Professional Documents

Culture Documents

PPPPPPP

PPPPPPP

Uploaded by

sahildargan090 ratings0% found this document useful (0 votes)

12 views1 pageThe document provides the compensation breakdown for an Associate Level 1 position at Acuvon Consulting Pvt. Ltd. It includes a monthly fixed salary of Rs. 1,10,000 and an annual variable bonus of up to Rs. 2,77,200 based on performance. Additional benefits include a joining bonus of Rs. 1,00,000, deferred bonus of Rs. 2,00,000, and annual other non-cash benefits such as medical insurance, personal accident insurance, and food reimbursement totaling Rs. 1,77,600.

Original Description:

Original Title

Ppppppp

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides the compensation breakdown for an Associate Level 1 position at Acuvon Consulting Pvt. Ltd. It includes a monthly fixed salary of Rs. 1,10,000 and an annual variable bonus of up to Rs. 2,77,200 based on performance. Additional benefits include a joining bonus of Rs. 1,00,000, deferred bonus of Rs. 2,00,000, and annual other non-cash benefits such as medical insurance, personal accident insurance, and food reimbursement totaling Rs. 1,77,600.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views1 pagePPPPPPP

PPPPPPP

Uploaded by

sahildargan09The document provides the compensation breakdown for an Associate Level 1 position at Acuvon Consulting Pvt. Ltd. It includes a monthly fixed salary of Rs. 1,10,000 and an annual variable bonus of up to Rs. 2,77,200 based on performance. Additional benefits include a joining bonus of Rs. 1,00,000, deferred bonus of Rs. 2,00,000, and annual other non-cash benefits such as medical insurance, personal accident insurance, and food reimbursement totaling Rs. 1,77,600.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

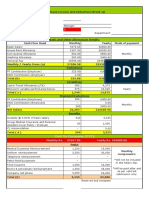

Compensation Breakup: Associate Level 1

Component description Monthly Annual

Fixed

Basic (includes employer share of PF) 38,500 4,62,000

HRA (50% of basic) 19,250 2,31,000

Special allowance 52,250 6,27,000

A. Total fixed salary 1,10,000 13,20,000

Variable

Bonus (maximum) - 2,77,200

B. Total variable salary - 2,77,200

Retirals

Gratuity (4.81% of basic) - 22,222

C. Total retirals - 22,222

D. Joining bonus 1,00,000

E. Deferred bonus 2,00,000

Total cash salary (A+B+C+D+E) - 19,19,422

Other benefits (non-cash)

Group medical insurance premium - 7,500

Group personal accident - 3,000

International travel insurance premium - 2,500

Team outings & offsite - 50,000

Food reimbursement - 39,600

Training & development - 75,000

F. Total other benefits (non-cash) - 1,77,600

Please note:

• PF is contributed at 12% of basic (included in basic)

• Bonus is subject to performance (company and individual employee) and can range between 0-40% of

last Basic + HRA. 40% is used for calculation

• Gratuity is contributed @4.81% of Basic, on separation after 5 years of continuous service, payable as

per Payment of Gratuity Act

• Joining bonus will be payable on satisfactory completion of working 1 month excluding notice period.

The person has to stay with the company for a period of 6 months excluding notice period, failing to

which the person has to payback the entire amount to the company

• Deferred bonus will be payable on satisfactory completion of working 2 years excluding notice period

• Other benefits are non-cash components based on average spend. This amount can vary for each year

and cannot be converted into cash pay-out for employee

• Group mediclaim insurance coverage of INR 3,00,000 per annum for employee, spouse and maximum

of 2 dependent children

• Group personal accidental insurance of INR 75,00,000 per annum for employee

• International travel insurance coverage of USD 250,000 per annum for employee

• Covers team outings and partial cost of offsite for employee, spouse and 2 dependent children

• Food reimbursement of INR 150 per day for the number of days employee is present in India office

• Average spend on employee learning & development and training program including internal

trainings, external trainings, development program, reimbursements for professional certifications

• Additional daily allowance for onsite travel. Onsite expenses will be borne by company

Acuvon Consulting Pvt. Ltd.

Corporate Office: Berger Delhi One, 18th Floor, Sector 16B, Noida, (UP) – 201301, India

Registered Office: E 19, Lajpat Nagar III, New Delhi – 110024, India

e: info@acuvon.com w: www.acuvon.com CIN No. U74999DL2018PTC340046

You might also like

- Clickworker AnswersDocument11 pagesClickworker Answersmohcen haji60% (63)

- 12 Audit of Hotel ChecklistDocument5 pages12 Audit of Hotel ChecklistPrakash Gopalkrishnan82% (11)

- Financial and Management Accounting QuizDocument5 pagesFinancial and Management Accounting Quizvignesh100% (1)

- Chapter 3 ParcorDocument6 pagesChapter 3 Parcornikki sy40% (5)

- Annexure 1 - Sayali TawadeDocument1 pageAnnexure 1 - Sayali TawadesayaliNo ratings yet

- Bill HotelDocument54 pagesBill Hotelidhul bram sakti100% (1)

- Letter of Offer - Wissen - Pintu Prasad GuptaDocument7 pagesLetter of Offer - Wissen - Pintu Prasad GuptaMd Rahmat AliNo ratings yet

- Scenario ADocument10 pagesScenario ADandyNo ratings yet

- INCOME TAXATION - Fringe Benefit TaxDocument7 pagesINCOME TAXATION - Fringe Benefit TaxErlle AvllnsaNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFAdarsh RaoNo ratings yet

- Investing Capital Group TeamDocument8 pagesInvesting Capital Group TeamCory BoatrightNo ratings yet

- Rel11 FSCM RPD DB Mapping SCMDocument96 pagesRel11 FSCM RPD DB Mapping SCMAnonymous STmh9rbfKNo ratings yet

- Acuvon Compensation - Junior AssociateDocument1 pageAcuvon Compensation - Junior AssociateJohn DoeNo ratings yet

- Acuvon Compensation - AssociateDocument1 pageAcuvon Compensation - AssociateJohn DoeNo ratings yet

- ADOBE - Compensation Breakup - Member of Technical StaffDocument2 pagesADOBE - Compensation Breakup - Member of Technical Staffdehejar970No ratings yet

- Accenture - OfferletterDocument1 pageAccenture - OfferletternittingulatiNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Annexure A414Document1 pageAnnexure A414aradhya.sharmaNo ratings yet

- Dasharath Kumar Sah - OfF319 - 2324 2Document2 pagesDasharath Kumar Sah - OfF319 - 2324 2eng.dasharath1996No ratings yet

- Dasharath Kumar Sah - OFF319 - 2324Document2 pagesDasharath Kumar Sah - OFF319 - 2324eng.dasharath1996No ratings yet

- 12290.0 - Gurrapu Bhargav StructureDocument1 page12290.0 - Gurrapu Bhargav StructureBhargav GurrapuNo ratings yet

- SE FY14 - Compensation Plan Group IIIDocument2 pagesSE FY14 - Compensation Plan Group IIISabyasachi DeNo ratings yet

- CTC BreakupDocument3 pagesCTC BreakupManjesh KumarNo ratings yet

- Mahesha HMDocument1 pageMahesha HMManjesh KumarNo ratings yet

- OfferLetter 535786Document2 pagesOfferLetter 535786dj.mustang09No ratings yet

- MediamintDocument1 pageMediamintKaparthi GujjarNo ratings yet

- Mohammed - Moinuddin Sutherland SalaryDocument2 pagesMohammed - Moinuddin Sutherland SalaryShoaib Khan -Vlog'sNo ratings yet

- FICO Compensation Details - FTE ConversionDocument1 pageFICO Compensation Details - FTE ConversionNiteshNo ratings yet

- CTC BreakupDocument2 pagesCTC BreakupbaluNo ratings yet

- Offer Compensation Breakup: Estimate Based On Current Conversion RateDocument1 pageOffer Compensation Breakup: Estimate Based On Current Conversion RateAyush Gupta 4-Year B.Tech. Electrical EngineeringNo ratings yet

- Offer Letter - Mohan KumarDocument3 pagesOffer Letter - Mohan KumarMohan MoniNo ratings yet

- Ashwinisudhakarrao EmekarDocument2 pagesAshwinisudhakarrao EmekarswatiNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- 10029-Test 5Document3 pages10029-Test 5pratap.reddyNo ratings yet

- Remuneration StructureDocument1 pageRemuneration StructureKiran Kumar JNo ratings yet

- Siva - Offer LetterDocument2 pagesSiva - Offer Letterpruthvirajaws1807No ratings yet

- Anusha Yenishetty PDFDocument2 pagesAnusha Yenishetty PDFSrinivasa Rao JagarapuNo ratings yet

- Swati Bhatt DevendraDocument3 pagesSwati Bhatt DevendraarvindNo ratings yet

- Promotion Letter ShwetaDocument2 pagesPromotion Letter ShwetayogeshNo ratings yet

- Monetisation ExerciseDocument3 pagesMonetisation ExerciseMariam Fatima BurhanNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFPurushothaman ANo ratings yet

- Letter PDFDocument2 pagesLetter PDFAnilkumar DaaraaNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFPurushothaman ANo ratings yet

- Ashok Kumar RamakrishnanpadmanabanDocument2 pagesAshok Kumar Ramakrishnanpadmanabanudayasankar KNo ratings yet

- OfferLetter Riya GuptaDocument2 pagesOfferLetter Riya Guptavermatanishq1610No ratings yet

- 1 BSG Compensation&TrainingDocument1 page1 BSG Compensation&TrainingBust everyNo ratings yet

- Siva - Offer LetterDocument3 pagesSiva - Offer Letterpruthvirajaws1807No ratings yet

- Airbus India - SAMPLE - Offer - LetterDocument2 pagesAirbus India - SAMPLE - Offer - LetterKshitij SinghNo ratings yet

- Surisetty Mohan Santosh Kumar 11440/19829199: Mallika Narendra Vyas Senior Vice President - Human ResourcesDocument2 pagesSurisetty Mohan Santosh Kumar 11440/19829199: Mallika Narendra Vyas Senior Vice President - Human ResourcesANUNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- AlfredDocument4 pagesAlfredAbhijeet SinghNo ratings yet

- Compensation 2Document5 pagesCompensation 2saimanasa23012000No ratings yet

- Counter OfferDocument1 pageCounter Offermac martinNo ratings yet

- VijayDocument2 pagesVijayFiroj AlamNo ratings yet

- CTC Structure FEB20Document2 pagesCTC Structure FEB20Wall Street Forex (WSFx)No ratings yet

- Abhishek Singh - Project Roll LetterDocument3 pagesAbhishek Singh - Project Roll LetterAbhishek SinghNo ratings yet

- Defined Benefit Pension Reporting - Chapter 19 - Assignment SetDocument3 pagesDefined Benefit Pension Reporting - Chapter 19 - Assignment SetNicoleNo ratings yet

- Finals Quiz No. 1 W AnswerDocument4 pagesFinals Quiz No. 1 W AnswerLouris DanielNo ratings yet

- Sample Structure 15lpa IX XDocument1 pageSample Structure 15lpa IX XKiran IconNo ratings yet

- IS - FY 16 - Comp Plan Group III (CL10 - CL13) - Revised - June 29 2016Document3 pagesIS - FY 16 - Comp Plan Group III (CL10 - CL13) - Revised - June 29 2016Sujan RajNo ratings yet

- Shreenath LNU PDFDocument3 pagesShreenath LNU PDFshrinathNo ratings yet

- Santhosh B-KGMDocument2 pagesSanthosh B-KGMAkshay BunniNo ratings yet

- Offer Letter-66e646Document2 pagesOffer Letter-66e646Solanki SahilNo ratings yet

- OfferLetter 225107Document2 pagesOfferLetter 225107NIKHIL RANANo ratings yet

- Aakash Shukla - PDFDocument1 pageAakash Shukla - PDFakkshukla20No ratings yet

- Samruddha Vilas Ghodake - Offer - SalesDocument2 pagesSamruddha Vilas Ghodake - Offer - SalesSam GNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Payment and Small BanksDocument27 pagesPayment and Small BanksDr.Satish RadhakrishnanNo ratings yet

- Changes in Marginal Cost of Lending Rate (MCLR) (Company Update)Document1 pageChanges in Marginal Cost of Lending Rate (MCLR) (Company Update)Shyam SunderNo ratings yet

- 9789241565486-engINFORME Estadísticas Sanitarias Mundiales Que Publica Anualmente La OMSDocument116 pages9789241565486-engINFORME Estadísticas Sanitarias Mundiales Que Publica Anualmente La OMSAnonymous 5zXu2FmRNo ratings yet

- Return On Capital Employed ROCEDocument2 pagesReturn On Capital Employed ROCERajesh Tipnis100% (1)

- Financial Risk Faced by Bank Al FalahDocument3 pagesFinancial Risk Faced by Bank Al FalahAlina NadeemNo ratings yet

- Co-Operative Organization/Society: Unit Objectives: After Completion, Students Are Expected To Know The FollowingDocument7 pagesCo-Operative Organization/Society: Unit Objectives: After Completion, Students Are Expected To Know The FollowingBinodBasnetNo ratings yet

- Financial Stability Report June 2022.pdf - ENDocument112 pagesFinancial Stability Report June 2022.pdf - ENFatiha YagoubNo ratings yet

- Course Primer - PSE CSSCDocument9 pagesCourse Primer - PSE CSSCRon CatalanNo ratings yet

- Income From Other SourcesDocument12 pagesIncome From Other Sourcessanjul2008No ratings yet

- Saving Account Opening Form in HDFC Bank For Resident IndiaDocument2 pagesSaving Account Opening Form in HDFC Bank For Resident Indiaashish.rac605350% (2)

- Capital Structure: Limits To The: Use of DebtDocument9 pagesCapital Structure: Limits To The: Use of DebtArini FalahiyahNo ratings yet

- Trade Cycle BBs 2nd YearDocument8 pagesTrade Cycle BBs 2nd YearSTAR Digital Arts100% (1)

- Q.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsDocument4 pagesQ.1. Write Short Notes On The Following (A) Business Entity Concept (B) Subsidiary Books (C) Errors of Principles (D) Promissory Notes (E) ProvisionsLekha DhagatNo ratings yet

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- Tutorial 4 (Comparison Method) - ZoningDocument3 pagesTutorial 4 (Comparison Method) - ZoningMinani MarcNo ratings yet

- BibliographyDocument2 pagesBibliographyGursharan SagguNo ratings yet

- JetBlue Airways IPO ValuationDocument16 pagesJetBlue Airways IPO ValuationDerek Levesque100% (2)

- Module 5 Solutions-1Document7 pagesModule 5 Solutions-1Neha Wadhwani AhujaNo ratings yet

- A Project ReportDocument8 pagesA Project Reportmistryjinal546790% (10)

- Forms of MergersDocument9 pagesForms of MergersVinit BansalNo ratings yet

- Case Study LBODocument4 pagesCase Study LBOadarshraj100% (3)

- Solved Examples On Lease AccountingDocument1 pageSolved Examples On Lease AccountingSoumen Sen100% (4)

- Bhageria Docs 2Document91 pagesBhageria Docs 2PolymerNo ratings yet