Professional Documents

Culture Documents

XI Half Yrly2023 24 - MS

XI Half Yrly2023 24 - MS

Uploaded by

꧁༺Bhavishya Gaur༻꧂Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

XI Half Yrly2023 24 - MS

XI Half Yrly2023 24 - MS

Uploaded by

꧁༺Bhavishya Gaur༻꧂Copyright:

Available Formats

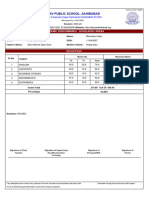

SET B---Half Yearly Examination - 2023- 24

Class XI (Marking Scheme)

1 c) Reliability 1

2 C) Rs 2000 1

3 c) A2, B1, C4, D3 1

4 D) Both b and c 1

5 b) Scientific 1

6 A)Both A and R are correct and R is the correct explanation of A 1

7 a) Principle based accounting standards 1

8 B) 1 -b, 2 a 1

9 b) Invoice 1

10 d) Debit side of Purchase a/c 1

11 A) Both A and R are correct and R is the correct explanation of A 1

12 c ) Nominal Acc 1

13 First case – Depletion used is in case of extraction of natural resources like mining etc. 1

Second case – Amortisation - The enterprise must be involved in certain specified contracted business where there is use of

intangible assets like Copyrights and Trademarks etc

14 c) 2 and 4 1

15 c ) Preparation of Final Accounts . 1

16 b ) Final entry 1

17 a) Both A and R are correct and R is the correct explanation of A 1

18 c) Both statement 1 and statement 2 are true 1

19 c ) 8.5% 1

20 A) Materiality Principle 1

21 Accounting terms 3

1. Rebate allowed to the buyer for making prompt payment – Cash Discount

2. The person or entity that has given monetary loan to our business organisation - Lender

3. The expenditure incurred to acquire or increasing the value of ‘Non-Current’ Assets – Capital expenditure

22 a) Source document 3

b) Specimen of Debit voucher

23 Balance c/d of Devender’s capital acc -- Rs 53,000 3

The balance indicates that the business owes him this amount.

24 Any three limitations 3

1. Accounting is not fully exact. 2. Unrealistic Information 3. Accounting ignores the qualitative elements. 4. Accounting

ignores effect of price level changes 5. Accounting may lead to window dressing.

25 A) Cash Basis = Rs 51000 3

B) Accrual Basis = Rs 63,000

26 Difference between revenue reserve and Capital Reserve. 3

i) Source of creation

ii) Purpose

iii) Usage

27 4

28 A) Historical Cost Principal with explanation 4

B) Meaning of Accounting Standards and IND AS

29 A) Closing capital- 15,00,000 - 2,00,000 = Rs 13,00,000 4

Profit = Closing capital - opening capital = Rs 13,00,000 - 7,50,000 = Rs 5,50,000

B) 13,00,000 +40,000 - 1,25,000- 7,50,000 = Rs 4,65,000

30 6

31 Bank bal overdraft -- rs 182000, deposited into bank Rs 56600 / 58100 ( contra entry) 6

33 6

Working notes:

100

3. Cost price of machinery (Without GST) = ₹1,34,400 x = ₹1,20,000

112

32 T S Grewal Book . Unsolved question No 27. 6

Machinery A/ C Bal c /d rs 40000, Prov for Depreciation Bal c/d 112500, Loss on sale Rs 51250

34 DK Goel Illustration 7 pg 12.16 6

Total of Sales Return Book : Sales Return – Rs 35700, Output CGST Rs 1020 , Output SGST Rs 1020 Output IGST 2244, Total -

Rs 39,984

Total of Purchase Return : Purchase Return – Rs 27,200 Input CGST Rs 432 Input SGST Rs 432 Input IGST Rs 2400 Total

30,464

You might also like

- MINICASE 1, 2 - Due On BB Week 4 Class 2 Sunset BoardsDocument2 pagesMINICASE 1, 2 - Due On BB Week 4 Class 2 Sunset BoardsKunpriya ArlaiNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Fraud ManualDocument106 pagesFraud Manualagjeezy100% (9)

- ACTBAS4 SyllabusDocument5 pagesACTBAS4 Syllabusroyanna martinNo ratings yet

- F Accountancy MS XI 2023-24Document9 pagesF Accountancy MS XI 2023-24bhaiyarakesh100% (1)

- Accountancy PaperDocument7 pagesAccountancy PaperPritika Ghai XI-Humanities RNNo ratings yet

- XI Account Questions PDFFDocument9 pagesXI Account Questions PDFFnazwaniiharshNo ratings yet

- Aw - State - Board Answer Key 2024-1 (Final)Document17 pagesAw - State - Board Answer Key 2024-1 (Final)pugazhbhuvaneshrvNo ratings yet

- 11th Accountancy Model Question PaperDocument12 pages11th Accountancy Model Question PaperArun RohillaNo ratings yet

- g11 Acc (Annual Exam) 23-24Document20 pagesg11 Acc (Annual Exam) 23-24arshpreetkaurrzzNo ratings yet

- RKG Class 11 Accounts Mock 1Document10 pagesRKG Class 11 Accounts Mock 1Sangket MukherjeeNo ratings yet

- XI PracticeDocument5 pagesXI Practicemcsworkshop777No ratings yet

- 2018 Economics For Engineers (HMTS 3101)Document2 pages2018 Economics For Engineers (HMTS 3101)gidanoNo ratings yet

- 11 Accountancy Practice PaperDocument9 pages11 Accountancy Practice PaperPlayer dude65No ratings yet

- 8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3Document112 pages8 Model Test Paper No. 9-10 From Vol 2 & Suggested Answers For Paper No. 1 - 3atsamitsingh01No ratings yet

- F Accountancy SQP XI 2023-24 FDocument9 pagesF Accountancy SQP XI 2023-24 Fbhaiyarakesh100% (4)

- Acc Xi See QP With BP, Ms-17-30Document15 pagesAcc Xi See QP With BP, Ms-17-30AmiraNo ratings yet

- Manthan Sachool QPDocument6 pagesManthan Sachool QPNancy ShangleNo ratings yet

- Hours) : - (L) : (Part-lI)Document11 pagesHours) : - (L) : (Part-lI)Sadhik LaluwaleNo ratings yet

- QP XI AccountancyDocument13 pagesQP XI AccountancySanjay Panicker100% (1)

- Bcom-3-Sem-Commerce-Company-Accounts-S-2019 - 2023-04-01T112847.188Document11 pagesBcom-3-Sem-Commerce-Company-Accounts-S-2019 - 2023-04-01T112847.188Sadhik LaluwaleNo ratings yet

- Revision II (Ratio Analysis)Document6 pagesRevision II (Ratio Analysis)Allwin GanaduraiNo ratings yet

- Adobe Scan 17 Jun 2024Document4 pagesAdobe Scan 17 Jun 2024ishani7.mazumderNo ratings yet

- AccountancyDocument12 pagesAccountancyArchana SinghNo ratings yet

- Adobe Scan 19 Feb 2023Document7 pagesAdobe Scan 19 Feb 2023Aman JainNo ratings yet

- Question 684609Document11 pagesQuestion 684609Kishan VithalaniNo ratings yet

- Answer To MTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial AccountingDocument17 pagesAnswer To MTP - Intermediate - Syllabus 2016 - June2020 - Set1: Paper 5-Financial AccountingMohit SangwanNo ratings yet

- Sample Paper AccountsDocument7 pagesSample Paper AccountsmenekyakiaNo ratings yet

- 1162 - Bba - 501 Cost Accounting - 1250 - (26-12-22 08 - 28 - 28 - 260 Am)Document7 pages1162 - Bba - 501 Cost Accounting - 1250 - (26-12-22 08 - 28 - 28 - 260 Am)Snehal MohodNo ratings yet

- Xi Account MSDocument5 pagesXi Account MSrohanjithesh2525No ratings yet

- Ac Test 80 M (1) - Watermark - WatermarkDocument5 pagesAc Test 80 M (1) - Watermark - Watermarkanikeshyadav0700No ratings yet

- ElementsBookKeepingAccountancy SQPDocument7 pagesElementsBookKeepingAccountancy SQPKanya PrakashNo ratings yet

- CAPE Accounting U1 2013 - 2021 P1s Answers - 240528 - 143141Document87 pagesCAPE Accounting U1 2013 - 2021 P1s Answers - 240528 - 143141Abby GailNo ratings yet

- CAPE Accounting 2013 U1 P1 PDFDocument9 pagesCAPE Accounting 2013 U1 P1 PDFBradlee SinghNo ratings yet

- Accounting 2nd PeriodicalDocument3 pagesAccounting 2nd Periodicaladb shopNo ratings yet

- Delhi Public School, VijayawadaDocument5 pagesDelhi Public School, VijayawadaDubai SheikhNo ratings yet

- Hsslive-xi-june-2022-qn-FY 49 (Accounts With AFS) PDFDocument16 pagesHsslive-xi-june-2022-qn-FY 49 (Accounts With AFS) PDFDanish JohnNo ratings yet

- Mtp-T2-Accuntancy-11 202324Document8 pagesMtp-T2-Accuntancy-11 202324aasthakalamkarlpsNo ratings yet

- MS SQP B.studies 12, Set-3, 2022-23Document5 pagesMS SQP B.studies 12, Set-3, 2022-23bbhbefNo ratings yet

- BS - MS 2023-24 - XiDocument6 pagesBS - MS 2023-24 - XiKhushbu DhindwalNo ratings yet

- CommerceDocument6 pagesCommerceshailesh.919613No ratings yet

- SQP 09 AccountancyDocument8 pagesSQP 09 AccountancyacguptaclassesNo ratings yet

- This Study Resource Was: International Institute of Islamic EconomicsDocument4 pagesThis Study Resource Was: International Institute of Islamic EconomicsJäy JâyNo ratings yet

- Xi Account QPDocument9 pagesXi Account QPPooja KukrejaNo ratings yet

- 11 Business Studies KeyDocument4 pages11 Business Studies KeyAnkit Kumar SinghNo ratings yet

- Paper2 Set1Document9 pagesPaper2 Set1deepsaha302No ratings yet

- 21936mtp Cptvolu1 Part4Document404 pages21936mtp Cptvolu1 Part4Arun KCNo ratings yet

- Terminal Sample 1 SolvedDocument14 pagesTerminal Sample 1 SolvedFami FamzNo ratings yet

- Commerce MCQs Practice Test 1Document8 pagesCommerce MCQs Practice Test 1Nirakar GoudaNo ratings yet

- Acc Xi See QP With BP, Ms-1-16Document16 pagesAcc Xi See QP With BP, Ms-1-16AmiraNo ratings yet

- AccountancyDocument8 pagesAccountancyvanitasharmap0124No ratings yet

- Accountancy Model Paper-2-1Document9 pagesAccountancy Model Paper-2-1Hashim SethNo ratings yet

- Xi BST MSDocument3 pagesXi BST MSwww.friendlyaniket1992No ratings yet

- 11th AccountDocument3 pages11th Accountnmzrv8jfq8No ratings yet

- Paper5 Set1 ADocument17 pagesPaper5 Set1 ASanchit ShrivastavaNo ratings yet

- 10 Quiz 2Document1 page10 Quiz 2Charlotte AlcomendasNo ratings yet

- Marking Scheme 2022 - 2023Document4 pagesMarking Scheme 2022 - 2023Adil MasudNo ratings yet

- Accountancy Class 11th (Term I) : Time:90 MinutesDocument5 pagesAccountancy Class 11th (Term I) : Time:90 MinutesImran farhathNo ratings yet

- Sem I Advanced Financial N Cost Accounting NewDocument8 pagesSem I Advanced Financial N Cost Accounting NewRudra PatilNo ratings yet

- Terminal Sample 1 UnsolvedDocument9 pagesTerminal Sample 1 UnsolvedFami FamzNo ratings yet

- ACBP5111Ea (1) .PDF 2008Document14 pagesACBP5111Ea (1) .PDF 2008Nhluvuko makondoNo ratings yet

- Question 1289158Document11 pagesQuestion 1289158groverpankaj04No ratings yet

- Exhibit Formats - PART - 1Document13 pagesExhibit Formats - PART - 1Shubham GuchaitNo ratings yet

- U6l6 151113052608 Lva1 App6892 Converted 200828093743Document123 pagesU6l6 151113052608 Lva1 App6892 Converted 200828093743꧁༺Bhavishya Gaur༻꧂No ratings yet

- Epitamicofcoronavirus 200810094237Document18 pagesEpitamicofcoronavirus 200810094237꧁༺Bhavishya Gaur༻꧂No ratings yet

- S 150619094659 Lva1 App6891 Converted 200810092449 220202053114Document15 pagesS 150619094659 Lva1 App6891 Converted 200810092449 220202053114꧁༺Bhavishya Gaur༻꧂No ratings yet

- Science Sound 200810093541Document22 pagesScience Sound 200810093541꧁༺Bhavishya Gaur༻꧂No ratings yet

- Maths ExemplerDocument308 pagesMaths Exempler꧁༺Bhavishya Gaur༻꧂No ratings yet

- PDF DocumentDocument1 pagePDF Document꧁༺Bhavishya Gaur༻꧂No ratings yet

- Sample Paper For Half Yearly Exam XI - 2023Document5 pagesSample Paper For Half Yearly Exam XI - 2023꧁༺Bhavishya Gaur༻꧂No ratings yet

- Latihan Quiz AKSK - Print - QuizizzDocument8 pagesLatihan Quiz AKSK - Print - QuizizzSausan AsusNo ratings yet

- Chapter 2Document44 pagesChapter 2Trinh Duc Manh (k15 HL)No ratings yet

- Dokumen - Tips 6018 p3 SPK Lembar Kerja Menyelesaikan Siklus AkuntansiDocument22 pagesDokumen - Tips 6018 p3 SPK Lembar Kerja Menyelesaikan Siklus AkuntansiM IkhsanNo ratings yet

- JD-Purchasing OfficerDocument4 pagesJD-Purchasing OfficerRonnel BonaguaNo ratings yet

- 77Document2 pages77Arian AmuraoNo ratings yet

- Fsa 7e Pref SMDocument16 pagesFsa 7e Pref SMTharindu PereraNo ratings yet

- WEEK 6-7 ULO A, B, C Answer KeyDocument4 pagesWEEK 6-7 ULO A, B, C Answer Keyzee abadilla100% (1)

- 2 Pdfsam Datey Customs ActDocument1 page2 Pdfsam Datey Customs ActdskrishnaNo ratings yet

- NFJPIA (Region XI) Brain GamesDocument6 pagesNFJPIA (Region XI) Brain GamesRonieOlarteNo ratings yet

- SBA ReviewerDocument5 pagesSBA ReviewerBrigit MartinezNo ratings yet

- Fac1601 Revision Notes - Chapter 1Document62 pagesFac1601 Revision Notes - Chapter 1Yaseen KherekarNo ratings yet

- Cytel Requirements Progress Tracker CRP-2A (SCM)Document809 pagesCytel Requirements Progress Tracker CRP-2A (SCM)sanjit biswasNo ratings yet

- AFAR Quiz 1 (B44)Document12 pagesAFAR Quiz 1 (B44)James RelletaNo ratings yet

- Graduates of 2018/2019 AY: Eaching NstitutesDocument256 pagesGraduates of 2018/2019 AY: Eaching Nstitutesyimam seeidNo ratings yet

- 12 PAS 1 Presentation of Financial Statements Part 1Document4 pages12 PAS 1 Presentation of Financial Statements Part 1Keanlyn UnwinNo ratings yet

- Accounting & Control: Cost ManagementDocument20 pagesAccounting & Control: Cost ManagementTirthNo ratings yet

- NTPC SipDocument18 pagesNTPC SipSaurabh ChaurasiaNo ratings yet

- P3 - Performance StrategyDocument17 pagesP3 - Performance StrategyWaqas BadshahNo ratings yet

- Hand Book For Drawing & Disbursing Officers (DDO Code)Document315 pagesHand Book For Drawing & Disbursing Officers (DDO Code)Atif NiaziNo ratings yet

- The Making of A CpaDocument46 pagesThe Making of A CpaMark Alyson NginaNo ratings yet

- Financial Accounting 14th Edition Warren Test Bank DownloadDocument81 pagesFinancial Accounting 14th Edition Warren Test Bank DownloadAmanda Strapp100% (22)

- UST Management Accounting Basic ConceptsDocument5 pagesUST Management Accounting Basic ConceptsNaddieNo ratings yet

- Finance Department Notification-2004 (205-258)Document54 pagesFinance Department Notification-2004 (205-258)Humayoun Ahmad Farooqi67% (6)

- Madras University Time Table Apr15Document18 pagesMadras University Time Table Apr15Vinodh BabuNo ratings yet

- Kores India LTD 2010Document10 pagesKores India LTD 2010Sriram RanganathanNo ratings yet

- Lecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceDocument16 pagesLecture - Discussion On Worksheet Preparation To Post Closing Trial BalanceGarp BarrocaNo ratings yet

- CV-Hasan AftabDocument2 pagesCV-Hasan AftabFahim FerozNo ratings yet