Professional Documents

Culture Documents

Vvneq1m5ymzryny1nuj2swrlwef0dz09 Invoice

Vvneq1m5ymzryny1nuj2swrlwef0dz09 Invoice

Uploaded by

TYCS35 SIDDHESH PENDURKAROriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vvneq1m5ymzryny1nuj2swrlwef0dz09 Invoice

Vvneq1m5ymzryny1nuj2swrlwef0dz09 Invoice

Uploaded by

TYCS35 SIDDHESH PENDURKARCopyright:

Available Formats

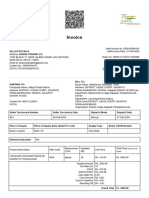

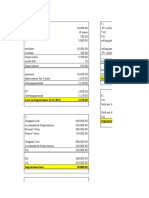

Invoice

GeM Invoice No: GEM-35212736

SELLER DETAILS: GeM Invoice Date: 04-Oct-2023

Address: FARHAN ENTERPRISES

R. No. 43, 1ST FLOOR, 9 KAKAL,, GOA STEEET,, FORT, Order No: GEMC-511687767131095

Mumbai, MAHARASHTRA, 400001 Order Date: 04-Oct-2023

Email Id: tahirali15389@gmail.com

Contact No : 08291137586

GSTIN: 27FEOPS5254B1Z6 Click here to download seller invoice

BILL TO:

Buyer Name: Mehar Alam , AD

SHIPPING TO:

Address: SFIO, 7th Floor, MTNL Building, Fort Mumbai,

Consignee Name: Mehar Alam

Maharasthra, 400001 Mumbai MAHARASHTRA 400001 NA

Address: SFIO, 7th Floor, MTNL Building, Fort Mumbai,

Serious Fraud Investigation Office (SFIO)

Maharasthra, 400001 RAIGARH(MH)

Department: NA

MAHARASHTRA 400001

Office Zone:CGO Complex Lodi Road

Organisation: Serious Fraud Investigation Office (SFIO)

Ministry: Ministry of Corporate Affairs

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

INV-000310 04-Oct-2023 Manual 04-Oct-2023

Place of Supply Place of Supply State (State/UT Code) Supply Type Consignee GSTIN Number

Consignee Location Maharashtra / 27 Intra-State

Delivery Instruction NA

Measuremen Supplied Total Price inclusive all

Product Description HSN Code Unit Price

t Unit Qty Taxes

Unbranded Glass tea kettle set 1500

851660 set 15 Rs. 1500.00 Rs. 22500.00

Mm Without

Taxable Amount Rs. 19067.80

Tax Rate (%) 18

CGST Rs. 1716.10

SGST/UTGST Rs. 1716.10

Cess Rate (%) 0.00

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. 0.00

Grand Total Rs. 22500.00

I /We hereby declare that our maximum turn over during last three years is only Rs. 3143687 and hence we arenotcovered under

the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are made applicable to us, we shall

issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shallbe liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Kaplan - Strategic Performance Measurement and Management in Nonprofit OrganizationsDocument18 pagesKaplan - Strategic Performance Measurement and Management in Nonprofit OrganizationsLeda Ripa100% (1)

- DANONE NARANG'S B'lueDocument11 pagesDANONE NARANG'S B'lueAmar100% (1)

- HR Consulting: PG Finance - Group 6Document12 pagesHR Consulting: PG Finance - Group 6Krushna Omprakash Mundada100% (2)

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- Target Face 150 (PSH)Document2 pagesTarget Face 150 (PSH)sarthakgan29No ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- ZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3Document2 pagesZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3nagasesha ReddyNo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Zk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 InvoiceDocument2 pagesZk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 Invoicerajrathwa85No ratings yet

- eFMyQStaTWk0dys2bnAxVjFlaElpZz09 InvoiceDocument2 pageseFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoicenagasesha ReddyNo ratings yet

- InvertedDocument2 pagesInvertedShrikant KeskarNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- PASTDocument2 pagesPASTpatel harshadNo ratings yet

- Bills Material PurchaseDocument2 pagesBills Material PurchaseChanchal PathakNo ratings yet

- ASSAMBILLDocument2 pagesASSAMBILLmahavirtrading0201No ratings yet

- DFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 InvoiceDocument2 pagesDFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 Invoiceomkar daveNo ratings yet

- TldEdURCaElod0FGVE12NldQL2l6Zz09 InvoiceDocument2 pagesTldEdURCaElod0FGVE12NldQL2l6Zz09 InvoicePratyush kumar NayakNo ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- Vishal Construction 1Document1 pageVishal Construction 1Mayur PolNo ratings yet

- Swakriti Construction - KF Sl24!06!06-2024Document1 pageSwakriti Construction - KF Sl24!06!06-2024nc607012No ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- Purchase Order: Bill To Address Ship To AddressDocument4 pagesPurchase Order: Bill To Address Ship To Addressarvind.tiwariNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- Purchase Order SampleDocument1 pagePurchase Order SampleAzhar MirNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceGaurav SinghNo ratings yet

- InvoiceDocument1 pageInvoiceLAKHAN TRIVEDINo ratings yet

- B No17 PDFDocument1 pageB No17 PDFFSPL HSENo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument2 pagesBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountTANUNo ratings yet

- Complition of Various DeliveryDocument22 pagesComplition of Various Deliverydipak kambleNo ratings yet

- UVdqZ0Y4UkFWd1J6STdzaWpmbkk1QT09 InvoiceDocument2 pagesUVdqZ0Y4UkFWd1J6STdzaWpmbkk1QT09 Invoicenagasesha ReddyNo ratings yet

- InvoiceDocument1 pageInvoice2125757csNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- Tyre InvoiceDocument2 pagesTyre Invoiceresidency.saharaNo ratings yet

- 61788601768019451Document52 pages61788601768019451lonewo2722No ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- Tika 232400344808Document1 pageTika 232400344808krishngupta2010No ratings yet

- TSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceDocument2 pagesTSs4MDFuOXVOWFNGL3hMYzl2bGQvZz09 InvoiceJitender NarulaNo ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- Tax InvoiceDocument1 pageTax Invoicesmarty sdNo ratings yet

- DldHNENiUVNKOU45Vit0MkZ4dXdXdz09 InvoiceDocument2 pagesDldHNENiUVNKOU45Vit0MkZ4dXdXdz09 Invoicedevenmistry2003No ratings yet

- Shree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDocument1 pageShree Chenaramjee Fancy Electric & Hardware Store: CGST SGSTDr. Shashank RkNo ratings yet

- Invoice 230915 140244Document1 pageInvoice 230915 140244manikandanNo ratings yet

- Book 2Document1 pageBook 2Eshwar UpadhayayNo ratings yet

- Tax Invoice: Description of Goods Amount Per Rate Quantity Hsn/SacDocument1 pageTax Invoice: Description of Goods Amount Per Rate Quantity Hsn/Sacanshagrawal0000No ratings yet

- Tax InvoiceDocument3 pagesTax Invoicerkmohit9792No ratings yet

- Tax Invoice: SBN Small Udhyog Machinery Private Limited Invoice1 22/03/2024Document1 pageTax Invoice: SBN Small Udhyog Machinery Private Limited Invoice1 22/03/2024Prince KumarNo ratings yet

- 69858227840019598Document2 pages69858227840019598jeelp625No ratings yet

- Eshwar Tradesr..Document1 pageEshwar Tradesr..ANAND KAGALENo ratings yet

- Dell BatteryinvoiceDocument1 pageDell BatteryinvoiceSatyam MishraNo ratings yet

- Inv No - 6554 PDFDocument1 pageInv No - 6554 PDFSunil PatelNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Nitesh MamgainNo ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- Amazon InvoiceDocument2 pagesAmazon InvoiceSumit RoyNo ratings yet

- Tax Invoice: United Squares PVT - Ltd. (Mumbai)Document1 pageTax Invoice: United Squares PVT - Ltd. (Mumbai)AthahNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Warrior GamingNo ratings yet

- N3JZZW1sTDhXRElyNnBUak9DcVJZZz09 InvoiceDocument2 pagesN3JZZW1sTDhXRElyNnBUak9DcVJZZz09 InvoiceJitender NarulaNo ratings yet

- NDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceDocument2 pagesNDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceInclusive Education BranchNo ratings yet

- Sanction StatusDocument76 pagesSanction StatusTYCS35 SIDDHESH PENDURKARNo ratings yet

- Processing of Professional Fees of M/s. Pipara & Co LLP in Case of IL&FS Limited & Its Group CompaniesDocument1 pageProcessing of Professional Fees of M/s. Pipara & Co LLP in Case of IL&FS Limited & Its Group CompaniesTYCS35 SIDDHESH PENDURKARNo ratings yet

- Additional Budget-Funds RequirementDocument2 pagesAdditional Budget-Funds RequirementTYCS35 SIDDHESH PENDURKARNo ratings yet

- Sanction StatusDocument76 pagesSanction StatusTYCS35 SIDDHESH PENDURKARNo ratings yet

- Sanction StatusDocument96 pagesSanction StatusTYCS35 SIDDHESH PENDURKARNo ratings yet

- AS9103 Key Char Variation PDFDocument98 pagesAS9103 Key Char Variation PDFErhanNo ratings yet

- MIS Quiz 3 Total 20 MCQS: A) DesignDocument4 pagesMIS Quiz 3 Total 20 MCQS: A) DesignZara KhanNo ratings yet

- Sajan PurposalDocument18 pagesSajan Purposalthesisfile01No ratings yet

- Non Conformity Report and Corrective, Preventive Action RequestDocument1 pageNon Conformity Report and Corrective, Preventive Action RequestvinothNo ratings yet

- New Project Report On Coalgate MbaDocument42 pagesNew Project Report On Coalgate MbaPrints Bindings71% (7)

- Robert Marciniak - 3010412115 - Full Paper - Center of ExcellenceDocument9 pagesRobert Marciniak - 3010412115 - Full Paper - Center of ExcellencesongaonkarsNo ratings yet

- Affiliate Marketing Strategy of Amazon IndiaDocument19 pagesAffiliate Marketing Strategy of Amazon IndiaZoulfati Hadji KassimNo ratings yet

- Accounting Reforms Accrual Accounting: The NDMC ExperienceDocument16 pagesAccounting Reforms Accrual Accounting: The NDMC ExperienceV.K. HASIJANo ratings yet

- Cost Accounting Foundations and Evolutions: Process CostingDocument19 pagesCost Accounting Foundations and Evolutions: Process CostingMarryRose Dela Torre FerrancoNo ratings yet

- Strategic Management Term PaperDocument12 pagesStrategic Management Term Paperapi-3715493100% (4)

- Accenture Next Generation Digital ProcurementDocument16 pagesAccenture Next Generation Digital Procurementamekheimar1975No ratings yet

- StrategicManagement - TCSDocument11 pagesStrategicManagement - TCSMohit LakhotiaNo ratings yet

- Business Simulation - IntroductionDocument7 pagesBusiness Simulation - IntroductionVuong Bui VietNo ratings yet

- UMN - Sr. Dir OIT - Position ProfileDocument4 pagesUMN - Sr. Dir OIT - Position ProfileLars LeafbladNo ratings yet

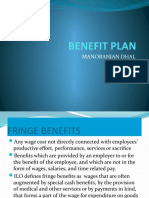

- Benefit PlanDocument11 pagesBenefit PlanSaurabh Kulkarni 23No ratings yet

- Data Quality Management Methods and ToolsDocument39 pagesData Quality Management Methods and ToolsTage Nobin100% (1)

- Eight Hats of Data Visualization-Communicator and ManagerDocument5 pagesEight Hats of Data Visualization-Communicator and ManagerAshok VaghamshiNo ratings yet

- MKMA1105. Principles of MarketingDocument8 pagesMKMA1105. Principles of MarketingThuy DungNo ratings yet

- AayanMoazzam 14477 9A BusinessDocument7 pagesAayanMoazzam 14477 9A BusinessPeshan MoazzamNo ratings yet

- Bond Refunding Analysis - App12CDocument7 pagesBond Refunding Analysis - App12CRimpy SondhNo ratings yet

- Atl Tinkerfest 2021 - Tinkerpreneur: Home Registration Form LogoutDocument2 pagesAtl Tinkerfest 2021 - Tinkerpreneur: Home Registration Form LogoutINDRA DAVENo ratings yet

- MakapisiDocument5 pagesMakapisiSouvik0% (3)

- Chapter 23 IaDocument4 pagesChapter 23 IaKiminosunoo LelNo ratings yet

- ACC 225 Business Laws and RegulationsDocument209 pagesACC 225 Business Laws and RegulationsFRAULIEN GLINKA FANUGAONo ratings yet

- Nov 23 MTP-1 (Q)Document8 pagesNov 23 MTP-1 (Q)luciferNo ratings yet

- Labor Law and Social LegislationsDocument4 pagesLabor Law and Social LegislationsCARLOS JUAN CASACLANGNo ratings yet

- AakerDocument4 pagesAakerSyed Ali Humza RizviNo ratings yet