Professional Documents

Culture Documents

National Freelancing Facilitation Policy 2021

National Freelancing Facilitation Policy 2021

Uploaded by

Sukaina SalmanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Freelancing Facilitation Policy 2021

National Freelancing Facilitation Policy 2021

Uploaded by

Sukaina SalmanCopyright:

Available Formats

f t

ra

National Freelancing

www.pseb.org.pk

D

www.moitt.gov.pk

www.techdestination.com

Facilitation Policy

2021

TechdestiNationPakistan

Consultation Draft TechDestPak

Table of Contents

1. List of Acronyms 3

2. Preamble 4

3. Pakistan’s Freelancing Landscape: 4

4. Policy Vision 6

5. Policy Objectives 6

6. Strategy Implementation 7

7. Key Components 7

a) Business development and ICT Exports 7

b) Facilitation 7

c) HR Development & Entrepreneurship 7

d) Legislations 7

e)

f)

g)

f t

Women Empowerment 8

Facilitation for the differently-abled community

Empowerment of remote and underserved areas

8. Fiscal & non-fiscal incentives for the Freelancers:

8

8

9

ra

9. Policy Implementation & Reviews 10

10. Annexure-1 11

11. Roles and Responsibilities 11

12. References 13

D

2 | National Freelancing Policy 2021

List of Acronyms

» APAC – Asia Pacific

» FBR – Federal Board of Revenue

» CIR – Committed Information Rate

» GoP – Government of Pakistan

» ICT – Information Communication Technology

» ITeS – Information Technology Enabled Services

» MoITT – Ministry of Information Technology and Telecommunication

» P@SHA – Pakistan Software Houses Association

»

f

QA – Quality Assurance

t

PSEB – Pakistan Software Export Board

PTA – Pakistan Telecommunication and Authority

ra

» SBP – State Bank of Pakistan

» SECP – Securities & Exchange Commission of Pakistan

» SMEs – Small and medium size Enterprises

D

» STPs – Software Technology Parks

» TDAP – Trade and Development Authority of Pakistan

» VoIP – Voice Over Internet Protocol

» VPN – Virtual Private Network

3 | National Freelancing Policy 2021

1. Preamble: group of prominent freelancers has also been

The growth of the Information Technology sought while preparing this draft.

(IT) and Information Technology enabled

Services (ITeS) sector is vital for Pakistan’s Pakistan’s Freelancing Landscape:

economic development. This sector has Freelancers have registered remarkable

tremendous potential and is expected to growth in numbers and income during recent

reach its set target of US$ 5 Billion in IT & ITeS years. The telecom infrastructure expansion

export remittances within the next three years. across the country has played a pivotal role in

The Government of Pakistan has invested freelancers’ development. This is now getting

heavily in this sector, especially in the last two global acknowledgment, a reputation for

decades, resulting in laying the foundations reliable and cost-effective IT and IT-enabled

for developing a knowledge-based economy services delivery. Freelancers from Pakistan

and digitally empowered society through the are ranked 3rd globally and have become

use and adoption of inclusive, affordable, and increasingly popular due to quality of work

sustainable technology. and cost-effectiveness compared to other

competing countries.

IT & ITeS export remittances surged to $1.23

billion during FY 2019-20, including US$150 As per ‘The 2020 Freelancer Income Report’

million earned by freelancers. Whereas, in the by a Payoneer, the role of technology advances

first seven months of the current FY 2020- and shifting work paradigms are fueling

21 (July 2020 – January 2021), freelancers’ a surge in freelancing with collaborative

export remittances have rapidly increased

to US$ 219 Million and are expected to cross

US$ 350 Million by the end of FY 2020-21. It is

f

estimated that, at present, around 100,000

“active” freelancers (who at least make $100 a

t

technologies making it easier for remote

workers to communicate and contribute.

Online marketplaces are making it easier for

freelancers to find work. Cross-border payment

platforms make it easier for freelancers to get

ra

month) are working from Pakistan and earning paid for their services, regardless of the client’s

valuable foreign exchange for the country. location. Whether an individual is making

To increase Pakistan’s freelancer’s footprint the shift from a full-time salaried position or

globally and gain a larger share of the global working to supplement an existing job with

outsourcing business, it is essential to devise some extra income, freelancing presents a

and implement a National Freelancing Policy. wealth of opportunities.

This would enable freelancers to work within

D

a supportive framework duly aligned with According to an international survey, the

enhancing demand generation and supply worldwide average hourly rate charged by

of IT & IT enabled Services to the international freelancers is US$ 21, showing that freelancing

markets worldwide. is providing an attractive earning potential

that, in many cases, far exceeds average wages,

With the right policy interventions, the especially in emerging economies. The most

number of freelancers in Pakistan can be popular fields of work for freelancers are web

increased tenfold in few years, generating self- development, graphics designing (30%),

employment for talented youth, bolstering IT & computer programming (19%), IT services

ITeS export remittances, and spurring economic (10%), multimedia production (8%), content

growth of the country. writing (8%), translation (7%), marketing (6%),

admin (3%), customer support (2%), project

The policy has been drafted by MoITT through management (2%), sales (2%), quality assurance

its departments PSEB, Ignite, and IT Wing (2%) and finance (1%).

of MoITT in consultation with the National

Freelancing Policy Committee comprised of In this digital world, freelancers have recognized

the representatives from SECP, SBP, FBR, and that they can earn a significant income and

Ministry of Commerce. Input from a working gain more freedom over their working and

4| Consultation Draft - National Freelancing Policy

employment conditions, with the ability to Freelancers’ Definition

choose projects and create a more excellent Freelancer is a type of self-employment where

work-life balance no matter where they are the individual works for themselves, carry

located. Likewise, businesses realize that having out temporary jobs / projects / contracts /

a growing freelancers’ workforce can provide assignments / tasks and relate to professions

them with the flexibility to scale and quality such as web development, software

service when costs need to be cut. development, graphics designing, computer

programming, IT services, multimedia

production, content writing, translation,

The United States of America is one of the marketing, IT solutions administration,

leading freelancing countries. According to the customer support, project management, sales

study “Freelance Forward 2020” carried out by activities, quality assurance, financial services,

Payoneer, 59 million Americans were engaged research activities, news reporting, medical

in providing freelancing services during the last services, interpretation, commercial advisories,

fiscal year, which makes up 36% of the USA’s tech consultancies, financial consultancies,

total workforce, generating $1.2 trillion in annual attorney services, etc. using IT platform and

earnings from freelancing. Research finds that software/tools to provide services in-country

hard skills, soft skills, and business skills are and globally.

fundamental to be a successful freelancer.

Most freelancers in the USA are aged between

18 to 22 years, followed by 23 to 38 years old, 39

to 54 years old, and 55+. Whereas in Asia, the

number of freelancers under the age of 35 is alot

higher, reflecting the potential of freelancing in

f

countries such as Pakistan.

t

ra

Freelancing is also playing a pivotal role in

closing the overall mean gender pay gap in

earnings. The mean hourly rate of female

freelancers is 84% (in APAC 85%) of the male’s

mean hourly rate freelancers across all fields.

D

5| Consultation Draft - National Freelancing Policy

2. Policy Vision: adoption rate for learning, upscaling,

To make Pakistan a leading enabler and and skill practice.

top marketplace for freelancing with 2. To introduce digital banking,

ease of doing business, carrying out skills e-payments, access to financial

development, capacity building, broad basing instruments, and capital, especially

the technology jobs to all corners of Pakistan low-interest loans for freelancers.

ensuring equitable inclusion all genders and 3. To provide income tax holiday to PSEB

abilities wealth generation, the economic well- registered freelancers till 2030.

being of the citizens and the achievement of 4. To increase access to health insurance,

sustainable economic growth of the country. life insurance, and employee liability

insurance through subsidies and

3. Policy Objectives: Government incentives.

• On average, each US freelancer is earning 5. Making employee liability insurance

$21000 per annum while the same for available in the country reducing

Pakistan is approximate stands @ US$ operational risks of the freelancers both

3500 per annum per active freelancer per locally and internationally

year, 100,000 freelancers’ active freelancer iii. HR Development and Entrepreneurship

approx. 1. To strengthen and build qualified

• Building the number of active freelancers human resources through capacity

in Pakistan to 1 Million freelancers and building and skill training programs.

increasing the average earning rate to 2. To create a registry of local freelancers

$5,000 per annum will potentially add

$5.0 Billion of export remittance inflows in

Pakistan every year.

f

• This policy aims to provide a framework for

this target and accelerate its achievement

t through a registration portal and

facilitating them by providing them a

platform to interact with the local and

international market.

3. Increasing dispensable income of the

ra

by facilitating the freelancers and population at large.

increasing wealth creation for themselves, iv. Legislations

their families, villages, and towns, and 1. Designating policy stakeholders and

earning valuable foreign exchange for the the policy review board’s formulation

country. to create a legal & litigation framework

suited to the freelancers.

i. Business Development v. Women Empowerment

D

1. To establish Pakistan as a leading 1. To empower the women and encourage

freelance market globally by creating them to start or resume their careers as

the transparent governance model, freelancers.

framework & policies and providing vi. Persons with Disabilities

International access to markets, 1. Enabling the inclusion of persons with

projects and clients. disability, retired and semi-retired

2. To bridge the gap and facilitate individuals, and the transgender

freelancers to interface with governing/ population.

regulatory authorities to enable vii. Empowerment of Remote and

business ease. Underserved Areas

3. To introduce a robust marketing 1. Ensuring the inclusion of remote

strategy & promotional plan for areas, small towns, underserved

freelancers. areas, secondary and tertiary cities

4. Increase in service exports and foreign for economic development, wealth

exchange of the country. creation, and reducing the gap with

ii. Facilitation metropolitan cities.

1. To enable a digital-ready environment

across the country and increase the

6| Consultation Draft - National Freelancing Policy

4. Strategy Implementation and private sector organizations will

1-Key Components collaborate on providing subsidized

a) Business development and ICT Exports health and life insurance to PSEB

To provide business opportunities to registered freelancers through existing

freelancers, the following strategic and future initiatives.

actions can be planned. • PSEB and relevant Governmental

• PSEB in collaboration and facilitation and private sector organizations will

with other governing bodies like M/o collaborate on providing collateral-free

Commerce, M/o Interior, and TDAP loans to PSEB registered freelancers

to organize inbound and outbound through existing and future initiatives.

delegations, IT exhibitions/meetups, • Establishment of facilitation desk at

roadshows, etc. through offered to PSEB and PSEB operated software

freelancers for their participation at technology parks for addressing matters

seminars, global exhibitions, trade related to registrations, taxations, dispute

fairs, and expos, allowing freelancers to resolution, etc.

showcase their portfolios and creating • PSEB, in collaboration with relevant

partnerships enabling to increase their Government and private sector

revenues. organizations, will work on enabling

• Multiple freelance marketplaces to linkages of PSEB registered freelancers

operate from Pakistan to compete with local and foreign investors.

against the international freelancing • PSEB, in collaboration with the Securities

platforms, ensuring competition,

which will reduce platform fees and

provide multiple channels of revenue

f

for Pakistani freelancers. This will also

provide strategic security to this sector

t and Exchange Commission of Pakistan,

will simplify the process of registering

a Single Member Company and offer

a fee discount to the PSEB registered

freelancers.

ra

by lowering dependence on foreign-

owned freelancing platforms. c) HR Development & Entrepreneurship

• Provide digital banking channels to • In partnership with other public and

freelancers in opening bank accounts, private sector organizations, Pakistan

enabling e-payments and access to Software Export Board will launch new

other financial instruments, increasing training and technology certifications

export remittances, simplifying outward initiatives for the local freelancers.

D

remittances for purchasing services/ • PSEB will create partnerships with

software/ tools/ digital platforms. multinational technology companies

(Tech MNCs) for subsidizing the course

b) Facilitation: materials and certifications, making

• PSEB will provide low-cost registration such material available to the local

and renewal @ Rs. 1,000 and 3,500, freelancers.

respectively, per annum and will facilitate

ease-of-doing-business through tax d) Legislations

incentives and other subsidies offered by i. Foreign Remittances

the Government. • PSEB, in collaboration with the State

• PSEB and relevant Government bodies Bank of Pakistan (SBP), will work to

will provide special visa facilitation to streamlining inward foreign exchange

freelancers with a record of a minimum remittances from freelancing activity

of three years of IT & ITeS export using freelancing defined codes by

remittances exceeding the US $5,000 SBP, which are subjected to income tax

per annum through formal banking exemptions.

channels. • PSEB will work with SBP for the

• PSEB and relevant Governmental allowance of foreign exchange bank

7| Consultation Draft - National Freelancing Policy

account opening for PSEB registered related to the payment and other legal

freelancers. and commercial disputes.

• It is proposed for SBP to enable the iv. Intellectual property and Data Protection

retention of 35% of foreign exchange Policy

income received as an inward remittance • It proposed to ensure the inclusion

in these foreign exchange business of freelancers and their digital and

accounts of the freelancers. physical products and services, brands

• PSEB will work with the Finance Ministry and trademarks, and any other

and Federal Board of Revenue to ensure intellectual properties in the National

the foreign exchange export remittances Data Protection Policy and Intellectual

received in freelancing codes will remain Property Policy in consultation with all

income tax exempted till 2030. associated stakeholders.

• SBP to mandate local banks to ensure

the foreign exchange payments received e) Women Empowerment

in the freelancers’ business account is • It is proposed to emphasize promoting

reconciled with the corresponding local training and work from home

PKR deposit in the recipient’s account. enablement for women and girls across

These recipients should not face any the country.

hassle in obtaining Proceed Realization

Certificates (PRCs) for such remittances. f) Facilitation for the differently-abled

• It is proposed for SBP to allow community

freelancers to use documents such as

bank statements, transaction history,

or freelancer marketplace payments

f

transaction statements in obtaining

PRC documents from the banks within

t • It is proposed that a national survey

be conducted enquiring the specially-

abled population about their willingness

and requirements for training, capacity

building, and enablement for adopting

ra

72 hours. freelancing as a career choice.

• It is recommended for SBP to instruct • It is proposed to ensuring free-of-cost

the commercial banks to ensure Internet bandwidth be made available for

adopting mechanisms of tracking and PSEB registered transgender freelancers

recording the transaction proceeds from and specially-abled freelancers across

freelancing activities both from local and Pakistan.

international sources. Freelancers must

D

not face any difficulties in providing g) Empowerment of remote and underserved

the complete traceable records of areas

such transactions to any government • It is proposed for mapping the telecom

organization. penetration through existing and future

ii. Financial Inclusion Government initiatives in urban and

• Facilitation of freelancers may also rural areas to ensure the provisioning

include access to bank loans, credit cards, of subsidized internet services for PSEB

leasing services, and ease of sending registered freelancers working in remote

payments abroad against services, and underserved areas.

software purchase, online platform • It is proposed to subsidize IT equipment

usages, and other similar business costs such as personal use laptops and

expenses. home networking equipment for the

iii. Local Escrow PSEB registered freelancers working in

• It is proposed to establish an Escrow remote and underserved areas.

cell in collaboration with PSEB, SBP, • It is proposed to run awareness programs

and other concerned authorities for on the district level to encourage

addressing the challenges of freelancers students, women, and others to start

and their local and international clients their careers as freelancers.

8| Consultation Draft - National Freelancing Policy

2- Fiscal & non-fiscal incentives for the to the PSEB registered freelancers

Freelancers: through commercial banks and financial

It is necessary to re-align the government institutions at subsidized rates.

strategies to attract a reasonable chunk • It is proposed that the facility of

from global spending on outsourcing subsidized health and life insurance

and freelancing services in Pakistan. This be made available to PSEB registered

will help create thousands of new jobs for freelancers under existing and future

freelancers in different sectors in line with Government and private initiatives.

the current Government policy of creating • It is proposed that PSEB registered

high-end and well-paying white color jobs freelancers be included in any home

for youth employed in the digital economy. loan schemes under the existing

and future Government and private

Presently, specific Government incentives initiatives subject to providing a record

for freelancers are lacking, and thus there of a minimum of 5 years of freelancing

is a need to consider incentives for the exports remittances of more than

freelancers to create a favorable business $10,000 per annum. Such home loan

environment. facilities shall be provided to these

qualified freelancers at a subsidized loan

a. Fiscal Incentives: rate.

Fiscal incentives for freelancers are • It is proposed for the provinces and

recommended in consultation with the the Federal Capital revenue boards to

working group of prominent freelancers

and freelancing community representatives.

Ministry of Information Technology and

f

Telecommunication (MoITT) will recommend

these proposals for inclusion in the relevant

t implement a reduced sales tax rate, not

exceeding 2%, against the local services

revenue earned by the PSEB registered

freelancers. It is further proposed that

this sales tax payment shall only be due

ra

documents such as Finance Bill and State at invoice month end plus 60 days.

Bank of Pakistan and SECP regulations etc.,

after due process. a. Non fiscal incentives:

• Income tax holiday on export income/ • It is proposed that Visa facilitation shall be

revenue/receipts of freelancers, duly provided for PSEB registered freelancers

registered with PSEB till 2030, subject whose export income/revenue for the

to receipt of income/revenue through last three years exceeds US$ 5,000/- for

D

formal banking channels in the specific each year and is remitted through formal

purpose codes assigned by the State banking channels.

Bank of Pakistan. • Fast track and simplified opening

• Introduction of incentivized registration of Foreign Currency bank accounts

fee package for freelancers by PSEB and for PSEB registered Freelancers and

access to PSEB programs and initiatives, retention of 35% foreign exchange in

including free and subsidized training, these bank accounts.

certifications, subsidized office space at • It is proposed to establish Technology

Software Technology Parks (STPs) across Business Branches of commercial banks

the country, and access to international in at least six Pakistan cities where

marketing and matchmaking technology-aware bank staff can help

opportunities. freelancers. PSEB can work with SBP and

• It is proposed for SECP to introduce a commercial banks in providing relevant

20% registration fee discount for PSEB training for the staff of these branches.

registered freelancers if they opt to • It is proposed to establish facilitation

register a Single-Member Company. desks at PSEB offices and PSEB

• It is proposed to make available operated Software Technology Parks

collateral-free loans up to Rs. 1.0 Million for freelancers to quickly resolve their

9| Consultation Draft - National Freelancing Policy

issues pertaining to taxation, banking, 3- Policy Implementation & Reviews:

Intellectual Property rights, Voice Over • The policy implementation will require

IP Whitelisting, Virtual Network Access consistent monitoring and evaluation of

(VPN), or any other legal or commercial its outcomes. However, an appropriate

matters. strategy will also be prepared to align the

• It is proposed Revenue Boards for ‘Action Plan’ with key priority areas for

PSEB to established a free centralized proper monitoring and evaluation. MoITT

VPN gateway service which Pakistan will encourage provincial departments

Telecommunication Authority will and bodies to use this National

whitelist to provide services to verified Freelancing Policy as a guideline for their

freelancers registered with PSEB. own freelancing facilitation initiatives.

• It is proposed that IP whitelisting is Provinces can identify their unique

available for Voice over IP (VoIP) traffic for requirements and implementation

PSEB registered freelancers, where the frameworks. However, broad alignment

VoIP traffic must not exceed 200 kbps. to the National Freelancing Policy may

• It is proposed to ensure the provisioning be pursued. Requisite measures will be

of Committed Information Rate (CIR) adopted to cope with the continuous

Internet bandwidth service by the ISPs/ inclusion of the latest trends and

telco operators packaged under “Work technologies; one such step will be to

from Home Packages” with a minimum ensure the policy review every three

of 20 Mbps connection at subsidized years to keep it relevant, vibrant, and up-

prices to be made available to PSEB

registered freelancers.

f t to-date.

ra

D

10 |Consultation Draft - National Freelancing Policy

Annexure - 1

Roles and Responsibilities Matrix

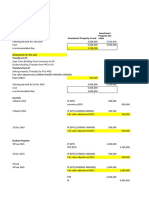

4- Roles and Responsibilities:

• Implementation of the National Freelancing Policy will involve multiple ministries and

departments. Considering the engagement of multiple ministries and departments, it is

appropriate to align the relevant bodies with their specific roles and responsibilities for

clarity. Responsibilities/assignments being proposed as part of this policy which is attached

at Annexure-1.

Lead Ministry/ Facilitating Ministries/

S.# Policy Initiative

Department Departments/ Bodies

Income Tax Holiday on • Ministry of IT and

• Ministry of Finance

export income/revenue Telecommunication

• Federal Board of

1 of freelancers registered • Pakistan Software Export

Revenue

with PSEB for till 2030 Board

starting from FY 2021-22

Introduction of

incentivized registration • Ministry of IT and

2

fee package for

Freelancers by PSEB and

access to PSEB programs

f

and initiatives etc.

20% registration fee

t

Ministry of IT and

Telecommunication

• Securities and

•

Telecommunication

Pakistan Software Export

Board

ra

Exchange

discount by SECP to

Commission of

freelancers registered • Pakistan Software Export

3 Pakistan

with PSEB if they opt to Board

• Ministry of IT and

be registered with SECP

Telecommunication

as an SMC (Pvt) Ltd.

Collateral free loans to • Ministry of IT and

freelancers’ registered Telecommunication

D

• Ministry of Finance

with PSEB by scheduled • Pakistan Software Export

• State Bank of

banks and financial Board

4 Pakistan

institutions at special rates • Financial Institutions

• Kamyab Jawan

up to Rs. 1 Million loans • Microfinancing &

without any collateral/ commercial banks

guarantee.

The facility of health

and life insurance • Sehat Insaaf • Ministry of IT and

to PSEB registered Program Telecommunication

5

freelancers under relevant • Ehsaas Initiative • Pakistan Software Export

Government initiatives or Board

programs.

11 |Consultation Draft - National Freelancing Policy

Lead Ministry/ Facilitating Ministries/

S.# Policy Initiative

Department Departments/ Bodies

• Ministry of IT and

Visa facilitation for PSEB Telecommunication

registered freelancers • Pakistan Software Export

whose export income/ Board

revenue for the last three • Ministry of Foreign • Ministry of Interior

6

years exceeds US$ 5,000/- Affairs • Ministry of Overseas

for each year and is Pakistanis and Human

remitted through formal Resource Development

banking channels. • Pakistan Software Export

Board

Fast track and simplified

• Ministry of Information

opening of Foreign

Technology &

currency bank accounts

Telecommunication

7 for PSEB registered State Bank of Pakistan

• Pakistan Software Export

Freelancers and 35%

Board

foreign exchange

• Commercial Banks

retention.

• Ministry of Information

Establishment of

Technology &

8

Technology Business

Branches of commercial

banks in at least six cities

f

of Pakistan.

Facilitation Desk at

t

State Bank of Pakistan

•

•

Telecommunication

Pakistan Software Export

Board

Commercial Banks

ra

PSEB offices and STPs • Pakistan Software Export

for Freelancers for quick Board

resolution of their issues • Pakistan

Ministry of IT and

9 pertaining to taxation, Telecommunication

Telecommunication

banking, Intellectual Authority

Property rights, IP • Intellectual Property

Whitelisting, or any other Office

D

matters.

Free VPN gateway for • Pakistan

verified Freelancers Telecommunication

registered with PSEB to Ministry of IT and Authority

10

get VPN access through Telecommunication • Pakistan Software Export

PSEB operated VPN Board

gateway.

• Pakistan

IP whitelisting for VoIP Telecommunication

traffic to PSEB registered Ministry of IT and Authority

11

Freelancers not exceeding Telecommunication • Pakistan Software Export

384 kbps traffic. Board

12 |Consultation Draft - National Freelancing Policy

Lead Ministry/ Facilitating Ministries/

S.# Policy Initiative

Department Departments/ Bodies

Committed information

rate (CIR) bandwidth

internet service from ISPs/ • Pakistan

telco operators packaged Telecommunication

as “Work From Home” Ministry of IT and Authority

12

with minimum 20 Mbps Telecommunication • Pakistan Software Export

connections – Special Board

subsidy can be availed in • Internet Service Providers

case of PSEB registered

freelancers.

PSEB registered

freelancers be included in

any home loan schemes • State Bank of Pakistan

under existing and future • Commercial Banks

Government and private • Pakistan Software Export

13 initiatives subject to a Ministry of Housing Board

minimum of 5 years and Works • Other financial

of freelancing exports Institutions

remittance record of

more than the US $10,000

annum.

The provinces and the

f

Federal Capital charge

a reduced sales tax rate

•

t Federal Board of

• Pakistan Software Export

ra

not exceeding 2% against Board

Revenue

the local services revenue • Ministry of Information

14 • Provincial Revenue

earned by the PSEB Technology &

Boards

registered freelancers. The Telecommunication

payment of this sales tax

to be due at invoice month

end plus 60 days.

D

References:

1. The 2020 Freelancer Income Report’ - Payoneer

2. Freelance Forward 2020 - Upwork

13 |Consultation Draft - National Freelancing Policy

f t

ra

D

Pakistan Software Export Board | Office No.2, 2nd Floor,

Evacuee Trust Complex, F-5 Agha Khan Road | Islamabad, Pakistan

+92 (51) 920 4074, Fax : + 92 (51) 920 4075

info@pseb.org.pk

www.pseb.org.pk, www.moitt.gov.pk, www.techdestination.com

TechdestiNationPakistan

TechDestPak

You might also like

- Fintech Philippines Report 2023Document31 pagesFintech Philippines Report 2023ykbharti101No ratings yet

- Business Plan - Coworking Project, WiesbadenDocument41 pagesBusiness Plan - Coworking Project, Wiesbadentv7134100% (6)

- General Electric-Turnaround Management Under Three Different CEOsW20699-PDF-ENG-ExamDocument11 pagesGeneral Electric-Turnaround Management Under Three Different CEOsW20699-PDF-ENG-ExamParth Mahajan50% (2)

- Recruitment and Selection Process at Infosys and Learning MateDocument78 pagesRecruitment and Selection Process at Infosys and Learning Matechao sherpa80% (10)

- Elevating Pakistan's IT SectorDocument12 pagesElevating Pakistan's IT SectorAhmad GilaniNo ratings yet

- CPN Paper - IT Industry in Nigeria - DITDDocument6 pagesCPN Paper - IT Industry in Nigeria - DITDOmololu DadaNo ratings yet

- Roxas City Digital Roadmap V1Document58 pagesRoxas City Digital Roadmap V1Pinoy TVNo ratings yet

- PB Template Digital Nation UsamaDocument7 pagesPB Template Digital Nation UsamaA S K KhanNo ratings yet

- Digital Cities Program Tuguegarao City RoadmapDocument51 pagesDigital Cities Program Tuguegarao City RoadmapShyra Dela CruzNo ratings yet

- Published in JanDocument3 pagesPublished in JanjamilkhannNo ratings yet

- ArticlesDocument5 pagesArticlesmuskan.j.talrejaNo ratings yet

- Fintech ProjectDocument11 pagesFintech ProjectJaveria Umar100% (1)

- Philippine Digital Strategy 2011-2016Document154 pagesPhilippine Digital Strategy 2011-2016tonyocruzNo ratings yet

- Stance:: Digital Transformation Brings Innovations, Growth and Improved GovernanceDocument6 pagesStance:: Digital Transformation Brings Innovations, Growth and Improved GovernanceSaba GhaziNo ratings yet

- National Study On Digital Trade Integration of Pakistan 1Document68 pagesNational Study On Digital Trade Integration of Pakistan 1Rabia TariqNo ratings yet

- Digitization Pakistan - in BriefDocument5 pagesDigitization Pakistan - in BriefFaisal RoohiNo ratings yet

- ADB Digital LendingDocument18 pagesADB Digital Lendingradakan298No ratings yet

- Ommunication Echnologies Nformation &: The World Bank GroupDocument29 pagesOmmunication Echnologies Nformation &: The World Bank GroupzachsNo ratings yet

- Fap Concept NoteDocument7 pagesFap Concept NoteMohsin RehmanNo ratings yet

- Promoting Information and Communication Technology in ADB OperationsFrom EverandPromoting Information and Communication Technology in ADB OperationsNo ratings yet

- Chapter # 1: 1.1 Definition of IT IndustriesDocument32 pagesChapter # 1: 1.1 Definition of IT IndustriesSajid ArifNo ratings yet

- Digitalization MaterialDocument7 pagesDigitalization MaterialGeneral UseNo ratings yet

- IT ITeS Industry Statistics 2019Document102 pagesIT ITeS Industry Statistics 2019Ayman MustakimNo ratings yet

- Concept Note Pakistan FinTech Network PFNDocument8 pagesConcept Note Pakistan FinTech Network PFNAbdulsamadNo ratings yet

- ICT SectorDocument22 pagesICT SectorSazzad HossainNo ratings yet

- Internship ReportDocument43 pagesInternship Reportmohammedhaneef9605No ratings yet

- Harnessing Technology for More Inclusive and Sustainable Finance in Asia and the PacificFrom EverandHarnessing Technology for More Inclusive and Sustainable Finance in Asia and the PacificNo ratings yet

- BoozCo Building Digital Middle East ICT PDFDocument20 pagesBoozCo Building Digital Middle East ICT PDFazmatnawazNo ratings yet

- Business Paper NGDocument4 pagesBusiness Paper NGPeter ChristopherNo ratings yet

- Ann04 PakistanDocument47 pagesAnn04 PakistanHafiz ArslanNo ratings yet

- BPO Sector in India - Opportunities, Threats and ChallengesDocument3 pagesBPO Sector in India - Opportunities, Threats and ChallengesNeeraj AgrawalNo ratings yet

- ForesightAfrica2024 Ch5Document22 pagesForesightAfrica2024 Ch5mowlikaNo ratings yet

- Indian Software IndustryDocument3 pagesIndian Software IndustryRicha TannaNo ratings yet

- IT Industry of PakistanDocument54 pagesIT Industry of PakistanAyaz Bhatti100% (1)

- Iot - Country PaperDocument15 pagesIot - Country PaperavNo ratings yet

- Digitization of Services in Pakistan:: Will The Emerging Trends Pave The Way For A Technology Revolution?Document19 pagesDigitization of Services in Pakistan:: Will The Emerging Trends Pave The Way For A Technology Revolution?Ahmed maljNo ratings yet

- Marketing CollateralDocument18 pagesMarketing CollateralMr DumbNo ratings yet

- OICCI Digital Report 2022 FinalDocument50 pagesOICCI Digital Report 2022 FinalbilalakNo ratings yet

- It Sector in India PDFDocument77 pagesIt Sector in India PDFAnish NairNo ratings yet

- Internship ReportDocument39 pagesInternship ReportAnkith BhansaliNo ratings yet

- The Fintech Industry of BangladeshDocument18 pagesThe Fintech Industry of BangladeshShabab Israk Pias67% (3)

- Fintech Ecosystem of Pakistan: Landscape StudyDocument30 pagesFintech Ecosystem of Pakistan: Landscape StudyMubashar BashirNo ratings yet

- Qatar's National ICT Plan 2015: Advancing The Digital AgendaDocument48 pagesQatar's National ICT Plan 2015: Advancing The Digital AgendaictQATAR100% (1)

- MBA PROJECT ON RECRUITMENT SELECTION RithvikDocument90 pagesMBA PROJECT ON RECRUITMENT SELECTION Rithviksamdetect41No ratings yet

- IJCRT2302233Document8 pagesIJCRT2302233dosah93991No ratings yet

- Motivation ProjectDocument50 pagesMotivation ProjectYoddhri DikshitNo ratings yet

- Roxas City Digital Roadmap 2022Document49 pagesRoxas City Digital Roadmap 2022armagnetoNo ratings yet

- DRC De4a en FinalDocument96 pagesDRC De4a en FinalAngelus Nkhoma juniorNo ratings yet

- Recruitment and SelectionDocument50 pagesRecruitment and SelectionDANUSH KNo ratings yet

- Annualreport2009 10Document132 pagesAnnualreport2009 10Abhishek KumarNo ratings yet

- PLDT Company Portfolio AnalysisDocument13 pagesPLDT Company Portfolio AnalysisMary Bernadette VillaluzNo ratings yet

- ITU Digital Skills ToolkitDocument88 pagesITU Digital Skills ToolkitopintoNo ratings yet

- Technical Services & IT SolutionsDocument6 pagesTechnical Services & IT SolutionsVernon VellozoNo ratings yet

- Working Capital Management of Birlasoft Ltd.Document43 pagesWorking Capital Management of Birlasoft Ltd.riyaNo ratings yet

- IT Term PaperDocument26 pagesIT Term PaperSaheb Jeet SinghNo ratings yet

- Standard Practice - Information System L5Document13 pagesStandard Practice - Information System L5bailiniNo ratings yet

- Digitising Nigeria: SHOKUNBI OpeyemiDocument22 pagesDigitising Nigeria: SHOKUNBI OpeyemiclintNo ratings yet

- Fin Tech or Tech Fin Discovery of An ExtantDocument9 pagesFin Tech or Tech Fin Discovery of An ExtantMaryam IraniNo ratings yet

- UPTU WATCH Development InitiativeDocument15 pagesUPTU WATCH Development InitiativeraghavmtNo ratings yet

- Asia-Pacific Financial Inclusion Forum 2021: Emerging Priorities in the COVID-19 EraFrom EverandAsia-Pacific Financial Inclusion Forum 2021: Emerging Priorities in the COVID-19 EraNo ratings yet

- Unlock Lucrative Opportunities with Modern Technology Skills: A Comprehensive Guide to Earning Big MoneyFrom EverandUnlock Lucrative Opportunities with Modern Technology Skills: A Comprehensive Guide to Earning Big MoneyNo ratings yet

- Note On How To Approach Pom CasesDocument2 pagesNote On How To Approach Pom CasesSukaina SalmanNo ratings yet

- Flavor FusionDocument23 pagesFlavor FusionSukaina SalmanNo ratings yet

- Negotiation Deal ActivityDocument4 pagesNegotiation Deal ActivitySukaina SalmanNo ratings yet

- Structure and Composition A. Senators and MembersDocument6 pagesStructure and Composition A. Senators and MembersSukaina SalmanNo ratings yet

- Exploring The Factors Which Impact The Purchasing Patterns and Creating Positive Word of Mouth Towards Hyundai Elantra'Document13 pagesExploring The Factors Which Impact The Purchasing Patterns and Creating Positive Word of Mouth Towards Hyundai Elantra'Sukaina SalmanNo ratings yet

- Lecture 12 DOES COMPENSATION AFFECT TASK PERFORMANCEDocument18 pagesLecture 12 DOES COMPENSATION AFFECT TASK PERFORMANCESukaina SalmanNo ratings yet

- Psychological Factors in Recruitment: Valeriu DeciuDocument11 pagesPsychological Factors in Recruitment: Valeriu DeciuSukaina SalmanNo ratings yet

- Cost Sheet - PVR ScreenDocument1 pageCost Sheet - PVR ScreensumitNo ratings yet

- Adigrat University Colleg of Bussiness and Economics Department of Accounting and FinaniceDocument53 pagesAdigrat University Colleg of Bussiness and Economics Department of Accounting and Finanicemubarek oumerNo ratings yet

- PDF Feasibility Study On A Hotel Project CompressDocument3 pagesPDF Feasibility Study On A Hotel Project CompressJohn Marlo CeleciosNo ratings yet

- Latest Resume - 1 ManishDocument5 pagesLatest Resume - 1 ManishmanishNo ratings yet

- How To Humanize Your AI ContentDocument12 pagesHow To Humanize Your AI ContentUmm AbdullahNo ratings yet

- Script For Constructive Digital FootprintDocument2 pagesScript For Constructive Digital FootprintloismyrelopezNo ratings yet

- Snake LTD - Class WorkingsDocument2 pagesSnake LTD - Class Workingsmusa morinNo ratings yet

- Service Quote SWQ000441Document1 pageService Quote SWQ000441WALTER KLISSMANNo ratings yet

- Chapter 13: KotlerDocument6 pagesChapter 13: Kotlerankita_shreeram100% (1)

- Ppog50 1Document12 pagesPpog50 1DrogNo ratings yet

- Sharekhan On Britannia Industries 2Document7 pagesSharekhan On Britannia Industries 2Himanshu BisaniNo ratings yet

- MARKETING-"Pricing" Present By: Jasmi Noor Bin SahudinDocument8 pagesMARKETING-"Pricing" Present By: Jasmi Noor Bin SahudinMohd Faisal BaharuddinNo ratings yet

- Heavy Equipment Sales ProposalDocument5 pagesHeavy Equipment Sales Proposalyummy playlist mineNo ratings yet

- BSBHRM506 Student AssessmentDocument81 pagesBSBHRM506 Student Assessmentklm klmNo ratings yet

- MNCAR Notable Transactions Q2Document5 pagesMNCAR Notable Transactions Q2Jason SandquistNo ratings yet

- Assignment #03 PDFDocument7 pagesAssignment #03 PDFAsim QureshiNo ratings yet

- Unit 1 Module 1 Bres 2Document5 pagesUnit 1 Module 1 Bres 2Judhelle Chloe RegardeNo ratings yet

- Kuratko9eCh07 - Pathways To Entrepreneurial Ventures - ClassDocument27 pagesKuratko9eCh07 - Pathways To Entrepreneurial Ventures - Classbristikhan405No ratings yet

- Brand RevitalizationDocument16 pagesBrand RevitalizationAmar PatroNo ratings yet

- Fiber Glass and AlemuniniumDocument43 pagesFiber Glass and AlemuniniumTesfaye Degefa100% (2)

- Strategic ManagementDocument144 pagesStrategic Managementalex abrha100% (1)

- 6251 Manufacturing Process 6251 S 2020Document4 pages6251 Manufacturing Process 6251 S 2020Satyam PatelNo ratings yet

- Mid-Term Exam For Cross Cultural ManagementDocument4 pagesMid-Term Exam For Cross Cultural ManagementNhung Phan Nguyễn HồngNo ratings yet

- Dah Chong Hong Annual Report 12761bDocument208 pagesDah Chong Hong Annual Report 12761bAnantNo ratings yet

- PS - Activity No. 4Document2 pagesPS - Activity No. 4eliakimNo ratings yet

- Product Management - Case Study Progress ReviewDocument7 pagesProduct Management - Case Study Progress Reviewm sriNo ratings yet

- Activity 6 - Elasticity of Demand ApplicationDocument2 pagesActivity 6 - Elasticity of Demand ApplicationJelo DavidNo ratings yet

- Merakisan: Farm SourcingDocument8 pagesMerakisan: Farm SourcingAkash DherangeNo ratings yet