Professional Documents

Culture Documents

Vol 2 No. 29 October 3, 2011

Vol 2 No. 29 October 3, 2011

Uploaded by

twinkjOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vol 2 No. 29 October 3, 2011

Vol 2 No. 29 October 3, 2011

Uploaded by

twinkjCopyright:

Available Formats

Vol 2 No.

29 October 3, 2011

developments that matter in financial markets

Global Currency Trading Soars Amidst Crisis

When economic integration progresses, interdependence among countries becomes stronger, which, in turn, implies more potential for spillovers. Viviane Reding, Vice President, European Commission

Introduction

MARKETS Equities Commodities Currencies Debt Banking Insurance Financial Services PRACTICE Executive Education Certification Consultancy Research Advisory Services FORUMS The Strategy Dialogue Financial Markets Forum fiNET Commodities Camp REPORTS Financial Markets Review Market Briefings SPL PROGRAMMES Markets in Motion Global Financial Markets Practice Winter School NATIONAL SIMULATION LAB w w w. f t k m c . c o m

The tensions in the financial markets, which became apparent in early August 2011, have intensified sharply in September 2011 on account of concerns over the downgrade of the US by Standard and Poors, euro zone financial crisis, currency intervention from Japan and Switzerland, etc. These factors have contributed to the volatility in global financial markets. However, currency markets have acted as the pressure valve for the global financial system with trading volumes surging to fresh highs worldwide.

Declining Carry Trade

Record Trading Volumes

ICAP, the worlds premier interdealer broker by trading volumes, reported that the total average daily spot FX volumes on the EBS platform were $186.9 billion in September 2011, an increase of 46 percent year on year. Similarly, NYSE: FXCM, a global online provider of foreign exchange trading, saw the retail customer trading volume touching $363 billion in August 2011, 17 percent higher than July 2011 and 36 percent higher than August 2010, and institutional customer trading volume reaching $120 billion in August 2011, 100 percent higher than July and 96 percent higher than August 2010. Trading volumes surged for exchange-traded foreign currency futures also, with the CME Group reporting that on an average 991,000 foreign exchange contracts changed hands during August 2011, up 11 percent from July and 21 percent higher than the same period last year.

Carry trades (i.e., borrowing funds in a currency with low interest rates and investing the proceeds in currencies that offer higher returns to collect the carrybetween the two rates) have been dealt a blow by the sharp volatility in the currency rates. Popular funding currenciesthe borrowing and selling leg of the trade have usually been the Japanese yen, Swiss franc, and the US dollar. Though the exact size of the market is unknown, the estimates put its size in outstanding deals at more than US$ 1,000 billion. Carry trade is popular with hedge funds and other large institutional investors. Carry trade has now become unattractive in view of sharp volatility in the currency market. However, carry trades are bound to return when the market calms down.

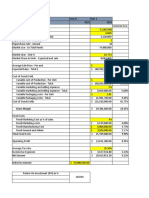

Top 10 Currency Traders (% of Overall Volume, May 2011)

Rank 1 2 3 4 5 6 7 8 9 10 Name Deutsche Bank Barclays Capital UBS AG Citi JPMorgan HSBC Royal Bank of Scotland Credit Suisse Goldman Sachs Morgan Stanley Market Share (in %) 15.64 10.75 10.59 8.88 6.43 6.26 6.20 4.80 4.13 3.64

Drivers of Volatility

Forthcoming Programme

The strains in the debt markets of the US and Europe have emerged as important drivers of volatility. With sluggish growth and very low interest rates in the core major economies, currencies such as the dollar, euro, pound-sterling and yen remain unattractive. Moreover, low interest rates in the US have compressed the yield differential between the dollar and low- yielding currencies such as the Japanese yen. Debt deleveraging in the major economies suggests many emerging currencies will continue to enjoy a growth and yield advantage, which should translate into gains for currencies in emerging economies.

Source: Euromoney FX survey 2011

High-Frequency Trading

INTERNATIONAL PROGRAMME ON COMMODITY MARKETS

October 11-15, 2011 Mumbai, India

For details, contact: Ms Maggie Mobile: +91 9930268329 Email: maggie.rodrigues@ftkmc.com Ms Meena Mobile: +91 9930267956 Email: meena.kulkarni@ftkmc.com

Market Volatility

25 21 17 13 9 5 25 5 Major currency volatility, left scale VIX equity volatility, right scale 85 65 45

Source: www.wellsfargo.com

2008

2009

2010

2011

High-frequency trading (HFT) has increased its presence in the foreign exchange (FX) market in recent months. This development is one aspect of a broader trend facilitated by the wider use of electronic trading in foreign exchange, both in the broker-dealer market and at the customer level. HFT in FX operates on high volume but small order size, low margin, low latency (with trade execution times measured in milliseconds), and short risk-holding period (typically well under five seconds). As such, it occurs mainly in the most liquid currencies. HFT participants in FX tend to be concentrated in three cities: Chicago, New York, and London. Outside these three centres, there are currently very few HFT firms. HFT firms conduct their FX activities mainly on inter-dealer electronic broking platforms such as EBS and Thomson Reuters (London-based companies) and multi-bank electronic communication networks such as Currenex, Hotspot FX, and FXall (US-based companies). They are also active on the Chicago Mercantile Exchange (CME) for trades involving FX futures. Contributed by M Ravindran & Pinky Jain

October 17-21, 2011 Mumbai, India

Published by Financial Technologies Knowledge Management Company Limited Exchange Square, 1st Floor, Suren Road, Chakala, Andheri (East), Mumbai - 400093. India. Tel: +91 22 6731 8842 Fax: +91 22 6726 9541 Email: marketsinmotion@ftkmc.com Website : www.ftkmc.com

Upcoming Programme:

For details, contact: Ms Maggie; Mobile: +91 9930268329 Ms Meena; Mobile: +91 9930267956

INTERNATIONAL PROGRAMME ON EXCHANGE OPERATIONS & ADMINISTRATION

Disclaimer: This Newsletter is prepared to enhance awareness and for information only. The information is taken from sources believed to be reliable but is not guaranteed by FTKMC as to its accuracy. The contents are not meant for taking decisions of any strategic nature or for investments, for which FTKMC will not be responsible.

You might also like

- The Foreign Exchange Matrix: A new framework for understanding currency movementsFrom EverandThe Foreign Exchange Matrix: A new framework for understanding currency movementsRating: 3.5 out of 5 stars3.5/5 (3)

- Net Present Value Sample Questions 2Document5 pagesNet Present Value Sample Questions 2Prashant Mathur50% (2)

- Foreign Exchange Market Raw MaterialDocument6 pagesForeign Exchange Market Raw MaterialVidhi Vora100% (1)

- FX Trading: A Guide to Trading Foreign ExchangeFrom EverandFX Trading: A Guide to Trading Foreign ExchangeRating: 5 out of 5 stars5/5 (1)

- GBF Unit - IVDocument50 pagesGBF Unit - IVKaliyapersrinivasanNo ratings yet

- CF Final Project 7Document22 pagesCF Final Project 7Khurram SattarNo ratings yet

- Forex (Foreign Exchange Market)Document22 pagesForex (Foreign Exchange Market)M.Zuhair Altaf50% (4)

- Foreign Exchange Market Dynamics, Participants and Transaction MethodsDocument33 pagesForeign Exchange Market Dynamics, Participants and Transaction MethodsKajal ChaudharyNo ratings yet

- Introduction To Foreign ExchangeDocument80 pagesIntroduction To Foreign ExchangeGlobalStrategyNo ratings yet

- Fera Vs FemaDocument60 pagesFera Vs Femamehulshahmbs100% (2)

- Foreign Exchange: Trading Game Is Less PredictableDocument5 pagesForeign Exchange: Trading Game Is Less PredictableRijek Iz KamenaNo ratings yet

- Project Report On Currency MarketDocument54 pagesProject Report On Currency MarketMansi KotakNo ratings yet

- Foreign Exchange MarketDocument44 pagesForeign Exchange Marketnitishaag100% (1)

- Chapter 7Document61 pagesChapter 7souravkiller4uNo ratings yet

- A Study On Technical Analysis On Forex Market With Reference To Star Fing PVT LTD, ChennaiDocument23 pagesA Study On Technical Analysis On Forex Market With Reference To Star Fing PVT LTD, ChennaikamaleshNo ratings yet

- Cfo Rex Basics and The EuroDocument4 pagesCfo Rex Basics and The EuroRickyWriterNo ratings yet

- Eco Project - 1457022686101Document37 pagesEco Project - 1457022686101Prathamesh GawadeNo ratings yet

- Foreign Exchange MarketDocument3 pagesForeign Exchange MarketJayesh BhandarkarNo ratings yet

- Trends in Global Stock Markets: Essentials of InvestingDocument1 pageTrends in Global Stock Markets: Essentials of Investingmahato28No ratings yet

- Forex Futures PDFDocument6 pagesForex Futures PDFAbfur DuraesaNo ratings yet

- Foreign ExchangeDocument29 pagesForeign ExchangeOmarNo ratings yet

- Foreign ExchangeDocument30 pagesForeign ExchangeAmy SorensenNo ratings yet

- Foreign Ex MKTDocument31 pagesForeign Ex MKTdarla85nagarajuNo ratings yet

- Foreign Exchange Market StructureDocument3 pagesForeign Exchange Market StructureSayon DasNo ratings yet

- FT Special Report Currncy Mar'11Document5 pagesFT Special Report Currncy Mar'11jian101No ratings yet

- Ibt Rev PDFDocument4 pagesIbt Rev PDFRose Vanessa BurceNo ratings yet

- Forex Magnates Q1 2014 Quarterly Industry ReportDocument18 pagesForex Magnates Q1 2014 Quarterly Industry ReportRon FinbergNo ratings yet

- Foreign Exchange Market: Presented By:-Parth Shingala Rohan Dhone Sandeep Singh Saikat Datta Ila JoshiDocument13 pagesForeign Exchange Market: Presented By:-Parth Shingala Rohan Dhone Sandeep Singh Saikat Datta Ila JoshiParth ShingalaNo ratings yet

- Chapter II. The Foreign Exchange MarketDocument19 pagesChapter II. The Foreign Exchange MarketThùy ThùyNo ratings yet

- The Foreign Exchange MarketDocument51 pagesThe Foreign Exchange Markethussien_economyNo ratings yet

- ForexDocument59 pagesForexMehul MalaviyaNo ratings yet

- Assignment 3 ECON 401Document4 pagesAssignment 3 ECON 401aleena asifNo ratings yet

- The Euro Interest Rate Swap MarketDocument10 pagesThe Euro Interest Rate Swap MarketAnatoni Roby CandraNo ratings yet

- Work 1094Document28 pagesWork 1094Raagwe ThapeloNo ratings yet

- Foreign Exchange Market DissertationDocument7 pagesForeign Exchange Market DissertationBuyCheapPaperUK100% (1)

- FX Counterparty Risk and Trading Activity in Currency Forward and Futures MarketsDocument32 pagesFX Counterparty Risk and Trading Activity in Currency Forward and Futures Marketsdk7mx97dvnNo ratings yet

- Seminar - 1: Svs Institute of Management StudiesDocument11 pagesSeminar - 1: Svs Institute of Management StudiesBini PooramNo ratings yet

- T (1) - Sunil SinghDocument97 pagesT (1) - Sunil Singhnani643No ratings yet

- Project Report On Currency MarketDocument54 pagesProject Report On Currency MarketSurbhi Aery63% (8)

- Eco Assignment FinalDocument44 pagesEco Assignment Finalenpreet kaur aroraNo ratings yet

- 2-The Markets For Foreign Exchange RatesDocument8 pages2-The Markets For Foreign Exchange Ratesyaseenjaved466No ratings yet

- Risk 0910 TullettDocument27 pagesRisk 0910 TullettJason PetroneNo ratings yet

- Currency Trader 0111 PR 07Document33 pagesCurrency Trader 0111 PR 07dilbert618No ratings yet

- Basic Concepts For The Currencies MarketDocument11 pagesBasic Concepts For The Currencies MarketRahul DevNo ratings yet

- The Carry Trade and FundamentalsDocument36 pagesThe Carry Trade and FundamentalsJean-Jacques RousseauNo ratings yet

- International Business FinanceDocument17 pagesInternational Business FinanceChirag Jain100% (1)

- Forex MarketDocument33 pagesForex MarketRiad TalukderNo ratings yet

- Print EcoDocument1 pagePrint EcoishanhbmehtaNo ratings yet

- International Markets TypesDocument9 pagesInternational Markets TypesHaji Saif UllahNo ratings yet

- Unit 5Document27 pagesUnit 5123kasaragod123No ratings yet

- Introduction of International Financial MarketsDocument37 pagesIntroduction of International Financial MarketsAngel JhamnaniNo ratings yet

- Class 3233Document18 pagesClass 3233Lal Malsawma MalzNo ratings yet

- Foreign Exchange MarketDocument24 pagesForeign Exchange MarketGaurav DhallNo ratings yet

- BIS On ForexDocument74 pagesBIS On ForexTony JoshNo ratings yet

- Forex Made Simple: A Beginner's Guide to Foreign Exchange SuccessFrom EverandForex Made Simple: A Beginner's Guide to Foreign Exchange SuccessNo ratings yet

- Asset Class Mastery: Maximize Profits From Forex, Futures, and CryptosFrom EverandAsset Class Mastery: Maximize Profits From Forex, Futures, and CryptosNo ratings yet

- Schematic - Preamp With Tone Control - 2023-09-23Document1 pageSchematic - Preamp With Tone Control - 2023-09-23Mario RazielNo ratings yet

- Ferdinand Emmanuel Edralin Marcos Sr. Was The Philippines' 10th President. HeDocument2 pagesFerdinand Emmanuel Edralin Marcos Sr. Was The Philippines' 10th President. HeShekinah0% (1)

- Income Tax II Illustration Clubbing of Incomes PDFDocument1 pageIncome Tax II Illustration Clubbing of Incomes PDFSubramanian SenthilNo ratings yet

- Partnership Review Mats Lpu No AnswerDocument13 pagesPartnership Review Mats Lpu No Answerjames VillanuevaNo ratings yet

- Inv Im23032024ob6291 20240331204950289Document2 pagesInv Im23032024ob6291 20240331204950289sivapolesNo ratings yet

- Unit-1 Concept and Types of Consumer: Importance (Significance) of ConsumersDocument45 pagesUnit-1 Concept and Types of Consumer: Importance (Significance) of ConsumersGarimaNo ratings yet

- FAC2602 Assignment 2 (S2) Suggested SolutionsDocument18 pagesFAC2602 Assignment 2 (S2) Suggested SolutionsBantse DubeNo ratings yet

- IELTS Writing Task 2 - 2nd HomeworkDocument3 pagesIELTS Writing Task 2 - 2nd HomeworkYusufhartomiNo ratings yet

- Cimigo Vietnam Consumer Trends 2021 5.PDF 5Document39 pagesCimigo Vietnam Consumer Trends 2021 5.PDF 5Ngọc DiệuNo ratings yet

- Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra MalvankarDocument3 pagesAnnual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra MalvankarKamalalakshmi NarayananNo ratings yet

- Shiv Shakti Herbal Center: Retail InvoiceDocument1 pageShiv Shakti Herbal Center: Retail InvoiceSandhya SrivastavaNo ratings yet

- Cao Bá Quát - Q OAIDocument5 pagesCao Bá Quát - Q OAIMinh Anh NguyenNo ratings yet

- BBG DWG PTT 129 01 PDFDocument1 pageBBG DWG PTT 129 01 PDFRezky Dian SunartoNo ratings yet

- Chapter 1 TaxationDocument8 pagesChapter 1 TaxationSeid KassawNo ratings yet

- Vivid Money SA Retail Fees and Withdrawal RightsDocument4 pagesVivid Money SA Retail Fees and Withdrawal RightsdavidoffsmiNo ratings yet

- Notice No 4Document1 pageNotice No 4nitish JhaNo ratings yet

- 1.before Adam SmithDocument31 pages1.before Adam SmithAaadddNo ratings yet

- 2 Assingment of ASCDocument4 pages2 Assingment of ASCIram Zulfiqar Ali FastNUNo ratings yet

- C2Document17 pagesC2Joseph Lee100% (1)

- PT Cahaya Xii Akl SMK KartiniDocument40 pagesPT Cahaya Xii Akl SMK Kartiniwahyudi yudiNo ratings yet

- Departmental Accounting IllustrationsDocument13 pagesDepartmental Accounting IllustrationsHarsha BabyNo ratings yet

- Learning Journey Dates: Year 7 Upto Year 10Document5 pagesLearning Journey Dates: Year 7 Upto Year 10Kogilan A/L Bama DavenNo ratings yet

- BPP QuestionsDocument11 pagesBPP Questionsmuhammaduzair00788No ratings yet

- Solana NFT 101Document22 pagesSolana NFT 101Tymur TkachenkoNo ratings yet

- Dashboard Ence602Document314 pagesDashboard Ence602api-707678106No ratings yet

- Iron & Steel Industry in IndiaDocument18 pagesIron & Steel Industry in IndiaRahul KolekarNo ratings yet

- Consolidated Balance Sheet As at March 31, 2021Document4 pagesConsolidated Balance Sheet As at March 31, 2021shreyansh naharNo ratings yet

- Gross MarginDocument2 pagesGross MarginEDxColdBloodedNo ratings yet

- Eva's Bakery Client List 27.06.23.xlsx - Sheet1Document6 pagesEva's Bakery Client List 27.06.23.xlsx - Sheet1russelstalkerNo ratings yet