Professional Documents

Culture Documents

Tax System

Tax System

Uploaded by

musor.as084Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax System

Tax System

Uploaded by

musor.as084Copyright:

Available Formats

XIII.

TAX SYSTEMS

XIII.1. DEFINITION

• Methods or schemes of imposing, assessing, and collecting taxes.

• Includes all the tax laws and regulations, the means of their enforcement, and the government offices,

bureaus and withholding agents which are part of the machineries of the government in tax collection.

XIII.2. TAX COLLECTION SYSTEMS

A. Withholding system on income tax

The payor of the withholds or deducts the tax on the income before releasing the same to the payes and

remits the same to the government

Types of withholding taxes collected under this system:

1. Creditable withholding tax

a. Withholding tax on compensation-an estimated tax required by the government to be withheld

by employers against the compensation income of their employees

b. Expanded withholding tax-an estimated tax required by the government to be deducted on

certain income payments made by taxpayers engaged in business

2. Final Withholding tax

A system of tax collection wherein payors are required to deduct the full tax on certain income

payments

B. Withholding System on Business Tax

When government agencies purchase goods or services, the law requires withholding of the relevant

business tax

C. Voluntary Compliance System

Taxpayer himself determines his income, reports the same through income tax returns and pays the tax

himself This system is also referred to as "Self-assessment Method"

D. Assessment or enforcement system

The government identifies non-compliant taxpayers, assesses their tax dues (including penalties),

demands for taxpayer's voluntary compliance or enforces collections by coercive means

XIII.3.TAX ADMINISTRATION

• Refers to the management of the tax system

• In the PH, the administration of the national tax system is entrusted to the Bureau of Internal Revenue

which is under the supervision and administration of the Department of Finance

XIII.3.A. CHIEF OFFICIALS OF THE BIR

1 Commissioner-chief of the BIR Romeo D. Lumagui, Jr.

4 Deputy Commissioners, each to be designated to the following

a Operations Group Maridur V. Rosario (OIC)

b Legal Enforcement Group Marissa O. Cabreros

c Information Systems Group: Ma. Rosario Charo G. Enriquez-Curiba

d Resource Management Group Teresita M. Angeles

XIII.3.B. POWERS OF THE BIR

1. Assessment and collection of taxes

2. Enforcement of all forfeitures, penalties and fines, and judgments in all cases decided in its favor by

the courts

3. Giving effect to, and administering the supervisory and police powers conferred to it by the NIRC and

other laws

4 Assignment of internal revenue officers and other employees to other duties

5. Provision and distribution of forms, receipts, certificates, ctamps, etc. to proper officials

6. Issuance of receipts and clearances

7. Submission of annual report, pertinent information to Congress and reports to the Congressional

Oversight Committee in matters of taxation

XIII.3.b. Powers and Authority of the Commissioner of Internal Revenue

4. To make an assessment and prescribe additional requirement for tax administration and enforcement

5. To examine tax returns and tax due thereon

6. To conduct inventory taking or surveillance

7. To prescribe presumptive gross sales and receipts for a taxpayer when

a. The taxpayer failed to issue receipts, or

b. The CIR believes that the books or other records of the taxpayer do not correctly reflect the

declaration in the return

8. To terminate tax period when the taxpayers.

a. Retiring from business,

b. Intending to leave the Philippines,

c. Intending to remove, hide, or conceal his property

d. Intending to perform any act tending to obstruct the proceedings for the collection of the tax or

render the same ineffective

9. To prescribe real property values

10. To compromise tax liabilities of taxpayers

11. To inquire into bank deposits, only under the following instances;

a. Determination of the gross estate of a decedent

b. To substantiate the taxpayer's claim of financial incapacity to pay tax in an application for tax

compromise

12. To accredit and register tax agents

13. To refund or credit internal revenue taxes

14.To abate or cancel tax liabilities in certain cases

15. To prescribe additional procedures or documentary requirements

16. To delegate his powers to any subordinate officer with a rank equivalent division chief of an office.

XIII.3.b. Powers and Authority of the Commissioner of Internal Revenue

• The power to the promulgation of rules and regulations to the Secretary of Finance

• The power to issue rulings of first impression or to reverse, revoke or modify any existing rulings of the

Bureau •The power to compromise or abate any tax liability the Regional Evaluation Boards may

compromise tax liabilities under the following:

a. Assessments are issued by the regional offices involving basic deficiency tax of P500,000 or less, and

b.Minor criminal violations discovered by regional and district officials

• The power to assign and reassign internal revenue officers to establishments where articles subject to

excise tax are produced or kept.

WHAT IS INCOME TAX

It is a tax on a person's income, emoluments, profits arising from property, practice of profession,

conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of

1997, as amended, less the deductions and/or personal and additional exemptions, if any, authorized for

such types of income, by the Tax Code, as amended, or other special laws.

Income subject to tax

a. Ordinary or Regular Income - subject to basic or normal tax

b. Certain Passive Income, subject specifically to final withholding tax

c. Certain capital gains, subject specifically to capital gains tax d. Special income subject to special rates

Income that are tax exempt

1.1. DEFINITION

• Individual Taxpayers- natural persons with income earned within the territorial of a taxing authority

1.2. Classification

•Resident Citizens

•Nonresident Citizens

•Resident Aliens

oEngaged in trade or business

o Not engaged in or business

1.4. NON-RESIDENT CITIZEN

1) Submit proof to the CIR:

• Fact of physical presence abroad w/ definite intention to reside there

2) PH citizen who leaves the PH

• as immigrant

• for employment permanently

• works abroad and physically present abroad most of the time

3) PH citizen who stayed outside the PH for 183 days or more by the end of the year (aggregate)

*Previous NRC and arrived in PH to reside permanently (to become a RC -treated as NRC regarding his

income abroad until the date of his arrival in the Philippines.

Includes Overseas Contract Workers / Overseas Filipino Workers and Filipino Seamen who received

compensation for services rendered abroad

OCWS/OFWs must be:

•Duly registered with Philippine Overseas Employment Administration (POEA)

• With valid Overseas Employment Certificate (OEC)

Filipino Seamen/ Seafarers must be:

• Duly registered with POEA

• With valid OEC

• With Seafarers Identification Record Book (SIRB) or Seaman's Book issued by the Maritime Industry

Authority (MARINA)

1.5.ALIEN

• not Filipinos.

1) Resident alien

2) Non-resident alien doing business in the Philippines.

3) Non-resident alien not doing business in the Philippines.

1.6. RESIDENT ALIEN

Residence: Philippines

Citizen: Abroad

1) Alien who is not mere transient or sojourner

2) Allen who lives in PH with no definite intention as to his stay

3) Alien with definite purpose which in its nature would require an extended stay & home is temporarily

in PH (even if w/ intention to return abroad)

4) Alien with residence in PH until he departs from PH

1.7 NON-RESIDENT ALIEN

Residence: Abroad

Citizen: Abroad

1) Alien w/ definite purpose but promptly accomplished

2) Mere transients or sojourners

"NRA engaged in trade or business"

• If his aggregate stay in PH > 180 days, and or

• Have business income in PH

"NRA not engaged in trade or business"

• If his aggregate stay in PH < 180 days

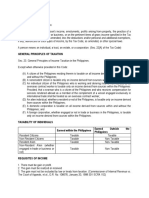

1.8.THE GENERAL CLASSIFICATION RULE FOR INDIVIDUALS

1. INTENTION-submit documentary proof to the CIR

2. In the absence of documentary proof, LENGTH OF STAY of the taxpayer is comedored

• A Resident Citizen who abroad for more than 183 days → NRC

• An Alien who stayed in the Philippines for 1 year or more → RA

• An Alien who stayed in the Philippines for not more than I year but more than 180 days→ NRA-ETB

• An Alien who stayed in the Philippines for 180 days or less → NRA-NETB

You might also like

- Taxation SituationalDocument113 pagesTaxation SituationalDaryl Mae Mansay100% (1)

- 7 - Financial Literacy - Review AssignmentDocument8 pages7 - Financial Literacy - Review AssignmentSm KimNo ratings yet

- Week 2 - Tax AdministrationDocument26 pagesWeek 2 - Tax AdministrationJuan FrivaldoNo ratings yet

- Income TaxationDocument22 pagesIncome TaxationMorano, Angeline G.No ratings yet

- Part I: Concept of Tax AdministrationDocument22 pagesPart I: Concept of Tax AdministrationShiela Marie Sta AnaNo ratings yet

- Income Taxation Handout No. 1-02 Complete TextDocument21 pagesIncome Taxation Handout No. 1-02 Complete TextTong WilsonNo ratings yet

- Chapter 2 Tax AdministrationDocument12 pagesChapter 2 Tax AdministrationGlomarie GonayonNo ratings yet

- Q1. What Is Tax Administration?Document10 pagesQ1. What Is Tax Administration?Joyce Ann RepanaNo ratings yet

- Intro. To Income Tax FTDocument52 pagesIntro. To Income Tax FTJOANA GRACE ALLORINNo ratings yet

- LM Tax AdministrationDocument26 pagesLM Tax AdministrationDennis PlacerNo ratings yet

- 03 Tax Administration - BigskyDocument4 pages03 Tax Administration - BigskyAbigail Espiritu SantoNo ratings yet

- Module No 2 - INCOME TAXATION PART1ADocument11 pagesModule No 2 - INCOME TAXATION PART1APrinces S. RoqueNo ratings yet

- Taxarion PresentationDocument39 pagesTaxarion PresentationNeri DelfinNo ratings yet

- Module 1 Internal Revenue TaxesDocument11 pagesModule 1 Internal Revenue TaxesSophia De GuzmanNo ratings yet

- PLM Tax Law 1 SY 2019-2020 Part 2 BIR Organization and Income Taxation Complete LectureDocument104 pagesPLM Tax Law 1 SY 2019-2020 Part 2 BIR Organization and Income Taxation Complete LectureJustine DagdagNo ratings yet

- 3-Taxes Tax-Laws Tax-AdministrationDocument81 pages3-Taxes Tax-Laws Tax-AdministrationrishanecezarNo ratings yet

- Lesson 4. Tax Administration.Document44 pagesLesson 4. Tax Administration.Si OneilNo ratings yet

- March 2, 2024 - Notes of BepitelDocument8 pagesMarch 2, 2024 - Notes of BepitelbepitelbreylleNo ratings yet

- Income Tax Topic 2Document33 pagesIncome Tax Topic 2Jenebyb SeraficaNo ratings yet

- Income TaxationDocument138 pagesIncome TaxationLimberge Paul CorpuzNo ratings yet

- Income Taxation - LAV Notes122621Document13 pagesIncome Taxation - LAV Notes122621Mil Roilo B EspirituNo ratings yet

- National TaxDocument6 pagesNational TaxRoi RimasNo ratings yet

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- Gross IncomeDocument33 pagesGross IncomeRey ViloriaNo ratings yet

- Lesson 5 Inclusions Exclusions From Gi Final TaxDocument17 pagesLesson 5 Inclusions Exclusions From Gi Final TaxOrduna Mae AnnNo ratings yet

- Taxes Tax and Tax AdministrationDocument20 pagesTaxes Tax and Tax AdministrationHoney OmosuraNo ratings yet

- Taxation ReportDocument79 pagesTaxation ReportkimNo ratings yet

- Power of The Bir and Cir-Income Taxation 101-02.23.20Document4 pagesPower of The Bir and Cir-Income Taxation 101-02.23.20Dhierissa LeeNo ratings yet

- Report in Taxation Group 3Document25 pagesReport in Taxation Group 3Patricia BacatanoNo ratings yet

- Bir LectureDocument4 pagesBir LectureClarisaJoy SyNo ratings yet

- Module 1 Introduction To TaxationDocument47 pagesModule 1 Introduction To TaxationFlameNo ratings yet

- Income TaxationDocument6 pagesIncome TaxationJahz Aira GamboaNo ratings yet

- Tax.02 Taxes, Tax Laws and Tax AdministrationDocument6 pagesTax.02 Taxes, Tax Laws and Tax AdministrationRhea Royce CabuhatNo ratings yet

- Basic Principles On Income TaxationDocument7 pagesBasic Principles On Income TaxationMark Kyle P. AndresNo ratings yet

- Inbound 8239813781222450855Document5 pagesInbound 8239813781222450855Dannilyn Tequiapo Binay-anNo ratings yet

- TAX - NotesDocument5 pagesTAX - NotesRaman JeerhNo ratings yet

- Taxation Week 2Document9 pagesTaxation Week 2Jurian Jaan PeligroNo ratings yet

- Share Taxpayer and Elements of Gross IncomeDocument24 pagesShare Taxpayer and Elements of Gross IncomeJessa Mae IgotNo ratings yet

- WK 3 v2 THE BIR AND CIRDocument10 pagesWK 3 v2 THE BIR AND CIRandrea arapocNo ratings yet

- Individual Income TaxationDocument76 pagesIndividual Income TaxationRoronoa ZoroNo ratings yet

- Income Tax 2Document10 pagesIncome Tax 2Blaise VENo ratings yet

- National TaxationDocument18 pagesNational TaxationShiela Joy CorpuzNo ratings yet

- Fundamental Concepts of Individual Income TaxationDocument43 pagesFundamental Concepts of Individual Income TaxationLawrence Ting100% (1)

- 2.0 Organization and Function of The BIR (Title 1 of Tax Code)Document19 pages2.0 Organization and Function of The BIR (Title 1 of Tax Code)dreample1003No ratings yet

- Written Report: A. National TaxesDocument6 pagesWritten Report: A. National TaxesJ. VinceNo ratings yet

- Reviewer On Tax Administration and Procedures (For Submission)Document44 pagesReviewer On Tax Administration and Procedures (For Submission)Miguel Anas Jr.No ratings yet

- Legal GroundDocument92 pagesLegal GroundSteve FervorNo ratings yet

- Tax Administration and EnforcementDocument189 pagesTax Administration and EnforcementDaniela Erika Beredo InandanNo ratings yet

- Income Taxation: Basic Priciples: 1. As To Subject Matter or ObjectDocument8 pagesIncome Taxation: Basic Priciples: 1. As To Subject Matter or ObjectcesalyncorillaNo ratings yet

- Tax by DimaampaoDocument90 pagesTax by Dimaampaoamun din100% (5)

- Black Panther Notes Income Taxation Part1Document27 pagesBlack Panther Notes Income Taxation Part1Malvin Aragon BalletaNo ratings yet

- Module 4 Income Taxation 1Document7 pagesModule 4 Income Taxation 1tabarnerorene17No ratings yet

- Tax by Dimaampao Legalground ComDocument90 pagesTax by Dimaampao Legalground ComRowela DescallarNo ratings yet

- Tax Reviewer by MoiDocument4 pagesTax Reviewer by MoiKenny BesarioNo ratings yet

- Income Tax Part IIDocument7 pagesIncome Tax Part IImary jhoyNo ratings yet

- II. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsDocument7 pagesII. INCOME TAXATION (RA 8242 Tax Reform Act of 1997) A. IndividualsRina TravelsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Property & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsFrom EverandProperty & Taxation: A Practical Guide to Saving Tax on Your Property InvestmentsNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Introduction To TaxationDocument33 pagesIntroduction To TaxationKami4038No ratings yet

- Far-1 2Document3 pagesFar-1 2Raymundo EirahNo ratings yet

- Us 2022 Tax UpdateDocument19 pagesUs 2022 Tax Updateapi-263318846No ratings yet

- Prelim - Intacc 1BDocument32 pagesPrelim - Intacc 1BMartha Nicole MaristelaNo ratings yet

- Financial Aspect Feasibility StudyDocument33 pagesFinancial Aspect Feasibility StudyDark ShadowNo ratings yet

- Lecture 1.3Document14 pagesLecture 1.3Ratan KalraNo ratings yet

- Assignment FRA Part 4: Please Read and Follow These Instructions CarefullyDocument6 pagesAssignment FRA Part 4: Please Read and Follow These Instructions Carefullyfinance aidNo ratings yet

- Maria Aries O. Poliquit: Assignment No. 8Document4 pagesMaria Aries O. Poliquit: Assignment No. 8Naima HajicaleNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023Kavin ShanmugamNo ratings yet

- Taxable and Non Taxable BenefitsDocument1 pageTaxable and Non Taxable BenefitsJade ivan parrochaNo ratings yet

- Carrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2Document31 pagesCarrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2FaIIen0nENo ratings yet

- MS Last Minute by HerculesDocument6 pagesMS Last Minute by HerculesFranklin ValdezNo ratings yet

- Unisa Exam Preparation GuideDocument21 pagesUnisa Exam Preparation Guideashton machingaNo ratings yet

- 3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaDocument1 page3rd Floor, JP Techno Park, No.3/1, Millers Road, Bangalore 560001, IndiaGamer JiNo ratings yet

- The Appraisal of Taxation As A Source of Revenue To Lagos State Board of Internal Revenue (Case of Lagos State, Nigeria)Document9 pagesThe Appraisal of Taxation As A Source of Revenue To Lagos State Board of Internal Revenue (Case of Lagos State, Nigeria)Akingbesote VictoriaNo ratings yet

- CIR vs. Shinko Elec. Industries Co., LTDDocument5 pagesCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNo ratings yet

- Accounting TermDocument8 pagesAccounting TermErick Danilo Salguero EscalanteNo ratings yet

- Daktronics E Dividend Policy in 2010Document26 pagesDaktronics E Dividend Policy in 2010IBRAHIM KHANNo ratings yet

- FABM 2 Part 1 SCIDocument39 pagesFABM 2 Part 1 SCIKeshlyn Kelly ToledoNo ratings yet

- Coc Project Level Three: Project One Koket Company Post Closing Trial Balance SEPTEMBER 20,2018Document4 pagesCoc Project Level Three: Project One Koket Company Post Closing Trial Balance SEPTEMBER 20,2018Aye Tube100% (5)

- Acc311 02 2022Document3 pagesAcc311 02 2022Saya PascualNo ratings yet

- P6 SMART Notes Till 03.25Document61 pagesP6 SMART Notes Till 03.25Ali AhmedNo ratings yet

- ch04 Income StatementDocument76 pagesch04 Income StatementFachrurrozie UnnesNo ratings yet

- Chapter 17 - Financial Planning and ForecastingDocument7 pagesChapter 17 - Financial Planning and ForecastingAnaNo ratings yet

- National Taxation System - RamosDocument10 pagesNational Taxation System - RamosAldrich RamosNo ratings yet

- Fabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionDocument16 pagesFabm 1 - Q2 - Week 1 - Module 1 - Preparing Adjusting Entries of A Service Business - For ReproductionJosephine C QuibidoNo ratings yet

- Finals Exam CfasDocument4 pagesFinals Exam Cfas3G Creatives Travel and ToursNo ratings yet

- ch01 Accounting in Action - StudentDocument13 pagesch01 Accounting in Action - StudentVũ Nhật TâmNo ratings yet