Professional Documents

Culture Documents

Lab BoP

Lab BoP

Uploaded by

gavharochka1996Copyright:

Available Formats

You might also like

- Solution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraDocument36 pagesSolution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Pereracranny.pentoseeu9227100% (52)

- Business Plan of Besties Online ServicesDocument6 pagesBusiness Plan of Besties Online Servicescompliance neilanztruckingNo ratings yet

- International Economics Chapter 8-12Document13 pagesInternational Economics Chapter 8-12Alfred Martin50% (2)

- Solutions Chapter 5 Balance of PaymentsDocument13 pagesSolutions Chapter 5 Balance of Paymentsfahdly67% (3)

- 6.1 and 6.2 - Balance of Payments Accounts & Exchange RatesDocument5 pages6.1 and 6.2 - Balance of Payments Accounts & Exchange RatesReed-Animated ProductionsNo ratings yet

- Shapiro Chapter 05 SolutionsDocument18 pagesShapiro Chapter 05 SolutionsRuiting ChenNo ratings yet

- Chapter 13 Homework - Group 4Document12 pagesChapter 13 Homework - Group 4Châu Anh TrịnhNo ratings yet

- I.B Unit 3Document17 pagesI.B Unit 3Nandini SinhaNo ratings yet

- III. The Balance of Payments: QuestionsDocument7 pagesIII. The Balance of Payments: Questionssanketsabale26No ratings yet

- International Economics 6Th Edition James Gerber Solutions Manual Full Chapter PDFDocument27 pagesInternational Economics 6Th Edition James Gerber Solutions Manual Full Chapter PDFRebeccaBartlettqfam100% (9)

- International Economics 6th Edition James Gerber Solutions ManualDocument6 pagesInternational Economics 6th Edition James Gerber Solutions Manualcalanthalovelloa5100% (31)

- Question and AnswerDocument2 pagesQuestion and AnswerAbdelnasir HaiderNo ratings yet

- The Balance of Payments: Chapter ObjectiveDocument20 pagesThe Balance of Payments: Chapter ObjectiveBigbi KumarNo ratings yet

- Instant Download PDF International Economics 6th Edition James Gerber Solutions Manual Full ChapterDocument29 pagesInstant Download PDF International Economics 6th Edition James Gerber Solutions Manual Full Chapterderiazpyaara100% (7)

- International Flow of FundsDocument10 pagesInternational Flow of FundsMinney EddyNo ratings yet

- WE - 11 - Balance of PaymentsDocument20 pagesWE - 11 - Balance of PaymentsKholoud KhaledNo ratings yet

- CH 4Document14 pagesCH 4Kamal YagamiNo ratings yet

- Intl Finance Assignment 2Document3 pagesIntl Finance Assignment 2Aalizae Anwar YazdaniNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of Paymentsনীল রহমানNo ratings yet

- Principles ProblemSet11Document5 pagesPrinciples ProblemSet11Bernardo BarrezuetaNo ratings yet

- Session 2 - Balance of PaymentsDocument5 pagesSession 2 - Balance of PaymentsRochelle DanielsNo ratings yet

- Unit 2 Tutorial2023Document4 pagesUnit 2 Tutorial2023TashaNo ratings yet

- The Global Financial System: Brief Chapter SummaryDocument25 pagesThe Global Financial System: Brief Chapter Summarybernandaz123No ratings yet

- Balance of Payments PDF 1a9lgilDocument28 pagesBalance of Payments PDF 1a9lgilS Copra AhmedNo ratings yet

- Chap03 Tutorial QuestionsDocument5 pagesChap03 Tutorial QuestionsHoang Bao Ngoc (K18 HCM)No ratings yet

- Tutorial 9 PresentDocument16 pagesTutorial 9 PresentLi NiniNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsMahender TewatiaNo ratings yet

- Exam IIsolDocument7 pagesExam IIsolbabydreaNo ratings yet

- Balance of Payment (BINAY SINGH) 11Document12 pagesBalance of Payment (BINAY SINGH) 11barhpatnaNo ratings yet

- What Is BoPDocument11 pagesWhat Is BoPJefry AjhaNo ratings yet

- Chapter V The Balance of PaymentDocument25 pagesChapter V The Balance of PaymentAshantiliduNo ratings yet

- Mishkin Econ12eGE CH19Document47 pagesMishkin Econ12eGE CH19josemourinhoNo ratings yet

- US Capital and Current AccountDocument23 pagesUS Capital and Current Accountsabyasachi_mitraNo ratings yet

- EOC ch9Document3 pagesEOC ch9dukeee158No ratings yet

- Balance of Payments: Phil Bryson Global Trade and FinanceDocument35 pagesBalance of Payments: Phil Bryson Global Trade and Financesaketmba1No ratings yet

- Homework: I. Questions For ReviewDocument12 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Notes - Balance of PaymentsDocument4 pagesNotes - Balance of PaymentsMeenal SharmaNo ratings yet

- Balance of Payments: Pankaj Kumar International Business EnvironmentDocument55 pagesBalance of Payments: Pankaj Kumar International Business EnvironmentChanisha KathuriaNo ratings yet

- Chapter 2Document4 pagesChapter 2Muhammad ImranNo ratings yet

- Balance of PaymentDocument14 pagesBalance of PaymentNaveen DevarasettiNo ratings yet

- Balance of Payments - NotesDocument6 pagesBalance of Payments - NotesJay-an CastillonNo ratings yet

- ÖrnekSoru IFM MidtermDocument5 pagesÖrnekSoru IFM MidtermMustafa TotanNo ratings yet

- Chapter 4: International Flow of Funds & Exchange RatesDocument14 pagesChapter 4: International Flow of Funds & Exchange RatesKaedeNo ratings yet

- Section A (Multiple Choice Questions) : Ractice EcturesDocument4 pagesSection A (Multiple Choice Questions) : Ractice Ecturesolaef1445No ratings yet

- International Finance Essay AnswersDocument8 pagesInternational Finance Essay AnswersPrateek MathurNo ratings yet

- Balance of PaymentDocument29 pagesBalance of PaymentArafat HossainNo ratings yet

- Ireland in The Global Economy MCQsDocument13 pagesIreland in The Global Economy MCQsVicki LanganNo ratings yet

- Balance of Payments - BOPDocument3 pagesBalance of Payments - BOPdeepanshu1234No ratings yet

- Lecture 2: Canada's Balance of PaymentsDocument4 pagesLecture 2: Canada's Balance of PaymentsmbizhtkNo ratings yet

- Chapter-8. Introduction To Open EconomyDocument25 pagesChapter-8. Introduction To Open EconomyprashantNo ratings yet

- Balance of Payments: Unit 3 6 HoursDocument53 pagesBalance of Payments: Unit 3 6 HoursNimish PandeNo ratings yet

- Chapter 4Document10 pagesChapter 4Askar GaradNo ratings yet

- BBMF2103 ITF Tutorial 2Document6 pagesBBMF2103 ITF Tutorial 2christyyjx-wp20No ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsDeepikatalwar599No ratings yet

- Full Download Solution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Perera PDF Full ChapterDocument36 pagesFull Download Solution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Perera PDF Full Chapterminoressceramicgypdr100% (24)

- BALANCE OF PAYMENTS & Theories of Exchagne Rate - Unit 3Document11 pagesBALANCE OF PAYMENTS & Theories of Exchagne Rate - Unit 3Sunni ZaraNo ratings yet

- The Balance of Payments - Edexcel Economics Unit 4Document31 pagesThe Balance of Payments - Edexcel Economics Unit 4mks93No ratings yet

- The Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andFrom EverandThe Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andNo ratings yet

- International Corporate Finance: Value Creation with Currency Derivatives in Global Capital MarketsFrom EverandInternational Corporate Finance: Value Creation with Currency Derivatives in Global Capital MarketsNo ratings yet

- LBMA LPPM MOU April 2013Document26 pagesLBMA LPPM MOU April 2013Tommy LiuNo ratings yet

- ABOUT UDA - UDAfunctions by Adding IMagesDocument23 pagesABOUT UDA - UDAfunctions by Adding IMagesMadhu MadhuuNo ratings yet

- Istoric Cont: Criterii de CautareDocument5 pagesIstoric Cont: Criterii de CautareDenis ZuzNo ratings yet

- 1st Order PDFDocument2 pages1st Order PDFNOR HAFIZA BINTI RUMLI MoeNo ratings yet

- Lending Company Regulation Act of 2007 (Ra 9474)Document5 pagesLending Company Regulation Act of 2007 (Ra 9474)Jessy Francis100% (1)

- Lecture 10Document27 pagesLecture 10riyat0601No ratings yet

- Credit Transactions ReviewerDocument10 pagesCredit Transactions ReviewertheresaNo ratings yet

- Guide To Indonesian Accounting, Commercial, and Tax Terms (ACT)Document85 pagesGuide To Indonesian Accounting, Commercial, and Tax Terms (ACT)Hartono WidjayaNo ratings yet

- Blockchain - 2 Business Perspective SudinDocument35 pagesBlockchain - 2 Business Perspective SudinAravindanNo ratings yet

- BASE24 External Message PDFDocument680 pagesBASE24 External Message PDFCamNo ratings yet

- Ethiopian Financial System PDFDocument2 pagesEthiopian Financial System PDFBrandon92% (66)

- Citibank N.A. - CEO Profile - Michael L. CorbatDocument1 pageCitibank N.A. - CEO Profile - Michael L. CorbatJ. F. El - All Rights ReservedNo ratings yet

- Session 1 - Finance For Non-Finance (19.08.2023)Document17 pagesSession 1 - Finance For Non-Finance (19.08.2023)Saroj AndhariaNo ratings yet

- Remittance Guide For Aljazira Online: Using Fawri Service For The First TimeDocument1 pageRemittance Guide For Aljazira Online: Using Fawri Service For The First Timehusnain aliNo ratings yet

- W654515 ReceiptpdfDocument1 pageW654515 ReceiptpdfSurendra SapkotaNo ratings yet

- CorrespondenceDocument4 pagesCorrespondenceRivaldo RobinsonNo ratings yet

- European Leveraged Finance Funding Structures Transformed September 2014Document30 pagesEuropean Leveraged Finance Funding Structures Transformed September 2014bharathaNo ratings yet

- Electronic Funds Transfer Form EmployeeDocument4 pagesElectronic Funds Transfer Form EmployeeTulyaNo ratings yet

- 5 6104822306436023525Document207 pages5 6104822306436023525Manthan prashar0% (1)

- AEC 302 Mock TestDocument5 pagesAEC 302 Mock TestRamanan R100% (1)

- SBK 2024 - Cedars International SchoolDocument3 pagesSBK 2024 - Cedars International Schoolge316.zana.hogirNo ratings yet

- Online Banking - Hong Leong Bank MalaysiaDocument1 pageOnline Banking - Hong Leong Bank MalaysiaNick HaffiziNo ratings yet

- MCQ All 25 Accounts XiDocument36 pagesMCQ All 25 Accounts XiSuraj GuptaNo ratings yet

- Gadaa-Bank 222Document18 pagesGadaa-Bank 222Melese LegeseNo ratings yet

- Consolidated Bank and Trust Corporation vs. Court of AppealsDocument24 pagesConsolidated Bank and Trust Corporation vs. Court of AppealsDoreen GarridoNo ratings yet

- Annual Report 2019Document304 pagesAnnual Report 2019fahadNo ratings yet

- Fria List of CasesDocument2 pagesFria List of CasesJhomel Delos ReyesNo ratings yet

- Pradhan Mantri Awas YojanaDocument7 pagesPradhan Mantri Awas YojanaMusekhirNo ratings yet

- Registration Form - : Career Opportunities in Leading Organization (Government, Semi-Government, Private)Document2 pagesRegistration Form - : Career Opportunities in Leading Organization (Government, Semi-Government, Private)Waqqs WaqasNo ratings yet

Lab BoP

Lab BoP

Uploaded by

gavharochka1996Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lab BoP

Lab BoP

Uploaded by

gavharochka1996Copyright:

Available Formats

E303

Lab “Balance of payments and exchange rate”

True or False Questions:

1. A negative net foreign investment on this year’s balance of payments accounts means a country is

a net debtor.

2. A nation running current account surplus is accumulating foreign assets.

3. Because the balance of payments accounts must balance, sub-accounts like the capital account

must balance, too.

4. If GDP, consumption, and domestic investment are all constant, when government spending rises

relative to taxes, the country will run a trade deficit.

5. An increase in U.S. imports from France will give rise to a supply of euros in exchange for dollars.

6. If Americans suddenly refuse to lend money to Mexico, we would expect the dollar to appreciate

relative to the peso.

Problems and Short Answer Questions:

1. Can you think of reasons why a government can be concerned about a large current account deficit

or surplus? Why might a government be concerned about its official settlements balance?

2. “A country is better off running the current account surplus rather than a current account deficit”.

Do you agree or disagree? Explain.

3. Is it possible for a country to have a current account deficit and at the same time it has a surplus in

its capital account? Explain your answer.

4. National savings can be used domestically or internationally. Explain the basis for this statement,

including the benefits to the nation of each use of its saving.

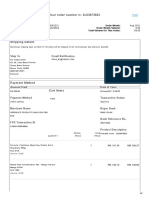

5. You are given the following information about a country’s international transactions during a year:

Entries Amount, $

Merchandise exports 330

Merchandise imports 198

Service imports 204

Service exports 196

Unilateral transfers, net -5

Increase in the country’s holding of foreign 202

assets, net (excluding official reserve

assets)

Increase of the country’s foreign holdings 102

of the country’s assets, net (excluding

official reserve assets)

Statistical discrepancy, net 4

a. Calculate the values of the country’s merchandise trade balance, goods and services balance, and

current account balance.

b. What is the value of the change in official reserve assets (net)? Is the country increasing or

decreasing its net holdings of official reserve assets?

6. Suppose the dollar exchange rates of the euro and the pound sterling are equally variable. The

euro, however, tends to depreciate unexpectedly against the dollar when the return on the rest of

your wealth is unexpectedly high, while the pound tends to appreciate unexpectedly in the same

circumstances. As a U.S. resident, which currency, the euro or the pound, would you consider

riskier?

You might also like

- Solution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraDocument36 pagesSolution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Pereracranny.pentoseeu9227100% (52)

- Business Plan of Besties Online ServicesDocument6 pagesBusiness Plan of Besties Online Servicescompliance neilanztruckingNo ratings yet

- International Economics Chapter 8-12Document13 pagesInternational Economics Chapter 8-12Alfred Martin50% (2)

- Solutions Chapter 5 Balance of PaymentsDocument13 pagesSolutions Chapter 5 Balance of Paymentsfahdly67% (3)

- 6.1 and 6.2 - Balance of Payments Accounts & Exchange RatesDocument5 pages6.1 and 6.2 - Balance of Payments Accounts & Exchange RatesReed-Animated ProductionsNo ratings yet

- Shapiro Chapter 05 SolutionsDocument18 pagesShapiro Chapter 05 SolutionsRuiting ChenNo ratings yet

- Chapter 13 Homework - Group 4Document12 pagesChapter 13 Homework - Group 4Châu Anh TrịnhNo ratings yet

- I.B Unit 3Document17 pagesI.B Unit 3Nandini SinhaNo ratings yet

- III. The Balance of Payments: QuestionsDocument7 pagesIII. The Balance of Payments: Questionssanketsabale26No ratings yet

- International Economics 6Th Edition James Gerber Solutions Manual Full Chapter PDFDocument27 pagesInternational Economics 6Th Edition James Gerber Solutions Manual Full Chapter PDFRebeccaBartlettqfam100% (9)

- International Economics 6th Edition James Gerber Solutions ManualDocument6 pagesInternational Economics 6th Edition James Gerber Solutions Manualcalanthalovelloa5100% (31)

- Question and AnswerDocument2 pagesQuestion and AnswerAbdelnasir HaiderNo ratings yet

- The Balance of Payments: Chapter ObjectiveDocument20 pagesThe Balance of Payments: Chapter ObjectiveBigbi KumarNo ratings yet

- Instant Download PDF International Economics 6th Edition James Gerber Solutions Manual Full ChapterDocument29 pagesInstant Download PDF International Economics 6th Edition James Gerber Solutions Manual Full Chapterderiazpyaara100% (7)

- International Flow of FundsDocument10 pagesInternational Flow of FundsMinney EddyNo ratings yet

- WE - 11 - Balance of PaymentsDocument20 pagesWE - 11 - Balance of PaymentsKholoud KhaledNo ratings yet

- CH 4Document14 pagesCH 4Kamal YagamiNo ratings yet

- Intl Finance Assignment 2Document3 pagesIntl Finance Assignment 2Aalizae Anwar YazdaniNo ratings yet

- Balance of PaymentsDocument14 pagesBalance of Paymentsনীল রহমানNo ratings yet

- Principles ProblemSet11Document5 pagesPrinciples ProblemSet11Bernardo BarrezuetaNo ratings yet

- Session 2 - Balance of PaymentsDocument5 pagesSession 2 - Balance of PaymentsRochelle DanielsNo ratings yet

- Unit 2 Tutorial2023Document4 pagesUnit 2 Tutorial2023TashaNo ratings yet

- The Global Financial System: Brief Chapter SummaryDocument25 pagesThe Global Financial System: Brief Chapter Summarybernandaz123No ratings yet

- Balance of Payments PDF 1a9lgilDocument28 pagesBalance of Payments PDF 1a9lgilS Copra AhmedNo ratings yet

- Chap03 Tutorial QuestionsDocument5 pagesChap03 Tutorial QuestionsHoang Bao Ngoc (K18 HCM)No ratings yet

- Tutorial 9 PresentDocument16 pagesTutorial 9 PresentLi NiniNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsMahender TewatiaNo ratings yet

- Exam IIsolDocument7 pagesExam IIsolbabydreaNo ratings yet

- Balance of Payment (BINAY SINGH) 11Document12 pagesBalance of Payment (BINAY SINGH) 11barhpatnaNo ratings yet

- What Is BoPDocument11 pagesWhat Is BoPJefry AjhaNo ratings yet

- Chapter V The Balance of PaymentDocument25 pagesChapter V The Balance of PaymentAshantiliduNo ratings yet

- Mishkin Econ12eGE CH19Document47 pagesMishkin Econ12eGE CH19josemourinhoNo ratings yet

- US Capital and Current AccountDocument23 pagesUS Capital and Current Accountsabyasachi_mitraNo ratings yet

- EOC ch9Document3 pagesEOC ch9dukeee158No ratings yet

- Balance of Payments: Phil Bryson Global Trade and FinanceDocument35 pagesBalance of Payments: Phil Bryson Global Trade and Financesaketmba1No ratings yet

- Homework: I. Questions For ReviewDocument12 pagesHomework: I. Questions For ReviewHailee HayesNo ratings yet

- Notes - Balance of PaymentsDocument4 pagesNotes - Balance of PaymentsMeenal SharmaNo ratings yet

- Balance of Payments: Pankaj Kumar International Business EnvironmentDocument55 pagesBalance of Payments: Pankaj Kumar International Business EnvironmentChanisha KathuriaNo ratings yet

- Chapter 2Document4 pagesChapter 2Muhammad ImranNo ratings yet

- Balance of PaymentDocument14 pagesBalance of PaymentNaveen DevarasettiNo ratings yet

- Balance of Payments - NotesDocument6 pagesBalance of Payments - NotesJay-an CastillonNo ratings yet

- ÖrnekSoru IFM MidtermDocument5 pagesÖrnekSoru IFM MidtermMustafa TotanNo ratings yet

- Chapter 4: International Flow of Funds & Exchange RatesDocument14 pagesChapter 4: International Flow of Funds & Exchange RatesKaedeNo ratings yet

- Section A (Multiple Choice Questions) : Ractice EcturesDocument4 pagesSection A (Multiple Choice Questions) : Ractice Ecturesolaef1445No ratings yet

- International Finance Essay AnswersDocument8 pagesInternational Finance Essay AnswersPrateek MathurNo ratings yet

- Balance of PaymentDocument29 pagesBalance of PaymentArafat HossainNo ratings yet

- Ireland in The Global Economy MCQsDocument13 pagesIreland in The Global Economy MCQsVicki LanganNo ratings yet

- Balance of Payments - BOPDocument3 pagesBalance of Payments - BOPdeepanshu1234No ratings yet

- Lecture 2: Canada's Balance of PaymentsDocument4 pagesLecture 2: Canada's Balance of PaymentsmbizhtkNo ratings yet

- Chapter-8. Introduction To Open EconomyDocument25 pagesChapter-8. Introduction To Open EconomyprashantNo ratings yet

- Balance of Payments: Unit 3 6 HoursDocument53 pagesBalance of Payments: Unit 3 6 HoursNimish PandeNo ratings yet

- Chapter 4Document10 pagesChapter 4Askar GaradNo ratings yet

- BBMF2103 ITF Tutorial 2Document6 pagesBBMF2103 ITF Tutorial 2christyyjx-wp20No ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsDeepikatalwar599No ratings yet

- Full Download Solution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Perera PDF Full ChapterDocument36 pagesFull Download Solution Manual For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Perera PDF Full Chapterminoressceramicgypdr100% (24)

- BALANCE OF PAYMENTS & Theories of Exchagne Rate - Unit 3Document11 pagesBALANCE OF PAYMENTS & Theories of Exchagne Rate - Unit 3Sunni ZaraNo ratings yet

- The Balance of Payments - Edexcel Economics Unit 4Document31 pagesThe Balance of Payments - Edexcel Economics Unit 4mks93No ratings yet

- The Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andFrom EverandThe Top 100 International Growth Stocks: Your Guide to Creating a Blue Chip International Portfolio for Higher Returns andNo ratings yet

- International Corporate Finance: Value Creation with Currency Derivatives in Global Capital MarketsFrom EverandInternational Corporate Finance: Value Creation with Currency Derivatives in Global Capital MarketsNo ratings yet

- LBMA LPPM MOU April 2013Document26 pagesLBMA LPPM MOU April 2013Tommy LiuNo ratings yet

- ABOUT UDA - UDAfunctions by Adding IMagesDocument23 pagesABOUT UDA - UDAfunctions by Adding IMagesMadhu MadhuuNo ratings yet

- Istoric Cont: Criterii de CautareDocument5 pagesIstoric Cont: Criterii de CautareDenis ZuzNo ratings yet

- 1st Order PDFDocument2 pages1st Order PDFNOR HAFIZA BINTI RUMLI MoeNo ratings yet

- Lending Company Regulation Act of 2007 (Ra 9474)Document5 pagesLending Company Regulation Act of 2007 (Ra 9474)Jessy Francis100% (1)

- Lecture 10Document27 pagesLecture 10riyat0601No ratings yet

- Credit Transactions ReviewerDocument10 pagesCredit Transactions ReviewertheresaNo ratings yet

- Guide To Indonesian Accounting, Commercial, and Tax Terms (ACT)Document85 pagesGuide To Indonesian Accounting, Commercial, and Tax Terms (ACT)Hartono WidjayaNo ratings yet

- Blockchain - 2 Business Perspective SudinDocument35 pagesBlockchain - 2 Business Perspective SudinAravindanNo ratings yet

- BASE24 External Message PDFDocument680 pagesBASE24 External Message PDFCamNo ratings yet

- Ethiopian Financial System PDFDocument2 pagesEthiopian Financial System PDFBrandon92% (66)

- Citibank N.A. - CEO Profile - Michael L. CorbatDocument1 pageCitibank N.A. - CEO Profile - Michael L. CorbatJ. F. El - All Rights ReservedNo ratings yet

- Session 1 - Finance For Non-Finance (19.08.2023)Document17 pagesSession 1 - Finance For Non-Finance (19.08.2023)Saroj AndhariaNo ratings yet

- Remittance Guide For Aljazira Online: Using Fawri Service For The First TimeDocument1 pageRemittance Guide For Aljazira Online: Using Fawri Service For The First Timehusnain aliNo ratings yet

- W654515 ReceiptpdfDocument1 pageW654515 ReceiptpdfSurendra SapkotaNo ratings yet

- CorrespondenceDocument4 pagesCorrespondenceRivaldo RobinsonNo ratings yet

- European Leveraged Finance Funding Structures Transformed September 2014Document30 pagesEuropean Leveraged Finance Funding Structures Transformed September 2014bharathaNo ratings yet

- Electronic Funds Transfer Form EmployeeDocument4 pagesElectronic Funds Transfer Form EmployeeTulyaNo ratings yet

- 5 6104822306436023525Document207 pages5 6104822306436023525Manthan prashar0% (1)

- AEC 302 Mock TestDocument5 pagesAEC 302 Mock TestRamanan R100% (1)

- SBK 2024 - Cedars International SchoolDocument3 pagesSBK 2024 - Cedars International Schoolge316.zana.hogirNo ratings yet

- Online Banking - Hong Leong Bank MalaysiaDocument1 pageOnline Banking - Hong Leong Bank MalaysiaNick HaffiziNo ratings yet

- MCQ All 25 Accounts XiDocument36 pagesMCQ All 25 Accounts XiSuraj GuptaNo ratings yet

- Gadaa-Bank 222Document18 pagesGadaa-Bank 222Melese LegeseNo ratings yet

- Consolidated Bank and Trust Corporation vs. Court of AppealsDocument24 pagesConsolidated Bank and Trust Corporation vs. Court of AppealsDoreen GarridoNo ratings yet

- Annual Report 2019Document304 pagesAnnual Report 2019fahadNo ratings yet

- Fria List of CasesDocument2 pagesFria List of CasesJhomel Delos ReyesNo ratings yet

- Pradhan Mantri Awas YojanaDocument7 pagesPradhan Mantri Awas YojanaMusekhirNo ratings yet

- Registration Form - : Career Opportunities in Leading Organization (Government, Semi-Government, Private)Document2 pagesRegistration Form - : Career Opportunities in Leading Organization (Government, Semi-Government, Private)Waqqs WaqasNo ratings yet