ratings yet

- Course Title: Financial Statement Analysis Course Code: FIN4233 Assignment No.1Document2 pagesCourse Title: Financial Statement Analysis Course Code: FIN4233 Assignment No.1ھاشم عمران واھلہNo ratings yet

- FM ReportDocument45 pagesFM ReportPurvesh TaheliyaniNo ratings yet

- Informe en Ingles Financial TraducidoDocument8 pagesInforme en Ingles Financial TraducidoMARIA OLGA PINEDO VILCHEZNo ratings yet

- Module 2 Financial StatementsDocument17 pagesModule 2 Financial StatementsRoss JorgensenNo ratings yet

- Assessment 1 Career Interest ReportDocument12 pagesAssessment 1 Career Interest Reportapi-586476688No ratings yet

- A Project On: Roll No. 332 Submitted ToDocument19 pagesA Project On: Roll No. 332 Submitted ToSagarNo ratings yet

- DU Finance BBA Course PlanDocument31 pagesDU Finance BBA Course PlanToxicant GamerNo ratings yet

- 11 MODULE 3 For AE 19 PDFDocument25 pages11 MODULE 3 For AE 19 PDFCJ GranadaNo ratings yet

- FMCG Comparative PerformanceDocument50 pagesFMCG Comparative Performanceavinash singhNo ratings yet

- 026 Amarjyot Singh PDFDocument48 pages026 Amarjyot Singh PDFJuzarNo ratings yet

- Synopsis 1Document6 pagesSynopsis 1Yogesh MalpathakNo ratings yet

- Abm Fujiya BHD Abmf Swot Analysis BacDocument13 pagesAbm Fujiya BHD Abmf Swot Analysis BacFauzi Al nassarNo ratings yet

- FinMan Financial ControlDocument16 pagesFinMan Financial ControlKezzi Ervin UngayNo ratings yet

- TIRUMALA DIARY PRJ Modified by Working CapitalDocument94 pagesTIRUMALA DIARY PRJ Modified by Working CapitalVamsi SakhamuriNo ratings yet

- WS 16 GRAND Strategy MatrixDocument6 pagesWS 16 GRAND Strategy MatrixTherese PascuaNo ratings yet

- 11 MODULE 3 For AE 19Document26 pages11 MODULE 3 For AE 19Yvonne Marie DavilaNo ratings yet

- Role of Financial Reporting and Financial Intermediaries in Capital Market Module 1 (Class 2and 3)Document32 pagesRole of Financial Reporting and Financial Intermediaries in Capital Market Module 1 (Class 2and 3)RajdeepNo ratings yet

- Module 6 Ratio Analysis and InterpretationDocument9 pagesModule 6 Ratio Analysis and InterpretationHeart MacedaNo ratings yet

- Information Sheet 1 - Introduction To Business EthicsDocument9 pagesInformation Sheet 1 - Introduction To Business EthicsJun Martine SalcedoNo ratings yet

- Shipra Kumari - PGFC2041Document50 pagesShipra Kumari - PGFC2041akashbro675No ratings yet

- Cost AccountingDocument25 pagesCost AccountingRizan MohamedNo ratings yet

- You Can Do This Ange Trust HimDocument74 pagesYou Can Do This Ange Trust Himjuzzcam.14No ratings yet

- Course Introduction To Accounting Introduction To AccountingDocument3 pagesCourse Introduction To Accounting Introduction To Accountingabooody1027No ratings yet

- Business Economics and Analysis - VirangaDocument15 pagesBusiness Economics and Analysis - VirangadrakipdNo ratings yet

- Bdo - Industryanalysis PaperDocument12 pagesBdo - Industryanalysis PaperJohn Michael Dela CruzNo ratings yet

- End Term Papers - CIF NewDocument11 pagesEnd Term Papers - CIF NewAdarsh JalanNo ratings yet

- G Love ProjectDocument54 pagesG Love Projectadebowale adejengbeNo ratings yet

- Finance Module 1 Intro To FinanceDocument8 pagesFinance Module 1 Intro To FinanceJOHN PAUL LAGAONo ratings yet

- CostAccounting PDFDocument25 pagesCostAccounting PDFAliza Ishra100% (1)

- Financial Management Project ReportDocument14 pagesFinancial Management Project ReportApoorva Pattnaik0% (1)

- Instructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaDocument14 pagesInstructional Module: Republic of The Philippines Nueva Vizcaya State University Bayombong, Nueva VizcayaMary JhoyNo ratings yet

- The Case of The Unit Investment Trust Fund (UITF) Research StudyDocument45 pagesThe Case of The Unit Investment Trust Fund (UITF) Research StudyRohit BadaveNo ratings yet

- Cruz, Aiyana Gabrielle - CFAS 04Document3 pagesCruz, Aiyana Gabrielle - CFAS 04Misha Laine de LeonNo ratings yet

- A Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.vijiDocument6 pagesA Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.vijiInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Investment Banking Interview PrepDocument56 pagesInvestment Banking Interview PrepNeil Grigg100% (3)

- 2013-ADB ASEI IB Country Study Philippines PDFDocument135 pages2013-ADB ASEI IB Country Study Philippines PDFTin Ampol Kris LiboonNo ratings yet

- Bwff6013 Group Assignment Class Discussant Group 3Document12 pagesBwff6013 Group Assignment Class Discussant Group 3Hamdiya SaladNo ratings yet

- Project PortfolioBSBCRT611 Project PortfolioDocument14 pagesProject PortfolioBSBCRT611 Project PortfolioParth PrajapatiNo ratings yet

- Assignment March 2020 Semester: Advance Financial AccountingDocument13 pagesAssignment March 2020 Semester: Advance Financial AccountingPrabavathi KarunanithiNo ratings yet

- RBI GR B 2019 Solution and Analysis FM Lyst7772Document81 pagesRBI GR B 2019 Solution and Analysis FM Lyst7772venshmasuslaNo ratings yet

- Econ F315 1923 20240111123625Document5 pagesEcon F315 1923 20240111123625TIRTH ANAND TRIVEDINo ratings yet

- Assignment Group - PortfolioDocument63 pagesAssignment Group - PortfolioSharmila DeviNo ratings yet

- ACC102 Module4 1206 1207 1208Document18 pagesACC102 Module4 1206 1207 1208Kylene MagtibayNo ratings yet

- 04 - Activity 1 - GROUP 5 - BSBA4.1ADocument3 pages04 - Activity 1 - GROUP 5 - BSBA4.1Avincelatayan04No ratings yet

- Reviewer 7Document2 pagesReviewer 7Shaina LimNo ratings yet

- INFOSHEET - SCI313-4 - Evolution and DiversityDocument17 pagesINFOSHEET - SCI313-4 - Evolution and DiversityShaina LimNo ratings yet

- INFOSHEET - SCI313-1 - The Nature of Science and Biological ProcessDocument10 pagesINFOSHEET - SCI313-1 - The Nature of Science and Biological ProcessShaina LimNo ratings yet

- Lesson 6Document4 pagesLesson 6Shaina LimNo ratings yet

- Trends in Stock MarketDocument28 pagesTrends in Stock MarketHarshraj ShahNo ratings yet

- BSP & Money Notes 9Document16 pagesBSP & Money Notes 9Michael VxchoricNo ratings yet

- Lab Siak Sap: Nama: Nugraha Aditya Pradana NPM: 1406623316 Kelas: SIAK ADocument19 pagesLab Siak Sap: Nama: Nugraha Aditya Pradana NPM: 1406623316 Kelas: SIAK AambarNo ratings yet

- CSC 1Document10 pagesCSC 1Nguyen Thi Hai YenNo ratings yet

- Country Risk AnalysisDocument29 pagesCountry Risk AnalysisBilal Raja100% (2)

- Little Book of Common Sense Investing WorkingDocument20 pagesLittle Book of Common Sense Investing WorkingUmesh AgrawalNo ratings yet

- Foundations of Financial Management: Stanley B. BlockDocument9 pagesFoundations of Financial Management: Stanley B. BlockElvis169No ratings yet

- Euro Currency MarketDocument6 pagesEuro Currency MarketHarsh JainNo ratings yet

- AsdasdasdasdDocument112 pagesAsdasdasdasdTan Wei ShengNo ratings yet

- CH 14 Var Vs Abs CostingDocument60 pagesCH 14 Var Vs Abs CostingShannon BánañasNo ratings yet

- Pavan Project On Equity Derivatives 2222222222222222222222222222Document55 pagesPavan Project On Equity Derivatives 2222222222222222222222222222ravan vlogsNo ratings yet

- AssignmentDocument14 pagesAssignmentAhmed HassanNo ratings yet

- FLSB-Topic 3-Discussion Questions On Contract LawDocument4 pagesFLSB-Topic 3-Discussion Questions On Contract LawAlois Trancy0% (1)

- The Grandmother With Faith in Indian StocksDocument3 pagesThe Grandmother With Faith in Indian Stockssac_divakarNo ratings yet

- Syailendra Sharia Money Market Fund - Mei - 2022Document1 pageSyailendra Sharia Money Market Fund - Mei - 2022Moslem CompanyNo ratings yet

- Comparative Analysis of Mutual FundsDocument101 pagesComparative Analysis of Mutual FundsSubhash BajajNo ratings yet

- BankMobile Full Fee Schedules PDFDocument2 pagesBankMobile Full Fee Schedules PDFminipower50No ratings yet

- Mint Money 1 For WEBDocument17 pagesMint Money 1 For WEBRoshan KumarNo ratings yet

- Analysis of Corporate Valuation Theories and A Valuation of ISSDocument112 pagesAnalysis of Corporate Valuation Theories and A Valuation of ISSJacob Bar100% (2)

- Shibanda Proposal 31-8-2021 (400) FinalDocument42 pagesShibanda Proposal 31-8-2021 (400) FinalDigichange AgronomistsNo ratings yet

- Nptel: Infrastructure Finance - Video CourseDocument3 pagesNptel: Infrastructure Finance - Video CourseGaneshNo ratings yet

- An Introduction To DTCC: Guide To Clearance & SettlementDocument36 pagesAn Introduction To DTCC: Guide To Clearance & Settlementmona2009pooja100% (3)

- Swot and ProductDocument5 pagesSwot and ProductavinishNo ratings yet

- Navjeet Singh SobtiDocument18 pagesNavjeet Singh SobtiShreyans GirathNo ratings yet