Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsAccounting Terms 1696826385

Accounting Terms 1696826385

Uploaded by

testing.testThis document lists and defines 100 important accounting terms. It covers basic accounting concepts like the accounting equation, financial statements, debits and credits, as well as more advanced topics like amortization, depreciation, accrual accounting, and ratios. The terms are organized alphabetically and each is concisely defined.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- Far Reviewer 1 7Document8 pagesFar Reviewer 1 7Angel Marie MartinezNo ratings yet

- ACCT Note 1Document10 pagesACCT Note 1kayla tsoiNo ratings yet

- FABM Dictionary 1Document32 pagesFABM Dictionary 1Candy TinapayNo ratings yet

- Financial Accounting - TestDocument9 pagesFinancial Accounting - TestAdriana MassaadNo ratings yet

- English For Accounting: Module Session 3 - Accounting Terms by Yulia Sulianti Se - Ak, M.IkomDocument3 pagesEnglish For Accounting: Module Session 3 - Accounting Terms by Yulia Sulianti Se - Ak, M.IkomWulan AyuNo ratings yet

- ACTBAS1 ReviewerDocument12 pagesACTBAS1 ReviewerRhobeMitchAilarieParelNo ratings yet

- Reviewer On Basic AccountingDocument8 pagesReviewer On Basic AccountingPRINCESS JOY BALAISNo ratings yet

- Define The FollowingDocument5 pagesDefine The FollowingSJHC 21No ratings yet

- 2 Accounting Work BookDocument89 pages2 Accounting Work Bookrachel rankuNo ratings yet

- Accounting TermsDocument3 pagesAccounting Termsnada_nastityNo ratings yet

- CH1 - Accounting in BusinessDocument18 pagesCH1 - Accounting in BusinessMaiaOshakmashviliNo ratings yet

- Ap ReviewerDocument4 pagesAp Reviewermaria cruzNo ratings yet

- AccountsDocument40 pagesAccountsSangeeth School of MusicNo ratings yet

- Fabm 2 Reviewer 1Document7 pagesFabm 2 Reviewer 1lun3l1ght18No ratings yet

- Fabm 2 ReviewerDocument5 pagesFabm 2 Reviewerlun3l1ght18No ratings yet

- Basic Accounting ConceptsDocument3 pagesBasic Accounting ConceptsVanSendrel Parate100% (1)

- Accounting TermsDocument6 pagesAccounting Termsmaribeldevera razonableNo ratings yet

- 100 Defination of Terms in Business Finance - CDocument8 pages100 Defination of Terms in Business Finance - CJudy Ann CapiñaNo ratings yet

- ACG 2021 - Definitions For Block 1Document2 pagesACG 2021 - Definitions For Block 1erg534No ratings yet

- Pharmaceutical AccountingDocument44 pagesPharmaceutical AccountingCedrix CuadernoNo ratings yet

- Accounting DefinitionsDocument15 pagesAccounting DefinitionsCh MehranNo ratings yet

- PFS StudyDocument19 pagesPFS Studyigorwalczak321No ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Accounting 1Document4 pagesAccounting 1Shoaib YousufNo ratings yet

- Fabm Research ProjectDocument41 pagesFabm Research ProjectMon Kiego MagnoNo ratings yet

- Accounting Terms: Study Online atDocument2 pagesAccounting Terms: Study Online atpearl042008No ratings yet

- Glossary of Financial AccountingDocument11 pagesGlossary of Financial Accountingnadimahmmed36No ratings yet

- Accounting - Basic Definitions Summary NotesDocument14 pagesAccounting - Basic Definitions Summary NotesbhavnaredlaNo ratings yet

- Basic AccountingDocument29 pagesBasic AccountingNoor UddinNo ratings yet

- Fabm ReviewerDocument5 pagesFabm ReviewerHeaven Krysthel Bless R. SacsacNo ratings yet

- 2301 Online Midterm Exam Study GuideDocument11 pages2301 Online Midterm Exam Study GuideRobin TNo ratings yet

- Accounting Term-WPS OfficeDocument9 pagesAccounting Term-WPS OfficeStefhanie Nicole C. GonzagaNo ratings yet

- Basic Book Keeping - GlossaryDocument3 pagesBasic Book Keeping - GlossaryTyranid SwarmlordNo ratings yet

- Acct 15Document15 pagesAcct 15academicexcellence21No ratings yet

- Basics of Financial AccountingDocument30 pagesBasics of Financial AccountingSAURABH PATELNo ratings yet

- Introducing Financial Statements and Transaction AnalysisDocument64 pagesIntroducing Financial Statements and Transaction AnalysisHazim AbualolaNo ratings yet

- Basic Accouting DefnationsDocument6 pagesBasic Accouting DefnationsSyed Amir Waqar100% (1)

- BasicsDocument11 pagesBasicsMukesh MukiNo ratings yet

- Accounting and FinanceDocument15 pagesAccounting and FinanceMadiha Rehman FarooquiNo ratings yet

- FABM 2 Lecture NotesDocument4 pagesFABM 2 Lecture NotesLucky MimNo ratings yet

- FABM 1 Major AccountsDocument31 pagesFABM 1 Major AccountscatajannicolinNo ratings yet

- Chapter 3Document12 pagesChapter 3spambryan888No ratings yet

- Extensive Theory PackageDocument70 pagesExtensive Theory PackageLeon BurresNo ratings yet

- Accountingdefinitions PDFDocument38 pagesAccountingdefinitions PDFVinny HungweNo ratings yet

- Acconting TermsDocument3 pagesAcconting TermsTapan Kumar MishraNo ratings yet

- Accounting Terms & DefinitionsDocument5 pagesAccounting Terms & DefinitionsMa Glenda Brequillo SañgaNo ratings yet

- Report ENTR FINANCEDocument11 pagesReport ENTR FINANCEJohn Paul EncinaresNo ratings yet

- General Journal (Record) Check Voucher Trial Balance (Prepare) General Ledger (Post)Document10 pagesGeneral Journal (Record) Check Voucher Trial Balance (Prepare) General Ledger (Post)Teajay BautistaNo ratings yet

- BalldaFAR ToFDocument12 pagesBalldaFAR ToFsantosemmanueljoseph2324No ratings yet

- Financial ControlDocument9 pagesFinancial Controlima funtanaresNo ratings yet

- Términos Contables en InglesDocument11 pagesTérminos Contables en InglesNicky JamesNo ratings yet

- Revision Notes Accounting ADocument5 pagesRevision Notes Accounting AAndrewNo ratings yet

- Principles of Accounts Unit TwoDocument12 pagesPrinciples of Accounts Unit Twotamera dellamoreNo ratings yet

- Managing The Venture's Financial ResourcesDocument28 pagesManaging The Venture's Financial ResourcesAnto DNo ratings yet

- Chapter 16 - Understanding Accounting and Financial InformationDocument6 pagesChapter 16 - Understanding Accounting and Financial InformationsyyleeNo ratings yet

- Small Business Accounting: Projecting and Evaluating PerformanceDocument40 pagesSmall Business Accounting: Projecting and Evaluating PerformanceRozen Jake Domingo ValenaNo ratings yet

- Quiz For CFASDocument5 pagesQuiz For CFASEunel AciertoNo ratings yet

- Accounting VocabularyDocument4 pagesAccounting Vocabularyapi-526065196No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- GST RegistrationDocument3 pagesGST RegistrationJabagodu SP & CoNo ratings yet

- Manufacturing Process For A PenDocument7 pagesManufacturing Process For A PenFeIipe MunozNo ratings yet

- SB19 Water-KomprimiertDocument101 pagesSB19 Water-KomprimiertNatasa KakesNo ratings yet

- UL White Paper - Tokenization ExplainedDocument16 pagesUL White Paper - Tokenization ExplainedacpereraNo ratings yet

- C16 - Lec 07 - Chemical ReactionsDocument62 pagesC16 - Lec 07 - Chemical ReactionsJohn Lloyd GildoNo ratings yet

- Experience Gokul BoopathiDocument4 pagesExperience Gokul BoopathiKeerthi VarshiniNo ratings yet

- E 20240407 Charge Calc MethodsDocument3 pagesE 20240407 Charge Calc Methodsamarsoni03697No ratings yet

- Tos - English 10 - First QuarterDocument2 pagesTos - English 10 - First QuarterDiomedes Colar100% (1)

- Play Format ExampleDocument3 pagesPlay Format ExamplemegbenignoNo ratings yet

- Tle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Document10 pagesTle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Joy BuycoNo ratings yet

- IT GovernanceDocument16 pagesIT Governanceterdesak100% (2)

- Notes For Chemistry PracticalsDocument32 pagesNotes For Chemistry Practicalsj0ntj2ivjyNo ratings yet

- Fallacies and BiasesDocument49 pagesFallacies and BiasesGela May SadianNo ratings yet

- Mixing Metaphor PDFDocument286 pagesMixing Metaphor PDFdphvuNo ratings yet

- .. Thesis Title .Document31 pages.. Thesis Title .Tanut VongsoontornNo ratings yet

- Web Pages With MVC3 and Razor SyntaxDocument282 pagesWeb Pages With MVC3 and Razor Syntaxozamaro100% (1)

- Tutorial Letter 203/2/2017: General Chemistry 1BDocument18 pagesTutorial Letter 203/2/2017: General Chemistry 1BLeigh MakanNo ratings yet

- The Present Perfect and The Present Perfect Continuous: Finished and Unfinished ActionsDocument26 pagesThe Present Perfect and The Present Perfect Continuous: Finished and Unfinished ActionsyahiaouimalekNo ratings yet

- Investigating Reliability Centered Maintenance RCMDocument5 pagesInvestigating Reliability Centered Maintenance RCMCRISTIAN ANDRES MEDRANO PULIDONo ratings yet

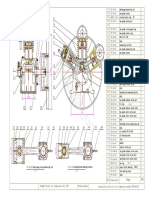

- Cwf-60-30air CompressorDocument2 pagesCwf-60-30air CompressorHuy Lễ NguyễnNo ratings yet

- MSDS - Arena VerdeDocument12 pagesMSDS - Arena VerdeSoledad OrtegaNo ratings yet

- Darkeden Legend - The Rare Skills ListDocument6 pagesDarkeden Legend - The Rare Skills ListGM Badr100% (4)

- Barton Floco Fra Automatic Sampler User ManualDocument40 pagesBarton Floco Fra Automatic Sampler User ManualedwinmenaNo ratings yet

- Insert A Pivot Table: Mba102-Advanced Statistics With Computer Application Module 4 Exercises Pivot TablesDocument12 pagesInsert A Pivot Table: Mba102-Advanced Statistics With Computer Application Module 4 Exercises Pivot TablesAdoree RamosNo ratings yet

- Control Commands: Model No. PT-LB423 PT-LB383 PT-LB353 PT-LW373 PT-LW333 PT-LB303 PT-TW351R PT-TW350 PT-TW410 PT-TW320Document1 pageControl Commands: Model No. PT-LB423 PT-LB383 PT-LB353 PT-LW373 PT-LW333 PT-LB303 PT-TW351R PT-TW350 PT-TW410 PT-TW3201015646541610312No ratings yet

- Off Shoring in MoroccoDocument22 pagesOff Shoring in MoroccoSara FARJANINo ratings yet

- Pada Wanita MenstruasiDocument7 pagesPada Wanita MenstruasiLab RS MMCNo ratings yet

- Rag & Bone - Fragments: Free Content Friday - Outbreak: Undead.. September 2021Document7 pagesRag & Bone - Fragments: Free Content Friday - Outbreak: Undead.. September 2021Brian PayneNo ratings yet

- Design of Experiments (DOE) TutorialDocument4 pagesDesign of Experiments (DOE) Tutorialmpedraza-1No ratings yet

- CMS Farming SystemDocument3 pagesCMS Farming SystemCarylSaycoNo ratings yet

Accounting Terms 1696826385

Accounting Terms 1696826385

Uploaded by

testing.test0 ratings0% found this document useful (0 votes)

7 views14 pagesThis document lists and defines 100 important accounting terms. It covers basic accounting concepts like the accounting equation, financial statements, debits and credits, as well as more advanced topics like amortization, depreciation, accrual accounting, and ratios. The terms are organized alphabetically and each is concisely defined.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document lists and defines 100 important accounting terms. It covers basic accounting concepts like the accounting equation, financial statements, debits and credits, as well as more advanced topics like amortization, depreciation, accrual accounting, and ratios. The terms are organized alphabetically and each is concisely defined.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views14 pagesAccounting Terms 1696826385

Accounting Terms 1696826385

Uploaded by

testing.testThis document lists and defines 100 important accounting terms. It covers basic accounting concepts like the accounting equation, financial statements, debits and credits, as well as more advanced topics like amortization, depreciation, accrual accounting, and ratios. The terms are organized alphabetically and each is concisely defined.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 14

100

Most Important

Accounting Terms

You Should not ignore

1

1. Account Balance - The total amount of money in an

account at a given time.

2. Accounts Payable - Money owed by a business to its

creditors for goods or services.

3. Accounts Receivable - Money owed to a business by its

customers for goods or services provided.

4. Accrual Basis Accounting - A method of accounting

that records transactions when they are earned or

incurred, not when cash changes hands.

5. Amortization - The gradual reduction of an intangible

asset's value over time.

6. Asset - Anything of value owned by a business, such as

cash, inventory, or property.

7. Audit - A systematic examination of a company's

financial records and processes.

8. Balance Sheet - A financial statement that shows a

company's assets, liabilities, and equity at a specific point

in time.

2

9. Bank Reconciliation - The process of matching a

company's records with those of its bank to ensure

accuracy.

10. Bookkeeping - The process of recording financial

transactions.

11. Capital Expenditure - Money spent on acquiring or

improving long-term assets.

12. Cash Flow Statement - A financial statement that

shows the movement of cash in and out of a business.

13. Cost of Goods Sold (COGS) - The direct costs

associated with producing goods or services.

14. Credit - An entry that increases liability or equity

accounts and decreases asset accounts.

15. Debit - An entry that increases asset accounts and

decreases liability or equity accounts.

16. Depreciation - The allocation of the cost of a tangible

asset over its useful life.

3

17. Double Entry Accounting - A system in which every

transaction has equal and opposite effects on two or more

accounts.

18. Equity - The ownership interest in a business, often

represented as shareholders' equity.

19. Expense - The cost incurred to generate revenue in a

business.

20. Financial Statement - Reports that summarize a

company's financial activities, including the income

statement, balance sheet, and cash flow statement.

21. Fixed Asset - A long-term asset, such as machinery or

property, used in a business.

22. General Ledger - A master accounting record that

contains all the accounts used by a company.

23. Income Statement - A financial statement that shows a

company's revenues, expenses, and profit or loss over a

specific period.

24. Internal Control - Policies and procedures implemented

to safeguard a company's assets and ensure accuracy in

financial reporting.

4

5. Journal Entry - The record of a financial transaction

before it is posted to the general ledger.

26. Liabilities - Debts or obligations owed by a business to

external parties.

27. Liquidation - The process of selling off a company's

assets to pay its debts.

28. Long-Term Liabilities - Debts or obligations that are

not due within the current year.

29. Net Income - The profit earned by a company after

deducting all expenses and taxes.

30. Operating Income - A company's profit from its core

business activities.

31. Overhead - Indirect costs not directly tied to the

production of goods or services.

32. Payroll - The list of employees and their wages or

salaries.

33. Profit and Loss Statement - Another term for the

income statement.

5

34. Revenue - The income earned from sales of goods or

services.

35. Trial Balance - A list of all account balances to check

for errors before preparing financial statements.

36. Accrued Expense - An expense that has been incurred

but not yet paid.

37. Asset Turnover Ratio - A measure of how efficiently a

company uses its assets to generate revenue.

38. Bad Debt - An amount that is unlikely to be collected

from a customer and is written off as a loss.

39. Budget - A financial plan that outlines expected

income and expenses.

40. Cash Accounting - A method of accounting that

records transactions when cash is received or paid.

41. Chart of Accounts - A list of all the accounts used by a

company.

42. Contingent Liability - A potential obligation that

depends on future events.

6

43. Cost Accounting - A branch of accounting focused

on tracking and controlling the costs of producing goods

or services.

44. Credit Memo - A document issued to reduce or cancel

an invoice.

45. Debit Memo - A document issued to increase the

amount of an invoice.

46. Dividend - A distribution of profits to shareholders.

47. FIFO (First-In, First-Out) - An inventory valuation

method where the oldest items are sold first.

48. GAAP (Generally Accepted Accounting Principles) -

A set of accounting standards and principles used in the

United States.

49. Gross Profit - The profit earned from sales after

deducting the cost of goods sold.

50. Income Tax - A tax on a company's profits.

51. Intangible Asset - A non-physical asset with value,

such as patents or trademarks.

7

52. Inventory - Goods held for sale in the normal course of

business.

53. Journal - The book or electronic record where

financial transactions are initially recorded.

54. LIFO (Last-In, First-Out) - An inventory valuation

method where the most recent items are sold first.

55. Marketable Securities - Investments that can be easily

converted into cash.

56. Net Assets - Total assets minus total liabilities.

57. Operating Expense - Costs associated with a company's

day-to-day operations.

58. Partnership - A business structure where two or more

individuals share ownership and responsibilities.

59. Prepaid Expense - An expense paid in advance,

recorded as an asset until it is used.

60. Retained Earnings - Profits that are reinvested in the

business rather than distributed to shareholders.

61. Statement of Cash Flows - A financial statement that

shows how cash is generated and used in a specific period.

8

62. Tax Deduction - An expense that reduces taxable

income.

63. Unearned Revenue - Money received in advance for

goods or services to be provided in the future.

64. Amortization Expense - The portion of an intangible

asset's cost expensed each period.

65. Audit Trail - A detailed record of all transactions,

enabling traceability and accountability.

66. Break-Even Point - The level of sales at which a

business covers its costs and neither makes a profit nor

incurs a loss.

67. Capital Stock - The total amount of shares issued by a

corporation.

68. Consolidation - Combining financial statements of

multiple entities into one.

69. Cost Allocation - The process of assigning indirect

costs to specific cost centers.

70. Credit Terms - The agreed-upon conditions for

payment between a buyer and seller.

9

71. Deferral - Delaying the recognition of revenue or

expenses to a future period.

72. Equity Method - Accounting for investments when a

company has significant influence over another entity.

73. FASB (Financial Accounting Standards Board) - The

organization responsible for setting accounting standards

in the United States.

74. Goodwill - The excess of the purchase price of a

business over the fair value of its net assets.

75. Gross Margin - The difference between revenue and

the cost of goods sold, expressed as a percentage.

76. Income Tax Expense - The amount of income tax

owed by a company in a given period.

77. Joint Venture - A business arrangement where two or

more entities collaborate for a specific project.

78. Liquidity - The ability of a company to meet its short-

term obligations with its current assets.

79. Materiality - The concept that financial information

should be reported if its omission or misstatement could

influence decisions.

10

80. Net Book Value - The carrying amount of an asset on

the balance sheet.

81. Operating Lease - A lease that does not transfer

ownership of the asset to the lessee.

82. Par Value - The nominal or face value of a share of

stock.

83. Quick Ratio - A measure of a company's ability to pay

its short-term liabilities with its most liquid assets.

84. Receivables Turnover - A ratio that measures how

efficiently a company collects on its accounts receivable.

85. Statement of Retained Earnings - A financial statement

that reconciles changes in retained earnings over a period.

86. Taxable Income - A company's income on which it is

subject to taxation.

87. Unexpired Cost - The portion of prepaid expenses that

has not yet been consumed.

88. Working Capital - The difference between current

assets and current liabilities.

11

89. 401(k) - A retirement savings plan that allows

employees to contribute a portion of their salary on a tax-

deferred basis.

90. Accruals - Unrecorded expenses or revenues that have

been incurred but not yet recognized.

91. Angel Investor - An individual who provides capital to

startups or small businesses in exchange for ownership

equity.

92. Articles of Incorporation - A legal document that

establishes the formation of a corporation.

93. Bankruptcy - A legal status of insolvency where a

business cannot meet its financial obligations.

94. Cash Equivalent - Short-term, highly liquid

investments that are easily convertible to cash.

95. Cost Driver - A factor that directly influences the cost

of producing goods or services.

96. Depreciation Expense - The cost allocated to a tangible

asset over its useful life.

12

97. Earnings Before Interest and Taxes (EBIT) - A measure

of a company's profitability before interest and taxes.

98. Financial Analyst - A professional who analyzes

financial data to make investment or business decisions.

99. Generally Accepted Accounting Principles (GAAP) - A

set of accounting standards and principles used in many

countries.

100. Hedge Fund - An investment fund that uses various

strategies to generate returns for its investors.

Do follow me for

more quality

content

You might also like

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- Far Reviewer 1 7Document8 pagesFar Reviewer 1 7Angel Marie MartinezNo ratings yet

- ACCT Note 1Document10 pagesACCT Note 1kayla tsoiNo ratings yet

- FABM Dictionary 1Document32 pagesFABM Dictionary 1Candy TinapayNo ratings yet

- Financial Accounting - TestDocument9 pagesFinancial Accounting - TestAdriana MassaadNo ratings yet

- English For Accounting: Module Session 3 - Accounting Terms by Yulia Sulianti Se - Ak, M.IkomDocument3 pagesEnglish For Accounting: Module Session 3 - Accounting Terms by Yulia Sulianti Se - Ak, M.IkomWulan AyuNo ratings yet

- ACTBAS1 ReviewerDocument12 pagesACTBAS1 ReviewerRhobeMitchAilarieParelNo ratings yet

- Reviewer On Basic AccountingDocument8 pagesReviewer On Basic AccountingPRINCESS JOY BALAISNo ratings yet

- Define The FollowingDocument5 pagesDefine The FollowingSJHC 21No ratings yet

- 2 Accounting Work BookDocument89 pages2 Accounting Work Bookrachel rankuNo ratings yet

- Accounting TermsDocument3 pagesAccounting Termsnada_nastityNo ratings yet

- CH1 - Accounting in BusinessDocument18 pagesCH1 - Accounting in BusinessMaiaOshakmashviliNo ratings yet

- Ap ReviewerDocument4 pagesAp Reviewermaria cruzNo ratings yet

- AccountsDocument40 pagesAccountsSangeeth School of MusicNo ratings yet

- Fabm 2 Reviewer 1Document7 pagesFabm 2 Reviewer 1lun3l1ght18No ratings yet

- Fabm 2 ReviewerDocument5 pagesFabm 2 Reviewerlun3l1ght18No ratings yet

- Basic Accounting ConceptsDocument3 pagesBasic Accounting ConceptsVanSendrel Parate100% (1)

- Accounting TermsDocument6 pagesAccounting Termsmaribeldevera razonableNo ratings yet

- 100 Defination of Terms in Business Finance - CDocument8 pages100 Defination of Terms in Business Finance - CJudy Ann CapiñaNo ratings yet

- ACG 2021 - Definitions For Block 1Document2 pagesACG 2021 - Definitions For Block 1erg534No ratings yet

- Pharmaceutical AccountingDocument44 pagesPharmaceutical AccountingCedrix CuadernoNo ratings yet

- Accounting DefinitionsDocument15 pagesAccounting DefinitionsCh MehranNo ratings yet

- PFS StudyDocument19 pagesPFS Studyigorwalczak321No ratings yet

- Module 2 Introducting Financial Statements - 6th EditionDocument7 pagesModule 2 Introducting Financial Statements - 6th EditionjoshNo ratings yet

- Accounting 1Document4 pagesAccounting 1Shoaib YousufNo ratings yet

- Fabm Research ProjectDocument41 pagesFabm Research ProjectMon Kiego MagnoNo ratings yet

- Accounting Terms: Study Online atDocument2 pagesAccounting Terms: Study Online atpearl042008No ratings yet

- Glossary of Financial AccountingDocument11 pagesGlossary of Financial Accountingnadimahmmed36No ratings yet

- Accounting - Basic Definitions Summary NotesDocument14 pagesAccounting - Basic Definitions Summary NotesbhavnaredlaNo ratings yet

- Basic AccountingDocument29 pagesBasic AccountingNoor UddinNo ratings yet

- Fabm ReviewerDocument5 pagesFabm ReviewerHeaven Krysthel Bless R. SacsacNo ratings yet

- 2301 Online Midterm Exam Study GuideDocument11 pages2301 Online Midterm Exam Study GuideRobin TNo ratings yet

- Accounting Term-WPS OfficeDocument9 pagesAccounting Term-WPS OfficeStefhanie Nicole C. GonzagaNo ratings yet

- Basic Book Keeping - GlossaryDocument3 pagesBasic Book Keeping - GlossaryTyranid SwarmlordNo ratings yet

- Acct 15Document15 pagesAcct 15academicexcellence21No ratings yet

- Basics of Financial AccountingDocument30 pagesBasics of Financial AccountingSAURABH PATELNo ratings yet

- Introducing Financial Statements and Transaction AnalysisDocument64 pagesIntroducing Financial Statements and Transaction AnalysisHazim AbualolaNo ratings yet

- Basic Accouting DefnationsDocument6 pagesBasic Accouting DefnationsSyed Amir Waqar100% (1)

- BasicsDocument11 pagesBasicsMukesh MukiNo ratings yet

- Accounting and FinanceDocument15 pagesAccounting and FinanceMadiha Rehman FarooquiNo ratings yet

- FABM 2 Lecture NotesDocument4 pagesFABM 2 Lecture NotesLucky MimNo ratings yet

- FABM 1 Major AccountsDocument31 pagesFABM 1 Major AccountscatajannicolinNo ratings yet

- Chapter 3Document12 pagesChapter 3spambryan888No ratings yet

- Extensive Theory PackageDocument70 pagesExtensive Theory PackageLeon BurresNo ratings yet

- Accountingdefinitions PDFDocument38 pagesAccountingdefinitions PDFVinny HungweNo ratings yet

- Acconting TermsDocument3 pagesAcconting TermsTapan Kumar MishraNo ratings yet

- Accounting Terms & DefinitionsDocument5 pagesAccounting Terms & DefinitionsMa Glenda Brequillo SañgaNo ratings yet

- Report ENTR FINANCEDocument11 pagesReport ENTR FINANCEJohn Paul EncinaresNo ratings yet

- General Journal (Record) Check Voucher Trial Balance (Prepare) General Ledger (Post)Document10 pagesGeneral Journal (Record) Check Voucher Trial Balance (Prepare) General Ledger (Post)Teajay BautistaNo ratings yet

- BalldaFAR ToFDocument12 pagesBalldaFAR ToFsantosemmanueljoseph2324No ratings yet

- Financial ControlDocument9 pagesFinancial Controlima funtanaresNo ratings yet

- Términos Contables en InglesDocument11 pagesTérminos Contables en InglesNicky JamesNo ratings yet

- Revision Notes Accounting ADocument5 pagesRevision Notes Accounting AAndrewNo ratings yet

- Principles of Accounts Unit TwoDocument12 pagesPrinciples of Accounts Unit Twotamera dellamoreNo ratings yet

- Managing The Venture's Financial ResourcesDocument28 pagesManaging The Venture's Financial ResourcesAnto DNo ratings yet

- Chapter 16 - Understanding Accounting and Financial InformationDocument6 pagesChapter 16 - Understanding Accounting and Financial InformationsyyleeNo ratings yet

- Small Business Accounting: Projecting and Evaluating PerformanceDocument40 pagesSmall Business Accounting: Projecting and Evaluating PerformanceRozen Jake Domingo ValenaNo ratings yet

- Quiz For CFASDocument5 pagesQuiz For CFASEunel AciertoNo ratings yet

- Accounting VocabularyDocument4 pagesAccounting Vocabularyapi-526065196No ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- GST RegistrationDocument3 pagesGST RegistrationJabagodu SP & CoNo ratings yet

- Manufacturing Process For A PenDocument7 pagesManufacturing Process For A PenFeIipe MunozNo ratings yet

- SB19 Water-KomprimiertDocument101 pagesSB19 Water-KomprimiertNatasa KakesNo ratings yet

- UL White Paper - Tokenization ExplainedDocument16 pagesUL White Paper - Tokenization ExplainedacpereraNo ratings yet

- C16 - Lec 07 - Chemical ReactionsDocument62 pagesC16 - Lec 07 - Chemical ReactionsJohn Lloyd GildoNo ratings yet

- Experience Gokul BoopathiDocument4 pagesExperience Gokul BoopathiKeerthi VarshiniNo ratings yet

- E 20240407 Charge Calc MethodsDocument3 pagesE 20240407 Charge Calc Methodsamarsoni03697No ratings yet

- Tos - English 10 - First QuarterDocument2 pagesTos - English 10 - First QuarterDiomedes Colar100% (1)

- Play Format ExampleDocument3 pagesPlay Format ExamplemegbenignoNo ratings yet

- Tle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Document10 pagesTle - Ia (Smaw NC I) Activity Sheet Quarter 1 - Competency 4.1-4.4Joy BuycoNo ratings yet

- IT GovernanceDocument16 pagesIT Governanceterdesak100% (2)

- Notes For Chemistry PracticalsDocument32 pagesNotes For Chemistry Practicalsj0ntj2ivjyNo ratings yet

- Fallacies and BiasesDocument49 pagesFallacies and BiasesGela May SadianNo ratings yet

- Mixing Metaphor PDFDocument286 pagesMixing Metaphor PDFdphvuNo ratings yet

- .. Thesis Title .Document31 pages.. Thesis Title .Tanut VongsoontornNo ratings yet

- Web Pages With MVC3 and Razor SyntaxDocument282 pagesWeb Pages With MVC3 and Razor Syntaxozamaro100% (1)

- Tutorial Letter 203/2/2017: General Chemistry 1BDocument18 pagesTutorial Letter 203/2/2017: General Chemistry 1BLeigh MakanNo ratings yet

- The Present Perfect and The Present Perfect Continuous: Finished and Unfinished ActionsDocument26 pagesThe Present Perfect and The Present Perfect Continuous: Finished and Unfinished ActionsyahiaouimalekNo ratings yet

- Investigating Reliability Centered Maintenance RCMDocument5 pagesInvestigating Reliability Centered Maintenance RCMCRISTIAN ANDRES MEDRANO PULIDONo ratings yet

- Cwf-60-30air CompressorDocument2 pagesCwf-60-30air CompressorHuy Lễ NguyễnNo ratings yet

- MSDS - Arena VerdeDocument12 pagesMSDS - Arena VerdeSoledad OrtegaNo ratings yet

- Darkeden Legend - The Rare Skills ListDocument6 pagesDarkeden Legend - The Rare Skills ListGM Badr100% (4)

- Barton Floco Fra Automatic Sampler User ManualDocument40 pagesBarton Floco Fra Automatic Sampler User ManualedwinmenaNo ratings yet

- Insert A Pivot Table: Mba102-Advanced Statistics With Computer Application Module 4 Exercises Pivot TablesDocument12 pagesInsert A Pivot Table: Mba102-Advanced Statistics With Computer Application Module 4 Exercises Pivot TablesAdoree RamosNo ratings yet

- Control Commands: Model No. PT-LB423 PT-LB383 PT-LB353 PT-LW373 PT-LW333 PT-LB303 PT-TW351R PT-TW350 PT-TW410 PT-TW320Document1 pageControl Commands: Model No. PT-LB423 PT-LB383 PT-LB353 PT-LW373 PT-LW333 PT-LB303 PT-TW351R PT-TW350 PT-TW410 PT-TW3201015646541610312No ratings yet

- Off Shoring in MoroccoDocument22 pagesOff Shoring in MoroccoSara FARJANINo ratings yet

- Pada Wanita MenstruasiDocument7 pagesPada Wanita MenstruasiLab RS MMCNo ratings yet

- Rag & Bone - Fragments: Free Content Friday - Outbreak: Undead.. September 2021Document7 pagesRag & Bone - Fragments: Free Content Friday - Outbreak: Undead.. September 2021Brian PayneNo ratings yet

- Design of Experiments (DOE) TutorialDocument4 pagesDesign of Experiments (DOE) Tutorialmpedraza-1No ratings yet

- CMS Farming SystemDocument3 pagesCMS Farming SystemCarylSaycoNo ratings yet