Professional Documents

Culture Documents

Assignment HM5.34 - CH

Assignment HM5.34 - CH

Uploaded by

Salsabila AufaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment HM5.34 - CH

Assignment HM5.34 - CH

Uploaded by

Salsabila AufaCopyright:

Available Formats

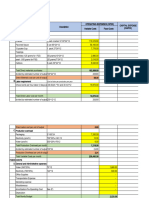

1 Prepare a job-order cost sheet for the proposed job. What is the expected per-unit cost?

Should Nutratask accept the price offered by the prospective customer? Why or why not?

Job-Order Cost Sheet

Potassium Aspartate

Materials Direct Labour

Type Quantity Cost/ unit Amount Hours Rate

Aspartic acid 195 5.75 $ 1,121.25 16 $ 12.50

Citric acid 15 2.02 30.30

K2CO3 (50%) 121.5 4.64 563.76

Rice 30 0.43 12.90

Total $ 1,728

Cost Summary :

Direct Material $ 1,728.21

Direct Labour 200.00

Overhead 220.00

Total Cost $ 2,148.21

Order required (300 kg) 300.00

Expexted Cost per unit $ 7.16

Price per unit 30% $ 9.31

The Price offered by the customer $ 8.80

Nutratask should not accept the price offered by the customer because it is

lower than the price per unit that aassigned by Nutratask. If the Nutratask

accepts the offering then the gross profit will be decrease.

2 Suppose Nutratask and the prospective customer agree on a price of cost plus 30 percent.

What is the gross profit that Nutratask expects to earn on the job?

Price per unit 30% $ 9.31

Revenue 300 $ 2,792.67

Cost of goods sold 2,148.21

Gross profit $ 644.46

3 What is the actual per-unit cost? The bid price is based on expected costs. How much did

Nutratask gain (or lose) because of the actual costs differing from the expected costs?

Suggest some possible reasons why the actual costs differed from the projected costs.

Actual per unit cost :

Direct Material $ 1,790.00

Direct Labour 225.00

Overhead 247.50

Total Cost $ 2,262.50

Order required (300 kg) 300.00

Actual Cost per unit $ 7.54

Price per unit 30% $ 9.80

Gain (lose) :

Total expected cost $ 2,148.21

Total actual cost $ 2,262.50

Lose $ -114.29

Unfavorable

Some possible reasons :

- The labour may have been inefficient

- Inefficient and possibly wasteful use of materials

- Increasing in overhead cost or materials cost caused by uncertainty event

Assume that the customer had agreed to pay actual manufacturing costs plus 30

percent. Suppose the actual costs are as described in Requirement 3 with one

addition: an underapplied overhead variance is allocated to Cost of Goods Sold

and spread across all jobs sold in proportion to their total cost (unadjusted cost

of goods sold). Assume that the underapplied overhead cost added to the job in

4 question is $30. Upon seeing the addition of the underapplied overhead in the

itemized bill, the customer calls and complains about having to pay for

Nutratask’s inefficient use of overhead costs. If you were assigned to deal with

this customer, what kind of response would you prepare? How would you

explain and justify the addition of the underapplied overhead cost to the

customer’s bill?

The customer's bill :

Direct Material $ 1,790.00

Direct Labour 225.00

Direct Labour 247.50

An underapplied overhead 30.00

Total cost $ 2,292.50

Total price 30% $ 2,980.25

We could explain to the customer that the addition of an underapplied overhead

is adjustment required for the actual cost and the production cost is controlled

by the overhead cost. If the customer still not satisfied, Nutratask could consider

to use the previous cost althought the gross profit is not maximum. This action is

a company's responsibility in providing services and maintaining customer trust.

irect Labour Overhead

Amount Cost Rate Amount

$ 200 $ 200 110% $ 220

$ 200.00 $ 220.00

You might also like

- Bergerac SystemsDocument4 pagesBergerac Systemsgogana93100% (1)

- Mathematics SBADocument6 pagesMathematics SBASeifer Rattan67% (3)

- Assigment 5.34Document7 pagesAssigment 5.34Indahna SulfaNo ratings yet

- AML-Excercise Week 4 (Reviandi Ramadhan)Document21 pagesAML-Excercise Week 4 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- Practice Questions - SolDocument8 pagesPractice Questions - SolNicholas LeeNo ratings yet

- Bergerac Systems: The Challenge of Backward IntegrationDocument8 pagesBergerac Systems: The Challenge of Backward IntegrationSujith KumarNo ratings yet

- Property, Plant and Equipement: Prior To Expense AfterDocument8 pagesProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNo ratings yet

- 78Document1 page78laale dijaanNo ratings yet

- Bergerac AUDocument2 pagesBergerac AUPratyashNo ratings yet

- Bergerac D3D3D3Systems: The Challenge of Backward IntegrationDocument4 pagesBergerac D3D3D3Systems: The Challenge of Backward IntegrationZee ShanNo ratings yet

- Chap 4 Job CostingDocument9 pagesChap 4 Job CostingWadiah AkbarNo ratings yet

- Bergessssssrac D3D3D3Systems: The Challenge of Backward IntegrationDocument4 pagesBergessssssrac D3D3D3Systems: The Challenge of Backward IntegrationZee ShanNo ratings yet

- Best Financial Forecast FinalDocument13 pagesBest Financial Forecast Finalitsmethird.26No ratings yet

- Dbergessssssrac D3D3D3Systems: The Challenge of Backward IntegrationDocument4 pagesDbergessssssrac D3D3D3Systems: The Challenge of Backward IntegrationZee ShanNo ratings yet

- 24GK0065Document12 pages24GK0065bernardorasimo26No ratings yet

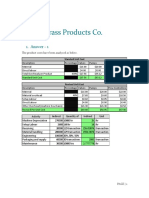

- Destin Brass Products Co.: 1. Answer - 1Document5 pagesDestin Brass Products Co.: 1. Answer - 1Chetan DasguptaNo ratings yet

- MFA - Assignment 2: Management and Financial Accounting - Individual Assignment 2Document9 pagesMFA - Assignment 2: Management and Financial Accounting - Individual Assignment 2Mohan sunderNo ratings yet

- Acct602 Managerial AccountingDocument8 pagesAcct602 Managerial AccountingHaroon KhurshidNo ratings yet

- Chapter 2 and 3 AssignmentDocument12 pagesChapter 2 and 3 AssignmentBien Carlo BuenaventuraNo ratings yet

- Program of Works:: Prop. Kiwalan Public Market BuildingDocument17 pagesProgram of Works:: Prop. Kiwalan Public Market BuildingFred Vincent BaldomeroNo ratings yet

- Cupcake Exports LTD.: Pre Cost Sheet-StarntalerDocument23 pagesCupcake Exports LTD.: Pre Cost Sheet-StarntalerromanNo ratings yet

- Activity Based Costing - APO 9Document13 pagesActivity Based Costing - APO 9manan guptaNo ratings yet

- 24GK0064Document13 pages24GK0064bernardorasimo26No ratings yet

- Imba Case 3: Situation OneDocument6 pagesImba Case 3: Situation OneK IdolsNo ratings yet

- Traditional Vs ABC Costing CaseDocument1 pageTraditional Vs ABC Costing Casesul239No ratings yet

- ClassicPenCompany 2023B2PGPMX012 KshitijDocument3 pagesClassicPenCompany 2023B2PGPMX012 KshitijSuraj KumarNo ratings yet

- CE ExpansionDocument101 pagesCE ExpansionvictoriaNo ratings yet

- Entrep CostingDocument3 pagesEntrep Costingpitik.h4wking.1naNo ratings yet

- ABC Practice Problems Answer KeyDocument10 pagesABC Practice Problems Answer KeyKemberly AribanNo ratings yet

- Cost Estimate (Super ST)Document9 pagesCost Estimate (Super ST)Erika BanguilanNo ratings yet

- Solutions-Chapter 6Document4 pagesSolutions-Chapter 6Saurabh SinghNo ratings yet

- CH 5 ExcelDocument37 pagesCH 5 ExcelssdsNo ratings yet

- CH14 AbcDocument8 pagesCH14 AbcamitNo ratings yet

- Contract ID No. 23GF0020Document9 pagesContract ID No. 23GF0020Asia Structural Developer CorpNo ratings yet

- Module 2 Case AssignmentDocument2 pagesModule 2 Case AssignmentMadison HeffronNo ratings yet

- Accy 211 - Week 7 Tut HWDocument1 pageAccy 211 - Week 7 Tut HWIsaac ElhageNo ratings yet

- Case Study WilkersonDocument2 pagesCase Study WilkersonHIMANSHU AGRAWALNo ratings yet

- Exam 2 ReviewDocument18 pagesExam 2 ReviewBrad MellerNo ratings yet

- ALLE0000Document3 pagesALLE0000Ernesto LeonNo ratings yet

- Documents - MX - Destin Brass Products Co 55f065486abf6 PDFDocument9 pagesDocuments - MX - Destin Brass Products Co 55f065486abf6 PDFNikhil WadhwaniNo ratings yet

- Jawaban Soal Kasus 4.2 Bab 17 Akmen LJT Dari Laptop AnasDocument9 pagesJawaban Soal Kasus 4.2 Bab 17 Akmen LJT Dari Laptop AnasMaksi angkatan35No ratings yet

- Suraj T S (Me Cs 4)Document4 pagesSuraj T S (Me Cs 4)Suraj TSNo ratings yet

- 19GK0198 - NoDocument20 pages19GK0198 - NoBernardo RasimoNo ratings yet

- CCCAC Chapter 3Document10 pagesCCCAC Chapter 3rochelle lagmayNo ratings yet

- 23GF0027Document13 pages23GF0027Asia Structural Developer CorpNo ratings yet

- Break Even Analysis in ExcelDocument6 pagesBreak Even Analysis in ExcelsnishapattarNo ratings yet

- Accounting Project Segment 3Document2 pagesAccounting Project Segment 3Zach James LebreiroNo ratings yet

- Actual Bills Total 2,215: BescomDocument1 pageActual Bills Total 2,215: BescomAlokNo ratings yet

- Aaa EditeddddDocument60 pagesAaa EditeddddCristine JacangNo ratings yet

- Class Work AnswersDocument4 pagesClass Work Answersdavid.samhon73No ratings yet

- 19GK0201 - NoDocument20 pages19GK0201 - NoBernardo RasimoNo ratings yet

- Costing: Production Staff 389.00 4Document61 pagesCosting: Production Staff 389.00 4Jelai MatisNo ratings yet

- Local Access Road in KisolonDocument10 pagesLocal Access Road in KisolonKeirl John AsinguaNo ratings yet

- Mabugnao P1 230m ROAD 102 (20 2022)Document1 pageMabugnao P1 230m ROAD 102 (20 2022)Abhyn ANo ratings yet

- Pia Mendez Mendoza SanchezDocument3 pagesPia Mendez Mendoza Sancheznt26k2jc9sNo ratings yet

- Answers To 11 - 16 Assignment in ABC PDFDocument3 pagesAnswers To 11 - 16 Assignment in ABC PDFMubarrach MatabalaoNo ratings yet

- Cost AssignmentDocument6 pagesCost AssignmentDaksh NagpalNo ratings yet

- Contract ID No. 23GF0020 - Detailed EstimateDocument7 pagesContract ID No. 23GF0020 - Detailed EstimateAsia Structural Developer CorpNo ratings yet

- Financial AssumptionsDocument15 pagesFinancial AssumptionsAngelica VinasNo ratings yet

- Costing DCDocument1 pageCosting DCMharco ColipapaNo ratings yet

- Chapter 5 - A2, B1, & 59Document5 pagesChapter 5 - A2, B1, & 59詹鎮豪No ratings yet

- KELOMPOK 8 - Business Plan Part 1 (Dragged) 2Document3 pagesKELOMPOK 8 - Business Plan Part 1 (Dragged) 2Salsabila AufaNo ratings yet

- Black and Red Geometric Technology Keynote PresentationDocument15 pagesBlack and Red Geometric Technology Keynote PresentationSalsabila AufaNo ratings yet

- 06 - Time Value of Money - 2Document77 pages06 - Time Value of Money - 2Salsabila AufaNo ratings yet

- 10-00-ENG - Stock ValuationDocument38 pages10-00-ENG - Stock ValuationSalsabila AufaNo ratings yet

- 07-01 - An Introduction To Risk and ReturnDocument69 pages07-01 - An Introduction To Risk and ReturnSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 31Document3 pages04-01 - Financial Analysis (Dragged) 31Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 20Document3 pages04-01 - Financial Analysis (Dragged) 20Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 4Document3 pages04-01 - Financial Analysis (Dragged) 4Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 26Document3 pages04-01 - Financial Analysis (Dragged) 26Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 15Document3 pages04-01 - Financial Analysis (Dragged) 15Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 14Document3 pages04-01 - Financial Analysis (Dragged) 14Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 8Document3 pages04-01 - Financial Analysis (Dragged) 8Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 19Document3 pages04-01 - Financial Analysis (Dragged) 19Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 9Document3 pages04-01 - Financial Analysis (Dragged) 9Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 16Document3 pages04-01 - Financial Analysis (Dragged) 16Salsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 18Document3 pages04-01 - Financial Analysis (Dragged) 18Salsabila AufaNo ratings yet

- 04-01 - Financial AnalysisDocument98 pages04-01 - Financial AnalysisSalsabila AufaNo ratings yet

- 04-01 - Financial Analysis (Dragged) 11Document6 pages04-01 - Financial Analysis (Dragged) 11Salsabila AufaNo ratings yet

- B. Intro To Business ValuationDocument4 pagesB. Intro To Business ValuationSalsabila AufaNo ratings yet

- Latihan UAS Soal 01Document3 pagesLatihan UAS Soal 01Salsabila AufaNo ratings yet

- Ass 10 01aDocument1 pageAss 10 01aSalsabila AufaNo ratings yet

- Assignment Week 1 - CHDocument2 pagesAssignment Week 1 - CHSalsabila AufaNo ratings yet

- Ass 10 03BDocument1 pageAss 10 03BSalsabila AufaNo ratings yet

- Ass 10 02DDocument2 pagesAss 10 02DSalsabila AufaNo ratings yet

- Ass 10 02CDocument1 pageAss 10 02CSalsabila AufaNo ratings yet

- Pricing Determination Perfect Competition: Dr. Vijay Kumar GuptaDocument5 pagesPricing Determination Perfect Competition: Dr. Vijay Kumar GuptaNnaemeka UMEH Christian DanielNo ratings yet

- General Conditions For The Supply and Installation of Mechanical, Electrical and Electronic ProductsDocument8 pagesGeneral Conditions For The Supply and Installation of Mechanical, Electrical and Electronic ProductsЯрослав ДронинNo ratings yet

- Bill of Sale (Motorcycle)Document2 pagesBill of Sale (Motorcycle)bradley omariNo ratings yet

- Real Estate NotesDocument8 pagesReal Estate NotesSteven ElsingaNo ratings yet

- Term Paper Business FinanceDocument31 pagesTerm Paper Business FinanceJodi LegpitanNo ratings yet

- Basic FinanceDocument23 pagesBasic FinanceGessille SalavariaNo ratings yet

- Nabus Vs PacsonDocument8 pagesNabus Vs PacsonGladys BantilanNo ratings yet

- CH 15 Inventory ManagementDocument21 pagesCH 15 Inventory ManagementAshwin MishraNo ratings yet

- Sandeep Garg Solutions Class 12 - Chapter 4Document4 pagesSandeep Garg Solutions Class 12 - Chapter 4Manshika LakhmaniNo ratings yet

- (비밀노트 (edu-lab.kr) ) 24대비 - 수특영어 05강 - 차별화된 최종찍기 - 통합 - OK - FDocument29 pages(비밀노트 (edu-lab.kr) ) 24대비 - 수특영어 05강 - 차별화된 최종찍기 - 통합 - OK - FᄋᄋNo ratings yet

- Lecture 2 A - Contracts Project Delivery Methods-Canadian FormsDocument38 pagesLecture 2 A - Contracts Project Delivery Methods-Canadian FormsKeyvan HajjarizadehNo ratings yet

- Quiz 1 - IPF 2022Document5 pagesQuiz 1 - IPF 2022Kunal MondalNo ratings yet

- Regional Science High School For Region 02: Camp Samal, Arcon, Tumauini, Isabela 3325Document28 pagesRegional Science High School For Region 02: Camp Samal, Arcon, Tumauini, Isabela 3325Niña MogarteNo ratings yet

- SDM Cases HighlightedDocument33 pagesSDM Cases HighlightedRoshan HmNo ratings yet

- Price Ceilings and Price FloorsDocument28 pagesPrice Ceilings and Price FloorsKRISP ABEARNo ratings yet

- CH.09.Job&Contract CostDocument38 pagesCH.09.Job&Contract CostRohit AgarwalNo ratings yet

- Quantitative Strategic AnalysisDocument16 pagesQuantitative Strategic AnalysisBlaine Bateman, EAF LLCNo ratings yet

- Customs IntroductionDocument62 pagesCustoms IntroductionJitendra VernekarNo ratings yet

- EbayDocument81 pagesEbayJohnny ChanNo ratings yet

- Surabaya Property Market Report: Colliers Half Year Report H1 2018 20 September 2018Document22 pagesSurabaya Property Market Report: Colliers Half Year Report H1 2018 20 September 2018anthony csNo ratings yet

- MBF and I2b NotesDocument100 pagesMBF and I2b NotesMKALl100% (1)

- Elton John Demetita - Unit II Activity 2 Business Ethical CasesDocument6 pagesElton John Demetita - Unit II Activity 2 Business Ethical CasesLaiven Ryle100% (1)

- As Short Revision Notes BusinessDocument31 pagesAs Short Revision Notes BusinessAbu BakarNo ratings yet

- Man TparDocument10 pagesMan TparFrederick GbliNo ratings yet

- Jose S Authentic Mexican Restaurant Case StudyDocument30 pagesJose S Authentic Mexican Restaurant Case StudyPrakash PrakashNo ratings yet

- Strama PaperDocument35 pagesStrama PaperHavanaNo ratings yet

- What Is Toyota Financial ServicesDocument3 pagesWhat Is Toyota Financial ServicesSaurabh TyagiNo ratings yet

- Chapter Eight: Using Financial Futures, Options, Swaps, and Other Hedging Tools in Asset-Liability ManagementDocument45 pagesChapter Eight: Using Financial Futures, Options, Swaps, and Other Hedging Tools in Asset-Liability Managementশাহরিয়ার মৃধাNo ratings yet