Professional Documents

Culture Documents

Solution

Solution

Uploaded by

Luffy Monkey0 ratings0% found this document useful (0 votes)

3 views2 pages1) Stockman Co. began 2010 with three jobs in process totaling $1,058,320. During the year, the company purchased materials, incurred labor costs, and applied overhead to jobs.

2) Jobs 247 through 255 were completed and delivered, with revenue of $2,264,774 received from customers.

3) The ending balances for the two remaining jobs in process total $589,600.

4) The cost of jobs sold is $1,772,904 after adjusting for $3,280 of underapplied overhead.

Original Description:

Solving

Original Title

8420480

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) Stockman Co. began 2010 with three jobs in process totaling $1,058,320. During the year, the company purchased materials, incurred labor costs, and applied overhead to jobs.

2) Jobs 247 through 255 were completed and delivered, with revenue of $2,264,774 received from customers.

3) The ending balances for the two remaining jobs in process total $589,600.

4) The cost of jobs sold is $1,772,904 after adjusting for $3,280 of underapplied overhead.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesSolution

Solution

Uploaded by

Luffy Monkey1) Stockman Co. began 2010 with three jobs in process totaling $1,058,320. During the year, the company purchased materials, incurred labor costs, and applied overhead to jobs.

2) Jobs 247 through 255 were completed and delivered, with revenue of $2,264,774 received from customers.

3) The ending balances for the two remaining jobs in process total $589,600.

4) The cost of jobs sold is $1,772,904 after adjusting for $3,280 of underapplied overhead.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

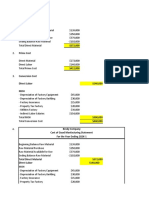

38. LO.4 (Journal entries; cost accumulation) Stockman Co.

began 2010 with three

jobs in process:

TYPE OF COST

Job No. Direct Material Direct Labor Overhead Total

247 $ 77,200 $ 91,400 $ 36,560 $ 205,160

251 176,600 209,800 83,920 470,320

253 145,400 169,600 67,840 382,840

Totals $399,200 $470,800 $188,320 $1,058,320

During 2010, the following transactions occurred:

1. Th e fi rm purchased and paid for $542,000 of raw material.

2. Factory payroll records revealed the following:

• Indirect labor incurred was $54,000.

• Direct labor incurred was $602,800 and was associated with the jobs as

follows:

Job No. Direct Labor Cost

247 $ 17,400

251 8,800

253 21,000

254 136,600

255 145,000

256 94,600

257 179,400

3. Material requisition forms issued during the year revealed the following:

• Indirect material issued totaled $76,000.

• Direct material issued totaled $466,400 and was associated with jobs as follows:

Job No. Direct Material Cost

247 $ 12,400

251 6,200

253 16,800

254 105,200

255 119,800

256 72,800

257 133,200

4. Overhead is applied to jobs on the basis of direct labor cost. Management budgeted

overhead of $240,000 and total direct labor cost of $600,000 for 2010. Actual total

factory overhead costs (including indirect labor and indirect material) for the year

totaled $244,400.

5. Jobs #247 through #255 were completed and delivered to customers, who paid for

the goods in cash. Th e revenue on these jobs was $2,264,774.

a. Journalize all preceding events.

b. Determine the ending balances for the jobs still in process.

c. Determine the cost of jobs sold, adjusted for underapplied or overapplied

overhead.

Solution:

a. Raw Material Inventory 542,000

Cash 542,000

Manufacturing Overhead 54,000

Work in Process Inventory 602,800

Wages/Salaries Payable (or Cash) 656,800

Manufacturing Overhead 76,000

Work in Process Inventory 466,400

Raw Material Inventory 542,400

Manufacturing Overhead 114,400

Various accounts 114,400

To record OH costs other than indirect labor and indirect

materials ($244,400 - $54,000 - $76,000)

Work in Process Inventory 241,120

Manufacturing Overhead 241,120

To apply OH at a rate of $.40 per DL$ (Job #247, $6,960;

#251, $3,520; #253, $8,400; #254, $54,640; #355,

$58,000;

#256, $37,840; and #257, $71,760)

Finished Goods Inventory 1,769,624

Work in Process Inventory

1,769,624

(See schedule below.)

Cash (or Accounts Receivable) 2,264,774

Sales 2,264,774

Cost of Goods Sold 1,769,624

Finished Goods Inventory 1,769,624

Schedule of Completed Jobs

Job Direct Material Direct Labor Applied OH Total

247 $ 89,600 $108,800 $ 41,692 $ 240,092

251 182,800 218,600 83,244 484,644

253 162,200 190,600 72,848 425,648

254 105,200 136,600 54,640 296,440

255 119,800 145,000 58,000 322,800

Totals $659,600 $799,600 $310,424 $1,769,624

b. Job Direct Material Direct Labor Applied OH Total

256 $ 72,800 $ 94,600 $ 37,840 $205,240

257 133,200 179,400 71,760 384,360

Totals $206,000 $274,000 $109,600 $589,600

c. Actual overhead $ 244,400

Applied overhead 241,120

Underapplied overhead 3,280

Unadjusted cost of jobs completed 1,769,624

Adjusted cost of jobs completed $1,772,904

You might also like

- Chapter 4. AssignmentDocument13 pagesChapter 4. AssignmentAnne Thea AtienzaNo ratings yet

- Job Costing Case Study ScribDocument3 pagesJob Costing Case Study ScribWilliam Y. OspinaNo ratings yet

- Bunnell Corporation Is A Manufacturer That Uses Job-Order Costing.Document6 pagesBunnell Corporation Is A Manufacturer That Uses Job-Order Costing.laale dijaanNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Job Order Pure ProblemsDocument19 pagesJob Order Pure ProblemsolafedNo ratings yet

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Reviewer Cost PrelimsDocument10 pagesReviewer Cost PrelimsClarence John G. BelzaNo ratings yet

- 6 - Browning MFTG Company Case SolutionDocument12 pages6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- Chapter 01Document13 pagesChapter 01Asim NazirNo ratings yet

- Chapter 5 - Solutions To Cost Accounting Book (Raiborn and Kinney, 2 Phil Edition)Document22 pagesChapter 5 - Solutions To Cost Accounting Book (Raiborn and Kinney, 2 Phil Edition)Mark Johnrei GandiaNo ratings yet

- Date Account Titles and Explanation Debit Credit Aug. 1 MaterialsDocument25 pagesDate Account Titles and Explanation Debit Credit Aug. 1 MaterialsRose Ann GarciaNo ratings yet

- CA CHP 7 MC Questions ShareDocument18 pagesCA CHP 7 MC Questions SharedangminhphuonggNo ratings yet

- Go - Chapter 5Document3 pagesGo - Chapter 5christian BagoodNo ratings yet

- Assignment Chapter 5Document3 pagesAssignment Chapter 5christian BagoodNo ratings yet

- 39 and 37Document5 pages39 and 37Vincent Luigil AlceraNo ratings yet

- Answer 20052016 Job-Order CostingDocument3 pagesAnswer 20052016 Job-Order CostingVũ Thu HoàiNo ratings yet

- Intro To SCM Cost Concepts Variable Costing QuizDocument58 pagesIntro To SCM Cost Concepts Variable Costing QuizRiza Zaira Esteban MateoNo ratings yet

- Costing and PricingDocument7 pagesCosting and PricingsiriusNo ratings yet

- Total Project CostDocument17 pagesTotal Project Costfrescy mosterNo ratings yet

- Assignment Cost AcctgDocument2 pagesAssignment Cost AcctgSheila Mae L. BordomeoNo ratings yet

- Toaz - Info Chapter 5 2019 Problem 1 Alexis Company PRDocument3 pagesToaz - Info Chapter 5 2019 Problem 1 Alexis Company PRAngela Ruedas33% (3)

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- Solutions MA Chapter 2 Book Version (Updated)Document7 pagesSolutions MA Chapter 2 Book Version (Updated)achhpilia.muskan.psNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Ca 4Document4 pagesCa 4lerabadolNo ratings yet

- Chapter 5 FS CASSAVA PIEDocument16 pagesChapter 5 FS CASSAVA PIEManto RoderickNo ratings yet

- Solutions-Chapter 2Document5 pagesSolutions-Chapter 2Saurabh SinghNo ratings yet

- Panganiban, Mary Grace S. OMGT 3101Document12 pagesPanganiban, Mary Grace S. OMGT 3101Mary Grace PanganibanNo ratings yet

- Professor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Document3 pagesProfessor Office's Beach Cabana Balance Sheets As of December 31, 2014 and 2013Precious Uminga100% (1)

- Assignment #1Document5 pagesAssignment #1Crizelda BauyonNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Financial Statement Analysis QuestionsDocument4 pagesFinancial Statement Analysis QuestionsRisha OsfordNo ratings yet

- Job Order CostingDocument3 pagesJob Order CostingGayzelle MirandaNo ratings yet

- Exercise No 1 (CGS CGM) - P SDocument11 pagesExercise No 1 (CGS CGM) - P SArun kumarNo ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- Titles Are Automatically Indented When Amount Is Entered. Do Not Indent Manually.)Document3 pagesTitles Are Automatically Indented When Amount Is Entered. Do Not Indent Manually.)music niNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Job Costing 1Document2 pagesJob Costing 1kaji cruzNo ratings yet

- Traditional Costing Vs AB CostingDocument8 pagesTraditional Costing Vs AB CostingWinda WidayantiNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- FS Financial StudyDocument6 pagesFS Financial StudyMarina AbanNo ratings yet

- Chapter 5 AssignmentDocument10 pagesChapter 5 AssignmentJohnray ParanNo ratings yet

- Tugas Managerial AccountinDocument3 pagesTugas Managerial Accountinlaurentinus fikaNo ratings yet

- Special ProjectDocument13 pagesSpecial ProjectKyle Harold BerkenkotterNo ratings yet

- Afar 2612 Job Order CostingDocument25 pagesAfar 2612 Job Order Costingcorpnet globalNo ratings yet

- Praktikum - Cost - Jordan Junior - 1832148Document24 pagesPraktikum - Cost - Jordan Junior - 1832148Jordan JuniorNo ratings yet

- PR AML 7 Feb 2021Document10 pagesPR AML 7 Feb 2021Indahna SulfaNo ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Assignment Lesson 3 ExerciseDocument9 pagesAssignment Lesson 3 ExerciseRica Joy BejaNo ratings yet

- Zartiga PrEDocument4 pagesZartiga PrEFritzie Ann ZartigaNo ratings yet

- Job Order Pure ProblemsDocument19 pagesJob Order Pure Problemsakber khan khanNo ratings yet

- Sadecki Corporation Balance Sheets Dec-31 Assets 2014 2013Document9 pagesSadecki Corporation Balance Sheets Dec-31 Assets 2014 2013mohitgaba19No ratings yet

- BaenDocument8 pagesBaenBrian ChoiNo ratings yet

- Job Item Direct Materials Direct Labor Factory Overhead TotalDocument3 pagesJob Item Direct Materials Direct Labor Factory Overhead Totalmusic niNo ratings yet

- Test 1 & Test 2 - MADocument8 pagesTest 1 & Test 2 - MAChi Nguyễn Thị KimNo ratings yet

- Problem 18-29 (Weighted-Average Method) : Quantity ScheduleDocument3 pagesProblem 18-29 (Weighted-Average Method) : Quantity ScheduleVon Andrei MedinaNo ratings yet

- Dec 31, 2014 ($) Dec 31, 2013 ($) AssetsDocument2 pagesDec 31, 2014 ($) Dec 31, 2013 ($) AssetsRegita Ayu ParamithaNo ratings yet

- UntitledDocument6 pagesUntitledJomar PenaNo ratings yet

- Updated Financial TablesDocument11 pagesUpdated Financial TablesFrescy MosterNo ratings yet

- Chapter 2 Sol 31-39Document8 pagesChapter 2 Sol 31-39Something ChicNo ratings yet

- P2Document27 pagesP2Trois90% (10)

- Report of Checks Issued 2023Document1 pageReport of Checks Issued 2023Jahzeel RubioNo ratings yet

- Investor Perseption Towards Tradingg in DerivativesDocument13 pagesInvestor Perseption Towards Tradingg in DerivativesBEPF 13 Parth LanghnejaNo ratings yet

- Form PDF 197504840210823Document9 pagesForm PDF 197504840210823jassramgarhia2812No ratings yet

- Service TaxDocument15 pagesService TaxMonu TulsyanNo ratings yet

- Atmiya Vidya Mandir: Current Student (2022 - 23)Document1 pageAtmiya Vidya Mandir: Current Student (2022 - 23)Kirtan J. PatelNo ratings yet

- Optimal Capital StructureDocument13 pagesOptimal Capital StructureScarlet SalongaNo ratings yet

- Buildingwealth PDFDocument39 pagesBuildingwealth PDFRamon de la CruzNo ratings yet

- Seek Overview 2008-2016 - Inflation-Adjusted VersionDocument4 pagesSeek Overview 2008-2016 - Inflation-Adjusted VersionBecca SchimmelNo ratings yet

- 10 - Chapter 3Document24 pages10 - Chapter 3Eloysa CarpoNo ratings yet

- CRM RBCDocument14 pagesCRM RBCKarthik ArumughamNo ratings yet

- Sarbanes-Oxley Act, Internal Control, and Management AccountingDocument2 pagesSarbanes-Oxley Act, Internal Control, and Management Accountingalexandro_novora6396No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- Cash Accounting and Cash Flow Planning With SAP Liquidity PlannerDocument17 pagesCash Accounting and Cash Flow Planning With SAP Liquidity PlannerLTSSILVANo ratings yet

- Simafore Whitepaper Customer Lifetime Value Modeling PDFDocument13 pagesSimafore Whitepaper Customer Lifetime Value Modeling PDFsafj,ndsaNo ratings yet

- FDNACCT - Quiz #1 - Set B - Answer KeyDocument4 pagesFDNACCT - Quiz #1 - Set B - Answer KeyIchi HasukiNo ratings yet

- Mechanics of Futures MarketDocument11 pagesMechanics of Futures MarketSUMIT JANKARNo ratings yet

- Closed Form Valuation of American Options by Bjerksund and StenslandDocument19 pagesClosed Form Valuation of American Options by Bjerksund and StenslandJonathan_Gonzale_289No ratings yet

- Trad Ic Mock Exam Answer KeyDocument15 pagesTrad Ic Mock Exam Answer KeyGener ApolinarioNo ratings yet

- Lec12 - Ratio AnalysisDocument85 pagesLec12 - Ratio AnalysisDylan Rabin Pereira100% (1)

- Third Bridge Forum Interview - Visa Earthport Acquisition Crossborder Payments Outlook - 21219Document12 pagesThird Bridge Forum Interview - Visa Earthport Acquisition Crossborder Payments Outlook - 21219How Xiang NgNo ratings yet

- Shehroz Walji Eliazar Kolachi: Engro FertilizersDocument24 pagesShehroz Walji Eliazar Kolachi: Engro FertilizersWajiha FatimaNo ratings yet

- Jaypee Business School: Page 1 of 1Document1 pageJaypee Business School: Page 1 of 1NAVYA BANSAL BBG220461No ratings yet

- Paye Guide For Employers PDFDocument54 pagesPaye Guide For Employers PDFLara Scott100% (2)

- University of Pune Oct - 2005, Mba III Sem - Question PaperDocument40 pagesUniversity of Pune Oct - 2005, Mba III Sem - Question PaperSonali BangarNo ratings yet

- San Miguel Brewery v. Law Union and Rock Insurance Co.Document2 pagesSan Miguel Brewery v. Law Union and Rock Insurance Co.Leslie Lerner100% (1)

- List of Payment Purpose Code KRDocument10 pagesList of Payment Purpose Code KRあいうえおかきくけこNo ratings yet

- Central Azucarera de Don Pedro V CTADocument3 pagesCentral Azucarera de Don Pedro V CTAChino Sison100% (1)

- Islamic Economy: ObjectivesDocument6 pagesIslamic Economy: ObjectivesIntiser RockteemNo ratings yet

- Module 3 Divisible ProfitsDocument8 pagesModule 3 Divisible ProfitsVijay KumarNo ratings yet