Professional Documents

Culture Documents

Bandhan US Treasury Bond 0 1yr FoF Sept 2023 - 1

Bandhan US Treasury Bond 0 1yr FoF Sept 2023 - 1

Uploaded by

nuthan.10986Copyright:

Available Formats

You might also like

- What Is A Mutual Fund?Document33 pagesWhat Is A Mutual Fund?Vaishali JoshiNo ratings yet

- Axis Triple Advantage Fund Application FormDocument8 pagesAxis Triple Advantage Fund Application Formrkdgr87880No ratings yet

- ATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Document5 pagesATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Glenda ReyesNo ratings yet

- HDFC MF Monthly Income Plan LTP December 2012Document18 pagesHDFC MF Monthly Income Plan LTP December 2012khadenileshNo ratings yet

- KIM - UTI Focused Equity FundDocument16 pagesKIM - UTI Focused Equity FundNaveen KurupNo ratings yet

- KIM Helios Overnight Fund CombinedDocument35 pagesKIM Helios Overnight Fund Combinedsanaa.kanjianiNo ratings yet

- P-7 PBF PKF Eng - PHSDocument6 pagesP-7 PBF PKF Eng - PHSKhalisNo ratings yet

- HDFC Short Term PlanDocument20 pagesHDFC Short Term PlanAbhishek ChandraNo ratings yet

- Schroder Dana Likuid OKTOBER 2022-1Document1 pageSchroder Dana Likuid OKTOBER 2022-1Dhanik JayantiNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)shoaib zamanNo ratings yet

- Key Information and Investment Disclosure Statement: Metro World Equity Feeder FundDocument3 pagesKey Information and Investment Disclosure Statement: Metro World Equity Feeder FundMartin MartelNo ratings yet

- Glacier Global Stock Feeder FundDocument2 pagesGlacier Global Stock Feeder FundMarkoNo ratings yet

- NFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688Document5 pagesNFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688kuchbhisochoNo ratings yet

- Performance Overview: As of Sep 13, 2023Document2 pagesPerformance Overview: As of Sep 13, 2023Tirthkumar PatelNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)himkecNo ratings yet

- Muthoot Fincorp - MLD OpportunityDocument11 pagesMuthoot Fincorp - MLD OpportunityRohan RautelaNo ratings yet

- Ecco - Faq Ver3Document3 pagesEcco - Faq Ver3sumitkumtha123No ratings yet

- rsm430 Lecture 1 Overview of Bond Market and Bond ValuationDocument30 pagesrsm430 Lecture 1 Overview of Bond Market and Bond ValuationGrace IdreesNo ratings yet

- 2250 A Prospectus It1ykmu6 en inDocument94 pages2250 A Prospectus It1ykmu6 en inVagamonNo ratings yet

- New Waste UploadDocument8 pagesNew Waste UploadGautam ShahNo ratings yet

- Loan Against Securities MeaningDocument6 pagesLoan Against Securities MeaningPratik LahotiNo ratings yet

- Dollarbull ETF Handbook (Dec 2022)Document24 pagesDollarbull ETF Handbook (Dec 2022)Jai HiralalNo ratings yet

- COMBO KIM Overnight Fund Financial Services Fund With Editable Forms PDFDocument55 pagesCOMBO KIM Overnight Fund Financial Services Fund With Editable Forms PDFsanaa.kanjianiNo ratings yet

- What Are Mutual FundsDocument12 pagesWhat Are Mutual FundsSuraj00sNo ratings yet

- Fund Focus - Axis Arbitrage Fund - June 2023Document3 pagesFund Focus - Axis Arbitrage Fund - June 2023YasahNo ratings yet

- Mutual Fund:: Asset Management CompanyDocument43 pagesMutual Fund:: Asset Management CompanymalaynvNo ratings yet

- IBTG (1 - 3 Year Treasury Bonds GBP)Document5 pagesIBTG (1 - 3 Year Treasury Bonds GBP)gibi.yu19No ratings yet

- Kim Sbi Energy Opportunities FundDocument101 pagesKim Sbi Energy Opportunities FundV S Pavan KumarNo ratings yet

- Short Term / Money Market Funds: Performance Returns Are Net of ExpensesDocument5 pagesShort Term / Money Market Funds: Performance Returns Are Net of ExpensesodescribdNo ratings yet

- FR Coll GuidelinesDocument23 pagesFR Coll GuidelinesJusta100% (1)

- Kim - Uti Nifty SDL Plus Aaa Psu Bond Apr 2026 75-25 Index FundDocument17 pagesKim - Uti Nifty SDL Plus Aaa Psu Bond Apr 2026 75-25 Index Fundanthony loboNo ratings yet

- Government Money Market I Fund (6) : Fixed Income Stable ValueDocument2 pagesGovernment Money Market I Fund (6) : Fixed Income Stable ValueiuxhpccxNo ratings yet

- Security Analysis Session 1 - 10Document18 pagesSecurity Analysis Session 1 - 10Taksh DhamiNo ratings yet

- Canara Robeco InDiGo Fund NFO FormDocument8 pagesCanara Robeco InDiGo Fund NFO Formrkdgr87880No ratings yet

- Why Mutual Fund April 10Document29 pagesWhy Mutual Fund April 10Malvika JhaNo ratings yet

- United GrowthDocument3 pagesUnited GrowthAries AliNo ratings yet

- Kim - Sbi Contra FundDocument24 pagesKim - Sbi Contra FundSharleneNo ratings yet

- Key Information Memorandum Of: WWW - Miraeassetmf.co - in Miraeasset@miraeassetmf - Co.inDocument21 pagesKey Information Memorandum Of: WWW - Miraeassetmf.co - in Miraeasset@miraeassetmf - Co.inMilanNo ratings yet

- 1.) Introduction and Rationale of Topic Chosen: 1.1) Mutual Fund - The ConceptDocument65 pages1.) Introduction and Rationale of Topic Chosen: 1.1) Mutual Fund - The ConceptMicro Solution IndiaNo ratings yet

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Peso Starter Fund Product Highlight Sheet - 082321Document11 pagesPeso Starter Fund Product Highlight Sheet - 082321Frost ByteNo ratings yet

- KIM - HDFC NIFTY SDL Plus G Sec Jun 2027 4060 Index Fund - 0Document44 pagesKIM - HDFC NIFTY SDL Plus G Sec Jun 2027 4060 Index Fund - 0Parasjkohli6659No ratings yet

- KIM - UTI Balanced Advantage Fund20230717-061540Document29 pagesKIM - UTI Balanced Advantage Fund20230717-061540jayswalhiralal899No ratings yet

- Product Highlights Sheets-Dynamic Income FundDocument7 pagesProduct Highlights Sheets-Dynamic Income FundCheeseong LimNo ratings yet

- LBP UITF FAQs - As of October 2020 FINALDocument10 pagesLBP UITF FAQs - As of October 2020 FINALMardezz AcordaNo ratings yet

- Amfi IapDocument30 pagesAmfi IapAshish AgarwalNo ratings yet

- Capital Market InstrumentsDocument7 pagesCapital Market InstrumentsManjunathreddy SeshadriNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document30 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Aravamudhan SrinivasanNo ratings yet

- Mutual Funds LakshmiDocument12 pagesMutual Funds LakshmilakshminayakotiNo ratings yet

- Sebi SharemarketDocument19 pagesSebi SharemarketbhavyaNo ratings yet

- BMO Aggregate Bond Index ETF BMO - Aggregate - Bond - Index - ETF-EN-CAD - UnitsDocument4 pagesBMO Aggregate Bond Index ETF BMO - Aggregate - Bond - Index - ETF-EN-CAD - UnitsNikal upNo ratings yet

- Financial Awareness 2 - Mutual FundDocument12 pagesFinancial Awareness 2 - Mutual FundArmanNo ratings yet

- Kim - Sbi Contra FuneDocument30 pagesKim - Sbi Contra FuneskbmnnitNo ratings yet

- Kim Sbi Fixed Maturity Plan (FMP) Series 79 (1130 Days)Document64 pagesKim Sbi Fixed Maturity Plan (FMP) Series 79 (1130 Days)nakulmudhikondaNo ratings yet

- Fs PDFDocument1 pageFs PDFJuhaizan Mohd YusofNo ratings yet

- BST 1 - Variable Life Insurance v1.0Document42 pagesBST 1 - Variable Life Insurance v1.0Donna Mae Palabay MalasigNo ratings yet

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingFrom EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNo ratings yet

Bandhan US Treasury Bond 0 1yr FoF Sept 2023 - 1

Bandhan US Treasury Bond 0 1yr FoF Sept 2023 - 1

Uploaded by

nuthan.10986Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bandhan US Treasury Bond 0 1yr FoF Sept 2023 - 1

Bandhan US Treasury Bond 0 1yr FoF Sept 2023 - 1

Uploaded by

nuthan.10986Copyright:

Available Formats

Click here to Know more

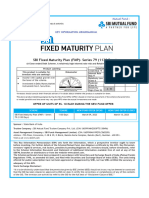

Bandhan US Treasury Bond 0-1

year Fund of Fund

An open ended fund of fund scheme investing in units / shares of overseas

Index Funds and / or Exchange Traded Funds which track an index

with US treasury securities in the 0-1 year maturity range as its constituents

(Formerly known as IDFC US Treasury Bond 0-1 year Fund of Fund)

An opportunity to diversify into international

debt-oriented strategy to help create a USD

asset to meet future USD expense

Fund Features:

(Data as on 31st August'23) PORTFOLIO (31 August 2023)

Category: Fund of Funds (Overseas)

Name Total (%)

Monthly Avg AUM: ` 110.83 Crores

JPMorgan ETFs BetaBuilders US Tre Bond0-1 yr UCITS 98.22%

Inception Date: 28 March 2023

Fund Manager: Mr. Sreejith Balasubramanian International Mutual Fund Units 98.22%

(Overseas portion) & Mr. Brijesh Shah (Debt portion).

Benchmark: ICE 0-1 Year US Treasury Clearing Corporation of India Ltd 1.99%

Securities Index

Exit Load: 0.10% of applicable NAV - if the units are TRI Party Repo Total 1.99%

redeemed/switched out within seven days from

the date of allotment; Net Current Asset -0.22%

Nil - if the units are redeemed/switched out

after 7 days from the date of allotment. (w.e.f May Grand Total 100.00%

16, 2023)

Minimum Investment Amount: Fresh Purchase

(including switch-in) - ` 1,000/- and in multiples of Re.

1/- thereafter Additional Purchase (including

switch-in) - ` 1,000/- and any amount thereafter

SIP (Minimum Amount): ` 100/- and in multiples of

Rs.1 thereafter

SIP Dates: (Monthly/Quarterly) Investor may

choose any day of the month except 29th, 30th and

31st as the date of installment.

Options Available: Income Distribution cum capital

withdrawal Option & Growth Option. Income

Distribution cum capital withdrawal Option under

each Plan further offers of choice of Payout of

Income Distribution cum capital withdrawal,

Reinvestment of Income Distribution cum capital

withdrawal& Transfer of Income Distribution cum

capital withdrawal.

SIP Frequency: Monthly/Quarterly (w.e.f.

09-11-2022)

Scheme risk-o-meter This product is suitable for investors who are seeking* Benchmark risk-o-meter

• To create wealth over long term.

• Generate returns through investing in US treasury securities in the 0-1 year

maturity range.

Investors understand that their *Investors should consult their "nancial advisers if in doubt about

principal will be at Very whether the product is suitable for them. ICE 0-1 Year US Treasury Securities Index

High risk

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

You might also like

- What Is A Mutual Fund?Document33 pagesWhat Is A Mutual Fund?Vaishali JoshiNo ratings yet

- Axis Triple Advantage Fund Application FormDocument8 pagesAxis Triple Advantage Fund Application Formrkdgr87880No ratings yet

- ATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Document5 pagesATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Glenda ReyesNo ratings yet

- HDFC MF Monthly Income Plan LTP December 2012Document18 pagesHDFC MF Monthly Income Plan LTP December 2012khadenileshNo ratings yet

- KIM - UTI Focused Equity FundDocument16 pagesKIM - UTI Focused Equity FundNaveen KurupNo ratings yet

- KIM Helios Overnight Fund CombinedDocument35 pagesKIM Helios Overnight Fund Combinedsanaa.kanjianiNo ratings yet

- P-7 PBF PKF Eng - PHSDocument6 pagesP-7 PBF PKF Eng - PHSKhalisNo ratings yet

- HDFC Short Term PlanDocument20 pagesHDFC Short Term PlanAbhishek ChandraNo ratings yet

- Schroder Dana Likuid OKTOBER 2022-1Document1 pageSchroder Dana Likuid OKTOBER 2022-1Dhanik JayantiNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)shoaib zamanNo ratings yet

- Key Information and Investment Disclosure Statement: Metro World Equity Feeder FundDocument3 pagesKey Information and Investment Disclosure Statement: Metro World Equity Feeder FundMartin MartelNo ratings yet

- Glacier Global Stock Feeder FundDocument2 pagesGlacier Global Stock Feeder FundMarkoNo ratings yet

- NFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688Document5 pagesNFO Note - Sundaram Multi Asset Allocation Fund-202401081632395341688kuchbhisochoNo ratings yet

- Performance Overview: As of Sep 13, 2023Document2 pagesPerformance Overview: As of Sep 13, 2023Tirthkumar PatelNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)himkecNo ratings yet

- Muthoot Fincorp - MLD OpportunityDocument11 pagesMuthoot Fincorp - MLD OpportunityRohan RautelaNo ratings yet

- Ecco - Faq Ver3Document3 pagesEcco - Faq Ver3sumitkumtha123No ratings yet

- rsm430 Lecture 1 Overview of Bond Market and Bond ValuationDocument30 pagesrsm430 Lecture 1 Overview of Bond Market and Bond ValuationGrace IdreesNo ratings yet

- 2250 A Prospectus It1ykmu6 en inDocument94 pages2250 A Prospectus It1ykmu6 en inVagamonNo ratings yet

- New Waste UploadDocument8 pagesNew Waste UploadGautam ShahNo ratings yet

- Loan Against Securities MeaningDocument6 pagesLoan Against Securities MeaningPratik LahotiNo ratings yet

- Dollarbull ETF Handbook (Dec 2022)Document24 pagesDollarbull ETF Handbook (Dec 2022)Jai HiralalNo ratings yet

- COMBO KIM Overnight Fund Financial Services Fund With Editable Forms PDFDocument55 pagesCOMBO KIM Overnight Fund Financial Services Fund With Editable Forms PDFsanaa.kanjianiNo ratings yet

- What Are Mutual FundsDocument12 pagesWhat Are Mutual FundsSuraj00sNo ratings yet

- Fund Focus - Axis Arbitrage Fund - June 2023Document3 pagesFund Focus - Axis Arbitrage Fund - June 2023YasahNo ratings yet

- Mutual Fund:: Asset Management CompanyDocument43 pagesMutual Fund:: Asset Management CompanymalaynvNo ratings yet

- IBTG (1 - 3 Year Treasury Bonds GBP)Document5 pagesIBTG (1 - 3 Year Treasury Bonds GBP)gibi.yu19No ratings yet

- Kim Sbi Energy Opportunities FundDocument101 pagesKim Sbi Energy Opportunities FundV S Pavan KumarNo ratings yet

- Short Term / Money Market Funds: Performance Returns Are Net of ExpensesDocument5 pagesShort Term / Money Market Funds: Performance Returns Are Net of ExpensesodescribdNo ratings yet

- FR Coll GuidelinesDocument23 pagesFR Coll GuidelinesJusta100% (1)

- Kim - Uti Nifty SDL Plus Aaa Psu Bond Apr 2026 75-25 Index FundDocument17 pagesKim - Uti Nifty SDL Plus Aaa Psu Bond Apr 2026 75-25 Index Fundanthony loboNo ratings yet

- Government Money Market I Fund (6) : Fixed Income Stable ValueDocument2 pagesGovernment Money Market I Fund (6) : Fixed Income Stable ValueiuxhpccxNo ratings yet

- Security Analysis Session 1 - 10Document18 pagesSecurity Analysis Session 1 - 10Taksh DhamiNo ratings yet

- Canara Robeco InDiGo Fund NFO FormDocument8 pagesCanara Robeco InDiGo Fund NFO Formrkdgr87880No ratings yet

- Why Mutual Fund April 10Document29 pagesWhy Mutual Fund April 10Malvika JhaNo ratings yet

- United GrowthDocument3 pagesUnited GrowthAries AliNo ratings yet

- Kim - Sbi Contra FundDocument24 pagesKim - Sbi Contra FundSharleneNo ratings yet

- Key Information Memorandum Of: WWW - Miraeassetmf.co - in Miraeasset@miraeassetmf - Co.inDocument21 pagesKey Information Memorandum Of: WWW - Miraeassetmf.co - in Miraeasset@miraeassetmf - Co.inMilanNo ratings yet

- 1.) Introduction and Rationale of Topic Chosen: 1.1) Mutual Fund - The ConceptDocument65 pages1.) Introduction and Rationale of Topic Chosen: 1.1) Mutual Fund - The ConceptMicro Solution IndiaNo ratings yet

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- Peso Starter Fund Product Highlight Sheet - 082321Document11 pagesPeso Starter Fund Product Highlight Sheet - 082321Frost ByteNo ratings yet

- KIM - HDFC NIFTY SDL Plus G Sec Jun 2027 4060 Index Fund - 0Document44 pagesKIM - HDFC NIFTY SDL Plus G Sec Jun 2027 4060 Index Fund - 0Parasjkohli6659No ratings yet

- KIM - UTI Balanced Advantage Fund20230717-061540Document29 pagesKIM - UTI Balanced Advantage Fund20230717-061540jayswalhiralal899No ratings yet

- Product Highlights Sheets-Dynamic Income FundDocument7 pagesProduct Highlights Sheets-Dynamic Income FundCheeseong LimNo ratings yet

- LBP UITF FAQs - As of October 2020 FINALDocument10 pagesLBP UITF FAQs - As of October 2020 FINALMardezz AcordaNo ratings yet

- Amfi IapDocument30 pagesAmfi IapAshish AgarwalNo ratings yet

- Capital Market InstrumentsDocument7 pagesCapital Market InstrumentsManjunathreddy SeshadriNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document30 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Aravamudhan SrinivasanNo ratings yet

- Mutual Funds LakshmiDocument12 pagesMutual Funds LakshmilakshminayakotiNo ratings yet

- Sebi SharemarketDocument19 pagesSebi SharemarketbhavyaNo ratings yet

- BMO Aggregate Bond Index ETF BMO - Aggregate - Bond - Index - ETF-EN-CAD - UnitsDocument4 pagesBMO Aggregate Bond Index ETF BMO - Aggregate - Bond - Index - ETF-EN-CAD - UnitsNikal upNo ratings yet

- Financial Awareness 2 - Mutual FundDocument12 pagesFinancial Awareness 2 - Mutual FundArmanNo ratings yet

- Kim - Sbi Contra FuneDocument30 pagesKim - Sbi Contra FuneskbmnnitNo ratings yet

- Kim Sbi Fixed Maturity Plan (FMP) Series 79 (1130 Days)Document64 pagesKim Sbi Fixed Maturity Plan (FMP) Series 79 (1130 Days)nakulmudhikondaNo ratings yet

- Fs PDFDocument1 pageFs PDFJuhaizan Mohd YusofNo ratings yet

- BST 1 - Variable Life Insurance v1.0Document42 pagesBST 1 - Variable Life Insurance v1.0Donna Mae Palabay MalasigNo ratings yet

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingFrom EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNo ratings yet