Professional Documents

Culture Documents

ISBAA - Scope and Fees - Tax Compliance and Advisory Services - RajuandPrasad

ISBAA - Scope and Fees - Tax Compliance and Advisory Services - RajuandPrasad

Uploaded by

shikha.mindfulCopyright:

Available Formats

You might also like

- Aws D8.1M 2013Document40 pagesAws D8.1M 2013vishesh dharaiya100% (3)

- Proposal For Recruitment Services WORD (1) 123Document5 pagesProposal For Recruitment Services WORD (1) 123ivinit75% (40)

- Emergency Evacuation Drill ScenarioDocument5 pagesEmergency Evacuation Drill ScenarioiMaaz RameyNo ratings yet

- Contact:-Mind Map ConsultingDocument5 pagesContact:-Mind Map ConsultingHimanshu AroraNo ratings yet

- Proposal For CBG Society - ElitraDocument3 pagesProposal For CBG Society - ElitraTyagi BalaNo ratings yet

- GST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingDocument4 pagesGST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingPC RKNo ratings yet

- A Project Report On Taxation in IndiaDocument59 pagesA Project Report On Taxation in IndiaYash Bhagat100% (1)

- Proposal On Statutory Audit of Uddipan Employees Gratuity FundDocument12 pagesProposal On Statutory Audit of Uddipan Employees Gratuity Fundbarna.du.mabsNo ratings yet

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaNo ratings yet

- Due Date For Payment of Service Tax & IntDocument3 pagesDue Date For Payment of Service Tax & IntKaran KhatriNo ratings yet

- Core Competencies Profile Summary: Ca Akash MaheshwariDocument2 pagesCore Competencies Profile Summary: Ca Akash MaheshwariDivya NinaweNo ratings yet

- Tender Account WorkDocument11 pagesTender Account WorkEsteban CastilloNo ratings yet

- In Partial Fulfilment For The Award of The Degree ofDocument15 pagesIn Partial Fulfilment For The Award of The Degree ofnithyaNo ratings yet

- Interim ReportDocument19 pagesInterim ReportKunvar MattewalNo ratings yet

- Documentation of Insurance Compny Management SystemsDocument131 pagesDocumentation of Insurance Compny Management SystemsNand Kishore DubeyNo ratings yet

- ChecklistDocument4 pagesChecklistpnpandcoNo ratings yet

- Brief Profile: Tax24.in, Tax24 Advisory ServicesDocument7 pagesBrief Profile: Tax24.in, Tax24 Advisory Servicessushil KumarNo ratings yet

- Practice Questions: Advanced Tax LawsDocument68 pagesPractice Questions: Advanced Tax LawsMehul Roy ChowdhuryNo ratings yet

- Tax Update From KSCADocument5 pagesTax Update From KSCAKanti JainNo ratings yet

- Complete Guide On Service Tax For The District Cooperative Central Bank LTD.Document5 pagesComplete Guide On Service Tax For The District Cooperative Central Bank LTD.ramprasadNo ratings yet

- Society Profile With BylawDocument65 pagesSociety Profile With BylawTax Co-operative CBENo ratings yet

- Sunny Thakral: Address: 130/28A, Jyoti Park, Near Ashirwad Banquet Garden, Gurgaon-122001Document4 pagesSunny Thakral: Address: 130/28A, Jyoti Park, Near Ashirwad Banquet Garden, Gurgaon-122001The Cultural CommitteeNo ratings yet

- AppointmentLetter 872133 DocDocument6 pagesAppointmentLetter 872133 DocDatta SheteNo ratings yet

- 1 Budget Impact 2012-13Document5 pages1 Budget Impact 2012-13Rajkamal TiwariNo ratings yet

- Income Tax Return AMANDocument35 pagesIncome Tax Return AMANNadeem ChoudharyNo ratings yet

- Chartered Accountants Certified ITR Cannot Be TrueDocument1 pageChartered Accountants Certified ITR Cannot Be TrueJAYESH CHUGHNo ratings yet

- REPORT INTERNSHIP - ContohDocument16 pagesREPORT INTERNSHIP - ContohMatthew JohnsonNo ratings yet

- Service Proposal - RUDKY TemplateDocument2 pagesService Proposal - RUDKY TemplateYuvraj Sharma PersandNo ratings yet

- Mighty - Top 50 QuestionsDocument79 pagesMighty - Top 50 QuestionsjvbsdNo ratings yet

- CV - Divya GoyalDocument1 pageCV - Divya GoyalGarima JainNo ratings yet

- Proposal Customs Advisory Services - MSSDocument5 pagesProposal Customs Advisory Services - MSSsigit l.prabowoNo ratings yet

- Resume - Aansh DesaiDocument2 pagesResume - Aansh Desaisiddhant jainNo ratings yet

- Company ProfileDocument4 pagesCompany Profileparas shahNo ratings yet

- Mr. Rajendra Jain File Scanned.Document36 pagesMr. Rajendra Jain File Scanned.tharundigistudiotmkNo ratings yet

- Lecture 3 - Setting Up Practice and TaxesDocument18 pagesLecture 3 - Setting Up Practice and TaxesSamruddhi chinchwadkarNo ratings yet

- A To Z Group of CompaniesDocument16 pagesA To Z Group of CompaniesGamboges C. IplNo ratings yet

- Group 15 - Legal and Accounting ReportDocument14 pagesGroup 15 - Legal and Accounting ReportG51Mamatha PatlollaNo ratings yet

- Tenders & NoticesDocument14 pagesTenders & NoticesJaya VatsNo ratings yet

- S R Batliboi-WPS OfficeDocument3 pagesS R Batliboi-WPS OfficeCA Nikunj RakholiyaNo ratings yet

- Report On B PlanDocument10 pagesReport On B PlanAdarsh AgarwalNo ratings yet

- Concept of Service Tax 8th Semester 164140058Document16 pagesConcept of Service Tax 8th Semester 164140058santosh lakhmaniNo ratings yet

- Amit Kumar Jha - ResumeDocument4 pagesAmit Kumar Jha - ResumeAmit KumarNo ratings yet

- A To Z Group of Companies ProfileDocument29 pagesA To Z Group of Companies Profileroopesh_1986No ratings yet

- Tooba DocumentDocument97 pagesTooba Documentjitendra kumarNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- Mumbai Tribunal Rules Reimbursement of ExpensesDocument5 pagesMumbai Tribunal Rules Reimbursement of ExpensestongkiNo ratings yet

- Documentation of Tax Deduction at SourceDocument147 pagesDocumentation of Tax Deduction at SourceNand Kishore DubeyNo ratings yet

- Professional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionDocument10 pagesProfessional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionWahab KNo ratings yet

- Pramila EL Offer LetterDocument5 pagesPramila EL Offer LetterVipul TyagiNo ratings yet

- DT InterviewDocument37 pagesDT Interviewanjali aggarwalNo ratings yet

- Amit Munka: Professional & Academic CredentialsDocument1 pageAmit Munka: Professional & Academic CredentialsAvinash ShelkeNo ratings yet

- Legal and Tax Aspects of BusinessDocument9 pagesLegal and Tax Aspects of Businesstejasmkakkad2001No ratings yet

- Abound Routes - Fee QuoteDocument2 pagesAbound Routes - Fee Quotefinserv2998No ratings yet

- IFA - ITRAF Brochure-10Document5 pagesIFA - ITRAF Brochure-10Lakshmi RaoNo ratings yet

- Nitin Mahinder & Associates: Chartered AccountantsDocument14 pagesNitin Mahinder & Associates: Chartered AccountantsNMA NMANo ratings yet

- Tutorial 1 (Answer) - Tax Evasion and AvoidanceDocument5 pagesTutorial 1 (Answer) - Tax Evasion and Avoidance--bolabolaNo ratings yet

- A. Senior Consultant-Accounts and Company Affairs - Key ResponsibilitiesDocument4 pagesA. Senior Consultant-Accounts and Company Affairs - Key ResponsibilitiesAksh JainNo ratings yet

- National Pension System For Corporates - PresentationDocument10 pagesNational Pension System For Corporates - PresentationSudeep KulkarniNo ratings yet

- Offer Letter-7Document1 pageOffer Letter-7ganesh pandiNo ratings yet

- Tds Project PDFDocument27 pagesTds Project PDFKalyani SatkarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- 2005 990-T and StatementsDocument15 pages2005 990-T and Statementsshikha.mindfulNo ratings yet

- 2004gates Foundation Annual ReportDocument33 pages2004gates Foundation Annual Reportshikha.mindfulNo ratings yet

- 2003gates Foundation Annual ReportDocument21 pages2003gates Foundation Annual Reportshikha.mindfulNo ratings yet

- Harika Contract KesavaRao Internal Audit 2016Document2 pagesHarika Contract KesavaRao Internal Audit 2016shikha.mindfulNo ratings yet

- 1999gates Foundation Annual ReportDocument50 pages1999gates Foundation Annual Reportshikha.mindfulNo ratings yet

- Grievance DocumentDocument2 pagesGrievance Documentshikha.mindfulNo ratings yet

- Pavan Form1Document1 pagePavan Form1shikha.mindfulNo ratings yet

- The Kinston Waterfront Now!Document46 pagesThe Kinston Waterfront Now!Kofi BooneNo ratings yet

- Einstein Hilbert Action With TorsionDocument19 pagesEinstein Hilbert Action With TorsionLillyOpenMindNo ratings yet

- Ebook - Electronics Tutorial PDFDocument213 pagesEbook - Electronics Tutorial PDFHari Laxman M100% (1)

- Scorpio SCDC LHD Mhawk Eiii v2 Mar12Document154 pagesScorpio SCDC LHD Mhawk Eiii v2 Mar12Romel Bladimir Valenzuela ValenzuelaNo ratings yet

- Strad Pressenda v3Document6 pagesStrad Pressenda v3Marcos Augusto SilvaNo ratings yet

- SHC English BulletinDocument1 pageSHC English BulletinMarcus Yee XiangNo ratings yet

- Karoora 2012 L-3 (2013)Document9 pagesKaroora 2012 L-3 (2013)FiraolNo ratings yet

- Basic Rules and Tips in Group DiscussionsDocument2 pagesBasic Rules and Tips in Group Discussionssudarsanamma89% (9)

- Executing / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseDocument6 pagesExecuting / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseBelle CartagenaNo ratings yet

- Barry Thompson Book CHAPTER 8 Cantron - Extraordinary Antioxidant and Ingenious Cancer KillerDocument32 pagesBarry Thompson Book CHAPTER 8 Cantron - Extraordinary Antioxidant and Ingenious Cancer Killermonluck100% (2)

- Service ManualDocument283 pagesService ManualcoquerasNo ratings yet

- United Republic of Tanzania Tanzania Civil Aviation Authority Application For Renewal of An Instrument RatingDocument4 pagesUnited Republic of Tanzania Tanzania Civil Aviation Authority Application For Renewal of An Instrument Ratingcapt.sahaagNo ratings yet

- Submitted By:-ITM B-School, Kharghar .: Application of Maxima & MinimaDocument12 pagesSubmitted By:-ITM B-School, Kharghar .: Application of Maxima & MinimaDeepali KunjeerNo ratings yet

- Lesson PlanDocument2 pagesLesson PlanLUZ SELENE OLIVARES BONILLANo ratings yet

- Preliminary Research of Acacia Mangium Glulam Integration in The PhilippinesDocument7 pagesPreliminary Research of Acacia Mangium Glulam Integration in The PhilippinesHalivier Conol LegaspinaNo ratings yet

- Inmarsat C System Definition Manula - Google SearchDocument2 pagesInmarsat C System Definition Manula - Google SearchasdfaNo ratings yet

- Chapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsDocument52 pagesChapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsAref DahabrahNo ratings yet

- 3 Methods For Crack Depth Measurement in ConcreteDocument4 pages3 Methods For Crack Depth Measurement in ConcreteEvello MercanoNo ratings yet

- Chapter 123 Final Na!!!Document34 pagesChapter 123 Final Na!!!Ricell Joy RocamoraNo ratings yet

- ONX 620 QuickStart Guide v10Document133 pagesONX 620 QuickStart Guide v10Haiward RinconNo ratings yet

- Quick Installation GuideDocument2 pagesQuick Installation GuidePaulo R. Lemos MessiasNo ratings yet

- Britain Food and DrinksDocument15 pagesBritain Food and DrinksAnny NamelessNo ratings yet

- Activities Guide and Evaluation Rubric - Step 5 - Final Assessment - Open Objective TestDocument9 pagesActivities Guide and Evaluation Rubric - Step 5 - Final Assessment - Open Objective TestWendy JaramilloNo ratings yet

- The Impact of Food Branding On Children's Eating Behaviour and ObesityDocument8 pagesThe Impact of Food Branding On Children's Eating Behaviour and ObesityAlessandraBattagliaNo ratings yet

- BS en 1713 - UtDocument20 pagesBS en 1713 - UtBoranAlouaneNo ratings yet

- Activity 3.module 1Document4 pagesActivity 3.module 1Juedy Lala PostreroNo ratings yet

- Professional Diploma in Marketing: Reading List 2011 - 2012Document6 pagesProfessional Diploma in Marketing: Reading List 2011 - 2012yaqub19799141100% (1)

- Royal College Grade 07 English Second Term Paper (221119 110652Document10 pagesRoyal College Grade 07 English Second Term Paper (221119 110652sandeepsubasinghe23No ratings yet

ISBAA - Scope and Fees - Tax Compliance and Advisory Services - RajuandPrasad

ISBAA - Scope and Fees - Tax Compliance and Advisory Services - RajuandPrasad

Uploaded by

shikha.mindfulOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ISBAA - Scope and Fees - Tax Compliance and Advisory Services - RajuandPrasad

ISBAA - Scope and Fees - Tax Compliance and Advisory Services - RajuandPrasad

Uploaded by

shikha.mindfulCopyright:

Available Formats

Raju and Prasad 401, Diamond House,

Chartered Accountants Adj. Amrutha Hills, Punjagutta,

Hyderabad – 500082

Email: hyderabad@rajuandprasad.com

Kind Attention: Mr. Chandrasekhar Goda

ISB Alumni Association

Gachibowli, Hyderabad – 500032

Sub: Proposal and Fees for Tax Compliance and Other Advisory services

Dear Sir,

We are pleased to present our scope of work and the fees thereon, which is based on our

understanding of your requirement. We thank you for the opportunity of being associated

with a prestigious institution like Indian School of Business (ISB) and its Alumni Association.

We look forward to working with you and your team.

If you have any queries or comments, please feel free to mail us or call me on

+919848882316.

Yours sincerely

For Raju and Prasad

Chartered Accountants

Y. Bala Krishna Reddy

Partner

Proposal for Tax compliance and Other Advisory Services

Raju and Prasad 401, Diamond House,

Chartered Accountants Adj. Amrutha Hills, Punjagutta,

Hyderabad – 500082

Email: hyderabad@rajuandprasad.com

Background

Indian School of Business Alumni Association (‘ISBAA’ or ‘association’) is an association

formed to promote, facilitate and develop stewardship leading to meaningful relationships

between alumni and School, as well as between alumni across classes – strengthen the

network.

The Association has approached Raju and Prasad Chartered Accountants for assistance in

connection with providing advisory and compliance based services in the domain of direct

tax and accounting aspects.

Scope of Services

At Raju and Prasad, we can provide you with a range of compliance and advisory services.

Based on our understanding of your requirements and experience gained over number of

years in imparting such services, we have summarized the scope of services in the ensuing

paragraphs

Part I –Registration of Association under section 12A of the Income tax Act (“Act”)

Discussion with the management on the detailed goals and objectives and future plan.

Coordination with the designated point of contact (in the association) and collation of

relevant documents for filing of application for registration under section 12A of the Act

Preparation of application in Form 10A and submission of the same to appropriate

authority in Income tax department

Representation before the appropriate authority and regular follow ups with Income tax

Authorities.

Proposal for Tax compliance and Other Advisory Services

Raju and Prasad 401, Diamond House,

Chartered Accountants Adj. Amrutha Hills, Punjagutta,

Hyderabad – 500082

Email: hyderabad@rajuandprasad.com

Part II –Assistance in Preparation and filing of Income tax Return (ITR)

In this regard, our scope of service would include:

Examining the tax positions to be adopted for preparation of computation of income

and the ITR and discussing the same with the Association.

Assistance in preparation and finalization of Income-tax computation prior to filing of

the ITR;

Assistance in preparation of the Income Tax return form which needs to be filed

electronically on the website of the Income-tax department.

Part III – Services relating to Transfer of funds from ISB

Assistance in calculation of the funds that are required to be transferred from ISB

Assistance in matters relating to accounting and related aspects on transfer of funds and

subsequent disclosure of the same in the financial statements.

Part IV – On call advisory services

Routine matters relating to the provisions of the Act including the Association’s

obligations with respect to withholding tax compliance in relation to payment in the

nature of salaries, payments to contractors, fees for professional services, lease

payments etc.

Analysing accounting implications and other implications under the provisions of the Act

arising out of various transactions/agreements entered into / proposed to be entered

into by the Association;

Analysing tax treaties (Double Taxation Avoidance Agreements) between India and any

other country to determine tax implications arising from international transactions

carried out or proposed to be carried out by the Association;

Proposal for Tax compliance and Other Advisory Services

Raju and Prasad 401, Diamond House,

Chartered Accountants Adj. Amrutha Hills, Punjagutta,

Hyderabad – 500082

Email: hyderabad@rajuandprasad.com

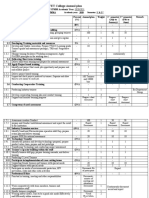

Fees

Raju and Prasad endeavours to provide quality services in a timely manner at a realistic cost.

Our fees are based on the nature of assignment and quality of people assigned for the job.

Based on the time estimates and efforts involved, we propose the following fees –

Part Scope of Work Fees in INR Payment terms

I Registration of Total – 30,000

Association under

section 12A

50% of total fees as the initial

a) Preliminary analysis 10,000 advance

and filing of

application Balance upon obtaining the

registration certificate

b) Representation 20,000

before Income tax

Authorities

II Assistance in 10,000 per 100% on filing of ITR

Preparation and filing of Financial year

ITR

III Services related to 5,000 100% on submission of invoice

transfer of funds from

ISB

IV On-Call advisory 3,000 per man Will be invoiced on a quarterly basis

services hour spent along with a summary of advices

given during the period.

100% payable on creation of Invoice.

The above does not include any out-of-pocket costs such as travelling (if any), conveyance,

courier etc. Such costs will be billed in addition to the above, on actual basis. Service tax @

15%(or at rates in force) shall be levied additionally.

Proposal for Tax compliance and Other Advisory Services

You might also like

- Aws D8.1M 2013Document40 pagesAws D8.1M 2013vishesh dharaiya100% (3)

- Proposal For Recruitment Services WORD (1) 123Document5 pagesProposal For Recruitment Services WORD (1) 123ivinit75% (40)

- Emergency Evacuation Drill ScenarioDocument5 pagesEmergency Evacuation Drill ScenarioiMaaz RameyNo ratings yet

- Contact:-Mind Map ConsultingDocument5 pagesContact:-Mind Map ConsultingHimanshu AroraNo ratings yet

- Proposal For CBG Society - ElitraDocument3 pagesProposal For CBG Society - ElitraTyagi BalaNo ratings yet

- GST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingDocument4 pagesGST 28 Council Meeting: Highlights of The Decisions Taken by The GST Council in Its 28th MeetingPC RKNo ratings yet

- A Project Report On Taxation in IndiaDocument59 pagesA Project Report On Taxation in IndiaYash Bhagat100% (1)

- Proposal On Statutory Audit of Uddipan Employees Gratuity FundDocument12 pagesProposal On Statutory Audit of Uddipan Employees Gratuity Fundbarna.du.mabsNo ratings yet

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaNo ratings yet

- Due Date For Payment of Service Tax & IntDocument3 pagesDue Date For Payment of Service Tax & IntKaran KhatriNo ratings yet

- Core Competencies Profile Summary: Ca Akash MaheshwariDocument2 pagesCore Competencies Profile Summary: Ca Akash MaheshwariDivya NinaweNo ratings yet

- Tender Account WorkDocument11 pagesTender Account WorkEsteban CastilloNo ratings yet

- In Partial Fulfilment For The Award of The Degree ofDocument15 pagesIn Partial Fulfilment For The Award of The Degree ofnithyaNo ratings yet

- Interim ReportDocument19 pagesInterim ReportKunvar MattewalNo ratings yet

- Documentation of Insurance Compny Management SystemsDocument131 pagesDocumentation of Insurance Compny Management SystemsNand Kishore DubeyNo ratings yet

- ChecklistDocument4 pagesChecklistpnpandcoNo ratings yet

- Brief Profile: Tax24.in, Tax24 Advisory ServicesDocument7 pagesBrief Profile: Tax24.in, Tax24 Advisory Servicessushil KumarNo ratings yet

- Practice Questions: Advanced Tax LawsDocument68 pagesPractice Questions: Advanced Tax LawsMehul Roy ChowdhuryNo ratings yet

- Tax Update From KSCADocument5 pagesTax Update From KSCAKanti JainNo ratings yet

- Complete Guide On Service Tax For The District Cooperative Central Bank LTD.Document5 pagesComplete Guide On Service Tax For The District Cooperative Central Bank LTD.ramprasadNo ratings yet

- Society Profile With BylawDocument65 pagesSociety Profile With BylawTax Co-operative CBENo ratings yet

- Sunny Thakral: Address: 130/28A, Jyoti Park, Near Ashirwad Banquet Garden, Gurgaon-122001Document4 pagesSunny Thakral: Address: 130/28A, Jyoti Park, Near Ashirwad Banquet Garden, Gurgaon-122001The Cultural CommitteeNo ratings yet

- AppointmentLetter 872133 DocDocument6 pagesAppointmentLetter 872133 DocDatta SheteNo ratings yet

- 1 Budget Impact 2012-13Document5 pages1 Budget Impact 2012-13Rajkamal TiwariNo ratings yet

- Income Tax Return AMANDocument35 pagesIncome Tax Return AMANNadeem ChoudharyNo ratings yet

- Chartered Accountants Certified ITR Cannot Be TrueDocument1 pageChartered Accountants Certified ITR Cannot Be TrueJAYESH CHUGHNo ratings yet

- REPORT INTERNSHIP - ContohDocument16 pagesREPORT INTERNSHIP - ContohMatthew JohnsonNo ratings yet

- Service Proposal - RUDKY TemplateDocument2 pagesService Proposal - RUDKY TemplateYuvraj Sharma PersandNo ratings yet

- Mighty - Top 50 QuestionsDocument79 pagesMighty - Top 50 QuestionsjvbsdNo ratings yet

- CV - Divya GoyalDocument1 pageCV - Divya GoyalGarima JainNo ratings yet

- Proposal Customs Advisory Services - MSSDocument5 pagesProposal Customs Advisory Services - MSSsigit l.prabowoNo ratings yet

- Resume - Aansh DesaiDocument2 pagesResume - Aansh Desaisiddhant jainNo ratings yet

- Company ProfileDocument4 pagesCompany Profileparas shahNo ratings yet

- Mr. Rajendra Jain File Scanned.Document36 pagesMr. Rajendra Jain File Scanned.tharundigistudiotmkNo ratings yet

- Lecture 3 - Setting Up Practice and TaxesDocument18 pagesLecture 3 - Setting Up Practice and TaxesSamruddhi chinchwadkarNo ratings yet

- A To Z Group of CompaniesDocument16 pagesA To Z Group of CompaniesGamboges C. IplNo ratings yet

- Group 15 - Legal and Accounting ReportDocument14 pagesGroup 15 - Legal and Accounting ReportG51Mamatha PatlollaNo ratings yet

- Tenders & NoticesDocument14 pagesTenders & NoticesJaya VatsNo ratings yet

- S R Batliboi-WPS OfficeDocument3 pagesS R Batliboi-WPS OfficeCA Nikunj RakholiyaNo ratings yet

- Report On B PlanDocument10 pagesReport On B PlanAdarsh AgarwalNo ratings yet

- Concept of Service Tax 8th Semester 164140058Document16 pagesConcept of Service Tax 8th Semester 164140058santosh lakhmaniNo ratings yet

- Amit Kumar Jha - ResumeDocument4 pagesAmit Kumar Jha - ResumeAmit KumarNo ratings yet

- A To Z Group of Companies ProfileDocument29 pagesA To Z Group of Companies Profileroopesh_1986No ratings yet

- Tooba DocumentDocument97 pagesTooba Documentjitendra kumarNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- Mumbai Tribunal Rules Reimbursement of ExpensesDocument5 pagesMumbai Tribunal Rules Reimbursement of ExpensestongkiNo ratings yet

- Documentation of Tax Deduction at SourceDocument147 pagesDocumentation of Tax Deduction at SourceNand Kishore DubeyNo ratings yet

- Professional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionDocument10 pagesProfessional Tax Maharashtra - Tax Slab, Payment, Applicability, Login, Due Date, ExemptionWahab KNo ratings yet

- Pramila EL Offer LetterDocument5 pagesPramila EL Offer LetterVipul TyagiNo ratings yet

- DT InterviewDocument37 pagesDT Interviewanjali aggarwalNo ratings yet

- Amit Munka: Professional & Academic CredentialsDocument1 pageAmit Munka: Professional & Academic CredentialsAvinash ShelkeNo ratings yet

- Legal and Tax Aspects of BusinessDocument9 pagesLegal and Tax Aspects of Businesstejasmkakkad2001No ratings yet

- Abound Routes - Fee QuoteDocument2 pagesAbound Routes - Fee Quotefinserv2998No ratings yet

- IFA - ITRAF Brochure-10Document5 pagesIFA - ITRAF Brochure-10Lakshmi RaoNo ratings yet

- Nitin Mahinder & Associates: Chartered AccountantsDocument14 pagesNitin Mahinder & Associates: Chartered AccountantsNMA NMANo ratings yet

- Tutorial 1 (Answer) - Tax Evasion and AvoidanceDocument5 pagesTutorial 1 (Answer) - Tax Evasion and Avoidance--bolabolaNo ratings yet

- A. Senior Consultant-Accounts and Company Affairs - Key ResponsibilitiesDocument4 pagesA. Senior Consultant-Accounts and Company Affairs - Key ResponsibilitiesAksh JainNo ratings yet

- National Pension System For Corporates - PresentationDocument10 pagesNational Pension System For Corporates - PresentationSudeep KulkarniNo ratings yet

- Offer Letter-7Document1 pageOffer Letter-7ganesh pandiNo ratings yet

- Tds Project PDFDocument27 pagesTds Project PDFKalyani SatkarNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNo ratings yet

- 2005 990-T and StatementsDocument15 pages2005 990-T and Statementsshikha.mindfulNo ratings yet

- 2004gates Foundation Annual ReportDocument33 pages2004gates Foundation Annual Reportshikha.mindfulNo ratings yet

- 2003gates Foundation Annual ReportDocument21 pages2003gates Foundation Annual Reportshikha.mindfulNo ratings yet

- Harika Contract KesavaRao Internal Audit 2016Document2 pagesHarika Contract KesavaRao Internal Audit 2016shikha.mindfulNo ratings yet

- 1999gates Foundation Annual ReportDocument50 pages1999gates Foundation Annual Reportshikha.mindfulNo ratings yet

- Grievance DocumentDocument2 pagesGrievance Documentshikha.mindfulNo ratings yet

- Pavan Form1Document1 pagePavan Form1shikha.mindfulNo ratings yet

- The Kinston Waterfront Now!Document46 pagesThe Kinston Waterfront Now!Kofi BooneNo ratings yet

- Einstein Hilbert Action With TorsionDocument19 pagesEinstein Hilbert Action With TorsionLillyOpenMindNo ratings yet

- Ebook - Electronics Tutorial PDFDocument213 pagesEbook - Electronics Tutorial PDFHari Laxman M100% (1)

- Scorpio SCDC LHD Mhawk Eiii v2 Mar12Document154 pagesScorpio SCDC LHD Mhawk Eiii v2 Mar12Romel Bladimir Valenzuela ValenzuelaNo ratings yet

- Strad Pressenda v3Document6 pagesStrad Pressenda v3Marcos Augusto SilvaNo ratings yet

- SHC English BulletinDocument1 pageSHC English BulletinMarcus Yee XiangNo ratings yet

- Karoora 2012 L-3 (2013)Document9 pagesKaroora 2012 L-3 (2013)FiraolNo ratings yet

- Basic Rules and Tips in Group DiscussionsDocument2 pagesBasic Rules and Tips in Group Discussionssudarsanamma89% (9)

- Executing / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseDocument6 pagesExecuting / Implementing Agency: Financial Management Assessment Questionnaire Topic ResponseBelle CartagenaNo ratings yet

- Barry Thompson Book CHAPTER 8 Cantron - Extraordinary Antioxidant and Ingenious Cancer KillerDocument32 pagesBarry Thompson Book CHAPTER 8 Cantron - Extraordinary Antioxidant and Ingenious Cancer Killermonluck100% (2)

- Service ManualDocument283 pagesService ManualcoquerasNo ratings yet

- United Republic of Tanzania Tanzania Civil Aviation Authority Application For Renewal of An Instrument RatingDocument4 pagesUnited Republic of Tanzania Tanzania Civil Aviation Authority Application For Renewal of An Instrument Ratingcapt.sahaagNo ratings yet

- Submitted By:-ITM B-School, Kharghar .: Application of Maxima & MinimaDocument12 pagesSubmitted By:-ITM B-School, Kharghar .: Application of Maxima & MinimaDeepali KunjeerNo ratings yet

- Lesson PlanDocument2 pagesLesson PlanLUZ SELENE OLIVARES BONILLANo ratings yet

- Preliminary Research of Acacia Mangium Glulam Integration in The PhilippinesDocument7 pagesPreliminary Research of Acacia Mangium Glulam Integration in The PhilippinesHalivier Conol LegaspinaNo ratings yet

- Inmarsat C System Definition Manula - Google SearchDocument2 pagesInmarsat C System Definition Manula - Google SearchasdfaNo ratings yet

- Chapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsDocument52 pagesChapter 3 Practice Problems Review and Assessment Solution 2 Use The V T Graph of The Toy Train in Figure 9 To Answer These QuestionsAref DahabrahNo ratings yet

- 3 Methods For Crack Depth Measurement in ConcreteDocument4 pages3 Methods For Crack Depth Measurement in ConcreteEvello MercanoNo ratings yet

- Chapter 123 Final Na!!!Document34 pagesChapter 123 Final Na!!!Ricell Joy RocamoraNo ratings yet

- ONX 620 QuickStart Guide v10Document133 pagesONX 620 QuickStart Guide v10Haiward RinconNo ratings yet

- Quick Installation GuideDocument2 pagesQuick Installation GuidePaulo R. Lemos MessiasNo ratings yet

- Britain Food and DrinksDocument15 pagesBritain Food and DrinksAnny NamelessNo ratings yet

- Activities Guide and Evaluation Rubric - Step 5 - Final Assessment - Open Objective TestDocument9 pagesActivities Guide and Evaluation Rubric - Step 5 - Final Assessment - Open Objective TestWendy JaramilloNo ratings yet

- The Impact of Food Branding On Children's Eating Behaviour and ObesityDocument8 pagesThe Impact of Food Branding On Children's Eating Behaviour and ObesityAlessandraBattagliaNo ratings yet

- BS en 1713 - UtDocument20 pagesBS en 1713 - UtBoranAlouaneNo ratings yet

- Activity 3.module 1Document4 pagesActivity 3.module 1Juedy Lala PostreroNo ratings yet

- Professional Diploma in Marketing: Reading List 2011 - 2012Document6 pagesProfessional Diploma in Marketing: Reading List 2011 - 2012yaqub19799141100% (1)

- Royal College Grade 07 English Second Term Paper (221119 110652Document10 pagesRoyal College Grade 07 English Second Term Paper (221119 110652sandeepsubasinghe23No ratings yet