Professional Documents

Culture Documents

ADL Designing Insurance Sales Channels 2023

ADL Designing Insurance Sales Channels 2023

Uploaded by

Gaspar BlaserOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ADL Designing Insurance Sales Channels 2023

ADL Designing Insurance Sales Channels 2023

Uploaded by

Gaspar BlaserCopyright:

Available Formats

VIEWPOINT

2023

DESIGNING INSURANCE

SALES CHANNELS FOR

M A X I M U M I M PA C T

Dimensioning channels

with data analytics AUTHORS

José González

Fierce competition for clients and the adoption of Guillem Casahuga

new technologies are pushing insurance companies Borja de la Cuesta

to make bold efforts to improve their sales force

Pau Fuentes

and emphasize their most profitable channels.

Developing a data-driven strategy to properly Eduardo Munguía

dimension sales channels will allow companies to Javier Novoa

maximize their resources and deploy efficiency

initiatives. In this Viewpoint, we define an organized

approach to sales dimensioning that can be used by

insurance companies and other sectors.

VIEWPOINT ARTHUR D. LITTLE

FIRS T S TEP S THE TRADITIONAL

TRIAL-AND - ERROR

The relationship between customer value

and acquisition cost has a direct impact on

APPROACH CAN LE AD

profitability. The output of each type of channel T O PA I N S TA K I N G L A B O R

differs in cost and target segment. For this A N D I N A D E Q U AT E

reason, it is important that channels align

R E S U LT S

with the company’s strategy to optimize ROI.

Our experience shows that the right channel

dimensioning can improve productivity by 10%-

20%. This Viewpoint explores how to define the

DEFINING THE

optimal process for dimensioning sales channels,

BES T CONFIGUR ATION

which focuses on creating optimal configurations

of agents in distribution channels. The actions Data analytics creates the foundation for this

that occur during and after this process are stage. For the purpose of dimensioning sales

paramount to improving agent performance. The channels, it involves the process of examining

traditional trial-and-error approach can lead to raw data to uncover hidden patterns, correlations,

painstaking labor and inadequate results. This market trends, and other relevant information

outcome is inevitable for any company in almost within each type of channel. These analyses are

every sector; our approach avoids these negative the basis for determining new segmentation

outcomes. models, establishing sources of customer

Although an insurance company’s sales potential value, or identifying value agent

department usually has the necessary knowledge drivers. The results establish a foundation for

and reporting tools to identify and track results, channel modeling in the next phase and provide

roadblocks, and game changers, dimensioning relevant insights about distribution performance,

the necessary efforts of each sales channel extraction of actionable insights, and positioning

is often hindered by a lack of resources. The in relation to peers.

agent configuration in a channel is typically Experience has shown that not all channels are

organized by comparing the variation of average suitable for all segments, nor do they have the

performance metrics and ratios impacting a same cost or offer the same return:

static profit and loss (P&L) statement. It assumes

linear behaviors that are a vague representation

- Remote channels typically offer a lower

acquisition cost but less advisory potential.

of the actual constraints faced by the sales force

The cost and effectiveness of the channel

(during the operation) and the sales director

depends on the quality of the leads. Internal

(during the sales strategy definition).

leads (e.g., former customers) offer better

A robust and flexible methodology, based on results, but their number is limited. External

market and internal data, is necessary for properly leads, on the other hand, have a lower

facing the endgame channel-sizing problem. This impact and can cost three to four times

data-driven approach has the additional benefit the acquisition cost.

of allowing sales directors to understand the

constraints and the best growth direction, while

incorporating efficiency improvements that have

been vetted and found worthy.

DESIGNING INSURANCE SALES CHANNELS FOR MAXIMUM IMPACT 2

VIEWPOINT ARTHUR D. LITTLE

- An insurance company’s own channels tend Internal and external analyses are conducted

to offer average performance at a medium- during the Phase 1. The completed internal

to-high cost. The risk falls on the company, so analysis provides important and useful

it must establish adequate management and information, including:

control policies. Poor channel management

can lead to a degradation of the acquisition

- Customer characteristics and product tenancy

cost and liability for the development of new - Customer-channel distribution relationships

distribution strategies. (customer mix per channel, acquisition cost)

- Intermediated channels offer a medium-to- - Customer value and its relationship with the

high, but variable, acquisition cost. These distribution channel

are suitable channels for targeting customer - Each channel’s contribution to business

segments where the agents have difficulty performance (volume, margin, persistency)

-

initiating a commercial conversation, or

Agent dynamic in the channel (rotation)

conversion is difficult.

New data analytics and the exploration tools used

- Agent sales performance (ranking, best

practices identification)

here can process a large amount of information

in a short period of time, which is needed to The external analysis involves benchmarking,

carry out different cross-check analyses and and the knowledge it provides can help

support the three-phase structured approach companies:

to dimensioning insurance sales channels.

- Understand current insurance market

dynamics

Three-phase methodology

- Analyze roles of each player

-

The Arthur D. Little (ADL) methodology to address

Identify best practices

endgame channel sizing combines data modeling

and business intelligence to design an optimal - Discover commercial opportunities (low

channel mix to make the sales process more product penetration in areas or niche markets)

efficient. The methodology is frequently divided

into three phases: (1) an exploratory analysis

- Define aspirational commercial objectives

(penetration by segments or regions)

to diagnose the problem, (2) an examination of

scenarios to find the optimization model, and

(3) an exploration of new initiatives (see Figure 1).

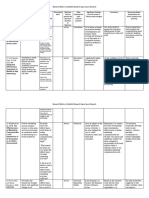

ure 1. Three-phase methodology to define optimal channel

mensioning

Figure 1. Three-phase methodology to define optimal channel dimensioning

01 02 03

Market & internal Optimization model Initiatives to go

diagnosis • Different channel- the extra mile

dimensioning scenarios • Ad hoc new initiatives

• External analysis

• Final-mix decision for improving sales

• Internal analysis

agents’ efficiency

Source: Arthur D. Little

DESIGNING INSURANCE SALES CHANNELS FOR MAXIMUM IMPACT 3

VIEWPOINT ARTHUR D. LITTLE

Defining different strategic scenarios provides Phase 3 begins once the agent configuration has

the starting point of the Phase 2, sales channel been selected. The attention shifts to the agents,

optimization. It involves forecast modeling and analyzes how to improve their productivity, and

scenario analysis using current and historical develops initiatives to help them go the extra

data patterns to determine probable future mile for their customers. Conducting interviews

outcomes. Scenario analysis interconnects all and follow-ups with the top-performing and

elements related to channel performance to show low-performing commercial agents will identify

the economic impact of different insurance sales best practices, pain points, as well as drivers

strategies (e.g., being cost-effective, maximizing that impact performance. During this phase, it

margins, or focusing on customer segments). is important to analyze incentive schemas, sales

support tools, sales area, or sales monitoring

Each scenario seeks to identify the best

and control. The knowledge gathered during this

configuration of agents in the channels to achieve

phase can be implemented later in the form of

a strategic objective (e.g., maximizing return, cost

effective best practices to improve overall agent

efficiency, maximizing customer acquisition). The

performance.

modeling will only work on the configuration of

agents in the channels in a ceteris paribus (“other

things equal”) environment. Thus, we can identify BES T PR AC TICES FOR

which configuration drives impact to the different IMPROVING CHANNEL

strategic ambitions. Understanding these drivers PRODUC TIVIT Y

in the channel configuration in the different

strategic ambitions will help select desirable The most common initiatives to improve

scenarios. The company’s decision makers are productivity can be classified into three sets:

responsible for selecting the optimal option to capabilities, time, and prioritization (see Figure 2).

achieve the financial and strategic objectives. Another course of action, also with three elements,

relies on tools, data, and ongoing training:

2. Areas where productivity can be improved 1. Volume — reducing the time spent on

purely commercial activities by making

Figure 2. Areas where productivity can be improved them simpler, faster, and/or more

automatic. Companies can adapt operational

Time processes and provide the necessary tools

to increase the time spent on sales and their

quality. Systemizing the selling process

helps create a standardized and streamlined

sales process, which can be easily replicated

across a sales team. This will help ensure

consistency and provides an opportunity to

introduce intelligence into the sales process.

Commercial

Sales support tools simplify the sales process

effectiveness

Prioritization

Capabilities

(e.g., a quotation tool), giving an agent time to

focus on customer engagement and advisory.

It is important to eliminate and reduce

administrative tasks (e.g., manual reporting

activities) or reduce sales preparation time

(e.g., sales pitches and competitor benchmarks

can be developed by a commercial intelligence

unit instead of agents).

Source: Arthur D. Little

Little:

DESIGNING INSURANCE SALES CHANNELS FOR MAXIMUM IMPACT 4

VIEWPOINT ARTHUR D. LITTLE

2. Focus — prioritizing commercial actions 3. Quality — improving or developing

through enhanced visibility/analysis of commercial skills of the sales force.

the available information. It is increasingly Developing standardized multichannel lead

common to use sales support tools that management with clear roles, responsibilities,

help prioritize the contacts most likely to be and interfaces can help to build a high-sales,

successful or to focus the conversation on the process-oriented company. Ongoing training,

most suitable product. These tools rely on the communications, and side-by-side coaching,

availability of customer information to extract using experienced agents and coaches, can

value for sales planning. Implementing tools create a strong sales culture. These best

that focus the agent’s activity on the right practices are essential to improving selling by

leads can improve productivity by 15%-25%. ensuring that agents have the necessary skills,

Additionally, the continuous improvement of tools, and processes to effectively engage

selection and sales conversion by tracking with customers, while maintaining high-

objective key performance indicators helps quality service standards.

develop data-driven funnel management. It

increases conversion rates and lowers the

chance of early cancellations or churns.

DESIGNING INSURANCE SALES CHANNELS FOR MAXIMUM IMPACT 5

VIEWPOINT ARTHUR D. LITTLE

CONCLUSION

SUMMARIZING THE PROCESS

E M P L O Y I N G A D ATA - D R I V E N A P P R O A C H

TO DIMENSION SALES CHANNELS ALLOWS

A N I N S U R A N C E C O M PA N Y T O R E A L I Z E

ITS FULL POTENTIAL

The expanding competition landscape and the availability of new

technology to address myriad issues and tasks have motivated

sales forces to revisit their approaches and strategies. Employing

a data-driven approach to dimension sales channels allows an

insurance company to realize its full potential while minimizing

deviations from target results. Ideally, using a strategic process

will launch the company toward a strong outcome:

1 Conduct external and internal analyses prior to the

optimization exercise to understand the main and hidden

blockers that hinder results and to define the constraints

and bundles for sales channel dimensioning.

2 Use data analytics models to replicate real challenges present

in the sale-dimensioning exercise to find the best configuration

for each insurance company and market.

3 Implement efficiency-improvement opportunities after the

best configuration is deployed.

4 Prioritize opportunities according to quantitative and

qualitative criteria and consider their potential enabling nature.

5 Deploy improvement opportunities, which can lead to a new

paradigm for an insurance company, and rerun the analytics

model for sales dimensioning to meet and exceed expectations.

DESIGNING INSURANCE SALES CHANNELS FOR MAXIMUM IMPACT 6

VIEWPOINT ARTHUR D. LITTLE

DESIGNING INSURANCE SALES CHANNELS FOR MAXIMUM IMPACT 7

Arthur D. Little has been at the forefront of innovation since

1886. We are an acknowledged thought leader in linking

strategy, innovation and transformation in technology-

intensive and converging industries. We navigate our clients

through changing business ecosystems to uncover new growth

opportunities. We enable our clients to build innovation

capabilities and transform their organizations.

Our consultants have strong practical industry experience

combined with excellent knowledge of key trends and dynamics.

ADL is present in the most important business centers around the

world. We are proud to serve most of the Fortune 1000 companies, in

addition to other leading firms and public sector organizations.

For further information, please visit www.adlittle.com.

Copyright © Arthur D. Little – 2023. All rights reserved.

You might also like

- Oncology Sales Force Strategy 07 2023Document7 pagesOncology Sales Force Strategy 07 2023angelrizoNo ratings yet

- The Value Shop and The Value NetworkDocument7 pagesThe Value Shop and The Value NetworkMarinela Tache100% (1)

- Panahi PHD ThesisDocument63 pagesPanahi PHD ThesisMohammedAbdulAzeemNo ratings yet

- RF Electronics - Design and Simulation - C J Kikkert - 2009Document223 pagesRF Electronics - Design and Simulation - C J Kikkert - 2009Risam AlbanjumasyNo ratings yet

- Strategic Cost Reduction Through ProcurementDocument15 pagesStrategic Cost Reduction Through Procurementandreas13890No ratings yet

- Multi-Channel MarketingDocument12 pagesMulti-Channel Marketingapi-3753771No ratings yet

- Accenture POV Front Office Cost ManagementDocument8 pagesAccenture POV Front Office Cost ManagementEVa CanceremoetNo ratings yet

- Segmentation White Paper Final 111505Document7 pagesSegmentation White Paper Final 111505Harsh DadhichNo ratings yet

- Competitive Strategy and Industry Analysis: A La Michael PorterDocument4 pagesCompetitive Strategy and Industry Analysis: A La Michael PorterDaria TomescuNo ratings yet

- How To Increase Margins and Profitability in DistributionDocument4 pagesHow To Increase Margins and Profitability in Distributionطه احمدNo ratings yet

- Sales Force and Channel ManagementDocument5 pagesSales Force and Channel Managementyacine ouchiaNo ratings yet

- IDCBlueRoads06Document10 pagesIDCBlueRoads06ADIL BENTALEBNo ratings yet

- Report On BTL Marketing1Document17 pagesReport On BTL Marketing1indofileNo ratings yet

- Chapter 14 ECON NOTESDocument12 pagesChapter 14 ECON NOTESMarkNo ratings yet

- Getting Customers To Say The Price Is RightDocument7 pagesGetting Customers To Say The Price Is RightProagme Proagme Monterrey ABB DistribuidorNo ratings yet

- Group 8 - The Strategy of International BusinessDocument42 pagesGroup 8 - The Strategy of International BusinessSilva, Phoebe Chates Bridget B.No ratings yet

- Chapter 9 Notes Question Amp SolutionsDocument5 pagesChapter 9 Notes Question Amp SolutionsPankhuri SinghalNo ratings yet

- Strategic Pricing - Value Based ApproachDocument4 pagesStrategic Pricing - Value Based ApproachdainesecowboyNo ratings yet

- Periscope For Financial InstitutionsDocument6 pagesPeriscope For Financial InstitutionsGia GiaNo ratings yet

- Opman Ch02 NotesDocument10 pagesOpman Ch02 NotesあいはらめいNo ratings yet

- Measuring and Managing Customer Lifetime Value:: A CLV Scorecard and Cohort Analysis in A Subscription-Based EnterpriseDocument14 pagesMeasuring and Managing Customer Lifetime Value:: A CLV Scorecard and Cohort Analysis in A Subscription-Based EnterpriseDounia SolaiNo ratings yet

- Benchmarking The Fast GrowthDocument14 pagesBenchmarking The Fast GrowthBảo Hân VũNo ratings yet

- 10 Lastbilsverksamhetens Fokusomraden EngDocument5 pages10 Lastbilsverksamhetens Fokusomraden EngHariramNo ratings yet

- Next in Insurance Overview 01 04 22Document9 pagesNext in Insurance Overview 01 04 22verdiNo ratings yet

- ABC - Activity Based CostingDocument15 pagesABC - Activity Based CostingjpereztmpNo ratings yet

- Front-End, Back-End and Integration Issues in Virtual Supply Chain Dynamics Modeling Adolfo Crespo MarquezDocument23 pagesFront-End, Back-End and Integration Issues in Virtual Supply Chain Dynamics Modeling Adolfo Crespo MarquezDaniel Stiven TamayoNo ratings yet

- Cost Volume Profit AnalysisDocument34 pagesCost Volume Profit AnalysisNaila Mukhtar100% (3)

- Chapter 13Document36 pagesChapter 13Dr. Usman YousafNo ratings yet

- Cost ReductionDocument16 pagesCost Reductionnga8vu-2No ratings yet

- Layout 1 - 1531747814the - Top - Seven - Trends - in - Management - AccountingDocument16 pagesLayout 1 - 1531747814the - Top - Seven - Trends - in - Management - Accountingyadialid medinaNo ratings yet

- Google Data Analytics StrategyDocument4 pagesGoogle Data Analytics StrategylemarqueNo ratings yet

- Five Levers For Optimizing Supply Chain CostsDocument6 pagesFive Levers For Optimizing Supply Chain Costsspyros_peiraiasNo ratings yet

- CRMdata Warehouse TaxonomyDocument23 pagesCRMdata Warehouse TaxonomyDavison GudoNo ratings yet

- 9 - The Marker - S DilemmaDocument7 pages9 - The Marker - S DilemmaCarlos AguayoNo ratings yet

- Uses of Predictive AnalyticsDocument4 pagesUses of Predictive AnalyticsRaiza OlandescaNo ratings yet

- Customer Profitability AnalysisDocument22 pagesCustomer Profitability Analysissity jurainaNo ratings yet

- A Customer-Centric Approach To Commercial ExcellenceDocument8 pagesA Customer-Centric Approach To Commercial ExcellencevarunmjNo ratings yet

- 4th Blog Presentation SidesDocument30 pages4th Blog Presentation Sidesapi-688199456No ratings yet

- Research MatrixDocument6 pagesResearch MatrixtagoashleyyNo ratings yet

- Supply Chain ManagementDocument9 pagesSupply Chain Managementnihar soni100% (1)

- X BSC - Measuring The Performance of Truly Strategic RelationshipsDocument5 pagesX BSC - Measuring The Performance of Truly Strategic RelationshipsAbeyNo ratings yet

- MKT103 - Module 3 (Strategic Pricing)Document5 pagesMKT103 - Module 3 (Strategic Pricing)Ezra KimNo ratings yet

- SampleStrategyMaps ForProfit 8.17.15 CM PDFDocument9 pagesSampleStrategyMaps ForProfit 8.17.15 CM PDFMookameli Matlama MookameliNo ratings yet

- Target Costing: Chart See Hotelling'sDocument25 pagesTarget Costing: Chart See Hotelling'sDirector operacionesNo ratings yet

- Week 1Document3 pagesWeek 1khaiNo ratings yet

- Cravens Piercy: Mcgraw-Hill/IrwinDocument29 pagesCravens Piercy: Mcgraw-Hill/IrwinNoor Cahyo WNo ratings yet

- 7 Trends in Management Accounting PART 2 01 - 2014 - Cokins PDFDocument7 pages7 Trends in Management Accounting PART 2 01 - 2014 - Cokins PDFRima AkidNo ratings yet

- NaderAsnafiIHTSE Tool and DieDocument6 pagesNaderAsnafiIHTSE Tool and DiePrince SharmaNo ratings yet

- For DMDocument46 pagesFor DM22-84337No ratings yet

- Advanced Analytics Can Drive The Next Wave of Growth For Travel and Logistics CompaniesDocument5 pagesAdvanced Analytics Can Drive The Next Wave of Growth For Travel and Logistics CompaniesLuis BarretoNo ratings yet

- CapabilityBrief Salesforce Channel EffectivenessDocument4 pagesCapabilityBrief Salesforce Channel Effectiveness66 zhaoNo ratings yet

- Chapter 8Document8 pagesChapter 8Brian DuelaNo ratings yet

- Vanraaij 2005Document10 pagesVanraaij 2005W HWNo ratings yet

- Supply Chain Management AssignmentDocument25 pagesSupply Chain Management AssignmenttejasNo ratings yet

- 02 Task Performance 1Document2 pages02 Task Performance 1Ed Gierson PascualNo ratings yet

- Pre Oral Defense PresentationDocument13 pagesPre Oral Defense PresentationNicolas SalcedoNo ratings yet

- CPO Dashboards: Ensuring Alignment, Driving ExcellenceDocument8 pagesCPO Dashboards: Ensuring Alignment, Driving ExcellenceajNo ratings yet

- Chap. 3 You Are in The Business of AnalyticsDocument11 pagesChap. 3 You Are in The Business of AnalyticsFrancesca TataruNo ratings yet

- For DMDocument44 pagesFor DM22-84337No ratings yet

- Competitor Analysis: Some Practical Approaches: John J. BrockDocument7 pagesCompetitor Analysis: Some Practical Approaches: John J. BrockcorNo ratings yet

- Strategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementFrom EverandStrategic Capability Response Analysis: The Convergence of Industrié 4.0, Value Chain Network Management 2.0 and Stakeholder Value-Led ManagementNo ratings yet

- ADL Risk Appetite 2023Document12 pagesADL Risk Appetite 2023Gaspar BlaserNo ratings yet

- ADL Electrifying The Future 2023Document12 pagesADL Electrifying The Future 2023Gaspar BlaserNo ratings yet

- ADL Reinvigorating Enterprise Risk MGT 2023Document12 pagesADL Reinvigorating Enterprise Risk MGT 2023Gaspar BlaserNo ratings yet

- Fox 2004 PDFDocument126 pagesFox 2004 PDFGaspar BlaserNo ratings yet

- 1 s2.0 S0021979706005376 MainDocument7 pages1 s2.0 S0021979706005376 MainGaspar BlaserNo ratings yet

- Catalytic Reforming: 2011 Refining Processes HandbookDocument3 pagesCatalytic Reforming: 2011 Refining Processes HandbookGaspar BlaserNo ratings yet

- Zhang Yan Et Al Speed and Energy Optimization Method For The Inland All-Electric Ship in Battery-Swapping Mode 2023Document12 pagesZhang Yan Et Al Speed and Energy Optimization Method For The Inland All-Electric Ship in Battery-Swapping Mode 2023Roberto VetranoNo ratings yet

- Bus Scheduling Optimization Based On Queuing TheoryDocument7 pagesBus Scheduling Optimization Based On Queuing TheoryLuis Enoc Espitia FontalvoNo ratings yet

- Or Lectures 2011 - Part 2Document191 pagesOr Lectures 2011 - Part 2Ahmed RamadanNo ratings yet

- OPTICast BrochureDocument2 pagesOPTICast BrochureIndra Pratap SengarNo ratings yet

- EconomicsDocument49 pagesEconomicsRebinNo ratings yet

- Essays On Computational Problems in InsuranceDocument125 pagesEssays On Computational Problems in InsuranceAlmaz GetachewNo ratings yet

- rp14 08 PDFDocument46 pagesrp14 08 PDFdodoltala2011No ratings yet

- Quantum Computing and FinanceDocument25 pagesQuantum Computing and FinancePhoebeNo ratings yet

- AI QuestionBank PartA&PartB RejinpaulDocument111 pagesAI QuestionBank PartA&PartB RejinpaulEdappadi k. PalaniswamiNo ratings yet

- Zero ForcingDocument11 pagesZero ForcingDuvan MuñozNo ratings yet

- 14Mx11 Probability and Statistics: Semester I 4 0 0 4Document36 pages14Mx11 Probability and Statistics: Semester I 4 0 0 4rnagu1969No ratings yet

- Advanced Optimization TechniquesDocument21 pagesAdvanced Optimization TechniquesshiekziaNo ratings yet

- University Mathematics II by Olaniyi Evans (2024)Document10 pagesUniversity Mathematics II by Olaniyi Evans (2024)Olaniyi EvansNo ratings yet

- 1999 Optimal Maneuver MethodDocument25 pages1999 Optimal Maneuver MethodfaizNo ratings yet

- Optimal Power Flow (DC and AC OPF)Document55 pagesOptimal Power Flow (DC and AC OPF)Quang ThangNo ratings yet

- Research Paper On Dynamic ProgrammingDocument7 pagesResearch Paper On Dynamic Programmingvguomivnd100% (1)

- CH 6 CDocument21 pagesCH 6 CvuduyducNo ratings yet

- Ibrahim Zeid and R. Sivasubramanian - CAD - CAM Theory and Practice-Tata McGraw Hill Education Private Limited (2009)Document848 pagesIbrahim Zeid and R. Sivasubramanian - CAD - CAM Theory and Practice-Tata McGraw Hill Education Private Limited (2009)037 Amit Semwal100% (1)

- Improved NSGA-II Algorithm For Optimization of Constrained FunctionsDocument4 pagesImproved NSGA-II Algorithm For Optimization of Constrained FunctionsdfasdgNo ratings yet

- Fnte Element Solut Ons: LS-DYNA and MoreDocument15 pagesFnte Element Solut Ons: LS-DYNA and MoreNikhilNo ratings yet

- Journal Paper EmeraldDocument9 pagesJournal Paper EmeraldGhasan ZetNo ratings yet

- Interactive Design of 3D Printable Robotic Creatures Paper PDFDocument9 pagesInteractive Design of 3D Printable Robotic Creatures Paper PDFpepgoteNo ratings yet

- Optimized Mobile Robot Positioning For Better Utilization of The Workspace of An Attached ManipulatorDocument6 pagesOptimized Mobile Robot Positioning For Better Utilization of The Workspace of An Attached ManipulatoregebalkNo ratings yet

- Faculty of Mathematics and Natural Sciences (30!10!2011) ArmeDocument70 pagesFaculty of Mathematics and Natural Sciences (30!10!2011) Armeqazed444100% (2)

- (2015) The Production Routing Problem A Review of Formulations and Solution Algorithms PDFDocument12 pages(2015) The Production Routing Problem A Review of Formulations and Solution Algorithms PDFJota Mike MikeNo ratings yet

- AHS-pipeline Route SelectionDocument11 pagesAHS-pipeline Route Selectioncadvis2kNo ratings yet

- Best Practice For Static & Dynamic Modeling and Simulation History Match Case - Model QAQC Criteria For Reliable Predictive ModeDocument13 pagesBest Practice For Static & Dynamic Modeling and Simulation History Match Case - Model QAQC Criteria For Reliable Predictive ModeAiwarikiaarNo ratings yet

- Marxan Tutorial CompressDocument114 pagesMarxan Tutorial CompressEddy HamkaNo ratings yet