Professional Documents

Culture Documents

Current Affair June

Current Affair June

Uploaded by

Tarun JhaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Current Affair June

Current Affair June

Uploaded by

Tarun JhaCopyright:

Available Formats

ECONOMIC DEVELOPMENT

# GS Paper (Prelims) & GS Paper III (Main)

INSOLVENCY AND

would provide a time-bound and cost-effective process

for resolving insolvency and bankruptcy.

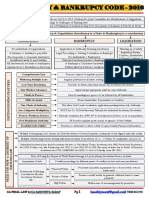

BANKRUPTCY CODE INSTITUTIONAL FRAMEWORK

#Banking #Economy IBBI (Insolvency & Bankruptcy Board of

India) as the regulating authority

National Company Law Tribunal (NCLT) admitted Go First's

voluntary insolvency plea under Section 10 of Insolvency and

Bankruptcy Code (2016). This admission by NCLT gave IBBI (Insolvency &

Information utilities Bankruptcy Board of

temporary moratorium on any legal action by the debtors (credit information

Instituional

Framework India) as the regulating

against the airline company. storing units) authority

INSOLVENCY AND BANKRUPTCY CODE

Exit from business is as integral to ease of doing

business as is an entry. Earlier frameworks for

resolution, such as Debt Recovery Tribunals, Lok Adalats Adjudicatory mechanisms, to facilitate a

timebound insolvency resolution procedure

and even Securitisation and Reconstruction of Financial and liquidation if necessary

Assets and Enforcement of Securities Interest Act

(SARFAESI Act) of 2002, which sought to ease the process PROCESS

of resolution or liquidation failed to do the task The IBC seeks to achieve the stated objectives through a

effectively. It was in this context that the government well-defined process that includes various stages,

decided to frame and enact the Insolvency and including initiation of insolvency, appointment of an

Bankruptcy Code (IBC) of 2016. insolvency professional, resolution plan, and liquidation.

Objective: The IBC, which came into existence in 2016,

aimed to create a single, comprehensive framework that

Initiation Insolvency Resolution Process Liquidation

Minimum amount of In case the application is admitted by the If either the Resolution plan is

default: adjudicating authority, a moratorium is rejected by the CoC or failed to be

₹ 1000 (for Individual) declared on all the legal proceedings approved by it within 330 days, the

against the debtor until the completion process of liquidation kicks in

₹ 1cr (for Companies)

of the CIRP. automatically.

Initiators:

A resolution professional is appointed by The proceeds of liquidation are

Debtor the NCLT who supersede the board of distributed among secured creditors,

Secured & Unsecured directors of the debtor company and unsecured creditors, Govt dues,

Preferential shareholders etc. in the

FOCUS | JUNE 2023 | RAU’S IAS 2

Economic Development

creditors supervises its assets. respective order of priority.

Employees Resolution Professional would help in

Adjudication Authority: chalking out a resolution plan and get it

approved by the committee of creditors

DRT (for individuals)

(CoC) with a majority of 66%.

NCLT (for companies)

PERFORMANCE OF INSOLVENCY & BANKRUPTCY CODE benches to the high number of cases are imbalanced.

The apprehension of losing the business to the Such delays, beyond the prescribed timelines further

resolution applicant in the event of a successful CIRP or leads decay of the value of assets.

the eventual liquidation has instilled a sense of fear in Lack of infrastructure and trained professionals to

the minds of Corporate Debtors. manage the insolvency process. At present, there are

This has resulted in improvement in corporate less than 1000 registered insolvency professionals.

repayment culture of the bank loans and resultant Time limit of 330 days to complete CRIP is proving

reduction in the nonperforming assets (NPAs) of the to be very difficult. For companies having many

banks in the recent years despite the adverse impact of creditors, will have hindrances in the smooth

COVID-19 pandemic on the trade and economy of the functioning of the creditor’s committee.

country. No strict liability of directors for wilfully delaying

Successful examples: /concealing insolvency of company

In Essar Steel resolution, the creditors managed to To address these challenges, the government has taken

recover 92.5% of ₹49,000 crore of debt outstanding. several measures, including increasing the number of

In Bhushan Steel case, 64% of ₹56,022 crore NCLT benches, increasing the number of insolvency

outstanding was retrieved, whereas Binani Cements in professionals, and amending the IBC to address practical

whose case all the ₹6,469 crore outstanding was challenges.

recovered. WAY FORWARD

However, Process of mediation be institutionalised and

Out of the 4,376 cases for which Corporate Insolvency integrated in CIRP Regulations with adequate

Resolution Process (CIRP) had commenced till now, provision to exclude the time taken in the mediation

only 2,653 have been closed, with just 348 (or 13.1%) process within the stipulated timeframe of 180, 270,

of those closed being disposed after approval of a or 330 days.

debt resolution plan. Setting up of additional benches of NCLT and

If we consider the proportion of outstanding credit National Company Law Appellate Tribunal should be

recovered from defaulters through the resolution taken to bring down the pendency.

process, the figure stands at 39.26% even for the Despite certain challenges faced so far, it deserves to be

minority of cases resolved through the CIRP, which is recognised that the IBC has significantly contributed to

not very much higher than the 26% registered for consistent improvement in India’s ranking in the World

cases dealt with under the SARFAESI Act. The Bank’s erstwhile ‘Ease of Doing Business’ over the years.

argument that the IBC would be a game changer is yet Timely modifications of the existing legislation and

to be validated. expanding to new areas (group insolvency, pre-pack

CHALLENGES process for all assets, cross-border insolvency regime)

would facilitate overall improvement in the insolvency

Backlog of cases in NCLT, which has led to delays in

resolution regime of the country.

the resolution process. The proportion of NCLT

FOCUS | JUNE 2023 | RAU’S IAS 3

Economic Development

COMMITTEE TO DEFINE

have more than one firm competing to provide same

good or services.

INFRASTRUCTURE E.g., Electricity transmission lines, Gas pipelines.

2) High Sunk Costs: Sunk cost refers to the money that

#Infrastructure #Economy has already been spent and cannot be recovered

even when the firm goes out of business. Typically,

infrastructure projects incur high sunk costs.

Finance ministry has tasked a high-level committee under

3) Non-tradability of output: Non tradable outputs

Bibek Debroy, chairman of the Economic Advisory Council to

are those which are produced and sold at the same

PM, to undertake a comprehensive assessment of the

location and cannot be transported to other

characteristics or parameters defining infrastructure and its

location. Generally, the infrastructure outputs are

financing framework.

consumed at the place they are produced and are

Infrastructure refers to basic physical and structural

non-tradeable. E.g., Fly over.

facilities, which are essential for an economy to

4) Non-rivalness in consumption: non-rivalness

function.

implies that the cost of providing a good or service

Infrastructure is also known as ‘social overhead

to an additional individual is zero. That means

capital’ and is a key enabler of socio-economic

consumption of an individual does not affect the

enhancement of a region or country.

consumption of others.

Social Overhead Capital refers to certain basic services

5) Price exclusion: Price exclusion means that the

required in the production of virtually all commodities.

enjoyment of benefits is contingent on payment of

In its narrow sense, it includes transportation,

user charges.

communication and power facilities. However, in its

6) Externalities: The benefits of Infrastructure projects

broader sense, facilities such as education, health, law

go beyond the immediate provision of services for

& order etc.

which they are built, which are not directly

There is no universally accepted definition of

measured.

infrastructure.

E.g., A gas pipeline contributes not only provides

National Statistical Commission headed by C.

access to energy but also results in environmental

Rangarajan identified six characteristics of

and social benefits.

infrastructure sector.

Based on the above features, Harmonized Master List of

CHARACTERISTICS OF INFRASTRUCTURE

Infrastructure sub-sectors is updated from time to time.

1) Natural Monopoly: A natural monopoly typically The latest updated list is as follows.

has high fixed costs meaning that it is impractical to

HARMONIZED MASTER LIST OF INFRASTRUCTURE SUB-SECTORS

Category Infrastructure sub-sectors

Roads and bridges

Ports

Shipyards

Inland Waterways

Transport and

Airport

Logistics

Railway track including electrical & signalling system, tunnels, viaducts, bridges

Railway rolling stock along with workshop and associated maintenance facilities

Railway terminal infrastructure including stations and adjoining commercial infrastructure

Urban Public Transport (except rolling stock in case of urban road transport)

FOCUS | JUNE 2023 | RAU’S IAS 4

Economic Development

Logistics Infrastructure

Bulk Material Transportation Pipelines

Electricity Generation

Electricity Transmission

Energy

Electricity Distribution

Oil/Gas/Liquefied Natural Gas (LNG) storage facility

Solid Waste Management

Water treatment plants

Water &

Sewage collection, treatment and disposal system

Sanitation

Irrigation (dams, channels, embankments, etc.)

Storm Water Drainage System

Telecommunication (fixed network)

Communication Telecommunication towers

Telecommunication & Telecom Services

Education Institutions (capital stock)

Sports Infrastructure

Hospitals (capital stock)

Tourism infrastructure

Common infrastructure for Industrial Parks

Social and

Post-harvest storage infrastructure

commercial

Terminal markets

infrastructure

Soil-testing laboratories

Cold Chain

Affordable Housing

Affordable Rental Housing Complex

Exhibition-cum-Convention Centre

NEED TO REDEFINE INFRASTRUCTURE

1. Some critical sectors are missing: Some critical

Central Board of Directors of Reserve Bank of India (RBI)

sectors like Electric Vehicle Charging infrastructure &

recently approved the transfer of ₹87,416 crore as surplus

Digital Public infrastructure are missing from the

to the Union government for the accounting year 2022-23,

current harmonised list.

almost thrice the ₹30,307 crore transferred for the previous

2. Inclusion of a sector in the infrastructure master list fiscal year. The RBI’s board also decided to raise the

leads to many benefits such as easier & cheaper Contingency Risk Buffer to 6% from 5.5% in the preceding

access to finance, land acquisition etc. year.

SOURCE OF EARNINGS FOR RBI

RBI DIVIDEND PAYMENTS Interest on Government securities held

Interests on loans and advances made

TO GOVERNMENT Interest earned on Liquid Adjustment Facility

#Mobilization of resources #RBI operations

FOCUS | JUNE 2023 | RAU’S IAS 5

Economic Development

Interest income from foreign currency assets held form of dividends. Surplus transfer from the Reserve

Earnings from forex swaps Bank is an important component of non-tax revenues to

the central government. However, the quantum of

Seigniorage

dividends shared with the central government depends

Composition of RBI’s balance sheet upon the amount of money provided for risk

provisioning, especially for contingency fund.

Liabilities Assets

There occurred a controversy regarding the excess

Capital Reserves Foreign Currency Assets capital reserves accumulated with the RBI and sharing of

Revaluation Accounts Gold dividend with the central government in 2018. To sort

Deposits of Banks and Investments in domestic out this controversy a committee (Bimal Jalan committee)

Government securities was appointed to review the Economic Capital

Framework. The Committee had prescribed a

Currency notes in Loans & Advances

Contingency Risk Buffer in the range of 5.5% to 6.5% of

circulation

its balance sheet.

Capital reserves: Two important components are

o Contingency fund: The fund is set aside by RBI for

meeting unforeseen contingencies like risks arising GREEN FINANCE

out of monetary policy operations, exchange rate

#Mobilization of resources #Green

risks or systemic risks.

o Asset development fund: This fund is set aside for

financing

investments in subsidiaries and associate

institutions and to meet internal capital

expenditure.

These two funds are considered as Risk provisions With a view to fostering and developing green finance

of the RBI and provisioned from the earnings of ecosystem in the country, RBI has announced a framework

RBI. Such capital required to withstand risks is also for green deposits.

known as Economic Capital. Preliminary estimates conducted for Paris Agreement

Revaluation Accounts: RBI maintains revaluation suggest that at least US$ 2.5 trillion (at 2014-15 prices)

accounts to insulate its assets (Gold, foreign currency, will be required for meeting its climate change actions

Investments in domestic and foreign securities) from between 2015 and 2030 (Government of India, 2015).

prevailing market trends. They include Currency and India’s ambition of generating 175 gigawatts of

Gold Revaluation Account (CGRA), Investment renewable energy by 2022 also entails massive funding.

Revaluation Account (IRA) and Foreign Exchange The financial sector can play a pivotal role in mobilizing

Forward Contracts Valuation Account (FCVA). resources and their allocation in green activities/projects.

Deposits: In its traditional role as a banker to the Green finance is also progressively gaining traction in

government, RBI usually accepts government India. However, there are some challenges to green

deposits, which constitutes a liability for the central financing in India.

bank. The central bank also accepts deposits from CHALLENGES TO GREEN FINANCING:

other banks and other financial institutions. Lack of clear definition: There is no clear-cut

Currency notes in circulation is a liability of the definition for “Green Finance” in India. Various terms

central bank. such as Climate finance, sustainable finance is used

HOW SURPLUS IS SHARED WITH CENTRAL interchangeably with green finance. It led to

GOVERNMENT? misunderstanding among stakeholders and made it

problematic to keep track of capital invested in green

After meeting the risk provisions and other operational

sectors.

expenditures (salaries etc.) from the earnings of RBI, the

surplus is transferred to the central government in the Green Washing: Greenwashing is the practice of

channelling proceeds from green finance towards

FOCUS | JUNE 2023 | RAU’S IAS 6

Economic Development

projects that have negligible environmental benefits to be the most common fixed-income ESG product in

and providing misleading information to the investors India earlier, and now products like green deposits are

and public about the environmental impacts of the gaining significance.

company. Such practises discourage green financing. Corporates looking for inclusion of a sustainability

Failure to internalize externalities: Infrastructure agenda into their treasury activities or those that have

investments in India didn’t efficiently internalise the limited opportunities for investment in

environmental externalities (Positive externalities are environmentally beneficial projects can invest in these

benefits arisen to third parties due to green green deposits.

investments and negative externalities are damages PURPOSE OF THE GREEN DEPOSIT FRAMEWORK

inflicted on third parties due to polluting investments).

To encourage banks to offer green deposits to

This resulted in insufficient capitalization of “green”

customers, protect interest of the depositors, aid

projects and excessive investment in “brown” projects.

customers to achieve their sustainability agenda, address

Maturity mismatches: Generally green projects greenwashing concerns and help augment the flow of

require long-term financing with low returns in the credit to green activities/projects.

initial years. This results in mismatch between long-

Key Guidelines:

term green investment and relatively short-term

interests of investors. Applicability: The provisions of these instructions

shall be applicable to Scheduled commercial banks

Information asymmetry: Lack of information on

(excluding payment banks, RRBs), deposit taking

commercial viability of green technologies and

NBFCs and Housing finance companies (HFCs)

uncertain policies on green investments resulted in

risk aversion by investors in projects of renewable The Banks shall issue green deposits as

energies. cumulative/non-cumulative deposits. On maturity, the

green deposits would be renewed or withdrawn at the

GOVERNMENT’S STEPS

option of the depositor. The green deposits shall be

Sovereign green bonds: denominated in Indian Rupees only.

o Sovereign green bonds are fixed interest-bearing The eligible banks shall put in place a comprehensive

financial instruments issued by any sovereign entity Board-approved policy on green deposits covering all

/ inter-governmental organisation /corporation. The aspects in detail for the issuance and allocation of

proceeds of these bonds are used only for green deposits.

environmentally conscious, climate-resilient

Allocation of funds: The proceeds raised form the

projects.

green deposits shall be allocated to the following

o Reserve Bank of India (RBI) recently auctioned its activities

maiden sovereign green bonds worth ₹8,000 crore

o Renewable energy

under its Sovereign green bond framework.

o Energy efficiency

o There is no cap on foreign investment in these

bonds because these instruments are considered o Clean transportation

as specified securities under the fully accessible o Climate change adaptation

route. o Pollution control

Green deposits: With a view to fostering and o Sustainable management of natural resources and

developing green finance ecosystem in the country waste management

further, RBI has put in place a Framework for

Projects involving nuclear power generation, generating

acceptance of Green Deposits by the banks.

energy from biomass and hydropower plants larger than

WHAT ARE GREEN DEPOSITS? 25MW are excluded from eligible projects.

A green deposit is a fixed-term deposit for investors The banks shall ensure that the funds raised through

looking to invest their surplus cash reserves in green deposits are allocated to the eligible green

environmentally friendly projects. Green bonds used activities/projects.

FOCUS | JUNE 2023 | RAU’S IAS 7

Economic Development

Third party verification: Allocation of funds raised UPI and RuPay debit card transactions. To

through green deposits shall be subject to an compensate for this, the body has sought an incentive

independent Third-Party Verification/Assurance which of Rs 4,000 crore in its representations to the ministry.

shall be done on an annual basis. The third-party Zero MDR is also seen as a hindrance in attracting

assessment would not absolve the bank of its more players to adopt these payment modes and

responsibility regarding the end-use of funds. invest more in the development of the tech

A review report shall be published by the banks infrastructure to handle the huge volumes of

covering the details about amount raised under green transactions.

deposits, amount of funding to the eligible green

PRELIMS PYQ

projects and third-party verification report.

Q) Which one of the following best describes the

term "Merchant Discount Rate" sometimes seen

MERCHANT DISCOUNT in news?

a) The incentive given by a bank to a merchant for

RATE accepting payments through debit cards pertaining to

that bank.

#Payment system #Banking b) The amount paid back by banks to their customers

when they use debit cards for financial transactions

for purchasing goods or services.

Payments Council of India (PCI), an industry body

representing payment fintech in the country, has requested c) The charge to a merchant by a bank for accepting

finance minister to restore Merchant Discount Rate (MDR) payments from his customers through the bank's

for RuPay debit cards, as payment aggregator fintechs debit cards.

continue to lose on revenue lines for processing payments d) The incentive given by the Government to merchants

through the card infrastructure. for promoting digital payments by their customers

MERCHANT DISCOUNT RATE through Point of Sale (PoS) machines and debit cards.

MDR (Merchant Discount Rate) refers to a fee that a

merchant is charged by their issuing bank for

accepting payments from their customers via credit ANGEL TAX

and debit cards. It is also known as Transaction

Discount Rate (TDR). While the card-issuing bank gets

#Taxation #External sector

a share of it, the remaining amount is distributed

between the payment network and point-of-sale

In the latest budget, the government has expanded the

terminal providers.

scope of Angel tax to cover foreign funding. This proposal

Push for Digitalisation:

has created uncertainty among the entrepreneurs.

The Government had mandated that large businesses

Angel tax: Angel tax refers to the income tax (30.6 %)

(With turnover greater than ₹50 crore) provide

imposed on any unlisted company (usually startup

customers with low-cost digital modes of payment

enterprises) in receipt of investment which is above the

and had asked banks to levy zero charges on the

fair market value. Such investment is treated as income

same.

from other sources for the tax purpose. This tax was

The finance minister gave this initiative a further push introduced in 2012 in the form of Section 56 (2) of the

by mandating that no MDR charges will be applicable Income Tax Act to plug money laundering practices.

on digital transactions via the Rupay and UPI

Earlier, angel tax provisions were applicable only for

platforms.

investments received from resident investors. However,

Concerns of Fintechs: Finance Bill 2023 has extended its applicability to non-

Payment aggregator fintechs are claiming that a loss resident investors as well.

of Rs 5,500 crore from no revenue being earned on

FOCUS | JUNE 2023 | RAU’S IAS 8

You might also like

- Ibc ChartsDocument7 pagesIbc Chartspiyush bansalNo ratings yet

- Ey The Insolvency and Bankruptcy Code 2016 An Overview PDFDocument6 pagesEy The Insolvency and Bankruptcy Code 2016 An Overview PDFRaghav DhootNo ratings yet

- IBC, 2016 (1-20 PG)Document20 pagesIBC, 2016 (1-20 PG)C.A Dhwanik ShahNo ratings yet

- Crypto Project Final Report - 1Document49 pagesCrypto Project Final Report - 1Deepak GowdaNo ratings yet

- BT Raport Anual Pe 2017 Asf December 2017Document41 pagesBT Raport Anual Pe 2017 Asf December 2017Amilia MarinNo ratings yet

- Pre-Post IBC-tableDocument4 pagesPre-Post IBC-tableChristina ShajuNo ratings yet

- IBC and BanksDocument23 pagesIBC and BanksAnonymous VFyoCxNo ratings yet

- Assignment 2 Insolvency and Bankruptcy CodeDocument3 pagesAssignment 2 Insolvency and Bankruptcy CodePratyush BaruaNo ratings yet

- Company Law PresentationDocument25 pagesCompany Law PresentationAnu kushwahaNo ratings yet

- IBC Chap 2Document28 pagesIBC Chap 2Chilapalli SaikiranNo ratings yet

- Pre Pack IBCDocument9 pagesPre Pack IBCNARENRSHARMANo ratings yet

- IBC Notes Part 1 by CA Vivek GabaDocument309 pagesIBC Notes Part 1 by CA Vivek Gabamadaanakansha91No ratings yet

- Can Pre-Packaged Insolvency Resolution Process For MSMEs Prove To Be A Game ChangerDocument2 pagesCan Pre-Packaged Insolvency Resolution Process For MSMEs Prove To Be A Game ChangerRomit ChandrakarNo ratings yet

- Demystifying The Insolvency and Bankruptcy CodeDocument23 pagesDemystifying The Insolvency and Bankruptcy Codedevashish taranekarNo ratings yet

- Analyzing The Viability of Pre-Packaged Insolvency Scheme in India - Saransh AwasthiDocument4 pagesAnalyzing The Viability of Pre-Packaged Insolvency Scheme in India - Saransh AwasthiSaransh AwasthiNo ratings yet

- IBC CodeDocument51 pagesIBC Coderajni agarwalNo ratings yet

- IbcDocument62 pagesIbcpankaj vermaNo ratings yet

- Value Addition Notes - Indian EconomyDocument6 pagesValue Addition Notes - Indian Economynikitash1222No ratings yet

- PPIRP (Pre Packaged Insolvency Resolution Process)Document14 pagesPPIRP (Pre Packaged Insolvency Resolution Process)Bhama AbhayNo ratings yet

- Evolving Landscape of Corporate Stress ResolutionDocument68 pagesEvolving Landscape of Corporate Stress ResolutiongowthampkfNo ratings yet

- Corporate Insolvency Resolution Procedure Under Indian Insolvency and Bankruptcy Code, 2016: A Comparative PerspectiveDocument8 pagesCorporate Insolvency Resolution Procedure Under Indian Insolvency and Bankruptcy Code, 2016: A Comparative PerspectiveDeva SharmaNo ratings yet

- IBC - FinalDocument79 pagesIBC - FinalTUSHAR SHERMALENo ratings yet

- Ias 12-12-19 PDFDocument19 pagesIas 12-12-19 PDFsamNo ratings yet

- EY IBC ReportDocument40 pagesEY IBC ReportShushrut KhannaNo ratings yet

- Women's Rights Are Human RightsDocument7 pagesWomen's Rights Are Human Rightstanmaya_purohitNo ratings yet

- Ibc 2016Document74 pagesIbc 2016Roshini Chinnappa100% (1)

- SSRN Id4706605Document13 pagesSSRN Id4706605Hitesh JethwaNo ratings yet

- Writing SampleDocument10 pagesWriting SampleV NITYANAND 1950137No ratings yet

- IBC - Paradigm Shift From 'Debtor-In-Possession' To 'Creditor-In-Control'Document7 pagesIBC - Paradigm Shift From 'Debtor-In-Possession' To 'Creditor-In-Control'Jai SoniNo ratings yet

- EÝ S Report On IBC's Journey and Next Phase of ReformsDocument64 pagesEÝ S Report On IBC's Journey and Next Phase of ReformsamolrNo ratings yet

- Resolution of NPA and Insolvency and Bankruptcy Code, 2016Document7 pagesResolution of NPA and Insolvency and Bankruptcy Code, 2016AkashNo ratings yet

- Insolvency Law FinalDocument19 pagesInsolvency Law FinalISHAN SINGHNo ratings yet

- A Resolve For ResolutionDocument18 pagesA Resolve For ResolutionSuraj KumarNo ratings yet

- Ibc FinalsDocument51 pagesIbc FinalsMALKANI DISHA DEEPAKNo ratings yet

- Concept of Insolvency and Bankruptcy: The IBC, 2016Document82 pagesConcept of Insolvency and Bankruptcy: The IBC, 2016Gautham ReddyNo ratings yet

- Insolvency and Bankruptcy Code of India: The Past, The Present and The FutureDocument11 pagesInsolvency and Bankruptcy Code of India: The Past, The Present and The FutureAdv Gaurav KhondNo ratings yet

- Essar Steel IBC Article - IBA Journal ADocument7 pagesEssar Steel IBC Article - IBA Journal ASakthi NathanNo ratings yet

- Insolvency and Bankruptcy CODE 2016 Regulatory Framework For Distressed M&As Under IBC 2016Document60 pagesInsolvency and Bankruptcy CODE 2016 Regulatory Framework For Distressed M&As Under IBC 2016IIM RohtakNo ratings yet

- The Insolvency and Bankruptcy Code, 2016: Erstwhile Legislative Framework New FrameworkDocument4 pagesThe Insolvency and Bankruptcy Code, 2016: Erstwhile Legislative Framework New FrameworkGyan PrakashNo ratings yet

- CCRA Session 19Document19 pagesCCRA Session 19VISHAL PATILNo ratings yet

- IBC Amendment Bill 2021 UPSC NotesDocument5 pagesIBC Amendment Bill 2021 UPSC NotesAvik PodderNo ratings yet

- Ey The Insolvency and Bankruptcy CodeDocument28 pagesEy The Insolvency and Bankruptcy CodeAnkita AggarwalNo ratings yet

- Report of The Working Group On Tracking Outcomes Under The Insolvency and Bankruptcy Code, 2016Document26 pagesReport of The Working Group On Tracking Outcomes Under The Insolvency and Bankruptcy Code, 2016SagarNo ratings yet

- TLP IBC Briefing Document - Compressed PDFDocument27 pagesTLP IBC Briefing Document - Compressed PDFPratik BakshiNo ratings yet

- COmpany LAw-1Document11 pagesCOmpany LAw-1Suruchi SinghNo ratings yet

- Insolvency and Bankruptcy CodeDocument27 pagesInsolvency and Bankruptcy Codeshivam_2607No ratings yet

- IBCDocument47 pagesIBCAmbuj JainNo ratings yet

- Insolvency and Bankruptcy Code (Amendment Bill), 2021: Why in NewsDocument4 pagesInsolvency and Bankruptcy Code (Amendment Bill), 2021: Why in NewsMehak KaushikkNo ratings yet

- Ibc, 2016Document24 pagesIbc, 2016Ekta ChaudharyNo ratings yet

- Future of Indian Banking The Road Ahead 17 23Document7 pagesFuture of Indian Banking The Road Ahead 17 23kamaiiiNo ratings yet

- Pre-Pack Insolvency Resolution Process: A Critical AnalysisDocument20 pagesPre-Pack Insolvency Resolution Process: A Critical AnalysisShivani SrivastavaNo ratings yet

- Article On Debt Recovery Tribunal - FinalDocument6 pagesArticle On Debt Recovery Tribunal - Finalvasantharao venkataraoNo ratings yet

- Authorities and Enforcement Mechanism in IBC 2016Document16 pagesAuthorities and Enforcement Mechanism in IBC 2016SNEHA SOLANKI0% (1)

- 72236cajournal Dec2022 3Document1 page72236cajournal Dec2022 3SUBHASISH AGRAWALNo ratings yet

- ICMA 30 MarchDocument50 pagesICMA 30 MarchNusrat ShatyNo ratings yet

- CFD - Financial - Distress Bankruptcy Process FinalDocument14 pagesCFD - Financial - Distress Bankruptcy Process Finalsuparshva99iimNo ratings yet

- RBI Governor On IBCDocument15 pagesRBI Governor On IBCyashs-pgdm-2022-24No ratings yet

- Essay 2019Document10 pagesEssay 2019Tushar KumarNo ratings yet

- Project ReportDocument31 pagesProject ReportDiksha ChhabraNo ratings yet

- THE IBC, 2016 SymbiosisDocument35 pagesTHE IBC, 2016 SymbiosisNavya TomerNo ratings yet

- Insolveny and Bankruptcy CodeDocument4 pagesInsolveny and Bankruptcy CodeSING ALONGNo ratings yet

- Bank Account StatementDocument1 pageBank Account Statement739589asdalkom.liveNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Module 4 - 7 - Different Ways of Calculating WACCDocument10 pagesModule 4 - 7 - Different Ways of Calculating WACCBaher WilliamNo ratings yet

- Regional Stock ExchangeDocument26 pagesRegional Stock ExchangeChandrika DasNo ratings yet

- New-Bank DAO TemplateDocument4 pagesNew-Bank DAO TemplateHarish MylatNo ratings yet

- Final ProposalDocument6 pagesFinal ProposalSanam_Sam_273780% (10)

- Redemption OF Debentures: After Studying This Unit, You Will Be Able ToDocument36 pagesRedemption OF Debentures: After Studying This Unit, You Will Be Able ToAkansha GuptaNo ratings yet

- Chapter 1 - International Financial Markets & MNCsDocument97 pagesChapter 1 - International Financial Markets & MNCsDung VươngNo ratings yet

- 7 Secrets of Eternal WealthDocument52 pages7 Secrets of Eternal WealthdhruvNo ratings yet

- Medical Repricing 95925429Document10 pagesMedical Repricing 95925429Jason MaldonadoNo ratings yet

- FbsDocument10 pagesFbsPrince Matthew NatanawanNo ratings yet

- Sma CertificateDocument2 pagesSma CertificateAnil MishraNo ratings yet

- TylerBD 2017 TVMCaseStudy MainDocDocument21 pagesTylerBD 2017 TVMCaseStudy MainDocAndro HutabaratNo ratings yet

- Class XII Acc PB HC Mock 2021-22Document15 pagesClass XII Acc PB HC Mock 2021-22Satinder SandhuNo ratings yet

- 2 - International Parity ConditionsDocument116 pages2 - International Parity ConditionsMUKESH KUMARNo ratings yet

- Foreign Exchange 111Document10 pagesForeign Exchange 111CHRISTIAN PAUL ALPECHENo ratings yet

- Reference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixDocument2 pagesReference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixMie CuarteroNo ratings yet

- BD5 SM12Document10 pagesBD5 SM12didiajaNo ratings yet

- Acc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291Document201 pagesAcc 291 Acc 291 Acc 291 Acc 291 Acc 291 Acc 291290acc100% (2)

- Iceland Foods RecommendationDocument2 pagesIceland Foods Recommendationccohen6410No ratings yet

- Financial Management Research Paper Financial Ratios of BritanniaDocument15 pagesFinancial Management Research Paper Financial Ratios of BritanniaShaik Noor Mohammed Ali Jinnah 19DBLAW036No ratings yet

- Project Allotment SheetDocument20 pagesProject Allotment SheetRoushan RajNo ratings yet

- ACCTG 221 Final Exam Part 1Document6 pagesACCTG 221 Final Exam Part 1Get BurnNo ratings yet

- Monetary Policy and Central Banking - Finance 7 SyllabusDocument9 pagesMonetary Policy and Central Banking - Finance 7 SyllabusMarjon DimafilisNo ratings yet

- AmericanExpressCompany 10K 20120224Document306 pagesAmericanExpressCompany 10K 20120224technoxplorer100% (1)

- Tybms Sem5 RM Nov19Document2 pagesTybms Sem5 RM Nov19Kritika SinghNo ratings yet

- FF Full Eng PDFDocument146 pagesFF Full Eng PDFAnonymous YgBIdKxvNo ratings yet

- Gisela Huyssen vs. Atty. Fred L. GutierrezDocument5 pagesGisela Huyssen vs. Atty. Fred L. GutierrezAdhara CelerianNo ratings yet