Professional Documents

Culture Documents

Ratios Solved Each Answer

Ratios Solved Each Answer

Uploaded by

natefir719Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios Solved Each Answer

Ratios Solved Each Answer

Uploaded by

natefir719Copyright:

Available Formats

Powered by AI

Bing

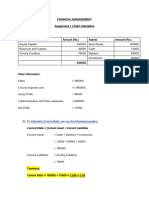

Based on the information you provided, here are the calculated ratios:

1. Current Ratio: Current Assets / Current Liabilities = (15,000 + 40,000 + 35,000 + 13,300 + 20,000 +

1,000) / (27,300 + 15,000) = 2.24

2. Quick Ratio: (Current Assets - Inventory) / Current Liabilities = (15,000 + 35,000 + 13,300 + 20,000 +

1,000 - 40,000) / (27,300 + 15,000) = 1.06

3. Cash Ratio: Cash / Current Liabilities = 1,000 / (27,300 + 15,000) = 0.02

4. Inventory Turnover Ratio: Cost of Goods Sold / Inventory = 470,000 / 40,000 = 11.75 times

5. Debtors Turnover Ratio: Net Credit Sales / Average Accounts Receivable. We don’t have the Net Credit

Sales and Average Accounts Receivable data available from the balance sheet.

6. Total Asset Turnover Ratio: Net Sales / Total Assets = 12,30,000 / (15,000 + 40,000 + 35,000 + 13,300 +

20,000 + 1,000 + 200,000 + 150,000) = 2.03 times

7. Working Capital Turnover Ratio: Net Sales / Working Capital. Working Capital is Current Assets -

Current Liabilities = (15,000 + 40,000 + 35,000 + 13,300 + 20,000 + 1,000) - (27,300 + 15,000) =82,00. So

Working Capital Turnover Ratio =12,00,/82,00=15 times

8. Creditors Turnover Ratio: Credit Purchases / Average Trade Payables. We don’t have the Credit Purchases

and Average Trade Payables data available from the balance sheet.

9. Debt Equity Ratio: Total Debts / Total Equity = Total Liabilities / Total Equity =

(27,00+15,00+200,00+150,00) / (500,00+200,00+92,50)=0.68

10. Total Debt Ratio: Total Debts / Total Assets = Total Liabilities / Total Assets =

(27,00+15,00+200,00+150,)00/(15,00+40,00+35,00+13,00+20,00+1,00+200,00+150,00)=0.68

11. Interest Coverage Ratio: EBIT/ Interest Expenses=703,00/40,00=17.57 times

Please note that for some ratios we need additional information that is not available from the balance sheet you

provided.

You might also like

- Ratio Analysis Questions & AnswersDocument10 pagesRatio Analysis Questions & AnswersNaveen ReddyNo ratings yet

- Financial Numericals RatiosDocument27 pagesFinancial Numericals Ratiosanks0909100% (2)

- Fsa Practical Record ProblemsDocument12 pagesFsa Practical Record ProblemsPriyanka GuptaNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisCrazy electroNo ratings yet

- RATIO Practice QuestionsDocument14 pagesRATIO Practice Questionspranay raj rathoreNo ratings yet

- Accounting RatiosDocument14 pagesAccounting RatiosnadishNo ratings yet

- Unit-5 Mefa.Document12 pagesUnit-5 Mefa.Perumalla AkhilNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-2Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-2Pramod VasudevNo ratings yet

- Ratio Analysis Problems and SolutionsDocument11 pagesRatio Analysis Problems and SolutionsAira Nhaire Cortez MecateNo ratings yet

- Understanding Financial Statements - 2024Document108 pagesUnderstanding Financial Statements - 2024sogutuNo ratings yet

- Null 5Document12 pagesNull 5Pragna SreeNo ratings yet

- FM AssignmentDocument7 pagesFM Assignmentkartika tamara maharaniNo ratings yet

- Corporate FinanceDocument5 pagesCorporate FinanceanusuyagaudNo ratings yet

- Finratioreviewproblemspart 1 Solutionsp 2021Document2 pagesFinratioreviewproblemspart 1 Solutionsp 2021Kevser BozoğluNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Par-1Document5 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Par-1Pramod VasudevNo ratings yet

- Ratios Solved ProblemsDocument8 pagesRatios Solved ProblemsYasser Maamoun50% (2)

- Assignment 1 FMDocument4 pagesAssignment 1 FMgobiNo ratings yet

- Assignment - 1 Ratio AnalysisDocument3 pagesAssignment - 1 Ratio Analysisparth limbachiyaNo ratings yet

- Accounting and Financial Statements 06 Class Notes RBI GRADEB FOUNDATION BATCH 2024Document86 pagesAccounting and Financial Statements 06 Class Notes RBI GRADEB FOUNDATION BATCH 2024Harsh JhaNo ratings yet

- Liquidity and Its TestDocument41 pagesLiquidity and Its TestSiddharth AroraNo ratings yet

- Corporate FinanceDocument9 pagesCorporate FinanceMayur AgarwalNo ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- Ratios & Interpretation 2022Document12 pagesRatios & Interpretation 2022Uma NNo ratings yet

- CBSE Class 12 Accountancy Ratio AnalysisDocument9 pagesCBSE Class 12 Accountancy Ratio AnalysisJyoti SinghNo ratings yet

- 04 Evaluating Operating and Financial Performance PDFDocument31 pages04 Evaluating Operating and Financial Performance PDFMiguel Gonzalez LondoñoNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- Management AccountingDocument7 pagesManagement AccountingNageshwar singhNo ratings yet

- Fsa Solved ProblemsDocument27 pagesFsa Solved ProblemsKumarVelivela100% (1)

- Mca RatiosDocument38 pagesMca RatiosGambhir Commerce Classes0% (1)

- By Team: Wisdom Makers Submit To: Prof. Kirit ChauhanDocument19 pagesBy Team: Wisdom Makers Submit To: Prof. Kirit ChauhanTushar JethavaNo ratings yet

- QRatiosDocument5 pagesQRatiosstriderjebby6512No ratings yet

- Accounting Ratios ExcelDocument5 pagesAccounting Ratios ExcelAYMAN Tolba Abo HAMZANo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- Accounting Ratios PDFDocument22 pagesAccounting Ratios PDFumerceoNo ratings yet

- 2015 - Valuation of SharesDocument31 pages2015 - Valuation of SharesGhanshyam KhandayathNo ratings yet

- Befa Unit - VDocument22 pagesBefa Unit - VMahesh BabuNo ratings yet

- Ratio: AnalysisDocument51 pagesRatio: AnalysisSatwik100% (1)

- XII-ACCOUNT L DeshettyDocument5 pagesXII-ACCOUNT L DeshettyL DeshettyNo ratings yet

- Corporate Finance 22vaCRTlVYrpDocument8 pagesCorporate Finance 22vaCRTlVYrpAdityaSinghNo ratings yet

- Ratio Analysis SRKDocument61 pagesRatio Analysis SRKsrkwin6No ratings yet

- Ratio AnalysisDocument2 pagesRatio Analysisswapnil choubeyNo ratings yet

- Chapter 5Document42 pagesChapter 5Aamrh AmrnNo ratings yet

- Test Your Knowledge - Ratio AnalysisDocument29 pagesTest Your Knowledge - Ratio AnalysisMukta JainNo ratings yet

- Learning Activity 1 - Analysis of Financial StatementsDocument3 pagesLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNo ratings yet

- Corporate FinanceDocument6 pagesCorporate Financejayesh jhaNo ratings yet

- Master of Business Administration Semester - I Subject Code& Name - Mba104 & Financial and Management Accounting AssignmentDocument8 pagesMaster of Business Administration Semester - I Subject Code& Name - Mba104 & Financial and Management Accounting AssignmentÑýì Ñýì ÑâìñgNo ratings yet

- Corporate Finance - Sem 3Document4 pagesCorporate Finance - Sem 3payablesNo ratings yet

- Chapter 1 NotesDocument7 pagesChapter 1 NotesSurelis AcostaNo ratings yet

- Analysis of Financial StatementsDocument17 pagesAnalysis of Financial StatementsRajesh PatilNo ratings yet

- Corporate FinanceDocument10 pagesCorporate Financeyjayai2309No ratings yet

- MobDocument4 pagesMobJun TdhNo ratings yet

- Ratio Analysis: Aditi Shanbhag 2010122 Kezia Fernandes 2010142 Nandini Chaudhury 2010149Document31 pagesRatio Analysis: Aditi Shanbhag 2010122 Kezia Fernandes 2010142 Nandini Chaudhury 2010149Rohit GuptaNo ratings yet

- Business Finance Week 4: Financial Ratios Analysis and Interpretation Background Information For LearnersDocument8 pagesBusiness Finance Week 4: Financial Ratios Analysis and Interpretation Background Information For LearnersCarl Daniel DoromalNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Chapter 6 - Corporate AccountingDocument23 pagesChapter 6 - Corporate Accountingtrieuong09071No ratings yet

- Teeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!From EverandTeeter-Totter Accounting: Your Visual Guide to Understanding Debits and Credits!Rating: 2 out of 5 stars2/5 (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet